Best Cape Coral, FL Car Insurance in 2025

The cheapest Cape Coral, FL car insurance is from GEICO, although rates vary by driver. Auto insurance in Cape Coral, FL must meet the state minimum requirement of $10,000 in personal injury protection and $10,000 in property damage liability. However, unlike most states, Florida drivers don’t have to carry bodily injury coverage. Compare quotes below to find the cheapest Cape Coral, FL car insurance rates near you.

Read moreFree Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

UPDATED: Oct 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Geico is the cheapest car insurance company in Cape Coral, FL

- Florida ranks number one in the U.S. for having the most uninsured drivers

- You aren’t required to carry bodily injury coverage in Cape Coral, but if you do, you have to carry $10,000 for one person and $20,000 for two or more people

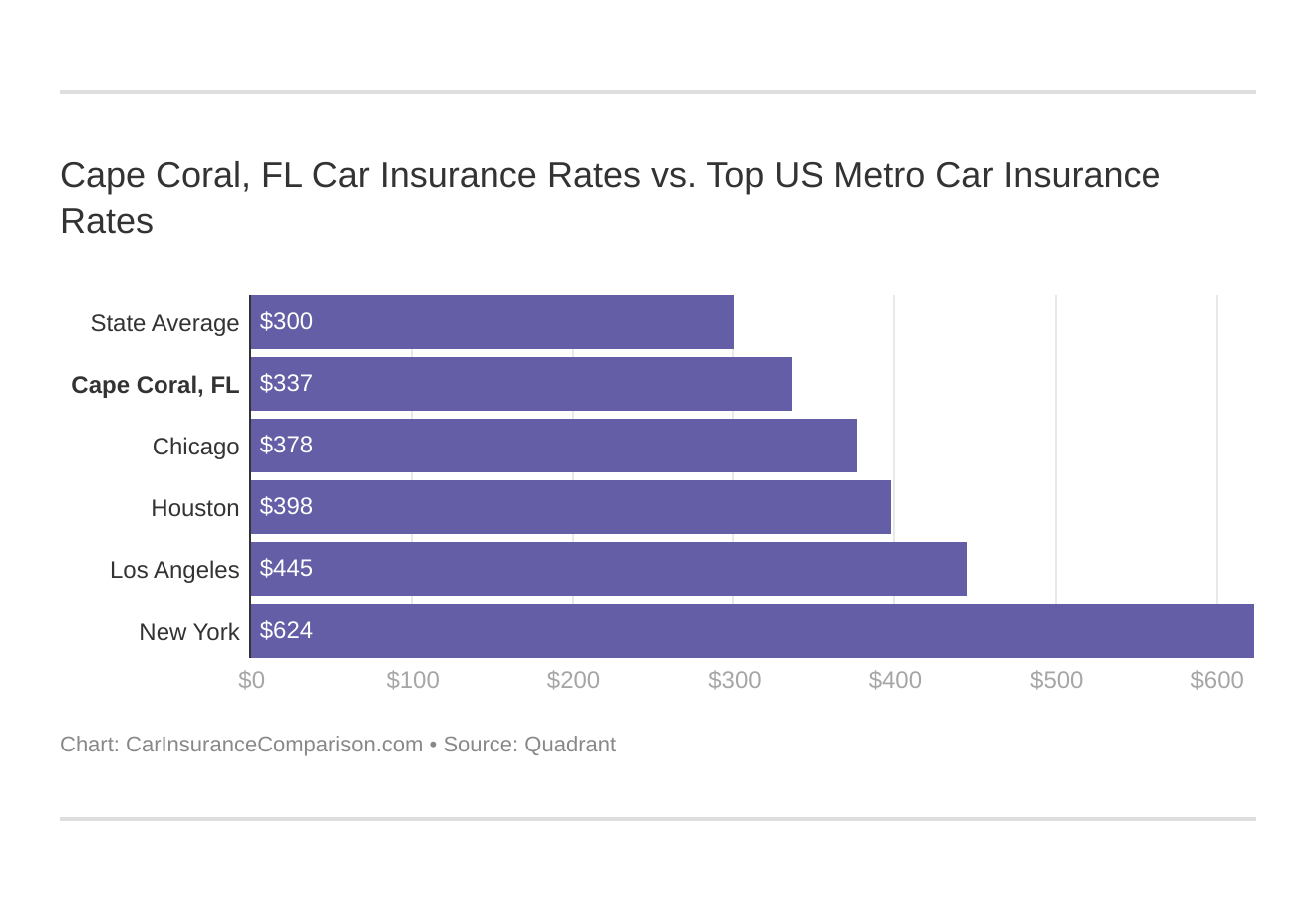

Cape Coral, FL car insurance is expensive. Rates fall between the state and national averages, and Florida car insurance rates are well above the national average.

To find the most affordable Cape Coral, FL car insurance, shop around and compare quotes from multiple companies.

