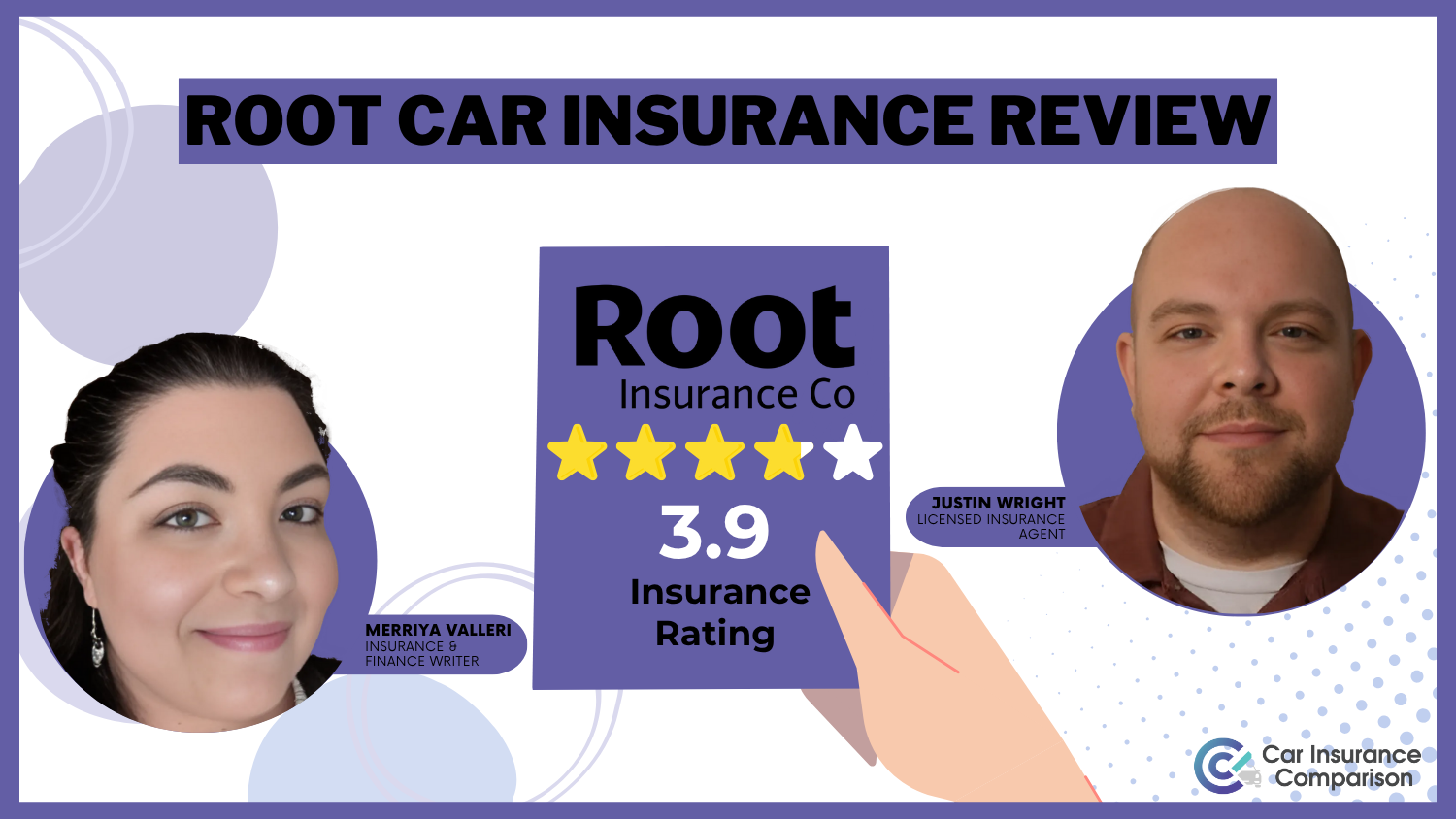

Root Car Insurance Review for 2025 [See Rates & Discounts Here]

Root car insurance quotes start at $16 per month, and safe drivers can earn up to 30% off. Our Root car insurance review found it bases rates on actual driving habits through its app. Unique coverages include roadside assistance, rental reimbursement, and protection for hit-and-run damage.

