Best Ford Edge Car Insurance in 2024

Insurance rates for a Ford Edge average $1,296 a year, or around $108 a month. On average, Ford Edge comprehensive insurance coverage costs $316, collision coverage costs $461, and liability coverage costs $366.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

UPDATED: Jul 17, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jul 17, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Key takeaways:

- Full coverage costs around $1,296 a year or $108 each month

- A liability-only policy costs around $519 a year or $43 each month

- Highest rates are for teenage drivers at around $4,737 a year or $395 each month

- Good drivers can save as much as $534 a year by earning policy discounts

- Ford Edge insurance costs around $223 less per year than the average vehicle

Ford Edge insurance rates average $1,296 a year or $43 a month for full coverage, which is less than the average vehicle partly because of its good safety ratings.

Good drivers can save up to $534 with policy discounts by practicing safe driving habits. We’ll go over safety and crash test ratings, factors that impact your car insurance rates, and more.

You can start comparing quotes for Ford Edge car insurance rates from some of the best car insurance companies by using our free online tool now.

Ford Edge Insurance Cost

The average Ford Edge car insurance rates are $1,296 a year or $108 a month.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Are Ford Edges Expensive to Insure?

The chart below details how Ford Edge insurance rates compare to other SUVs like the Kia Telluride, Dodge Durango, and Mitsubishi Outlander Sport.

| Vehicle | Comprehensive | Collision | Liability | Total |

| Ford Edge | $266 | $500 | $372 | $1,296 |

| Kia Telluride | $376 | $688 | $316 | $1,516 |

| Dodge Durango | $348 | $562 | $372 | $1,440 |

| Mitsubishi Outlander Sport | $280 | $512 | $332 | $1,260 |

| Mazda CX-9 | $332 | $542 | $390 | $1,422 |

| GMC Terrain | $322 | $562 | $316 | $1,336 |

| Jeep Compass | $294 | $500 | $372 | $1,324 |

However, there are a few things you can do to find the cheapest Ford insurance rates online.

What Impacts the Cost of Ford Edge Insurance?

The Ford Edge trim and model you choose can impact the total price you will pay for Ford Edge car insurance coverage.

Age of the Vehicle

Older Ford Edge models generally cost less to insure. For example, auto insurance rates for a 2020 Ford Edge are $1,296, while 2010 Ford Edge rates are $1,086, a difference of $210.

| Model Year | Comprehensive | Collision | Liability | Total |

| 2020 Ford Edge | $266 | $500 | $372 | $1,296 |

| 2019 Ford Edge | $254 | $482 | $390 | $1,284 |

| 2018 Ford Edge | $244 | $478 | $398 | $1,278 |

| 2017 Ford Edge | $236 | $466 | $416 | $1,276 |

| 2016 Ford Edge | $228 | $446 | $430 | $1,262 |

| 2015 Ford Edge | $216 | $430 | $442 | $1,246 |

| 2014 Ford Edge | $206 | $400 | $452 | $1,216 |

| 2013 Ford Edge | $198 | $376 | $456 | $1,188 |

| 2012 Ford Edge | $190 | $338 | $460 | $1,146 |

| 2011 Ford Edge | $178 | $310 | $460 | $1,106 |

| 2010 Ford Edge | $172 | $292 | $464 | $1,086 |

Driver Age

Driver age can have a significant impact on the cost of Ford Edge auto insurance. For example, 20-year-old drivers pay approximately $1,585 each year for their Ford Edge auto insurance than 30-year-old drivers.

Driver Location

Where you live can have a large impact on Ford Edge insurance rates. For example, drivers in New York may pay $337 a year more than drivers in Chicago.

Your Driving Record

Your driving record can have an impact on the cost of Ford Edge car insurance. Teens and drivers in their 20’s see the highest jump in their Ford Edge car insurance with violations on their driving record.

Ford Edge Safety Ratings

Your Ford Edge auto insurance rates are influenced by the Ford Edge’s safety ratings. See the breakdown below:

| Test Type | Rating |

| Small overlap front: driver-side | Good |

|---|---|

| Small overlap front: passenger-side | Good |

| Moderate overlap front | Good |

| Side | Good |

| Roof strength | Good |

| Head restraints and seats | Good |

| Source: Insurance Institute for Highway Safety | |

Ford Edge Crash Test Ratings

Poor Ford Edge crash test ratings could mean higher Ford Edge car insurance rates.

| Vehicle Tested | Overall | Frontal | Side | Rollover |

| 2020 Ford Edge SUV FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2020 Ford Edge SUV AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2019 Ford Edge SUV FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2019 Ford Edge SUV AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2018 Ford Edge SUV FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2018 Ford Edge SUV AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2017 Ford Edge SUV FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2017 Ford Edge SUV AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2016 Ford Edge SUV FWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 2016 Ford Edge SUV AWD | 5 stars | 5 stars | 5 stars | 4 stars |

| 1-5 Star Rating Scale, N/R = No Rating | Source: National Highway Traffic Safety Administration | ||||

|---|---|---|---|---|

Ford Edge Safety Features

The numerous safety features of the Ford Edge help contribute to lower insurance rates. The 2020 Ford Edge has the following safety features:

- Driver Air Bag

- Passenger Air Bag

- Front Head Air Bag

- Rear Head Air Bag

- Front Side Air Bag

- 4-Wheel ABS

- 4-Wheel Disc Brakes

- Brake Assist

- Electronic Stability Control

- Daytime Running Lights

- Child Safety Locks

- Traction Control

- Blind Spot Monitor

- Lane Departure Warning

- Lane Keeping Assist

- Cross-Traffic Alert

Ford Edge Insurance Loss Probability

Insurance loss probability on the Ford Edge fluctuates between each type of coverage. The lower percentage means lower Ford Edge car insurance rates; higher percentages mean higher Ford Edge auto insurance rates.

| Insurance Coverage Category | Loss Rate |

| Collision | -47% |

|---|---|

| Property Damage | no data |

| Comprehensive | -7% |

| Personal Injury | no data |

| Medical Payment | no data |

| Bodily Injury | no data |

| Source: Insurance Institute for Highway Safety | |

Ford Edge Finance and Insurance Cost

If you are financing a Ford Edge, most lenders will require your carry higher Ford Edge coverage options including comprehensive coverage, so be sure to shop around and compare Ford Edge auto insurance quotes from the best auto insurance companies using our FREE tool below.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Ways to Save on Ford Edge Insurance

There are many ways that you can save on Ford Edge car insurance to get the best value possible. Below are five scenarios you can explore to help keep your Ford Edge car insurance rates low.

- Ask About Retiree Discounts

- Take Public Transit Instead of Driving Your Ford Edge

- Check Your Ford Edge Policy Carefully to Ensure All Information is Correct

- Consider Using a Tracking Device on Your Ford Edge

- Tell Your Insurer How You Use Your Ford Edge

Top Ford Edge Insurance Companies

Who is the top auto insurance company for Ford Edge insurance rates? While the actual rates you pay will depend on many factors, here are some of the top companies offering Ford Edge auto insurance coverage (ordered by market share). Many of these companies offer discounts for security systems and other safety features that the Ford Edge offers.

| Rank | Company | Volume | Market Share |

| 1 | State Farm | $65,615,190 | 9.3% |

| 2 | Geico | $46,106,971 | 6.6% |

| 3 | Progressive | $39,222,879 | 5.6% |

| 4 | Liberty Mutual | $35,600,051 | 5.1% |

| 5 | Allstate | $35,025,903 | 5.0% |

| 6 | Travelers | $28,016,966 | 4.0% |

| 7 | USAA | $23,483,080 | 3.3% |

| 8 | Chubb | $23,388,385 | 3.3% |

| 9 | Farmers | $20,643,559 | 2.9% |

| 10 | Nationwide | $18,442,145 | 2.6% |

| Source: Insurance Information Institute | |||

Compare Free Ford Edge Insurance Quotes Online

You can start comparing quotes for Ford Edge car insurance rates from some of the best car insurance companies by using our free online tool now.

There are too many factors that come into play to give a clear answer about how much someone would have to pay for car insurance for a Ford Edge. There are many different types of car insurance coverage options and discounts that affect the final rates.

While an exact number is difficult to come by, a look at the national average insurance cost for this car shows that you should expect to pay a little over $1,000 a year for car insurance.

After finding a rate that you like, you can learn more about that car insurance provider by going to their official website.

In addition, you can do research on the National Association of Insurance Commissioner’s website to find out important financial information about car insurance companies.

Use our FREE online tool now to compare car insurance quotes by typing your ZIP into the box at the top of this page!

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

What is the average insurance cost I should expect to pay with a Ford Edge?

The majority of the ownership cost that someone pays for their vehicle is spent on gas.

According to Yahoo! Autos, 11 percent of the total ownership costs for the Ford Edge should go to insurance.

This figure translates to between $1,053 and $1,095 annually. Depending on how much you drive in your Edge, you could spend up to $3,000 a year on gas for it.

What are the most necessary forms of car insurance coverage?

The first type of car insurance coverage that a policyholder should focus on is liability coverage. Liability coverage protects the policyholder financially if they are found responsible for an accident.

An accident that causes injuries or property damage can be very expensive if the person responsible does not have enough insurance.

The two types of liability coverage offered by car insurance companies are bodily injury and property damage. Bodily injury coverage will pay if someone is injured or killed in an accident caused by the policyholder.

Property damage coverage will pay for the damage to the other car or any other property, like buildings, that is damaged because of the policyholder. If someone does not have enough liability coverage, they could be sued.

Uninsured and underinsured motorist coverage is a way the policyholder can protect themselves against other drivers that do not have enough car insurance.

If the policyholder is in an accident with someone that does not have enough car insurance, they could get stuck paying part of the bill for damages and injuries.

This type of coverage would also protect the policyholder if they are the victim of a hit-and-run accident.

There are also two types of insurance that are meant to provide coverage for the policyholder’s car.

Collision coverage will pay for the damage caused by a collision whether it is with another car or an object like a tree.

Comprehensive coverage pays for the damage caused by anything other than a collision.

