Best Car Insurance When Self-Employed in 2025 (Top 10 Companies)

State Farm, Progressive, and Allstate emerge as top picks for the best car insurance when self-employed, offering rates as low as $33/month. These companies excel in tailored coverage by understanding the unique needs of self-employed individuals, offers customizable policies that provide comprehensive protection.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

UPDATED: Nov 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Self-Employed

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Self-Employed

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for Self-Employed

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviewsState Farm, Progressive and Allstate emerges as the top picks for the best car insurance when self-employed, providing tailored coverage and competitive rates for individuals navigating the demands of self-employment.

With a focus on understanding the unique needs of self-employed workers, these companies offer customizable policies that provide comprehensive protection while accommodating budgetary considerations.

Our Top 10 Company Picks: Best Car Insurance When Self-Employed

| Company | Rank | Self-Employed Discount | Multi-Policy Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | 15% | Personalized Service | State Farm | |

| #2 | 12% | 12% | Bundle Discounts | Progressive | |

| #3 | 8% | 14% | Customer Service | Allstate | |

| #4 | 7% | 10% | Online Convenience | Geico | |

| #5 | 9% | 15% | Business-Use Coverage | Farmers | |

| #6 | 10% | 18% | Multi-Policy Discounts | Liberty Mutual |

| #7 | 11% | 16% | Safe-Driving Discounts | Travelers | |

| #8 | 6% | 13% | Customizable Policies | American Family | |

| #9 | 8% | 14% | Quick Claims | Esurance | |

| #10 | 10% | 15% | Roadside Assistance | AAA |

Whether it’s personalized service, bundle discounts, or customer service excellence, these insurers stand out in meeting the diverse needs of self-employed individuals on the road. Explore your car insurance options by entering your ZIP code above and finding which companies have the lowest rates.

#1 – State Farm: Top Overall Pick

Pros

- Personalized Service: State Farm distinguishes itself by offering a personalized approach meticulously tailored to cater to the unique and diverse needs of each individual.

- Discounts: As an independent contractor or self-employed individual, you have the freedom to shape your own career path.

- Reputation: State Farm car insurance review highlights its consistent dependability and strong financial stability, positioning it as a pillar of strength within its field.

Cons

- Pricing: While our rates may be higher compared to some competitors, it’s important to recognize the value and quality that come with our services.

- Limited Online Features: Suggests that the range and depth of services and features available on digital platforms could be reduced.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#2 – Progressive: Best for Unleash Savings

Pros

- Bundle Discounts: Progressive presents an enticing opportunity for policyholders by extending substantial discounts when bundling multiple policies.

- Online Convenience: Tailored for the modern digital consumer, our platform is meticulously crafted to cater to the needs and preferences of online users, offering a flawless and intuitive digital journey.

- Innovative Tools: Progressive car insurance review showcase advanced technology to observe and assess driving behaviors, facilitating tailored discounts and rewards.

Cons

- Customer Service: Several customers have voiced their concerns regarding the level of satisfaction they experience with our customer service.

- Limited Personalization: When policies lack customization, they might not effectively address the specific requirements and circumstances of individuals.

#3 – Allstate: Best for Navigating Safely

Pros

- Customer Service: Exceptional ratings for customer service signify that the quality of service provided to customers is outstanding.

- Customizable Policies: Allstate car insurance review suggests a variety of policy options are offered, allowing customization to meet specific preferences or requirements.

- Discounts: Enjoy significant savings with our multi-policy discount, offering up to a 14% reduction for holders who combine multiple policies.

Cons

- Cost: Premiums may vary depending on individual profiles, potentially resulting in higher rates for specific demographics or risk categories.

- Limited Online Features: Online platform features may lack sophistication or may not be as advanced as desired.

#4 – Geico: Best for Effortless Coverage

Pros

- Online Convenience: Geico is renowned for its intuitive and accessible online platform, which provides users with a seamless and hassle-free experience.

- Quick Claims: Implementing a streamlined claims process facilitates quicker settlements, enhancing efficiency and reducing processing time.

- Competitive Rates: Geico car insurance review showcase affordability while maintaining competitive rates and high-quality service standards.

Cons

- Discounts: Our selection of discounts is more restricted in comparison to certain competitors.

