Best Car Insurance for Pharmacists in 2025 (Top 10 Companies)

The three leading providers for the best car insurance for pharmacists, including Progressive, State Farm, and Allstate, are showcased, with Progressive leading with a minimum coverage rate of $33. These companies offer competitive options, ensuring pharmacists have a range of choices tailored to their needs.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

UPDATED: Feb 12, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 12, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Pharmacist

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Pharmacist

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for Pharmacist

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews

As pharmacists navigate the roads, they require insurance that not only offers competitive rates but also understands their profession’s unique demands.

Our Top 10 Company Picks: Best Car Insurance for Pharmacists

| Company | Rank | Pharmacist Discount | Multi-Vehicle Discount | Best for | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 15% | 17% | Bundle Discounts | Progressive | |

| #2 | 12% | 15% | Customizable Policies | State Farm | |

| #3 | 10% | 18% | Big Discounts | Allstate | |

| #4 | 8% | 14% | Policy Options | Liberty Mutual |

| #5 | 9% | 16% | Accident Forgiveness | Farmers | |

| #6 | 11% | 15% | Online Convenience | Esurance | |

| #7 | 7% | 18% | Add-on Coverages | Safeco | |

| #8 | 6% | 13% | Customizable Coverage | Travelers | |

| #9 | 8% | 14% | Quick Claims | American Family | |

| #10 | 10% | 15% | Personalized Service | Safe Auto |

The professional liability insurance policy will protect you from the financial burden of having to pay for damages arising from an accident by yourself.

Delve into our analysis to uncover how these top providers cater to pharmacists’ needs and provide the best value in car insurance coverage. If you are a pharmacist in need of better auto insurance coverage, start comparing rates by entering your ZIP code above.

#1 – Progressive: Top Overall Pick

Pros

- Bundle Discounts: Progressive offers significant discounts for pharmacists, with up to 15% off on car insurance. Additionally, their multi-vehicle discount of up to 17% makes it an attractive option for those insuring multiple vehicles.

- Customizable Policies: Progressive allows for personalized coverage, giving pharmacists the flexibility to tailor their policies according to their specific needs and preferences.

- Online Convenience: Progressive provides a user-friendly online platform, making it convenient for pharmacists to manage their policies and claims efficiently.

Cons

- Pharmacist Discount Limit: In a Progressive car insurance review, it was observed that although Progressive provides a respectable 15% discount for pharmacists, some competitors may offer higher discounts.

- Coverage Limitations: Some pharmacists might find coverage options limited compared to other providers when they compare insurance rates, despite customizable policies.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#2 – State Farm: Best for Customizable Policies

Pros

- Customizable Policies: In a State Farm car insurance review, State Farm’s customizable policies enable pharmacists to tailor coverage to their needs.

- Multi-Vehicle Discount: State Farm provides a substantial multi-vehicle discount of up to 15%, making it an attractive choice for families or individuals with multiple cars.

- Reputation for Customer Service: State Farm is known for its excellent customer service, ensuring that pharmacists receive the support they need.

Cons

- Pharmacist Discount Limit: While State Farm offers a competitive discount, it may not be as high as some other companies on the list.

- Policy Options: State Farm’s insurance pharmacist options may be less diverse than other providers despite offering customizable policies.

#3 – Allstate: Best for Big Discounts

Pros

- Big Discounts: Allstate provides pharmacists with a substantial discount of up to 10%, making it an attractive option for those looking for significant savings.

- Multi-Vehicle Discount: Offering up to 18% off for insuring multiple vehicles, Allstate is a strong contender for families or individuals with more than one car.

- Wide Range of Coverage Options: Allstate stands out with its diverse policy options, allowing pharmacists to choose coverage that aligns with their unique needs.

Cons

- Pharmacist Discount Limit: In an Allstate car insurance review, the discount, while notable, may not match some competitors’.

- Claim Handling Time: Some customers have reported concerns about the time it takes for Allstate to process and settle claims, potentially causing inconvenience for pharmacists in need of quick resolutions.

