Best Rental Car Reimbursement Coverage in 2025 (Find the Top 10 Companies Here!)

Progressive, Allstate, and Geico have the best rental car reimbursement coverage. At Progressive, rental car insurance costs $15/mo on a minimum coverage policy. Rental car reimbursement insurance covers the cost of a rental car when your vehicle is being repaired or replaced after a covered claim.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

UPDATED: Jul 16, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jul 16, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Rental Car Reimbursement Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for Rental Car Reimbursement Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Rental Car Reimbursement Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsYou will find the best rental car reimbursement coverage at Progressive, Allstate, and Geico.

Rental car reimbursement coverage can help you stay on the road if your car needs to be repaired or replaced, and it’s a relatively cheap car insurance option.

Understanding your car insurance policy and having the right coverage is essential to making sure you’re covered.

If you have found yourself without transportation in the past due to an accident or other incident that required your car to be repaired or replaced, rental car reimbursement insurance may be the solution for your future needs.

Our Top 10 Company Picks: Best Rental Car Reimbursement Coverage

| Company | Rank | Multi-Policy Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | A+ | Widespread Availability | Progressive | |

| #2 | 25% | A+ | Customized Policies | Allstate | |

| #3 | 25% | A++ | Flexible Coverage | Geico | |

| #4 | 17% | A++ | Comprehensive Coverage | State Farm | |

| #5 | 20% | A+ | Organization Discount | Nationwide |

| #6 | 20% | A+ | Personalized Service | American Family | |

| #7 | 10% | A++ | Military Benefits | USAA | |

| #8 | 8% | A++ | Safe Drivers | Travelers | |

| #9 | 10% | A | Signal App | Farmers | |

| #10 | 10% | A | Business Vehicles | Liberty Mutual |

If you’re looking to buy rental car reimbursement auto insurance, enter your ZIP code to get rental car reimbursement car insurance quotes for free.

- Progressive has the best rental car insurance coverage

- Rental car coverage covers the cost of a rental car after a covered claim

- There are coverage limits based on the daily cost of a rental car

#1 – Progressive: Top Pick Overall

Pros

- Widespread Availability: You can buy auto insurance from Progressive in any U.S. state.

- Multi-Policy Discounts: Adding home or renters insurance will lower your auto insurance rates.

- Name Your Price Tool: Use this free tool to see if you can afford rental reimbursement coverage within your budget.

Cons

- Claim Reviews: Progressive has received negative feedback from some customers. Read our Progressive car insurance review to discover more.

- Young Driver Rates: Teens purchasing Progressive insurance independently will have higher policy rates.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#2 – Allstate: Best for Customized Policies

Pros

- Customized Policy: In addition to car insurance rental reimbursement plans, Allstate offers several other ways to customize a policy to meet your insurance needs.

- 24/7 Support: If you need help with your auto insurance rental reimbursement plan or claim, you can contact Allstate 24/7.

- Good Driver Discounts: Being a good driver pays off at Allstate. Learn more in our Allstate car insurance review.

Cons

- Local Agent Availability: Most communication with Allstate won’t be through local agents.

- Customer Complaints: The company does have a higher number of complaints than most companies.

#3 – Geico: Best for Flexible Coverage

Pros

- Flexible Coverage: Get flexible auto insurance with rental coverage at Geico. Read our Geico car insurance review for more information.

- Roadside Assistance: Get help with breakdowns and towing in addition to rental car reimbursement.

- Multiple Discounts: Save with anything from a military discount to a good student discount.

Cons

- Local Agent Availability: Geico’s physical locations with local agents are limited in availability.

- Coverage Availability: Some add-on coverages may not be available in some states.

#4 – State Farm: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage: State Farm offers great comprehensive coverage policies in addition to State Farm rental car insurance. Read more in our State Farm review.

- Financial Stability: Your State Farm rental car reimbursement will be backed by a financially sound company.

- Local Support: In most cases, customers can find local support to help them with a State Farm car rental.

Cons

- High-Risk Rates: State Farm rental car coverage will be expensive for DUI or multi-accident drivers.

- Accident Forgiveness: It can be hard to qualify for accident forgiveness.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Organization Discount

Pros

- Organization Discount: Nationwide offers discounts to members of some organizations.