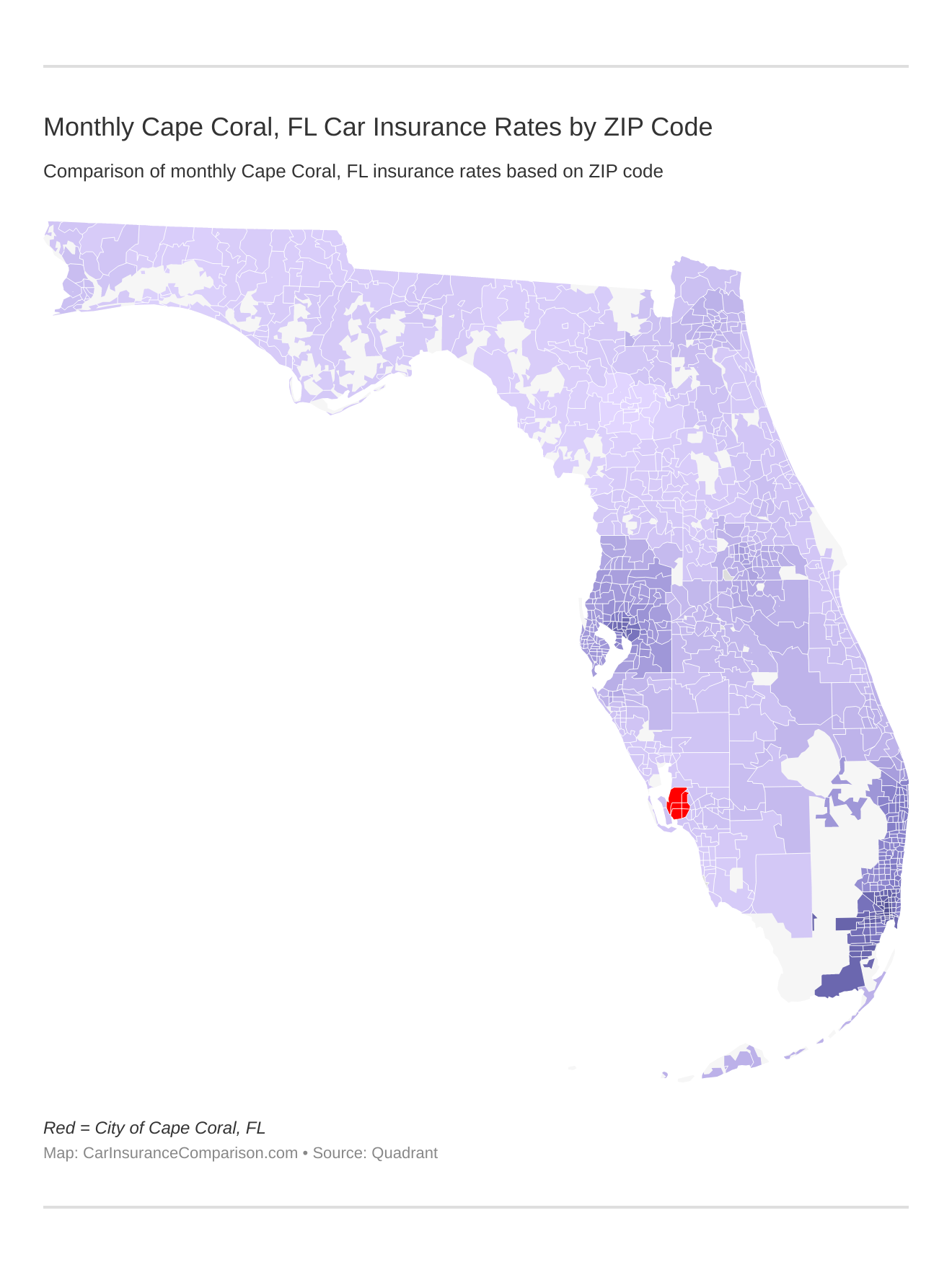

What are the monthly insurance rates in Cape Coral, FL car insurance by ZIP Code?

Check out the monthly Cape Coral, FL auto insurance rates by ZIP Code below:

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

What are car insurance rates in Cape Coral, FL compared to top US metro car insurance rates?

You might find yourself asking how does my Cape Coral, FL auto insurance coverage stack up against other top metro auto insurance rates? We’ve got your answer below.

Enter your ZIP code now to compare Cape Coral, CL car insurance rates.

What is the cheapest car insurance company in Cape Coral, FL?

