Compare New Hampshire Car Insurance Rates [2025]

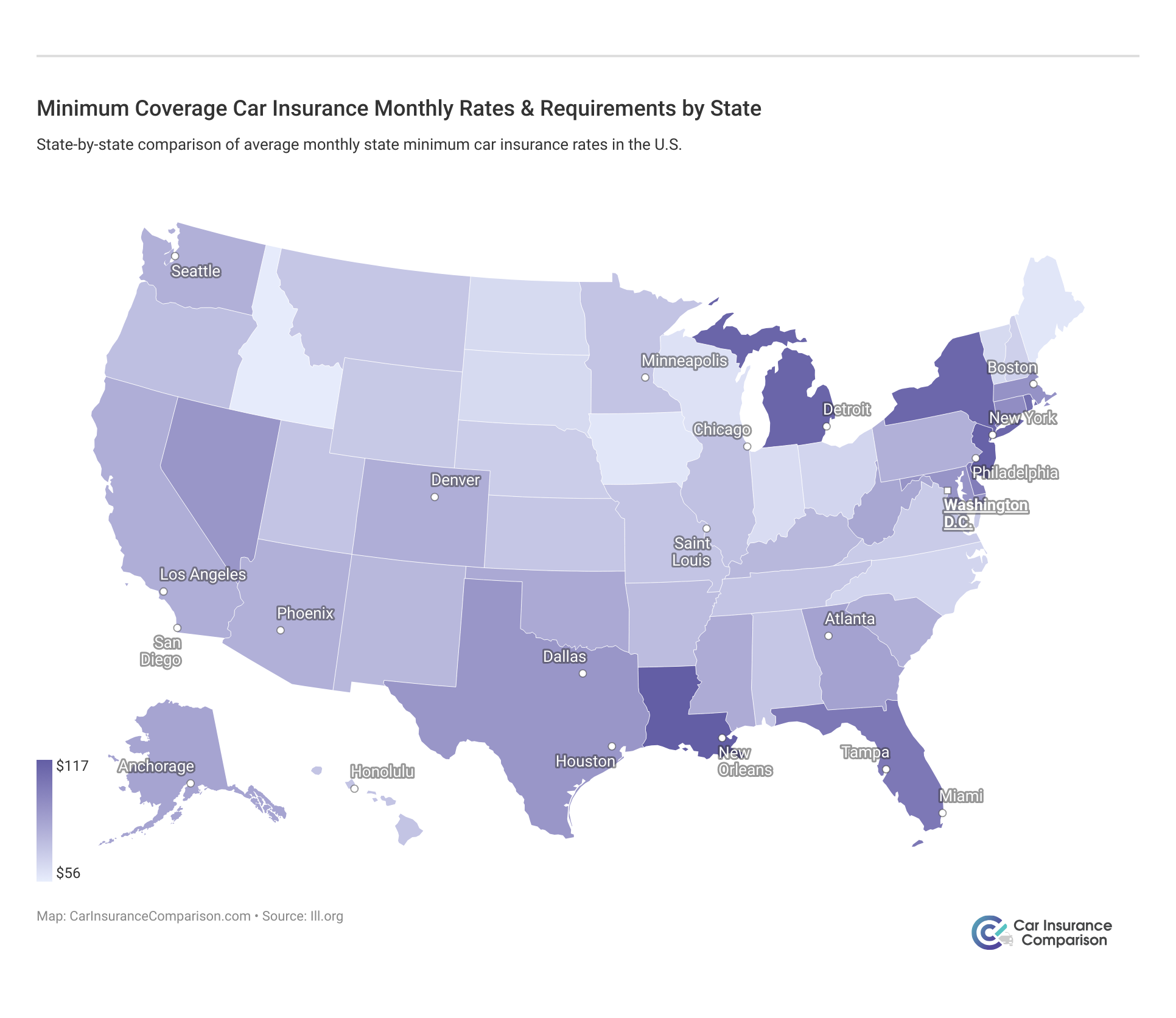

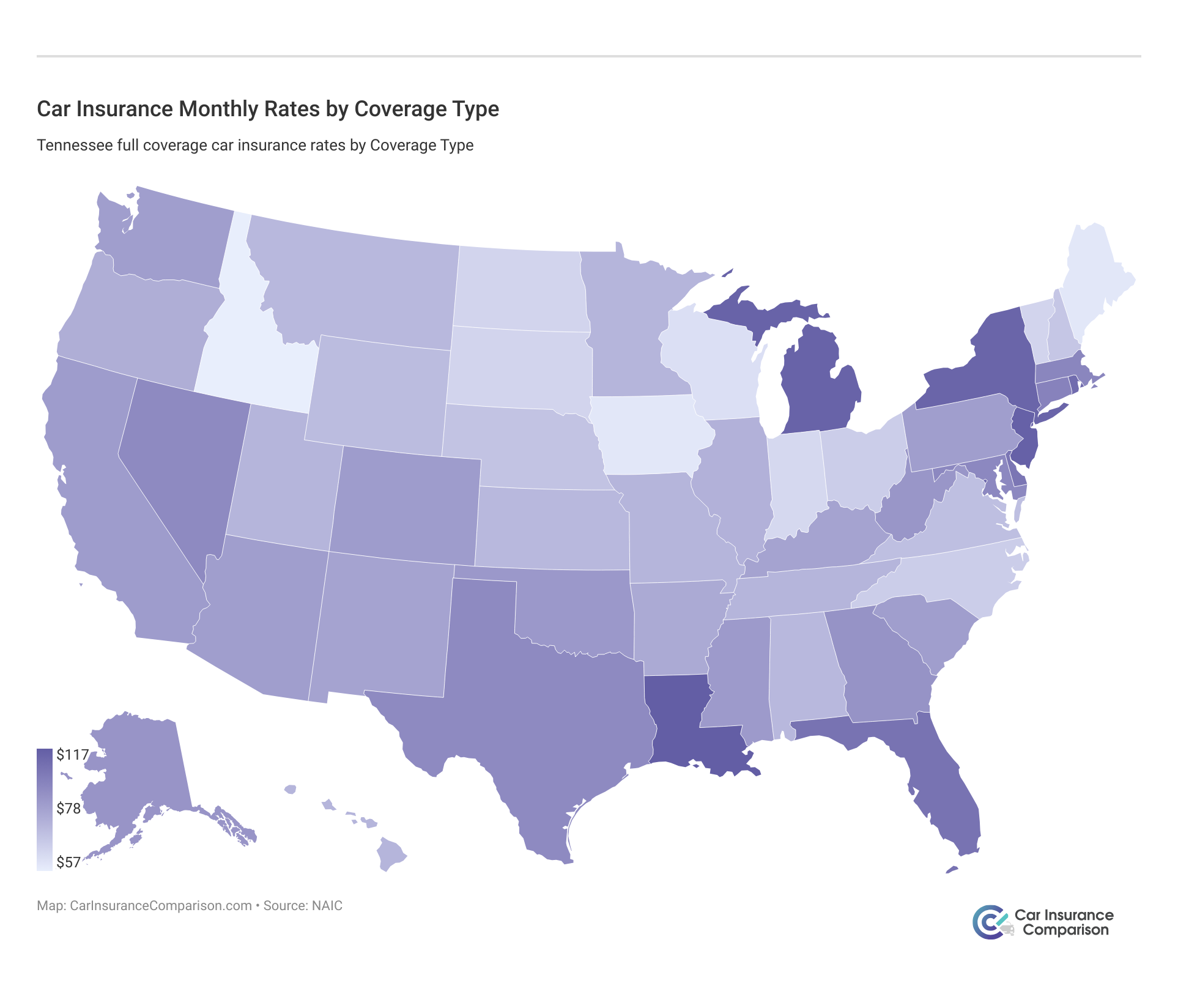

New Hampshire car insurance is generally affordable, but drivers can compare New Hampshire car insurance rates to find even cheaper rates. The average cost of a minimum liability insurance policy in New Hampshire is $31 per month, while a full coverage policy costs an average of $84 per month.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

UPDATED: Jan 10, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 10, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

New Hampshire Road Stats Summary.csv

| New Hampshire Statistics Summary | Details |

|---|---|

| Roadway Miles in State | "Total in State: 16,210 miles Vehicle Miles Driven: 13.05 billion" |

| Vehicles Registered | 1.25 million |

| Population | $1,359,711.00 |

| Most Popular Vehicle | Chevy Silverado 1500 |

| Uninsured Drivers | "9.8% U.S. Rank: 35th" |

| Total Traffic Fatalities | "Total: 105 Speeding: 60 Drunk Driving: 29" |

| Average Annual Premiums | "Liability: $410/yr Collision: $315/yr Comprehensive: $115/yr Average Full Coverage Rates: $840/yr" |

| Cheapest Provider | Geico |

New Hampshire generally has cheap car insurance for the majority of drivers, especially if you take the time to compare New Hampshire car insurance rates. All New Hampshire drivers must carry minimum liability insurance but can opt for full coverage insurance for more protection.

Read on to learn more about what New Hampshire car insurance coverages you must carry and the average rates you’ll pay. If you want to start searching for affordable New Hampshire car insurance right away, check out our free quote comparison tool.

New Hampshire Insurance Coverage and Rates

Trying to learn the ins and outs about all the car insurance companies in New Hampshire can appear to be an impossible mountain to summit.The good news is we’ve committed to being your sherpa along the way by collecting and organizing the important information you need to make an intelligent and confident decision about your car insurance carrier and level of coverage, all for the best price in your state.We’ll help you to know what the state requires, what you may want or need, and where you can get it at the best rates possible for your circumstance.

New Hampshire Minimum Coverage

New Hampshire is the only state that doesn’t require you to carry any car insurance coverage. However, choosing to forego insurance altogether may expose you to great financial liability and possible financial ruin in the case an at-fault accident. Considering the low cost of minimum coverage in most states, it’s really worth the purchase.

New Hampshire is a fault state (also commonly referred to as “tort”), meaning the person who was at fault in the car accident is also legally and financially responsible for any resulting damages.All drivers in New Hampshire are required to carry minimum liability insurance levels of 25/50/25 to satisfy basic overage. This means that car owners must carry the following minimum levels of liability insurance:

- $25,000 for bodily injury or death of one person in an accident caused by the owner of the insured vehicle

- $50,000 for total bodily injury or death in an accident caused by the owner of the insured vehicle

- $25,000 for property damage per accident caused by the owner of the insured vehicle

Additionally, if you do choose to carry liability insurance, New Hampshire mandates that you also car Medical Payments Coverage (Med Pay) of at least $1,000 to cover medical expenses after a crash regardless of who is the responsible party.

