Best Jeep Commander Car Insurance in 2025 (Check Out the Top 10 Companies)

The top three companies for the best Jeep Commander car insurance are Progressive, State Farm, and Geico with rates for only $40/mo. These providers are known in ensuring your peace of mind through competitive rates, comprehensive coverage, and dependable service for Jeep Commander owners seeking quality service.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Aug 28, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Aug 28, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Jeep Commander

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Jeep Commander

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Jeep Commander

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews

Look for the best Jeep Commander car insurance through our great picks Progressive, State Farm, and Geico for as low as $40 per month for tailored coverage and amazing service.

Some of the factors that influence Jeep Commander rates include the model’s age and safety features, along with your personal driving record.

Our Top 10 Company Picks: Best Jeep Commander Car Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 20% A+ Customizable Plans Progressive

#2 17% B Reliable Service State Farm

#3 25% A++ Affordable Rates Geico

#4 10% A+ Strong Discounts Allstate

#5 15% A++ Military Members USAA

#6 12% A New Drivers Liberty Mutual

#7 14% A+ Bundling Options Nationwide

#8 18% A Customer Service Farmers

#9 15% A Young Drivers American Family

#10 13% A++ Online Tools Travelers

Learn how Jeep Commander insurance rates are determined, including how minimum car insurance requirements by state affect your premiums. Enter your ZIP code now.

- Progressive offers affordable rates and comprehensive coverage

- Costs vary based on the car’s age, the driver’s age, and where they live

- Jeep Commander insurance begins at just $40 a month

#1 – Progressive: Top Overall Pick

Pros

- Competitive Rates for Best Jeep Commander Car Insurance: Progressive offers some of the most competitive rates for Jeep Commander insurance, with premiums starting around $40 per month. The 20% multi-policy discount further reduces costs, making it an appealing option for affordable coverage.

- Comprehensive Coverage Options: Progressive provides customizable plans, ensuring that you can tailor your insurance to fit the specific needs of your Jeep Commander. This flexibility helps you find the best Jeep Commander car insurance that aligns with your preferences. Read more in our review of Progressive car insurance.

- 24/7 Customer Service: Progressive’s round-the-clock customer support is beneficial for managing claims and addressing issues anytime. This level of service contributes to a positive experience with the best Jeep Commander car insurance.

Cons

- Mixed Customer Reviews: Some users report issues with claims processing delays and inconsistent customer service. This variability might affect your experience with the best Jeep Commander car insurance if you encounter service problems.

- Higher Rates for High-Risk Drivers: Drivers with a poor driving history may find that Progressive’s rates are less competitive. This can result in higher premiums, impacting your ability to secure the best Jeep Commander car insurance if you are considered high-risk.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#2 – State Farm: Best for Reliable Service

Pros

- Reliable Service for Best Jeep Commander Car Insurance: State Farm is known for its reliable service and effective claims handling. Despite a lower multi-policy discount of 17%, their A.M. Best rating of B reflects their stability and dependability, making them a solid choice for the best Jeep Commander car insurance.

- Good Discounts: Offers various discounts, including those for safe driving and multiple policies. This helps lower the cost of the best Jeep Commander car insurance, making it more affordable.

- Local Agents: With a vast network of local agents, State Farm provides personalized service and tailored advice, ensuring you get the best Jeep Commander car insurance suited to your needs which you can check out in our State Farm car insurance review.

Cons

- Less Competitive Rates: State Farm’s rates may not be the lowest compared to other providers. This could impact the affordability of the best Jeep Commander car insurance if you do not qualify for discounts.

- Limited Digital Tools: Their online tools and app features are not as advanced as some competitors, which might affect your ability to manage your policy efficiently with the best Jeep Commander car insurance.

#3 – Geico: Best for Affordable Rates

Pros

- Affordable Rates for Best Jeep Commander Car Insurance: Geico is renowned for offering some of the most affordable rates for Jeep Commander insurance, including a 25% multi-policy discount. Their A++ rating from A.M. Best ensures financial stability and reliability.

