Best Dodge Durango Car Insurance in 2025 (Find the Top 10 Companies Here)

Farmers, Progressive, and Liberty Mutual have the best Dodge Durango car insurance, with monthly rates starting at $65. These companies also offer competitive coverage and dependable services. Compare your options for the best Dodge Durango car insurance to get the best rate. Get your quotes today.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

UPDATED: Nov 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

3,072 reviews

3,072 reviewsCompany Facts

Full Coverage for Dodge Durango

A.M. Best Rating

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Dodge Durango

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 3,792 reviews

3,792 reviewsCompany Facts

Full Coverage for Dodge Durango

A.M. Best Rating

Complaint Level

Pros & Cons

3,792 reviews

3,792 reviewsFarmers, Progressive, and Liberty Mutual are the leading providers of the best Dodge Durango car insurance for as little as $65 a month.

That’s the reason we’ve put up this useful guide to explain how Dodge Durango auto insurance quotes are determined and the various types of car insurance that can impact your rates.

For a wealth of useful information and advice, continue reading.

Our Top 10 Company Picks: Best Dodge Durango Car Insurance

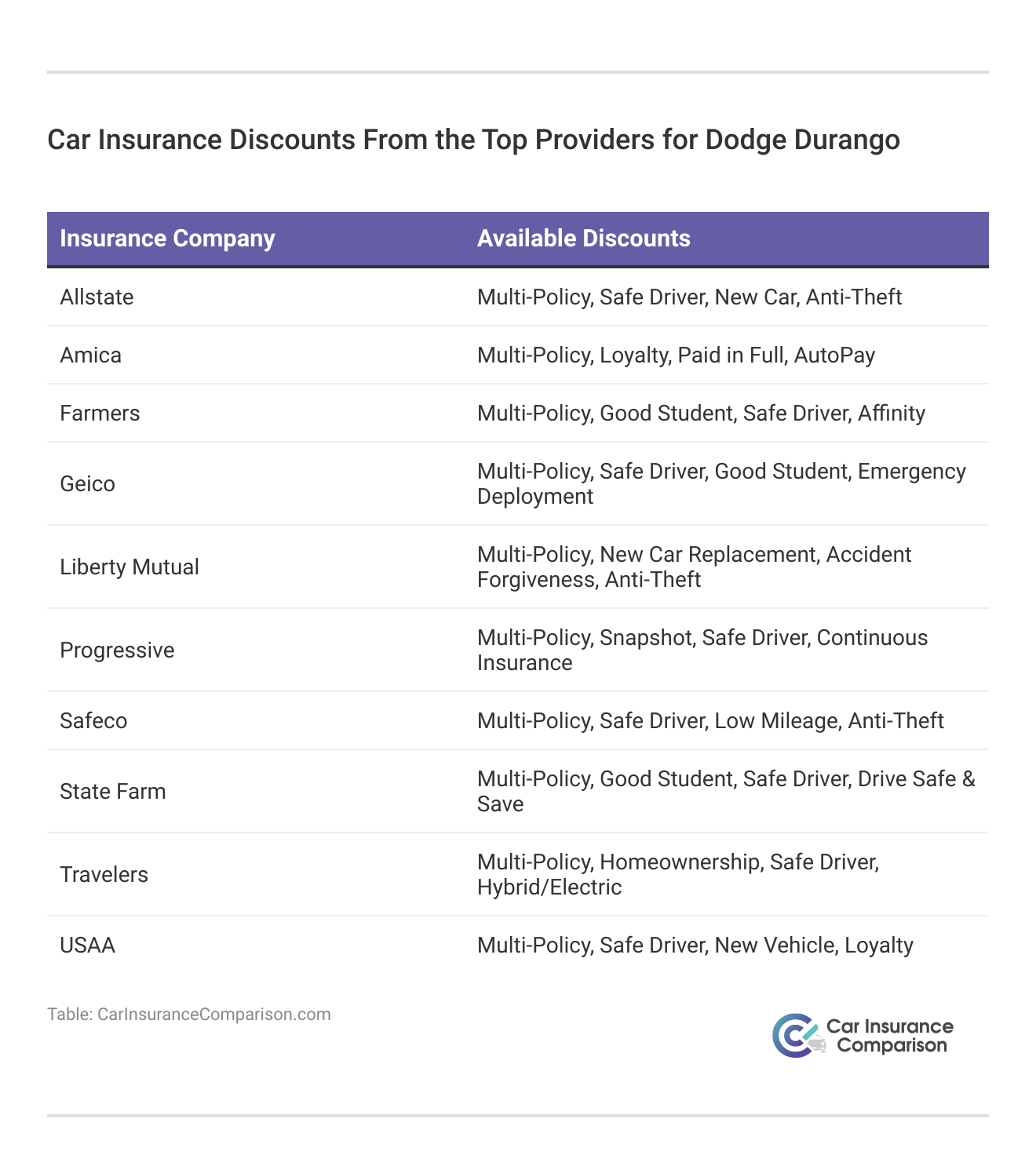

| Company | Rank | Multi-Policy Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 15% | A++ | Customizable Policies | Farmers | |

| #2 | 10% | A++ | Online Tools | Progressive | |

| #3 | 12% | A | Competitive Pricing | Liberty Mutual |

| #4 | 10% | A++ | Military Families | USAA | |

| #5 | 10% | A+ | Accident Forgiveness | Allstate | |

| #6 | 15% | A+ | Customer Service | Amica | |

| #7 | 15% | A++ | Low Rates | Geico | |

| #8 | 17% | B | Young Drivers | State Farm | |

| #9 | 12% | A | High-Risk Drivers | Safeco | |

| #10 | 10% | A | Hybrid Vehicles | Travelers |

With our free online tool, you can begin comparing prices for Dodge Durango auto insurance rates from some of the top auto insurance providers right now. Just enter your ZIP code above.

- Minimum coverage costs around $65 each month

- A liability-only policy costs around $48 each month

- Dodge Durango insurance costs around $6 less per month than the average vehicle

#1 – Farmers: Top Overall Pick

Pros

- Customizable Policies: Farmers offers a wide range of customizable policies, allowing Dodge Durango owners to tailor their coverage, making it one of the best Dodge Durango car insurance options for those needing specific protection. Explore more through Farmers car insurance review.