If you choose to carry liability insurance, New Hampshire does require you to carry Uninsured/Underinsured Motorist coverage at the same level of your liability coverage. The amount of risk to which you’re willing to allow yourself to be exposed is totally up to you. Part of adulting is doing the uncomfortable cost-benefit analysis to make those hard decisions about how to spend your money.Is the amount of money you’re saving by not carrying liability coverage (or carrying the bare minimum) worth the vulnerability to potential litigation in the future?

Ultimately, the decision is up to you.If you have substantial assets that you wish to protect, you want to consider increasing your liability coverage. Moving forward, we will examine how much drivers in New Hampshire pay on average for their car insurance. The amount you will actually pay will probably differ from these given figures, but this information will give you a reasonable foundation from which you can build out your specific circumstance with confidence.

Premiums as a Percentage of Income

Disposable Personal Income (DPI) is the amount of money you retain after paying the government its share in the form of taxes.New Hampshire Percentage of Income Car Insurance.csv| Annual Full Coverage Average Premiums | Monthly Full Coverage Average Premiums | Annual Per Capita Disposable Personal Income | Monthly Per Capita Disposable Personal Income | Percentage of Income |

|---|---|---|---|---|

| $840.00 | $70.00 | $49,120.00 | $4,093.33 | 1.71% |

You are mandated by law to carry at least the basic coverage. A full coverage policy includes liability, comprehensive, and collision insurance. Here’s a peek at the average cost of each:New-Hampshire-Rates-Compared-to-the-National-Average-2019-03-07.csv

| Coverage Type | National Average | New Hampshire Average |

|---|---|---|

| Full Coverage | $1009.38 | $818.75 |

| Liability | $538.73 | $400.56 |

| Collision | $322.61 | $307.42 |

| Comprehensive | $148.04 | $110.77 |

Now that we have sorted through some data about auto insurance costs to the individual consumer, let’s take a look at some important statistics about the insurance companies themselves.

Loss Ratio

First, let’s tackle the concept of loss ratio and what it means for your insurance. What exactly is a loss ratio? How and why does it affect your premiums?https://youtu.be/w62D16qYX6AThe insurance loss ratio is the proportionate relationship of incurred losses to earned premiums expressed as a percentage.

A high loss ratio means that an insurance company has too many customers filing claims, which will subsequently lead to a rise in future premiums for all consumers.For example, an auto insurer collects $100,000 of premiums in a given year and pays out $65,000 in claims, the company’s loss ratio is 65 percent ($65,000 incurred losses/$100,000 earned premiums).

Add-ons, Endorsements, Riders

Just under 10 percent of drivers in New Hampshire (9.9 percent to be precise) don’t have insurance, which ranks as the 35th highest percentage in the nation. Despite the increasing popularity of pay-by-the-mile auto insurance plans offered by companies like Metromile, presently they are unavailable in New Hampshire.

Other Usage-Based Insurance programs (UBI) are active and available to drivers in New Hampshire. Programs like Drivewise from Allstate, Snapshot from Progressive, or SmartRide from Nationwide offer discounts to drivers based on your driving proficiency.In addition to these add-ons, there are several more optional enhancements that you can explore to decide which ones may be right for you:

- Gap Insurance

- Personal Umbrella Policy (PUP)

- Rental Car Reimbursement

- Emergency Roadside Assistance, such as towing

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

Read More: How do you get a Metromile car insurance quote online?

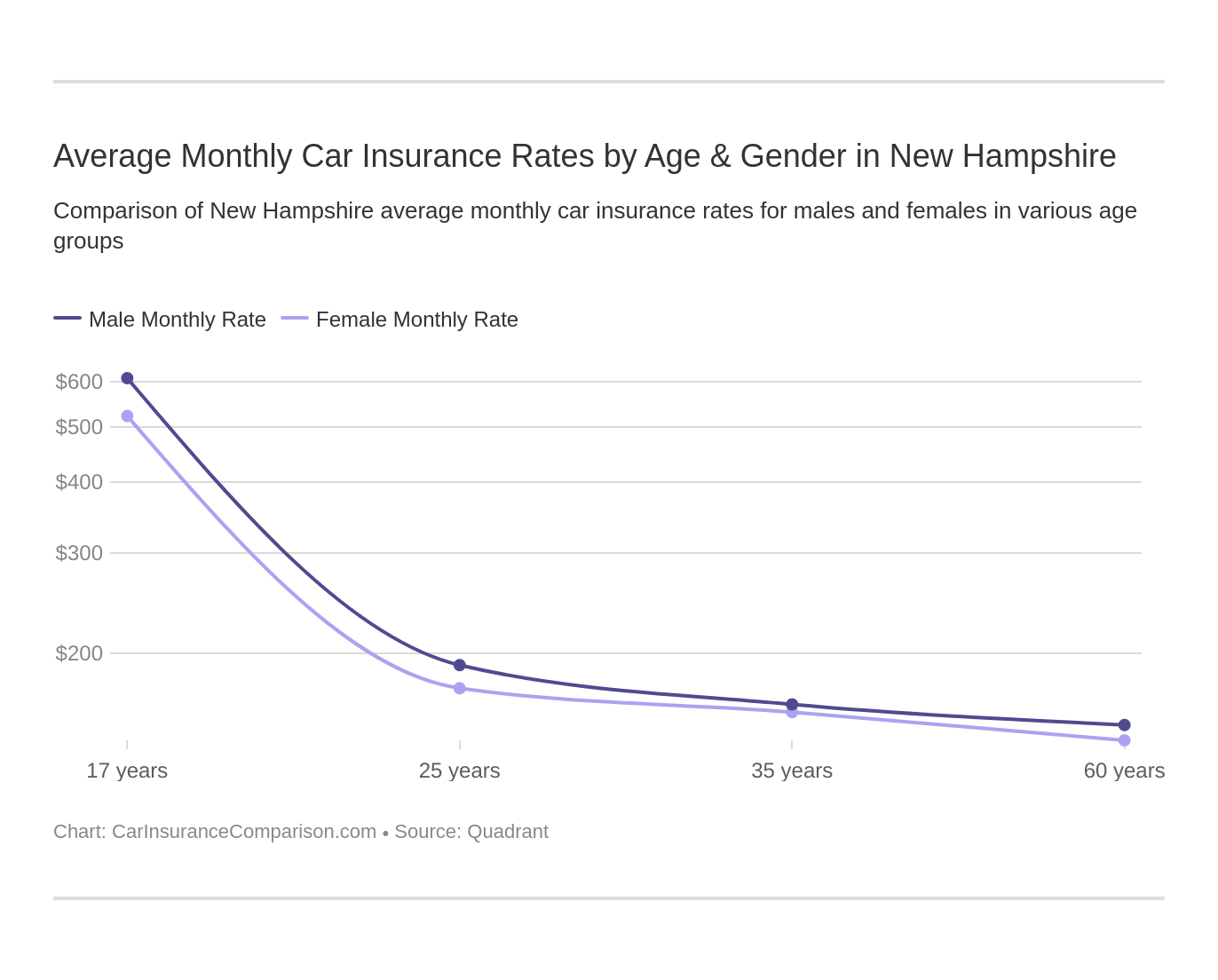

Average Monthly Car Insurance Rates by Age & Gender in NH

With an official motto of “Live free or die,” the residents of New Hampshire clearly place a high premium on their independence. But which gender will pay a higher car insurance premium in the Granite State, men or women?Let’s find out.

NH Male vs. Female Monthly Rates Comparison| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| $337 | $425 | $173 | $183 | $164 | $174 | $176 | $193 | |

| $214 | $297 | $92 | $139 | $88 | $87 | $79 | $79 | |

| $367 | $466 | $152 | $163 | $132 | $134 | $119 | $125 |

| $527 | $582 | $134 | $135 | $114 | $104 | $99 | $100 | |

| $190 | $208 | $434 | $460 | $412 | $445 | $335 | $377 | |

| $339 | $419 | $126 | $143 | $113 | $113 | $103 | $103 | |

| $356 | $389 | $104 | $113 | $83 | $81 | $77 | $77 |

Here’s a look at the Most Expensive Demographic rates in the Granite State. Where do you stack up? Which company would best serve you and your family?Most Expensive Car Insurance Monthly Rates by Provider, Age, & Gender in New Hampshire

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| $430 | $470 | $220 | $240 | $145 | $165 | $125 | $135 | |

| $440 | $470 | $225 | $245 | $145 | $165 | $125 | $135 | |

| $430 | $460 | $220 | $240 | $140 | $155 | $120 | $130 | |

| $400 | $440 | $205 | $225 | $135 | $150 | $115 | $125 | |

| $450 | $480 | $230 | $250 | $150 | $170 | $130 | $140 |

| $440 | $470 | $225 | $245 | $145 | $160 | $125 | $135 |

| $420 | $450 | $210 | $230 | $140 | $160 | $120 | $130 | |

| $410 | $460 | $215 | $235 | $140 | $155 | $120 | $130 | |

| $450 | $490 | $235 | $255 | $155 | $175 | $135 | $145 |

| $420 | $450 | $210 | $230 | $135 | $150 | $115 | $125 |

While you cannot ever put a price on independence, it’s if you’re an independent woman who is single and 17 in New Hampshire, you’re going pay to over four times as much be insured with USAA than a married 35-year-old woman.

