Best Colorado Springs, CO Car Insurance in 2025

The rates for car insurance in Colorado Springs, CO, are $119.83/mo. Colorado requires 25/50/15 for minimum liability coverage. Compare quotes online to save more.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

UPDATED: Oct 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- The Colorado Springs economy relies heavily on the military

- Drivers in Colorado Springs typically pay $1,438 per year for car insurance

- If you are searching for insurance coverage, compare rates from multiple companies to find the best deal

Colorado Springs is home to about half a million people in south-central Colorado drivers.

The city sits at the base of Pikes Peak — one of America’s most famous mountains — and encompasses nearly 186 square miles surrounded by prairies, mountains, woodlands, and mineral springs.

The city’s economy relies heavily on the military, with Army and Air Force installations employing over 20 percent of the people living in El Paso County. Colorado Springs is also home to the United States Olympic Committee headquarters and training center.

The residents of Colorado Springs drive for both business and pleasure, and every one of them must meet the minimum requirements for car insurance.

Compare car insurance for FREE with our zip code search at the top of this page!

How much are Colorado Springs auto insurance rates?

All vehicles garaged in Colorado Springs must be covered with adequate auto insurance coverage, as defined by both the city and the state.

Car insurance minimums for Colorado Springs are currently set at 25/50/15, which is the industry notation meaning $25,000 of bodily injury liability coverage per person, $50,000 of bodily injury liability insurance per accident, and $15,000 of property damage liability coverage per accident.

While a 25/50/15 policy meets legal obligations, it might not provide sufficient financial protection in the event of an accident. It’s recommended that you invest in higher liability limits.

Colorado Springs drivers are not required to pay for uninsured or underinsured motorist coverage or medical payments coverage, but professionals do recommend purchasing these insurance options.

Remember that liability car insurance only pays for other drivers’ damages. If you want your own damages covered after an accident or other incident involving your vehicle, add collision coverage and comprehensive coverage to your policy.

Additional coverage will raise your auto insurance premium, but it’s important to make sure you are adequately protected.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