- Strong Local Agent Network: Farmers has a robust network of local agents, making it easier for Dodge Durango owners to find the best Dodge Durango car insurance with personalized support. Their agents provide expert guidance, ensuring you get the coverage you need.

- Comprehensive Coverage Options: Farmers provides extensive coverage options, including accident forgiveness, making it a top contender for the best Dodge Durango car insurance. Their A++ rating signifies financial strength, giving you peace of mind that claims will be paid promptly.

Cons

- Higher Premiums: Farmers’ premiums can be on the higher side, which might be a disadvantage for Dodge Durango owners looking for the best Dodge Durango car insurance at a lower cost. The elevated costs could deter budget-sensitive customers.

- Mixed Customer Service Reviews: While Farmers generally offers good service, some customers have reported mixed experiences, which could affect your decision when seeking the best Dodge Durango car insurance. These varying service experiences might influence overall satisfaction.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#2 – Progressive: Best for Online Tools

Pros

- Extensive Online Tools: Progressive is known for its robust online tools, such as the Name Your Price tool, making it a top choice for Dodge Durango owners looking for the best Dodge Durango car insurance with easy online management. Their A++ A.M. Best rating provides solid financial stability.

- Competitive Pricing: Progressive offers competitive pricing, especially for drivers with clean records, making it an attractive option for the best Dodge Durango car insurance. Their 10% multi-policy discount adds further savings potential. Learn more through Progressive car insurance discounts.

- Snapshot Program: Progressive’s Snapshot program rewards safe driving with discounts, offering a unique way for Dodge Durango owners to secure the best Dodge Durango car insurance at a lower cost. This usage-based program can lead to significant savings for careful drivers.

Cons

- Higher Rates for High-Risk Drivers: Progressive tends to charge higher rates for high-risk drivers, which could be a drawback for Dodge Durango owners seeking the best Dodge Durango car insurance with lower premiums. The increased costs for high-risk profiles might be a deterrent.