- User-Friendly Website: Geico’s highly user-friendly website and mobile app make it easy to get quotes and manage your policy online, which is a significant advantage when seeking the best Jeep Commander car insurance.

- Wide Range of Discounts: Offers extensive discounts for factors such as good driving habits and bundling. These discounts help you secure the best Jeep Commander car insurance at a lower overall cost. Find out more in our Geico car insurance review.

Cons

- Customer Service Variability: The quality of customer service can vary, with some reports of less satisfactory experiences with claims and support. This variability might affect your experience with the best Jeep Commander car insurance.

- Limited Coverage Options: Geico may offer fewer optional coverage choices compared to some competitors. This limitation could affect your ability to find the best Jeep Commander car insurance with specialized features.

#4 – Allstate: Best for Strong Discounts

Pros

- Strong Discounts for Best Jeep Commander Car Insurance: Allstate provides substantial discounts, including a 10% multi-policy discount, which can help reduce the cost of the best Jeep Commander car insurance.

- Local Agent Network: Allstate’s extensive network of local agents offers personalized service and customized insurance solutions, enhancing your experience with the best Jeep Commander car insurance. Find out more through our Allstate car insurance review.

- Customizable Coverage: Offers various coverage options and add-ons, allowing you to tailor your policy to fit the specific needs of your Jeep Commander, ensuring you get the best Jeep Commander car insurance.

Cons

- Higher Premiums: Allstate’s rates can be higher compared to some competitors, which might impact the affordability of the best Jeep Commander car insurance if you do not qualify for discounts.

- Mixed Reviews: Customer feedback on claims handling and service consistency is varied, with some reports of issues. This variability could affect your overall satisfaction with the best Jeep Commander car insurance.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#5 – USAA: Best for Military Members

Pros

- Best for Military Members: USAA provides exceptional coverage and service specifically for military personnel and their families. Their A++ rating from A.M. Best reflects their strong financial position, making them an excellent choice for the best Jeep Commander car insurance if you qualify.

- Competitive Rates: USAA offers highly competitive rates, including a 15% multi-policy discount for bundling with other insurance types, making it easier to find the best Jeep Commander car insurance at an affordable price.

- Excellent Customer Service: Highly rated for customer service, USAA offers outstanding support to its members, contributing to a positive experience with the best Jeep Commander car insurance.

Cons

- Eligibility Restrictions: USAA’s coverage is limited to military members, veterans, and their families. This restricts access for non-military individuals who are looking for the best Jeep Commander car insurance.

- Limited Physical Locations: Fewer physical locations and local agents may affect the availability of in-person service, which could impact the convenience of managing your best Jeep Commander car insurance. Find out more through our USAA car insurance review.

#6 – Liberty Mutual: Best for New Drivers

Pros

- New Driver Discounts: Liberty Mutual offers special discounts for new drivers, which can be beneficial for families. Their 12% multi-policy discount further reduces costs, making it a strong option for the best Jeep Commander car insurance.

- Customizable Policies: Provides a high degree of policy customization, allowing you to adjust coverage options for your Jeep Commander. This flexibility helps you secure the best Jeep Commander car insurance tailored to your needs. Read more through our Liberty Mutual insurance review.

- Comprehensive Coverage: Offers various coverage options, including rental car reimbursement, ensuring thorough protection for your Jeep Commander with the best Jeep Commander car insurance.

Cons

- Higher Premiums: Premiums with Liberty Mutual can be higher compared to some competitors, especially if you do not qualify for discounts or have a less-than-perfect driving record. This may affect the affordability of the best Jeep Commander car insurance.

- Inconsistent Customer Service: Customer service experiences can vary, with some reports of slower response times or issues with claims handling, potentially impacting your experience with the best Jeep Commander car insurance.