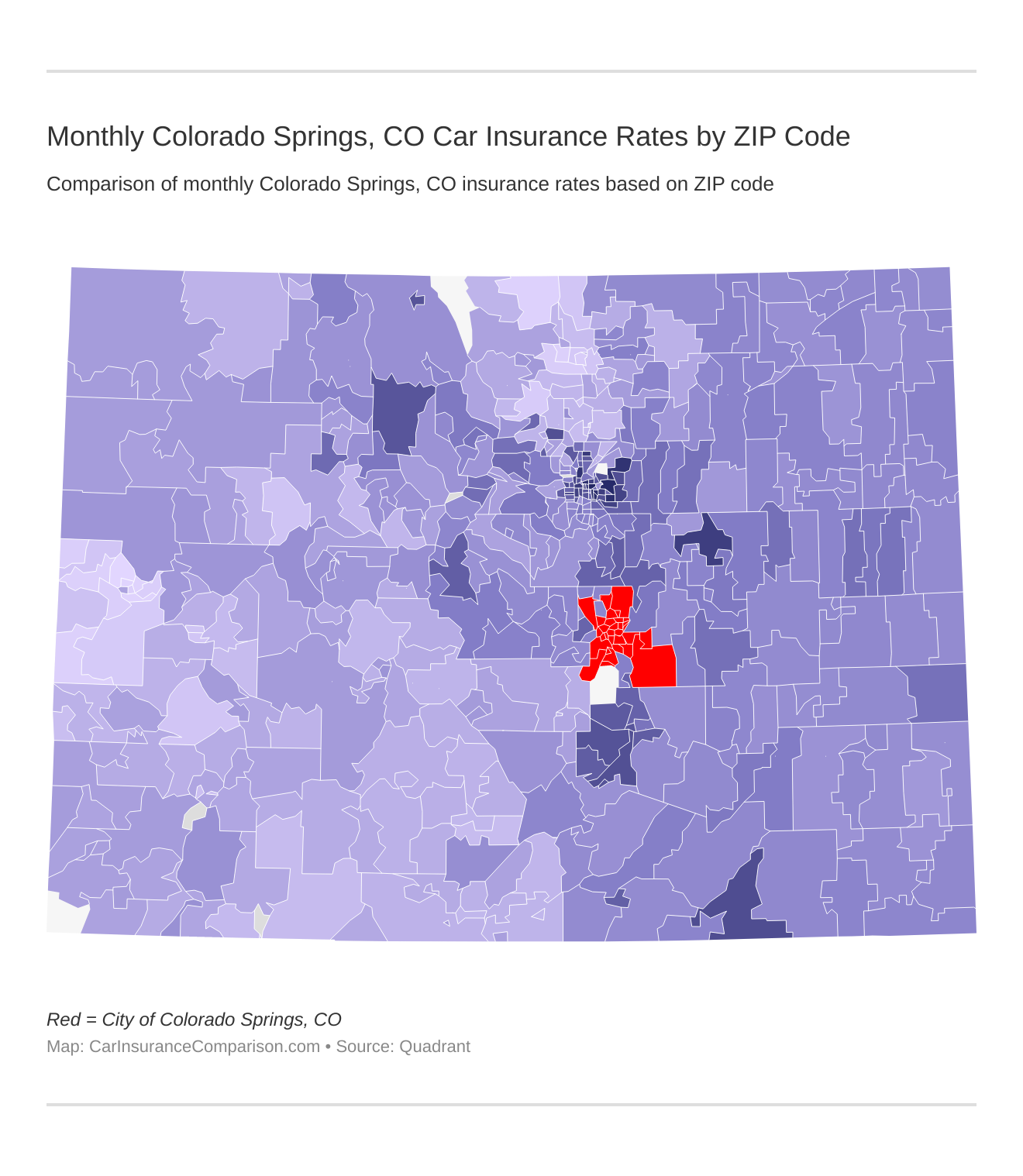

What are the monthly Colorado Springs, CO car insurance rates by ZIP Code?

ZIP codes will play a major role in your car insurance rates because factors like crime and traffic are calculated by ZIP code. Check out the monthly Colorado Springs, Colorado auto insurance rates by ZIP Code below:

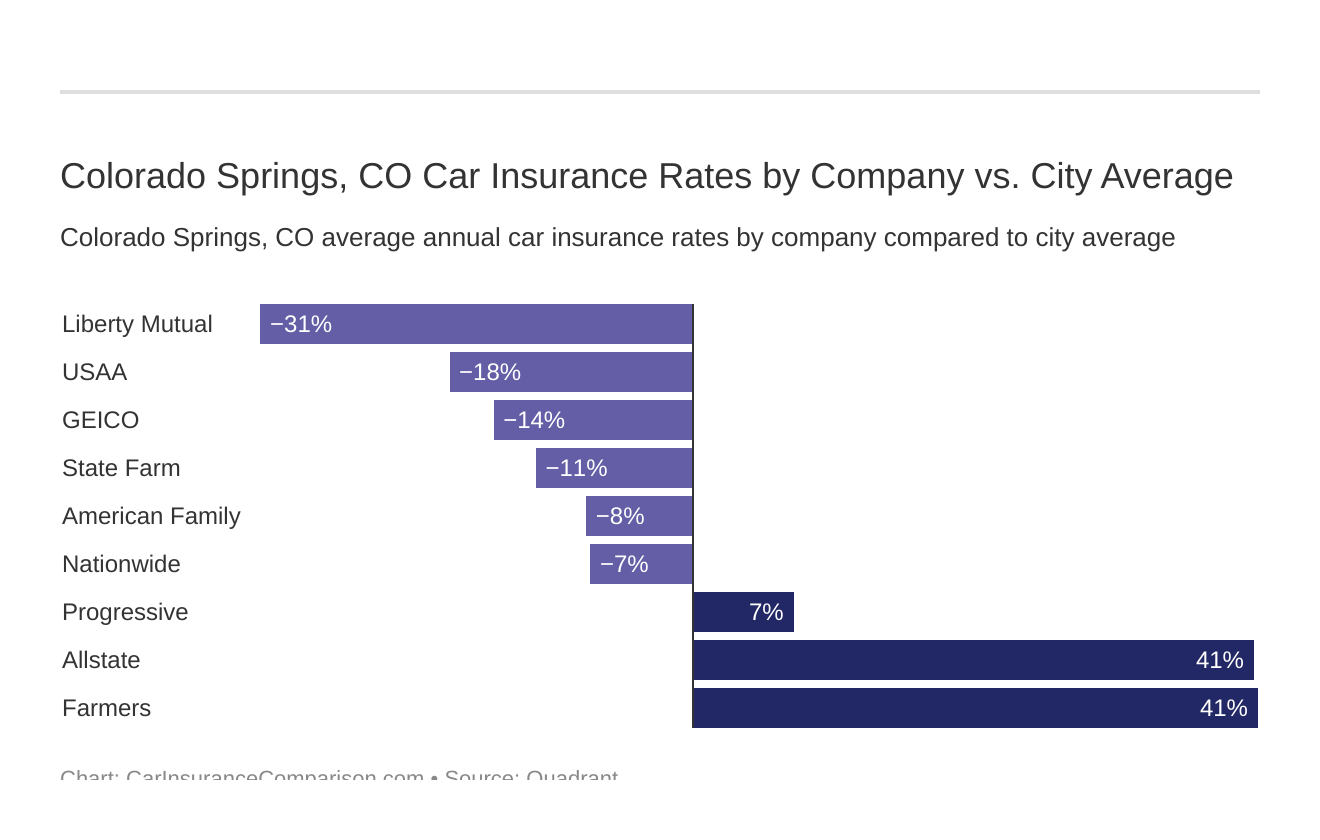

What are the cheapest car insurance companies in Colorado Springs?

