Best Car Insurance for Independent Contractors in 2025 (Top 10 Companies)

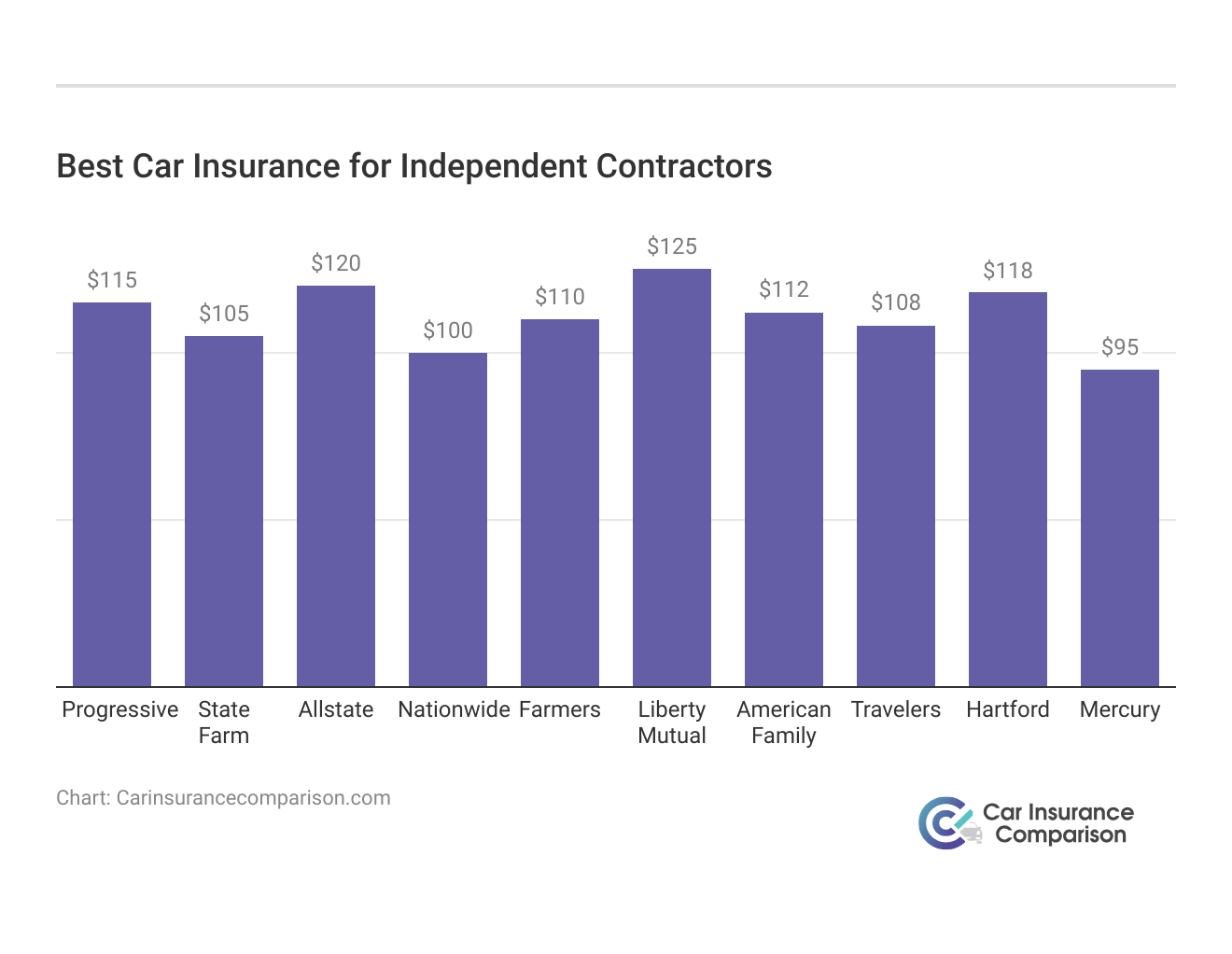

Progressive, State Farm, and Allstate offer the best car insurance for independent contractors, with rates starting at $95. offering tailored coverage starting at $95. Their policies are designed to meet the unique needs of independent contractors, providing peace of mind on the road.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

UPDATED: Mar 18, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 18, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Independent Contractors

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Independent Contractors

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for Independent Contractors

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews

Among them, Progressive emerges as the top choice, providing customizable policies and convenient online management tools. Whether you’re a rideshare driver or a freelancer using your vehicle for work, finding the right insurance coverage is crucial, and these companies deliver.