- Customer Service: Some customers have provided feedback indicating that their interactions with customer service have been varied, encompassing both positive and negative experiences.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#5 – Farmers: Best for Coverage Protection

Pros

- Business-Use Coverage: These options go beyond standard insurance plans and are designed to provide specific protections for various aspects of business operations.

- Discounts: Farmers car insurance review highlights the bundled discount of up to 15% when you combine various policies into one comprehensive package.

- Customer Service: Consistently favorable customer service ratings indicate a positive overall experience for customers.

Cons

- Cost: The premiums may appear relatively higher in comparison to those offered by some competitors.

- Online Features: The functionalities of online platforms might be less sophisticated or developed compared to others.

#6 – Liberty Mutual: Best for Financial Stability

Pros

- Multi-Policy Discounts: Enjoy substantial savings of up to 18% when you bundle policies together, unlocking significant discounts that enhance your financial benefits.

- Financial Stability: Liberty Mutual stands out for its robust financial foundation and well-established presence in the insurance industry.

- Customer Service: Liberty Mutual car insurance review highlights commendable customer service, showcasing the remarkable level of aid and care extended to clients.

Cons

- Pricing: Premiums from this provider might appear to be higher when compared to those offered by some competitors.

- Discount Limitations: Discounts often come with specific limitations and eligibility criteria that dictate who can benefit from them and under what circumstances.

#7 – Travelers: Best for Driving Smart

Pros

- Safe-Driving Discounts: Get a discount of up to 16% on your insurance rates by demonstrating safe driving practices, as highlighted in Travelers car insurance review.

- Financial Stability: It suggests an ability to weather economic downturns, pursue growth opportunities, and fulfill financial obligations with confidence.

- Coverage Options: A wide array of coverage options are accessible, providing a comprehensive selection to cater to various needs and preferences.

Cons

- Pricing: Premiums can vary depending on individual profiles, with some demographics or risk factors potentially leading to higher premium rates.

- Limited Online Features: Online features could potentially lack the sophistication found in other platforms or applications.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#8 – American Family: Best for Tailored Protection

Pros

- Customizable Policies: Provides a range of policy choices tailored to individual needs and preferences, allowing for customization to better suit unique requirements.

- Discounts: Enjoy significant savings with our multi-policy discount, offering up to a generous 13% off when you bundle your insurance policies with us.

- Coverage Options: Provides a broad selection of coverage options tailored to suit different preferences and requirements, as outlined in the American Family car insurance review.

Cons

- Cost: Premiums can vary in relative terms based on specific individual profiles, potentially resulting in higher rates for certain demographics or risk categories.

- Limited Discounts: Providing customized discount options that are tailored to particular profiles or demographics, thereby limiting access to certain discounts based on predetermined criteria or characteristics.

#9 – Esurance: Best for Swift Security

Pros

- Quick Claims: Efficient claims processing to expedite settlements, ensuring a swift and hassle-free experience for all parties involved.

- Online Convenience: How do you get an Esurance car insurance quote? An intuitive and user-friendly online platform designed to enhance accessibility and ease of use for all users.

- Discounts: Maximize your savings by bundling multiple policies together and enjoy discounts of up to 14%.

Cons

- Customer Service: A variety of customers have provided feedback indicating a range of experiences with the customer service provided.

- Limited Discounts: The range of discount options available is more restricted compared to what some competitors offer.

#10 – AAA: Best for Roadside Assistance

Pros

- Roadside Assistance: Provides comprehensive roadside assistance benefits, ensuring support and aid in various vehicle-related emergencies and breakdowns.

- Multi-Policy Discounts: Discover significant discounts of up to 15% when you merge various policies into one comprehensive bundle with AAA car insurance review.

- Financial Stability: AAA stands as a venerable institution, boasting a robust financial foundation that underscores its enduring presence and reliability in its respective domain.

Cons

- Cost: Premiums from this provider may seem higher compared to those of certain competitors when you put them side by side.

- Discount Limitations: Discounts often come with specific limitations and eligibility criteria that dictate who can benefit from them and under what circumstances.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Driving Through the Stress: Navigating Self-Employed Car Insurance Rates

It is no secret that excessive stress can cause a lot of problems in a person’s life. Normally we think of heart attacks, nervous breakdowns, and family issues, but stress can even impact how safe a person is behind the wheel. Out of 60 classifications ranked from cheapest to most expensive, self-employment car insurance rates came in at number 48, with annual premiums of approximately $1,218.

