Best Chevrolet Equinox Car Insurance in 2025 (Find the Top 10 Companies Here)

The best Chevrolet Equinox car insurance is provided by the top firms Progressive, State Farm, and Geico, with monthly rates starting at around $55. You can secure a more affordable premium by comparison shopping and seeking out discounts. Getting cheap Chevy Equinox car insurance can be easier than you think.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

UPDATED: Aug 30, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Aug 30, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Chevrolet Equinox

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Chevrolet Equinox

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Chevrolet Equinox

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsWith monthly rates starting at about $55, Progressive, State Farm, and Geico are the top providers of the best Chevrolet Equinox car insurance.

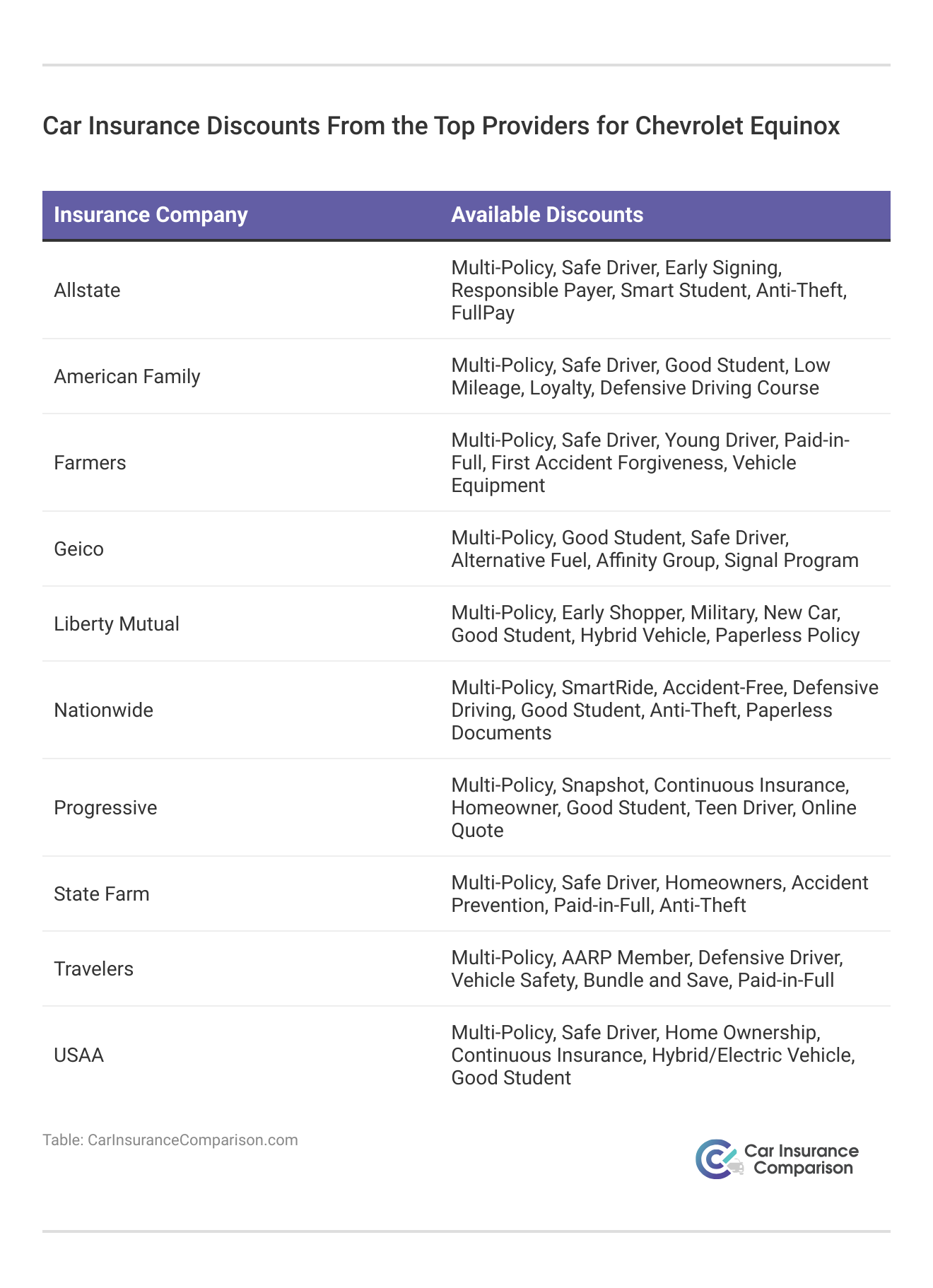

The average insurance rates for Chevrolet Equinox are $149 less per year than the average vehicle. Good drivers can save up to $565 a year on their Equinox insurance with policy discounts by being safe and courteous while out on the roads.

Our Top 10 Company Picks: Best Chevrolet Equinox Car Insurance

| Company | Rank | Good Driver Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 20% | A++ | Low Rates | Progressive | |

| #2 | 25% | B | Customer Satisfaction | State Farm | |

| #3 | 15% | A+ | Coverage Options | Geico | |

| #4 | 10% | A+ | Local Agents | Allstate | |

| #5 | 28% | A++ | Military Families | USAA | |

| #6 | 12% | A | Online Tools | Liberty Mutual |

| #7 | 18% | A | Customizable Policies | Farmers | |

| #8 | 22% | A+ | Affordable Rates | Nationwide |

| #9 | 17% | A++ | Car Replacement | Travelers | |

| #10 | 14% | A | Family Discounts | American Family |

Whether you use usage-based car insurance programs or a traditional car insurance policy, read through our comprehensive guide to better understand how your Chevrolet Equinox insurance rates are calculated.

You can start comparing the best Chevrolet Equinox car insurance quotes from some of the leading companies by entering your ZIP code above.

- Teen drivers pay the most, with rates around $417 monthly

- Insuring a Chevy Equinox costs $149 less annually than the average vehicle

- Safe drivers can save up to $565 per year with discounts

#1 – Progressive: Top Overall Pick

Pros