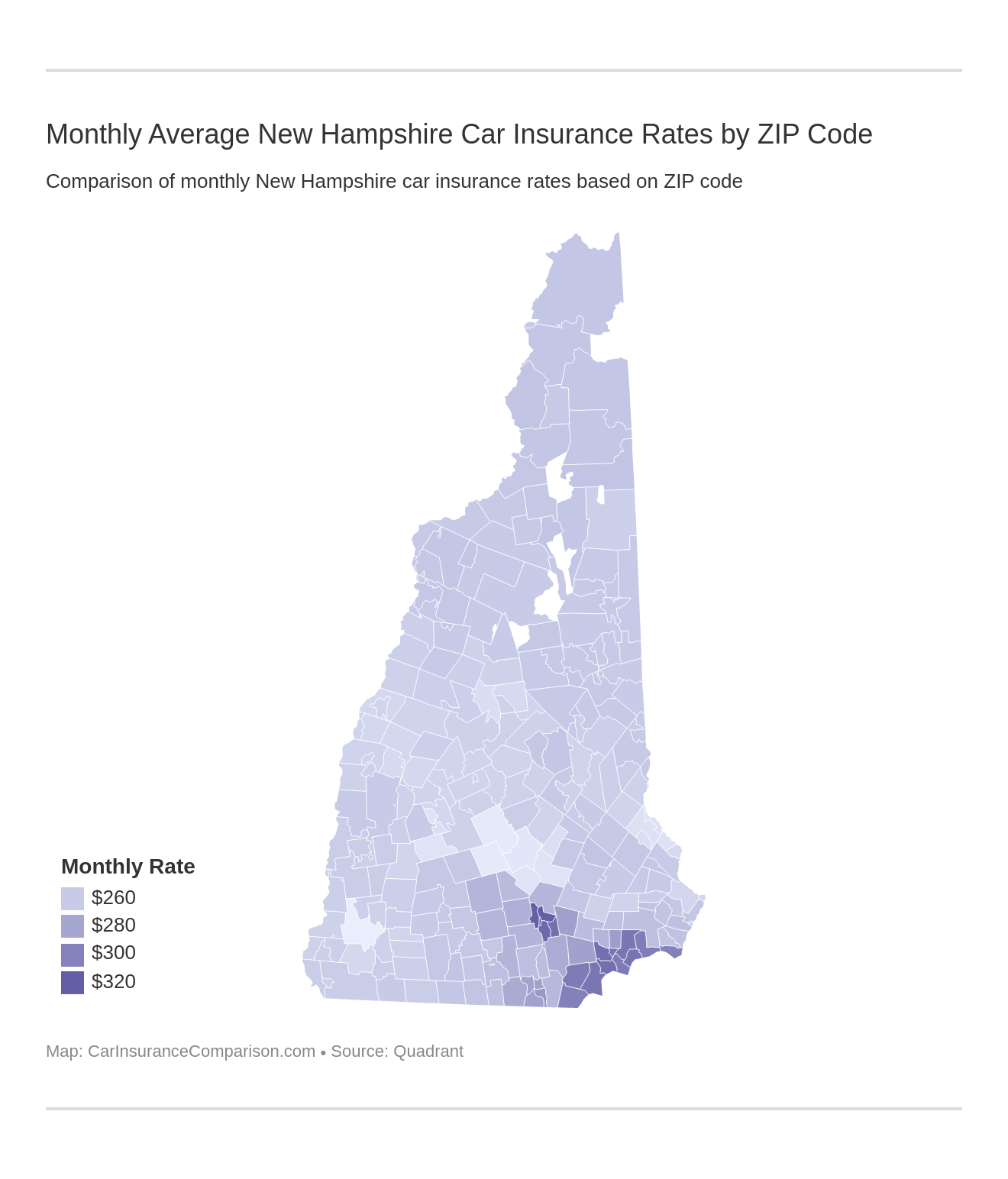

New Hampshire Insurance Rates by ZIP Code

Will you get more affordable car insurance coverage living closer to lakes, the mountains, or the forests?Let’s find out by taking a look at the most expensive ZIP codes in New Hampshire. Here is a chart with the average annual premiums in New Hampshire by ZIP code:

NH Zip Code Average Annual Premium Rank.csv| Rank | Zip Code | Grand Total | Compared to Average |

