Best Olathe, KS Car Insurance in 2025

The cheapest Olathe, KS car insurance is offered by American Family, although rates will vary by driver. Auto insurance in Olathe must meet the state minimum requirements of 25/50/25 in liability coverage, 25/50 in uninsured-underinsured motorist coverage, and $4,500 in personal injury protection. These limits are low, and drivers should consider increasing their limits and adding additional coverage to save on out pocket Olathe car insurance costs.

Read moreFree Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michael Vereecke

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Commercial Lines Coverage Specialist

UPDATED: Nov 4, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 4, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- American Family offers the cheapest car insurance to all drivers in Olathe, KS

- Olathe, KS is part of the larger Kansas City, MO metropolitan area

- Car insurance rates in Olathe are below average

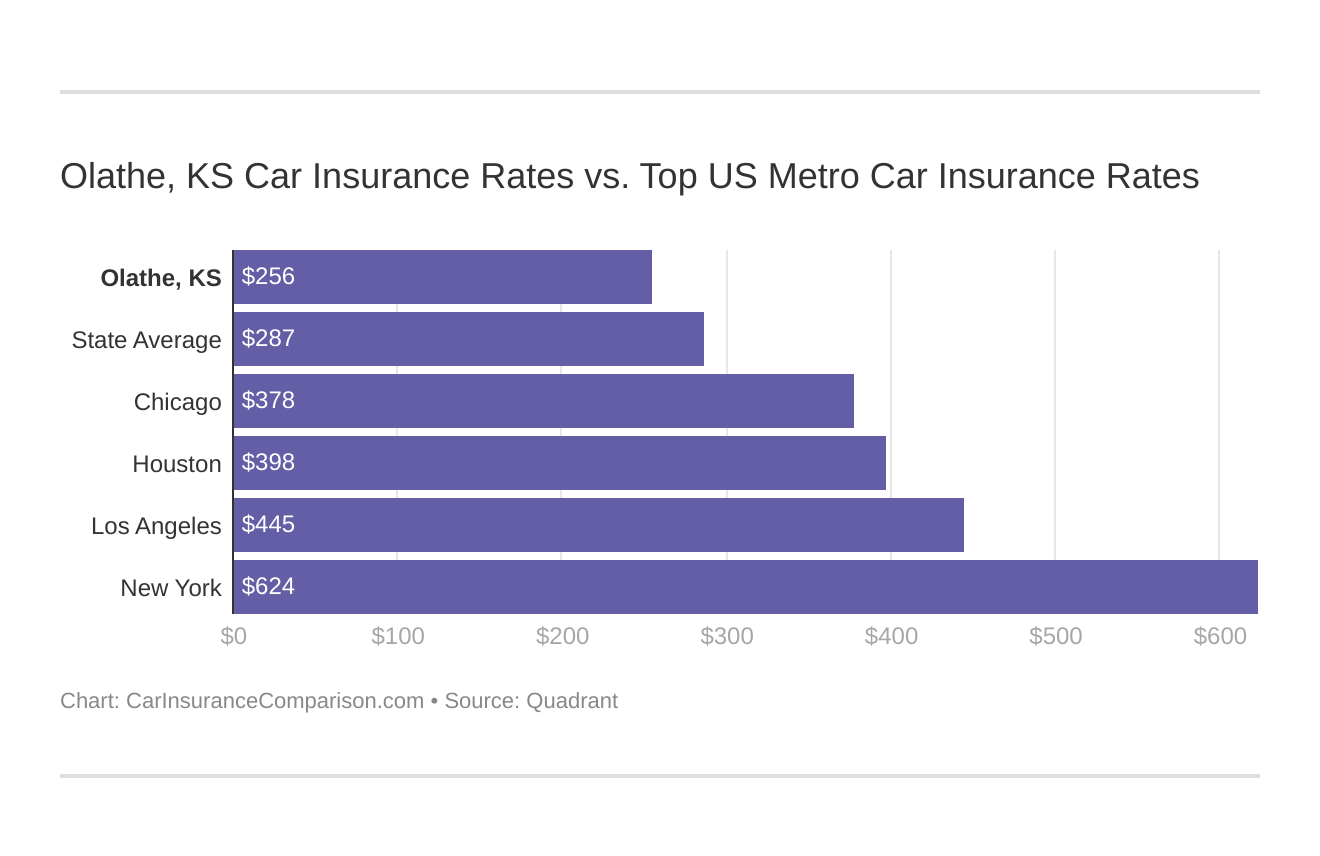

Olathe, KS car insurance costs are fairly low. Although average Kansas car insurance rates are more expensive than the national average, Olathe rates are less than both the state and national averages.

Even though average rates are low, you still want to find the most affordable Olathe, KS car insurance out there. Compare rates from multiple companies to find cheap car insurance for you.

