Best Austin, TX Car Insurance in 2025

Car insurance in Austin, TX averages $323 a month. Austin, Texas car insurance requirements are 30/60/25, but you might need full coverage insurance if your car is financed. To find cheap Austin car insurance rates, compare quotes from the top car insurance companies in Austin, TX.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Joel Ohman

Executive Chairman

Joel Ohman is the CEO of a private equity-backed digital media company. He is a published author, angel investor, and serial entrepreneur who has a passion for creating new things, from books to businesses. He has previously served as the founder and resident CFP® of a national insurance agency, Real Time Health Quotes. He has an MBA from the University of South Florida. Joel has been mentione...

Executive Chairman

UPDATED: Jan 6, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 6, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Average car insurance rates in Austin, TX are $3,875/year

- The cheapest car insurance company in Austin for teen drivers is USAA

- The cheapest car insurance company in Austin is USAA

If you need to buy Austin, Texas car insurance, the options can be confusing. Everything you need to know about car insurance in Austin, TX is right here.

You’ll find Austin car insurance rates, the cheapest Austin, TX car insurance companies, and information on Texas car insurance laws. You can also compare Austin, Texas car insurance rates to Arlington car insurance rates, El Paso car insurance rates, and San Antonio car insurance rates.

Ready to find affordable Austin, TX car insurance today? Enter your ZIP code for fast, free Austin car insurance quotes.

Cheapest Austin, TX Car Insurance Rates By Age, Gender, and Marital Status

How do age, gender, and marital status affect Austin, TX car insurance rates? Every Austin, Texas car insurance company weighs these factors differently, so check out the comparison rates.

Annual Car Insurance Rates by Age, Gender, and Marital Status in Austin, Texas

| Insurance Company | Married 35-Year-Old Female | Married 35-Year-Old Male | Married 60-Year-Old Female | Married 60-Year-Old Male | Single 17-Year-Old Female | Single 17-Year-Old Male | Single 25-Year-Old Female | Single 25-Year-Old Male |

|---|---|---|---|---|---|---|---|---|

| Allstate | $3,552 | $3,576 | $3,505 | $3,505 | $9,474 | $11,415 | $4,387 | $4,559 |

| American Family | $2,765 | $3,094 | $2,638 | $3,036 | $7,759 | $10,177 | $4,052 | $4,638 |

| Geico | $2,557 | $2,767 | $2,458 | $2,801 | $5,746 | $5,954 | $2,781 | $2,779 |

| Nationwide | $2,144 | $2,178 | $1,898 | $2,006 | $6,092 | $7,809 | $2,521 | $2,725 |

| Progressive | $2,310 | $2,206 | $2,059 | $2,097 | $9,701 | $10,824 | $2,749 | $2,801 |

| State Farm | $2,146 | $2,146 | $1,917 | $1,917 | $5,272 | $6,742 | $2,342 | $2,412 |

| USAA | $1,594 | $1,594 | $1,529 | $1,507 | $4,536 | $4,910 | $2,113 | $2,243 |

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Minimum Car Insurance in Austin, TX

Every driver must carry the minimum car insurance required by the state in Austin, TX. Take a look at the Texas car insurance requirements.

Minimum Required Car Insurance Coverage in Austin, Texas

| Liability Insurance Required | Minimum Coverage Limits Required |

|---|---|

| Bodily Injury Liability Coverage | $30,000 per person $60,000 per accident |

| Property Damage Liability Coverage | $25,000 minimum |

Cheapest Austin, TX Car Insurance Rates by Credit Score

Your credit affects car insurance costs in Austin, TX. If your credit is good, you may be able to get a good credit discount. Compare credit history car insurance rates in Austin from top companies for good, fair, and poor credit.

Annual Car Insurance Rates by Credit Score in Austin, Texas

| Insurance Company | Poor | Fair | Good |

|---|---|---|---|

| Allstate | $6,981 | $5,121 | $4,387 |

| American Family | $6,516 | $4,159 | $3,635 |

| Geico | $5,379 | $3,039 | $2,023 |

| Nationwide | $4,095 | $3,299 | $2,871 |

| Progressive | $4,883 | $4,227 | $3,920 |

| State Farm | $4,407 | $2,743 | $2,186 |

| USAA | $3,663 | $2,130 | $1,717 |

Cheapest Austin, TX Car Insurance Rates by Driving Record

Your driving record is one of the biggest factors affecting car insurance costs. Car insurance with a bad driving record is typically more expensive. Compare bad driving record car insurance rates in Austin, TX to rates for a clean record with top companies.

Annual Austin, Texas Car Insurance Rates by Driving Record

| Group | Clean Record | With 1 Accident | With 1 DUI | With 1 Speeding Violation |

|---|---|---|---|---|

| Allstate | $4,242 | $6,606 | $6,896 | $4,242 |

| American Family | $4,325 | $5,569 | $4,861 | $4,325 |

| Geico | $2,951 | $3,924 | $3,250 | $3,796 |

| Nationwide | $2,971 | $2,971 | $4,392 | $3,353 |

| Progressive | $3,790 | $4,895 | $4,421 | $4,268 |

| State Farm | $2,751 | $3,174 | $3,771 | $2,751 |

| USAA | $1,861 | $2,760 | $3,257 | $2,136 |

Cheapest Austin, TX Car Insurance for Teen Drivers

Teen car insurance in Austin, TX can be expensive. Take a look at rates from the top car insurance companies in Austin for teenagers.

Annual Car Insurance Rates for Teen Drivers in Austin, Texas

| Insurance Company | Single 17-Year-Old Female | Single 17-Year-Old Male |

|---|---|---|

| Allstate | $9,474 | $11,415 |

| American Family | $7,759 | $10,177 |

| Geico | $5,746 | $5,954 |

| Nationwide | $6,092 | $7,809 |

| Progressive | $9,701 | $10,824 |

| State Farm | $5,272 | $6,742 |

| USAA | $4,536 | $4,910 |

Cheapest Austin, TX Car Insurance for Seniors

Take a look at Austin, TX rates on car insurance for seniors from top companies. Shopping around can make a big difference for senior drivers.

Annual Car Insurance Rates for Senior Drivers in Austin, Texas

| Insurance Company | Married 60-Year-Old Female | Married 60-Year-Old Male |

|---|---|---|

| Allstate | $3,505 | $3,505 |

| American Family | $2,638 | $3,036 |

| Geico | $2,458 | $2,801 |

| Nationwide | $1,898 | $2,006 |

| Progressive | $2,059 | $2,097 |

| State Farm | $1,917 | $1,917 |

| USAA | $1,529 | $1,507 |

Cheapest Austin, TX Car Insurance Rates After a DUI

A DUI in Austin, TX increases car insurance rates. Compare Austin, Texas car insurance after a DUI by the company to find the cheapest option.

Annual Car Insurance Rates After a DUI in Austin, Texas

| Insurance Company | Annual Car Insurance Rates With a DUI |

|---|---|

| Allstate | $6,896 |

| American Family | $4,861 |

| Geico | $3,250 |

| Nationwide | $4,392 |

| Progressive | $4,421 |

| State Farm | $3,771 |

| USAA | $3,257 |

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Cheapest Austin, TX Car Insurance Rates by Commute Length

How does how far you drive affect car insurance rates in Austin, TX by commute? Take a look at a comparison of the top companies by commute length.

