Best Chevrolet Avalanche Car Insurance in 2025 (Find the Top 10 Companies Here)

For the best Chevrolet Avalanche car insurance, Progressive, Allstate, and Geico stand out as the top three providers. Progressive offers the most affordable rate, starting at $35 monthly. These companies excel due to their competitive rates and comprehensive coverage options for Chevrolet Avalanche owners.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Aug 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Aug 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Chevrolet Avalanche

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for Chevrolet Avalanche

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Chevrolet Avalanche

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews

Progressive, Allstate, and Geico are the best for Chevrolet Avalanche car insurance, offering the best value for coverage. Progressive stands out for its competitive pricing, while Allstate and Geico provide excellent coverage options and reliable service.

Each of these insurers excels in delivering comprehensive protection and appealing discounts. More information is available about this provider in our article called “Compare Car Insurance by Coverage Type.”

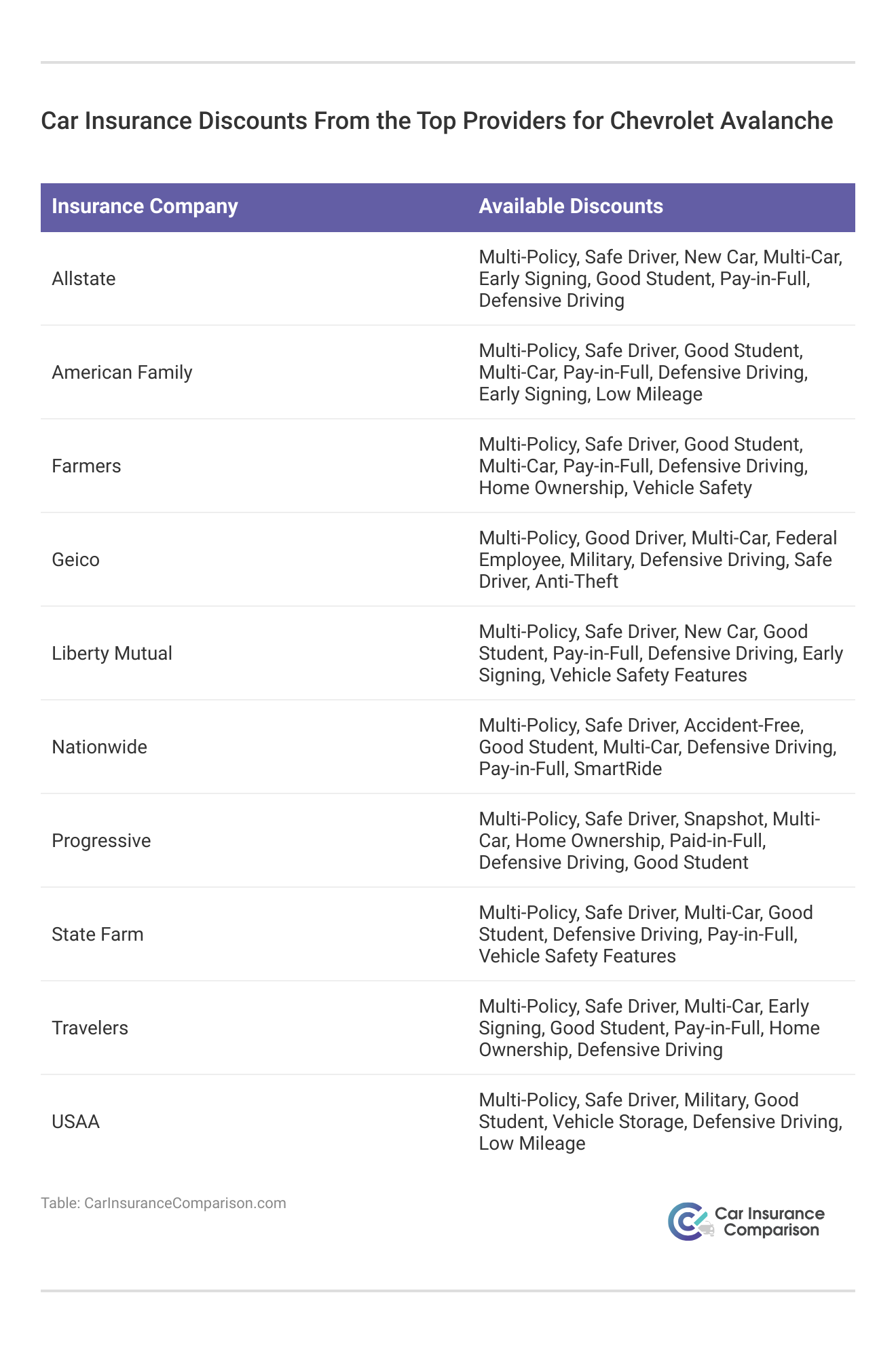

Our Top 10 Company Picks: Best Chevrolet Avalanche Car Insurance

Company Rank UBI Discount A.M. Best Best For Jump to Pros/Cons

#1 30% A+ Extensive Coverage Progressive

#2 30% A+ Comprehensive Options Allstate

#3 25% A++ Affordable Premiums Geico

#4 30% A++ Military Discounts USAA

#5 40% A+ Broad Coverage Nationwide

#6 30% A++ Versatile Policies Travelers

#7 30% B Local Agents State Farm

#8 30% A Strong Financials Farmers

#9 30% A Personalized Service American Family

#10 30% A Innovative Discounts Liberty Mutual

Compare these leading providers to secure the most cost-effective and robust coverage for your Chevrolet Avalanche.

Get the right car insurance at the best price — enter your ZIP code above to shop for coverage from the top insurers.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – Progressive: Top Overall Pick

Pros

- Generous UBI Reduction for Chevrolet Avalanche: Progressive offers a notable 30% reduction on usage-based insurance (UBI), which significantly lowers the cost for insuring the Chevrolet Avalanche. This discount is beneficial for individuals who track their driving patterns and keep their mileage low.