#4 – Liberty Mutual: Best for Policy Options

Pros

- Policy Options: Liberty Mutual offers a diverse range of policy options, allowing pharmacists to tailor their coverage to meet specific needs.

- Multi-Vehicle Discount: With a multi-vehicle discount of up to 14%, Liberty Mutual provides additional savings for pharmacists insuring multiple cars.

- Solid Pharmacist Discount: While not the highest, an 8% discount is still a decent saving for pharmacists on their car insurance premiums.

Cons

- Pharmacist Discount Limit: In a Liberty Mutual car insurance review, the pharmacist discount is relatively moderate compared to other providers.

- Claim Handling: Some customers have reported mixed experiences with Liberty Mutual’s claim handling, with concerns about the time it takes to process claims.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#5 – Farmers: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Farmers stands out with its accident forgiveness feature, providing pharmacists with peace of mind by not increasing rates after their first at-fault accident.

- Multi-Vehicle Discount: Farmers offers a competitive multi-vehicle discount of up to 16%, making it an appealing option for those with multiple cars.

- Decent Pharmacist Discount: In a Farmers Car Insurance Review, a pharmacist discount of up to 9% is offered, resulting in significant savings on car insurance premiums.

Cons

- Coverage Limitations: Some pharmacists might find that Farmers’ coverage options are not as extensive as those offered by other providers.

- Online Interface: While Farmers has an online presence, the user interface may not be as intuitive or convenient as some competitors.

#6 – Esurance: Best for Online Convenience

Pros

- Online Convenience: Esurance is known for its online convenience, providing pharmacists with an easy-to-use platform for managing policies and claims.

- Pharmacist Discount: Offering an 11% discount for pharmacists, Esurance provides a higher savings opportunity compared to several other providers.

- Multi-Vehicle Discount: With a multi-vehicle discount of up to 15%, Esurance is an attractive option for those with more than one vehicle.

Cons

- Limited Agent Interaction: Esurance’s focus on online services might be a drawback for pharmacists who prefer more personalized interactions with insurance agents.

- Claim Handling: In an Esurance vs. Allstate, some customers express concerns about claim processing times, causing delays.

#7 – Safeco: Best for Add-on Coverages

Pros

- Add-on Coverages: Safeco excels in providing a variety of add-on coverages, allowing pharmacists to enhance their policies with additional protections as needed.

- High Multi-Vehicle Discount: With a multi-vehicle discount of up to 18%, Safeco offers one of the highest savings for pharmacists insuring multiple vehicles.

- Decent Pharmacist Discount: While not the highest, a 7% discount is still a respectable saving for pharmacists on their car insurance premiums.

Cons

- Pharmacist Discount Limit: In a Safeco car insurance review, the pharmacist discount is moderately competitive.

- Online Interface: Safeco’s online interface may not be as user-friendly or feature-rich as some other providers, which might be a drawback for those who prefer online management.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#8 – Travelers: Best for Customizable Coverage

Pros

- Customizable Coverage: Travelers is known for its customizable coverage options, allowing pharmacists to tailor their policies to match their specific needs and preferences.

- Pharmacist Discount: While modest, a 6% discount can still contribute to savings on car insurance premiums for pharmacists.

- Multi-Vehicle Discount: Travelers provides a multi-vehicle discount of up to 13%, offering additional savings for pharmacists with more than one car.

Cons

- Pharmacist Discount Limit: In a Travelers car insurance review, the pharmacist discount is lower than some competitors on the list.

- Claim Handling: Some customers have reported mixed experiences with Travelers’ claim handling, with concerns about delays and communication.

#9 – American Family: Best for Quick Claims

Pros

- Quick Claims: American Family stands out with its emphasis on quick claims processing, ensuring that pharmacists experience efficient and prompt service during the claims process.

- Pharmacist Discount: With an 8% discount, American Family provides pharmacists with a decent opportunity to save on car insurance premiums.

- Multi-Vehicle Discount: Offering up to 14% off for insuring multiple vehicles, American Family is a solid choice for families or individuals with more than one car.