- Limited Local Agent Support: Progressive primarily operates online and over the phone, which might not be ideal for Dodge Durango owners who prefer the best Dodge Durango car insurance with in-person service. The absence of local agents is a disadvantage for those seeking personalized assistance.

#3 – Liberty Mutual: Best for Competitive Pricing

Pros

- Competitive Pricing: Liberty Mutual offers competitive rates, especially for Dodge Durango owners seeking the best Dodge Durango car insurance with cost-effective options. Additionally, their 12% multi-policy discount adds to the overall affordability, making them a strong contender in the market.

- Wide Range of Coverage Options: Liberty Mutual provides a variety of coverage options, making it ideal for those looking for the best Dodge Durango car insurance with comprehensive protection. This flexibility allows you to tailor your policy, ensuring full coverage for your vehicle.

- Customizable Policies: Liberty Mutual allows for significant policy customization, giving Dodge Durango owners the ability to build the best Dodge Durango car insurance plan that suits their individual needs. This customization ensures that you’re only paying for the coverage you need. Read it more through the Liberty Mutual car insurance review.

Cons

- Customer Service Variability: Liberty Mutual has received mixed reviews regarding customer service, which could be a concern for Dodge Durango owners seeking the best Dodge Durango car insurance with reliable support. Inconsistent service experiences might impact overall satisfaction.

- Potentially High Premiums for Certain Drivers: Liberty Mutual’s rates can be higher for certain driver profiles, which may not be ideal for Dodge Durango owners looking for the best Dodge Durango car insurance at an affordable rate. The potential for increased premiums is a drawback for some.

#4 – USAA: Best for Military Families

Pros:

- Excellent Customer Service: USAA is renowned for its top-notch customer service, making it a top contender for Dodge Durango owners seeking the best Dodge Durango car insurance with personalized support. USAA’s focus on military families ensures tailored care and a high level of customer satisfaction.

- Competitive Rates for Military Families: USAA offers highly competitive rates for military families, making it an excellent choice for those seeking the best Dodge Durango car insurance within this group. Their A++ financial rating ensures reliable claims handling.

- Extensive Coverage Options: USAA provides a broad range of coverage options, including roadside assistance, making it ideal for those seeking the best Dodge Durango car insurance. Their A++ rating and commitment to military personnel ensure robust coverage tailored to your needs.

Cons:

- Eligibility Restrictions: USAA is only available to military members, veterans, and their families, which limits access for those seeking the best Dodge Durango car insurance outside this group. This restriction could be a significant drawback. To find out more, visit Allstate vs. USAA insurance review.

- Limited Local Agents: USAA operates primarily online and by phone, which might not appeal to Dodge Durango owners seeking the best Dodge Durango car insurance with in-person service. The lack of local agents could be a disadvantage.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#5 – Allstate: Best for Accident Forgiveness

Pros

- Accident Forgiveness Program: Allstate’s Accident Forgiveness program ensures that your premium won’t increase after your first accident, making it an attractive option for the best Dodge Durango car insurance. Allstate provides both financial security and incentives for safe driving.

- New Car Replacement: Allstate’s new car replacement coverage is a significant benefit for newer Dodge Durango owners looking for the best Dodge Durango car insurance. Their strong financial rating ensures that you can replace your vehicle without significant out-of-pocket costs.

- Innovative Digital Tools: Allstate offers a suite of digital tools, including the Drivewise app, making it ideal for those seeking the best Dodge Durango car insurance with a tech-savvy approach. Their A+ rating and customer-focused programs further enhance their appeal.

Cons

- Higher Rates: Allstate’s rates are often higher than those of some competitors, which may be a drawback for Dodge Durango owners looking for the best Dodge Durango car insurance with lower premiums. The higher costs could deter budget-conscious drivers.

- Mixed Customer Service Reviews: Some Dodge Durango owners have reported dissatisfaction with their service, which could affect those seeking the best Dodge Durango car insurance with consistent support. This inconsistency might impact overall satisfaction. For more information visit Allstate car insurance review.