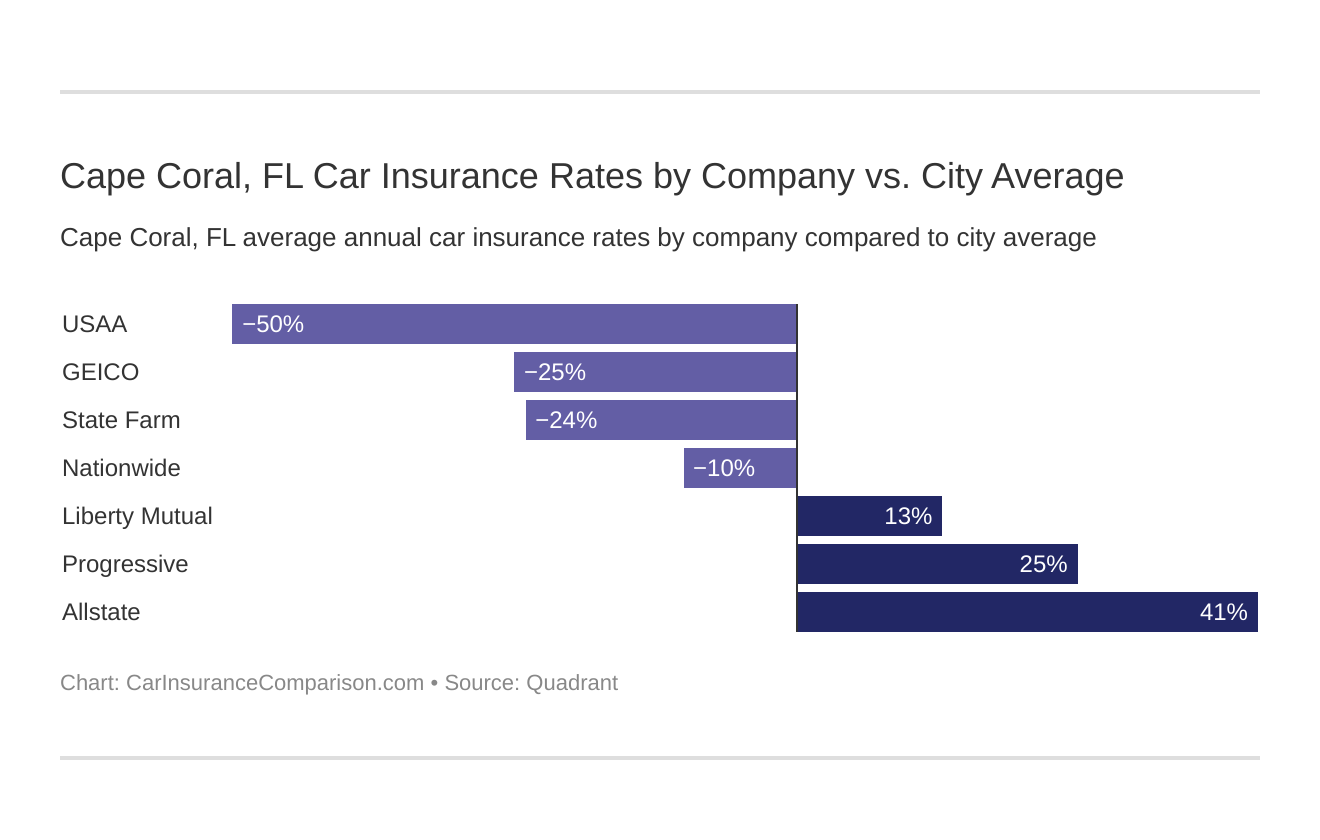

Geico is the cheapest car insurance company in Cape Coral, FL that offers coverage to all drivers. USAA is actually the cheapest overall, but it only offers insurance to members of the military, veterans, and their families. Can military members get a discount on car insurance? They usually can if they go through a company that specializes in selling to the armed forces.

Which Cape Coral, FL auto insurance company has the cheapest rates? And how do those rates compare against the average Florida auto insurance company rates? We’ve got the answers below.

The top-ranking Cape Coral, FL car insurance companies listed from least to most expensive are:

- USAA – $2,437.89

- Geico – $3,151.97

- State Farm – $3,177.35

- Nationwide – $3,675.61

- Liberty Mutual – $4,603.77

- Progressive – $5,188.11

- Allstate – $6,110.16

There are many factors that affect your auto insurance rates, including age, gender, marital status, driving record, and credit history.

Where you live is also a big factor in your rates. If you live in or near a big city, you will pay higher rates. For example, in another larger city, car insurance in Tallahassee, FL is similar to Cape Coral when it comes to rates.

Another reason that car insurance in Cape Coral is so high is that Florida ranks number one in the U.S. for the number of uninsured drivers. Auto insurance companies in Florida raise rates to compensate, although it seems a bit counterintuitive to make insurance even more inaccessible to the average driver.

