Best Fort Worth, TX Car Insurance in 2025

Car insurance in Fort Worth, TX is determined by state law, and you will need to prove financial responsibility if you're at fault in an accident. Fort Worth, TX car insurance rates are higher than average at $107, but Fort Worth car insurance coverage is still cheaper than the national average. Compare free Fort Worth car insurance quotes now with our comparison tool below.

Read moreFree Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

UPDATED: Oct 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Texas requires financial responsibility if you’re at fault in an accident. Purchasing insurance will give you the protection you’re required to have

- Texas has more DUI fatalities than any other state and that fact will be reflected in your car insurance premiums

- Compare companies online with a free quote tool to get started in your search for car insurance in Fort Worth

Fort Worth is a city located in Tarrant County, Texas. The population estimate of the city, as of 2014, was 812,238 and it has been growing since 2000 at a rapid rate.

With all these people in Fort Worth, we can assume there are a number of cars on the road that must be insured. If you are moving to or live in the Fort Worth area, you must ensure that you have the proper insurance for your vehicle in the event of an accident.

By purchasing car insurance, one can make sure their car is fully protected. We can help you find the best car insurance by entering your ZIP code above! We will do all the work for you and make sure you are fully protected.

Average Fort Worth Car Insurance Rates

If you are moving to the Fort Worth area or are purchasing a Fort Worth car insurance policy, expect to pay somewhere in the neighborhood of $1,292 for car insurance rates. Over a 50 year span, this will equate to $64,600.

When compared to other areas of the country, this rate is approximately 11% lower than the national average.

Many factors are taken into consideration when calculating the rates. They include auto theft rates, car policy laws, fixed prices, liability coverage requirements, payoff, and traffic concentration.

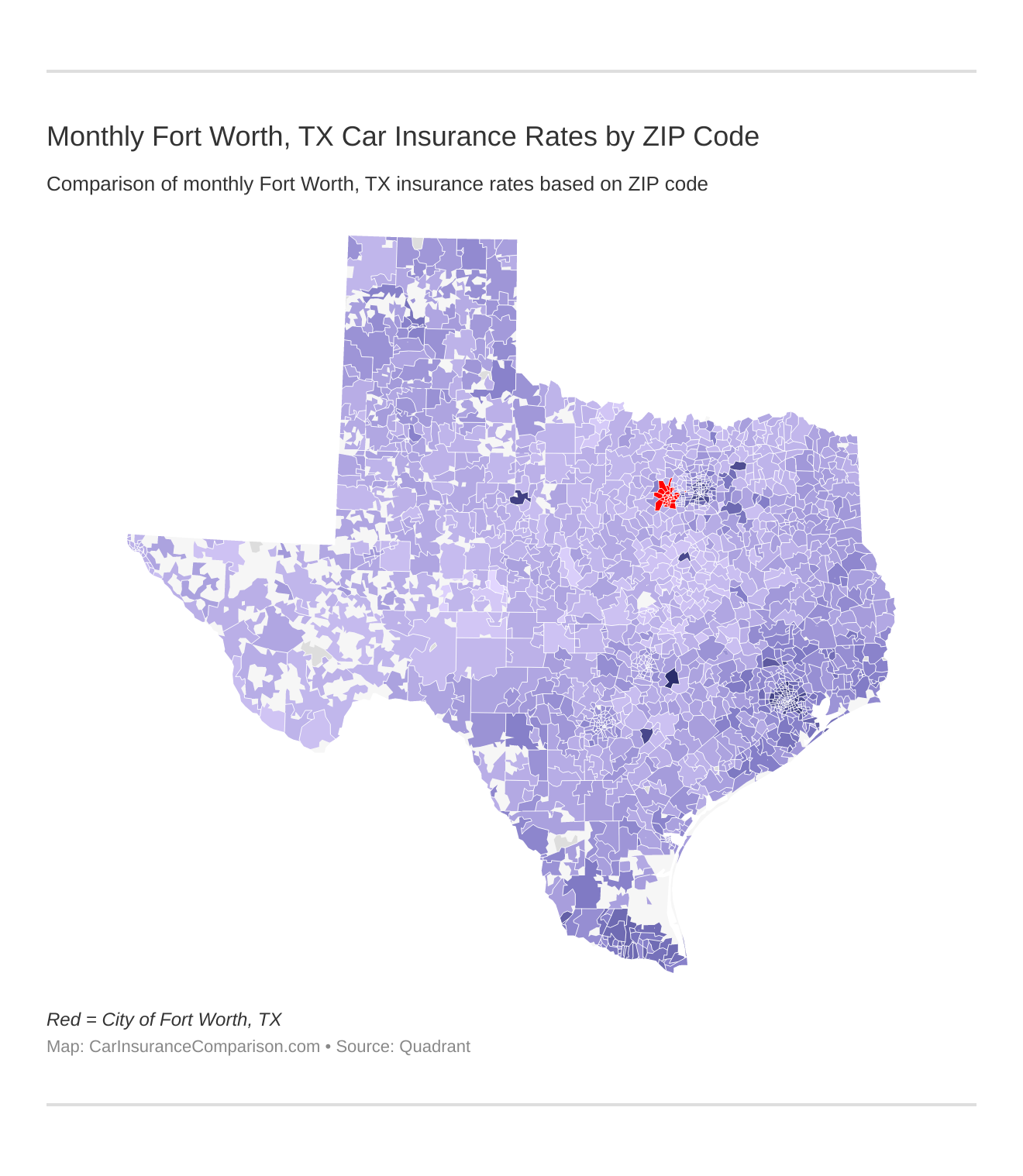

Monthly Fort Worth, TX Car Insurance Rates by ZIP Code

ZIP codes will play a major role in your car insurance rates because factors like crime and traffic are calculated by ZIP code. Check out the monthly Fort Worth, Texas auto insurance rates by ZIP Code below:

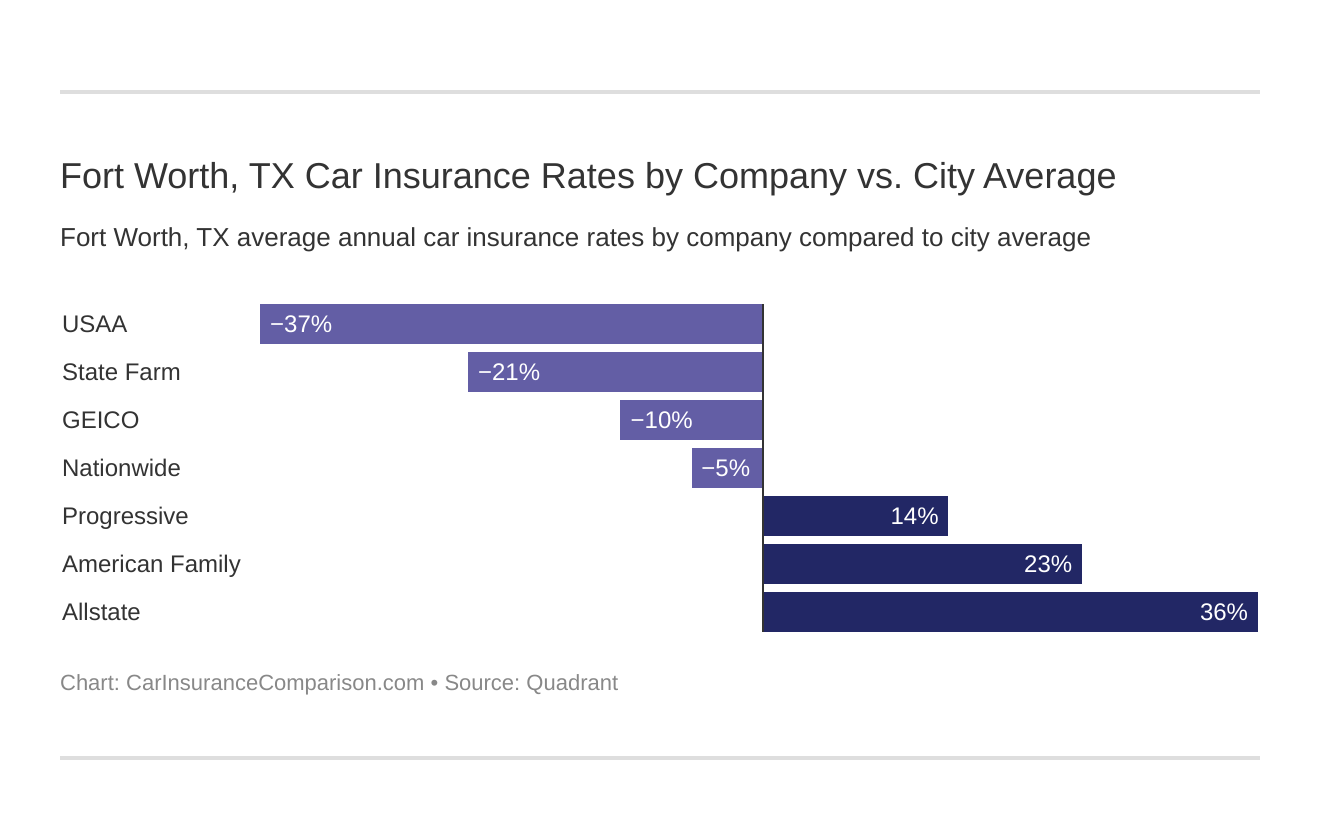

Fort Worth, TX Car Insurance Rates by Company vs. City Average

Which Fort Worth, TX car insurance company has the best rates? And how do those rates compare against the average Texas car insurance company rates? We’ve got the answers below.