#7 – Nationwide: Best for Bundling Options

Pros

- Bundling Options for Best Jeep Commander Car Insurance: Nationwide offers significant savings through bundling car insurance with other policies, such as home insurance. Their A+ rating from A.M. Best highlights their financial stability, making them a top choice for the best Jeep Commander car insurance.

- Strong Financial Stability: With an A+ rating, Nationwide’s financial strength ensures reliable coverage and claims handling, contributing to their reputation as a provider of the best Jeep Commander car insurance, which you can learn about in our Nationwide review.

- Excellent Customer Service: Known for good customer service, Nationwide provides responsive support and assistance, enhancing your experience with the best Jeep Commander car insurance.

Cons

- Premiums Can Be Higher: Nationwide’s premiums may be higher compared to some competitors, which could impact the cost-effectiveness of the best Jeep Commander car insurance if you do not qualify for discounts.

- Limited Discounts for High-Risk Drivers: Drivers with a history of accidents or violations may find that Nationwide offers fewer discounts, which can affect the affordability of the best Jeep Commander car insurance.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#8 – Farmers: Best for Customer Service

Pros

- Customer Service Excellence: Farmers is praised for its strong customer service, which is crucial for managing claims and policy details effectively. This reputation for excellent service makes them a solid choice for the best Jeep Commander car insurance.

- Flexible Coverage Options: Provides a wide range of coverage options and customization opportunities, ensuring you can find the best Jeep Commander car insurance that suits your specific needs.

- Local Agent Support: With a network of local agents, Farmers offers personalized service and expert advice, helping you secure the best Jeep Commander car insurance tailored to your requirements. Refer to our comprehensive report titled “Farmers Car Insurance Review.”

Cons

- Higher Premiums for Some Drivers: Premiums with Farmers may be higher for drivers with less-than-perfect records. This can affect the affordability of the best Jeep Commander car insurance if you fall into a higher-risk category.

- Mixed Customer Feedback: While customer service is generally strong, some users report issues with claims processing and overall satisfaction, which might affect your experience with the best Jeep Commander car insurance.

#9 – American Family: Best for Young Drivers

Pros

- Young Driver Discounts: American Family offers discounts specifically for young drivers, which can be beneficial for families with newly licensed drivers. This helps in securing the best Jeep Commander car insurance at a lower rate.

- Competitive Rates: Offers competitive rates with a 15% multi-policy discount, making it easier to find affordable coverage for your Jeep Commander. Learn more through our American Family car insurance review.

- Strong Customer Service: Known for good customer service, American Family ensures that you receive support and assistance when needed, enhancing your experience with the best Jeep Commander car insurance.

Cons

- Higher Rates for Older Vehicles: Premiums may be higher for older Jeep Commander models compared to newer vehicles. This could impact the overall cost-effectiveness of the best Jeep Commander car insurance.

- Regional Variability: The quality of service and coverage options can vary by region, which might affect your experience with the best Jeep Commander car insurance depending on your location.

#10 – Travelers: Best for Online Tools

Pros

- Excellent Online Tools: Travelers provides robust online tools and resources, making it easy to manage your policy and get quotes. This digital convenience is a key feature for finding the best Jeep Commander car insurance.

- Strong Financial Stability: With an A++ rating from A.M. Best, Travelers demonstrates strong financial stability, ensuring reliable coverage and claims handling for the best Jeep Commander car insurance.

- Flexible Coverage Options: Provides a range of coverage options and add-ons, allowing you to tailor your policy to fit your specific needs and secure the best Jeep Commander car insurance. For a comprehensive analysis, refer to our detailed guide titled “Travelers Car Insurance Review.”

Cons

- Higher Premiums for High-Risk Drivers: Travelers may have higher premiums for drivers with poor driving records, impacting the affordability of the best Jeep Commander car insurance for high-risk individuals.