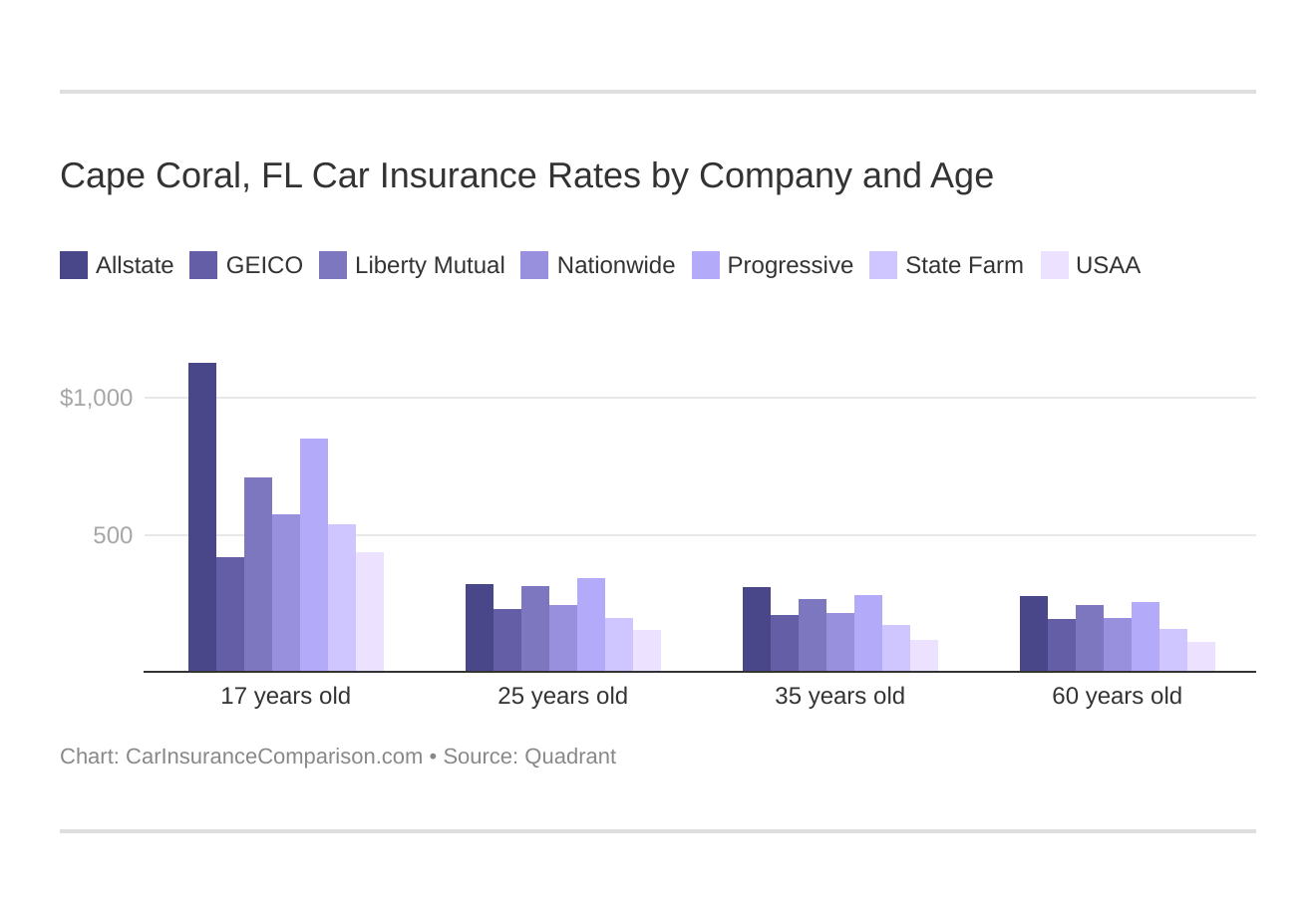

Cape Coral, FL auto insurance rates by company and age is an essential comparison because the top auto insurance company for one age group may not be the best company for another age group. The average cost is thousands of dollars regardless of who you go with, whether you speak to an independent insurance agency or you’re insured by one of the bigger, distinct companies like the Allstate insurance company or Geico. Who is cheaper? Geico vs. Allstate? Make sure you compare the two companies for discounts and cheaper pricing.