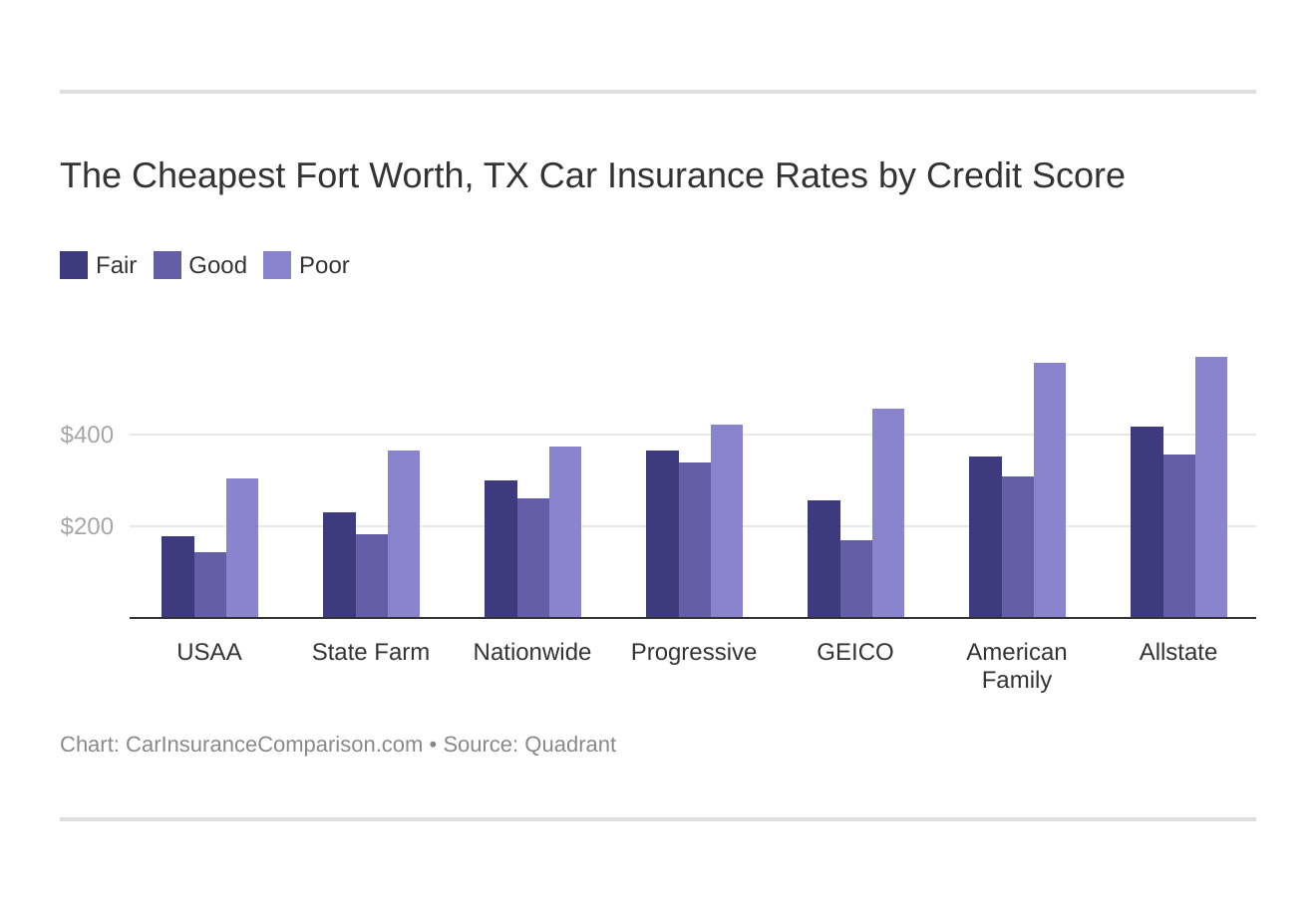

The Cheapest Fort Worth, TX Car Insurance Rates by Credit Score

Your credit score will play a significant role in your Fort Worth car insurance rates unless you live in these states where discrimination based on credit is not allowed: California, Hawaii, and Massachusetts. Find the cheapest Fort Worth, TX car insurance rates by credit score below.