- Low Rates: Progressive consistently offers some of the lowest rates for the best Chevrolet Equinox car insurance, making it a great option for budget-conscious drivers. With competitive premiums, Equinox owners can benefit from affordable coverage without sacrificing quality. Their A++ A.M. Best rating ensures financial stability.

- Snapshot Program: Progressive’s Snapshot program rewards safe driving with potential discounts on the best Chevrolet Equinox car insurance. This usage-based insurance tool can lead to significant savings for Equinox owners who maintain a clean driving record. Their strong customer service further supports the value of this program. See our Progressive car insurance review for more information.

- 24/7 Customer Support: Progressive offers 24/7 customer support, ensuring that Equinox owners have access to assistance at any time. This availability is crucial for managing the best Chevrolet Equinox car insurance and resolving any issues that may arise. Their high A.M. Best rating adds confidence in their reliability.

Cons

- Complex Pricing Structure: Progressive’s pricing structure can be complex, which may make it difficult for Equinox owners to understand their premiums fully. This complexity might affect the clarity of the best Chevrolet Equinox car insurance offers they receive. While their rates are competitive, the lack of transparency could be a drawback.

- Customer Service Variability: Some customers have reported inconsistent experiences with Progressive’s customer service, which can impact the quality of the best Chevrolet Equinox car insurance. While 24/7 support is available, the variability in service quality may be a concern for Equinox owners seeking reliable assistance.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#2 – State Farm: Best for Customer Satisfaction

Pros

- High Customer Satisfaction: State Farm is known for its high customer satisfaction ratings, making it a top choice for the best Chevrolet Equinox car insurance. Their focus on customer service and support helps ensure that Equinox owners receive excellent care and assistance with their policies. Their A.M. Best rating of B also reflects their solid financial standing.

- Generous Good Driver Discount: State Farm offers a generous 25% Good Driver Discount, which helps Equinox owners save significantly on the best Chevrolet Equinox car insurance. This discount is among the highest in the industry, providing substantial savings for drivers who maintain a clean driving record. Their commitment to customer satisfaction enhances the value of this discount.