- Comprehensive Protection Choices: Progressive maintains an A+ rating from A.M. Best, reflecting its robust financial standing and reliability. Their protection options are extensive, including liability, collision, comprehensive, and additional safeguards tailored to suit various needs for the Chevrolet Avalanche.

- Substantial Savings with UBI: The 30% UBI reduction is a major benefit for Chevrolet Avalanche owners, providing considerable savings compared to standard insurance rates. This reduction rewards prudent driving and responsible vehicle use. For a thorough examination of Progressive’s services, refer to our detailed guide in the “Progressive Car Insurance Review.”

Cons

- Higher Premiums Despite Discounts: Even with the generous UBI reduction, Progressive’s premiums for the Chevrolet Avalanche might still be on the higher side compared to some rivals. This could be a factor for those with tighter budgets.

- Limited Customization Options: While Progressive provides a broad range of coverage, the options for tailoring specific aspects of the policy for the Chevrolet Avalanche might be somewhat restricted compared to some other insurers.

#2 – Allstate: Best for Comprehensive Options

Pros

- Substantial UBI Reduction for Chevrolet Avalanche: Allstate offers a considerable 30% discount on UBI, which helps reduce insurance costs for the Chevrolet Avalanche. This reduction is particularly beneficial for those who demonstrate safe driving practices.

- Wide Range of Protection Choices: Allstate’s A+ rating from A.M. Best signifies its strong financial stability and dependability. The company provides an extensive array of protection options, including collision, comprehensive, rental reimbursement, and more, ensuring complete coverage for the Chevrolet Avalanche.

- Valuable Coverage Benefits: Allstate’s extensive options are designed to address various requirements and scenarios, offering ample protection and peace of mind for Chevrolet Avalanche owners. Learn more in our article called “Allstate Car Insurance Review.”

Cons

- Possibly Higher Premiums: Despite the 30% UBI discount, Allstate’s premiums for the Chevrolet Avalanche may still be relatively high compared to other providers. This could be a disadvantage for those seeking more cost-effective options.

- Complex Policy Terms: The broad range of coverage options might result in intricate policy terms and conditions, making it challenging for Chevrolet Avalanche owners to navigate and choose the most suitable coverage.