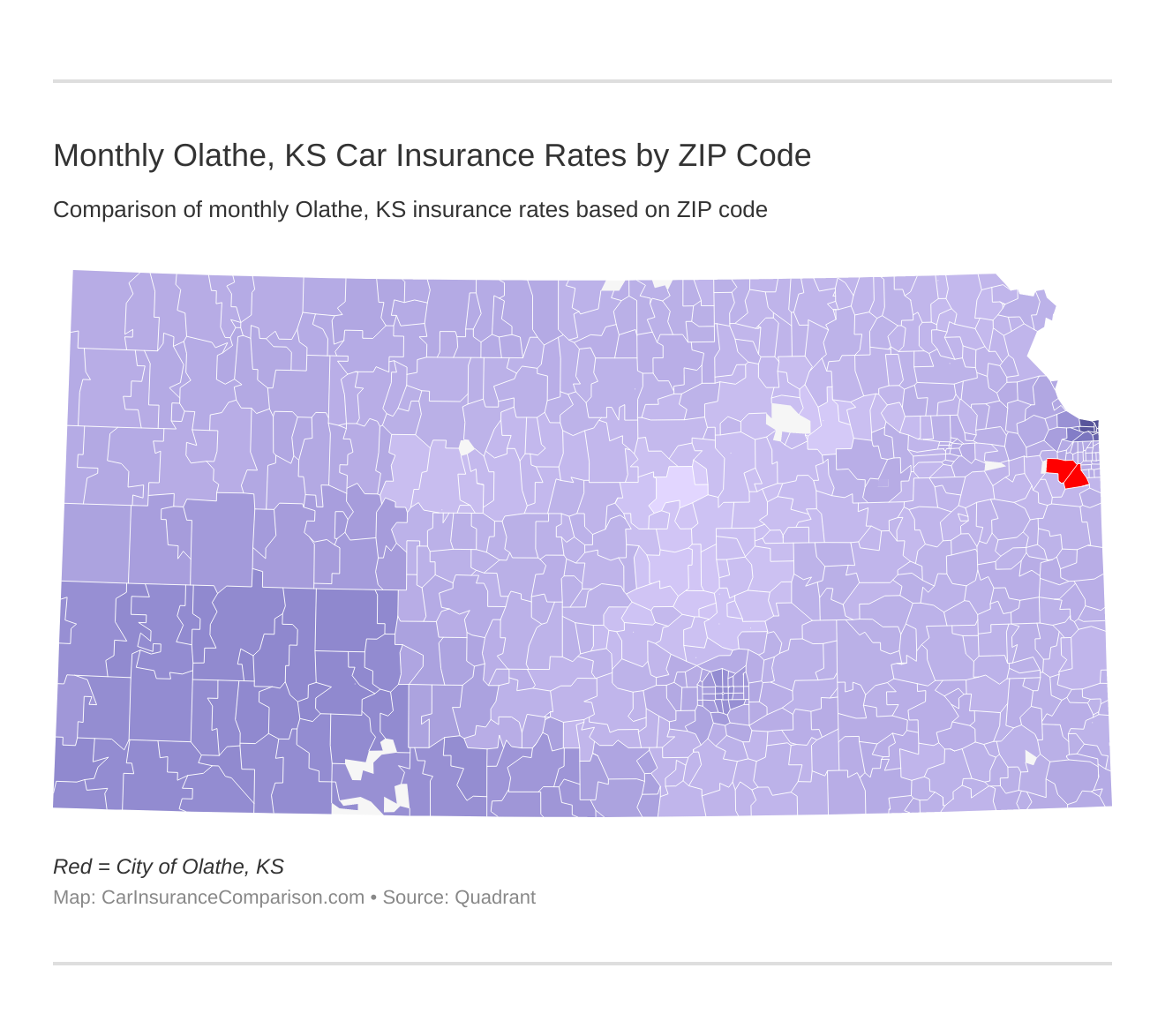

Monthly Olathe, KS Car Insurance Rates by ZIP Code

ZIP codes will play a major role in your car insurance rates because factors like crime and traffic are calculated by ZIP code. Check out the monthly Olathe, Kansas auto insurance rates by ZIP Code below:

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Olathe, KS Car Insurance Rates vs. Top US Metro Car Insurance Rates

You might find yourself asking how does my Olathe, Kansas stack up against other top US metro areas’ auto insurance rates? We’ve got your answer below.

Enter your ZIP code now to compare free Olathe, KS car insurance quotes today.

What is the cheapest car insurance company in Olathe, KS?