- Local Agents: With a vast network of local agents, State Farm provides personalized service that is ideal for managing the best Chevrolet Equinox car insurance. Equinox owners can benefit from face-to-face interactions and tailored advice. The availability of local support adds a personal touch to their insurance offerings.

Cons

- Higher Rates for Some Drivers: While State Farm offers excellent service, their rates can be higher for certain drivers, which may affect those seeking the best Chevrolet Equinox car insurance at the lowest cost. This could be a disadvantage for Equinox owners who are more budget-conscious. Check out our article titled “State Farm Car Insurance Review” to view the customer ratings and reviews.

- Limited Online Tools: State Farm’s online tools are not as advanced as some competitors, which may be a drawback for Equinox owners who prefer digital management of their insurance policies. This limitation might impact the convenience of managing the best Chevrolet Equinox car insurance online.

#3 – Geico: Best for Coverage Options

Pros

- Extensive Coverage Options: Geico offers a variety of coverage options, making it a strong contender for the best Chevrolet Equinox car insurance. Equinox owners can choose from comprehensive and collision coverage to meet their specific needs. Their A+ A.M. Best rating underscores their reliability and financial stability. Explore further with this Geico car insurance review.

- Affordable Rates: Known for its competitive pricing, Geico provides affordable rates for the best Chevrolet Equinox car insurance. Their 15% Good Driver Discount helps drivers save on premiums while enjoying comprehensive coverage. Geico’s emphasis on low-cost insurance options makes it appealing to budget-conscious drivers.

- User-Friendly App: Geico’s mobile app is highly rated for its ease of use, allowing Equinox owners to manage their insurance policies and file claims conveniently. This user-friendly interface enhances the experience of securing the best Chevrolet Equinox car insurance. The app’s features contribute to a seamless insurance management process.

Cons

- Limited Coverage Customization: Geico’s coverage options may be less customizable compared to some competitors, which could be a drawback for Equinox owners seeking specific coverage features. This limitation might affect the ability to tailor the best Chevrolet Equinox car insurance to individual needs.

- Mixed Claims Satisfaction: While Geico provides low rates, some customers have reported mixed experiences with claims satisfaction. This variability can impact the quality of the best Chevrolet Equinox car insurance and may be a concern for drivers prioritizing reliable claims processing.

#4 – Allstate: Best for Local Agents

Pros

- Local Agent Support: Allstate’s extensive network of local agents provides personalized service, making it a strong option for the best Chevrolet Equinox car insurance. Equinox owners can benefit from tailored advice and face-to-face interactions with knowledgeable agents. This personalized support enhances the overall insurance experience.

- Diverse Coverage Options: Allstate offers a diverse range of coverage options, including unique add-ons like accident forgiveness, ideal for Equinox owners seeking the best Chevrolet Equinox car insurance. Their flexibility in coverage options ensures that drivers can find the right policy for their needs. Allstate’s A+ A.M. Best rating further supports its reliability.

- Strong Discount Programs: Allstate offers a variety of discounts, including a 10% Good Driver Discount, helping Equinox owners save on their premiums. These discounts make it easier to find affordable coverage while maintaining high-quality insurance for the best Chevrolet Equinox car insurance. Their discount programs add value to their policies.

Cons

- Higher Premiums for Some Drivers: Allstate’s premiums can be higher for certain drivers, which may affect those seeking the best Chevrolet Equinox car insurance at the lowest possible cost. This could be a disadvantage for Equinox owners who are more price-sensitive. Balancing cost and coverage may be a concern.

- Customer Service Inconsistencies: Some customers have reported inconsistencies in Allstate’s customer service, which could impact the experience of managing the best Chevrolet Equinox car insurance. While local agents provide personalized support, overall service quality may vary, affecting customer satisfaction. Expand your knowledge through our Allstate car insurance review.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#5 – USAA: Best for Military Families

Pros

- Exclusive Discounts for Military Families: USAA offers special discounts for military families, making it an excellent choice for the best Chevrolet Equinox car insurance for those who serve. Their 28% Good Driver Discount and military-specific benefits provide substantial savings and comprehensive coverage. USAA’s A++ A.M. Best rating reflects their strong financial position.