Annual Car Insurance Rates by Commute Length in Austin, Texas

| Insurance Company | 10 Mile Commute, 6,000 Annual Mileage | 25 Mile Commute, 12,000 Annual Mileage |

|---|---|---|

| Allstate | $5,361 | $5,632 |

| American Family | $4,770 | $4,770 |

| Geico | $3,418 | $3,543 |

| Nationwide | $3,422 | $3,422 |

| Progressive | $4,343 | $4,343 |

| State Farm | $3,112 | $3,112 |

| USAA | $2,472 | $2,535 |

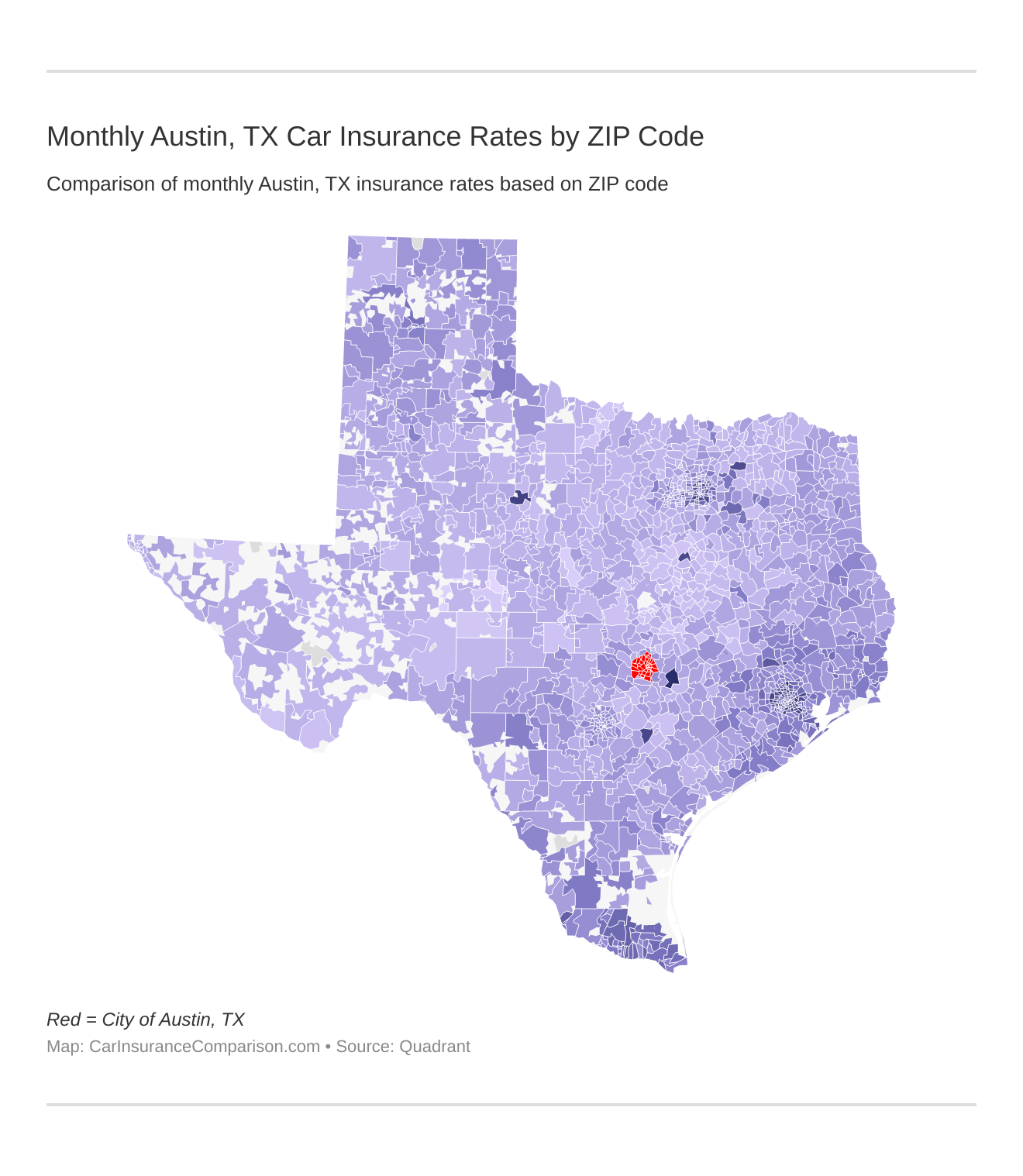

Cheapest Car Insurance Rates by ZIP Codes in Austin

From East Austin to Clarksville, and from Tarrytown to Hyde Park, where you live can have a significant impact on your rates.

Find more info about the monthly Austin, TX auto insurance rates by ZIP Code below:

Because densely populated urban neighborhoods typically have higher rates of accidents, theft, and vandalism than rural areas, car insurance averages tend to be higher if you live in one of these types of neighborhoods within your city.

Is your Austin ZIP code causing your insurance rates to rise? Find your ZIP code in the table below to see if you’re paying more than your neighbors.

Austin, Texas Average Annual Car Insurance Rates by ZIP Code

Austin ZIP Code Average Annual Car Insurance Rate

78728 $5,248.29

78717 $5,274.30

78759 $5,351.94

78727 $5,358.64

78757 $5,366.46

78756 $5,398.41

78739 $5,399.53

78729 $5,417.72

78734 $5,460.57

78749 $5,465.81

78732 $5,469.55

78730 $5,475.65

78738 $5,511.16

78704 $5,520.17

78703 $5,528.13

78745 $5,552.52

78737 $5,561.82

78731 $5,564.15

78750 $5,567.19

78735 $5,573.92

78705 $5,630.93

78701 $5,631.23

78748 $5,669.34

78733 $5,685.70

78702 $5,686.93

78722 $5,697.56

78751 $5,708.31

78746 $5,715.30

78736 $5,735.27

78758 $5,752.99

78726 $5,779.22

78752 $5,797.42

78754 $5,826.18

78742 $5,837.60

78723 $5,851.27

78747 $5,856.66

78653 $5,927.06

78721 $5,930.46

78753 $5,932.66

78719 $5,999.00

78725 $6,085.49

78724 $6,087.12

78744 $6,115.49

78741 $6,208.76

78712 $6,259.11

78799 $6,648.89

78710 $7,029.64

According to these numbers, the Austin ZIP code with the highest average rate is 78710, located in the northeast part of town outside of the U.S. Route 183.

At an average rate of $7,029.64, residents in this ZIP code are paying $1,781.35 more for car insurance per year than those living in the ZIP code with the lowest rate, which is 78728.

The Best Cheap Car Insurance Companies in Austin, TX

Take a look at a side-by-side comparison of the top car insurance companies in Austin, TX to find the best option for your needs.

Average Annual Car Insurance Rates by Company in Austin, Texas

| Insurance Company | Average Annual Rates |

|---|---|

| Allstate | $5,496 |

| American Family | $4,770 |

| Geico | $3,480 |

| Nationwide | $3,422 |

| Progressive | $4,343 |

| State Farm | $3,112 |

| USAA | $2,503 |

Category Winners: Cheapest Car Insurance in Austin, Texas

Find the cheapest car insurance companies in Austin, TX for each category right here.