- Online Quotes: You can quickly get an online quote to see how much auto rental reimbursement coverage will cost at Nationwide.

- Good Driver Discount: Save on your rental car insurance by proving your safe driving skills to Nationwide.

Cons

- Bundling Choices: Nationwide’s bundling discount is restricted to specific bundling combinations. Learn more by reading about Nationwide car insurance discounts.

- Claims Processing Delays: Some customers have complained about claims processing at Nationwide.

#6 – American Family: Best for Personalized Service

Pros

- Personalized Service: American Family is a great choice for customers who want personalized service.

- Accident Forgiveness: You may be able to avoid increased rates.

- Roadside Assistance: Add to get help with easy repairs or tows in addition to rental car coverage.

Cons

- Limited Availability: Coverage is not sold everywhere.

- High-Risk Rates: Rates are most competitive for safe drivers. Find out more in our American Family review.

#7 – USAA: Best for Military Benefits

Pros

- Military Benefits: USAA offers benefits like discounts on shopping. Learn more by reading about USAA car insurance discounts.

- Customer Service: The majority of customers are happy with USAA’s representatives.

- Roadside Assistance: Another great coverage to add in addition to your rental car insurance.

Cons

- Limited Eligibility: USAA serves military and veterans only.

- Coverage Options: USAA’s coverage options are simpler, though you can get all the basics at the company.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#8 – Travelers: Best for Safe Drivers

Pros

- Safe Drivers: Travelers’ rates are competitive for safe drivers. Learn more in our Travelers car insurance review.

- Roadside Assistance: A great coverage to consider besides rental car coverage.

- Multi-Policy Discount: Great if you want to keep all your insurance at one company.

Cons

- IntelliDrive Program: The program may raise your rates in some states if you aren’t a safe driver.

- Customer Reviews: There are some complaints about customer service and claims.

#9 – Farmers: Best for Signal App

Pros

- Signal App: Good drivers will benefit from Farmers’ Signal app. Read more in our Farmers review.

- Agent Support: Local agents are widely available for personalized assistance.

- Multi-Vehicle Discount: This discount is great for families insuring multiple vehicles.

Cons

- High-Risk Rates: Farmers’ rates are most competitive for low-risk customers.

- Claim Experience: There is some negative feedback regarding claims.

#10 – Liberty Mutual: Best for Business Vehicles

Pros

- Business Vehicles: Liberty Mutual offers great commercial insurance for business vehicles.

- 24/7 Service: Get round-the-clock support for rental cars.

- Bundling Discount: Great for customers wanting to keep all their insurance at one company. Find out more by reading about Liberty Mutual discounts.

Cons

- High-Risk Rates: Rental car insurance is most affordable for low-risk drivers.

- Customer Satisfaction: Liberty Mutual doesn’t stand out regarding customer satisfaction ratings.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Car Insurance Rental Reimbursement Explained

What does rental reimbursement mean? Rental car reimbursement coverage is an optional add-on that you can add to a car insurance policy to provide coverage for a rental car or public transportation costs while your vehicle is being repaired or replaced after a covered claim (learn more: How do you file a car insurance claim?).

View this post on Instagram

Much of your rental car reimbursement coverage will depend on what other types of coverage you have. For example, if you have comprehensive coverage, your rental reimbursement policy will cover transportation for any incident that is covered by your comprehensive policy.

If you’re not at fault for an accident, rental car reimbursement for a not-at-fault accident will provide the same coverage.

Many car insurance companies will let you choose where to rent your vehicle, but some companies partner with specific car rental agencies, which can make payment easier. Instead of paying out of pocket and being reimbursed, the agency may be able to bill the insurance company directly.

Brandon Frady Licensed Insurance Agent

Rental car reimbursement coverage may have an expense limit. For example, your policy could offer up to $30 a day with a maximum of $750 per claim.

Where to Buy Car Rental Reimbursement

Most major car insurance companies offer rental car reimbursement insurance as an optional add-on for your existing car insurance policy. Some car insurance companies will have requirements that you must meet to buy rental car reimbursement coverage.