- Exceptional Customer Service: USAA is known for its exceptional customer service, providing reliable support to military families and Equinox owners alike. This high level of service is crucial for managing the best Chevrolet Equinox car insurance and resolving any issues efficiently. USAA’s strong reputation for customer care enhances its appeal.

- Competitive Pricing: USAA offers competitive pricing for the best Chevrolet Equinox car insurance, with rates that are often lower than those of many competitors. Their focus on affordability, combined with their high-quality coverage, makes them a top choice for military families seeking cost-effective insurance. Discover more through our USAA car insurance review.

Cons

- Membership Eligibility: USAA’s insurance is only available to military members and their families, which limits its accessibility for non-military Equinox owners. This exclusivity might be a drawback for those seeking the best Chevrolet Equinox car insurance but who do not meet the membership criteria. The limited eligibility can restrict potential customers.

- Fewer Local Agents: USAA primarily operates online and over the phone, with fewer local agents available for face-to-face interactions. Equinox owners who prefer in-person service might find this aspect less convenient when managing the best Chevrolet Equinox car insurance.

#6 – Liberty Mutual: Best for Online Tools

Pros

- Advanced Online Tools: Liberty Mutual offers advanced online tools and a user-friendly app for managing your insurance policy, making it easier to handle the best Chevrolet Equinox car insurance. Their digital features streamline policy management and enhance the user experience. The A rating from A.M. Best supports their reliability in providing these tools.

- Accident Forgiveness: Liberty Mutual car insurance review offers accident forgiveness, which can prevent your premium from increasing after your first accident. This benefit is valuable for securing the best Chevrolet Equinox car insurance by protecting drivers from rate hikes following a claim. Their A rating reflects their commitment to providing quality insurance.

- Bundle Discounts: Liberty Mutual provides discounts for bundling auto and home insurance, making it easier for Equinox owners to secure the best Chevrolet Equinox car insurance while saving on multiple policies. This bundling option adds convenience and potential cost savings. Their advanced online tools help manage these bundled policies effectively.

Cons

- Higher Premiums for Some Drivers: Liberty Mutual’s premiums can be higher for certain drivers, which might impact those seeking the best Chevrolet Equinox car insurance at the lowest cost. This could be a disadvantage for budget-conscious Equinox owners. Balancing cost and coverage may be a concern.

- Mixed Customer Service Reviews: Liberty Mutual has received mixed reviews regarding its customer service, which could affect the experience of managing the best Chevrolet Equinox car insurance. While they offer advanced tools, inconsistent service quality may be a drawback for some customers.

#7 – Farmers: Best for Customizable Policies

Pros

- Customizable Policies: Farmers offers a wide range of customizable policies, allowing Equinox owners to tailor their coverage to their specific needs. This flexibility is key to finding the best Chevrolet Equinox car insurance that suits individual preferences. Their A rating from A.M. Best supports their ability to provide reliable coverage options.

- Innovative Coverage Options: Farmers provides innovative coverage options such as accident forgiveness and new car replacement, making it easier to secure the best Chevrolet Equinox car insurance. These options offer additional protection and peace of mind for Equinox owners. Their 18% Good Driver Discount enhances their value proposition.

- Flexible Payment Plans: Farmers offer flexible payment plans, allowing Equinox owners to choose a payment schedule that fits their budget. This flexibility is important for managing the best Chevrolet Equinox car insurance without financial strain. Their customizable policies and local support add value to their offerings.

Cons

- Potential for Higher Rates: Farmers’ rates can be higher for certain drivers, which might be a disadvantage for those seeking the best Chevrolet Equinox car insurance at the lowest possible cost. This could affect budget-conscious Equinox owners looking for affordable premiums. Balancing costs with coverage may be challenging. Delve deeper with this Farmers car insurance review.