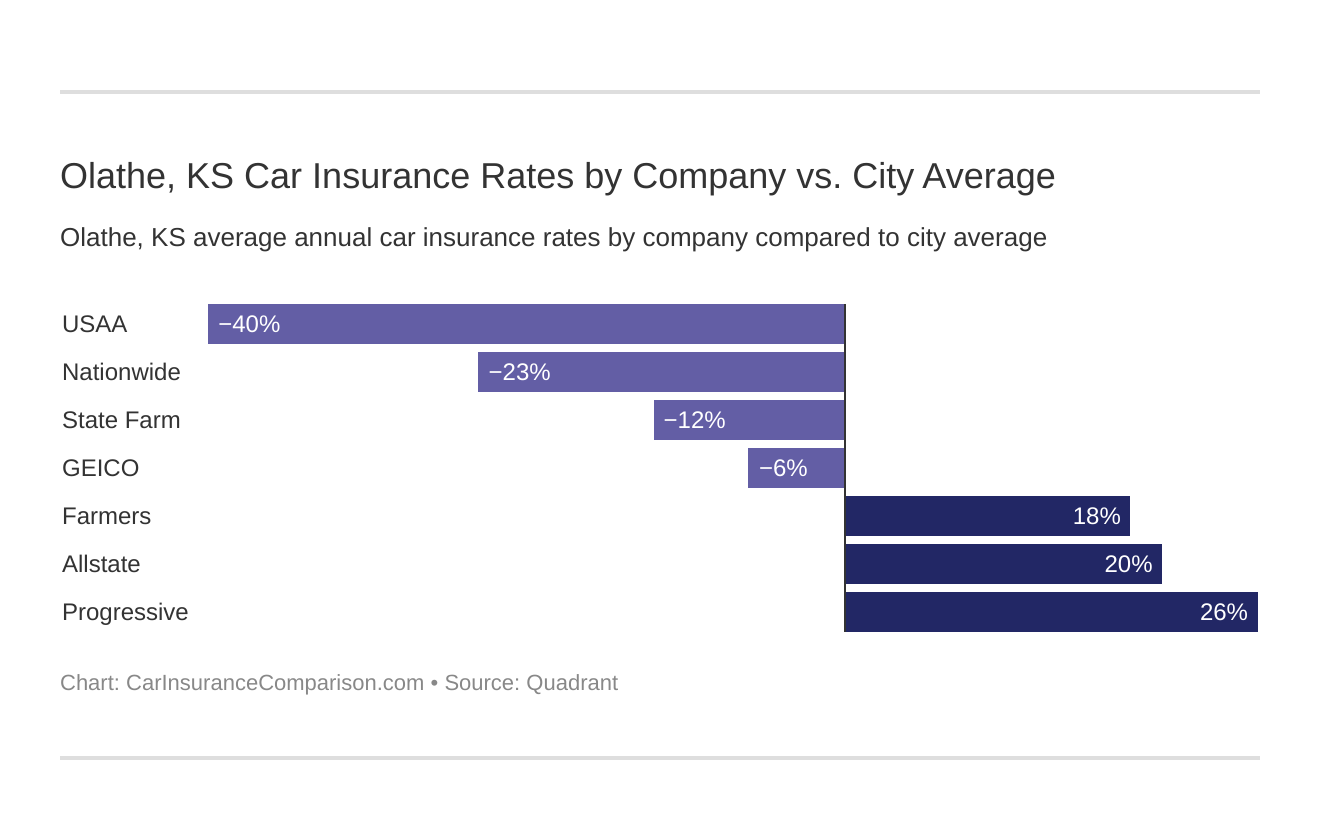

Although USAA actually offers the cheapest car insurance in Olathe, it only offers coverage to the military, veterans, and their families. American Family is the cheapest company that offers coverage to all Olathe drivers.

Which Olathe, KS car insurance company has the best rates? And how do those rates compare against the average Kansas car insurance company rates? We’ve got the answers below.

The top car insurance companies in Olathe, KS listed from least to most expensive are:

- USAA car insurance – $2,038.20

- American Family car insurance – $2,111.54

- Nationwide car insurance – $2,439.86

- State Farm car insurance – $2,725.68

- Geico car insurance – $2,896.90

- Farmers car insurance – $3,661.61

- Allstate car insurance – $3,735.92

- Progressive car insurance – $3,980.76

- Travelers car insurance – $4,113.05

- Liberty Mutual car insurance – $4,654.82

Read more: Liberty Mutual vs. Travelers Car Insurance Comparison

There are many different factors that affect car insurance rates, including your age, driving record, and credit history. Even the Olathe, KS weather can raise your rates since rain and snow can lead to more accidents.

Where you live can also impact your auto insurance rates. Drivers who live in larger cities with higher crime and traffic rates will pay more. For example, Wichita car insurance is more expensive than coverage in Olathe.