Our Top 10 Best Companies: Best Car Insurance for Independent Contractors

| Company | Rank | Multi-Policy Discount | Low-Mileage Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | 30% | Online Convenience | >Progressive |

|

| #2 | 17% | 30% | Many Discounts | >State Farm | |

| #3 | 25% | 30% | Add-on Coverages | Allstate | |

| #4 | 20% | 30% | Usage Discount | Nationwide |

| #5 | 20% | 15% | Local Agents | Farmers | |

| #6 | 15% | 30% | Customizable Polices | Liberty Mutual |

| #7 | 25% | 20% | Student Savings | American Family | |

| #8 | 13% | 10% | Accident Forgiveness | Travelers | |

| #9 | 25% | 20% | Deductible Reduction | The Hartford |

| #10 | 15% | 10% | Multi-Policy Discount | Mercury |

Keep reading to learn about commercial vs. personal car insurance. If you want to jump right into finding the most affordable auto insurance company for independent contractors, use our free quote comparison tool.

Our free online comparison tool above allows you to compare cheap car insurance quotes instantly — just enter your ZIP code to get started.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – Progressive: Top Overall Pick

Pros

- Online Convenience: Progressive car insurance review excels in providing a seamless online experience, allowing independent contractors to easily manage their policies, file claims, and access resources through a user-friendly digital platform.

- Maximum Multi-Policy Discount: Offering a substantial multi-policy discount of up to 10%, Progressive encourages customers to bundle their insurance needs, potentially leading to significant cost savings.

- Maximum Low-Mileage Discount: Independent contractors who drive fewer miles can benefit from Progressive’s generous low-mileage discount of up to 30%, contributing to reduced premiums.

Cons

- Limited Local Presence: While Progressive offers online convenience, it may lack the local presence that some contractors prefer for face-to-face interactions or localized support.

- Discount Variation: While Progressive provides excellent discounts, the actual discount percentages may vary based on factors such as location and individual circumstances.

#2 – State Farm: Best for Many Discounts

Pros

- Many Discounts: State Farm car insurance review emphasize that it stands out for its diverse range of discounts, offering up to 17% in multi-policy discounts and up to 30% for low-mileage, providing contractors with various avenues for potential savings.

- Maximum Low-Mileage Discount: Independent contractors who drive infrequently can capitalize on State Farm’s substantial low-mileage discount, potentially reducing their insurance costs significantly.

- Established Reputation: State Farm’s long-standing reputation and extensive network of agents can instill confidence in independent contractors, knowing they are dealing with a well-established and reputable insurance provider.

Cons

- Pricing Variability: Offers numerous discounts, the actual pricing may vary based on individual circumstances, potentially making it challenging to predict exact costs.

- Limited Online Interaction: State Farm’s emphasis on a traditional agent-based model may not cater to those who prefer a more online-centric approach for managing their insurance needs.

#3 – Allstate: Best for Add-On Coverages

Pros

- Add-on Coverages: Allstate car insurance review distinguishes itself by offering a wide array of add-on coverages, allowing independent contractors to customize their policies to meet specific needs, and enhancing overall protection.

- Maximum Multi-Policy Discount: With a substantial multi-policy discount of up to 25%, Allstate incentivizes customers to bundle their insurance, potentially resulting in significant cost savings.

- Maximum Low-Mileage Discount: Independent contractors who drive less can benefit from Allstate’s generous low-mileage discount of up to 30%, contributing to potential premium reductions.

Cons

- Higher Premiums: While Allstate provides comprehensive coverage options, its premium rates may be comparatively higher than some other providers, impacting affordability for certain contractors.

- Complexity in Coverage Options: The multitude of add-on coverages offered by Allstate might be overwhelming for some independent contractors, requiring careful consideration and potentially leading to confusion.

Independent Contractors Car Insurance Cost

There isn’t a specific independent contractor insurance policy, but business auto insurance will cover you if you use your personal vehicle for work.