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

UPDATED: May 14, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: May 14, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Root Insurance

Monthly Rates

$16BBB Rating:

A+Complaint Level:

LowPros

- Usage-based pricing

- Mobile app functionality

- Quick quote process

Cons

- Limited state availability

- Mandatory driving test

This Root car insurance review covers how the company offers personalized rates starting at $16 per month based on your driving behavior.

Root Insurance Car Insurance Rating

| Rating Criteria |  |

|---|---|

| Overall Score | 3.9 |

| Business Reviews | 3.0 |

| Claim Processing | 4.5 |

| Company Reputation | 4.0 |

| Coverage Availability | 4.4 |

| Coverage Value | 3.8 |

| Customer Satisfaction | 1.7 |

| Digital Experience | 4.0 |

| Discounts Available | 3.7 |

| Insurance Cost | 4.1 |

| Plan Personalization | 4.0 |

| Policy Options | 3.4 |

| Savings Potential | 3.9 |

Root Insurance Company uses a mobile app to track your driving, potentially lowering rates for safe drivers. While ideal for tech-savvy drivers, those with poor driving records may face higher rates.

Root’s app makes it easy to manage policies and claims, making it simple to understand how to file a car insurance claim, but it’s still wise to compare quotes for the best deal.

- Root car insurance review shows rates start as low as $16/month for safe drivers

- Usage-based pricing rewards low-mileage, responsible driving habits

- Get quick Root car insurance quotes through the app with up to 30% discounts

Quit overpaying for auto insurance. Our free quote comparison tool allows you shop for quotes from the top providers near you by entering your ZIP code.

Root Car Insurance Cost

Root Insurance monthly car insurance rates vary by age, gender, and coverage level, with younger drivers paying the highest premiums and costs decreasing with age. For instance, a 16-year-old male pays $130 for minimum and $230 for full coverage, while a 45-year-old male pays only $16 and $43, respectively.

Root Car Insurance Monthly Rates by Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $120 | $210 |

| 16-Year-Old Male | $130 | $230 |

| 18-Year-Old Female | $105 | $195 |

| 18-Year-Old Male | $115 | $215 |

| 25-Year-Old Female | $75 | $140 |

| 25-Year-Old Male | $85 | $155 |

| 30-Year-Old Female | $65 | $120 |

| 30-Year-Old Male | $70 | $130 |

| 45-Year-Old Female | $55 | $110 |

| 45-Year-Old Male | $16 | $43 |

| 60-Year-Old Female | $50 | $95 |

| 60-Year-Old Male | $55 | $100 |

| 65-Year-Old Female | $48 | $90 |

| 65-Year-Old Male | $52 | $95 |

Female drivers generally receive slightly lower rates across all age groups, and full coverage is consistently more expensive than minimum coverage due to the added protection it provides. Therefore, it is important to compare options when searching for the best full coverage car insurance.

Car insurance rates typically drop after 25 but may rise after 65. For example, seniors can save by enrolling in a defensive driving course.

Brad Larson Licensed Insurance Agent

Full coverage car insurance rates vary significantly by credit score, with drivers with good credit paying the lowest premiums and those with poor credit facing much higher costs. Among the companies listed, Root offers the most affordable rates across all credit tiers at $105 for good credit, $130 for fair credit, and $190 for poor credit.

Full Coverage Car Insurance Monthly Rates by Credit Score

| Insurance Company | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| $130 | $160 | $220 | |

| $128 | $158 | $218 | |

| $120 | $150 | $200 | |

| $110 | $140 | $180 | |

| $135 | $170 | $230 |

| $122 | $152 | $210 |

| $115 | $145 | $205 | |

| $105 | $130 | $190 |

| $125 | $155 | $210 | |

| $132 | $162 | $222 |

In contrast, insurers like Liberty Mutual and Travelers charge up to $230 and $222 for drivers with poor credit. This data shows that maintaining a strong credit score can lead to substantial savings on full coverage premiums through good credit car insurance discounts.