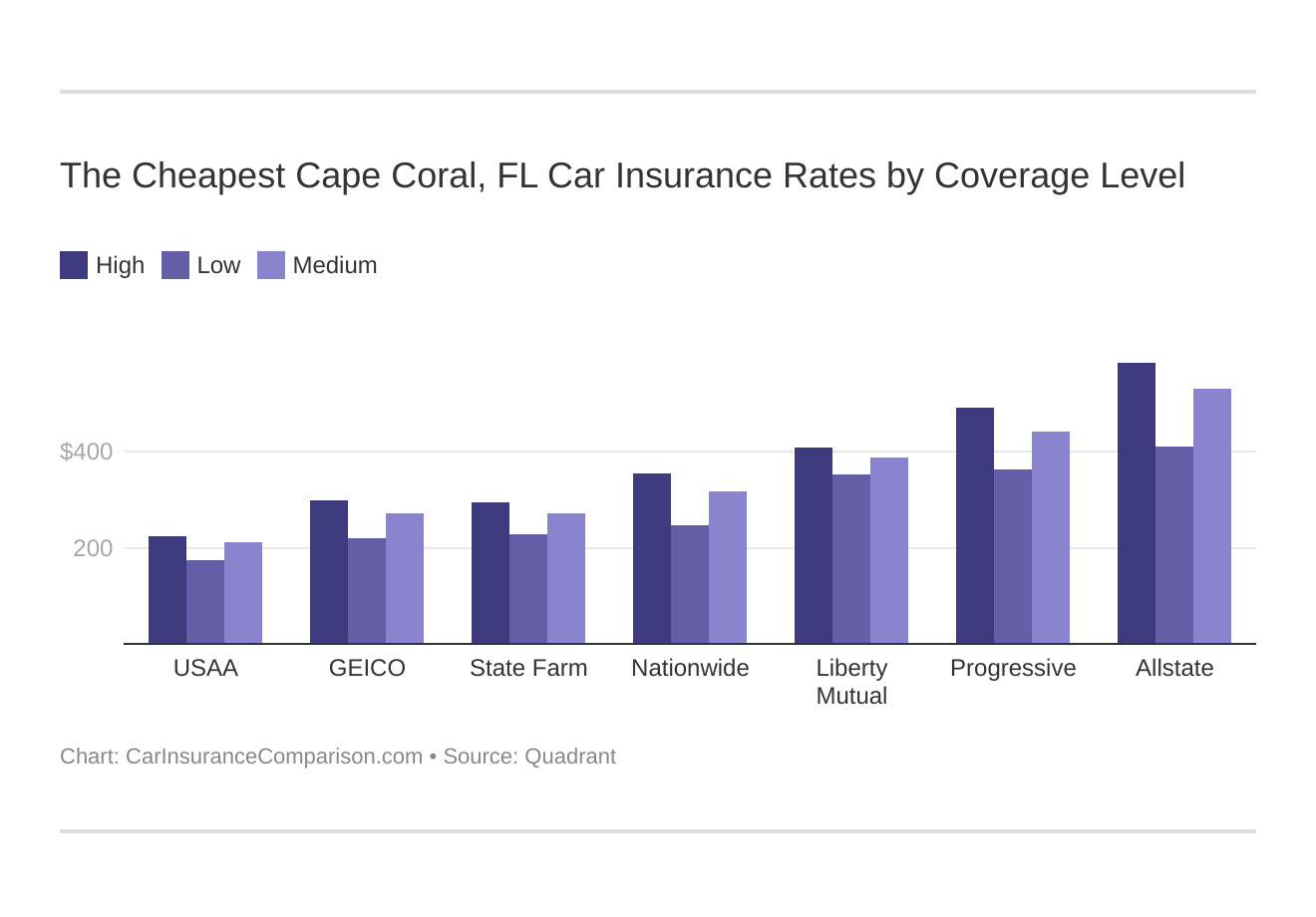

Your coverage level will play a major role in your Cape Coral auto insurance rates. Find the cheapest Cape Coral, FL auto insurance rates by coverage level below:

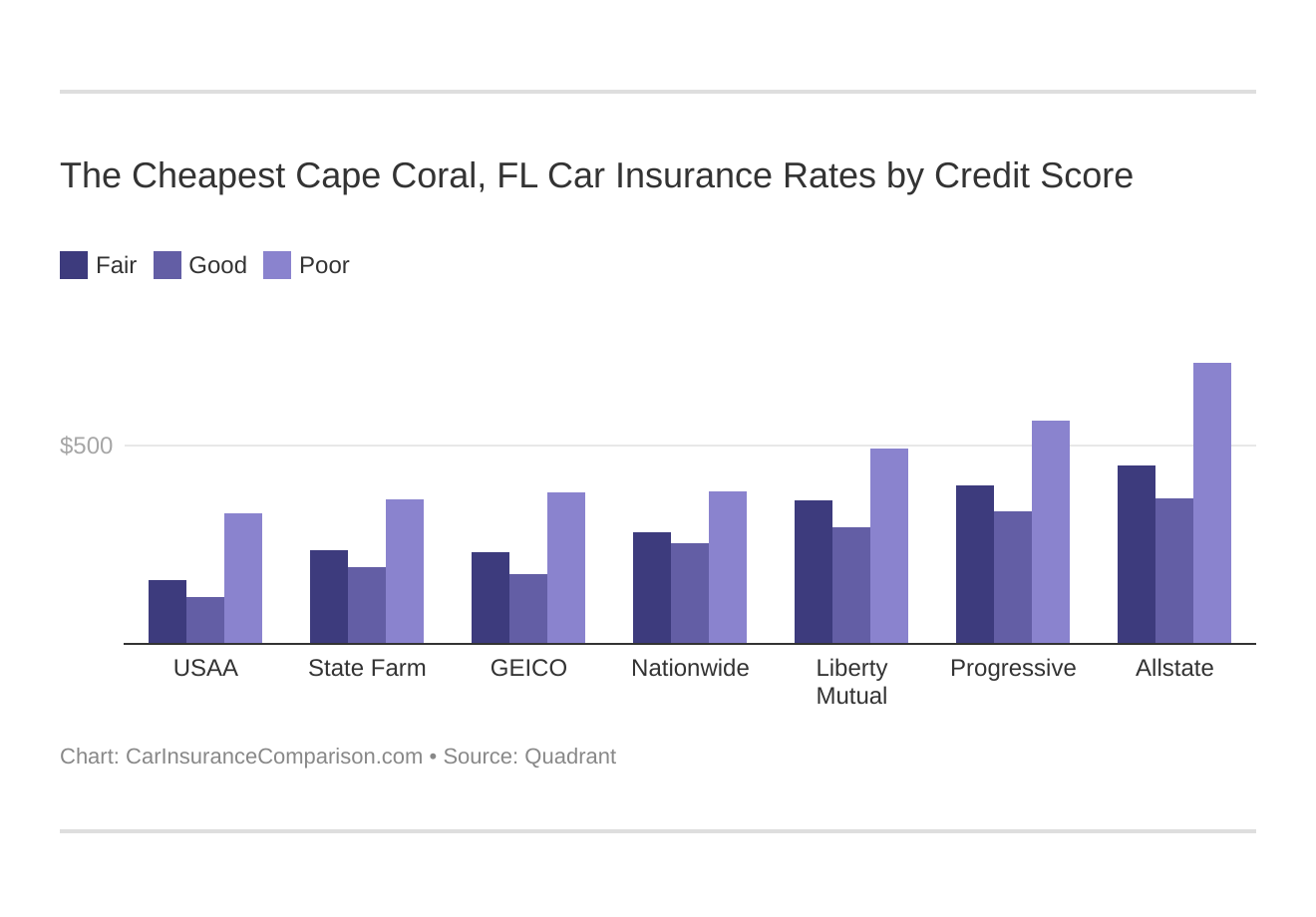

Your credit score will play a major role in your Cape Coral auto insurance rates unless you live in these states where discrimination based on credit is not allowed: California, Hawaii, and Massachusetts. Find the cheapest Cape Coral, FL auto insurance rates by credit score below.