|---|---|---|---|

| 1 | 03104 | $3,845.88 | $686.89 |

| 2 | 03101 | $3,835.72 | $676.73 |

| 3 | 03102 | $3,825.66 | $666.67 |

| 4 | 03103 | $3,762.33 | $603.34 |

| 5 | 03841 | $3,735.99 | $577.00 |

| 6 | 03811 | $3,725.58 | $566.59 |

| 7 | 03109 | $3,720.88 | $561.89 |

| 8 | 03826 | $3,695.88 | $536.89 |

| 9 | 03858 | $3,694.35 | $535.36 |

| 10 | 03848 | $3,689.28 | $530.29 |

| 11 | 03079 | $3,678.46 | $519.47 |

| 12 | 03865 | $3,653.43 | $494.44 |

| 13 | 03087 | $3,648.72 | $489.73 |

| 14 | 03827 | $3,640.47 | $481.48 |

| 15 | 03076 | $3,611.18 | $452.19 |

| 16 | 03874 | $3,610.79 | $451.80 |

| 17 | 03859 | $3,512.48 | $353.49 |

| 18 | 03060 | $3,451.59 | $292.60 |

| 19 | 03819 | $3,424.28 | $265.29 |

| 20 | 03064 | $3,405.94 | $246.95 |

| 21 | 03032 | $3,404.93 | $245.94 |

| 22 | 03062 | $3,400.72 | $241.73 |

| 23 | 03038 | $3,394.58 | $235.59 |

| 24 | 03063 | $3,389.41 | $230.42 |

| 25 | 03049 | $3,331.53 | $172.54 |

| 26 | 03053 | $3,324.24 | $165.25 |

| 27 | 03073 | $3,314.36 | $155.37 |

| 28 | 03045 | $3,294.84 | $135.85 |

| 29 | 03031 | $3,277.35 | $118.36 |

| 30 | 03110 | $3,272.93 | $113.94 |

| 31 | 03873 | $3,269.18 | $110.19 |

| 32 | 03106 | $3,268.15 | $109.16 |

| 33 | 03070 | $3,263.40 | $104.41 |

| 34 | 03281 | $3,260.44 | $101.45 |

| 35 | 03051 | $3,242.99 | $84.00 |

| 36 | 03046 | $3,227.36 | $68.37 |

| 37 | 03052 | $3,214.50 | $55.51 |

| 38 | 03036 | $3,213.97 | $54.98 |

| 39 | 03054 | $3,201.58 | $42.59 |

| 40 | 03055 | $3,200.23 | $41.24 |

| 41 | 03833 | $3,197.58 | $38.59 |

| 42 | 03862 | $3,194.47 | $35.48 |

| 43 | 03033 | $3,187.78 | $28.79 |

| 44 | 03041 | $3,185.18 | $26.19 |

| 45 | 03856 | $3,180.82 | $21.83 |

| 46 | 03044 | $3,176.64 | $17.65 |

| 47 | 03842 | $3,174.72 | $15.73 |

| 48 | 03048 | $3,173.94 | $14.95 |

| 49 | 03885 | $3,173.12 | $14.13 |

| 50 | 03261 | $3,172.67 | $13.68 |

| 51 | 03570 | $3,170.23 | $11.24 |

| 52 | 03084 | $3,168.50 | $9.51 |

| 53 | 03590 | $3,164.31 | $5.32 |

| 54 | 03871 | $3,164.19 | $5.20 |

| 55 | 03844 | $3,163.02 | $4.03 |

| 56 | 03575 | $3,162.30 | $3.31 |

| 57 | 03586 | $3,161.98 | $2.99 |

| 58 | 03870 | $3,161.79 | $2.80 |

| 59 | 03034 | $3,161.67 | $2.68 |

| 60 | 03576 | $3,160.98 | $1.99 |

| 61 | 03071 | $3,160.05 | $1.06 |

| 62 | 03086 | $3,159.94 | $0.95 |

| 63 | 03579 | $3,159.78 | $0.79 |

| 64 | 03582 | $3,159.77 | $0.78 |

| 66 | 03593 | $3,156.04 | -$2.95 |

| 67 | 03592 | $3,154.79 | -$4.20 |

| 68 | 03840 | $3,153.42 | -$5.57 |

| 69 | 03588 | $3,152.90 | -$6.09 |

| 70 | 03249 | $3,151.96 | -$7.03 |

| 71 | 03585 | $3,150.03 | -$8.96 |

| 72 | 03584 | $3,149.75 | -$9.24 |

| 73 | 03246 | $3,149.74 | -$9.25 |

| 74 | 03740 | $3,149.45 | -$9.54 |

| 75 | 03785 | $3,148.85 | -$10.14 |

| 76 | 03244 | $3,147.66 | -$11.33 |

| 77 | 03037 | $3,146.95 | -$12.04 |

| 78 | 03468 | $3,146.12 | -$12.87 |

| 79 | 03823 | $3,144.79 | -$14.20 |

| 80 | 03082 | $3,144.30 | -$14.69 |

| 81 | 03057 | $3,143.93 | -$15.06 |

| 82 | 03215 | $3,143.86 | -$15.13 |

| 82 | 03238 | $3,143.86 | -$15.13 |

| 84 | 03234 | $3,143.33 | -$15.66 |

| 85 | 03458 | $3,142.33 | -$16.66 |

| 86 | 03852 | $3,140.95 | -$18.04 |

| 87 | 03043 | $3,140.88 | -$18.11 |

| 88 | 03242 | $3,139.93 | -$19.06 |

| 89 | 03825 | $3,139.52 | -$19.47 |

| 90 | 03583 | $3,138.79 | -$20.20 |

| 91 | 03817 | $3,138.62 | -$20.37 |

| 91 | 03850 | $3,138.62 | -$20.37 |

| 91 | 03883 | $3,138.62 | -$20.37 |

| 91 | 03890 | $3,138.62 | -$20.37 |

| 91 | 03897 | $3,138.62 | -$20.37 |

| 96 | 03774 | $3,138.01 | -$20.98 |

| 97 | 03561 | $3,137.67 | -$21.32 |

| 98 | 03263 | $3,137.04 | -$21.95 |

| 99 | 03589 | $3,136.79 | -$22.20 |

| 99 | 03597 | $3,136.79 | -$22.20 |

| 99 | 03765 | $3,136.79 | -$22.20 |

| 99 | 03771 | $3,136.79 | -$22.20 |

| 99 | 03780 | $3,136.79 | -$22.20 |

| 99 | 03832 | $3,136.79 | -$22.20 |

| 99 | 03838 | $3,136.79 | -$22.20 |

| 99 | 03847 | $3,136.79 | -$22.20 |

| 107 | 03580 | $3,136.50 | -$22.49 |

| 108 | 03824 | $3,136.38 | -$22.61 |

| 109 | 03884 | $3,136.05 | -$22.94 |

| 110 | 03598 | $3,135.81 | -$23.18 |

| 111 | 03845 | $3,133.95 | -$25.04 |

| 112 | 03846 | $3,133.18 | -$25.81 |

| 113 | 03237 | $3,132.54 | -$26.45 |

| 114 | 03442 | $3,132.50 | -$26.49 |

| 115 | 03813 | $3,132.06 | -$26.93 |

| 116 | 03595 | $3,131.61 | -$27.38 |

| 117 | 03440 | $3,131.41 | -$27.58 |

| 118 | 03259 | $3,130.46 | -$28.53 |

| 119 | 03886 | $3,130.38 | -$28.61 |

| 120 | 03812 | $3,130.25 | -$28.74 |

| 121 | 03861 | $3,129.92 | -$29.07 |

| 122 | 03816 | $3,129.85 | -$29.14 |

| 123 | 03282 | $3,129.14 | -$29.85 |

| 124 | 03875 | $3,129.12 | -$29.87 |

| 125 | 03849 | $3,129.06 | -$29.93 |

| 126 | 03860 | $3,127.97 | -$31.02 |

| 127 | 03254 | $3,127.11 | -$31.88 |

| 128 | 03830 | $3,127.00 | -$31.99 |

| 129 | 03289 | $3,126.81 | -$32.18 |

| 130 | 03047 | $3,126.80 | -$32.19 |

| 131 | 03743 | $3,126.70 | -$32.29 |

| 131 | 03864 | $3,126.70 | -$32.29 |

| 133 | 03814 | $3,126.34 | -$32.65 |

| 134 | 03872 | $3,126.15 | -$32.84 |

| 135 | 03227 | $3,126.14 | -$32.85 |

| 136 | 03882 | $3,125.99 | -$33.00 |

| 137 | 03773 | $3,125.79 | -$33.20 |

| 138 | 03836 | $3,125.50 | -$33.49 |

| 139 | 03574 | $3,125.16 | -$33.83 |

| 140 | 03279 | $3,124.58 | -$34.41 |

| 141 | 03818 | $3,124.54 | -$34.45 |

| 142 | 03290 | $3,124.15 | -$34.84 |

| 142 | 03820 | $3,124.15 | -$34.84 |

| 144 | 03262 | $3,123.89 | -$35.10 |

| 145 | 03255 | $3,120.94 | -$38.05 |

| 146 | 03449 | $3,120.67 | -$38.32 |

| 147 | 03447 | $3,118.97 | -$40.02 |

| 148 | 03285 | $3,118.72 | -$40.27 |

| 149 | 03251 | $3,118.08 | -$40.91 |

| 150 | 03225 | $3,117.31 | -$41.68 |

| 151 | 03470 | $3,113.18 | -$45.81 |

| 152 | 03857 | $3,112.71 | -$46.28 |

| 153 | 03749 | $3,112.22 | -$46.77 |

| 154 | 03887 | $3,111.28 | -$47.71 |

| 155 | 03603 | $3,109.13 | -$49.86 |

| 156 | 03602 | $3,108.89 | -$50.10 |

| 157 | 03601 | $3,108.67 | -$50.32 |

| 158 | 03451 | $3,108.29 | -$50.70 |

| 159 | 03465 | $3,107.78 | -$51.21 |

| 160 | 03461 | $3,107.24 | -$51.75 |

| 161 | 03224 | $3,106.71 | -$52.28 |

| 162 | 03456 | $3,105.83 | -$53.16 |

| 163 | 03040 | $3,103.42 | -$55.57 |

| 164 | 03218 | $3,103.25 | -$55.74 |

| 165 | 03896 | $3,103.04 | -$55.95 |

| 166 | 03815 | $3,102.44 | -$56.55 |

| 167 | 03605 | $3,102.34 | -$56.65 |

| 168 | 03441 | $3,101.79 | -$57.20 |

| 169 | 03452 | $3,101.63 | -$57.36 |

| 170 | 03609 | $3,101.57 | -$57.42 |

| 171 | 03231 | $3,100.58 | -$58.41 |

| 172 | 03233 | $3,099.14 | -$59.85 |

| 173 | 03581 | $3,098.48 | -$60.51 |

| 174 | 03462 | $3,098.02 | -$60.97 |

| 175 | 03464 | $3,097.91 | -$61.08 |

| 176 | 03769 | $3,097.73 | -$61.26 |

| 176 | 03779 | $3,097.73 | -$61.26 |

| 178 | 03855 | $3,097.12 | -$61.87 |

| 179 | 03608 | $3,094.82 | -$64.17 |

| 180 | 03777 | $3,094.76 | -$64.23 |

| 181 | 03240 | $3,094.36 | -$64.63 |

| 182 | 03894 | $3,094.29 | -$64.70 |

| 183 | 03752 | $3,092.66 | -$66.33 |

| 184 | 03266 | $3,091.88 | -$67.11 |

| 185 | 03241 | $3,091.74 | -$67.25 |

| 186 | 03443 | $3,091.00 | -$67.99 |

| 186 | 03457 | $3,091.00 | -$67.99 |

| 186 | 03604 | $3,091.00 | -$67.99 |

| 186 | 03607 | $3,091.00 | -$67.99 |

| 190 | 03751 | $3,090.66 | -$68.33 |

| 191 | 03853 | $3,090.41 | -$68.58 |

| 192 | 03448 | $3,090.10 | -$68.89 |

| 193 | 03217 | $3,089.85 | -$69.14 |

| 194 | 03220 | $3,089.09 | -$69.90 |

| 194 | 03745 | $3,089.09 | -$69.90 |

| 196 | 03746 | $3,088.79 | -$70.20 |

| 197 | 03768 | $3,087.85 | -$71.14 |

| 198 | 03222 | $3,087.63 | -$71.36 |

| 199 | 03467 | $3,087.02 | -$71.97 |

| 200 | 03223 | $3,086.71 | -$72.28 |

| 201 | 03455 | $3,085.99 | -$73.00 |

| 202 | 03445 | $3,085.58 | -$73.41 |

| 203 | 03256 | $3,085.51 | -$73.48 |

| 204 | 03837 | $3,085.25 | -$73.74 |

| 205 | 03809 | $3,084.47 | -$74.52 |

| 206 | 03782 | $3,084.02 | -$74.97 |

| 207 | 03077 | $3,083.73 | -$75.26 |

| 208 | 03276 | $3,083.36 | -$75.63 |

| 209 | 03253 | $3,082.56 | -$76.43 |

| 210 | 03466 | $3,082.21 | -$76.78 |

| 211 | 03278 | $3,081.47 | -$77.52 |

| 212 | 03851 | $3,081.10 | -$77.89 |

| 213 | 03444 | $3,081.03 | -$77.96 |

| 214 | 03268 | $3,079.41 | -$79.58 |

| 215 | 03754 | $3,077.33 | -$81.66 |

| 216 | 03770 | $3,077.25 | -$81.74 |

| 217 | 03042 | $3,074.73 | -$84.26 |

| 218 | 03269 | $3,073.67 | -$85.32 |

| 219 | 03835 | $3,072.68 | -$86.31 |

| 220 | 03741 | $3,071.72 | -$87.27 |

| 221 | 03781 | $3,070.81 | -$88.18 |

| 222 | 03243 | $3,070.38 | -$88.61 |

| 223 | 03307 | $3,070.22 | -$88.77 |

| 224 | 03216 | $3,070.06 | -$88.93 |

| 225 | 03235 | $3,068.97 | -$90.02 |

| 226 | 03784 | $3,068.10 | -$90.89 |

| 227 | 03257 | $3,066.31 | -$92.68 |

| 228 | 03810 | $3,066.17 | -$92.82 |

| 229 | 03750 | $3,065.88 | -$93.11 |

| 230 | 03450 | $3,064.85 | -$94.14 |

| 231 | 03252 | $3,064.63 | -$94.36 |

| 232 | 03230 | $3,063.98 | -$95.01 |

| 233 | 03287 | $3,063.82 | -$95.17 |

| 234 | 03226 | $3,057.79 | -$101.20 |

| 235 | 03280 | $3,055.34 | -$103.65 |

| 236 | 03260 | $3,052.95 | -$106.04 |

| 237 | 03854 | $3,049.39 | -$109.60 |

| 238 | 03801 | $3,046.47 | -$112.52 |

| 239 | 03748 | $3,039.66 | -$119.33 |

| 240 | 03272 | $3,038.38 | -$120.61 |

| 241 | 03446 | $3,037.08 | -$121.91 |

| 242 | 03284 | $3,033.79 | -$125.20 |

| 243 | 03755 | $3,032.36 | -$126.63 |

| 244 | 03766 | $3,030.03 | -$128.96 |

| 245 | 03245 | $3,029.02 | -$129.97 |

| 246 | 03869 | $3,028.86 | -$130.13 |

| 247 | 03753 | $3,023.42 | -$135.57 |

| 248 | 03291 | $3,013.06 | -$145.93 |

| 249 | 03264 | $2,994.72 | -$164.27 |

| 250 | 03258 | $2,993.83 | -$165.16 |

| 251 | 03273 | $2,991.56 | -$167.43 |

| 252 | 03839 | $2,986.51 | -$172.48 |

| 253 | 03867 | $2,980.81 | -$178.18 |

| 253 | 03868 | $2,980.81 | -$178.18 |

| 255 | 03878 | $2,978.65 | -$180.34 |

| 256 | 03274 | $2,977.73 | -$181.26 |

| 257 | 03221 | $2,967.97 | -$191.02 |

| 258 | 03275 | $2,962.53 | -$196.46 |

| 259 | 03304 | $2,960.07 | -$198.92 |

| 260 | 03301 | $2,935.65 | -$223.34 |

| 261 | 03303 | $2,919.52 | -$239.47 |

| 262 | 03229 | $2,913.60 | -$245.39 |

| 263 | 03435 | $2,901.99 | -$257.00 |

| 264 | 03431 | $2,887.77 | -$271.22 |

New Hampshire Insurance Rates by City

New Hampshire Car Insurance Monthly Rates by Zip Code

| ZIP | Rate |

|---|---|

| 3101 | $95 |

| 3301 | $100 |

| 3801 | $120 |

| 3431 | $90 |

| 3755 | $110 |

| 3060 | $105 |

| 3246 | $115 |

| 3561 | $85 |

| 3820 | $98 |

| 3264 | $100 |

Where does your hometown rank statewide?