Car Insurance for Independent Contractors: Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $120 | $230 |

| American Family | $112 | $235 |

| Farmers | $110 | $220 |

| Liberty Mutual | $125 | $240 |

| Mercury | $95 | $190 |

| Nationwide | $100 | $200 |

| Progressive | $115 | $225 |

| State Farm | $105 | $210 |

| The Hartford | $118 | $228 |

| Travelers | $108 | $215 |

For independent contractors, the need for business car insurance depends on usage. Minimal business use may find value in Progressive’s $115/month minimum coverage. However, heavy business reliance warrants full coverage, with State Farm at an affordable $210/month and Allstate providing comprehensive protection at $230/month. The rate table offers a quick comparison, aiding contractors in making informed choices based on their specific work-related driving patterns.

The IRS defines an independent contractor as a non-employee hired by a company to work on a contract basis with clients of their choice. They may often use their own vehicles to chauffeur clients or passengers and deliver products. Some common independent contractors who need business car insurance are, Rideshare and delivery drivers, Administrative and personal assistants, and Physical and massage therapists. Check out our guide titled “Best Car Insurance for Delivery Drivers“

Don’t assume your personal policy automatically covers you if you’re an independent contractor. Most insurance companies will deny car insurance claims on accidents while performing your job if you don’t carry business coverage.

The main factors affecting your commercial car insurance rates are vehicle type, personal driving record, where you live, and how far you drive. For example, insurance rates on a large commercial truck or regular minivan will be higher than rates for a sedan.

However, contractors who occasionally use their vehicles for work can reduce their rates based on mileage. The table below shows how standard car insurance rates can vary based on how far you drive per year.

Full Coverage Car Insurance Monthly Rates by Annual Mileage & Provider

Insurance Company 6,000 Miles 12,000 Miles

Allstate $403 $411

American Family $283 $290

Farmers $348 $351

Geico $264 $272

Liberty Mutual $500 $513

Nationwide $286 $289

Progressive $336 $337

State Farm $265 $279

Travelers $367 $372

USAA $207 $216

Some factors influencing commercial car insurance rates are out of your control. However, shopping around with multiple companies can help you find the most affordable business car insurance companies in your neighborhood.

Difference Between Business vs. Personal Car Insurance

Your personal auto insurance doesn’t cover business use of your car, and your policy will specifically exclude coverages for accidents or damages sustained while working.

The table below lists different insurance scenarios and whether business or personal car insurance covers you for it.

Read more:

Personal vs. Commercial Car Insurance Coverage Situations

Personal Car Insurance

Covers You WhenCommercial Car Insurance

Covers You When

Commuting to your job site. Driving around to meet clients.

Running out to grab pizza for your fellow workers. Delivering your baked goods to customers.

Throwing a box of office supplies in the back of your car. Regularly using your vehicle to transport tools and equipment to job sites.

Not sure what constitutes “business use of your car?” Answer the following questions to determine if you need business vs. personal auto insurance:

- Do you travel to remote work locations?

- Do you make deliveries?

- Do you transport products or people?

- Do you visit clients?

- Do you haul work equipment?

If you answered yes to any questions above, buy commercial car insurance to ensure you’re adequately covered. Your rates will likely increase when you add coverage, but you can save money by maintaining a good driving record and asking for discounts.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Business Auto Policy Coverage

Business car insurance provides the same coverages as a personal policy, including liability, collision, and comprehensive coverage. You can also purchase the following additional coverages with your commercial policy: Rental reimbursement, Uninsured motorist insurance, Medical payments coverage, and Roadside assistance.

Your state may require some of these additional coverages depending on where you live. Research your state laws before comparing business car insurance quotes so you know you’re getting the proper coverage. Explore our comprehensive resource auto insurance laws.

Best Car Insurance Companies for Independent Contractors

The best commercial auto insurance company for you depends on where you live and how often you use your personal vehicle for business use. For example, you may be able to save money with limited delivery driver car insurance.

When comparing companies online, examine each company’s policy offerings and read customer reviews. You want to find an insurer offering the right business policies at affordable rates and a fast and friendly claims process.

J.D. Power ranks commercial car insurance companies based on product selection, price, and customer service. The top seven business car insurance companies are: Allstate, State Farm car insurance review, Erie, Farmers, Chubb, Travelers, and Nationwide.

All top insurers are available in all 50 states, except for Nationwide and Erie. However, you may find a local company specializing in business auto at competitive rates. Compare quotes from at least three companies in your area to find the best price for your policy.

What You Need to Know About Business Car Insurance for Independent Contractors

A personal policy doesn’t cover business use of your car. Consequently, you need to carry business coverage if you’re an independent contractor and use your personal vehicle for work.