Some of the circumstances that comprehensive insurance covers are:

- Theft

- Broken glass

- Fire damage

- Storm damage

Medical payments and personal injury protection are both coverage options that will pay for medical care.

Personal injury protection coverage is also known as no-fault insurance because it will pay out no matter who causes an accident.

These coverages are especially important for people that do not have health insurance or have inadequate health coverage.

What are some common, but completely optional, forms of car insurance coverage for the Ford Edge?

Some other popular, but not strictly necessary, car insurance options include:

- Glass coverage

- Rental reimbursement

- Towing and labor coverage

Full glass coverage will cover the cost of having to replace a windshield without making the policyholder pay their deductible first.

If the covered vehicle is damaged and has to be repaired, the policyholder will be able to rent a car for free if they have rental reimbursement insurance.

Towing and labor coverage will pay for the towing and labor if the covered car breaks down and needs to be repaired.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

What kinds of discounts are available to lower car insurance rates?

After someone chooses the types of car insurance coverage they need, they can then look into car insurance discounts.

There are so many car discounts offered by the majority of car insurance providers that everyone should be able to qualify for at least one.

The first type of car insurance discounts applies to the policyholder’s car. A car with good safety features will certainly qualify for a discount. Having

Having air bags and anti-lock brakes like most cars today do will qualify the policyholder for a safe car discount. There is also a discount available for people that have a car with an alarm system.

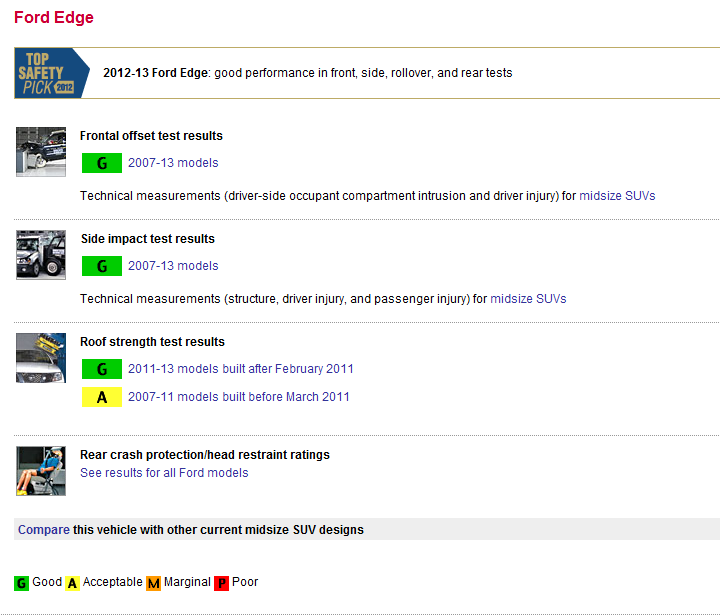

Check out the safety ratings for the Ford Edge below:

Source: IIHS

The second type of car insurance discount applies to the policyholder’s account. If they have more than one car and cover them all through the same provider, they will be able to get a multiple car discount.

If the policyholder owns their own home and gets a home insurance policy through the same company as their car insurance policy, they will qualify for a multiple policy discount.

The policyholder can also get discounts for taking classes. Defensive driving school and driver training courses can offer a significant discount.

Type your ZIP code in the box at the bottom of the page now to compare car insurance rates today!

Frequently Asked Questions

Are there any specific safety features in the Ford Edge that can help lower insurance rates?

Yes, certain safety features in the Ford Edge can potentially help lower insurance rates. Features such as anti-lock brakes, airbags, stability control, lane departure warning, blind-spot monitoring, and advanced driver assistance systems (ADAS) may be taken into consideration by insurance companies when determining premiums. It’s always a good idea to inquire with your insurance provider about potential discounts for safety features.

Will the cost of insurance for the Ford Edge vary based on the model year?

Yes, the cost of insurance for a Ford Edge can vary based on the model year. Generally, newer vehicles tend to have higher insurance rates due to their higher market value and potentially costlier repairs or replacement parts. However, other factors, such as the availability of safety features and historical data on the vehicle’s performance, also play a role in determining insurance rates.

How does the Ford Edge’s trim level affect insurance rates?

The trim level of a Ford Edge can affect insurance rates to some extent. Higher trim levels often come with more advanced features and additional options, which can increase the vehicle’s value and potentially affect repair or replacement costs. As a result, insurance premiums may be higher for higher trim levels compared to the base model. However, the impact may vary depending on the insurance company’s specific rating criteria.

Are insurance rates for the Ford Edge impacted by the driver’s age?

Yes, the driver’s age can impact insurance rates for the Ford Edge. Younger drivers, particularly those under the age of 25, often face higher insurance premiums due to statistical data indicating that they are more prone to accidents. Older, more experienced drivers, on the other hand, may be eligible for lower insurance rates. However, other factors such as driving history and location also influence the overall insurance premium.

How can I save on Ford Edge insurance?

There are several ways to save on Ford Edge insurance. These include practicing safe driving habits, comparing quotes from different insurance companies, taking advantage of discounts for safety features, multiple policies, and driver training courses.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.