- Limited In-Person Service: Fewer physical locations and local agents might affect the convenience of in-person service, potentially impacting your overall experience with the best Jeep Commander car insurance.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

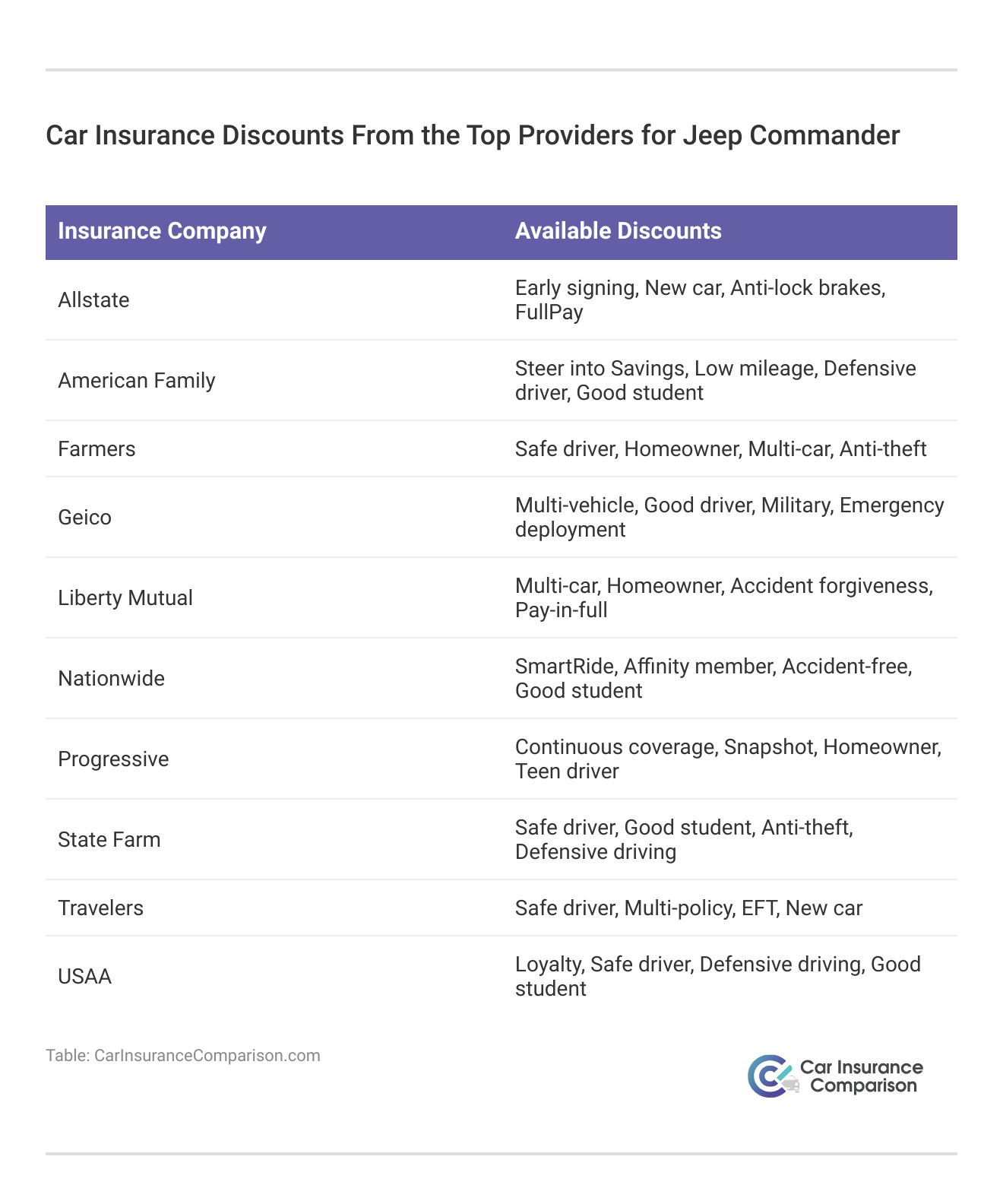

Jeep Commander Car Insurance

When determining how much car insurance to buy for a Jeep Commander, it’s essential to consider several key factors to make an informed decision. First, check if your state mandates a minimum coverage level, which is the least amount of insurance you must carry to drive legally.