Cons

- Pharmacist Discount Limit: In an American Family car insurance review, the discount offered may not match some competitors.

- Coverage Options: Some pharmacists might find that American Family’s coverage options are not as extensive or diverse as those offered by other providers.

#10 – Safe Auto: Best for Personalized Service

Pros

- Personalized Service: Safe Auto emphasizes personalized service, providing pharmacists with a more individualized and attentive approach to their insurance needs.

- Higher Pharmacist Discount: With a 10% discount, Safe Auto offers pharmacists a relatively higher savings opportunity compared to some competitors.

- Multi-Vehicle Discount: In the American Family vs. Safe Auto car insurance comparison, Safe Auto offers a multi-vehicle discount of up to 15%, making it an attractive option for individuals who own multiple vehicles.

Cons

- Pharmacist Discount Limit: While higher than some, the pharmacist discount might still be lower than what is offered by certain competitors.

- Limited Coverage Options: Safe Auto may not offer as many coverage options as some other providers, potentially limiting the choices available to pharmacists.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

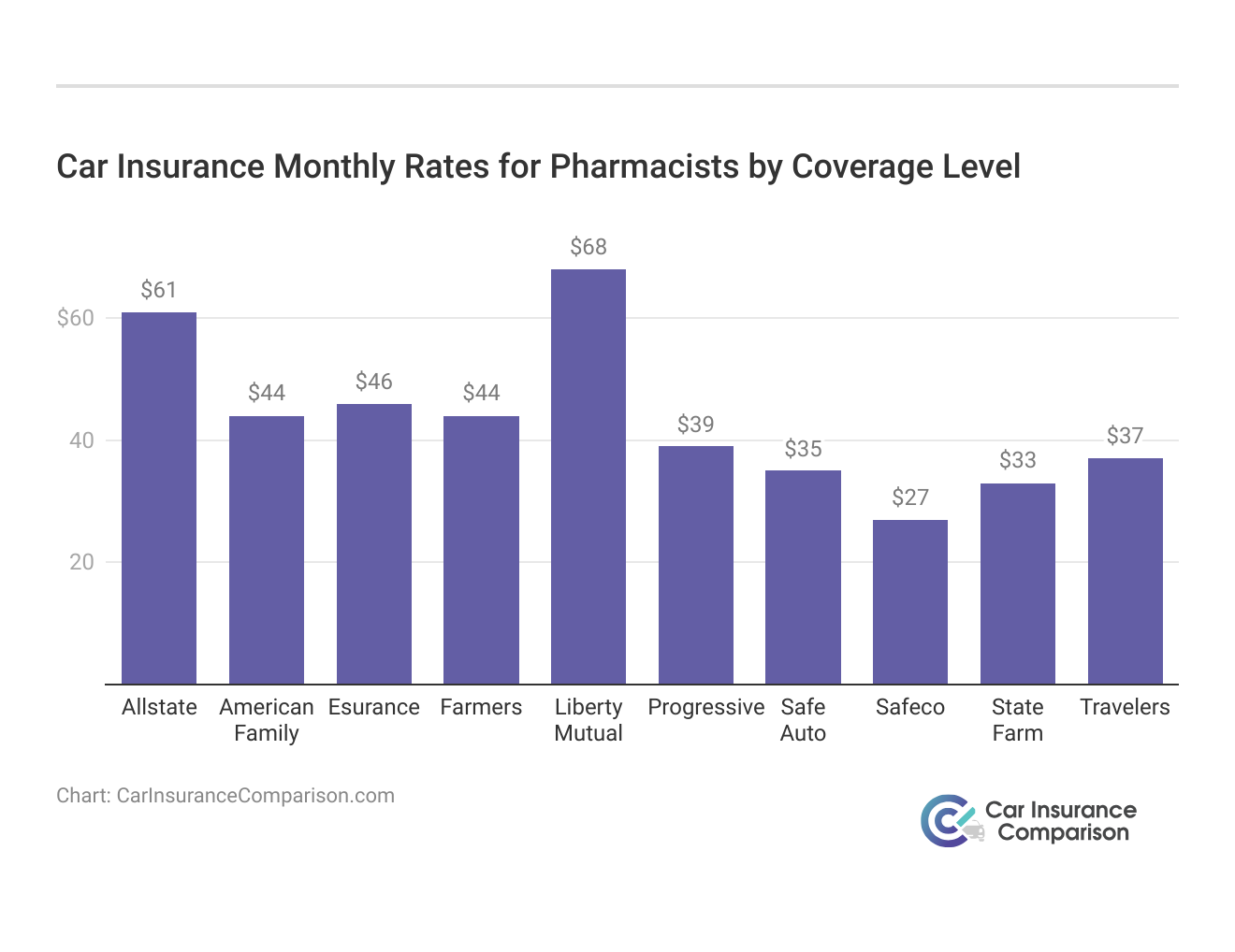

Comparative Analysis: Average Monthly Car Insurance Rates for Pharmacists by Coverage Type

The table presents a comparative analysis of the average monthly car insurance rates for pharmacists across various insurance companies, considering both full coverage and minimum coverage options.

Pharmacists Car Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $61 | $160 | |

| $44 | $117 | |

| $46 | $114 | |

| $44 | $139 | |

| $68 | $174 |

| $39 | $105 | |

| $35 | $93 |

| $27 | $71 | |

| $33 | $86 | |

| $37 | $99 |

For pharmacist liability insurance cost, Safeco offers comprehensive coverage at $71 per month, while Liberty Mutual’s rate is $174. For minimal coverage, Safeco’s rate is $27, and Liberty Mutual’s is $68.”

Progressive stands out as the best choice for pharmacists, offering tailored coverage, bundle discounts, and a competitive monthly rate of $105 for basic coverage and $39 for comprehensive.

Dani Best Licensed Insurance Producer

State Farm provides competitive rates for auto insurance for pharmacists and best liability insurance for pharmacists, making it a top choice. It underscores the need to consider factors like budget and coverage preferences when selecting an insurance provider.