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

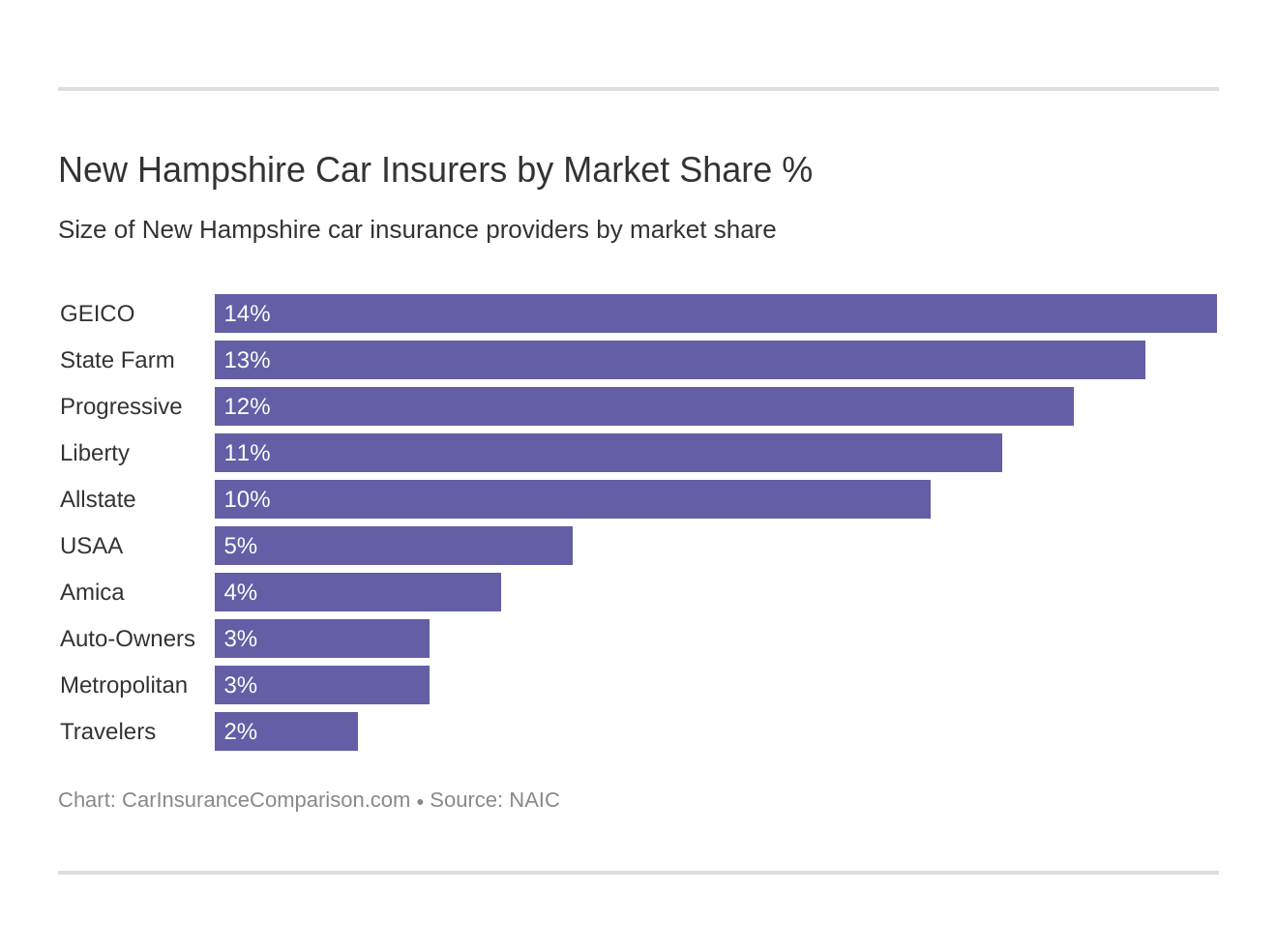

New Hampshire Car Insurance Companies

Making the right choice on your auto insurance coverage is an important decision. That decision can be even more difficult to make when you consider the hundreds of different companies from which to choose.How can you possibly do enough research on each one to be confident with your selection? Who’s going to give you the best rates?

Who has the best customer service? Do you qualify for any discounts or upgrades?Fear not! We will assist you in figuring out which data is most meaningful to you when deciding on the best New Hampshire car insurance company for you.

You should seriously take into account the public reputation and perception of any company from which you’re considering purchasing auto insurance.

Be very wary of any company that is notorious for having a troubling reputation.An insurer’s public reputation can be a clear indication of the kind of rates it offers to its consumers. We’ll show how the largest companies rate in the areas of financial stability and customer satisfaction.

Financial Ratings

AM Best is a credit rating agency. It evaluates insurance companies and grades them based on their financial stability. The table below shows the ten largest insurance companies in New Hampshire as measured by direct premiums written with their AM Best rating.New-Hampshire-AM-Best-Ratings-2019-03-07.csv

| Company | Direct Premiums Written | AM Best Rating |

|---|---|---|

| Geico | $114,977 | A++ |

| State Farm | $106,434 | B |

| Progressive | $103,823 | A+ |

| Liberty Mutual | $97,114 | A |

| Allstate | $84,945 | A+ |

| USAA | $44,555 | A++ |

| Amica | $29,976 | A+ |

| Auto-Owners | $27,987 | A++ |

| Metropolitan | $25,318 | A |

| Travelers | $20,099 | A++ |

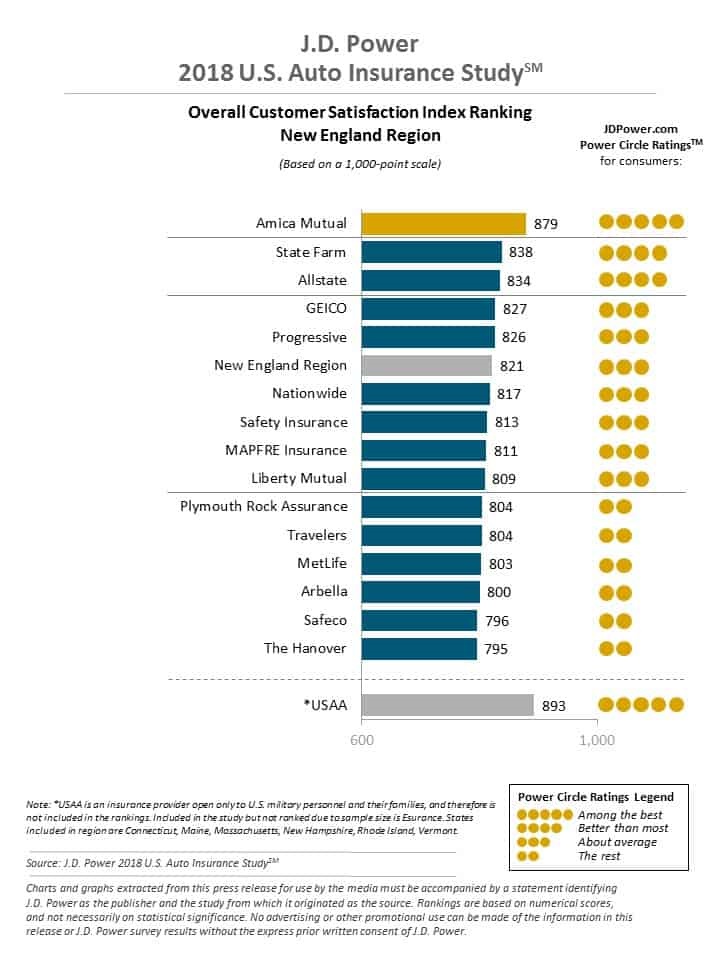

Customer Satisfaction Ratings

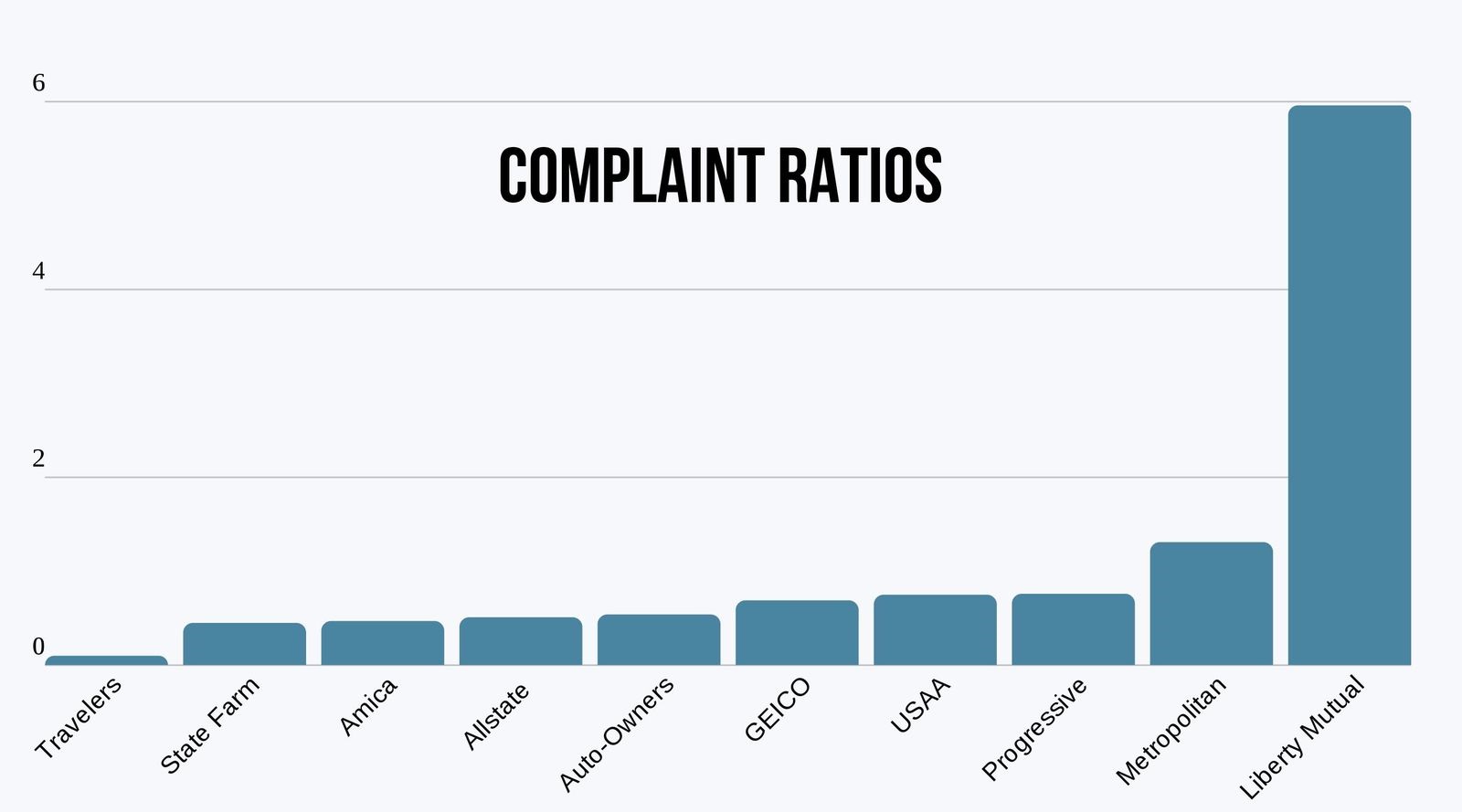

Companies in New Hampshire with the Most and Least Complaints

Loyalty. Trust. Honesty. Communication. Devotion. These are all ingredients for a long-lasting and relationship in which both parties are satisfied.However, in some cases, long-term viability is impossible. No matter what one party says or does, the other party can never be pleased.

As far as satisfaction is concerned: They’re never going to get it.In such cases where the customer is dissatisfied, he or she can file a complaint. Those complaints, justified or not, are factored into a company’s complaint ratios.The complaint ratio is how many complaints a company receive per one million dollars of business written.

Largest Car Insurance Companies in New Hampshire

This chart gives a visual representation of the car insurance companies with the largest market share in New Hampshire.

