Best Port St. Lucie, FL Car Insurance in 2025

The cheapest car insurance in Port St. Lucie, Florida is USAA, however, auto insurance rates will vary for each person. Port St. Lucie, FL car insurance must meet the state minimum requirements with coverage levels of $10K for PIP and $10K for PDL. Compare Port St. Lucie, FL car insurance rates online to get the best price for you.

Read moreFree Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Laura D. Adams

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Insurance & Finance Analyst

UPDATED: Nov 4, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 4, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- On average, Port St. Lucie, FL car insurance costs $4,534/yr or $378/mo

- The cheapest car insurance company in Port St. Lucie, Florida is USAA

- Port St. Lucie’s vehicle thefts are much lower than in other popular Florida cities

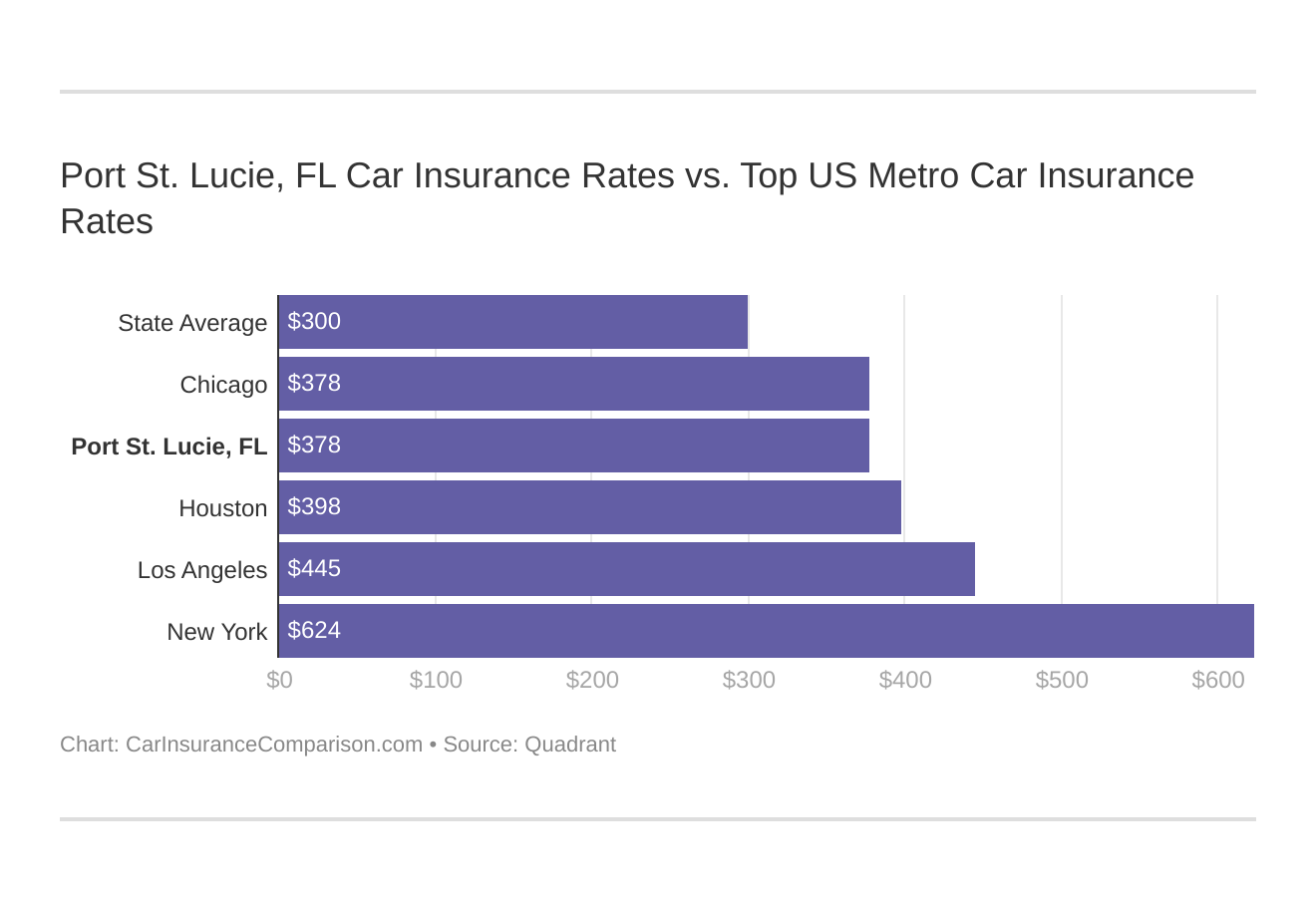

Port St. Lucie, FL car insurance is $378 per month on average. That’s below the Florida car insurance average of $390 per month, but still high.

Why is car insurance in Port St. Lucie, FL so expensive?

Car insurance rates are determined by various factors, including the company you choose, your driving history, and much more. Don’t worry – we’re here to help you find affordable car insurance.

Our guide explains how you can find the cheapest car insurance in Port St. Lucie, Florida.

Ready to find affordable Port St. Lucie, FL car insurance rates? Enter your ZIP code above to get started.