#3 – Geico: Best for Affordable Premiums

Pros

- Attractive UBI Reduction: Geico provides a 25% discount on UBI, which helps keep premiums lower for the Chevrolet Avalanche. This reduction benefits those who maintain good driving habits and low mileage.

- Superior Financial Stability: With an A++ rating from A.M. Best, Geico is recognized for its exceptional financial strength, ensuring reliable and comprehensive coverage for the Chevrolet Avalanche. See more details on our guide titled Geico car insurance review.

- Cost-Effective Insurance: Geico is known for offering affordable insurance premiums, making it an appealing option for Chevrolet Avalanche owners who are looking for budget-friendly coverage without compromising essential protection.

Cons

- Less Generous UBI Reduction: The 25% UBI discount, although helpful, is lower compared to some other insurers, which may not provide as substantial savings for Chevrolet Avalanche owners.

- Limited Comprehensive Coverage Options: Geico’s coverage choices might not be as extensive or customizable as those of some competitors, potentially limiting options for Chevrolet Avalanche insurance.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – USAA: Best for Military Discounts

Pros

- Significant UBI Reduction: USAA offers a notable 30% UBI discount for the Chevrolet Avalanche, providing considerable savings for policyholders. This reduction is particularly beneficial for those who monitor their driving habits and keep mileage low. Check out insurance savings in our complete article called USAA car insurance review.

- Exceptional Financial Strength: USAA’s A++ rating from A.M. Best highlights its superior financial stability and reliability in delivering insurance coverage for the Chevrolet Avalanche.

- Exclusive Military Benefits: USAA’s specialized offerings for military members, including unique discounts and tailored protection options, make it an excellent choice for Chevrolet Avalanche owners who are active-duty service members or veterans.

Cons

- Eligibility Restrictions: USAA’s services are exclusively available to military personnel and their families, limiting access for non-military Chevrolet Avalanche owners.

- Potentially Higher Rates for Non-Military: For those not eligible for military discounts, standard premiums for the Chevrolet Avalanche with USAA might be higher compared to other insurers.

#5 – Nationwide: Best for Broad Coverage

Pros

- Highest UBI Reduction: Nationwide offers an impressive 40% discount on UBI, making coverage for the Chevrolet Avalanche more affordable. This substantial reduction is ideal for drivers who practice safe driving and maintain low mileage. Access comprehensive insights into our article called Nationwide car insurance discounts.

- Strong Financial Ratings: Nationwide’s A+ rating from A.M. Best indicates its solid financial health and reliability, ensuring dependable protection for the Chevrolet Avalanche.

- Extensive Coverage Options: Nationwide provides a broad spectrum of coverage options, including liability, collision, comprehensive, and additional benefits, catering to various needs for Chevrolet Avalanche owners.

Cons

- Higher Standard Premiums: Even with the generous 40% UBI discount, standard premiums for the Chevrolet Avalanche with Nationwide might still be relatively high, which could be a concern for cost-conscious individuals.

- Complex Policy Selection: The extensive range of coverage options might result in complexity when selecting the right policy for the Chevrolet Avalanche, potentially causing confusion for some policyholders.

#6 – Travelers: Best for Versatile Policies

Pros

- Generous UBI Savings: Travelers provides a substantial 30% rebate on usage-based insurance (UBI) for Chevrolet Avalanche owners. This discount is especially advantageous for those with minimal annual mileage, reducing the overall insurance expenditure. Read up on the “Travelers Car Insurance Review” for more information.

- A++ Financial Stability: Holding an A++ rating from A.M. Best, Travelers showcases exceptional fiscal health, assuring reliable coverage and peace of mind for Chevrolet Avalanche drivers.

- Broad Range of Coverage Choices: Travelers offers a wide array of customizable insurance plans, enabling Chevrolet Avalanche owners to adjust their policies to meet specific requirements, from extensive coverage to collision and liability.

Cons

- Moderate Discount Scope: Although Travelers presents a solid 30% UBI rebate, this may not be as extensive as discounts provided by other insurers, potentially limiting overall savings for Chevrolet Avalanche owners.