Complaint Ratios for New Hampshire’s 10 Largest Auto Insurers

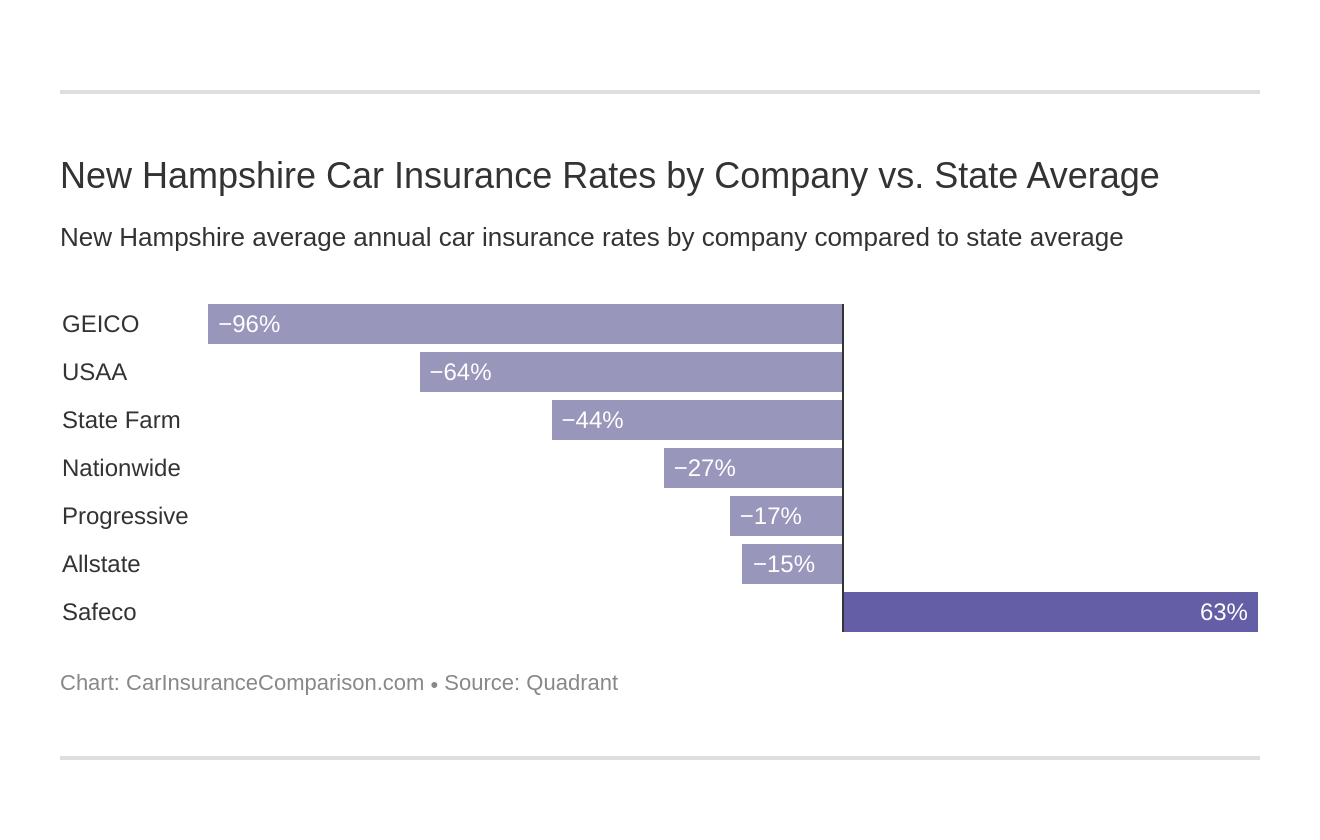

New Hampshire Car Insurance Rates by Company

Now, we’re going to compare and contrast the top car insurance companies to see which of them give the best rates on average in New Hampshire.

New Hampshire Rates by Carrier and Commute

NH Average Annual Rates by Carrier and Commute.csv

| Company | 10-mile Commute/6,000 Annual Mileage | 25-Mile Commute/12,000 annual mileage |

|---|---|---|

| $1,598.00 | $1,625.33 | |

| $1,901.80 | $1,940.56 | |

| $2,137.31 | $2,236.31 | |

| $2,487.58 | $2,487.58 |

| $2,691.13 | $2,691.13 | |

| $2,700.46 | $2,774.94 | |

| $8,476.86 | $8,476.86 |

Commute is just one of a number of factors that can seriously impact your rates.

New Hampshire Rates by Carrier and Coverage Level

NH Average Annual Rates by Carrier and Coverage Level.csv

| Company | Coverage Type | Average Annual Rate |

|---|---|---|

| High | $8,836.20 |

| Medium | $8,450.31 |

| Low | $8,144.06 |

| High | $2,817.35 | |

| High | $2,797.82 | |

| Medium | $2,734.45 | |

| Medium | $2,691.20 | |

| Low | $2,661.29 | |

| Low | $2,652.92 |

| Low | $2,584.38 | |

| Medium | $2,453.07 |

| High | $2,356.75 |

| High | $2,282.92 | |

| Medium | $2,189.03 | |

| Low | $2,088.49 | |

| High | $1,997.66 | |

| Medium | $1,917.96 | |

| Low | $1,847.91 | |

| High | $1,695.58 | |

| Medium | $1,602.39 | |

| Low | $1,537.03 |

New Hampshire Rates by Carrier and Credit History

Have you ever wondered how your credit history influences the quotes you receive from car insurance companies? Consumer Reports conducted a study for New Hampshire analyzing the effect of credit history on premiums.NH Average Annual Rates by Carrier and Credit History.csv

| Company | Credit History | Average Annual Rate |

|---|---|---|

| Good | $1,140.00 | |

| Good | $1,020.00 | |

| Good | $1,080.00 | |

| Fair | $1,380.00 | |

| Fair | $1,260.00 | |

| Poor | $1,620.00 | |

| Fair | $1,320.00 | |

| Good | $1,224.00 |

| Good | $1,320.00 | |

| Fair | $1,464.00 |

| Good | $1,176.00 | |

| Fair | $1,560.00 | |

| Poor | $1,500.00 | |

| Fair | $1,416.00 | |

| Poor | $1,704.00 |

| Poor | $1,656.00 | |

| Poor | $1,560.00 | |

| Poor | $1,800.00 | |

| Good | $1,200.00 |

| Fair | $1,440.00 |

| Poor | $1,680.00 |

New Hampshire Rates by Carrier and Driving Record

Traffic violations will more than likely have a negative impact on your car insurance rates. How severely they will be affected will differ from company to company. Each auto insurer has its own underwriting criteria and assesses violations differently. Here is a quick look at how top car insurance companies in New Hampshire price various driving infractions:NH Average Annual Rates by Carrier and Driving Record.csv

| Company | Driving Record | Average Annual Rate |

|---|---|---|

| Clean record | $1,437.50 | |

| With 1 speeding violation | $1,437.50 | |

| Clean record | $1,483.03 | |

| With 1 accident | $1,590.83 | |

| With 1 speeding violation | $1,724.12 | |

| Clean record | $1,914.01 |

| With 1 DUI | $1,980.83 | |

| With 1 accident | $1,996.60 | |

| Clean record | $2,013.89 | |

| With 1 speeding violation | $2,013.89 | |

| With 1 speeding violation | $2,129.05 |

| With 1 accident | $2,157.23 | |

| Clean record | $2,276.40 | |

| Clean record | $2,312.48 | |

| With 1 DUI | $2,480.96 | |

| With 1 DUI | $2,550.23 | |

| With 1 DUI | $2,562.23 | |

| With 1 speeding violation | $2,655.21 | |

| With 1 accident | $2,657.49 |

| With 1 speeding violation | $2,711.71 | |

| With 1 DUI | $2,923.20 | |

| With 1 accident | $3,095.98 | |

| With 1 accident | $3,190.12 | |

| With 1 DUI | $3,249.78 |

| Clean record | $5,324.37 |

| With 1 speeding violation | $9,084.16 |

| With 1 accident | $9,624.42 |

| With 1 DUI | $9,874.47 |

New Hampshire Rates by Carrier and Demographic

New Hampshire Car Insurance Monthly Rates by Provider, Age, & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| $230 | $250 | $130 | $140 | $95 | $105 | $85 | $90 | |

| $220 | $240 | $125 | $135 | $90 | $100 | $80 | $85 | |

| $210 | $235 | $120 | $130 | $85 | $95 | $75 | $80 | |

| $200 | $230 | $115 | $125 | $80 | $90 | $70 | $75 | |

| $240 | $260 | $135 | $145 | $100 | $110 | $90 | $95 |

| $225 | $245 | $125 | $135 | $90 | $100 | $80 | $85 |

| $215 | $240 | $120 | $130 | $85 | $95 | $75 | $80 | |

| $210 | $235 | $120 | $130 | $85 | $90 | $75 | $80 | |

| $250 | $270 | $140 | $150 | $105 | $115 | $95 | $100 |

| $220 | $240 | $125 | $135 | $90 | $100 | $80 | $85 |

Note: Focus on the company that best suits your specific circumstance.

A married 35-year-old female will pay $1,352.09 on average with State Farm, compared to $4,942.38 she would pay with Safeco,

When shopping for the best car insurance rates for your personal situation, you must choose to do it your way. Your life, your insurance, your choice. You have to do it your way and select the company that’s best for you!The only way to ensure that you’re getting the most favorable premium quotes is to compare rates from multiple carriers.Another way to be certain you can maintain low insurance rates is to be a good driver. In order to be a good driver requires that you know the rules of the road and that you obey them. We’ll review the laws of the Granite State so that you can keep a rock-solid driving record.

New Hampshire Laws

Trying to memorize every traffic law in New Hampshire would be both mind-numbing and impractical. We’ll help you to sift through the non-essentials and highlight those regulations which are most relevant New Hampshire drivers.

Car Insurance Laws

State laws have considerable influence on auto insurance. Each state determines the type of tort law and threshold (if any) that applies in the state, the type and amount of liability insurance required, and the system used for approval of insurer rates and forms.

Insurance companies in New Hampshire are subject to the regulations set by that state insurance commissioner. Ultimately, all rates and regulations must meet the fair competition standards set by the National Association of Insurance Commissioners (NAIC).

Car Insurance Rate-Setting Regulations

“Open competition” is the capitalistic process in which rates are formed; however, if the insurance commissioner decides that rates are excessive or could be harmful to the company’s solvency, he or she will step in and adjust those figures.

High-Risk Insurance

The SR-22 form must be filed by drivers who have committed violations or have multiple infractions, as well as uninsured drivers and others. If your license has been revoked or suspended, you may need to file an SR-22 to have it reinstated.The following infractions will necessitate your needing to carry SR-22 coverage:

- DWI – (1st, 2nd, Subsequent, and Aggravated).

- Underage DWI – (1st, 2nd, Subsequent, Aggravated).

- Leaving Scene of Accident.

- Conduct After Accident.

- Subsequent (2nd) offense Reckless Operation.