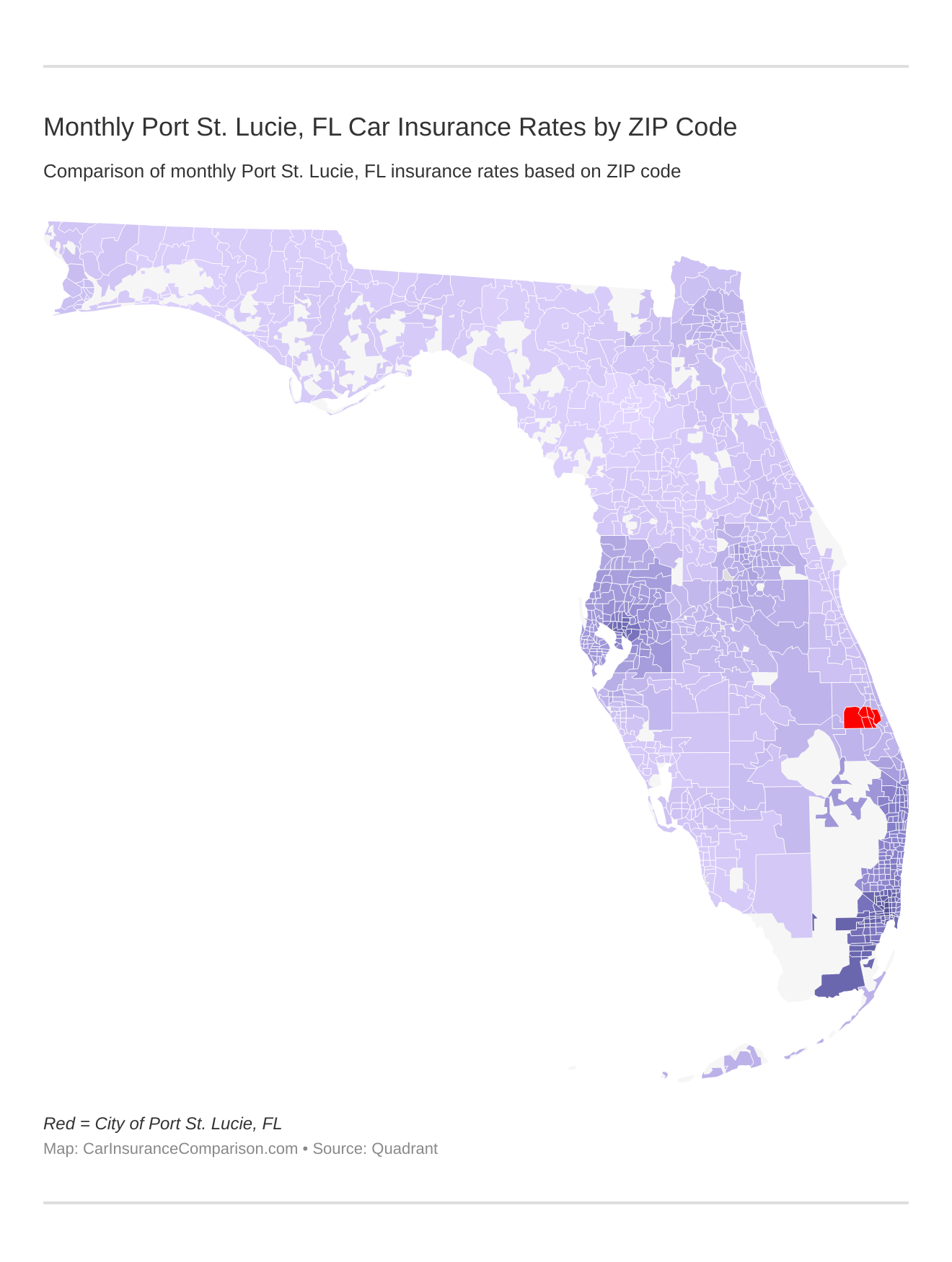

Monthly Port St. Lucie, FL Car Insurance Rates by ZIP Code

Find more info about the monthly Port St. Lucie, FL auto insurance rates by ZIP Code below:

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Port St. Lucie, FL Car Insurance Rates vs. Top US Metro Car Insurance Rates

Which city you live in will have a major affect on car insurance. That’s why it’s vital to compare Port St. Lucie, FL against other top US metro areas’ auto insurance rates.