- Potentially Elevated Premiums: Despite the attractive discounts, Travelers’ base rates might still be relatively higher compared to competitors, affecting affordability for Chevrolet Avalanche insurance.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – State Farm: Best for Local Agents

Pros

- Appealing Bundling Discounts: State Farm delivers significant savings through bundling various insurance policies. For Chevrolet Avalanche owners who require multiple types of coverage, this can substantially lower overall insurance costs.

- 30% UBI Rebate: State Farm offers a 30% discount on usage-based insurance, benefiting Chevrolet Avalanche drivers who cover fewer miles annually.

- Extensive Local Agent Network: State Farm’s extensive network of local representatives ensures personalized assistance and support, ideal for Chevrolet Avalanche owners seeking customized insurance solutions and face-to-face service. For additional details, explore our comprehensive resource titled State farm car insurance review.

Cons

- Limited Discount Relative to Competitors: State Farm’s bundling rebate might not be as competitive as those provided by some other insurers, potentially impacting savings for Chevrolet Avalanche drivers.

- Potentially Higher Base Premiums: Even with discounts, State Farm’s fundamental rates could be higher for specific coverage levels, which might influence the overall cost for Chevrolet Avalanche insurance.

#8 – Farmers: Best for Strong Financials

Pros

- High UBI Discount: Farmers offers a 30% discount on usage-based insurance, making it a cost-effective choice for Chevrolet Avalanche owners with low mileage. Delve into our evaluation of Farmers car insurance review.

- A Financial Strength Rating: Farmers’ A rating from A.M. Best indicates strong financial health, providing reassurance of dependable and secure coverage for Chevrolet Avalanche drivers.

- Diverse Coverage Alternatives: Farmers provides a variety of insurance options, allowing Chevrolet Avalanche owners to select the most suitable policy to meet their particular needs, including liability, collision, and comprehensive coverage.

Cons

- Comparative Discount Scope: The 30% UBI rebate provided by Farmers might not be as extensive as discounts offered by other insurers, potentially limiting savings for Chevrolet Avalanche drivers.

- Higher Base Rates: Farmers’ basic premiums can be more elevated than those of some competitors, affecting the overall cost-efficiency of insurance for a Chevrolet Avalanche.

#9 – American Family: Best for Personalized Service

Pros

- High UBI Discount: American Family offers a 30% discount on usage-based insurance, which is advantageous for Chevrolet Avalanche owners who drive infrequently. Check out insurance savings in our complete article called “American Family Car Insurance Review.”

- A Financial Rating: With an A rating from A.M. Best, American Family exhibits solid fiscal stability, ensuring dependable coverage and security for Chevrolet Avalanche drivers.

- Highly Personalized Customer Service: American Family is recognized for delivering highly customized service, making it an excellent choice for Chevrolet Avalanche owners seeking tailored insurance solutions and dedicated support.

Cons

- Higher Premiums: Choosing American Family Insurance for your Chevrolet Avalanche might lead to elevated premiums compared to those from other insurers.

- Mixed Customer Service: Experiences with American Family’s support for Chevrolet Avalanche owners are notably diverse. While some clients value the personalized care and assistance, others report facing difficulties, such as delays in claim resolution and inconsistencies in service quality.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best for Innovative Discounts

Pros

- Substantial UBI Rebate: Liberty Mutual provides a 30% discount on usage-based insurance, benefiting Chevrolet Avalanche owners with lower annual mileage by decreasing their insurance premiums.

- A.M. Best A Rating: Liberty Mutual holds an A rating from A.M. Best, reflecting strong financial stability and reliability, ensuring robust coverage for Chevrolet Avalanche drivers. Discover more about offerings in our article called Liberty Mutual car insurance review.

- Innovative Discount Programs: Liberty Mutual offers inventive discount opportunities, including potential savings for safe driving and other qualifying behaviors, which can improve affordability for Chevrolet Avalanche insurance.

Cons

- Discount Range Limitations: Liberty Mutual’s 30% UBI discount, while notable, may not be as extensive as those provided by some competitors, potentially limiting overall savings for Chevrolet Avalanche owners.