For example, you may need to have collision or comprehensive coverage in place before obtaining rental car reimbursement insurance. You can get quotes for these coverages from any of the popular rental car reimbursement companies, such as Progressive.

Cost of Rental Car Reimbursement Coverage

How much is rental reimbursement coverage? Rental car reimbursement insurance rates will vary based on the amount of coverage you purchase.

Car Insurance Monthly Rates for Rental Cars by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $18 | $30 |

| American Family | $20 | $32 |

| Farmers | $19 | $31 |

| Geico | $12 | $20 |

| Liberty Mutual | $21 | $33 |

| Nationwide | $16 | $27 |

| Progressive | $15 | $25 |

| State Farm | $16 | $28 |

| Travelers | $17 | $29 |

| USAA | $15 | $26 |

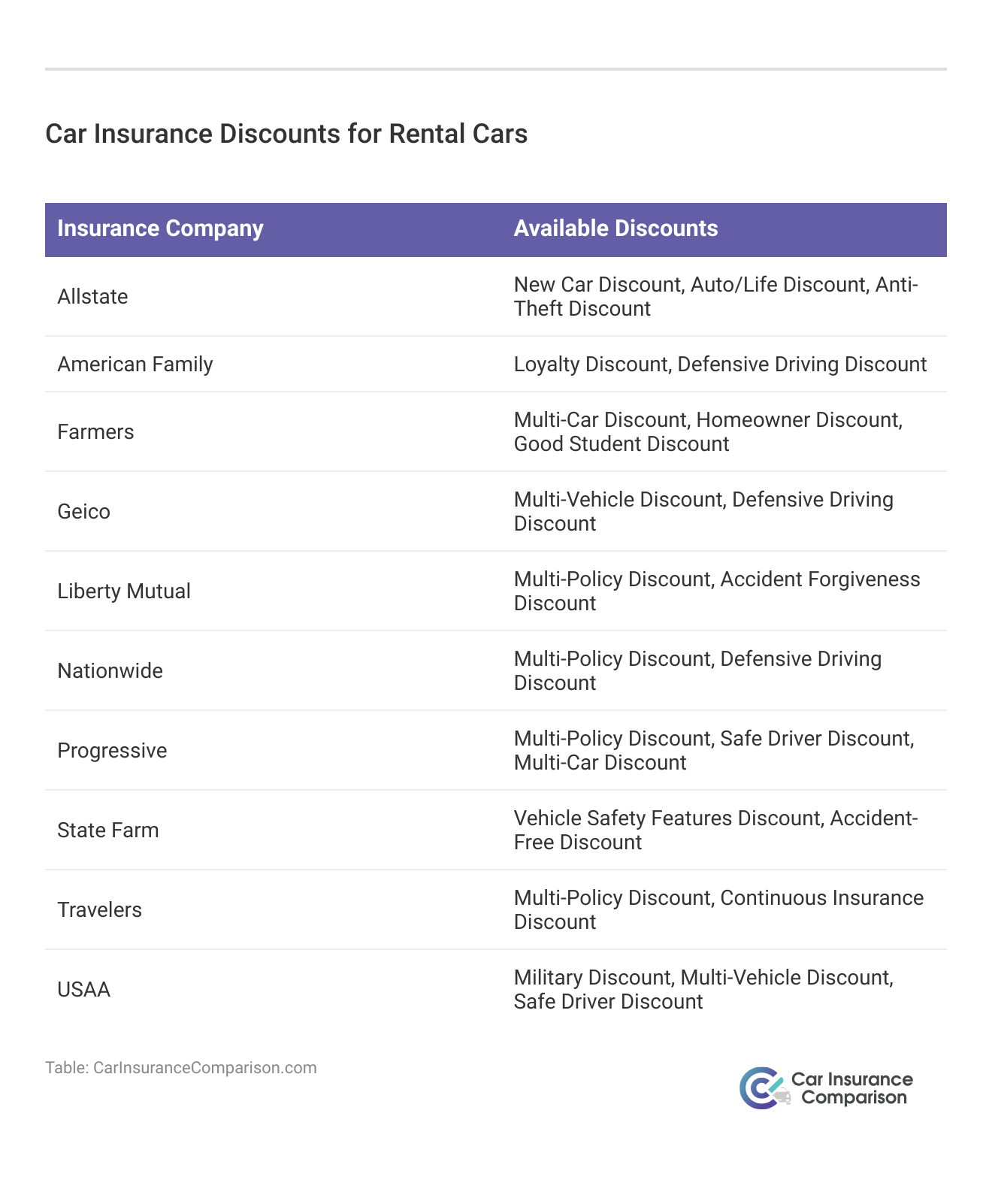

There is generally no car insurance deductible for rental car reimbursement insurance, but you may have to pay a deductible for your other types of coverage. You may be able to save more on rental car reimbursement insurance by shopping for discounts at the best companies.

You may want to choose a rental vehicle that does not exceed your daily coverage limit. If the cost of the rental car is more than your daily or maximum coverage limit, you will have to pay for the excess yourself.

The Final Word on The Best Rental Car Reimbursement Coverage

Is rental car reimbursement worth it? Rental car reimbursement coverage may be worth the small monthly cost for some people. If you know you would not be able to afford to pay for the cost of a rental car or other transportation after an accident or other incident, you may want to pay for rental car reimbursement insurance. You can also take advantage of car insurance discounts to help lower the cost of higher coverage.

If you can afford to pay for a rental car, then rental car reimbursement may not be the best option for you. However, for long-term needs, rental car reimbursement insurance can save you a large sum of money, even if you have to pay for some costs out of pocket.

You may want to base the amount of coverage you buy on the average car rental costs in your area. Paying a couple of dollars per month more for higher coverage limits could save you money in the long run.

If you need help finding an affordable rental car reimbursement car insurance company, enter your ZIP code into our free quote comparison tool below.

Frequently Asked Questions

What is rental car reimbursement coverage?

Wondering what is rental reimbursement? Rental car reimbursement coverage is an optional add-on to a car insurance policy that provides coverage for a rental car or public transportation expenses while your vehicle is being repaired or replaced after a covered claim (learn more: How do you file a car insurance claim?). It helps you stay on the road during the repair process.