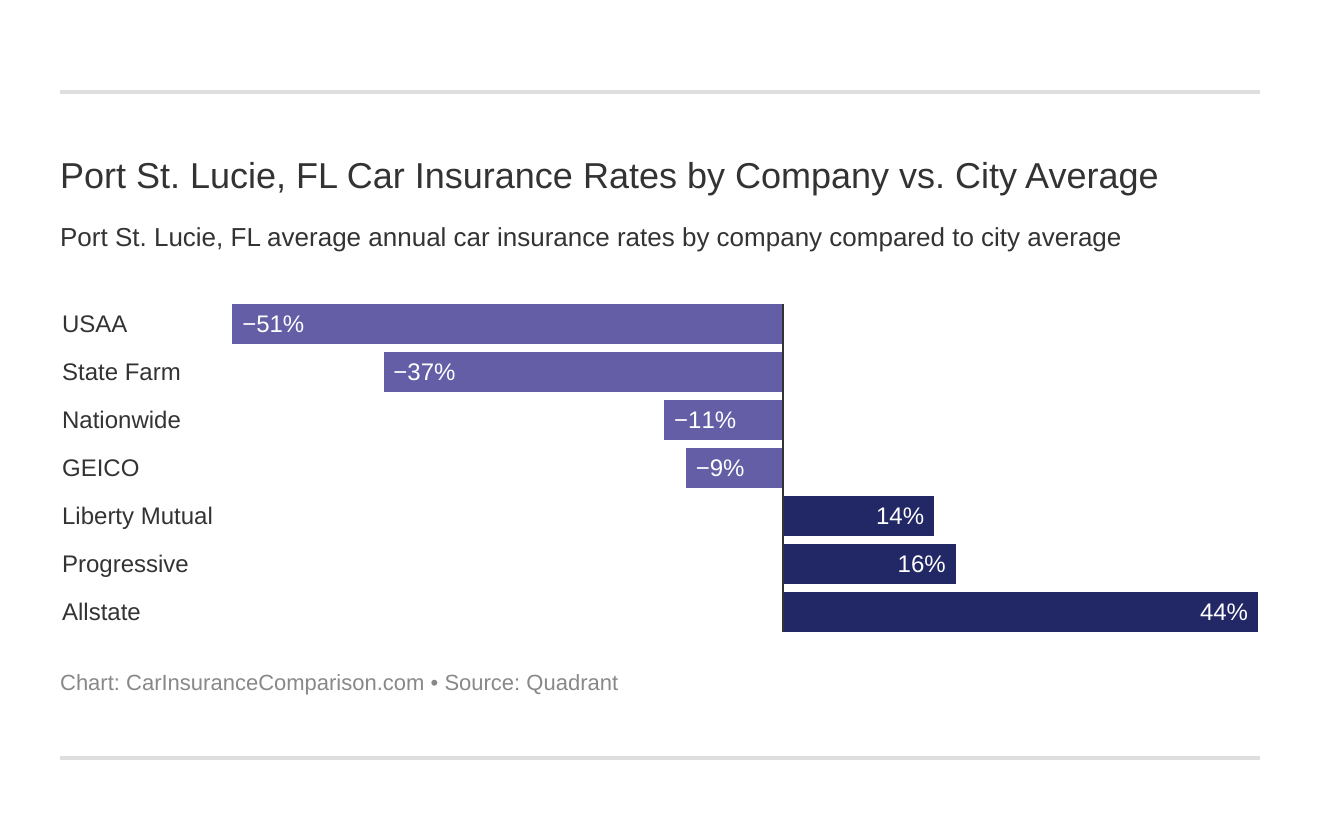

What is the cheapest car insurance company in Port St. Lucie, FL?

The cheapest car insurance company in Port St. Lucie, FL is USAA. However, USAA is only available to military veterans and their immediate families. The next most affordable companies are State Farm and Nationwide.

The cheapest Port St. Lucie, FL car insurance company can be discovered below. You then might be asking, “How do those rates compare against the average Florida car insurance company rates?” We cover that as well.

Here are the best auto insurance companies in Port St. Lucie, Florida ranked from cheapest to most expensive:

- USAA car insurance – $2,700

- State Farm car insurance – $3,131

- Nationwide car insurance – $4,050

- Geico car insurance – $4,166

- Liberty Mutual car insurance – $5,231

- Progressive car insurance – $5,346

- Allstate car insurance – $7,113

USAA, State Farm, Nationwide, and Geico are the only Port St. Lucie car insurance companies with cheaper than average auto insurance rates. However, there are many factors that affect car insurance rates.

The most critical factor is your driving history. Some car insurance companies provide 15 to 40 percent off annual rates if you have a clean driving record. You can even save money if your credit score is good.

Another crucial factor that determines auto insurance is location. Car insurance providers partially base your rates on your ZIP code.

So what’s the cheapest neighborhood in Port St. Lucie? The most affordable ZIP code in Port St. Lucie, FL is 34953, and its average car insurance cost is $294 per month.