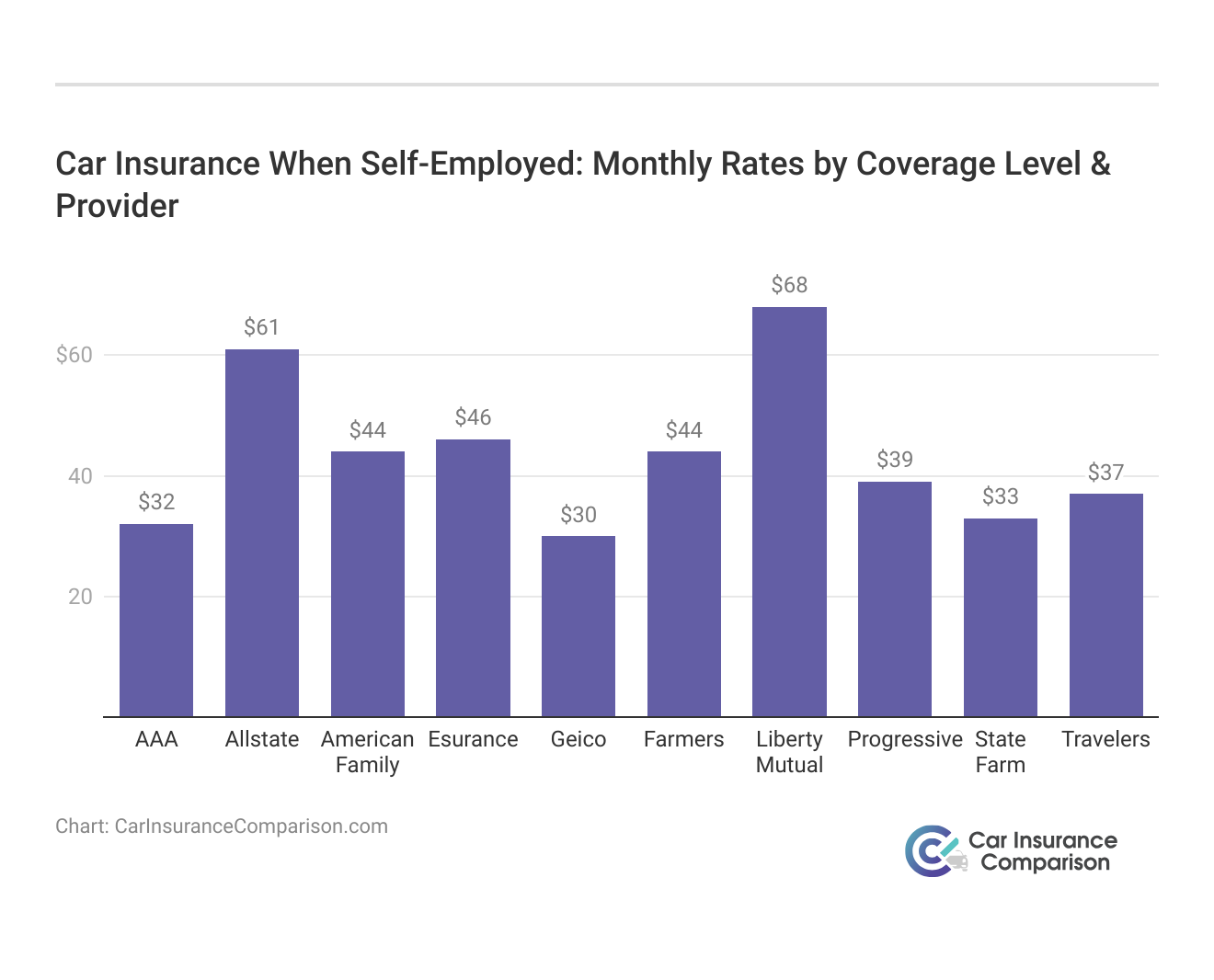

Car Insurance When Self-Employed: Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $32 | $86 |

| Allstate | $61 | $160 |

| American Family | $44 | $117 |

| Esurance | $46 | $114 |

| Geico | $30 | $80 |

| Farmers | $44 | $139 |

| Liberty Mutual | $68 | $174 |

| Progressive | $39 | $105 |

| State Farm | $33 | $86 |

| Travelers | $37 | $99 |

When considering car insurance options for self-employed workers, it is essential to examine the coverage rates provided by various insurance companies. The coverage rates presented in the table highlight the average monthly premiums for both full coverage and minimum coverage policies.