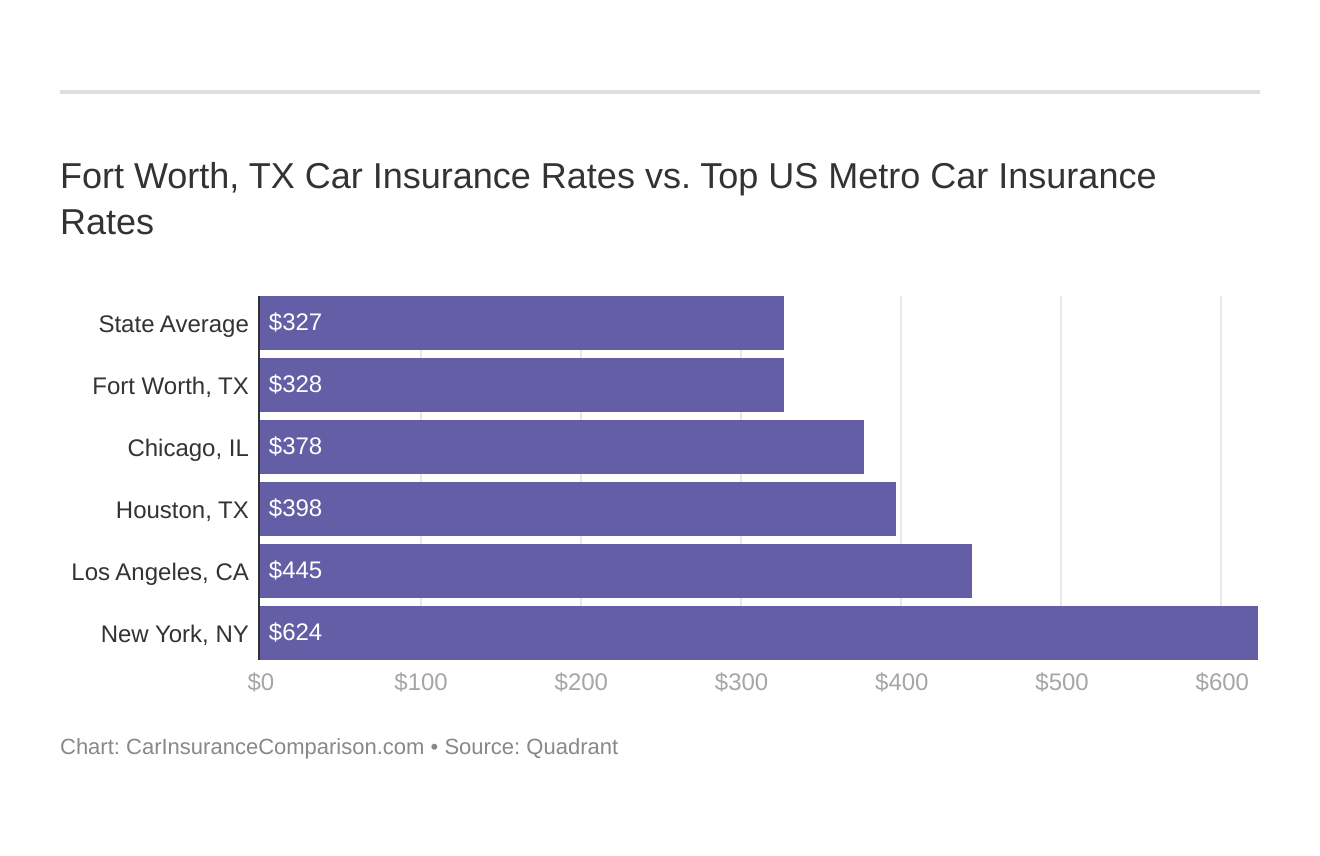

Fort Worth, TX Car Insurance Rates vs. Top US Metro Car Insurance Rates

You might find yourself asking how does my Fort Worth, Texas stack up against other top US metro areas’ auto insurance rates? We’ve got your answer below.

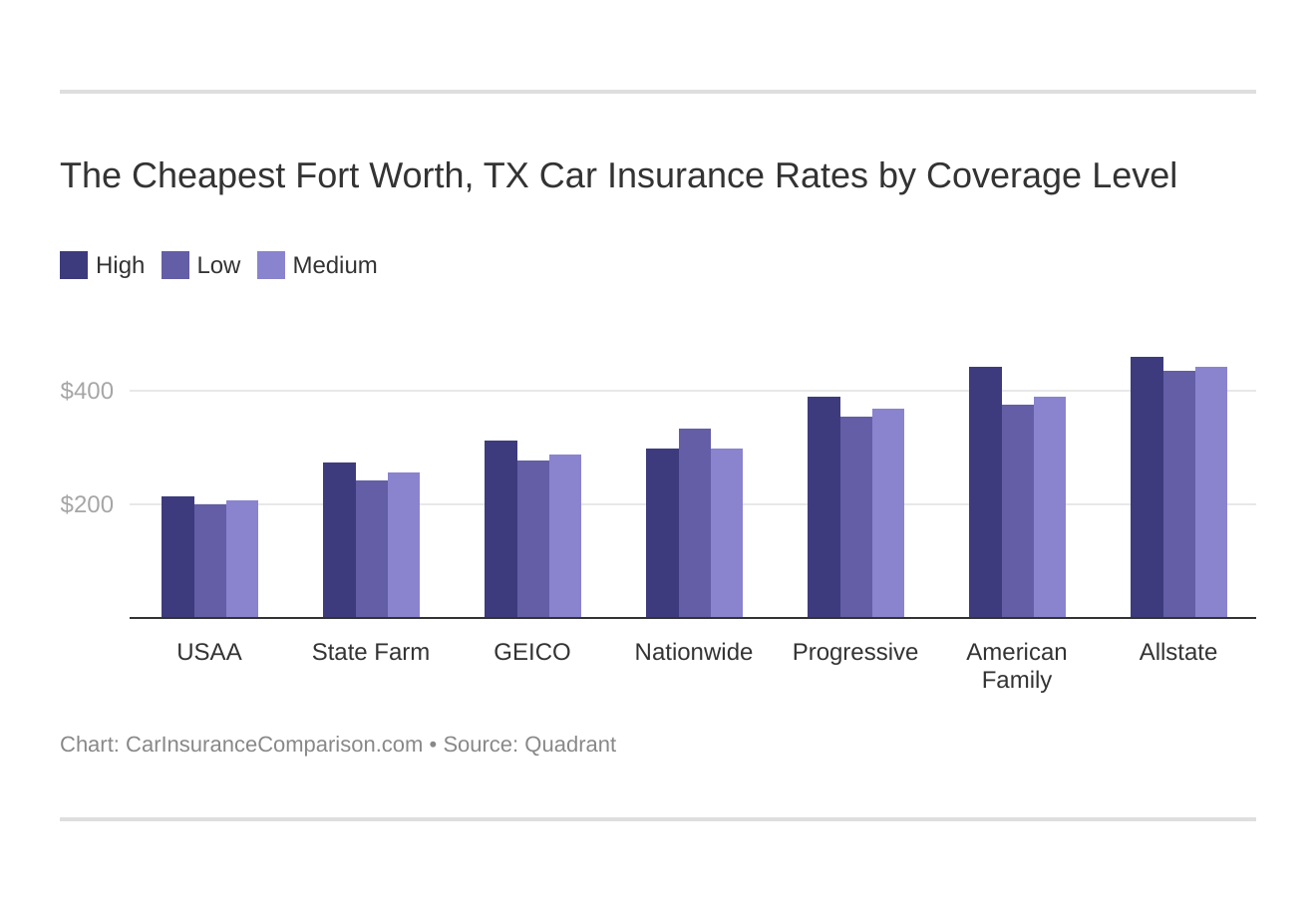

The Cheapest Fort Worth, TX Car Insurance Rates by Coverage Level

Your coverage level will play a major role in your Fort Worth car insurance rates. Find the cheapest Fort Worth, TX car insurance rates by coverage level below:

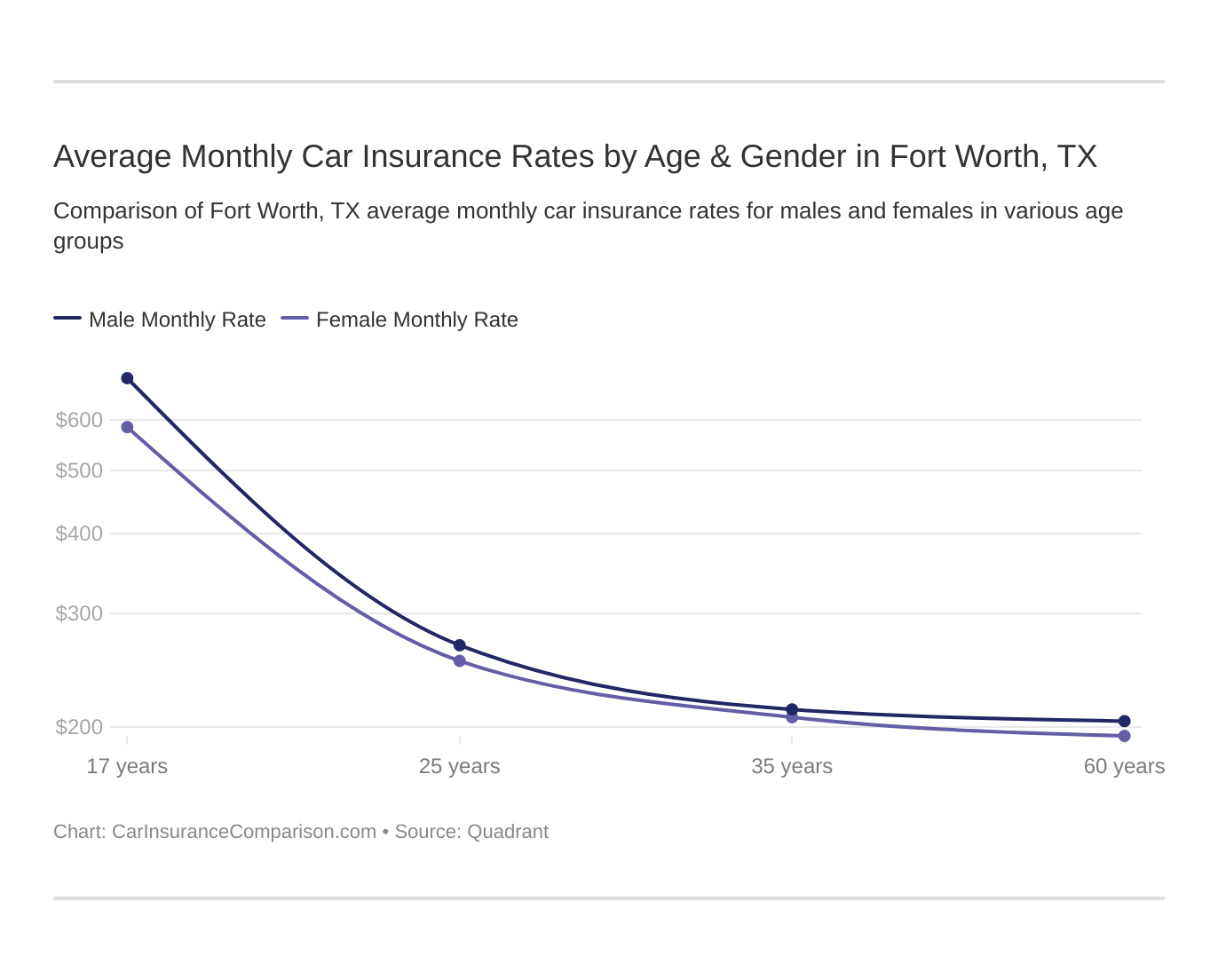

Average Monthly Car Insurance Rates by Age & Gender in Fort Worth, TX

These states are no longer using gender to calculate your car insurance rates — Hawaii, Massachusetts, Michigan, Montana, North Carolina, and Pennsylvania. But age is still a major factor because young drivers are often considered high-risk. TX does use gender, so check out the average monthly car insurance rates by age and gender in Fort Worth, TX.