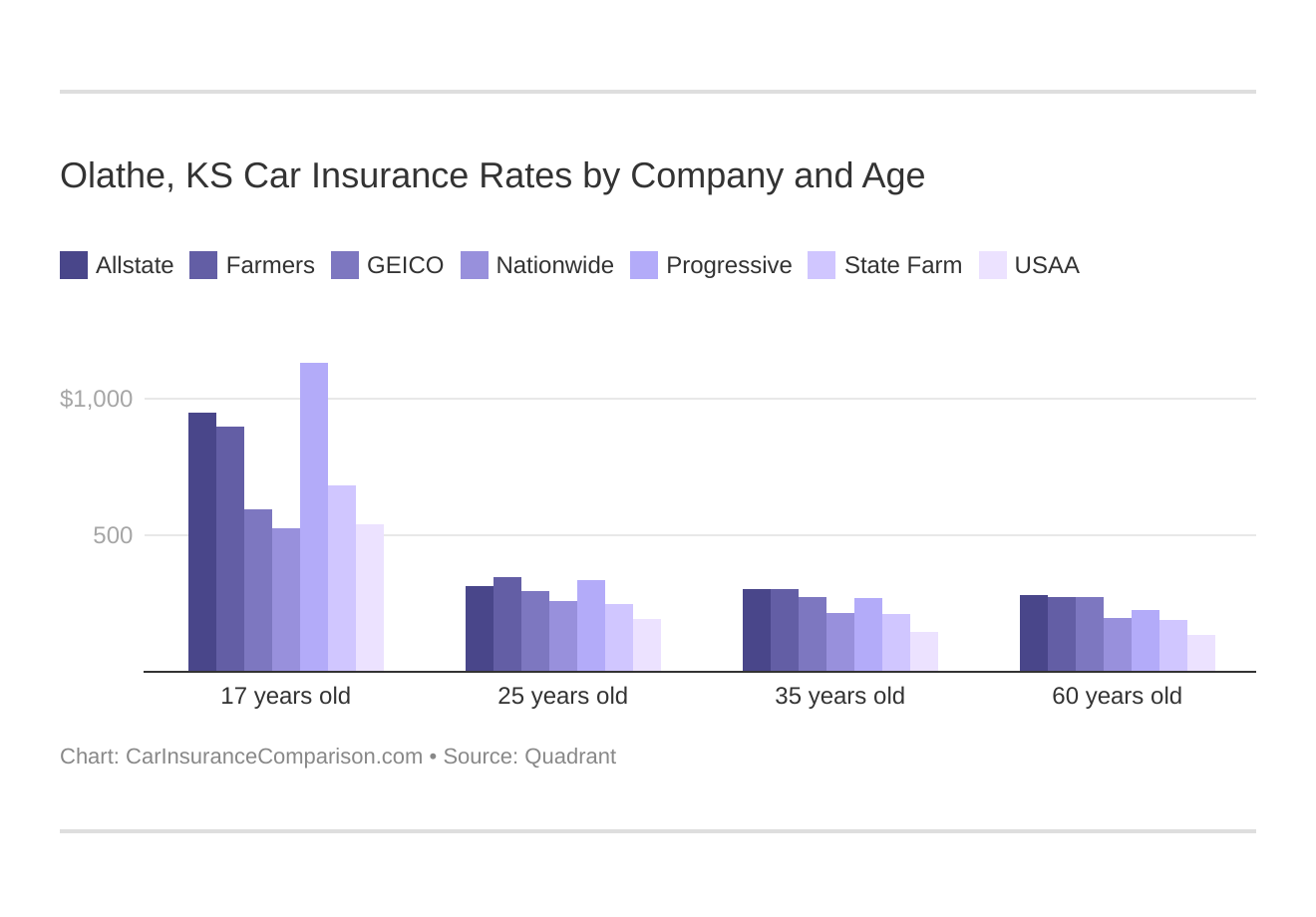

Olathe, KS car insurance rates by age is an essential comparison because the top car insurance company for one age group may not be the best company for another age group.