As pharmacists evaluate their insurance options, this detailed breakdown facilitates informed decision-making based on their specific needs and financial considerations.

Auto Insurance Discounts Available To Pharmacists

Discover tailored options from top providers like Progressive, State Farm, and Allstate to meet pharmacists’ unique needs. Prioritize both protection and affordability with our comparison of Healthcare Worker Car Insurance Rates. Explore how these choices can help pharmacists find the ideal coverage for their journeys.

Membership to Professional Organizations

In the eyes of the insurer, the level of education one requires to become a pharmacist is a strong indicator of integrity and personal responsibility. Therefore, pharmacy as a profession qualifies you for an auto insurance discounts.

Additionally, when you become a member of the American Pharmacists Association, you automatically qualify for a discount for belonging to a respected professional organization.

Loyalty Discount

All auto insurance companies offer discounts to customers who have stuck with them for a long time. Typically, this type of discount can cut your auto insurance costs by about 5%-10%. While sticking to one insurer isn’t always the best idea, sometimes, if the rates are good and the service is exemplary, loyalty can save you a substantial amount in car insurance average cost.

Multi-Policy Discount

Adding several cars to your policy can save you a few bucks in car insurance. However, multi-policy goes beyond having more than one vehicle in your policy.

For example, you can bundle your car insurance and homeowner’s policies under one insurer and get a good discount.

Multi-policy discounts are not exclusive to homeowner’s and auto insurance policies only. Any other combination of policies can fetch a significant discount depending on the insurer.

Good Driver Discount

Even without the auto insurance discount as the incentive, being a safe driver and adhering to all the traffic rules is good for you and fellow drivers on the road. Having no traffic violations and having no claims will reflect positively on your auto insurance rates.

Some auto insurers will give you a good driver discount if you maintain a clean driving record for a given number of years.

In most cases, the level of discount will continually increase for as long as you will maintain the clean record. Some auto insurers will incorporate your good driving record in the calculation or your rates as opposed to presenting it as a separate discount. If you don’t see any good driver discount on your policy, clarify with you agent contact/insurer.