Best Annual Car Insurance Rates by Company in Austin, Texas

| Category | Insurance Company |

|---|---|

| Teenagers | USAA |

| Seniors | USAA |

| Clean Record | USAA |

| With 1 Accident | USAA |

| With 1 DUI | Geico |

| With 1 Speeding Violation | USAA |

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Cheapest Austin, TX Car Insurance Rates by Coverage Level

How much car insurance you need will have an impact on your Austin car insurance rates. Find the cheapest Austin, TX car insurance rates by coverage level.

Annual Car Insurance Rates by Coverage Level in Austin, Texas

| Insurance Company | Low | Medium | High |

|---|---|---|---|

| Allstate | $5,366 | $5,447 | $5,676 |

| American Family | $4,459 | $4,607 | $5,243 |

| Geico | $3,306 | $3,446 | $3,689 |

| Nationwide | $3,689 | $3,279 | $3,297 |

| Progressive | $4,163 | $4,327 | $4,540 |

| State Farm | $2,948 | $3,106 | $3,281 |

| USAA | $2,411 | $2,493 | $2,606 |

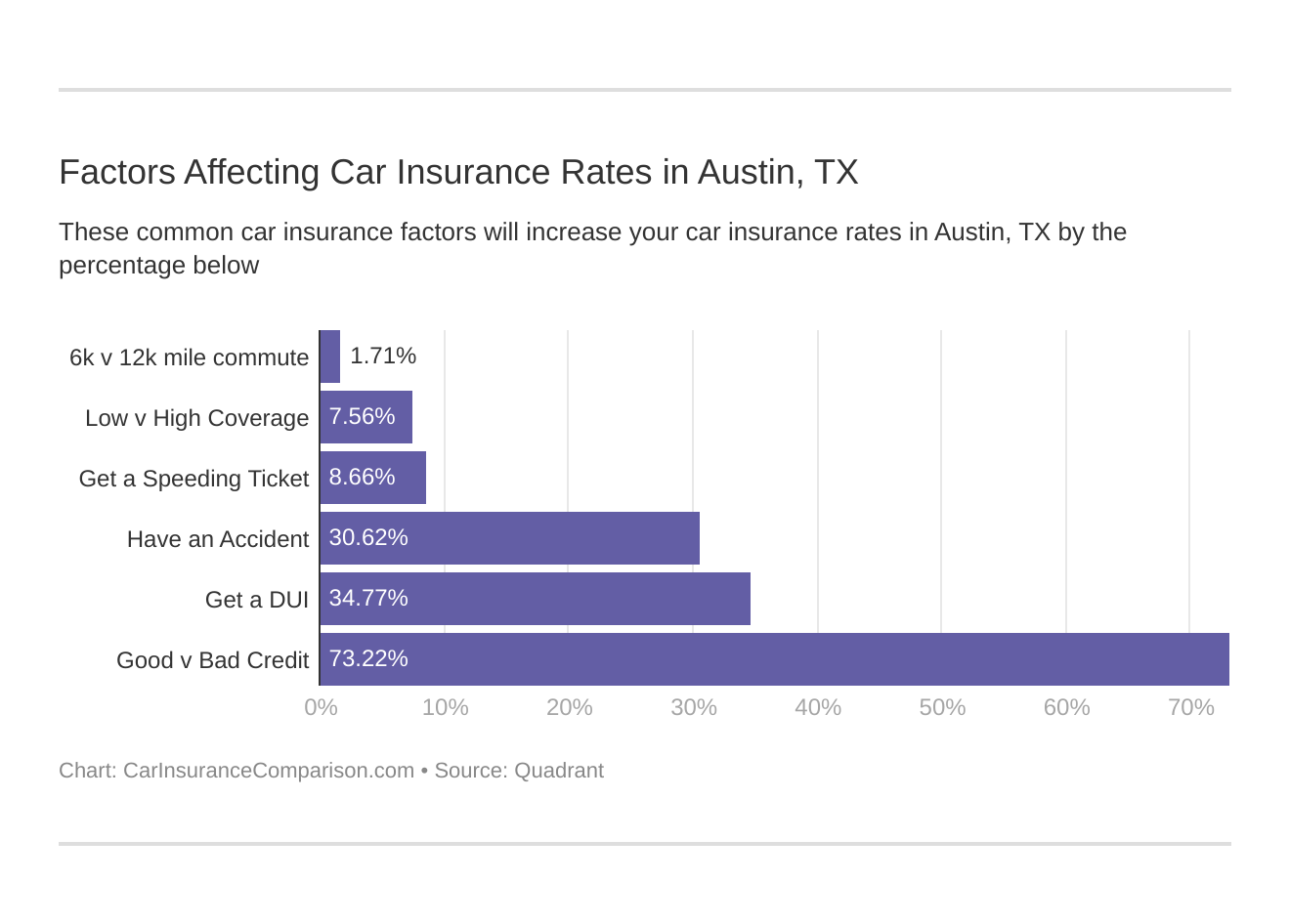

Car Insurance Factors in Austin, Texas

Perhaps you’ve heard of Silicon Valley, the California region home to several tech giants like Apple, Google, and Lockheed Martin.

Factors affecting car insurance rates in Austin, TX may include your commute, coverage level, tickets, DUIs, and credit. Controlling these risk factors will ensure you have the cheapest Austin, Texas car insurance.

But what about the Silicon Hills? This is quickly becoming the new moniker for Austin, as the city is gaining more and more influence and prominence in the tech industry.

Google, IBM, National Instruments, Dell, Electronic Arts, and Apple all have offices or headquarters in or around Austin, Texas.

Without a doubt, Austin’s emergence as the Silicon Hills is just one indicator of the strength of its local economy and job market. And at the end of the day, factors like jobs, wages, housing, and education can all make an impact on your overall car insurance rates.

Austin, Texas Growth and Prosperity

This leads us to Austin’s track record for growth and prosperity. First, let’s talk about growth. According to the Brookings Institution, growth indicators measure the change in the size of a city’s economy, as well as the level of entrepreneurial activity.

Growth not only creates new opportunities for individuals, but it can also help a city become more economically efficient.

The good news for Austin? Brookings’ Metro Monitor Report reveals that the Austin-Round Rock, TX area is outpacing much of the country in growth. Austin ranks first for growth out of the country’s 100 largest metro areas

Austin also ranks first in the percent change in jobs, up 29.6 percent

The city’s percent change in GMP is up 46.9 percent, giving the city a second-place ranking. Finally, the percentage change in jobs at young firms is up 34.5 percent, which is another first-place ranking.

As for prosperity, researchers say that it captures the change in the average amount of wealth and income produced by an economy. In other words, when a metropolitan area grows by increasing the productivity of its workers, the value of that labor also rises.

In terms of prosperity, Austin ranks ninth out of 100 cities. The city’s percentage change in productivity is up 13.3 percent, which lands it in eighth place out of 100.

The city’s percentage change in the standard of living is up 9.5 percent, which puts Austin in 17th place) out of 100. Finally, Austin’s percentage change in average annual wage is up by 11.5 percent, putting it in seventh place.

Median Household Income in Austin, Texas

DataUSA reports that Austin’s median household income is on the rise. In 2017, the median income in Austin was $67,755. Now, that number is up to $71,543. This not only represents a huge increase over the previous year’s median income, but it is also higher than the national median income of $61,937.

If we factor in the city’s average insurance rate of $5,248.29 into the median household income, we can conclude a resident is spending 7.75 percent of his or her income on car insurance.