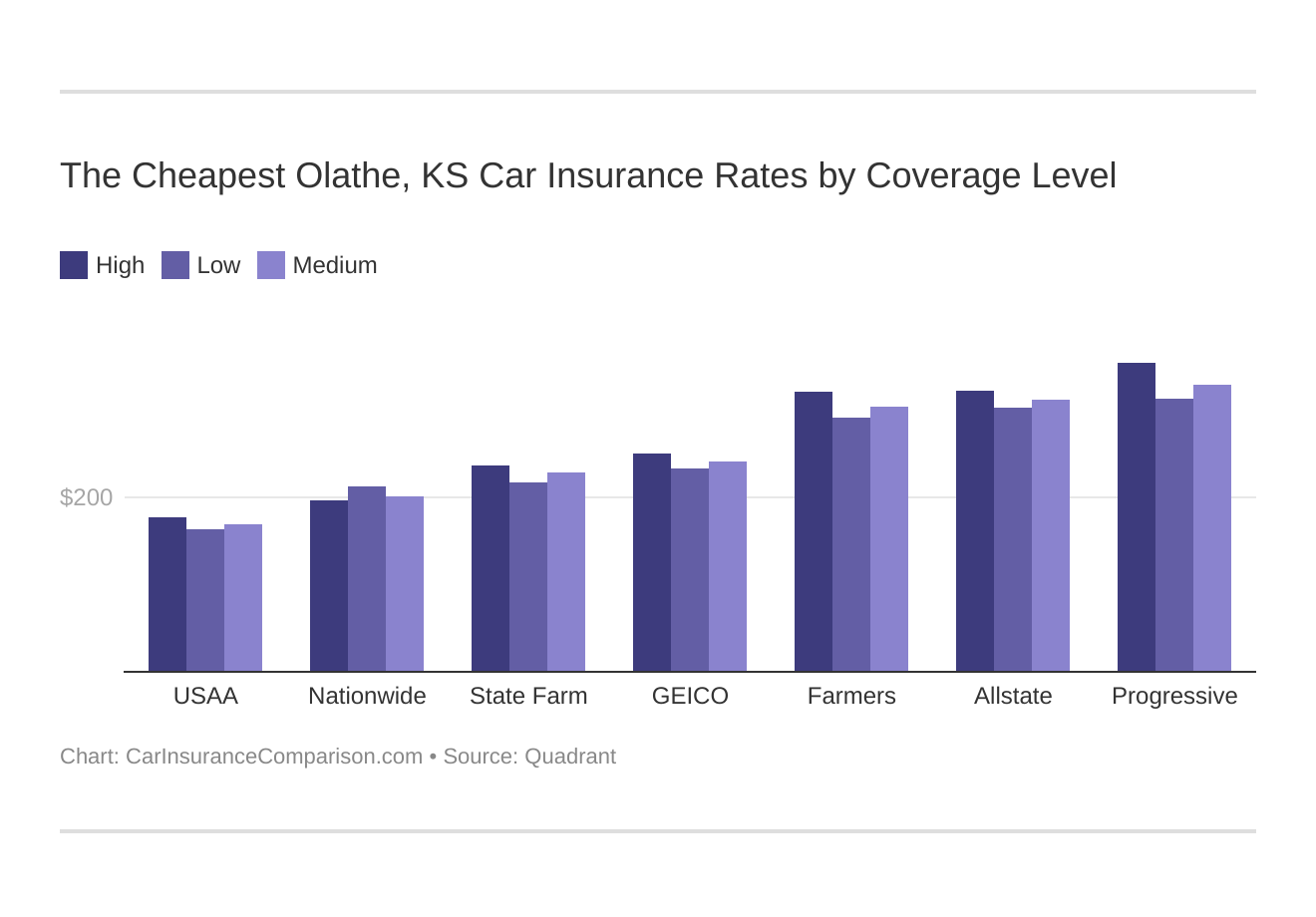

Your coverage level will play a major role in your Olathe car insurance rates. Find the cheapest Olathe, KS car insurance rates by coverage level below:

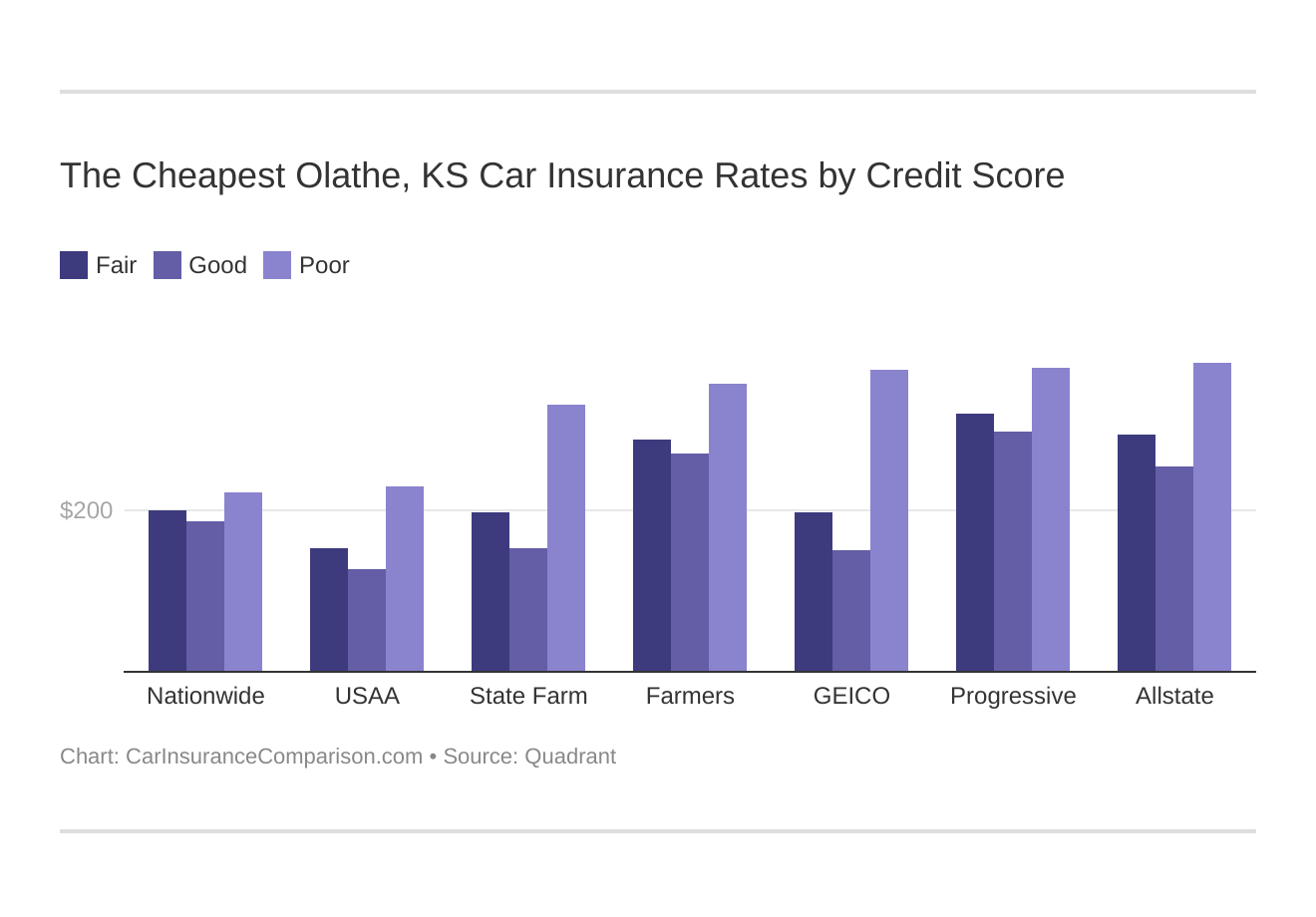

Your credit score will play a significant role in your Olathe car insurance rates unless you live in these states where discrimination based on credit is not allowed: California, Hawaii, and Massachusetts. You may be able to get a good credit discount. Find the cheapest Olathe, KS car insurance rates by credit score below.