- Customer Service Variability: Farmers have received mixed feedback on customer service, which could impact the experience of managing the best Chevrolet Equinox car insurance. While local agents offer personalized support, the variability in service quality may be a concern for some customers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#8 – Nationwide: Best for Affordable Rates

Pros

- Affordable Rates: Nationwide offers competitive rates for the best Chevrolet Equinox car insurance, helping Equinox owners save on premiums while maintaining comprehensive coverage. Their A+ A.M. Best rating reflects their financial stability and ability to provide affordable insurance. Visit our article on “Nationwide Car Insurance Discounts” for additional information.

- Comprehensive Coverage Options: Nationwide provides a variety of coverage options, ensuring that Equinox owners can find the best Chevrolet Equinox car insurance to suit their needs. Their policies include comprehensive and collision coverage, offering robust protection. Nationwide’s strong financial rating supports its comprehensive offerings.

- Good Customer Service: Nationwide is known for its good customer service, making it easier for Equinox owners to manage their insurance policies and get assistance when needed. This positive customer service experience is important for securing the best Chevrolet Equinox car insurance. Their A+ A.M. Best rating further underscores their reliability.

Cons

- Limited Online Tools: Nationwide’s online tools may not be as advanced as some competitors, which could be a drawback for Equinox owners who prefer digital management of their insurance policies. This limitation might affect the convenience of securing the best Chevrolet Equinox car insurance online.

- Inconsistent Claims Processing: Some customers have reported inconsistent experiences with Nationwide’s claims processing, which could impact the overall quality of the best Chevrolet Equinox car insurance. Reliable claims handling is crucial for maintaining customer satisfaction and trust.

#9 – Travelers: Best for Car Replacement

Pros

- Car Replacement Coverage: Travelers offers car replacement coverage, which ensures that Equinox owners can get a replacement vehicle if theirs is totaled. This benefit is valuable for securing the best Chevrolet Equinox car insurance by providing additional protection. Their A++ A.M. Best rating reflects their strong financial stability.

- 24/7 Customer Service: Travelers offers 24/7 customer service, ensuring that Equinox owners have access to assistance at any time. This round-the-clock support is crucial for managing the best Chevrolet Equinox car insurance and addressing any issues that may arise. Their A++ A.M. Best rating underscores their reliability.

- Discount Programs: Travelers offers various discount programs, including a discount for bundling multiple policies, which can help Equinox owners save on the best Chevrolet Equinox car insurance. These discounts add value and affordability to their coverage options. Their strong customer service further supports their insurance offerings.

Cons

- Higher Rates for Some Drivers: Travelers’ rates can be higher for certain drivers, which might be a drawback for those seeking the best Chevrolet Equinox car insurance at a lower cost. This could impact budget-conscious Equinox owners. Balancing cost and coverage may be a concern.

- Customer Service Inconsistencies: Some customers have reported inconsistencies in Travelers’ customer service, which could affect the experience of managing the best Chevrolet Equinox car insurance. Reliable service is essential for maintaining customer satisfaction and effective claims handling. Read our Travelers car insurance review to find out more.

#10 – American Family: Best for Family Discounts

Pros

- Family Discounts: American Family offers family discounts, which can be beneficial for households with multiple drivers. These discounts help lower the cost of the best Chevrolet Equinox car insurance for families. Their A rating from A.M. Best reflects their strong financial stability and ability to provide valuable discounts.

- High Customer Satisfaction: American Family is known for its high customer satisfaction ratings, providing reliable support and service to Equinox owners. This positive feedback is important for managing the best Chevrolet Equinox car insurance and ensuring a good customer experience. Their strong financial rating further supports their reputation.

- Customizable Policies: American Family offers customizable policies that allow Equinox owners to tailor their coverage to their specific needs. This flexibility is key to finding the best Chevrolet Equinox car insurance that matches individual preferences. Their family discounts and high customer satisfaction enhance their appeal. Gain further insight with our American Family car insurance review.

Cons

- Higher Premiums for Some Drivers: American Family’s premiums can be higher for certain drivers, which might be a disadvantage for those seeking the best Chevrolet Equinox car insurance at the lowest possible cost. This could affect budget-conscious Equinox owners. Balancing cost and coverage may be challenging.