The SR-22 requirements in New Hampshire and the relevant forms can be found here.Here is a list of some major violations that will earn points on your license or even a suspension in New Hampshire:

- Aggravated DWI: 6 points

- Transporting drugs in a motor vehicle: 6 points

- Disobeying police officer: 6 points

- DWI: 6 points

- Road racing: 6 points

- False report of theft: 6 points

- School bus violation: 6 points

- Driving without proof of financial responsibility: 4 points

- Improper passing: 4 points

- Speeding at a rate of 25 mph or greater over the posted speed limit: 4 points

- Speeding at a rate of 1-24 mph over posted speed limit: 3 points

- Failure to display or produce a license for an officer: 2 points

Read more: Compare School Bus Insurance Rates

Windshield Coverage

New Hampshire has no specific laws requiring insurance companies to offer special glass coverage or no-deductible windshield replacement. Your insurance company may require you to use a specific repair shop in order to receive coverage. As a consumer, you have the right to choose repair vendor but you may be required to pay the difference in the quote.For a detailed summary of windshield and glass coverage in New Hampshire, click here.

Automobile Insurance Fraud in New Hampshire

Insurance fraud is the second largest economic crime in America. Premium rates are raised dramatically by insurance companies and passed on to the consumers in attempts to combat fraud.There are two classifications of fraud: hard and soft.

- Hard Fraud – A purposefully fabricated claim or accident

- Soft Fraud – A misrepresentation of information to the insurance company

Soft fraud is more common than hard fraud. Twenty to 40 percent of consumers admitted to lying to their insurer about one of the following:

- Number of annual miles driven

- Number of drivers in the household

- How the vehicle would be used

Insurance fraud is a crime no matter how you slice it. Even the “little, white lie” you tell to get a lower rate can lead to harmful consequences. That kind of willful misrepresentation of facts is called known as “rate evasion” and is $16 billion annual expense to auto insurers according to the Insurance Information Institute. If you suspect insurance fraud or have been the victim of fraud, you can contact the New Hampshire Department of Insurance to report such activity.

Statute of Limitations

New Hampshire’s statute of limitations for filing a claim is three years for both personal injury and property damage.

Vehicle Licensing Laws

New Hampshire’s DMV has an online portal where residents can perform tasks such renew their registrations and drivers’ licenses, update or change their address, and retrieve their driving history. Vehicle registration and insurance information can be easily accessed through the state database.

Teen Driver Laws

New Hampshire DMV’s Bureau of Driver Licensing provides valuable resources, training, and education for teen drivers and their parents.New Hampshire Teen Driving Laws

| Type of License | Minimum Age | Driving Requirement | Time Restriction | Passenger Restriction |

|---|---|---|---|---|

| Permit | 15½ years | Licensed adult (25+) supervising | ❌ | No more passengers than seat belts |

| Restricted License | 16 years | 40 driving hours (10 at night), Driver Ed | No driving 1-4 a.m. | 1 passenger under 25 (excluding family); seat belt limit |

| Unrestricted License | 16½ years (or 18 years) | Hold restricted license 6 months or be 18 | ❌ | ❌ |

Older Driver License Renewal

New Hampshire can never be accused of ageism against its senior population when it comes to their driving laws. Everyone in the general population, including seniors, must abide by the same renewal requirements.

Elderly drivers in New Hampshire must get their licenses renewed every five years just like every other driver in the general population. Just like the rest of the general population, senior drivers must show proof of adequate vision at every renewal. And just like the rest of the general population, elderly motorists are allowed to renew online every other renewal.

New Resident Licensing

Once a person has established residency in New Hampshire, they have 60 days to register their vehicle and to obtain a New Hampshire Driver’s License.

License Renewal

Driver licenses must be renewed every five years. Drivers are permitted to renew online every other renewal. Save yourself the hassle; don’t wait until your license is expired before beginning the renewal process.

Rules of the Road

Keep Right and Move Over Laws

New Hampshire law requires that you keep right if driving slower than the average speed of traffic around you.New Hampshire published an updated memo to its “Move Over” law on June 8, 2012. The law states:

You must vacate the lane of travel next to an emergency vehicle as it displays its emergency lights if it is safe to do so. If you cannot move over, you must maintain a reduced speed so that you could stop if that emergency worker entered the roadway.

Speed Limits

NH Speed Limits.csv

| Type of Roadway | Speed Limit |

|---|---|

| Rural Interstates | 65 mph; 70 mph on specified segments of road |

| Urban Interstates | 65 mph |

| Other Limited Access Roads | 55 mph |

| Other Roads | 55 mph |

Seat belt Laws

There are no seat belt laws except for children under 18 years. New Hampshire is the only state in the U.S. that has no seat belt requirement for people over 18 years old.

Car Seat Laws

All children 6 years old or younger, or less than 57 inches, are required to be seated in a child safety seat. They are not permitted to use an adult seat belt under any circumstances. Children ages 7-17 years (or younger than seven but are at least 57 inches tall) are permitted to wear adult safety belts.New-Hampshire-Cell-Phone-Restrictions.csv

| Cell Phone and Texting Restrictions | Details |

|---|---|

| Hand-held ban | all drivers |

| Young drivers all cellphone ban | drivers younger than 18 |

| Texting ban | all drivers |

| Enforcement | primary |

Ridesharing

The following companies offer ridesharing protection in New Hampshire:

- Geico

- Liberty Mutual

- USAA

- State Farm

New Hampshire does not mandate any minimum insurance limits required for Uber, Lyft, or other ridesharing companies. Read about who offers rideshare car insurance for more information.

Safety Laws

Promoting safety and preventing chaos are the ultimate goals of any traffic laws. The New Hampshire Department of Transportation (NHDOT) has as extended its partnership with State Farm to sponsor the Motorist Safety Patrol of I-93.In accordance with the National Highway Traffic Saftey Administration (NHTSA), New Hampshire released its most recent Highway Safety Plan in 2017 as an additional resource for drivers.

DUI Laws

New Hampshire’s DUI laws are as strict as everywhere else in the U.S.. The Blood-Alcohol Content (BAC) limit in the state is 0.08 percent; the High BAC limit is between 0.16 percent.New-Hampshire-DUI-Penalties.csv

| Type of Penalty | First Offense | Second Offense | Third Offense | Fourth and Subsequent Offenses |

|---|---|---|---|---|

| Driver's License Suspension | Nine months - six years. Six months of the sentence may be suspended for enrollment in 20 hour Impaired Driver Intervention Program | Three years minimum | Lifetime - may be reinstated after five years | Lifetime - may be reinstated after seven years |

| Imprisonment | No minimum | 30 days (mandatory minimum) - one year | 180 days - one year | 30 days - seven years, minimum six months deferred jail time |

| Fine | $500 minimum | $750 minimum | $750 minimum | $930 minimum |

| Other | N/A | IID required for one - two years after license reinstatement; Seven-day Multiple Offender Program (MOP) required | IID required one - two years after license reinstatement; 28 day MOP required | IID required one - two years after license reinstatement; 28 day MOP required |

Drug-Impaired Driving Laws

At present, New Hampshire has marijuana-impaired specific laws.

New Hampshire Can’t-Miss Facts

Here are interesting tidbits and knowledge nuggets about the Granite State:

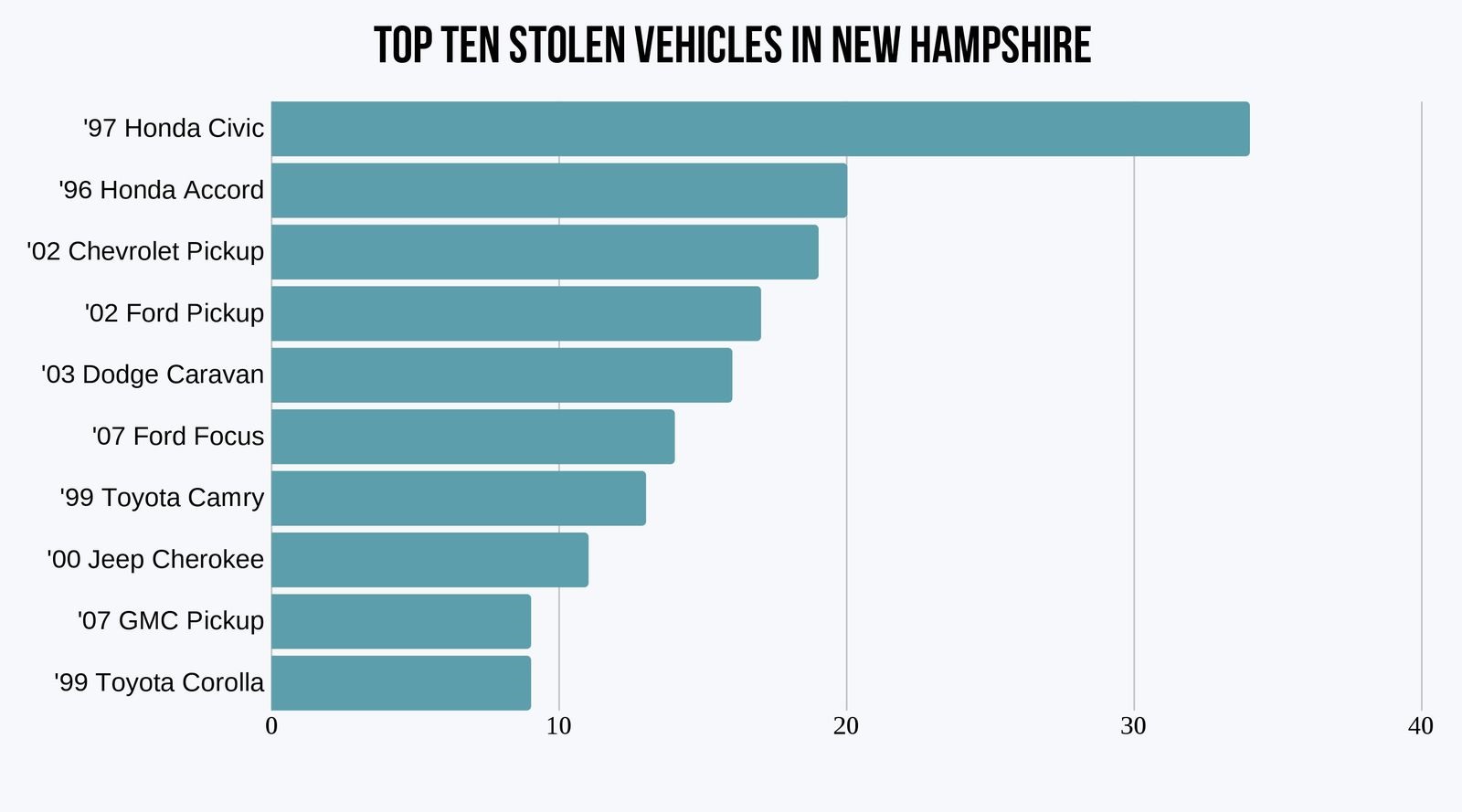

Vehicle Theft in New Hampshire

Car theft is a serious matter. If you’ve ever been the victim of such larceny, the sense of personal violation and disrespect can leave you feeling vulnerable. This chart below reveals which cars in New Hampshire are most susceptible to being stolen.