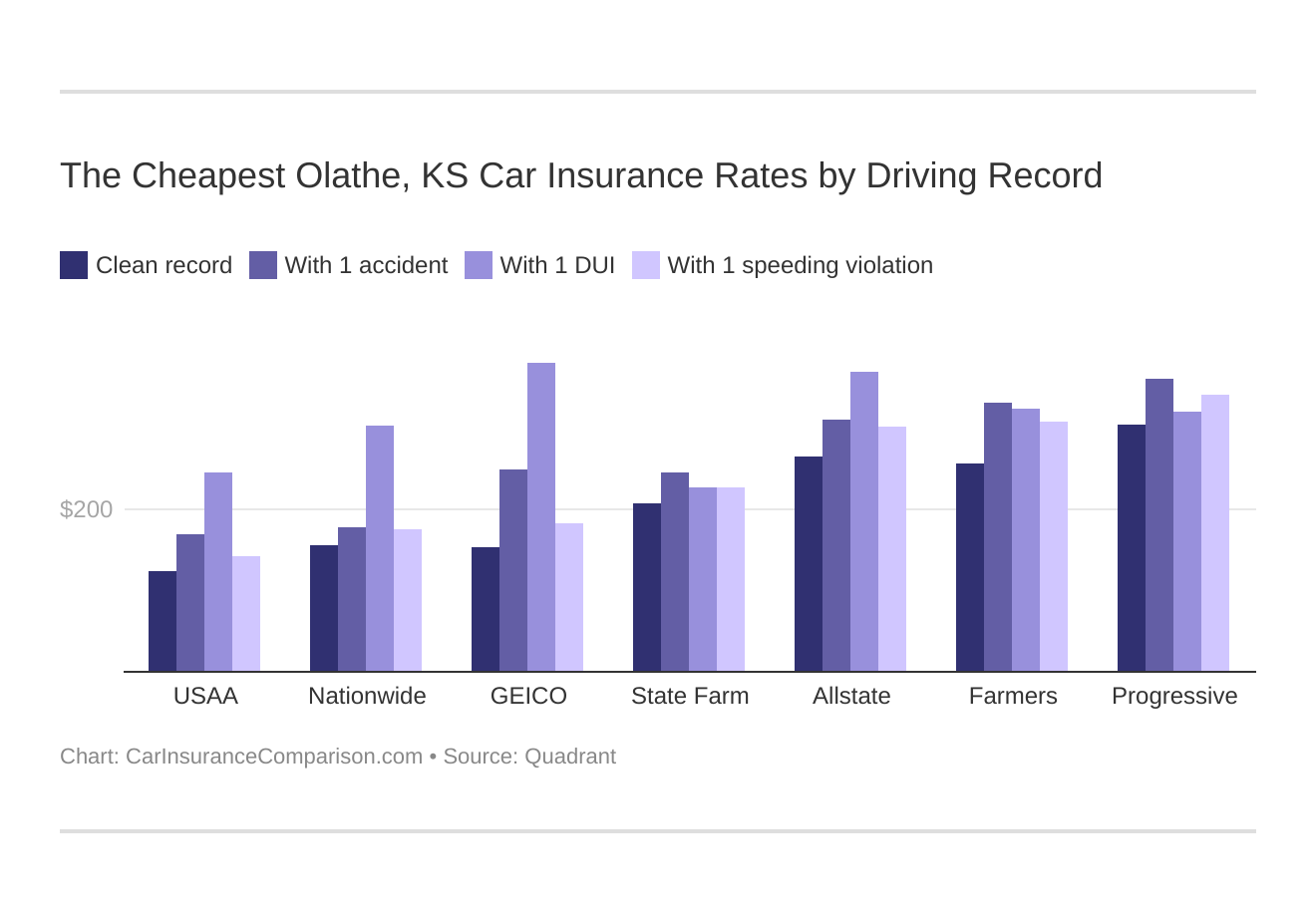

Your driving record will play a major role in your Olathe car insurance rates. For example, other factors aside, a Olathe, KS DUI may increase your car insurance rates 40 to 50 percent. Find the cheapest Olathe, KS car insurance with a bad driving record.