Safety Features Discounts

In most cases, auto insurance companies will offer discounts for vehicles that come installed with safety features. The discount will vary among providers. The best thing is to shop around inquiring about specific discounts and qualify for them to slash your rates. Here are some of the safety features you can install in your car to be eligible for these discounts.

- Anti-Theft System: Having working anti-theft tracking devices can reduce your car insurance rates because if your car is stolen, it will be easy to recover and the insurer will not have to replace it. The discount will reflect in your comprehensive part of your policy.

- Anti-Lock Brake System: Anti-Lock Brake System braking system reduces the chances of collision or overturning in a tight spot. Therefore, having them installed will earn you a discount on the collision section of your policy.

- Air Bags: Having full front seat and driver’s side air bags can earn you significant discounts. The discounts are specific medical payments or the personal injury protection portion of your policy.

- Daytime Running Lights: Installing your vehicle with daytime running lights as standard equipment could earn you a small discount on your auto insurance policy.

Auto insurance companies have different methods of issuing discounts to their customers. Specifically, ask your insurer about available discounts and how to qualify for each. To make the most out of these discount opportunities, present your American association of pharmacists’ membership certificates and inform your insurer about any safety features installed in your car.

Car Insurance Policies for Pharmacists

The most common types of auto insurance coverage in the U.S. are the state-mandated liability coverage, collision, and comprehensive policies.

Liability Coverage

An auto liability policy pays for the damages resulting from an at-fault car accident. This type of coverage caters for medical costs of any bodily injuries caused by the accident as well the damage to any third party property. For additional details, click here to learn more about affordable auto insurance following an at-fault accident.

Collision and Comprehensive Coverage

A combination of these two policies and liability coverage results in what’s popularly known as full coverage. Full coverage will provide protection for a vast array of risks but does not provide a full cover. You are still exposed to a good number of risks. To ensure the highest level of protection, you can add uninsured/underinsured motorist protection and the personal injury protection to your policy.

As a pharmacist, you are eligible for all the auto insurance discounts associated with the medical profession.

Compare pharmacy insurance quotes from various providers to maximize available discounts and secure the most competitive rates.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Case Studies: Exploring Tailored Solutions for Pharmacist Car Insurance

Pharmacists, like many professionals, rely heavily on their vehicles for commuting to work and running errands. Understanding the importance of securing suitable car insurance coverage tailored to their needs is paramount.

- Case Study #1 – Bundle Discounts: Sarah, a pharmacist, chooses Progressive for her car insurance. With rates of $105 monthly for basic coverage and $39 for comprehensive, it’s budget-friendly. Progressive’s options suit pharmacists seeking savings without compromise, illustrating a pharmacist liability insurance comparison and pharmacist insurance company selection tailored to needs.

- Case Study #2 – Customization: John, a pharmacist, prefers customizable car insurance. Our State Farm insurance review found the company offers competitive rates of $86 monthly for basic coverage and $33 for comprehensive. State Farm’s customizable policies let John tailor coverage to his needs. With a reliable reputation and focus on client satisfaction, State Farm ensures John feels confident in his coverage with personalized insurance.

- Case Study #3 – Significant Discounts: Meet Emily, a pharmacist who values discounts. Allstate is her preferred choice, offering coverage at $160 monthly for basic needs and $61 for comprehensive. Allstate stands out for its commitment to significant discounts, making it appealing for budget-conscious pharmacists. Emily is reassured knowing her car insurance meets her coverage needs and saves her money.

In this study, we delve into the world of pharmacist car insurance rates, analyzing the top contenders and their offerings to assist pharmacists in making informed decisions about their coverage.

Frequently Asked Questions

Is car insurance mandatory for pharmacists in the United States?

Yes, car insurance is mandatory for all car owners in the United States, including pharmacists. It is a legal requirement to have auto insurance coverage that meets the state-mandated minimums. Failure to comply may result in legal consequences, and you won’t be able to drive legally on major U.S. roads without meeting the specified insurance requirements

What are the common auto insurance discounts available to pharmacists?