#6 – Amica: Best for Customer Service

Pros:

- Exceptional Customer Service: Amica is known for its top-tier customer service, making it a top choice for Dodge Durango owners seeking the best Dodge Durango car insurance with reliable support. Amica combines excellent service with financial stability. Our complete Amica car insurance review goes over this in more detail.

- Dividend Policies: Amica offers dividend policies, which can lower overall insurance costs, a valuable feature for those searching for the best Dodge Durango car insurance with cost-saving benefits. Their A+ rating further enhances their reliability, and these dividends can significantly reduce your premiums.

- Flexible Payment Options: Amica provides flexible payment plans, making it easier for Dodge Durango owners to manage the best Dodge Durango car insurance within their budget. Their high financial rating and customer-first approach ensure that your payments are manageable.

Cons:

- Higher Premiums: Amica’s premiums are typically higher than those of some competitors, which could be a drawback for those looking for the best Dodge Durango car insurance on a budget. The higher costs may not align with all financial situations.

- Limited Availability: Amica is not available in all states, which could limit access for Dodge Durango owners seeking the best Dodge Durango car insurance in their area. Despite their strong coverage options and excellent service, this restriction could be a significant disadvantage.

#7 – Geico: Best for Low Rates

Pros

- Affordable Rates: Geico offers some of the lowest rates in the industry, making it an excellent choice for Dodge Durango owners seeking the best Dodge Durango car insurance. Geico provides strong financial security along with affordable options.

- Easy Online Tools: Geico’s user-friendly website and mobile app make managing your policy convenient, and ideal for those looking for the best Dodge Durango car insurance with online management. Visit our Geico insurance review to learn more.

- Extensive Discount Opportunities: Geico provides a variety of discounts, including safe driver and military discounts, which can make the best Dodge Durango car insurance even more affordable. These discounts, combined with their A++ financial rating, enhance the value of your policy.

Cons

- Limited Local Agents: Geico primarily operates online and over the phone, which might be a drawback for Dodge Durango owners who prefer the best Dodge Durango car insurance with face-to-face service. The absence of local agents could be a disadvantage for those seeking personalized interaction.

- Higher Premiums for High-Risk Drivers: Geico’s rates can be higher for high-risk drivers, making it less attractive for those seeking the best Dodge Durango car insurance at a low cost. The increased premiums could be a concern for drivers with less-than-perfect records.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#8 – State Farm: Best for Young Drivers

Pros

- Strong Local Agent Network: State Farm has an extensive network of local agents, which is beneficial for Dodge Durango owners seeking the best Dodge Durango car insurance with personalized service. Their B rating from A.M. Best indicates solid financial backing.

- Young Driver Discounts: State Farm offers significant discounts for young drivers, which can make the best Dodge Durango car insurance more affordable for families with teenage drivers. Their B rating reflects adequate financial stability, and the savings for young drivers can be substantial.

- Comprehensive Coverage Options: State Farm provides a wide range of coverage options, including collision, comprehensive, and uninsured motorist coverage, ensuring the best Dodge Durango car insurance. Delve more through our State Farm insurance review.

Cons

- Higher Premiums: State Farm’s premiums can be higher than those of some competitors, making it less appealing for Dodge Durango owners seeking the best Dodge Durango car insurance at a low cost. The higher costs could be a disadvantage for budget-conscious drivers.

- Limited Digital Tools: State Farm’s digital tools are not as advanced as those of other providers, which is a disadvantage for tech-savvy Dodge Durango owners who prefer the best Dodge Durango car insurance with online management. The lack of sophisticated digital features is a drawback for some.

#9 – Safeco Insurance: Best for High-Risk Drivers

Pros

- Tailored for High-Risk Drivers: Safeco specializes in offering coverage for high-risk drivers, making it a strong contender for Dodge Durango owners seeking the best Dodge Durango car insurance with flexible options.

- Comprehensive Coverage Options: Safeco offers a wide range of coverage options, including accident forgiveness and diminishing deductibles, providing Dodge Durango owners with the best Dodge Durango car insurance that adapts to their needs.

- 24/7 Claims Support: Safeco’s 24/7 claims support ensures that Dodge Durango owners can access the best Dodge Durango car insurance assistance whenever they need it. This round-the-clock service adds an extra layer of security and convenience.