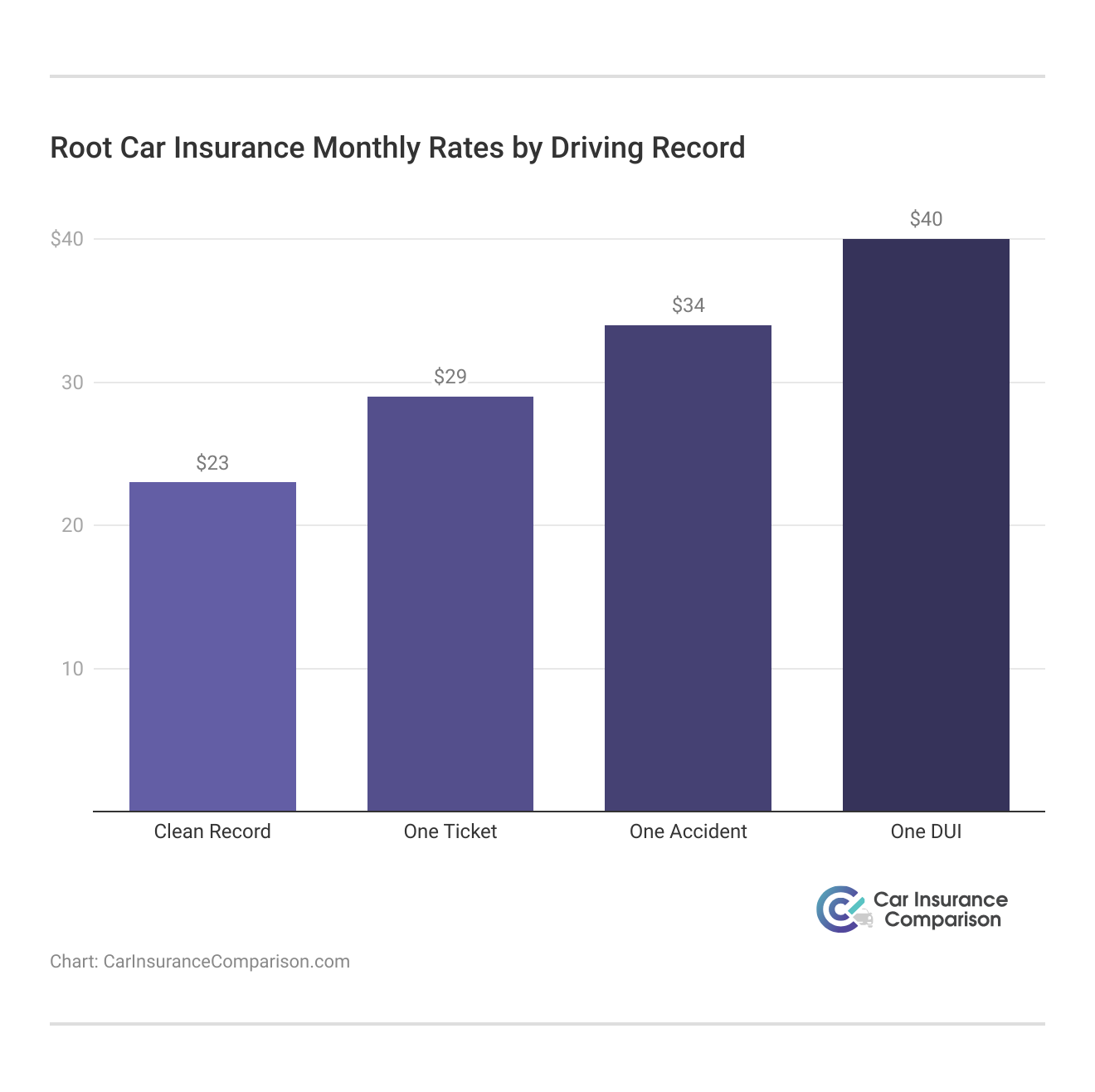

Root Insurance car insurance rates increase with driving infractions, reflecting the added risk associated with a less-than-perfect record.