Homeownership in Austin, Texas

Believe it or not, drivers who own their homes tend to pay lower rates for car insurance than drivers who rent. This leads to an important question: are more Austin residents buying or renting their homes?

According to DataUSA, Austin’s homeownership rate in 2017 was 45 percent. This was lower than the national average of 63.9 percent. Austin’s homeownership rate is also lower than most of its neighboring cities and communities.

DataUSA also reveals that the median property value in Austin is on the rise. It is up from $308,500 in 2016 to $332,700 in 2017. It is now up even more at $365,500.

Education in Austin, Texas

Your level of education and where you work can also have a bearing on your premiums. For some, this can result in discounts on car insurance for college graduates. For others? A difference in rates.

According to City-Data, the biggest universities in Austin by enrollment are as follows:

- The University of Texas at Austin (Full-time enrollment: 45,500)

- Austin Community College District (Full-time enrollment: 25,957)

- Saint Edward’s University (Full-time enrollment: 4,308)

- Concordia University-Texas (Full-time enrollment: 2,192)

- The Art Institute of Austin (Full-time enrollment: 1,587)

From DataUSA, we discovered that the largest universities by enrollment are also the largest in the city by degrees awarded. The University of Texas at Astin awarded 17,181 degrees.

Austin Community College District awarded 3,394 degrees. Finally, Saint Edward’s University awarded 1,104 degrees.

Wage by Race and Ethnicity in Common Jobs in Austin, Texas

In moving from higher education to careers, we’re now taking a closer look at the workforce. Specifically, let’s look at what people are getting paid in common jobs by race, ethnicity, and gender. While we don’t have data specific to Austin, we do have data specific to the state of Texas.

DataUSA reveals that in 2017, the highest-paid race and ethnicity in the state were Asian people, with an average salary of $66,972.

We took a closer look at the average full-time salaries of the state’s Miscellaneous managers and calculated what percentage of their incomes would go toward car insurance. Check it out in the table below.

Austin, Texas Miscellaneous Manager Wages by Race and Ethnicity

Miscellaneous Managers

by Race or EthnicityAverage Salary Percentage of Income

Going Toward Car Insurance

American Indian $111,159.00 4.72%

Asian $106,579.00 4.92%

White $103,116 5.09%

Two or More Races $86,431.00 6.07%

Black $69,172.00 7.59%

Other $62,098.00 8.45%

Of this group, we see that the highest-paid managers by race or ethnicity are American Indians. At an average salary of $111,159.00, they’re paying 4.72 percent of their income toward car insurance.

The lowest-paid group of workers by race/ethnicity is categorized as other. With an average salary of $62,098.00, they’re paying 8.45 percent of their income toward car insurance.

Wage by Gender in Common Jobs in Austin, Texas

When it comes to wage by gender, we’re again looking at data specific to the state of Texas. What we found is that in 2017, the average salary among males in Texas was $65,834, or 1.4 times higher than that of females.

See what we mean in the table below, which compares the average salary among Miscellaneous Managers by gender. We also calculated what percentage of their income went towards car insurance.

Austin, Texas Miscellaneous Manager Wages by Gender

Miscellaneous Managers by Gender Average Salary Percentage of Income Going Toward Car Insurance

Male $114,333 4.59%

Female $76,690 6.84%

As you can see, the gender wage gap exists even in Austin, Texas. Despite women often receiving lower average car insurance costs in Austin, TX than their male counterparts, the percentage of their average salary that goes toward car insurance is still around 2 percent higher than what men pay.

Poverty by Age and Gender in Austin, Texas

It’s estimated that 15.4 percent of Austin’s residents live below the poverty line. Researchers go on to say the largest three demographic groups living in poverty were females aged 18 to 24, females aged 25 to 34, and males aged 18 to 24. If you’re struggling to pay for your insurance, look into low-income car insurance options.

Poverty by Race and Ethnicity in Austin, Texas

The most common racial or ethnic group living below the poverty line in Austin, TX in 2017 was white people, making up a total population of 92,067. That was followed by Hispanic people, with a total population of 71,383.

The third was the other category, with 16,456 people in total.

Employment by Occupations in Austin, Texas

Finally, let’s take a look at the most popular and common occupations in Austin, Texas.

The most common job groups by number are as follows:

- Management Occupations: 72,616 people

- Sales & Related Occupations: 59,951 people

- Office & Administrative Support Occupations: 57,474 people

These stats remind us that employment in Austin is on the rise, increasing from 548,000 employees in 2016 to 551,000 in 2017.

What is driving like in Austin, Texas?

We get it. You want to know what driving in Austin is really like. Whether you’re new to the area or a long-time resident, understanding what happens on Austin’s roads is critical.

If you’re not sure how to begin gaining better insight into Austin’s traffic, don’t worry — you don’t have to look far. Now, we’re diving into a point-by-point analysis of what it really means to drive in Austin.

Roads in Austin, Texas

Highways, loops, state roads, and tolls. You name it, and it’s likely part of Austin’s infrastructure.

At the end of the day, the key for any Austin driver is knowing how to navigate the city’s many thoroughfares.

Major Highways near Austin, Texas

When it comes to how many highways are in the state of Texas, we found our answer through InterstateGuide. Texas has 25 active routes spanning over 3,501 miles.

Of these 25 routes, just one crosses through the city of Austin, and that’s I-35. If that number seems small, don’t worry, Austin is still home to plenty of state roads, loops, and expressways.

Interstate 35 is 1,568 miles long with its north end in Duluth, Minnesota, and its south end in Laredo, Texas. For the Austin driver, I-35 is a well-traveled path leading to countless destinations throughout the city.

Tolls in Austin, Texas

Austin is home to several tolled roads and segments, including:

- Loop 1

- SH 45 N

- SH 130 Segments 1-4

- SH 45 SE

The big question for drivers, though, is how much do they cost?

State officials say that really depends on how far you drive, what kind of vehicle you’re driving, and whether you have a TxTag on your car. It’s important to note that drivers who don’t have a TxTag can expect to pay 33 percent more on most routes.

We checked, and found rates as low as 50 cents, and some just under $8.00.

Popular Road Trip Sites in Austin

From live music to the arts, and from BBQ to the Hill Country. Without a doubt, Austin has no shortage of tourist attractions and day trips. Ready to learn about a few local favorites?

The Barton Springs Pool is a natural springs pool located in Zilker Park. It has average temperatures of 68 to 70 degrees year-round.

The State Capitol is located in the heart of downtown Austin. The State Capitol is open for tours for most days, except holidays.

Mount Bonnell is considered the highest point in Austin. Mount Bonell offers a breathtaking view of the city

The University of Texas at Austin is another great tourist attraction. It’s more than a higher-education institution. The University of Texas is also home to the Blanton Museum of Art, the Harry Ransom Center, and the LBJ Presidential Library

Finally, don’t miss the bats under the Congress Avenue Bridge. Starting late March to early fall, onlookers can spend an evening observing the largest urban bat colony in the world.

Road Conditions in Austin, Texas

Potholes and poor roads are more than just an inconvenience. They can be pricey problems with a negative impact on your car.

Add to those potholes plenty of rain, and now you have a serious problem.

Unfortunately, Austin is prone to flooding when it rains, and the city itself is rife with potholes.