- Limited Availability of Online Tools: American Family’s online tools may not be as advanced as those of some competitors, which could be a drawback for Equinox owners who prefer digital management of their insurance policies. This limitation might impact the convenience of securing the best Chevrolet Equinox car insurance online.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

The Cost of Chevrolet Equinox Insurance

How much does a Chevrolet Equinox cost to insure? The average Chevrolet Equinox car insurance costs are $1,370 a year or $114 a month.

Chevrolet Equinox Car Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $70 | $205 |

| American Family | $59 | $109 |

| Farmers | $67 | $201 |

| Geico | $65 | $153 |

| Liberty Mutual | $68 | $152 |

| Nationwide | $64 | $128 |

| Progressive | $60 | $130 |

| State Farm | $55 | $110 |

| Travelers | $63 | $156 |

| USAA | $60 | $130 |

However, many factors impact your Chevrolet Equinox cost for insurance. Companies will consider the age of your model as well as what trim level you chose.

Take a look at the table below to see how much insurance rates are for the Chevrolet Equinox based on different driver demographics and coverage type.

Chevrolet Equinox Car Insurance Monthly Rates by Coverage Type

| Type | Rates |

|---|---|

| Discount Rate | $67 |

| High Deductibles | $98 |

| Average Rate | $114 |

| Low Deductibles | $144 |

| High Risk Driver | $243 |

| Teen Driver | $417 |

As you can see, your rates will vary depending on your deductible levels, and how low or high risk of a driver you are.

Driver Age and Chevrolet Equinox Car Insurance Rates

Driver age can have a significant impact on Chevrolet Equinox car insurance rates. For example, 30-year-old drivers pay $60 more for Chevrolet Equinox car insurance than 40-year-old drivers.

Which age group has the least affordable car insurance and why? Teenage drivers receive the highest average car insurance rates for the Equinox because of their lack of driving experience. Younger drivers are also statistically responsible for causing more accidents.

If you’re a young driver in need of car insurance, consider seeking out good student discounts and safe driver discounts to help lower your average rates. Start comparing the most accurate car insurance rates by entering your ZIP code below.

Driving Record and Chevrolet Equinox Car Insurance Rates

Your driving record can have an impact on the cost of your Chevrolet Equinox car insurance.

Teens and drivers in their 20s see the highest jump in their Chevrolet Equinox car insurance with violations on their driving record. If you can maintain a perfect driving record, you will be eligible for safe driver discounts.

What is a safe driver discount? It is a way insurance companies reward clients who prove they are safe drivers by not filing insurance claims or committing any driving infractions.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Collision Coverage for the Chevrolet Equinox

Collision insurance is going to cover the costs associated with repairing or even replacing your vehicle if it gets damaged after colliding with another car or object. This also includes hitting a tree, colliding with a telephone pole, or driving over a patch of black ice.

The general rule of thumb is that the more you pay for your vehicle, the more expensive your collision coverage will be. Therefore, the MSRP of the Chevrolet Equinox does have an impact on your car insurance rates, especially if you’re investing in a fuller coverage policy.

In most states, you don’t have to get collision coverage to legally drive on the roads. But if you just bought a brand-new Chevrolet Equinox and wish to protect that investment, it’s best to err on the side of caution by getting this coverage.

The next table will show you the average monthly costs for collision insurance for this vehicle based on the model year.

Chevrolet Equinox Collision Car Insurance Rates by Model Year

| Model Year | Monthly Rates |

|---|---|

| 2024 Chevrolet Equinox | $46 |

| 2023 Chevrolet Equinox | $45 |

| 2022 Chevrolet Equinox | $44 |

| 2021 Chevrolet Equinox | $43 |

| 2020 Chevrolet Equinox | $42 |

| 2019 Chevrolet Equinox | $41 |

| 2018 Chevrolet Equinox | $42 |

| 2017 Chevrolet Equinox | $41 |

| 2016 Chevrolet Equinox | $40 |

| 2015 Chevrolet Equinox | $38 |

| 2014 Chevrolet Equinox | $35 |

These rates are taken from the average monthly cost for collision insurance across each trim level of the Chevrolet Equinox. For example, the $46 figure from the 2024 model year takes into account what that policy costs for the base L model, LS, LT, and the Premier top-tier model.