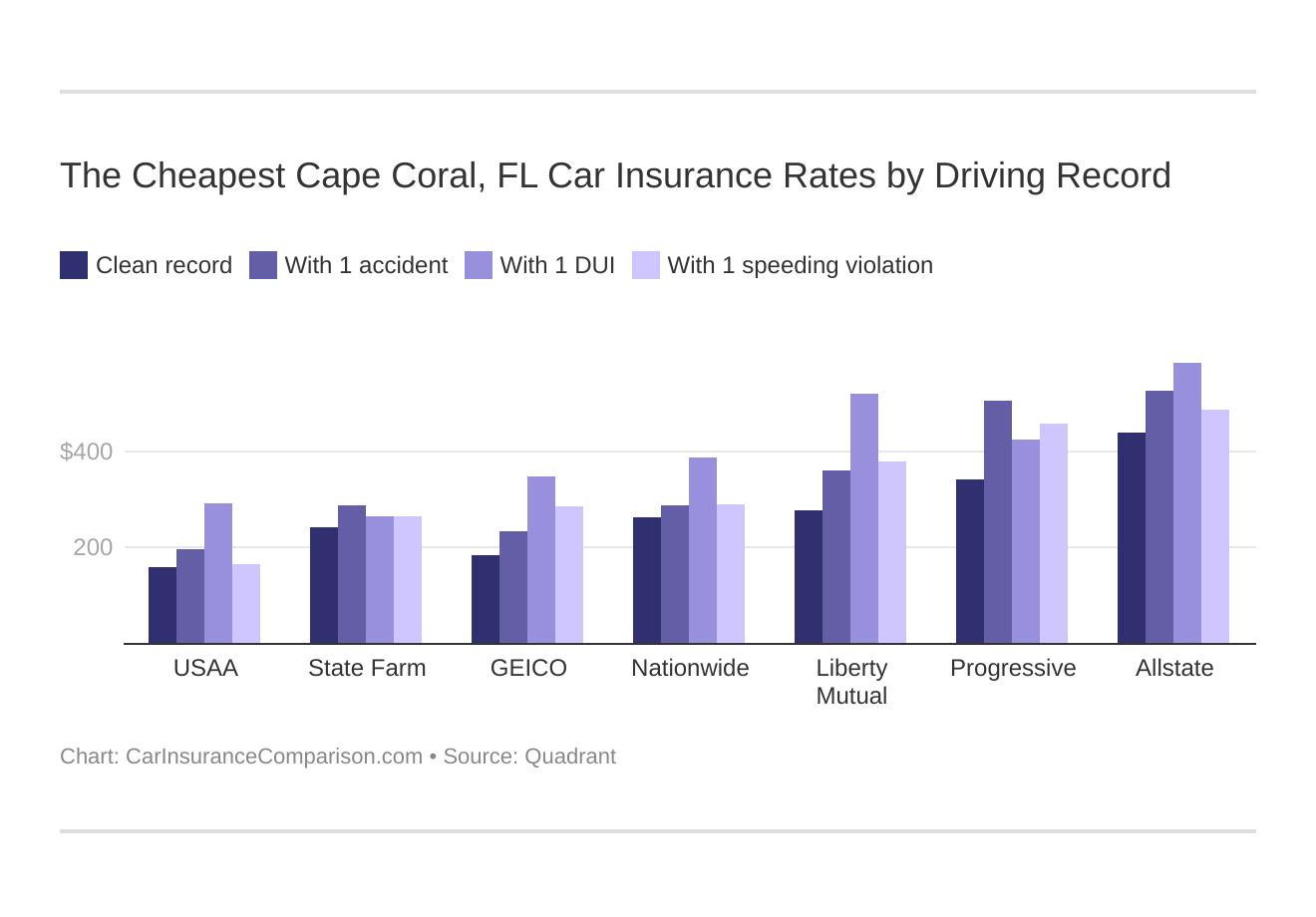

Your driving record will play a major role in your Cape Coral auto insurance rates. Factors like being a high-risk driver, or having a driving history of accidents will put a huge damper on the variety of coverages available. Finding the best high-risk car insurance can be difficult. The better your driving skills, the better your potential coverage plan will be. Other factors aside, a Cape Coral, FL DUI may increase your auto insurance rates 40 to 50 percent. Find the cheapest Cape Coral, FL auto insurance rates by driving record.