According to the national transportation group, TRIP, and its urban roads report, we learned that 16 percent of Austin’s roads are considered to be in poor condition. Another 32 percent are considered to be in mediocre condition.

Fortunately, 8 percent are considered to be in fair condition and a total of 44 percent are in good condition. The estimated vehicle operating cost in your city is around $507 annually.

These numbers are not the worst, but they are not the best either.

Red-Light and Speeding Cameras in Austin, Texas

As of June 2, 2019, the use of red-light cameras in the State of Texas is prohibited. That’s because Governor Greg Abbott signed legislation outlawing the use of cameras.

Even though red-light cameras are not being used in your city, remember that traffic violations can cause your annual car insurance rates to increase drastically.

Our expert advice is to always practice safe driving techniques. Not only will it help keep the roads safe, but if your driving record stays clean, you can save money by qualifying for safe driver discounts.

Vehicles in Austin, Texas

Without a doubt, Austin drivers want to know that their neighborhoods and their cars are safe. Therefore, we are breaking down the statistics that matter the most to you.

Let’s start by taking a closer look at Austin’s car trends. We’ll wrap up by ending with crime statistics in the city. Keep reading.

Most Popular Vehicle Owned in Austin, Texas

According to YourMechanic, in almost every part of the country, the most common cars are sedans from Honda, Toyota, Ford, or Chevrolet.

As for the vehicle Austin residents prefer to drive? While one might assume it’s a pickup truck, that isn’t the case. It’s none other than the Honda Fit.

We checked with the Insurance Institute for Highway Safety and found that the 2019 Honda Fit has strong safety ratings across the board, except for its headlights

We also looked into the Honda Fit’s fuel economy with the Office of Energy Efficiency and Renewable Energy. That ranges from 31 to 36 miles per gallon combined city and highway, and with an estimated annual fuel cost of $1,100 to $1,250.

If you’re looking for a new car, consider one of the cars with the lowest car insurance rates.

Cars Per Household in Austin, Texas

What is the average number of cars per household in the city of Austin?

According to DataUSA, 46.4 percent of homes in the city had two cars.

Households Without a Car in Austin, Texas

While the average number of cars in Austin remains steady, the number of households without cars is actually declining.

The total number decreased from 6.9 percent in 2015, to only 6 percent in 2016. The number has stayed steady ever since.

Speed Traps in Austin, Texas

Austin drivers on the lookout for speed traps need to look no further than the National Motorists Association, which manages The National Speed Trap Exchange site.

In looking at the 10 Worst Texas Speed Trap Cities, Austin takes the number 2 spot with a grand total of 13 known and confirmed speed traps.

We took a closer look, and several of the top submissions included locations around I-35, Dean Keeton, and MoPac.

As for the Texas city claiming the top spot on this list? That would be Houston, with 45 listed speed traps.

Vehicle Theft in Austin, Texas

Here’s what you need to know about car theft in the city of Austin. According to the FBI Uniform Crime Reporting Program, the city ranked fifth in the state for the most car thefts in 2018.

Who else made the list? Find out below.

- Houston: 11,596 car thefts

- Dallas: 7,913 car thefts

- San Antonio: 6,864 car thefts

- Fort Worth: 2,706 car thefts

- Austin: 2,079 car thefts

We dug deeper and discovered that from January to April of 2019, Austin Police reported 825 auto theft cases and 15 attempted thefts. The top stolen vehicle makes and models during this time period were as follows:

- Ford F150

- Honda Civic

- Honda Accord

- Toyota Camry

- Nissan Altima

Unfortunately, none of these statistics will help lower your rates for car insurance. If car theft is a concern of yours, consider investing in comprehensive car insurance coverage.

Safest Neighborhoods in Austin, Texas

A deeper analysis of Austin’s crime led us to Neighborhood Scout. According to their site, Neighborhood Scout’s Crime Risk Reports provide an instant, supposedly objective assessment of property and violent crime risks and rates for different U.S. addresses and neighborhoods.

What are the safest neighborhoods in Austin according to the research? Take a look at Austin’s top 10 safest neighborhoods.

- N Quinlan Park Rd / Fm 620 Rd N

- Route 290 / El Rey Blvd

- The High Rd / Encinas Rojas St

- Brushy Creek

- N Cuernavaca Dr / N River Hills Rd

- W Parmer Ln / Anderson Mill Rd

- Fm 620 Rd S / Murfin Rd

- Hudson Bend

- Shady Hollow

- Ranch Rd N / Shady Ln

If you live in these neighborhoods, you will have a better chance of securing lower car insurance quotes in large part because of the lower than average crime rates.

Crime Rates in Austin, Texas

Next, we’re comparing the rate of violent crime per 1,000 residents in Austin to the rest of the state of Texas. According to Neighborhood Scout, Austin has a lower violent crime rate than Texas. The city’s rates are only 4.27 per 1,000 residents, compared to the state which is 4.39 per 1,000 residents.

What about your chances of becoming a victim of violent crime in Austin? Experts say that’s 1 in 234, compared to 1 in 228 in the state.

And as for Austin’s Crime Index? That’s 11 out of 100. In other words, Austin is assessed to be safer than 11 percent of all U.S. cities.

Get a better look at Austin’s annual crime statistics, broken down by violent crimes and property crimes, in the following table.

Austin, Texas Crime Rates

Details Violent Crime Property Crime Total

Number of crimes 4,058 31,792 35,850

Crime rate

(per 1,000 residents)4.27 33.44 37.71

While these numbers are not uncommon in larger metropolitan areas, like Austin, your insurance premiums will still be higher than if you lived somewhere with fewer people and lower crime rates.

Traffic in Austin, Texas

Bad traffic makes for frustrated and aggravated drivers. At least, that’s the logic behind GasBuddy’s Top 10 Cities with the Most Aggressive Drivers.

If you haven’t guessed it by now, Austin landed a spot on the list, along with cities like Los Angeles, Atlanta, Orlando, and Detroit.

Patrick DeHaan, head of petroleum analysis at GasBuddy, once said frustration while driving in bumper to bumper traffic leads motorists to drive more aggressively and with more urgency. Driving angry can put you at a higher risk of getting into an accident.

Be mindful of these facts. Bad traffic congestion on roads you drive regularly can lead to high car insurance rates.

Traffic Congestion in Texas

The INRIX 2018 Global Traffic Scorecard analyzes congestion and mobility trends in over 200 cities all over the world.

In reviewing the data, we learned that Austin not only earned a place this list, but the city has also moved up the list. This means that, unfortunately, traffic in Austin has gotten worse over the years.

See more details in the table below.

Austin, Texas Traffic Rank

INRIX Global Traffic Scorecard Rankings and Details

2018 Rank: 84

Hours Lost: 104

2017 Rank: 89

Hours Lost: 108

Cost of congestion per driver $1,452

These stats also show that drivers are losing an estimated $1,452 a year from congestion.

The good news? The estimated number of hours Austin drivers are losing in traffic has gone down from 108 hours in 2017, to 104 hours in 2018. See what we mean in the next table.

Austin, Texas Traffic Rank

INRIX Global Traffic Scorecard Rankings and Details

2018 Rank: 84

Hours Lost: 104

2017 Rank: 89

Hours Lost: 108

Cost of congestion per driver $1,452

Hopefully, over time traffic-related issues in your city start to resolve. Until they do, expect your car insurance rates to remain higher than if you lived in a less densely-populated city.