Cons

- Mixed Customer Service Reviews: Some Safeco customers have reported inconsistent experiences with customer service, which could be a concern for those looking for the best Dodge Durango car insurance with dependable support. For more information visit Safeco car insurance review.

- Higher Premiums for Younger Drivers: Safeco tends to charge higher premiums for younger drivers, which might be a disadvantage for Dodge Durango owners seeking the best Dodge Durango car insurance. The elevated costs for younger demographics could make them less appealing to this group.

#10 – Travelers: Best for Hybrid Vehicles

Pros

- Ideal for Hybrid Vehicles: Travelers is known for offering competitive rates for hybrid vehicles, making it a top choice for the best Dodge Durango car insurance that supports environmentally friendly options. This focus on hybrid vehicles aligns well with the increasing popularity of eco-friendly driving.

- Extensive Discount Opportunities: Travelers provides a variety of discounts, including multi-policy, good student, and hybrid vehicle discounts, helping Dodge Durango owners secure the best Dodge Durango car insurance at a reduced cost.

- Strong Financial Stability: Travelers has an A rating from A.M. Best, indicating solid financial strength, which is crucial for those seeking the best Dodge Durango car insurance with a reliable and secure provider. This stability ensures that your claims will be handled efficiently.

Cons

- Limited Local Agent Presence: Travelers operate primarily online and through call centers, which might not suit Dodge Durango owners who prefer the best Dodge Durango car insurance with in-person service. The lack of local agents could be a drawback for those who value face-to-face interactions.

- Higher Premiums for Certain Models: Travelers may charge higher premiums for certain Dodge Durango models, particularly those with higher repair costs, which could be a disadvantage for those looking for the best Dodge Durango car insurance at an affordable rate. For more information, visit Travelers car insurance review.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Dodge Durango: What You’ll Pay for Insurance

The average annual insurance cost for a Dodge Durango is about $120 per month. This rate can vary based on several factors, including the specific model year and trim of the Durango, as well as the driver’s individual profile.

Dodge Durango Car Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $92 | $190 | |

| $85 | $180 | |

| $95 | $198 | |

| $75 | $175 | |

| $88 | $185 |

| $80 | $170 | |

| $90 | $195 | |

| $87 | $195 | |

| $98 | $198 | |

| $65 | $160 |

Insurance premiums are influenced by the vehicle’s safety features, repair costs, and overall risk profile, as detailed in the car insurance comparison chart. For example, newer models or those with advanced safety technologies might incur higher premiums, while older models could be less expensive to insure.

Additionally, the driver's location, age, and driving history play significant roles in determining the final insurance cost.Kristen Gryglik Licensed Insurance Agent

The Dodge Durango’s classification as a mid-size SUV generally means it may have higher insurance rates compared to smaller vehicles, but this can be offset by safety features and personal driving habits.

Guide to Insuring a Dodge Durango

The Dodge Durango tends to have higher insurance costs compared to other SUVs. With an average monthly premium of $120, it is more expensive than the Ford Expedition ($110) and Chevrolet Tahoe ($116), but cheaper than the Honda Passport ($122) and Volvo XC90 ($124).

The Jeep Grand Cherokee and GMC Terrain are less expensive at $117 and $111, respectively. Despite these higher costs, there are strategies and tools available online to help you find the most affordable Dodge Durango insurance rates from the best auto insurance companies. Enter your ZIP code below.

Factors Affecting Dodge Durango Insurance Cost

The cost of insuring a Dodge Durango can vary based on several factors, including the vehicle’s age, driver profile, location, and safety features. Newer models typically have higher insurance rates; for example, a 2020 Durango costs $120 to insure compared to $100 for a 2011 model.

Dodge Durango Car Insurance Monthly Rates by Age

| Age | Rates |

|---|---|

| 16 | $676 |

| 18 | $630 |

| 20 | $486 |

| 30 | $222 |

| 40 | $200 |

| 45 | $194 |

| 50 | $181 |

| 60 | $172 |

Driver age also impacts costs, with 20-year-olds paying significantly more than 30-year-olds. Location plays a major role too, as drivers in Los Angeles might pay $103 more monthly than those in Indianapolis.