- Potentially Elevated Premiums: The base premiums with Liberty Mutual might be relatively higher, which could impact the overall cost-effectiveness of insurance for Chevrolet Avalanche drivers.

Chevrolet Avalanche Insurance Rates: Minimum vs. Full Coverage

When choosing car insurance for your Chevrolet Avalanche, understanding the coverage rates offered by different providers is essential. Discover more about offerings in our article called “Minimum Car Insurance Requirements by State.”

Chevrolet Avalanche Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $55 $150

American Family $47 $137

Farmers $52 $145

Geico $40 $120

Liberty Mutual $53 $148

Nationwide $48 $140

Progressive $50 $135

State Farm $45 $130

Travelers $46 $132

USAA $35 $110

The table below outlines the monthly rates for both minimum and full coverage options from various insurance companies. For minimum coverage, rates range from $35 with USAA to $55 with Allstate.

For full coverage, the rates vary from $110 with USAA to $150 with Allstate. Geico offers the most affordable full coverage at $120, while Allstate’s full coverage is the highest at $150.

This information helps in comparing the costs associated with different levels of protection across top insurance providers for the Chevrolet Avalanche.

Chevrolet Avalanche insurance rates average $1,422 a year or $119 a month for full coverage. Good drivers can save up to $586 a year in policy discounts by staying safe out on the roads. Let’s look at Chevrolet Avalanche insurance rates, safety features, and more.

You can start comparing quotes for Chevrolet Avalanche car insurance rates from some of the best car insurance companies by using our free online tool now.

Are Chevrolet Avalanches Expensive to Insure

The chart below details how Chevrolet Avalanche insurance rates compare to other trucks like the Toyota Tacoma, GMC Sierra, and Nissan Frontier.

Chevrolet Avalanche Car Insurance Monthly Rates vs. Similar Vehicles by Coverage Type

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Toyota Tacoma | $25 | $40 | $33 | $110 |

| GMC Sierra | $28 | $50 | $31 | $122 |

| Nissan Frontier | $25 | $42 | $35 | $116 |

| Toyota Tundra | $27 | $43 | $37 | $121 |

| Chevrolet Colorado | $21 | $37 | $31 | $102 |

| Ford F-150 | $27 | $39 | $31 | $110 |

However, there are a few things you can do to find the cheapest Chevrolet insurance rates online.

Read More: Compare Ford vs. Chevrolet Car Insurance Rates

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

What Impacts the Cost of Chevrolet Avalanche Insurance

The Chevrolet Avalanche trim and model you choose will affect the total price you will pay for Chevrolet Avalanche insurance coverage. Check out insurance savings in our complete guide titled “Factors That Affect Car Insurance Rates.”

Age of the Vehicle

Older Chevrolet Avalanche models generally cost less to insure. For example, auto insurance for a 2012 Chevrolet Avalanche costs $1,422, while 2010 Chevrolet Avalanche insurance costs are $1,350, a difference of $72.

Chevrolet Avalanche Car Insurance Monthly Rates by Age of the Vehicle

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| 2024 Chevrolet Avalanche | $23 | $38 | $49 | $123 |

| 2023 Chevrolet Avalanche | $23 | $37 | $49 | $123 |

| 2022 Chevrolet Avalanche | $23 | $37 | $49 | $122 |

| 2021 Chevrolet Avalanche | $22 | $36 | $49 | $122 |

| 2020 Chevrolet Avalanche | $22 | $36 | $48 | $121 |

| 2019 Chevrolet Avalanche | $21 | $35 | $48 | $121 |

| 2018 Chevrolet Avalanche | $21 | $35 | $48 | $120 |

| 2017 Chevrolet Avalanche | $21 | $33 | $48 | $119 |

| 2016 Chevrolet Avalanche | $20 | $33 | $48 | $118 |

| 2015 Chevrolet Avalanche | $20 | $32 | $48 | $117 |

| 2014 Chevrolet Avalanche | $19 | $31 | $48 | $116 |

| 2013 Chevrolet Avalanche | $19 | $30 | $48 | $115 |

| 2012 Chevrolet Avalanche | $21 | $33 | $48 | $119 |

| 2011 Chevrolet Avalanche | $19 | $31 | $48 | $115 |

| 2010 Chevrolet Avalanche | $19 | $29 | $48 | $113 |

This difference underscores the influence of vehicle age on insurance costs, helping owners to make better-informed choices about their insurance and possibly reduce expenses by choosing older models.