Transportation in Austin, Texas

Statistics show that the typical commute time for Austin workers in 2017 was 22.7 minutes. This figure represents a shorter commute time than that of the typical U.S. worker, who averaged 25.5 minutes.

But for some drivers, it gets worse. It is estimated that 1.75 percent of Austin’s workforce has what is known as a “super commute”, which means your driving distance to work is in excess of 90 minutes.

Statistics additionally show that Austin drivers prefer to drive alone, at a share of 74 percent. This compares to a share of just under 10 percent for those who prefer to carpool.

Busiest Highways Near Austin, Texas

By now, it should come as no surprise that Austin has a lot of traffic. But just how congested are the city’s roads when compared to other cities in the rest of the state?

This question led us to a study conducted by the Texas A&M Transportation Institute, in which experts ranked the state’s 100 most congested roads. We checked and discovered several Austin road segments made the list.

Among some of the highest-ranked roads were:

- I-35 from US 290 N/SS6, to Ben White Blvd/SH 71 (ranked 3rd)

- I-35 from Ben White Blvd / SH71 to Slaughter Ln (ranked 19th)

- Mopac Expwy / SL1 from US 183 to S Capital of Texas Hwy/ SL 360 (ranked 21st)

As you already know, busy streets increase your chances of being involved in a car accident. That extra risk might cause your car insurance rates to increase as well.

How safe are Austin, Texas streets and roads?

By analyzing statistics from the National Highway Traffic Safety Administration, we can get a better understanding of road fatality trends in Austin.

We will start by looking at the number of county-wide fatalities in the county where Austin is located, Travis County.

We see that numbers actually decreased from 2015 to 2016, but then remained the same in 2017.

See more details in the following table.

Travis County Road Fatalities

| Vehicle Crash Type | 2017 | 2016 | 2015 | 2014 | 2013 |

|---|---|---|---|---|---|

| Total vehicle fatalities | 120 | 120 | 145 | 95 | 112 |

| Alcohol-impaired driver (BAC = .08+) | 57 | 44 | 71 | 50 | 54 |

| Single-vehicle crash | 64 | 68 | 74 | 45 | 60 |

| Crashes involving speeding | 30 | 28 | 43 | 33 | 37 |

| Crashes involving a roadway departure | 56 | 47 | 51 | 47 | 50 |

| Crashes involving an intersection | 33 | 26 | 39 | 32 | 23 |

| Passenger car occupant fatalities | 43 | 44 | 53 | 39 | 35 |

| Pedestrian fatalities | 24 | 35 | 39 | 12 | 26 |

| Pedal cyclist fatalities | 5 | 2 | 3 | 1 | 2 |

As you can see, fatalities in crashes involving an alcohol-impaired driver fluctuated from 2013 to 2017. After a sharp increase from 2014 to 2015, single-vehicle crash fatalities have been declining.

Fatalities in crashes involving speeding have gone both up and down between 2013 and 2017. In 2017, the fatalities in crashes involving a roadway departure increased to 56. This represents the highest number of fatalities in this time period.

Fatalities in crashes involving an intersection or that were intersection related also increased from 2016 to 2017. However, passenger car occupant fatalities have steadily decreased from 2015 to 2017. The same can be said about pedestrian fatalities in the same time period.

Finally, the number of pedal cyclist fatalities increased from 2016 to 2017. This increase marks the highest number of fatalities in this time period.

The Fatality Analysis Reporting System (FARS) tracks fatalities specific to certain types of roads. Among them are:

- Arterial roads, or roads that carry large amounts of traffic.

- Minor arterials, or smaller roads that link cities, towns, and geographical areas.

- Collector roads that either “collect” local traffic to arterial roads, or serve as intra-county connections.

Here’s a look at FARS fatality statistics specific to Travis County, and in comparison to the state:

Travis County Fatal Crashes by Road Function Class

Road Type Fatalities in Travis County Fatalities in Texas

Rural Interstate 0 176

Urban Interstate 10 402

Freeway and Expressway 14 260

Other 41 982

Minor Arterial 20 652

Collector Arterial 17 600

Local 6 261

Unknown 1 10

Total 109 3,343

Travis County is large, and Austin has a pretty high population density. Overall, these numbers prove that the roads near Austin are surprisingly safe for drivers.

America’s Best Drivers

Austin residents interested in seeing how they stack up against drivers in other parts of the country have a resource in Allstate’s annual America’s Best Drivers Report.

Of the 200 cities listed, Austin has a 160th place ranking and a 39.2 percent likelihood for drivers to get into a collision. See more details of how the city ranked over the years in the following table.

Austin, Texas Allstate America's Best Drivers Report Ranking

Austin, Texas Details Ranking

2019 Best Drivers Report

ranking160

Average Number of Years Between

Collisions7.6

2018 Best Drivers Report

ranking159

Change in ranking from 2018 -1

Relative collision likelihood (as a percent) 39.2%

Unfortunately, as you can see from the table above, the city’s 2019 ranking is a downgrade from the previous year’s ranking of 159.

Ridesharing in Austin, TX

Without a doubt, ridesharing services in Austin have grown in popularity, but not without some bumps in the road.

In 2016, both Uber and Lyft temporarily halted services in Austin in light of city regulations requiring drivers to get fingerprint background checks.

That law was overturned by Texas Governor Greg Abbott in 2017, opening the door for both Uber and Lyft to return to the city. You can say the rest is history, as the services continue to thrive in the area.

According to RideGuru, the following rideshare services are available in Austin:

- Uber

- RideAustin

- Lyft

- Fasten

- Fare

- Wingz

- Curb

Prices will vary from trip to trip. Be sure to compare rates ahead of time by checking out company sites and apps.

If you drive for one of these companies, you may want to look for rideshare car insurance.

E-star Repair Shops in Austin, Texas

Should your car sustain damage as a result of a collision, getting into a reliable car shop will be essential.

We searched for the top 10 E-star Repair shops in Austin. Take a look at what we found in the following table.

Austin, TX E-Star Repair Shops

E-Star Repair Shop Address Contact Information

Service King North Lamar 6518 North Lamar Blvd.

Austin, TX 78752email: [email protected]

P: (512) 454-0461

F: (512) 454-9870

Caliber - Austin - South Lamar 1804 South Lamar Blvd

Austin, TX 78704email: [email protected]

P: (512) 444-6411

F: (972) 906-7164

Caliber - Austin - North Lamar 8735 North Lamar Blvd.

Austin, TX 78753email: [email protected]

P: (512) 836-0163

F: (972) 906-7164

Caliber - Austin - Braker Lane 109 East Braker Ln.

Austin,TX 78753email: [email protected]

P: (512) 836-3970

F: (972) 906-7164

Caliber - Austin - Manchaca 6222 Manchaca Rd.

Austin, TX 78745

P: (512) 443-4862

F: (972) 906-7164

Service King - South Austin 7501 South I-35

Austin, TX 78744email: [email protected]

P: (512) 442-0461

F: (512) 442-3387

Caliber - Austin - Highway 620 12322 Highway RR 620 North

Auustin,TX 78750email: [email protected]

P: (512) 331-8083

F: (972) 906-7164

Service King - Round Rock 16604 North IH 35

Austini,TX 78728email: [email protected]

P: (512) 246-0460

Service King - Lakeway 1403 Highway 620

Lakeway, TX 78734email: [email protected]

P: (512) 266-9846

F: (512) 266-9981

Caliber - Round Rock - Mays 1809 North Mays St.