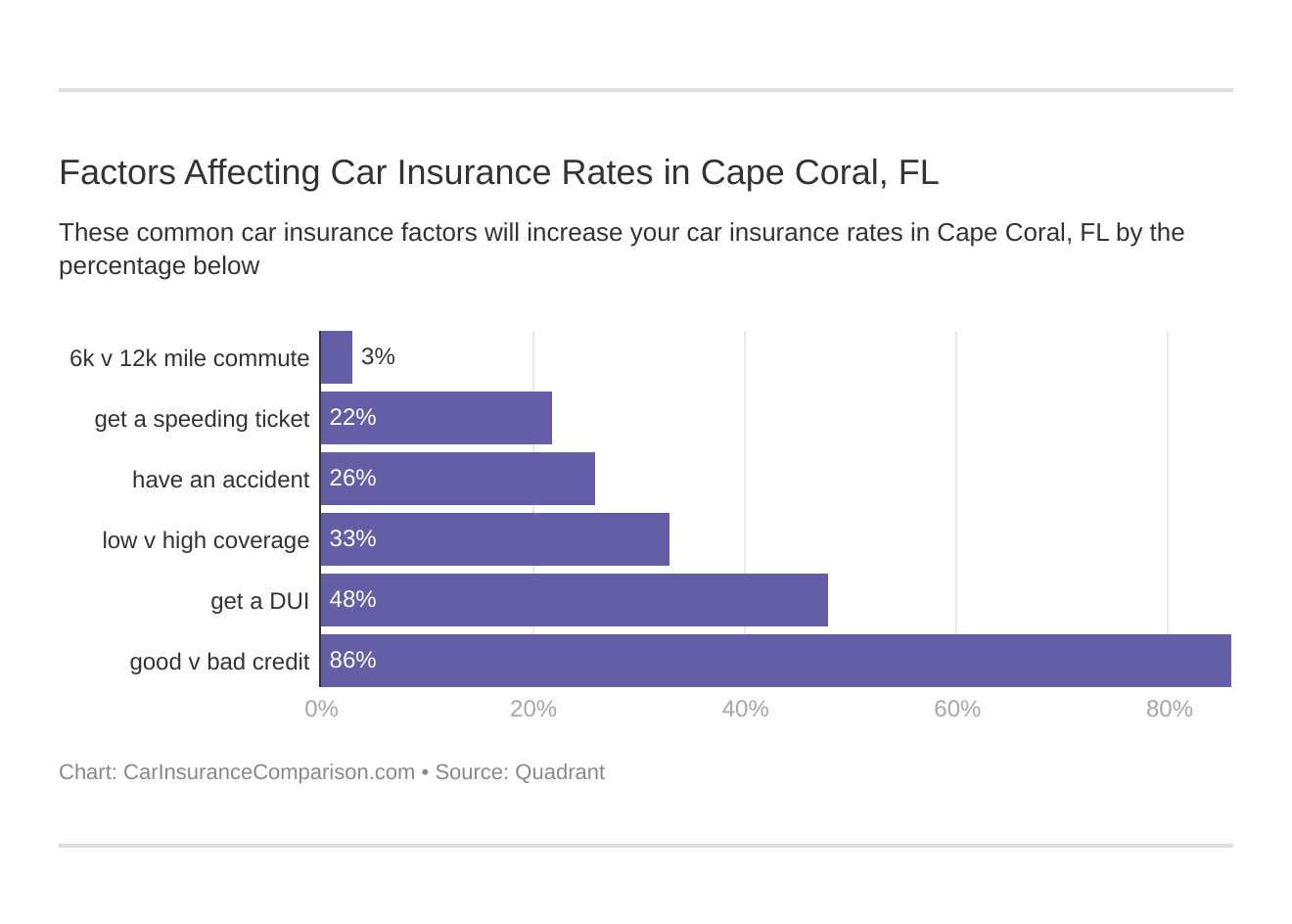

Other points that will affect auto insurance rates in Cape Coral, FL may include your commute, coverage level, tickets, DUIs, and credit. Controlling these factors will help you maintain affordable insurance Cape Coral, Florida auto insurance.