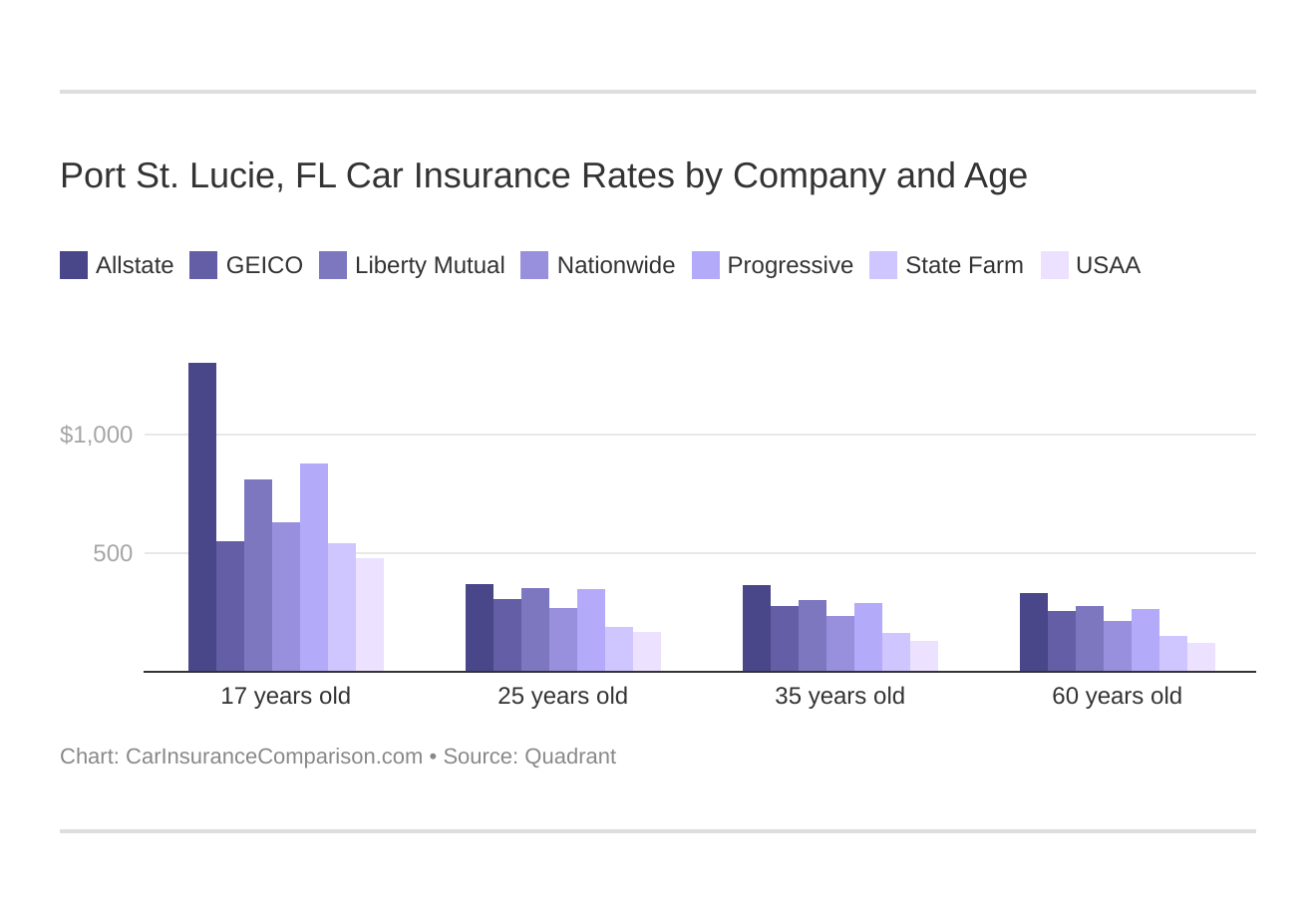

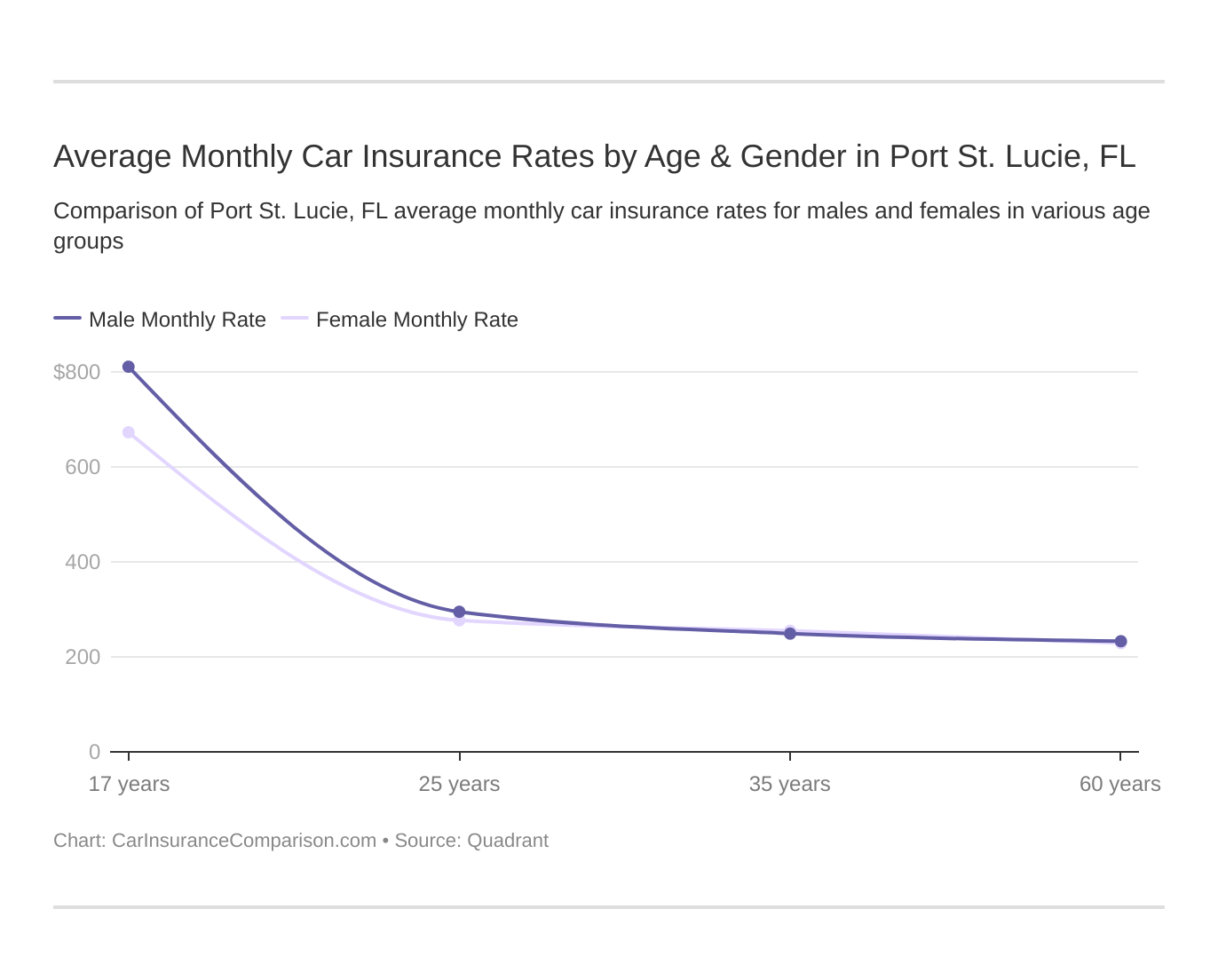

Port St. Lucie male drivers under 25 have the most expensive car insurance rates. Meanwhile, married drivers who are 25 and older pay significantly less for car insurance.