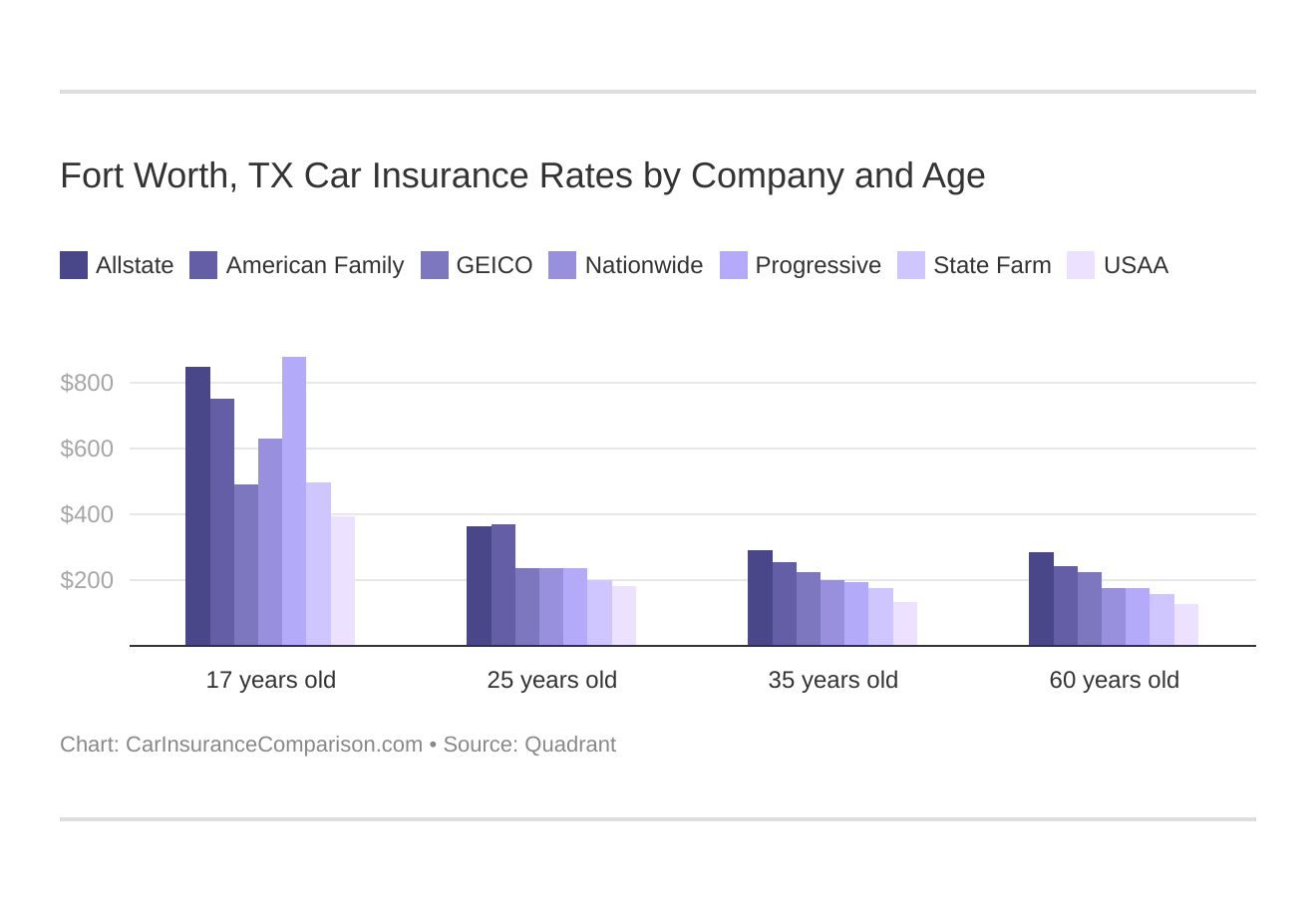

Fort Worth, TX Car Insurance Rates by Company and Age

Fort Worth, TX car insurance rates by company and age is an essential comparison because the top car insurance company for one age group may not be the best company for another age group.