Rond Rock, TX 78664email: [email protected]

P: (512) 388-3020

F: (972) 906-7164

Thanks to Esurance’s E-Star Direct Repair Program, drivers have access to a database of more than 1,400 reputable repair shops.

Businesses participating in the network not only provide customers with online monitoring of repairs but also ensure those repairs will be guaranteed.

Weather in Austin, Texas

Without a doubt, Texas is known for its hot weather. But thankfully, the city of Austin doesn’t sustain scorching temperatures all year round.

In the table below, we look at the city’s average temperature and precipitation, according to U.S Climate Data.

Austin, Texas Weather Data

Austin, TX Weather Averages

Annual high temperature 79.8°F

Annual low temperature 59°F

Average temperature 69.4°F

Average annual precipitation - rainfall: 34.25 inches

Austin drivers, take note, the city can be prone to a lot of rainfall, as evidenced in the city’s average precipitation of 34.25 inches.

This leads us to take a closer look at the dangers associated with flooding. Keep reading to learn more.

Natural Disasters in Austin, Texas

Here’s what you need to know, flooding is a real concern in Central Texas. Leaders with Austin’s Watershed Protection Department put it plainly.

Austin is located in the heart of what is known as Flash Flood Alley. Residents of the city must be alert to the dangers of flooding both in the home and on the road. Flash floods happen quickly and swiftly, and can easily carry away entire vehicles.

In fact, about 75 percent of flood-related deaths in Texas occur in vehicles.

In times of heavy rain, city officials advise the residents to check ATXfloods.com for known, flooded roads.

Experts also recoupment that you avoid low water crossings and actively look for water over the road. If you see any, turn around, do not attempt to drive through the water.

You should also turn around if a road is barricaded. Keep in mind that the road may be heavily damaged underneath the floodwater, which you likely will not be able to see. You also need to use extreme caution if you’re driving at night, as it may be difficult to see whether a road is flooded.

Finally, it is important to be reminded of the benefits of comprehensive car insurance coverage. Should your car sustain damage as a result of inclement weather, comprehensive coverage is what would kick in to cover costs.

Public Transit in Austin, Texas

Through Capital Metro, Austin residents have a number of public transit options, including the MetroBus, MetroExpress, MetroRapid, the MetroRail, and various University of Texas shuttles.

Although fares will vary by service, passenger, and program, you can begin to get a good idea of what you’ll pay by looking at Capital Metro’s local fares in the table below.

Austin, Texas Capital Metro Bus Fares

Local Service in Austin Total Fare

Single ride $1.25

Single ride, reduced $0.60

Day pass $2.50

Day pass, reduced $1.25

7-day pass $11.25

31-day pass $41.25

31-day pass, reduced $20.60

Fares can be purchased in person, online, or through the CapMetro App available on Apple, Android, and Windows.

Alternate Transportation in Austin, Texas

In the mood to go from four wheels to two? Lucky for you, scooter and bike rental services Bird and Lime are available in Austin. Bird additionally has rentals available specifically to students at the University of Texas at Austin.

Renting from either company begins by downloading their respective apps, and using them to locate available scooters or bikes. From there, users are typically charged a small unlocking fee, usually $1. After that, you’re usually charged by the minute.

Parking in Metro Areas in Austin, Texas

Here’s the deal, parking in metropolitan areas can be incredibly frustrating. It’s why we’ve done the research for you here and now, and we’re breaking down some of the dos and don’ts of parking in Austin. Keep reading.

Street Parking and Garages in Austin, TX

According to the city’s Department of Transportation, there are about 3,000 on-street parking spaces downtown, and more than 14,000 off-street parking spaces in surface lots and garages.

Metered parking in Austin, TX

Parking meters in the downtown Austin area from IH-35 to Lamar Boulevard and Lady Bird Lake to 10th Street usually operate at the following times of day:

- Monday and Tuesday: 8 a.m. to 6 p.m.

- Wednesday through Friday: 8 a.m. to 12 midnight

- Saturday: 11 a.m. to 12 midnight.

Officials go on to say that on-street parking meters in the area near Barton Springs Road and South Lamar, including Toomey Road, Lee Barton Drive, and others, are enforced Monday through Saturday from 8 a.m. to midnight.

Keep in mind that these rates and times of enforcement can vary based on location.

Finally, when it comes to cost, parking costs $1.20 per hour for city-owned, on-street, metered parking spaces located downtown between Lamar Boulevard, I-35, Lady Bird Lake, and 10th Street.

All other city-owned, on-street, metered parking spaces cost $1 per hour. Drivers can pay on-site, or through the ParkATX mobile app.

Air Quality in Austin, TX

There’s no other way to say it, our vehicles have an impact on the environment. Take it from the Union of Concerned Scientists, who point out that cars, trucks, and buses powered by fossil fuels are huge contributors to air pollution.

Not only is transportation a major source of global warming emissions in the United States, but our cars and trucks also emit more than half of the nitrogen oxides in our air. Studies have even linked pollutants from vehicle exhausts to adverse impacts on almost every organ system in the human body.

Fortunately, the United States Environmental Protection Agency annually produces the Air Quality Index (AQI) reports, which measure pollutants in an area to help us rack the safety levels of our air. The higher the AQI, the more polluted the air.

We gathered data for the Austin-Round Rock region to see how safe the air is in your city. Check out Austin’s results in the table below.

Austin, Texas Air Quality Index Report

Air Quality in Austin-

Round Rock, TX2018 2017 2016

Days with Air Quality Index 365 365 366

Good days 239 262 280

Moderate days 117 99 85

Days unhealthy for sensitive groups 9 4 1

Days unhealthy 0 0 0

Days very unhealthy 0 0 0

As you can see from the table above, the number of “good” AQI days actually decreased from 2016 to 2018. On that same page, the number of both “moderate” and “unhealthy days for sensitive groups” increased in this same time period.

Fortunately, there have been no “unhealthy” or “very unhealthy” days recorded in Austin from 2016 to 2018.

Military and Veterans in Austin, Texas

When it comes to states with the most active duty and reserve members of the military, Texas is second only to the state of California. The large number of military personnel is why we want to explore what discounts are available to them and their families in Austin, Texas.

While searching the web for this kind of information may seem tedious, remember, we’ve done the bulk of the hard work for you. In fact, we’ve already gathered all of the need-to-know data right here.

Statistics show that the largest share of Austin’s military population, at just under 12,000, served in the Gulf War. The next highest share is among those who served in Vietnam.

Do you live in Austin and are part of the military? Keep reading to learn what discounts and options are available to you.

Military Bases Near Austin, Texas

While Austin isn’t home to a military base, the Fort Hood Army Base is roughly an hour from the city. According to the Army, the 214,968-acre installation is the only post in the United States capable of stationing and training two armored divisions.

What is noteworthy, however, is that Austin recently became home to the Army Futures Command (AFC) Headquarters. This proved to be a significant move, as it marked the first time the Army placed a major command within an urban setting, and not on a military base.

The reasoning? The Army wanted to be immersed in an environment where innovation occurs at faster speeds than what the previous process allowed. After searching for a location that had the right combination of top-tier academic talent, cutting-edge industry, and innovation in the private sector, Austin, Texas was chosen as the prime location.