Comparing Port St. Lucie, Florida car insurance rates by age is an essential comparison because the top car insurance company for one age group may not be the best company for another age group.

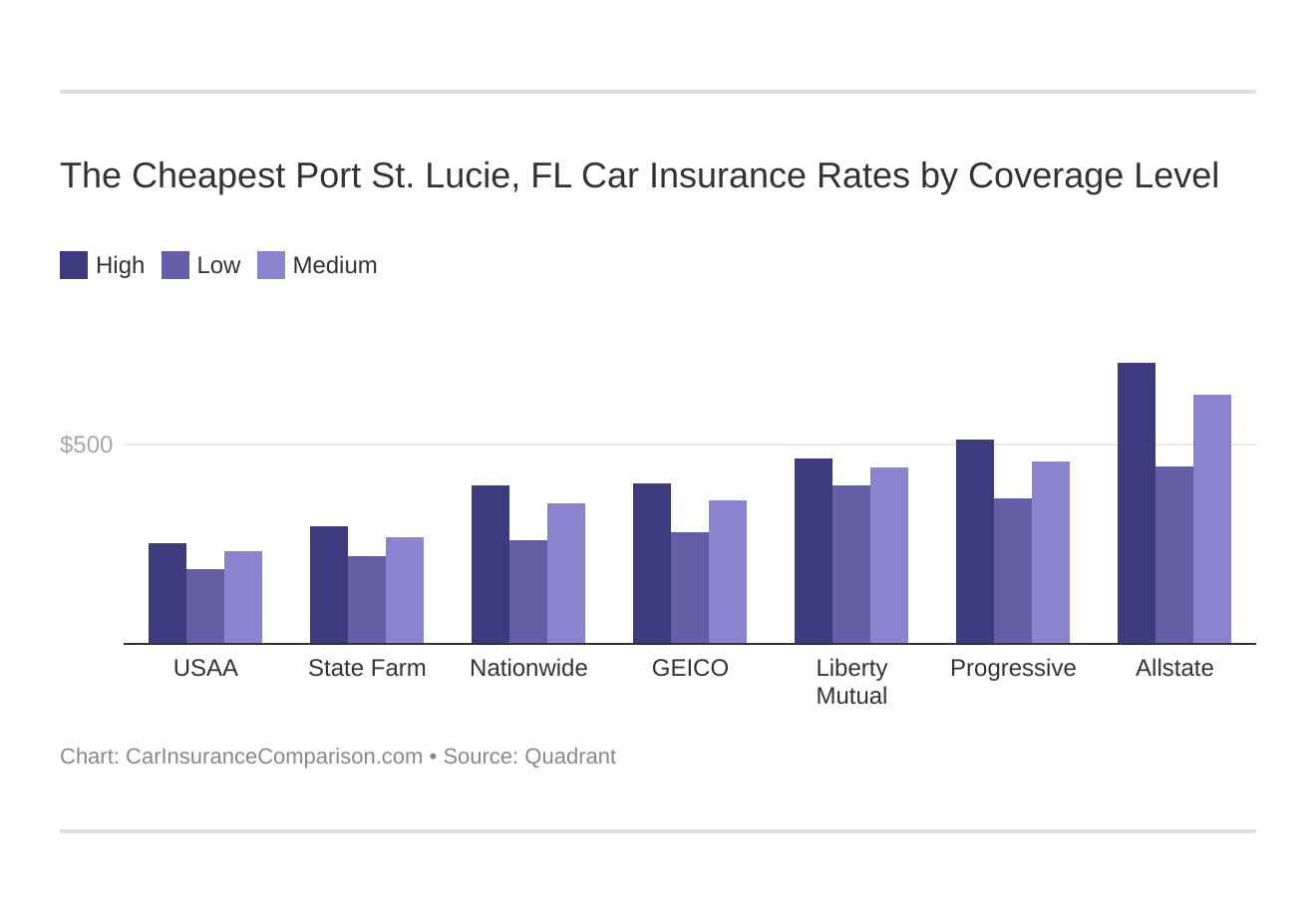

Your coverage level will play a major role in your Port St. Lucie, FL car insurance rates. Find the cheapest Port St. Lucie, Florida car insurance rates by coverage level below:

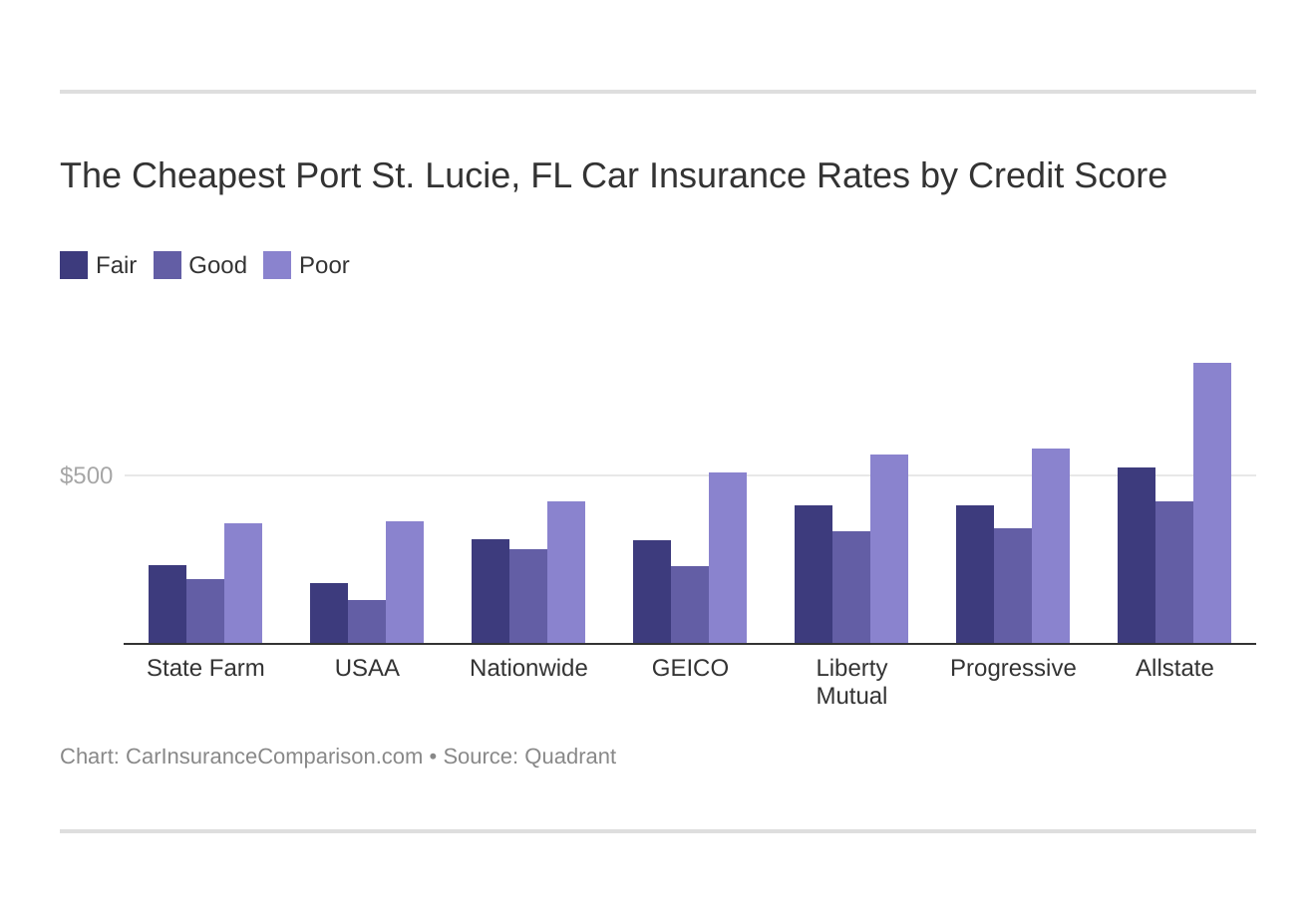

Your credit score will play a major role in your Port St. Lucie, FL car insurance rates unless you live in these states where discrimination based on credit is not allowed: California, Hawaii, and Massachusetts. You may be able to get a good credit discount. Find the cheapest Port St. Lucie, Florida car insurance rates by credit score below.