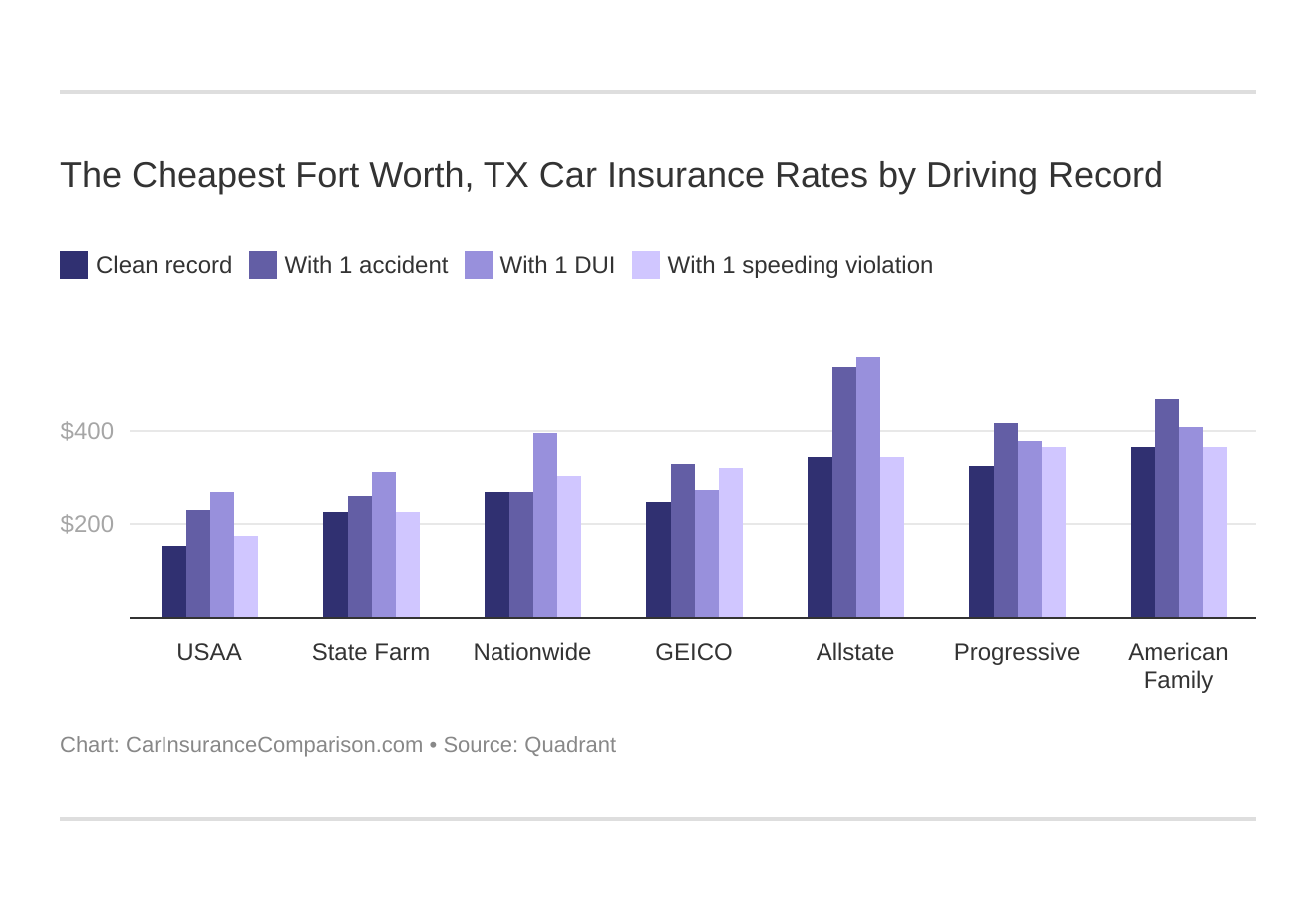

The Cheapest Fort Worth, TX Car Insurance Rates by Driving Record

Your driving record will play a major role in your Fort Worth car insurance rates. For example, other factors aside, a Fort Worth, TX DUI may increase your car insurance rates 40 to 50 percent. Find the cheapest Fort Worth, TX car insurance rates by driving record.

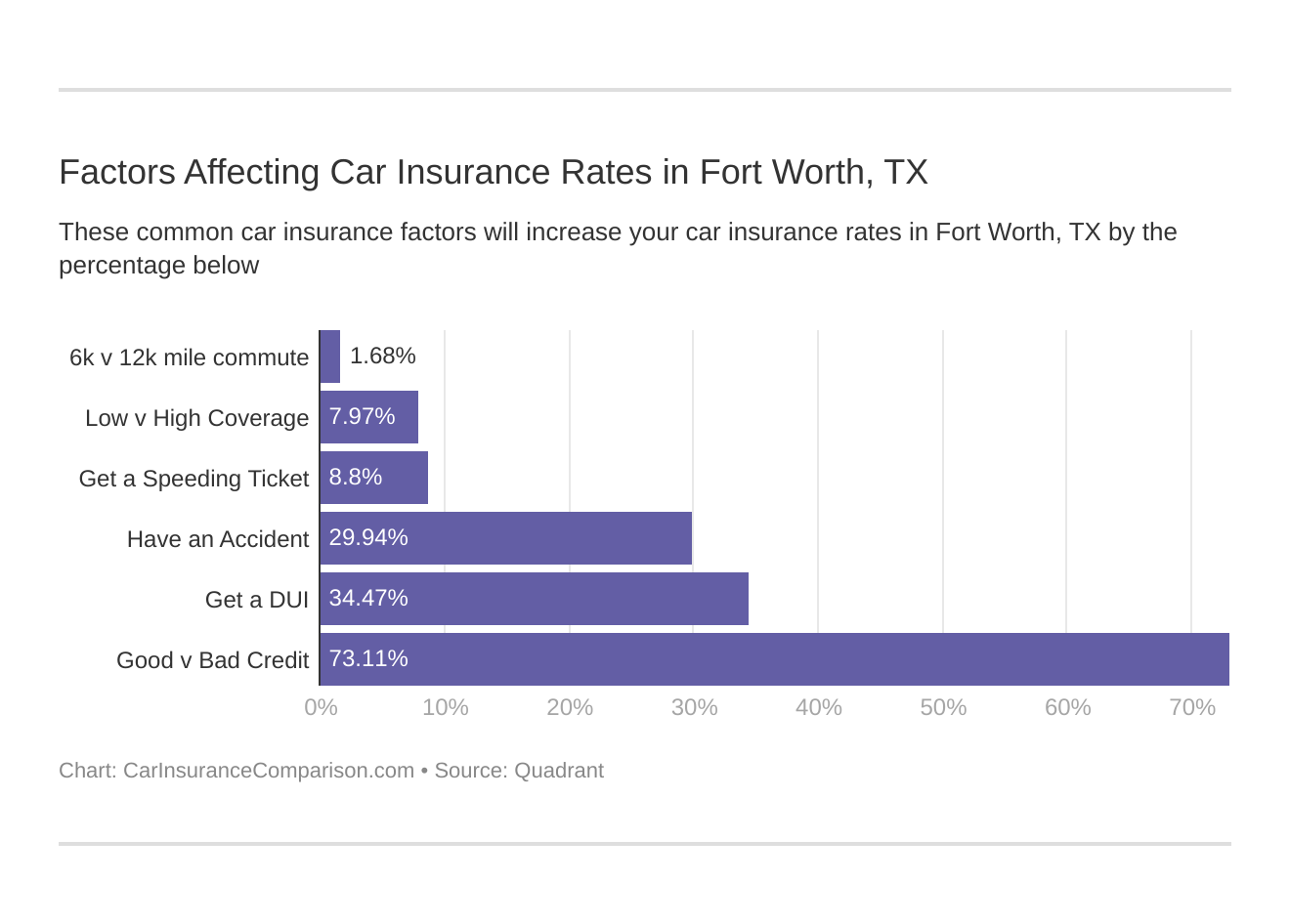

Factors Affecting Car Insurance Rates in Fort Worth, TX

Factors affecting car insurance rates in Fort Worth, TX may include your commute, coverage level, tickets, DUIs, and credit. Controlling these factors will help you maintain cheap Fort Worth, Texas car insurance.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Fort Worth Car Insurance Requirements and Laws

Drivers in Fort Worth must meet the requirements which are set forth by the state in order to drive on the roads. It is estimated though that approximately one in every five cars is operated by an uninsured motorist.