For minimum coverage, drivers with a clean record pay $23 per month, while those with one ticket, one accident, or one DUI pay $29, $34, and $40, respectively. Full coverage follows a similar pattern, with rates rising from $30 for a clean record to $40 for a DUI, depending on your driving habits. Root is a potential option for cheap car insurance after a DUI, depending on your driving habits.

Car Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 | |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 |

| $56 | $150 | |

| $23 | $61 |

| $47 | $123 | |

| $53 | $141 |

Root offers some of the best options for cheap car insurance, with monthly premiums starting at just $23 for minimum coverage and $61 for full coverage. In contrast, other providers like Liberty Mutual and Allstate charge considerably more, with Liberty Mutual reaching $96 and $248, respectively.

Geico, State Farm, and Progressive offer relatively competitive rates but still exceed Root’s pricing, making Root a standout choice for cost-conscious drivers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Root Car Insurance Discounts & Other Ways to Save on Your Premium

Root Insurance separates itself by providing multiple opportunities for drivers to cut the cost of their car insurance if they meet more than mere traditional demographics, but also demonstrate safe habits and wise policy decisions.

Root Car Insurance Discounts

| Discount |  |

|---|---|

| Safe Driver | 30% |

| Anti-Theft | 25% |

| Military | 20% |

| Bundling | 10% |

| Good Student | 10% |

| Pay-in-Full | 10% |

| Safety Features | 10% |

| Paperless | 5% |

From built-in discounts to behavior-based savings through the Root app, customers can lower their monthly premiums and get the most value from their coverage.

- Take the Test Drive Early: Download the Root app and complete the test drive early to access personalized rates and maximize potential savings.

- Customize Your Coverage Wisely: Using the Root app to adjust coverage and deductibles, raising or lowering optional coverage can reduce your premium while keeping you protected.

- Maintain a Good Credit Score: Although Root focuses on driving behavior, credit still plays a role in some states. Improving your credit score can help unlock better pricing tiers, especially for full coverage.

- Avoid Gaps in Coverage: Maintaining continuous insurance coverage shows you’re a responsible driver. Like most insurers, Root may offer lower rates to drivers who haven’t let their policies lapse.

- Drive Less Frequently: While not a direct discount, driving fewer miles and avoiding risky habits like hard braking or late-night trips can help lower your rate during Root’s test drive analysis.

Standard discounts and unique savings based on driving behavior make Root one of the best car insurance discounts, making it easy for policyholders to cut costs without sacrificing protection.

Whether you have a great driving record, a new driver, or are loving your coverage through the app, Root’s approach to car insurance puts you in control by giving you the confidence behind the wheel.

Essential Root Car Insurance Coverage Options

Selecting the best car insurance involves knowing the coverage you need to protect yourself, your car and others on the road. Root Insurance offers various essential coverages that meet legal requirements and provide added peace of mind in the event of an accident, theft, or unexpected damage.

- Bodily Injury Liability Coverage: This coverage pays for others’ medical costs, lost wages, and funeral expenses if you’re at fault. It’s required in most states and shields you from expensive injury claims.

- Property Damage Liability: Required in all states, covers repair costs for someone else’s vehicle or property if you’re at fault, helping you avoid out-of-pocket expenses.

- Collision Coverage: Collision insurance pays to repair or replace your car after an accident, no matter who’s at fault, and often covers hit-and-run or uninsured driver incidents.

- Comprehensive Coverage: Comprehensive coverage protects your car from non-collision damage like theft, vandalism, weather, and animals, covering repairs or replacement up to its fair market value.

- Uninsured Motorist Property Damage (UMPD): UMPD helps pay for damage if you’re hit by an uninsured driver or in a hit-and-run and may offer a lower deductible than a collision.

With these core coverage options, Root helps ensure you’re protected from common and costly scenarios, such as an at-fault accident, storm damage, or an uninsured driver.

By customizing your policy in the Root app, you can select the coverages that best suit your needs and budget while keeping your protection strong. This is especially true when you use tools like comparing car insurance by coverage type to make informed decisions.

Root Car Insurance Ratings & Customer Satisfaction

Root Insurance has made its name as a reliable provider in the auto insurance industry, and it’s scored high marks with major agencies as well as with customers. From customer satisfaction to volume of complaints, the figures show a company committed to service and transparency.