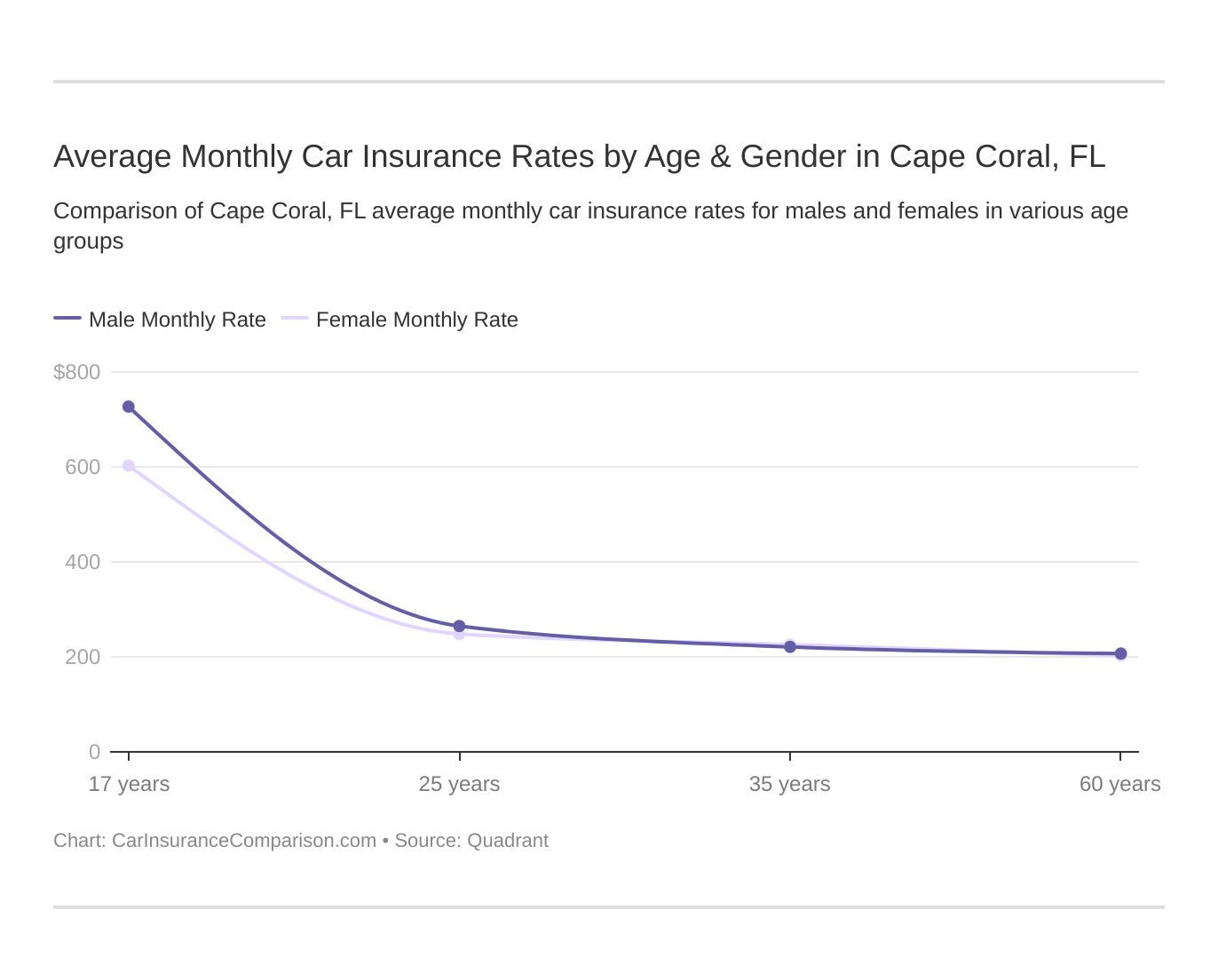

These states no longer using gender to calculate your auto insurance rates — Hawaii, Massachusetts, Michigan, Montana, North Carolina, and Pennsylvania. But age is still a significant factor because young drivers are often considered high-risk. Florida does use gender, so check out the average monthly auto insurance rates by age and gender in Cape Coral, FL. Comparing car insurance rates by age is always a good thing to do while shopping for coverage.

What car insurance coverage is required in Cape Coral, FL?

Most states require that drivers carry at least a minimum amount of auto insurance. Florida is no different.

The minimum amount of auto insurance required in Cape Coral, Florida is:

- $10,000 in personal injury protection (PIP) coverage

- $10,000 for property damage liability (PDL)

What’s unusual is that Florida doesn’t require you to carry bodily injury coverage. That’s because Florida is a no-fault state. This means that if you are in an accident, your auto insurance pays for damages and injuries, regardless of who is at fault. Since such a large of percent of drivers are uninsured in the state and providers don’t particularly care about affordable car insurance, allowing for drivers to be exempt from purchasing bodily injury liability actually puts more money in their pocket.

If you do decide to carry bodily injury, you must carry $10,000 for one person and $20,000 for two or more people. Since the amount of financial obligations that each driver has will impact what kind of Florida insurance they can afford, looking for car insurance discounts and looking for minimum coverage can lead to more ease on the road.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

What affects car insurance rates in Cape Coral, FL?

Traffic can also affect your car insurance rates. More traffic equals a greater chance of an accident, meaning less chances for road safety.

Although INRIX doesn’t list information for Cape Coral, Nearby For Myers, FL ranks as the 71st most congested city in the United States. Cape Coral shares that traffic volume.

Even though there is a lot of traffic, City-Data reports that commute time is only around 15 minutes in Cape Coral. Although most drivers prefer to make their commute alone, about 10 percent carpool.

Auto theft also raises car insurance rates. According to the FBI, there were only 170 motor vehicle thefts in Cape Coral, FL, and there were 226 in nearby Fort Myers in one year. City drivers often pay higher insurance costs, making it harder to access affordable auto insurance. Having a clean driving record will help you get a better chance of affordable coverage.

Cape Coral, FL Car Insurance: The Bottom Line

Cape Coral auto insurance is expensive for many different reasons, such as the high number of uninsured motorists and minimum coverage amounts required. What is uninsured or underinsured motorist coverage? Make sure you look into this coverage in case an uninsured driver hits you. Finding a dedicated service to provide adequate coverage and affordable rates is imperative for road safety.

Before you buy Cape Coral, FL car insurance, compare average rates from multiple companies to find the best coverage at the lowest price. You can also check the rating among users, common customer complaints, and customer service rating. If you want a company with a little more personal touch, you can always speak to an independent agent!

Enter your ZIP code now to compare Cape Coral, Fl car insurance quotes today.

Frequently Asked Questions

What are the monthly insurance rates in Cape Coral, FL car insurance by ZIP Code?

To check the monthly rates, enter your ZIP code in the free quote tool.

How do car insurance rates in Cape Coral, FL compare to top US metro car insurance rates?

To compare rates, enter your ZIP code and view the rates for Cape Coral, FL.

Which is the cheapest car insurance company in Cape Coral, FL?

GEICO is the cheapest car insurance company in Cape Coral, FL for all drivers.

What factors affect auto insurance rates in Cape Coral, FL?

Factors such as age, gender, driving record, credit history, and where you live can affect auto insurance rates in Cape Coral, FL.

What car insurance coverage is required in Cape Coral, FL?

The minimum required coverage in Cape Coral, FL is $10,000 in personal injury protection and $10,000 in property damage liability.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.