Notably, State Farm and AAA stand out with the lowest rates for both types of coverage, offering full coverage at $86 and $32, respectively, and minimum coverage at $33 and $32, respectively. Geico also provides competitive rates, offering full coverage at $80 and minimum coverage at $30.

On the other end of the spectrum, Liberty Mutual tends to have higher rates, with $174 for full coverage and $68 for minimum coverage. It is evident that there is a considerable range in coverage rates among the listed insurance companies, providing self-employed individuals with the flexibility to choose a plan that aligns with their budget and coverage preferences.

Car Insurance When Self-Employed: Monthly Rates by Age, Gender, & Provider

| Insurance Company | 20-Year-Old Female | 20-Year-Old Male | 30-Year-Old Female | 30-Year-Old Male | 45-Year-Old Female | 45-Year-Old Male | 60-Year-Old Female | 60-Year-Old Male |

|---|---|---|---|---|---|---|---|---|

| AAA | $200 | $220 | $180 | $200 | $150 | $170 | $130 | $150 |

| Allstate | $220 | $240 | $200 | $220 | $170 | $190 | $150 | $170 |

| American Family | $210 | $230 | $190 | $210 | $160 | $180 | $140 | $160 |

| Esurance | $190 | $210 | $170 | $190 | $140 | $160 | $120 | $140 |

| Geico | $180 | $200 | $160 | $180 | $130 | $150 | $110 | $130 |

| Farmers | $230 | $250 | $210 | $230 | $180 | $200 | $160 | $180 |

| Liberty Mutual | $240 | $260 | $220 | $240 | $190 | $210 | $170 | $190 |

| Progressive | $200 | $220 | $180 | $200 | $150 | $170 | $130 | $150 |

| State Farm | $210 | $230 | $190 | $210 | $160 | $180 | $140 | $160 |

| Travelers | $220 | $240 | $200 | $220 | $170 | $190 | $150 | $170 |

An individual who has tons of things on the mind and is highly anxious about getting work done is also someone who may not necessarily pay full attention to driving, and that person is more prone to having an accident.

Discover monthly car insurance rates tailored for self-employed workers across different age groups and genders. Compare premiums from leading insurers such as AAA, Allstate, Geico, and others to find the best coverage options for your unique needs.

Driving Through Financial Storms: Navigating Insurance Challenges for Self-Employed Individuals

When you apply for a new policy, the company you applied with checks your credit rating as part of the quote process. This may put some self-employed individuals at a disadvantage because their credit rating can be artificially affected by their business successes or failures.

In other words, a business owner’s personal finances may be completely in order, having all his bills current and having never missed a payment. Yet if his business suffered a couple of loans that resulted in a few late payments, that would reflect poorly on his credit rating.

State Farm stands out as the optimal choice for self-employed workers, offering personalized service, competitive rates, and a 10% self-employed worker discount.

Melanie Musson Published Insurance Expert

Furthermore, insurance companies are smart enough to know that when a company is facing financial stress, owners are not at their best performance. Financial worries coupled with the everyday routine of keeping customers happy can make a very potent situation behind the wheel. Another thing the car insurance companies know is that financial stress is the most difficult part of being a small business owner.

Balancing Act: Navigating Insurance for Dual-Use Vehicles

It goes without saying that many small business owners and self-employed contractors use their vehicles for both personal and business use. If insuring the vehicle for the business, the customer feels as though he’s paying too much; if it’s insured as a personal vehicle, the insurance provider believes it’s taking too high a risk for too little return.

Finding a happy medium between the two is generally difficult to accomplish. In almost every case, a dual-use vehicle will be classified as a business vehicle for insurance purposes. This classification naturally drives insurance rates up.