Texas Car Insurance Requirements and Laws

Any person driving in the state of Texas must have the ability to pay if they are responsible for an accident. Most choose to meet this requirement with an automobile liability insurance policy. What does a car insurance policy cover?

- Replacement of the other driver’s vehicle if it is totaled and you are at fault

- Repair of the other driver’s vehicle if it is damaged and you are at fault

- Medical expenses of the other driver and other parties injured as a result of your actions

The state also requires a certain amount of minimum coverage. Here is what each driver must maintain before hitting the streets of Forth Worth.

- $30,000 worth of coverage for each injured party

- $60,000 worth of coverage per accident

- $25,000 worth of property damage

If you are currently insured in Fort Worth, your policy should be checked on a regular basis. This ensures that you are covered if an accident does happen.

Financial responsibility in the form of car insurance must be proven if requested. There are a number of situations in which you may be asked to provide this proof. Here are just a few examples:

- When you attempt to register or renew a car registration in the city or state

- When you are stopped routinely or after an accident, if requested by a law enforcement officer

- When you go to obtain or renew a driver’s license

In the event you cannot provide the necessary proof of car insurance, you will be subject to penalties. Not only may you be fined for failure to have this coverage, you may also have your license suspended.

Either can cost you a great deal more than meeting the insurance requirements as set forth by the state.

Fort Worth Car Insurance Companies and Agents

When you go to choose a Fort Worth car insurance company and/or agent, you will find that you have many to select from. Research on these various companies will be your responsibility.

All will ensure you obtain the minimum requirements by law so factors such as customer service, comprehensive coverage and policy rates will need to be looked at. Companies you may wish to look into to see if they meet your needs include:

- Farmers Insurance

- State Farm Insurance

- Alfa Vision

- Foremost

- Infinity

- MetLife Auto and Home

- Safeco

- The Hartford

- Allstate

- Kemper

If you prefer to work one on one with an independent insurance agent, you will have a number to choose from. Some agencies that you may wish to consider when comparing car insurance include:

- Tucker Agency

- Granger Group

- Cordell & Company Insurance

- Rainbow Insurance Agency

- Statesman Insurance Group

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Fort Worth Driving and Car Insurance Statistics

Texas leads the country in DUI fatalities. In 2008, there were 59 fatal accidents in Forth Worth. Eighty-five cars and 130 people were involved. In addition, Fort Worth saw 20 pedestrian accidents and it is believed that.

This is not the only danger to your vehicle either which is why car insurance is so important. In 2013, 2,399 auto thefts were reported to the Fort Worth Police.

Fort Worth Car Insurance Comparison

Who has the cheapest car insurance in Texas? Take care when comparing online car insurance policies for the Fort Worth area. Many people choose to base their decision solely on the premium. This can be very dangerous as you may find when an accident does occur, that you do not have the coverage you thought you did.

Be sure to read the car insurance policies carefully to see what is included and excluded. By doing so, you can protect yourself if the worst does happen.

Customer service must be a factor that is considered when comparing car insurance rates. Accidents don’t always happen during normal business hours.

Will your insurance company be there for you in your time of need? This is of great importance when you find yourself injured or hurt in the middle of the night.

Comprehensive coverage should also be looked at closely when you are choosing this option. Will the insurer provide you with the current market value of the car or the replacement value?

Don’t rush the process when comparing Fort Worth car insurance companies. Take time and do some research. Make sure the company you are choosing is financially sound and will be there for you when you need them.

Hopefully, you will never need to call your insurance agent to help you after an accident, but if you do, taking these steps will help to ensure the process is as painless as possible.

To save you time, enter your ZIP code and compare car insurance quotes for FREE!

Frequently Asked Questions

What are the average car insurance rates in Fort Worth, TX?

The average car insurance rates in Fort Worth, TX, are around $1,292 per year or $107 per month. Over a 50-year span, this would amount to $64,600.

How do Fort Worth car insurance rates compare to the national average?

Fort Worth car insurance rates are cheaper than the national average. They are approximately 11% lower than the average rates in other parts of the country.

How does my ZIP code affect my car insurance rates in Fort Worth, TX?

ZIP codes play a significant role in determining car insurance rates. Factors like crime rates and traffic conditions are considered when calculating rates. You can check the monthly car insurance rates by ZIP code to get an idea of the rates in your area.

Which car insurance company offers the best rates in Fort Worth, TX?

The rates offered by car insurance companies can vary. To find the best rates, it’s recommended to compare quotes from multiple companies. Some companies you may consider are Allstate, State Farm, and Geico.

How does credit score affect car insurance rates in Fort Worth, TX?

In Fort Worth, TX, your credit score can significantly impact your car insurance rates. However, in some states like California, Hawaii, and Massachusetts, discrimination based on credit is not allowed. You can find the cheapest car insurance rates in Fort Worth, TX, based on your credit score.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.