Driver Age

Driver age can have a significant impact on the cost of Chevrolet Avalanche auto insurance. For example, 20-year-old drivers pay approximately $1,739 each year for their Chevrolet Avalanche auto insurance than 30-year-old drivers.

Chevrolet Avalanche Car Insurance Monthly Rates by Age

| Age | Rates |

|---|---|

| Age: 16 | $680 |

| Age: 18 | $433 |

| Age: 20 | $269 |

| Age: 30 | $124 |

| Age: 40 | $119 |

| Age: 45 | $115 |

| Age: 50 | $108 |

| Age: 60 | $106 |

Understanding these cost variations allows drivers to manage their insurance expenses more effectively and seek opportunities to reduce higher premiums, such as through discounts or improved driving habits.

Driver Location

Where you live can have a large impact on Chevrolet Avalanche insurance rates. For example, drivers in Houston may pay $1,048 a year more than drivers in Columbus.

Ford Fiesta Car Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Los Angeles, CA | $203 |

| New York, NY | $187 |

| Houston, TX | $186 |

| Jacksonville, FL | $172 |

| Philadelphia, PA | $159 |

| Chicago, IL | $156 |

| Phoenix, AZ | $138 |

| Seattle, WA | $115 |

| Indianapolis, IN | $101 |

| Columbus, OH | $98 |

Your Driving Record

Your driving record can have an impact on the cost of Chevrolet Avalanche car insurance. Teens and drivers in their 20’s see the highest jump in their Chevrolet Avalanche car insurance with violations on their driving record.

Chevrolet Avalanche Car Insurance Monthly Rates by Age & Driving Record

| Age | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Age: 16 | $680 | $950 | $1,280 | $870 |

| Age: 18 | $433 | $650 | $880 | $560 |

| Age: 20 | $269 | $440 | $660 | $380 |

| Age: 30 | $124 | $195 | $310.00 | $170 |

| Age: 40 | $119 | $185 | $295.00 | $165 |

| Age: 45 | $115 | $180 | $290.00 | $160 |

| Age: 50 | $108 | $175 | $280 | $155 |

| Age: 60 | $106 | $170 | $270 | $150 |

Keeping a clean driving record can help drivers avoid higher insurance premiums and secure more affordable coverage for their Chevrolet Avalanche. Being aware of this can guide better choices regarding driving behaviors and insurance options.

Chevrolet Avalanche Crash Test Ratings

Chevrolet Avalanche crash test ratings can impact your Chevrolet Avalanche car insurance rates. See Chevrolet Avalanche crash test results below:

Volvo S60 Crash Test Ratings

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2023 Volvo S60 | 5 stars | 5 stars | 5 stars | 4 stars |

| 2022 Volvo S60 | 5 stars | 5 stars | 5 stars | 4 stars |

| 2021 Volvo S60 | 5 stars | 5 stars | 5 stars | 4 stars |

| 2020 Volvo S60 | 5 stars | 5 stars | 5 stars | 4 stars |

These ratings allows you to make well-informed choices regarding the safety of your Chevrolet Avalanche and the associated insurance expenses.

Chevrolet Avalanche Safety Features

Chevrolet Avalanche safety features can lower the cost of your insurance. The safety features for the 2020 Chevrolet Avalanche include:

- Driver Air Bag

- Passenger Air Bag

- Front Head Air Bag

- Rear Head Air Bag

- Front Side Air Bag

These features underscore the vehicle’s commitment to safety and could positively impact your insurance costs.