Auto insurance providers offer various discounts for pharmacists. Some of the common discounts include membership discounts for belonging to professional organizations like the American Pharmacists Association, loyalty discounts for long-term policyholders, multi-policy discounts for bundling different insurance policies, good driver discounts for maintaining a clean driving record, and safety features discounts for vehicles equipped with safety features.

What types of coverage are essential for pharmacists in auto insurance policies?

The most common types of auto insurance coverage for pharmacists are liability coverage, which pays for damages resulting from an at-fault accident, and comprehensive and collision coverage for additional protection. Full coverage, combining liability, comprehensive, and collision, is a popular choice. Pharmacists are also eligible for auto insurance discounts associated with the medical profession.

Can parents add their pharmacist children to their car insurance policies?

Yes, parents can typically add their pharmacist children to their car insurance policies. However, the addition may result in higher premiums due to the increased risk associated with less experienced drivers. Insurance providers may have specific policies and guidelines regarding adding young or inexperienced drivers to existing policies.

Are there insurance companies that specialize in providing coverage for parents?

Insurance companies don’t specialize solely in providing coverage for parents. However, many insurance providers offer policies suitable for families and parents. It’s advisable to research and compare quotes from different companies to find the best coverage and rates based on your individual circumstances and the needs of your family.

Read on to learn more about “Does car insurance cover all the drivers in a single home?” and find additional information.

How do I find the best pharmacist insurance agency

To find the best pharmacist insurance agency, consider factors such as experience working with pharmacists, reputation, customer reviews, available coverage options, and the ability to customize policies to meet your needs.

Are there specific healthcare worker car insurance discounts available for pharmacists?

Yes, many insurance companies offer healthcare worker car insurance discounts, including pharmacists. These discounts may vary but often include savings for belonging to professional organizations, maintaining a clean driving record, and bundling policies.

What is the best pharmacist insurance for liability coverage?

The best pharmacist liability insurance varies depending on individual needs and preferences. However, providers like Progressive, State Farm, and Allstate often offer competitive rates and tailored coverage options for pharmacists. Read more about how occupation affects car insurance rates for additional information.

Which pharmacist liability insurance companies are reputable and reliable?

Several reputable insurance companies offer pharmacist liability insurance, including Progressive, State Farm, Allstate, and others. It’s essential to research each company’s reputation, financial stability, and customer satisfaction ratings.

How does pharmacist liability insurance cost compare among different providers?

Pharmacist liability insurance costs can vary among different providers based on factors such as coverage limits, deductibles, location, and the individual pharmacist’s risk profile. It’s advisable to obtain quotes from multiple insurers to compare costs effectively. Explore our resources on the rationale behind why certain auto insurance providers exclusively offer six-month policy terms.

Is Pharmacist Mutual Car Insurance available in my area?

Pharmacist Mutual auto insurance is available in select regions. To determine availability in your area, you can request a quote or contact Pharmacist Mutual directly.

What are some unique coverage options provided by pharmacy insurance companies?

Pharmacy insurance companies may offer unique coverage options such as liability coverage tailored to pharmacy operations, protection for pharmaceutical inventory, and coverage for professional liability or malpractice claims.

Is pharmacist liability insurance mandatory for all pharmacists?

Pharmacist liability insurance is not always mandatory, but it is highly recommended to protect against potential legal and financial risks associated with dispensing medications.

How do I find reputable pharmacist liability insurance companies?

Researching online, seeking recommendations from colleagues, and consulting with insurance agents who specialize in professional liability coverage can help identify reputable pharmacist liability insurance companies.

Can I add my pharmacist child from Adams Farm Pharmacy to my car insurance policy?

Yes, parents can typically add their pharmacist children from Adams Farm Pharmacy to their car insurance policies. However, it may result in higher premiums due to factors like age and driving experience.

What are the key differences between Farmers vs Safe Auto insurance for pharmacists?

Farmers and Safe Auto are both insurance providers that offer coverage options for pharmacists. Differences may include premium rates, coverage options, customer service, and discounts available. Comparing quotes and policies from both companies can help determine the best fit.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.