If business owners cannot afford to keep separate personal and business vehicles, they will end up paying pretty high rates on the single vehicle they do own. Furthermore, for those whose business vehicle is a large van or truck, the expense goes even higher.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Case Studies: Self-Employed Stories of Tailored Coverage, Bundle Triumphs, and Service Excellence

Explore real-life experiences showing how insurance providers meet the unique needs of self-employed workers, providing practical solutions for peace of mind on the road.

- Case Study #1 – Personalized Service Triumphs: Self-employed consultant John secured tailored car insurance with State Farm, enjoying a 10% discount for his high-mileage lifestyle. Their personalized service earned him a 15% multi-policy discount, meeting his unique needs seamlessly. To gain further insights, consult our comprehensive guide titled “How much does mileage affect car insurance rates?“

- Case Study #2 – Bundling for Maximum Savings: Emily, a self-employed artist, sought cost-effective yet comprehensive insurance. Progressive’s bundle discounts caught her attention, offering both savings and protection. With their user-friendly platform, Emily secured a 12% discount, aligning perfectly with her needs for flexibility and savings in her high-stress creative industry.

- Case Study #3 – Customer Service Excellence: Sarah, a photographer, sought top-tier customer service from her insurer. Allstate’s stellar reputation attracted her, providing prompt assistance and tailored coverage. With discounts and reliable support, Sarah now enjoys peace of mind on her assignments.

By delving into these tales, seekers of protection can glean the wisdom necessary to make informed decisions, ensuring that their assets are shielded against the unpredictable tides of fate.

State Farm leads the pack for self-employed professionals, providing tailored service, competitive rates, and a 10% discount for entrepreneurs.

Jeff Root Licensed Life Insurance Agent

These stories offer valuable insights for individuals seeking the right insurance, helping them make informed choices to protect their vehicles and businesses.

The Bottom Line: Navigating Car Insurance for the Self-Employed

Frequently Asked Questions

What are the average self-employed worker car insurance rates?

The average self-employed worker car insurance rates are approximately $101.50 per month, ranking as the 48th most expensive out of 60 job classifications.

Why do self-employed individuals pay higher car insurance rates?

Insurance companies consider factors such as stress levels, financial stress, dual use of vehicles, and high mileage when determining car insurance rates for self-employed individuals.

By entering your ZIP code below, you can get instant car insurance quotes from top providers.

How does stress affect car insurance rates for self-employed workers?

Excessive stress can impact a person’s driving ability and increase the likelihood of accidents. Insurance companies take this into account when setting rates.

To learn more, explore our comprehensive resource titled “Understanding Car Accidents.”

How does financial stress affect car insurance rates for self-employed workers?

Self-employed individuals may face financial stress due to their business, which can impact their credit rating. Insurance companies consider credit ratings when determining rates.

How does dual use of vehicles affect car insurance rates for self-employed workers?

Many self-employed individuals use their vehicles for both personal and business purposes. Insuring a dual-use vehicle can be challenging, leading to higher insurance rates.

What does TPL mean in car insurance?

Third-party liability insurance, or TPL for short, along with Accident Benefits, is an important form of protection in your automobile policy. Even if you do everything you can to prevent damage or injury, they can often result in legal proceedings and lawsuits.

To delve deeper, refer to our in-depth report titled “Compare Liability Car Insurance: Rates, Discounts, & Requirements.”

What is the coverage of comprehensive car insurance?

Comprehensive coverage protects you against theft, weather-related events, and other major things beyond your control. Comprehensive coverage often covers “unforeseen events” like break-ins or broken windshield wipers due to hail.

What is the best job to put on car insurance?

Car insurance is all about risk, therefore if an insurer thinks your job is low risk, your car insurance will be cheaper. Occupations such as secretaries, medical secretaries, legal secretaries, personal assistants, and clerical assistants are favored by most insurers.

What is the highest type of car insurance?

Fully comprehensive car insurance gives you the highest level of cover. If you’re looking for peace of mind or have a new or expensive car, this could be the right policy for you.

To gain in-depth knowledge, consult our comprehensive resource titled “Best Insurance for Luxury Cars.”

Which category of car insurance is best?

Yes, the premium for comprehensive care insurance is on the higher side when compared to the other types of car insurance in India. This is only because comprehensive car insurance offers more protection for your car than other types of motor insurance.

Comparing quotes is the easiest way to find affordable car insurance. Simply enter your ZIP code below into our free comparison tool to see rates in your area.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.