Chevrolet Avalanche Finance and Insurance Cost

If you are financing a Chevrolet Avalanche, you will pay more if you purchase Chevrolet Avalanche auto insurance at the dealership, so be sure to shop around and compare Chevrolet Avalanche auto insurance quotes from the best companies using our free tool below. Check out insurance savings in our complete guide title “Does Car Insurance Cover Non-accident Repairs?”

Methods for Reducing Insurance Costs on the Chevrolet Avalanche

There are many ways that you can save on Chevrolet Avalanche car insurance to get the best value possible. Below are five scenarios you can explore to help keep your Chevrolet Avalanche car insurance rates low.

- Never drink and drive your Chevrolet Avalanche.

- Check your Chevrolet Avalanche policy carefully to ensure all information is correct.

- Park your Chevrolet Avalanche somewhere safe – like a garage or private driveway.

- Move to an area with better weather.

- Ask about retiree discounts.

These steps can help you secure the best possible rates and value for your coverage. Access comprehensive insights into our article called “Compare Comprehensive Car Insurance: Rates, Discounts, & Requirements.”

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Leading Chevrolet Avalanche Insurance Providers

Several top car insurance companies offer competitive rates for the Chevrolet Avalanche rates based on factors like discounts for safety features. Take a look at this list of top car insurance companies that are popular with Chevrolet Avalanche drivers organized by market share.

Top Volvo S60 Car Insurance Providers by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $66,153,063 | 9% |

| #2 | Geico | $46,358,896 | 6% |

| #3 | Progressive | $41,737,283 | 6% |

| #4 | Allstate | $39,210,020 | 5% |

| #5 | Liberty Mutual | $36,172,570 | 5% |

| #6 | Travelers | $28,786,741 | 4% |

| #7 | USAA | $24,621,246 | 3% |

| #8 | Chubb | $24,199,582 | 3% |

| #9 | Farmers | $20,083,339 | 3% |

| #10 | Nationwide | $18,499,967 | 3% |

Ultimately, this information helps ensure that Chevrolet Avalanche drivers secure reliable and cost-effective insurance coverage.

Chevrolet Avalanche Insurance Cost

The average Chevrolet Avalanche auto insurance costs are $1,422 a year or $119 a month. Read up on the “How Do You Get Competitive Quotes for Car Insurance?” for more information.

Chevrolet Avalanche Car Insurance Monthly Rates by Coverage Type

| Category | Rates |

|---|---|

| Average Rate | $119 |

| Discount Rate | $70 |

| High Deductibles | $102 |

| High Risk Driver | $252 |

| Low Deductibles | $149 |

| Teen Driver | $433 |

This knowledge empowers Chevrolet Avalanche owners to make informed decisions about their coverage options and financial commitments.

Evaluate Chevrolet Avalanche Insurance Quotes Available Online for Free

Comparing free Chevrolet Avalanche insurance quotes online allows you to easily find the best coverage at competitive rates. By evaluating offers from various providers, you can pinpoint the most affordable and comprehensive options tailored to the unique needs of your Chevrolet Avalanche.

Progressive offers the most extensive coverage options with an A+ rating from A.M. Best.

Brad Larson Licensed Insurance Agent

Utilize online tools to quickly gather and compare quotes, ensuring you secure the best possible deal for your vehicle. Learn more in our article called “Collision vs. Comprehensive: What is the Difference?”

Stop overpaying for car insurance. Our free quote comparison tool allows you to shop for quotes from the top providers near you by entering your ZIP code below.

Frequently Asked Questions

Are Chevrolet Avalanches expensive to insure?

Chevrolet Avalanche insurance rates are comparable to other trucks. Shop around for the best rates.

For additional details, explore our comprehensive resource titled “Compare Car Insurance Rates by State.”

What factors impact the cost of Chevrolet Avalanche insurance?

Factors like the vehicle’s trim, age, driver’s age, location, and driving record affect insurance cost.

How do Chevrolet Avalanche crash test ratings affect insurance rates?

Higher crash test ratings can lead to lower insurance premiums.

How can I save on Chevrolet Avalanche insurance?

Consider higher deductibles, discounts, safe driving, installing safety features, and comparing quotes.

Which insurance companies offer competitive rates for Chevrolet Avalanche?