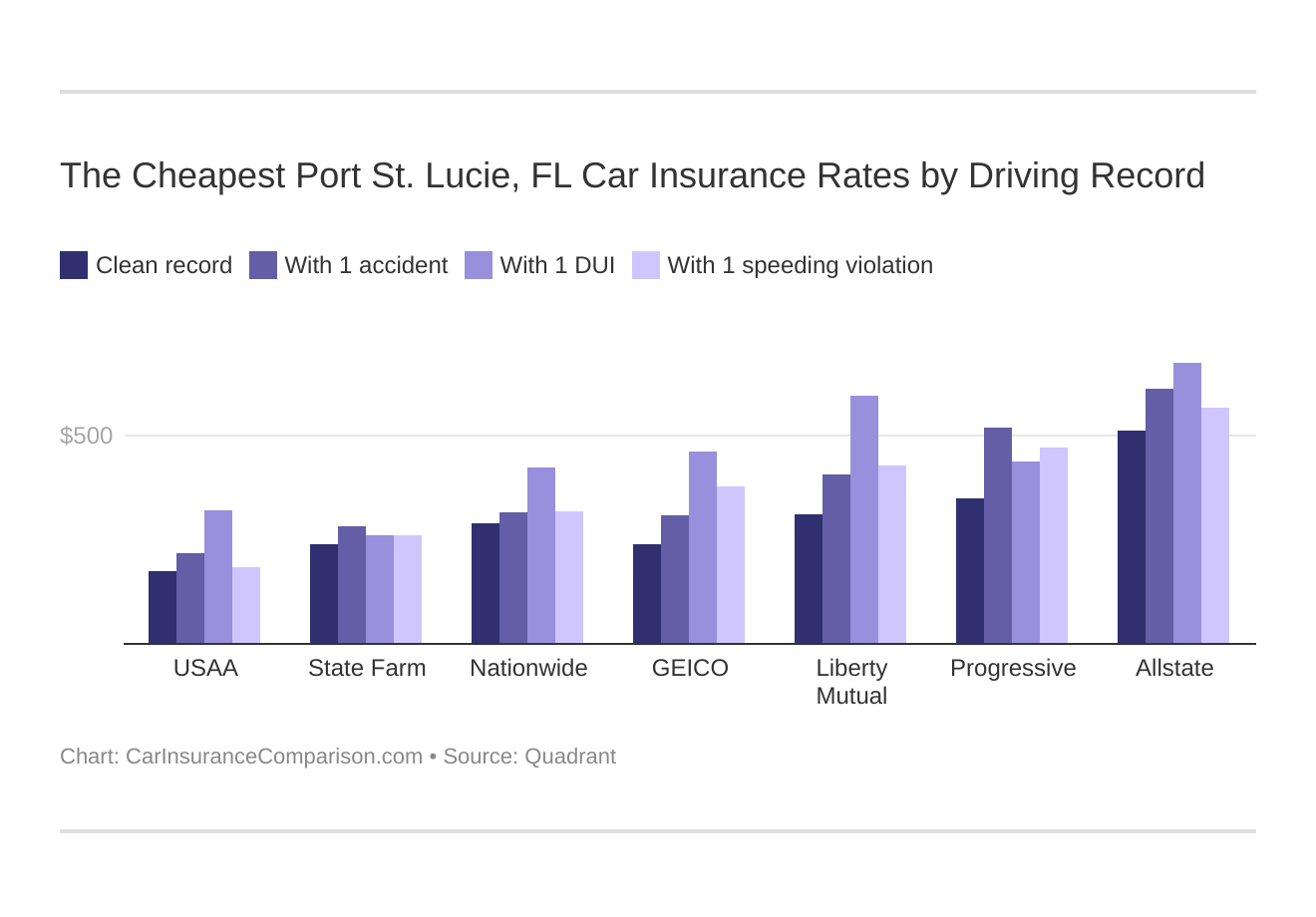

Your driving record will affect your Port St. Lucie car insurance rates. For example, a Port St. Lucie, Florida DUI may increase your car insurance rates 40 to 50 percent. Find the cheapest Port St. Lucie, Florida car insurance with a bad driving record.