Root Car Insurance Business Ratings and Consumer Reviews

| Agency |  |

|---|---|

| Score: 850 / 1,000 Above Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices |

|

| Score: 78/100 Good Customer Feedback |

|

| Score: 0.85 Fewer Complaints Than Avg. |

Consumer Reports rates it 78 out of 100, indicating solid customer feedback. According to NNARoots, the complaint index stands at 0.85, receiving fewer complaints than the industry average. Customer satisfaction ratings like these often reflect better service and more reliable experiences with car insurance companies.

Comment

byu/jledwards7 from discussion

inpersonalfinance

A Reddit user with expertise in telematics-based insurance shared that Root is a legitimate, state-regulated provider, and their pricing heavily favors low-mileage drivers.

To maximize savings with Root, maintain safe driving habits during the app’s test drive period, as your premium is primarily based on how well and how little you drive.

Chris Tepedino Feature Writer

While driving behavior matters, the reviewer notes that miles driven is the top factor in Root’s algorithm. For those who don’t drive much, Root can offer significant savings, just be sure to match coverage limits when comparing quotes.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Pros and Cons of Root Car Insurance

Root car insurance takes a fresh approach to auto coverage, using mobile technology and telematics to price policies based on how you drive.

Pros

- Usage-Based Pricing: Root calculates rates based on actual driving behavior, not just demographics, rewarding safe drivers with lower premiums.

- Referral Rewards: Root offers referral incentives, so you and a friend can benefit when they take a test drive and get a quote.

- Potential for Major Savings: Some users report savings of up to $900/year, especially low-mileage drivers and those with clean driving records.

Root Insurance suits safe, low-mileage drivers with its savings and app-based features, but may not fit frequent drivers or those wanting traditional service.

Cons

- Mixed Claims Experience: While some report fast claims processing, others have cited delays or inconsistent service, particularly for complex claims.

- May Not Be Cost-Effective for Riskier Drivers: Drivers with poor records or inconsistent driving behavior may receive higher rates than traditional insurers.

Root stands out for its usage-based pricing and ability to deliver actual savings to responsible, low-mileage drivers, a key factor when considering how much does mileage affect car insurance rates, since driving fewer miles often leads to lower premiums.

View this post on Instagram

However, weighing that against potential downsides like claims variability and higher rates for riskier drivers is essential. Root may be an innovative, cost-effective choice if your driving habits are strong.

Root Car Insurance Offers Smart Savings for Drivers

Root Insurance offers a modern, usage-based approach by pricing policies based on driving behavior rather than demographics. This Root car insurance review highlights its strengths, including low rates for safe, low-mileage drivers, a top-rated app, and easy policy management.

However, drawbacks include limited availability, a required test drive, and mixed claims experiences. For a broader look at coverage options, it’s wise to also compare comprehensive car insurance. Root is a solid choice for tech-savvy drivers looking to save through responsible driving.

Need the cheapest car insurance possible? Enter your ZIP code into our free comparison tool to find the most affordable rates for your vehicle.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

Do Root auto insurance reviews mention claims processing?

Reviews are mixed regarding claims. Some users report a fast and smooth digital claims process, while others mention delays or communication issues, especially with more complex claims. This suggests that claim experience may vary depending on individual situations.

How do claims experiences compare for Root vs. USAA car insurance?

USAA is widely praised for its efficient and reliable claims service, often earning top ratings in industry surveys. Root offers digital claims processing through its app, but user reviews on claims handling are more mixed, with some reporting delays or limited support for complex cases.

Affordable car insurance rates are just a click away. Enter your ZIP code into our free quote tool to find the best policy for you.

Which is cheaper for safe drivers, Root vs. State Farm car insurance?

Root is often cheaper for safe, low-mileage drivers, with rates starting at $23/month for minimum coverage and $30/month for full coverage. State Farm may be competitive with discounts like Drive Safe & Save, especially when bundling, as noted in the best companies for bundling home and car insurance.

Are Root Insurance company reviews positive about the app experience?