Vehicle Theft by City

The table below gives a breakdown of the top cities for auto theft within the state.New-Hampshire-Vehicle-Theft-by-City-2019-03-08.csv

| City | Motor vehicle theft |

|---|---|

| Manchester | 159 |

| Nashua | 68 |

| Salem | 35 |

| Derry | 27 |

| Rochester | 24 |

| Claremont | 20 |

| Portsmouth | 20 |

| Laconia | 19 |

| Keene | 17 |

| Belmont | 15 |

| Hampton | 15 |

| Plaistow | 15 |

Risky and Harmful Behavior

For your information, we’ve compiled a list of all driving-related fatalities in New Hampshire.

Fatality by County

New-Hampshire-Fatalities-by-County-2019-03-08.csv

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Hillsborough County | 28 | 27 | 24 | 27 | 20 |

| Rockingham County | 30 | 18 | 29 | 28 | 16 |

| Merrimack County | 7 | 13 | 16 | 13 | 12 |

| Strafford County | 16 | 9 | 12 | 15 | 12 |

| Belknap County | 10 | 4 | 6 | 8 | 11 |

| Cheshire County | 17 | 7 | 2 | 11 | 10 |

| Coos County | 5 | 3 | 7 | 6 | 7 |

| Carroll County | 7 | 6 | 6 | 10 | 6 |

| Grafton County | 10 | 4 | 9 | 14 | 5 |

| Sullivan County | 5 | 4 | 3 | 4 | 3 |

Fatality Rates Rural Vs. Urban

New-Hampshire-Fatalities-by-Roadway-Type-2019-03-08.csv

| Type of Roadway | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|

| Rural | 60 | 87 | 48 | 66 | 75 | 51 |

| Urban | 48 | 48 | 47 | 48 | 61 | 51 |

Fatalities by Person Type

New-Hampshire-Fatalities-by-Person-Type-2019-03-08.csv

| Occupant/Nonoccupant | Person Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|

| Occupants | Passenger Car | 58 | 42 | 49 | 57 | 46 |

| – | Light Truck - Pickup | 14 | 6 | 10 | 23 | 9 |

| – | Light Truck - Utility | 15 | 8 | 12 | 14 | 12 |

| – | Light Truck - Van | 4 | 2 | 3 | 1 | 3 |

| – | Light Truck - Other | 0 | 0 | 0 | 1 | 0 |

| – | Large Truck | 1 | 2 | 0 | 0 | 1 |

| – | Other/Unknown Occupants | 2 | 2 | 1 | 1 | 2 |

| – | Total Occupants | 94 | 62 | 75 | 97 | 73 |

| Motorcyclists | Total Motorcyclists | 24 | 17 | 26 | 19 | 15 |

| Nonoccupants | Pedestrian | 12 | 12 | 8 | 17 | 11 |

| – | Bicyclist and Other Cyclist | 4 | 3 | 3 | 2 | 2 |

| – | Other/Unknown Nonoccupants | 1 | 1 | 2 | 1 | 1 |

| – | Total Nonoccupants | 17 | 16 | 13 | 20 | 14 |

| Combined | Total Persons | 135 | 95 | 114 | 136 | 102 |

EMS Response Time

New-Hampshire-EMS-Response-Times-2019-03-08.csv

| Crash Location | Time of Crash to EMS Notification (minutes) | EMS Notification to EMS Arrival (minutes) | EMS Arrival at Scene to Hospital Arrival (minutes) | Time of Crash to Hospital Arrival (minutes) |

|---|---|---|---|---|

| Rural | 1.27 | 12 | 31 | 45.58 |

| Urban | 0.71 | 10 | 24 | 35.05 |

Transportation

So, how bad is the commute look for the motorists of New Hampshire? How does rush-hour traffic compare to the rest of the nation? What methods do they use to get to work? The answers to those questions are coming up next.

Car Ownership

Commute Time

At 25.2 minutes, New Hampshire motorists almost mirror the national average of 25.3 minutes of commute time. Only 3.37 percent of drivers in New Hampshire experience a “super commute” of 90 minutes or more.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

The Final Word on Comparing New Hampshire Car Insurance

Car insurance in New Hampshire is affordable, making it easier to carry a full coverage policy on your car for a reasonable price. To find the best New Hampshire car insurance, you will need to compare New Hampshire car insurance rates.

If you want to start comparing rates today, use our free quote comparison tool to find the best New Hampshire insurance company in your area.

Frequently Asked Questions

How can I compare car insurance rates in New Hampshire?

To compare car insurance rates in New Hampshire, you can follow these steps:

- Gather information: Collect details about your vehicle, driving history, and insurance needs.

- Research insurance companies: Look for reputable insurance providers that offer coverage in New Hampshire.

- Request quotes: Reach out to different insurance companies and provide the necessary information to receive accurate quotes.

- Compare coverage options: Review the coverage levels, deductibles, and additional features offered by each insurer.

- Evaluate costs: Consider the premiums and any potential discounts offered by each insurer.

- Choose the best option: Select the insurance policy that provides the coverage you need at a price that fits your budget.

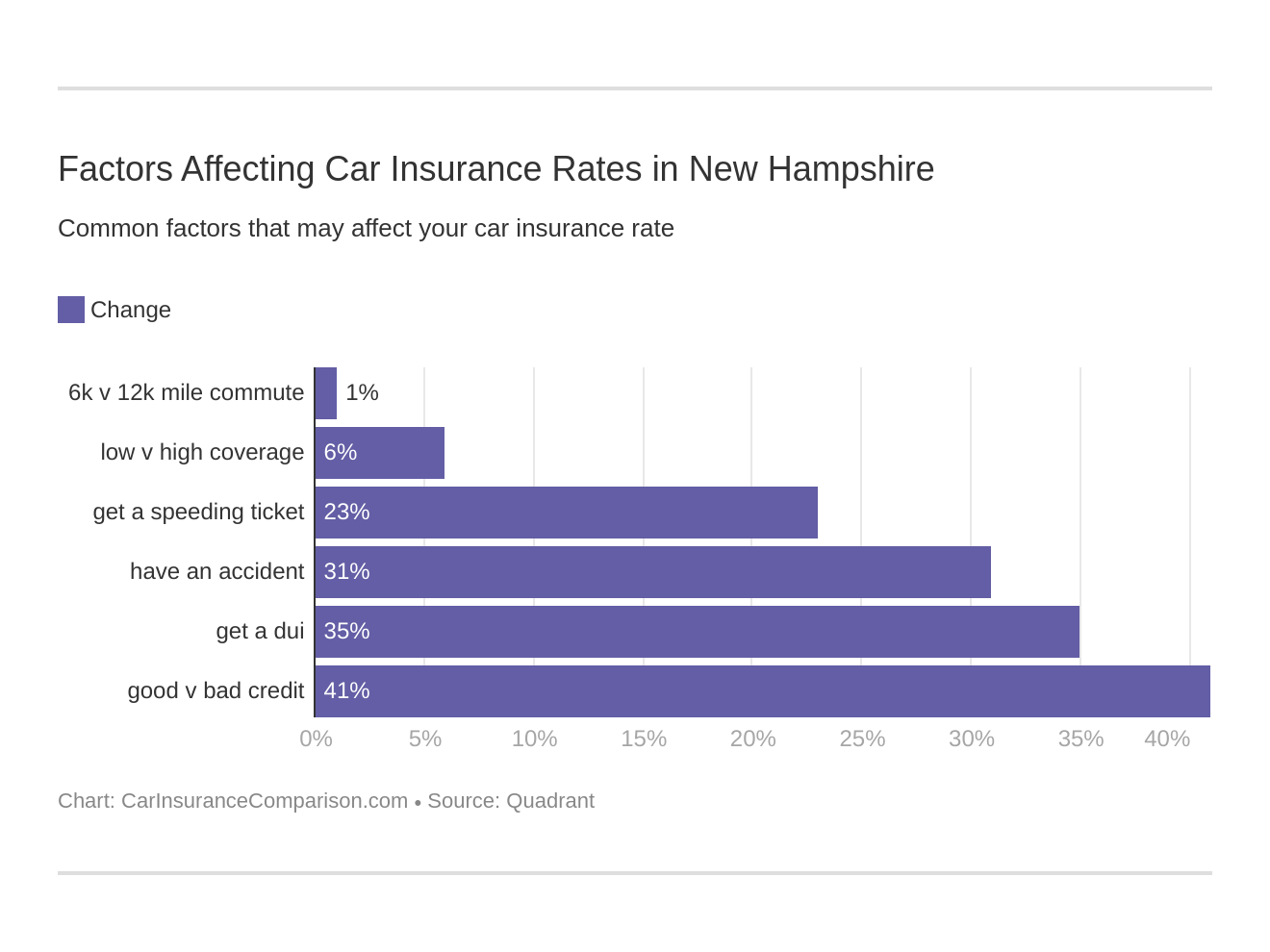

What factors can affect car insurance rates in New Hampshire?

Several factors can influence car insurance rates in New Hampshire. These may include:

- Your age, gender, and marital status

- Your driving record and claims history

- The make, model, and year of your vehicle

- The coverage limits and deductibles you choose

- The amount of mileage you drive annually

- The location where your vehicle is primarily parked in New Hampshire

Are car insurance rates the same for all drivers in New Hampshire?

No, car insurance rates can vary among drivers in New Hampshire. Insurance companies consider individual factors such as driving record, age, gender, and vehicle type when determining premiums. Each driver’s unique circumstances can affect the rates they receive.

How can I save money on car insurance in New Hampshire?

Here are some tips to potentially save money on car insurance in New Hampshire:

- Maintain a clean driving record and avoid accidents or traffic violations.

- Bundle your car insurance with other policies, such as home or renters insurance, to potentially receive a multi-policy discount.

- Inquire about available discounts, such as safe driver discounts or discounts for completing defensive driving courses.

- Consider raising your deductibles if you can afford to pay a higher amount out of pocket in the event of a claim.

- Shop around and compare quotes from different insurance companies to find the most competitive rates.

Are there any specific considerations for car insurance in New Hampshire?

When obtaining car insurance in New Hampshire, it’s important to consider the specific driving conditions and risks in the state. Factors such as local accident rates, weather patterns, and the proximity to densely populated areas may influence the coverage you need. It’s advisable to discuss these considerations with insurance agents or companies familiar with the region.

Where can I find more information about car insurance in New Hampshire?

To gather more information about car insurance in New Hampshire, you can:

- Visit the websites of insurance companies that operate in New Hampshire and explore their coverage options.

- Contact local insurance agents or brokers who can provide personalized guidance based on your specific needs and location.

- Check with the New Hampshire Insurance Department or other relevant state agencies for resources and information on car insurance requirements and regulations.

How much does New Hampshire car insurance cost?

Full coverage in New Hampshire costs an average of $84 per month.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.