How much is rental car reimbursement insurance?

The cost of rental car reimbursement insurance varies based on the coverage limits you choose. Rates can be as low as a few dollars per month. It’s important to do an excess car insurance comparison from different car insurance companies to find the best option for your needs. Use our tool to compare rates today.

Where can I find rental car reimbursement insurance?

You can find rental car reimbursement insurance from most major car insurance companies. It is typically offered as an optional add-on to your existing car insurance policy. Check with your current car insurance provider or explore quotes from different companies to find the coverage that suits you best.

Does rental car reimbursement insurance have a deductible?

Generally, rental car reimbursement insurance does not have a deductible. However, it’s important to note that other types of coverage in your policy may have deductibles. Make sure to review your car insurance policy to understand any deductibles that may apply.

Is rental car reimbursement worth it?

Whether rental car reimbursement coverage is worth it depends on your personal circumstances. If you wouldn’t be able to afford a rental car or alternative transportation after an accident or incident, then it may be worth the small monthly cost. However, if you can afford to pay for a rental car out of pocket, it might not be necessary. Consider your financial situation and the potential costs of renting a car before making a decision on what types of coverage to carry (read more: Compare Car Insurance by Coverage Type).

Can I choose any rental car agency with rental car reimbursement coverage?

Many car insurance companies allow you to choose the rental car agency of your preference. However, some companies may have partnerships with specific rental car agencies, which can simplify the payment process. In such cases, the rental agency may bill the insurance company directly, reducing the need for out-of-pocket expenses.

Who has the best rental car reimbursement coverage?

Progressive, Allstate, and Geico have the best rental car insurance.

Who has the cheapest rental car reimbursement coverage?

Geico has the cheapest rates for rental car insurance added to a minimum coverage policy.

Do I need rental reimbursement?

You may want to get rental reimbursement coverage if you wouldn’t be able to afford the cost of a rental car. You can find affordable rates by shopping around for cheap car insurance quotes.

Does my car insurance cover rental cars internationally?

Most car insurance companies won’t cover international rental cars.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.