Military Discounts by Provider in Austin, Texas

We looked into which of the major insurance companies provide car insurance discounts for military personnel in Texas. Here’s what we found in terms of who is providing them, and who the discounts are available to:

- Geico (active or retired)

- USAA (membership exclusive to military personnel)

- Liberty Mutual (active duty)

- Allstate

- Farmers

- Met Life (based on years of service, retired or active)

Keep in mind that discounts may vary from person to person, and from even city to city. Be sure to speak with an agent or representative to learn more.

USAA Rates in Austin, Texas

Austin drivers tied to the military will undoubtedly consider USAA car insurance as an option, as the provider exclusively serves the military community. We compared USAA’s rates against other large providers in the state.

Check it out the details in the table below.

Austin, Texas Average Annual Car Insurance Rates for Military Personnel

Insurace Company Average Annual Premium Higher/Lower than

State AveragePercentage Higher/Lower

than State Average

$2,487.89 -$1,555.39 -38.47%

$5,485.44 $1,442.16 35.67%

$4,848.72 $805.44 19.92%

$3,263.28 -$780.00 -19.29%

$3,867.55 -$175.73 -4.35%

$4,664.69 $621.41 15.37%

$2,879.94 -$1,163.34 -28.77%

It’s clear that USAA not only has the lowest average rate on this list, but it’s also the lowest when compared to the Texas state average by more than $1,500.

On the other hand, Allstate’s rates are the furthest from USAA’s, to the tune of nearly $3,000. If you are a military family living in Austin, Texas, USAA should definitely be on your list of companies to compare rates from.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Unique City Laws in Austin, Texas

Whether you’re going from state to state, or from city to city, keeping up with the local laws that govern drivers can be difficult.

But as we wrap up our complete guide to cheap car insurance in Austin, TX, we’re making a point to highlight the important rules and regulations you need to know.

Click it or Ticket in Austin, Texas

2019 marks the 20th anniversary of the state’s Click it or Ticket campaign. Click it or Ticket represents a massive law enforcement push to ensure Texans are using their seatbelts at all times.

Drivers can expect officers to ramp up their enforcement efforts periodically throughout the year. Not complying can result in tickets and stiff fines.

Hands-Free Driving in Austin, Texas

In 2017, Texas state lawmakers passed a law making texting and driving illegal throughout the entire state. Some additional restrictions outlined by the Texas Department of Transportation include:

- Drivers with learner’s permits cannot use handheld cell phones in the first six months of driving.

- Drivers under the age of 18 cannot use wireless communications devices.

- School bus operators cannot use cell phones while driving if children are present.

To summarize, here’s what you need to know about cell phones and driving in the city of Austin. The use of all electronic hand-held devices while driving or riding a bike is prohibited.

In other words, Austin is a hands-free city with stricter ordinances than the state.

Food Trucks in Austin, Texas

Those wishing to operate a food truck in the city of Austin or Travis County must adhere to a set of guidelines and requirements, beginning with applying for a Mobile Food Vendor Permit and a Mobile Vending Permit.

According to city and county regulations, all mobile vendors or food trucks must obtain a Mobile Food Vendor permit before operating within the city.

The permit process will require an application review and a physical inspection of the mobile unit. Vendors must complete the application review and pass the physical inspection before they receive a permit.

To learn more about the process, contact the Austin/Travis County Health & Human Services Department’s Environmental Health Services Division.

You should take some time to learn about what insurance coverage is needed for food trucks in Texas.

Tiny Homes in Austin, Texas

Tiny homes are making a big mark in Austin, with communities like Village Farm Austin and Constellation ATX quickly taking root.

According to the Tiny House Society of the United States, Austin, Texas allows all sizes of tiny houses, as long as they are on foundations. Any tiny house on wheels is considered a recreational vehicle, or RV, and will be treated as such.

Should you decide to pursue a tiny home in Austin, remember to review your insurance options. Be sure to do all of your homework and research concerning any local codes and regulations you’ll need to comply with.

Parking Laws in Austin, Texas

In addition to what we discussed concerning parking in metro areas, there are a few other rules and regulations you should keep in mind when parking in Austin, Texas.

First, the city of Austin’s Restricted Front Yard and Side Yard Parking Ordinance prohibits parking a car in the front or side yard of a residence, except in a driveway or a paved parking space.

Next, if a car is left on the street in violation it can be tagged immediately.

Once tagged, the owner has 48 hours to fix the problem or remove the vehicle from the street.

Also, you cannot leave a trailer of any kind on the street unattached from a motor vehicle. Finally, in Austin, an abandoned vehicle is defined as one that is either parked illegally, or is mechanically inoperable.

Compare Car Insurance Quotes in Austin, TX

Ready to find affordable Austin, Texas car insurance today? Enter your ZIP code for fast, free Austin, TX car insurance quotes.

Frequently Asked Questions

What is the average monthly car insurance rate in Austin, TX?

The average monthly car insurance rate in Austin, TX is $323.

What are the car insurance requirements in Austin, TX?

The car insurance requirements in Austin, TX are 30/60/25. However, if your car is financed, you may need full coverage insurance.

How can I compare car insurance rates in Austin, TX?

To compare car insurance rates in Austin, TX, you can follow these steps:

- Gather information: Collect details about your vehicle, driving history, and insurance needs.

- Research insurers: Look for reputable insurance companies that operate in Austin, TX.

- Obtain quotes: Contact insurance providers directly or use online comparison tools to request quotes.

- Compare coverage and costs: Evaluate the coverage options, policy limits, deductibles, and premiums offered by different insurers.

- Consider additional factors: Take into account customer reviews, financial stability of the insurance companies, and available discounts.

- Make an informed decision: Choose a car insurance policy that best fits your needs and budget.

What factors can affect car insurance rates in Austin, TX?

Several factors can influence car insurance rates in Austin, TX. Here are some common ones:

- Age and gender of the driver

- Driving history and record

- Type of vehicle and its value

- ZIP code or location

- Annual mileage

- Coverage limits and deductibles

- Credit history

- Claims history

- Marital status

- Driver’s education and occupation

What is the minimum car insurance required in Austin, TX?

Every driver in Austin, TX must carry the minimum car insurance required by the state. You can find the specific requirements for Texas car insurance.

Are there any discounts available for car insurance in Austin, TX?

Yes, many car insurance providers in Austin, TX offer various discounts. The availability of discounts may vary by insurer, but some common ones include:

- Multi-policy discount (bundling car insurance with other policies like home or renters insurance)

- Good driver discount (for maintaining a clean driving record)

- Good student discount (for students with good academic performance)

- Safety features discount (for vehicles equipped with safety features like anti-lock brakes or airbags)

- Defensive driving course discount

- Usage-based insurance discount (for using a telematics device to track driving habits)

- Loyalty discount (for staying with the same insurer for an extended period)

- Paid-in-full discount (for paying the entire premium upfront)

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Joel Ohman

Executive Chairman

Joel Ohman is the CEO of a private equity-backed digital media company. He is a published author, angel investor, and serial entrepreneur who has a passion for creating new things, from books to businesses. He has previously served as the founder and resident CFP® of a national insurance agency, Real Time Health Quotes. He has an MBA from the University of South Florida. Joel has been mentione...

Executive Chairman

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.