Yes, many Root Insurance company reviews praise the mobile app for its simplicity, easy policy management, and smooth claims process. Users appreciate the ability to get quotes, track driving, and file claims all in one place.

Is customer support a strong point according to Root car insurance customer reviews?

Customer support receives varied feedback in Root car insurance customer reviews. Some users appreciate quick responses through the app, while others feel support can be slow or inconsistent during high-volume periods.

How good is Root car insurance for young or first-time drivers?

Root can be a great choice for younger or first-time drivers who practice safe habits. As highlighted in the cheapest car insurance companies for new drivers, its focus on driving behavior rather than age can lead to lower rates compared to traditional insurers that often charge more based on age alone.

What’s the main difference between Root Insurance vs. Allstate?

Root Insurance uses telematics to set rates based on your actual driving behavior, while Allstate relies more on traditional factors like age, credit, and driving history. Root is ideal for safe, low-mileage drivers, while Allstate offers broader access and agent support.

How does the Root Insurance rating compare to traditional insurers?

Root Insurance rating scores are competitive with many established insurers. While it may not yet match the scale of industry giants like State Farm or Allstate, its strong customer satisfaction and lower complaint index (0.85 per NAIC) show it performs well among tech-driven, usage-based providers.

Is Root a good car insurance for low-mileage drivers?

Yes, Root is a great option for low-mileage drivers and is often considered among the best low-mileage car insurance providers, as its rates are heavily influenced by how much you drive. If you don’t drive often, you could see significantly lower premiums compared to traditional insurers.

How do customer service experiences compare between Nationwide vs. Root car insurance?

Nationwide has a long-standing reputation with strong agent support and claims handling. Root, being app-based, offers digital claims and support, which may appeal more to tech-savvy users but has received mixed reviews for complex claims.

How easy is it to file a claim according to a Root Insurance claims review?

Most Root Insurance claims reviews highlight the convenience of filing a claim through the app. Users can upload photos, provide details, and track progress in real time, making it one of the more user-friendly digital claim experiences in the industry.

Is Root car insurance legit for offering low rates and real savings?

Absolutely. Root offers legit low rates, starting at $23/month with up to 30% off for safe driving, making it a smart choice for low-mileage drivers. However, savings vary, and high-mileage or riskier drivers may see higher rates, making it worth exploring options listed under the best car insurance for high-risk drivers.

Does Root Insurance require a long-term commitment?

Does Root Insurance cover rental cars after an accident?

Yes, Root Insurance offers optional rental car coverage that helps pay for a rental vehicle while your car is being repaired after a covered accident.

How does Root vs. Geico car insurance pricing compare for safe drivers?

Root typically offers lower rates for safe, low-mileage drivers, starting at $23/month for minimum coverage and $61 for full coverage, which relies on traditional factors that affect car insurance rates.

Does Root offer gap insurance for leased or financed vehicles?

Yes, Root offers gap insurance as an optional add-on for drivers who lease or finance their vehicles. This coverage helps pay the difference between your car’s actual cash value and what you still owe on your loan if the car is totaled.

Are root insurance Columbus reviews generally positive for pricing?

Yes, most root insurance Columbus reviews are favorable when it comes to pricing, especially for drivers with clean records and low mileage. Users often report noticeable savings compared to traditional insurers in the Columbus area.

What do Root Insurance Google reviews say about pricing?

Reviews often praise Root’s low rates, with pricing starting at $16/month for minimum coverage and $43/month for full coverage from safe driver car insurance discounts.

When should I use the Root Insurance customer service number instead of the app?

You should use the Root Insurance customer service number for urgent matters like policy cancellation, claim disputes, or technical issues that can’t be resolved within the app.

Finding cheap car insurance quotes is easy. Just enter your ZIP code into our free comparison tool to instantly compare quotes near you.

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

MRub_

Fast, efficient, inexpensive

miss_gaby

Quick and easy

TEDIVA

Great Company

Roman_S

Great job

Jakearrr

Fantastic Experience

Texasgirl63

Auto insurance

Xan52

Fraud! Beware!

Frustratedashell

Money for nothing

Karolina_pilvyte

Easy sign up and affordable pricing

Kay_street

Insurance for the people