Additionally, a driver’s record can affect insurance rates, with younger drivers facing the highest increases for violations.

Safety ratings and features of the Durango, such as airbags, ABS, and electronic stability control, can also influence insurance costs. Lower insurance loss probability rates generally lead to lower premiums, while higher rates increase costs.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Tips for Reducing Dodge Durango Insurance Costs

To save on your Dodge Durango insurance, consider these effective strategies. First, if you’ve recently moved, it’s wise to compare insurance quotes from different companies, as rates can vary significantly by location.

You can easily obtain and compare these quotes online for free, which may help you discover potential car insurance discounts. Additionally, if you’re an older driver, taking a refresher course can lead to discounts, as many insurers offer reduced rates for drivers who update their skills and knowledge.

Another money-saving option is to consider renting a car instead of purchasing a second Dodge Durango, which can help avoid additional insurance costs.

Lastly, opting for a Dodge Durango model with lower repair costs can further reduce your insurance premiums, as vehicles with less expensive parts and repairs often attract lower insurance rates. Enter your ZIP code below to start finding discounts.

Key Insights in Securing the Best Dodge Durango Insurance

Finding the right insurance for your Dodge Durango doesn’t have to be a daunting task. By exploring options from top providers like Farmers, Progressive, and Liberty Mutual, you can secure quality coverage starting at $65 per month.

The average insurance rate of $120 per month for the Dodge Durango reflects its classification as a mid-size SUV, but with the right strategy—such as comparing quotes, considering different coverage levels, and taking advantage of available discounts—you can find a car insurance policy that suits your needs and budget.

Enter your ZIP code below and start comparing quotes today to ensure you get the best protection for your Dodge Durango at the most affordable rate.

Frequently Asked Questions

What are the average car insurance rates for a Dodge Durango?

The average insurance rate for a Dodge Durango is around $120 per month. Actual rates can vary based on factors like driving history, location, and coverage options.

Are Dodge Durangos expensive to insure?

Dodge Durangos are typically not expensive to insure compared to other SUVs. Their favorable safety ratings and moderate repair costs contribute to lower premiums. Additionally, lower theft rates and eligibility for various insurance discounts help keep insurance costs reasonable.

Overall, these factors make the Dodge Durango a more affordable option for insurance. Enter your ZIP code now.

What factors impact the cost of Dodge Durango insurance?

The cost of Dodge Durango insurance is influenced by factors such as the age of the vehicle, driver’s age, driver’s location, and driving record.

What are the safety ratings of the Dodge Durango?

The Dodge Durango has good safety ratings overall, with specific ratings varying based on the test type.

How can I save money on car insurance for a Dodge Durango?

You can save money on car insurance for a Dodge Durango by comparing quotes from different insurance companies, choosing higher deductibles, and taking advantage of policy discounts. Enter your ZIP code now.

Which insurance companies offer coverage for Dodge Durango?

Some of the best auto insurance companies that offer coverage for Dodge Durango include State Farm, Geico, Progressive, Liberty Mutual, and Allstate.

What makes Farmers a strong option for Dodge Durango insurance?

Farmers is a strong option due to its customizable policies and robust local agent network, offering tailored coverage and personalized support for Dodge Durango owners.

How does Progressive’s Snapshot program benefit Dodge Durango owners?

Progressive’s Snapshot program rewards safe driving with discounts, helping Dodge Durango owners save on the best Dodge Durango car insurance by reducing their premiums based on driving habits. Enter your ZIP code now.

Why might Liberty Mutual be a good choice for those needing comprehensive Dodge Durango coverage?

Liberty Mutual is a good choice due to its wide range of coverage options and the ability to customize policies, ensuring comprehensive car insurance for Dodge Durango owners with competitive pricing.

What are some potential drawbacks of choosing Safeco for Dodge Durango insurance?

Potential drawbacks of choosing Safeco include mixed customer service reviews and higher premiums for younger drivers, which may affect satisfaction and affordability for some Dodge Durango owners.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.