Independent contractors who haul equipment, travel to worksites, or deliver products/passengers need a business auto policy. With this increased risk level, insurance companies require additional coverage to protect themselves and you against damages.

Business car insurance costs between $100 and $200 per month, but you can lower your rates by maintaining a good driving record and reducing your annual mileage. Independent contractors who occasionally use their vehicles for work will have the lowest commercial car insurance rates. Read our guide thoroughly “How much does mileage affect car insurance rates?” to gain more insight.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Case Studies: Navigating Insurance Solutions for Independent Contractors

This highlight the diverse needs and preferences of independent contractors when it comes to insurance solutions. Each contractor prioritizes different aspects such as online convenience, savings through bundling, reputation assurance, customization, and maximizing savings through discounts.

- Case Study #1– Online Convenience Wins: Maria prefers managing her insurance online and finds Progressive’s user-friendly digital platform ideal for easy policy management and claims processing.

- Case Study #2– Multi-Policy Savings: John, another independent contractor, prioritizes savings through bundling and seeks assurance from a reputable provider. State Farm becomes his top pick, offering significant discounts for multi-policy car insurance discounts bundles. State Farm’s longstanding reputation and extensive agent network provide John with the confidence he desires.

- Case Study #3– Customized Policies: Emily values flexibility and savings, making Liberty Mutual her top choice for customizable policies and discounts like the low-mileage discount, aligning perfectly with her needs.

These case studies illustrate the importance of understanding individual preferences and priorities when selecting insurance solutions for independent contractors.

Progressive emerges as the top choice for independent contractors, offering unparalleled online convenience for policy management and claims processing.

Melanie Musson Published Insurance Expert

By aligning with providers that meet their unique needs, contractors can ensure they have the coverage and support necessary for their business endeavors. When you’re ready to see how much you can save on your car insurance, enter your ZIP code below into our free comparison tool.

Frequently Asked Questions

Do independent contractors need a specific insurance policy for their work vehicles?

Yes, independent contractors should consider business car insurance for their work vehicles. While personal auto insurance covers personal use, it often excludes coverage for accidents or damages that occur while working. Business car insurance provides the necessary protection for work-related activities.

What factors should independent contractors consider when choosing an insurance provider?

Independent contractors should consider factors such as online convenience, available discounts (multi-policy, low-mileage), coverage options, and whether the provider offers customizable policies. Additionally, personal preferences, such as the desire for local agents or an emphasis on digital tools, can influence the decision-making process.

Why is it important for independent contractors to bundle policies?

Bundling policies, combining multiple insurance policies with the same provider, often leads to substantial discounts known as multi-policy discounts. This can result in significant cost savings for independent contractors, making it a financially advantageous choice.

Get the minimum car insurance coverage you need to drive legally by entering your ZIP code into our free quote comparison tool below.

How does deductible reduction work in insurance policies for independent contractors?

Deductible reduction is a feature that allows independent contractors to lower the out-of-pocket expenses they would incur in the event of a claim. Insurance providers offering deductible reduction typically provide options for reducing the deductible amount, offering financial relief during claims.

Are there specific discounts for independent contractor students?

Yes, some insurance providers offer student savings as a discount for independent contractors who are students themselves or have student-aged drivers in their household. Providers like American Family may provide additional discounts tailored to the unique circumstances of student contractors.

What type of car insurance do independent contractors need?

Independent contractors typically need commercial auto insurance if they use their vehicles for work beyond just commuting. Learn more with our comprehensive guide titled “Compare Commercial Car Insurance: Rates, Discounts, & Requirements“.

How do I determine if I need personal or commercial car insurance?

If you use your vehicle frequently for work tasks like carrying equipment, visiting clients, or transporting goods, you’ll likely need commercial insurance.

How can independent contractors save money on car insurance?

Save money by bundling policies, choosing a higher deductible, keeping a clean driving record, and regularly comparing quotes to find the best rates.

Gain further insights by checking our comprehensive guide titled “How to combine car insurance coverage with the right deductible“.

Can I deduct my car insurance premiums on my taxes?

Yes, if you use your vehicle for business, you can usually deduct the business-use portion of your car insurance premiums on your taxes.

What factors affect the cost of commercial car insurance for independent contractors?

The cost is affected by factors like the type of vehicle, your driving history, the coverage needed, and how much you use your vehicle for business.

Explore your car insurance options by entering your ZIP code below and finding which companies have the lowest rates.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.