Jeep Commander Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $60 $135

American Family $48 $115

Farmers $57 $130

Geico $45 $110

Liberty Mutual $52 $128

Nationwide $59 $122

Progressive $55 $125

State Farm $50 $120

Travelers $53 $126

USAA $40 $100

Understanding what this minimum amount covers is crucial, as it typically includes liability insurance but may not provide comprehensive protection. Additionally, consider whether additional coverage options, such as collision or comprehensive insurance, are available and affordable for you.

Michelle Robbins

Licensed Insurance Agent

These options can offer more extensive protection for your vehicle, especially for a robust and capable SUV like the Jeep Commander.

Once you’re clear on state requirements, take the time to review what your chosen insurance plan actually covers, ensuring it aligns with your needs and the specific risks associated with driving a Jeep Commander.

To ensure you’re making the right choice, consider consulting with the best auto insurance companies, which can provide tailored advice and coverage options to meet your specific needs. Enter your ZIP code now to begin.

Jeep Commander Different Types of Coverage

Frequently Asked Questions

Are Jeep Commander car insurance rates higher than average?

Jeep Commander car insurance rates can vary depending on several factors, including the driver’s profile, location, and insurance provider.

The rates may be influenced by factors such as the vehicle’s safety features, repair costs, and historical data on claims for the Jeep Commander.

To determine if the rates are higher or lower than average, it is recommended to compare quotes from multiple insurance providers.

Can I get insurance for a used Jeep Commander?

Yes, insurance is available for used Jeep Commanders. The insurance coverage options and rates may vary based on factors such as the vehicle’s age, condition, mileage, and any modifications.

When obtaining insurance for a used Jeep Commander, it’s essential to provide accurate information about the vehicle’s current condition and any changes made to it since its original purchase. Enter your ZIP code now to begin.

Which insurance provider offers the highest multi-policy discount for Jeep Commander coverage?

How does Geico’s A++ rating impact its reliability for Jeep Commander car insurance?

Geico’s A++ rating from A.M. Best indicates exceptional financial stability, ensuring reliable coverage and claims handling for Jeep Commander insurance. This high rating contributes to Geico’s reputation as a dependable choice for comprehensive car insurance.

What makes Progressive a strong option for customizable Jeep Commander insurance plans?

Progressive is known for offering highly customizable insurance plans, allowing Jeep Commander owners to tailor coverage to their specific needs.

This flexibility makes Progressive a strong choice for those seeking personalized insurance solutions. Enter your ZIP code now to begin.

How does State Farm’s discount structure benefit Jeep Commander owners?

State Farm provides a 17% multi-policy discount, which can lower the cost of Jeep Commander insurance for those who bundle multiple policies. This discount structure helps make State Farm a cost-effective option for comprehensive and full coverage car insurance.

What specific advantage does USAA offer for military members seeking Jeep Commander insurance?

USAA offers specialized coverage and competitive rates for military members, which can be highly beneficial for those insuring a Jeep Commander. The company’s focus on military families ensures tailored support and understanding of unique needs.

How does Liberty Mutual support new drivers with its Jeep Commander insurance policies?

Liberty Mutual provides tailored insurance options and discounts for new drivers, which can help reduce premiums for those insuring a Jeep Commander.

This focus on new drivers makes Liberty Mutual an appealing choice for younger or newly licensed individuals. nter your ZIP code now to begin.

What are the key factors contributing to Nationwide’s reputation for bundling options with Jeep Commander coverage?

Why might Farmers’ customer service be considered a significant pro for Jeep Commander insurance?

Farmers is noted for its strong customer service and personalized support through a network of local agents, which enhances the overall experience for Jeep Commander owners.

This level of service helps ensure that policyholders receive attentive and effective assistance.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.