It’s likely that your collision coverage will be cheaper than the averages displayed in the table above if you have a base-level Equinox.

Read more: Compare Mazda vs. Chevy Midsize SUV Safety Rating

Find the best Chevrolet Equinox car insurance by entering your five-digit ZIP code into our FREE quote box below and start comparing the most accurate car insurance rates.

Comprehensive Coverage for the Chevrolet Equinox

What does it mean to have comprehensive car insurance? Comprehensive coverage protects your vehicle from damage that is outside of your control.

For example, if your Chevrolet Equinox was parked on the street and a large tree branch fell on it during a storm, this type of insurance would help you pay for the cost of repairs.

Schimri Yoyo Licensed Agent & Financial Advisor

The following table will show you the average rates for comprehensive coverage on the Chevrolet Equinox for model years running between 2019 and 2023.

Chevrolet Equinox Comprehensive Car Insurance Rates by Model Year

| Model Year | Monthly Rates |

|---|---|

| 2023 Chevrolet Equinox | $28 |

| 2022 Chevrolet Equinox | $26 |

| 2021 Chevrolet Equinox | $25 |

| 2020 Chevrolet Equinox | $24 |

| 2019 Chevrolet Equinox | $22 |

You might have noticed that there was a gradual progression in costs from the most recent model year to the oldest model year. This is due to the general rule that the more expensive the vehicle is, the more it costs to insure.

Get the best Chevrolet Equinox car insurance rates by entering your ZIP code below and compare accurate quotes instantly.

Frequently Asked Questions

Is the Chevrolet Equinox expensive to insure?

Compared to similar vehicles, the Chevy Equinox is reasonably priced to insure. Only the Toyota RAV4 has lower insurance costs.

What safety features does the Chevrolet Equinox have?

The Equinox comes with features like StabiliTrak stability control, ABS brake assist, multiple airbags, and a steel safety cage. These features contribute to its good safety ratings. Enter your ZIP code below to find the best Chevy Equinox insurance rates.

How much does it cost to insure a Chevy Equinox?

The average cost of Chevrolet Equinox insurance is $114 per month or $1,370 annually. Factors like the model’s age, trim level, and location affect the rates.

What impacts the cost of Chevrolet Equinox insurance?

The model’s age, your driving record, location, and safety features affect insurance rates. Newer models and younger drivers tend to have higher premiums.

How can I save on Chevrolet Equinox insurance?

You can lower your insurance costs by comparing quotes, maintaining a clean driving record, choosing a higher deductible, and utilizing available discounts like safe driver and bundled policies. Enter your ZIP code below to find the best Chevy Equinox insurance rates.

What is a significant benefit of choosing Progressive for Chevrolet Equinox insurance?

Progressive is known for offering low rates and a substantial Safe Driver Discount of 20%. Their A++ A.M. Best rating highlights their strong financial stability and reliability.

How much does the average Chevrolet Equinox insurance cost per year?

The average cost of Chevrolet Equinox insurance is $1,370 annually or $114 per month. This cost can vary based on factors such as the vehicle’s model year and the driver’s profile.

Which insurance provider offers the highest Good Driver Discount for the Chevrolet Equinox?

USAA offers the highest Good Driver Discount at 28%. This discount is particularly beneficial for military families and veterans seeking affordable insurance. Enter your ZIP code below to find the best Chevy Equinox insurance rates.

What is one of the cons associated with Liberty Mutual’s Chevrolet Equinox insurance?

One con is that Liberty Mutual’s premiums can be higher for some drivers, potentially impacting those seeking lower-cost insurance. Additionally, there are mixed reviews regarding their customer service. For additional information, see our comprehensive car insurance guide.

How does Nationwide’s customer service compare to other providers for Chevrolet Equinox insurance?

Nationwide is known for its good customer service, which contributes to a positive experience for managing insurance policies. However, their online tools may not be as advanced as those of some competitors.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.