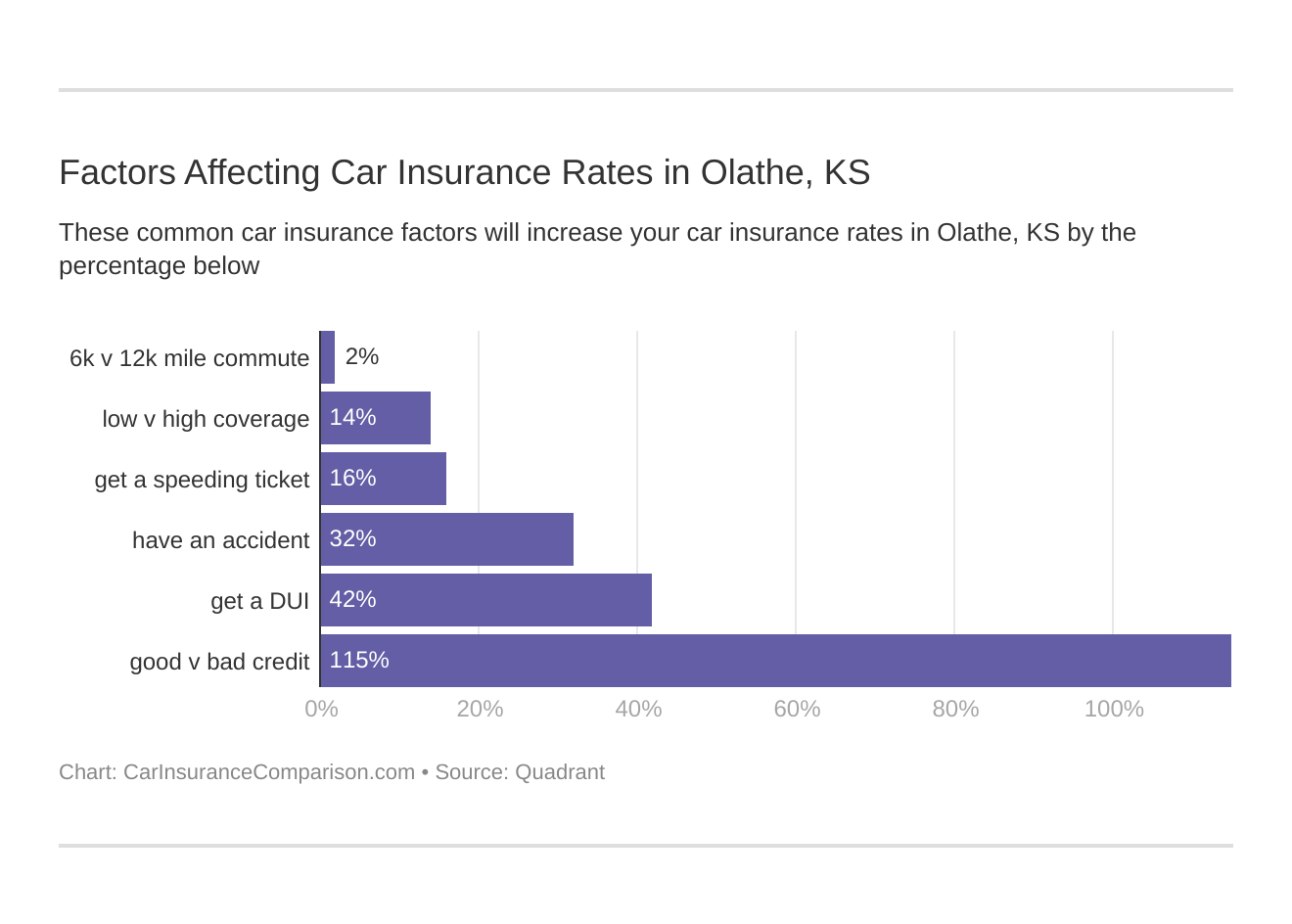

Factors affecting car insurance rates in Olathe, KS may include your commute, coverage level, tickets, DUIs, and credit. Controlling these factors will help you maintain cheap Olathe, Kansas car insurance.