Shop around and compare quotes from different providers to find the best rates.

To find out more, explore our guide titled “Average Car Insurance Rates by Age and Gender.”

Which category of car insurance is best for a Chevrolet Avalanche?

Fully comprehensive car insurance offers the highest level of coverage for a Chevrolet Avalanche, protecting against damage to other vehicles or property, and providing peace of mind for new or expensive models.

Is a Chevrolet Avalanche a good vehicle to insure?

The Chevrolet Avalanche, produced from 2001 to 2013, is generally a reliable vehicle, but certain model years like 2002, 2003, 2004, 2005, 2007, 2008, and 2010 may have higher insurance rates due to reported issues.

Which brand of car has the cheapest insurance, and how does the Chevrolet Avalanche compare?

Subaru vehicles are typically the least expensive to insure. However, the Chevrolet Avalanche can also be affordable to insure if you choose the right coverage options and provider.

Which insurance is best for a Chevrolet Avalanche after 5 years?

For a Chevrolet Avalanche older than 5 years, a zero-depreciation add-on cover is a better option to complement comprehensive car insurance, as it increases claim amounts by covering repair and depreciation costs.

To learn more, explore our comprehensive resource on “How do you file a car insurance claim?”

Which insurance company has the highest customer satisfaction for Chevrolet Avalanche owners?

USAA leads in customer satisfaction for home insurance, which may correlate with their auto insurance services. Amica Mutual and Country Insurance also rank high, ensuring quality service for Chevrolet Avalanche owners.

Who is the best car protection company for a Chevrolet Avalanche?

Endurance is the best car warranty company for a Chevrolet Avalanche due to its six coverage options, low cost, and trustworthy reputation. Autopom is another top choice for its positive customer service experience.

Affordable car insurance rates are just a click away. Enter your ZIP code into our free quote tool below to find the best policy for you.

Which insurance company is best at paying claims for a Chevrolet Avalanche?

American Family, State Farm, Allstate, Liberty Mutual, and Progressive are known for efficiently paying claims, offering reliability for Chevrolet Avalanche insurance coverage.

What is the cheapest car insurance type for a Chevrolet Avalanche?

Fully comprehensive insurance is often the least expensive for a Chevrolet Avalanche, though individual rates may vary based on personal circumstances.

Learn more by reading our guide titled “Compare Monthly Car Insurance: Rates, Discounts, & Requirements.”

Which car insurance group offers the cheapest rates for a Chevrolet Avalanche?

Group 1 insurance typically offers the cheapest rates, but it’s essential to compare quotes for the Chevrolet Avalanche specifically.

What is the most basic car insurance for a Chevrolet Avalanche?

The most basic car insurance for a Chevrolet Avalanche is state-required liability coverage, which covers injuries and damages you’re liable for in an accident, with common limits of $25,000 per person for bodily injury.

How long will a Chevrolet Avalanche last, and how does this affect insurance?

A Chevrolet Avalanche can last up to 250,000 miles, which can positively impact insurance rates due to its reliability.

At what age is car insurance most expensive for a Chevrolet Avalanche?

Car insurance rates are highest for drivers aged 16 to 24, impacting the cost of insuring a Chevrolet Avalanche for younger drivers.

Access comprehensive insights into our guide titled “Does the age of a car affect car insurance rates?”

Who insures the most cars, and is this beneficial for Chevrolet Avalanche owners?

State Farm is the largest car insurance provider in the U.S., offering widespread availability and potentially better rates for Chevrolet Avalanche owners.

What are the four recommended types of insurance for a Chevrolet Avalanche?

Experts recommend having liability, comprehensive, collision, and uninsured/underinsured motorist coverage for a Chevrolet Avalanche. Employer coverage is often best, but getting quotes from multiple providers can yield discounts.

What type of insurance is most important for a Chevrolet Avalanche?

Liability coverage is the most essential type of car insurance for a Chevrolet Avalanche, ensuring protection against legal and financial responsibilities in an accident.

Ready to find cheaper car insurance coverage? Enter your ZIP code below to begin.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.