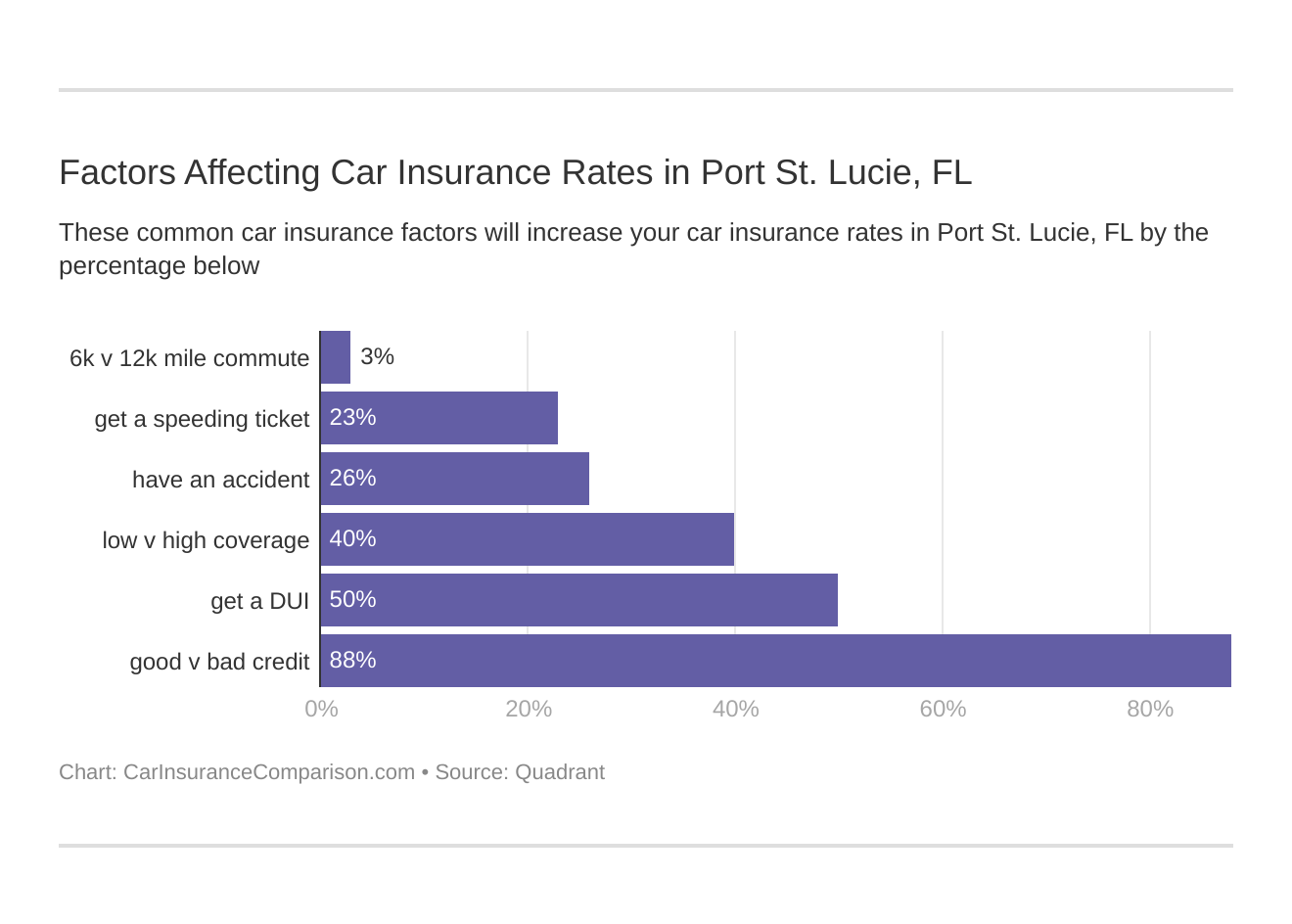

Factors affecting car insurance rates in Port St. Lucie, FL may include your commute, coverage level, tickets, DUIs, and credit. Controlling these risk factors will ensure you have the cheapest Port St. Lucie, Florida car insurance.

These states no longer use gender to calculate your car insurance rates — Hawaii, Massachusetts, Michigan, Montana, North Carolina, and Pennsylvania. But age is still a large factor because young drivers are considered high-risk drivers in Port St. Lucie. Therefore, teen car insurance is more expensive. FL does use gender, so check out the average monthly car insurance rates by age and gender in Port St. Lucie, FL.

What are the minimum car insurance coverage requirements in Port St. Lucie, FL?

All Florida drivers must carry the minimum amount of liability car insurance required, which is:

- $10,000 for personal injury protection (PIP)

- $10,000 for property damage liability (PDL)

It’s recommended that you get a higher coverage limit. Florida’s coverage car insurance requirements are lower than average. Therefore, it would be best to buy a higher coverage limit, such as 50/100/50.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

What affects car insurance rates in Port St. Lucie, FL?

Your daily commute to work and your city’s vehicle theft rate can determine your car insurance cost. Your chances of getting into an accident increase the more you drive. Vehicle thefts, on the other hand, determine your chances of filing a comprehensive insurance claim.

According to the FBI statistics, the city of Port St. Lucie had 81 car thefts. That’s not much compared to cities like Miami and Orlando. That means comprehensive coverage rates could be lower than average in the city.

The Port St. Lucie commute is about four minutes slower than the national average. According to City-Data, it takes 29 minutes for the average driver to get work in Port St. Lucie, Florida.

The higher than average commute time of your area could increase your car insurance rates.

Port St. Lucie, FL Car Insurance: The Bottom Line

You can find cheap car insurance in Port St. Lucie, Florida by maintaining a clean driving record. If you have a good credit score, you will also find lower rates.

Also, your vehicle’s safety and anti-theft features can save you money with car insurance discounts.

Before you buy car insurance in Port St. Lucie, Florida be sure you’ve checked rates with multiple companies. Enter your ZIP code below to get fast, free Port St. Lucie, FL car insurance quotes.

Frequently Asked Questions

How can I find cheap car insurance in Port St. Lucie, FL?

To find cheap car insurance in Port St. Lucie, FL, consider the following steps:

- Compare quotes from multiple insurance companies to get the best price.

- Maintain a clean driving record and consider taking defensive driving courses.

- Improve your credit score, as it can affect your car insurance rates.

- Install safety features in your vehicle and inquire about available discounts.

- Review your coverage needs and consider higher deductibles or different coverage options to lower your premiums.

What factors affect car insurance rates in Port St. Lucie, FL?

Several factors can impact car insurance rates in Port St. Lucie, FL. These include your driving record, credit score, location (ZIP code), commute distance, and the type of coverage you choose. Insurance companies also take into account demographics such as age and gender. It’s important to maintain a clean driving record, improve your credit score, and explore discounts to potentially lower your car insurance rates.

What are the minimum car insurance coverage requirements in Port St. Lucie, FL?

In Port St. Lucie, FL, all drivers must carry the minimum amount of liability car insurance, which includes $10,000 for personal injury protection (PIP) and $10,000 for property damage liability (PDL). While these are the minimum requirements, it’s advisable to consider higher coverage limits to ensure you are adequately protected.

What is the cheapest car insurance company in Port St. Lucie, FL?

The cheapest car insurance company in Port St. Lucie, FL is USAA. However, it is important to note that USAA is only available to military veterans and their immediate families. The next most affordable companies in Port St. Lucie are State Farm and Nationwide. It’s always recommended to compare quotes from multiple insurance companies to find the best price for your specific situation.

Can I get car insurance coverage if I have a poor driving record?

Yes, even if you have a poor driving record, you can still obtain car insurance coverage in Port St. Lucie, FL. However, insurance companies may consider you a higher risk and charge higher premiums. Shopping around and comparing quotes from different insurers can help you find the most affordable option.

Are there any discounts available to lower my car insurance rates in Port St. Lucie, FL?

Yes, many car insurance companies offer various discounts that can help lower your rates. These discounts may include safe driver discounts, multi-policy discounts, good student discounts, and more. It’s recommended to inquire about available discounts when obtaining quotes from different insurers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Laura D. Adams

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Insurance & Finance Analyst

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.