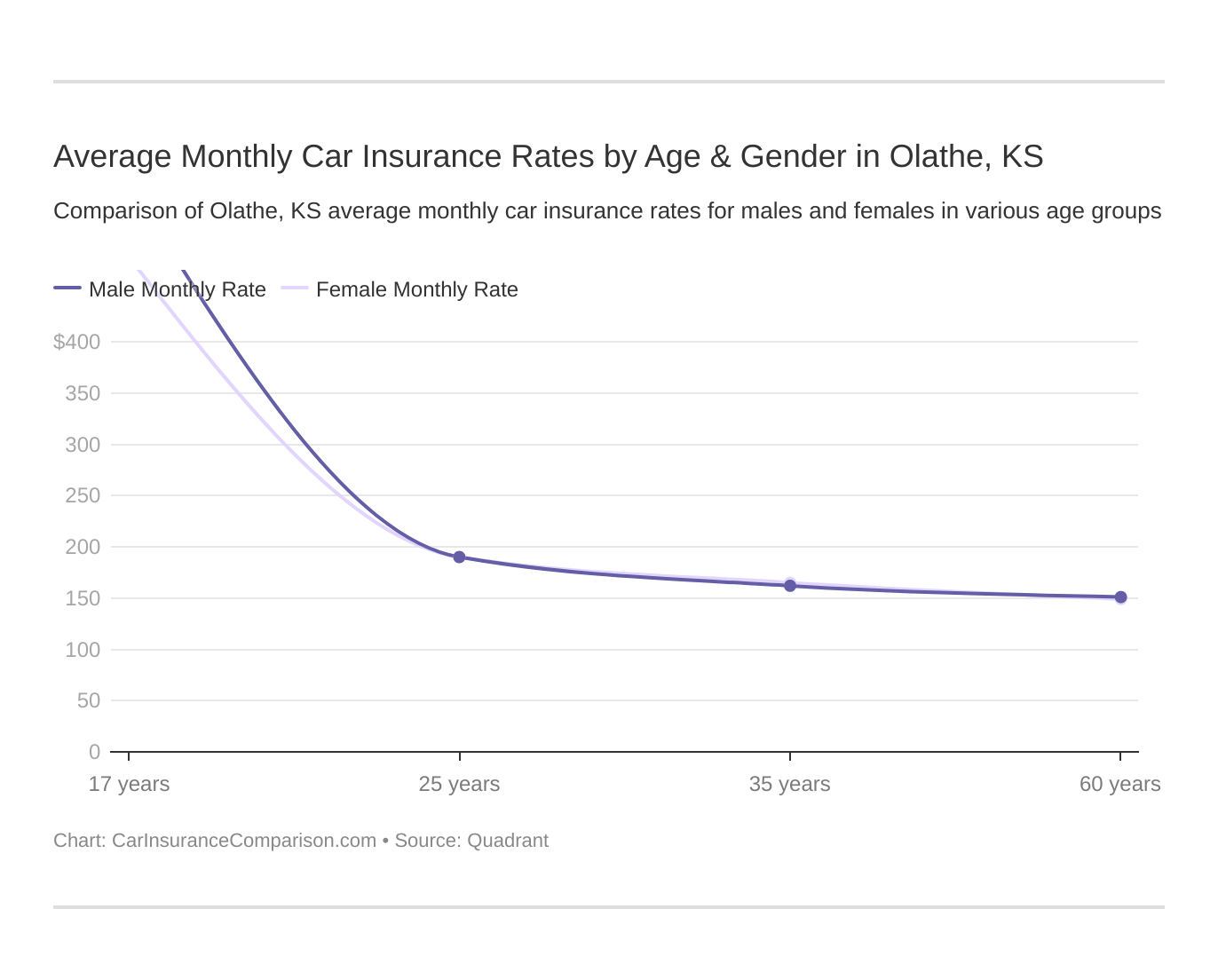

These states are no longer using gender to calculate your car insurance rates — Hawaii, Massachusetts, Michigan, Montana, North Carolina, and Pennsylvania. But age is still a major factor because young drivers are often considered high-risk. Therefore, teen car insurance is more expensive. KS does use gender, so check out the average monthly car insurance rates by age and gender in Olathe, KS.

What car insurance coverage is required in Olathe, KS?

Most states, including Kansas, require drivers to carry at least a minimum amount of liability car insurance coverage. Drivers in Olathe must carry:

- $25,000 per person and $50,000 per incident for bodily injury liability

- $25,000 per incident for property damage

- $4,500 in personal injury protection (PIP) coverage

- $25,000 per person and $50,000 per incident for uninsured/underinsured motorist coverage

Kansas is a no-fault state, meaning that your car insurance will pay for damages and injuries no matter who caused the accident. This is why PIP coverage is required.

It’s easy to see that the minimum required coverage in Olathe will be exhausted quickly in a serious accident. Drivers should consider increasing limits and adding additional coverages such as comprehensive car insurance and collision car insurance to be fully insured.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

What affects car insurance rates in Olathe, KS?

Traffic can cause your car insurance rates to go up. More traffic equals a higher chance of being in an accident.

INRIX doesn’t have data for Olathe, but it does list nearby Kansas City, MO as the 86th most congested city in the U.S.

City-Data reports that most drivers in Olathe, KS commute around 20 minutes.

Theft can also drive your auto insurance rates up. According to the FBI, there were 152 motor vehicle thefts in Olathe in one year.

Olathe, KS Car Insurance: The Bottom Line

Rates in the city are pretty low but shop around before you buy Olathe, KS car insurance. Each company will charge different rates, and comparison shopping will help you find the best coverage at the cheapest rate.

Enter your ZIP code to compare Olathe, KS car insurance rates from multiple companies for free today.

Frequently Asked Questions

What information do I need to provide when comparing car insurance rates in Olathe, KS?

When comparing car insurance rates in Olathe, KS, you will typically need to provide the following information:

- Personal details: Name, age, gender, and address.

- Vehicle information: Make, model, year, and vehicle identification number (VIN).

- Driving history: Details about any accidents, violations, or claims you have had in the past.

- Desired coverage: The types of coverage you need, such as liability, collision, comprehensive, and any specific coverage limits or deductibles.

Are there any specific considerations for Olathe, KS that may affect car insurance rates in 2023?

Yes, there are specific considerations for Olathe, KS that may impact car insurance rates in 2023. Some factors to consider include:

- Local weather conditions: Olathe experiences a range of weather conditions throughout the year, including severe storms. Insurers may take this into account when determining rates.

- Traffic congestion: If Olathe has high traffic congestion levels or accident rates, it can influence insurance premiums.

- Vehicle theft rates: The rate of vehicle thefts in Olathe may affect comprehensive coverage rates, especially if your car is more susceptible to theft.

Local regulations: Stay informed about any recent changes to local laws or regulations that could impact car insurance rates or requirements.

Can I customize my car insurance coverage in Olathe, KS?

Yes, you can often customize your car insurance coverage in Olathe, KS to suit your needs. Most insurance companies offer various coverage options that you can choose from, such as liability, collision, comprehensive, uninsured/underinsured motorist, and more. You can also adjust coverage limits and deductibles based on your preferences and budget. Discuss your specific requirements with insurance providers to create a policy that meets your needs.

Can my credit score affect car insurance rates in Olathe, KS?

Yes, in some states, including Kansas, insurance companies may consider credit history when determining car insurance rates. Your credit score can be a factor in assessing your level of risk as a policyholder. Insurers believe that individuals with better credit scores are more likely to be responsible and file fewer claims. It’s a good idea to maintain good credit to potentially secure better car insurance rates. However, each insurance company may have its own policies regarding credit scores, so it’s advisable to inquire with specific insurers for more accurate information.

How often should I review my car insurance rates in Olathe, Kansas?

It’s recommended to review your car insurance rates in Olathe, Kansas, annually or when significant life events occur, such as buying a new car, moving to a new address, or experiencing changes in your driving patterns or insurance needs. Regular reviews ensure you have the most appropriate coverage at the best available rates.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Michael Vereecke

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Commercial Lines Coverage Specialist

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.