Which Colorado Springs, CO car insurance company has the best rates? And how do those rates compare against the average Colorado car insurance company rates? We’ve got the answers below.

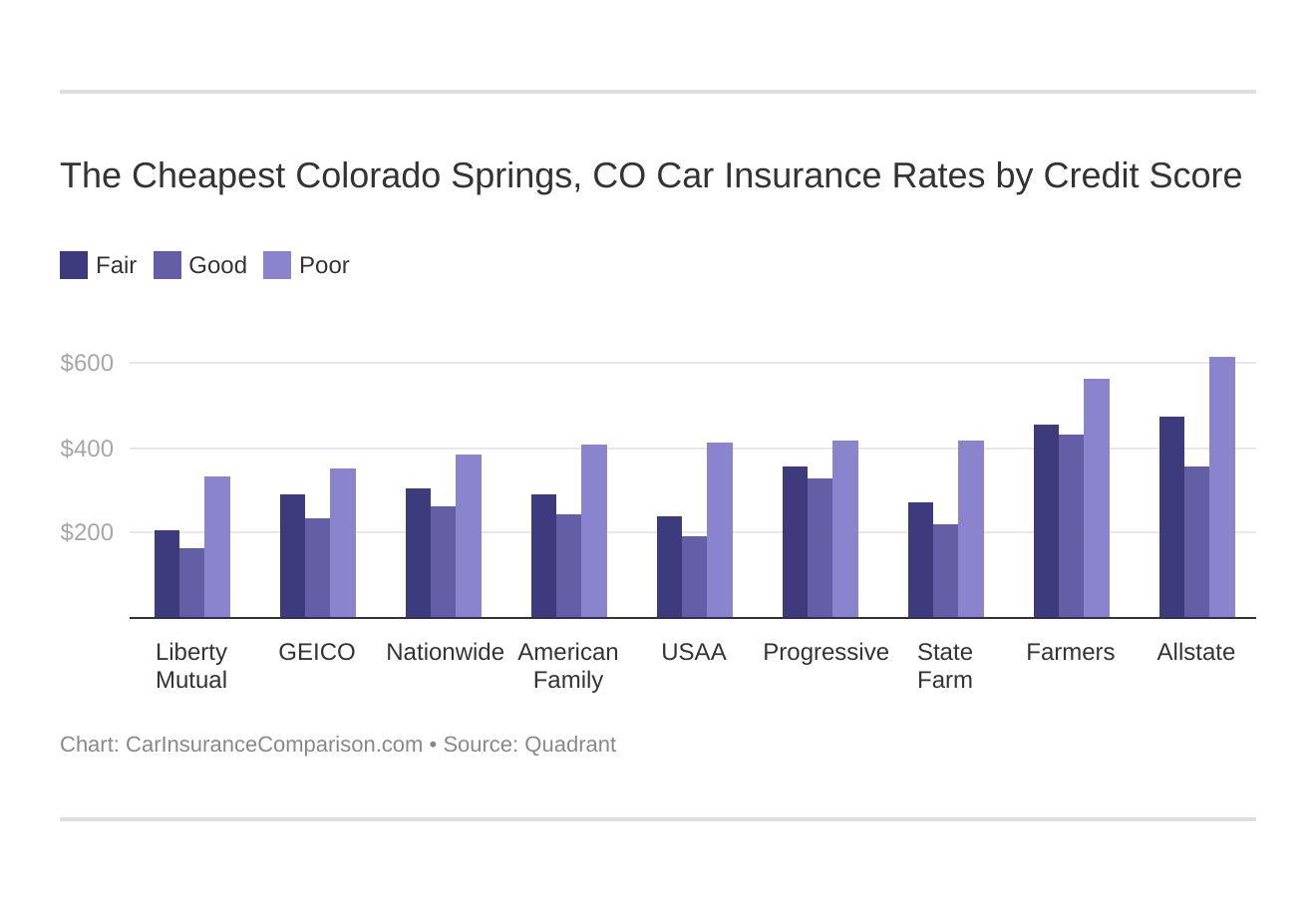

How does credit score affect car insurance rates in Colorado Springs?

Your credit score will play a significant role in your Colorado Springs car insurance rates unless you live in these states where discrimination based on credit is not allowed: California, Hawaii, and Massachusetts. With a high credit score, you could qualify for a good credit discount.

Find the cheapest Colorado Springs, CO car insurance rates by credit score below.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

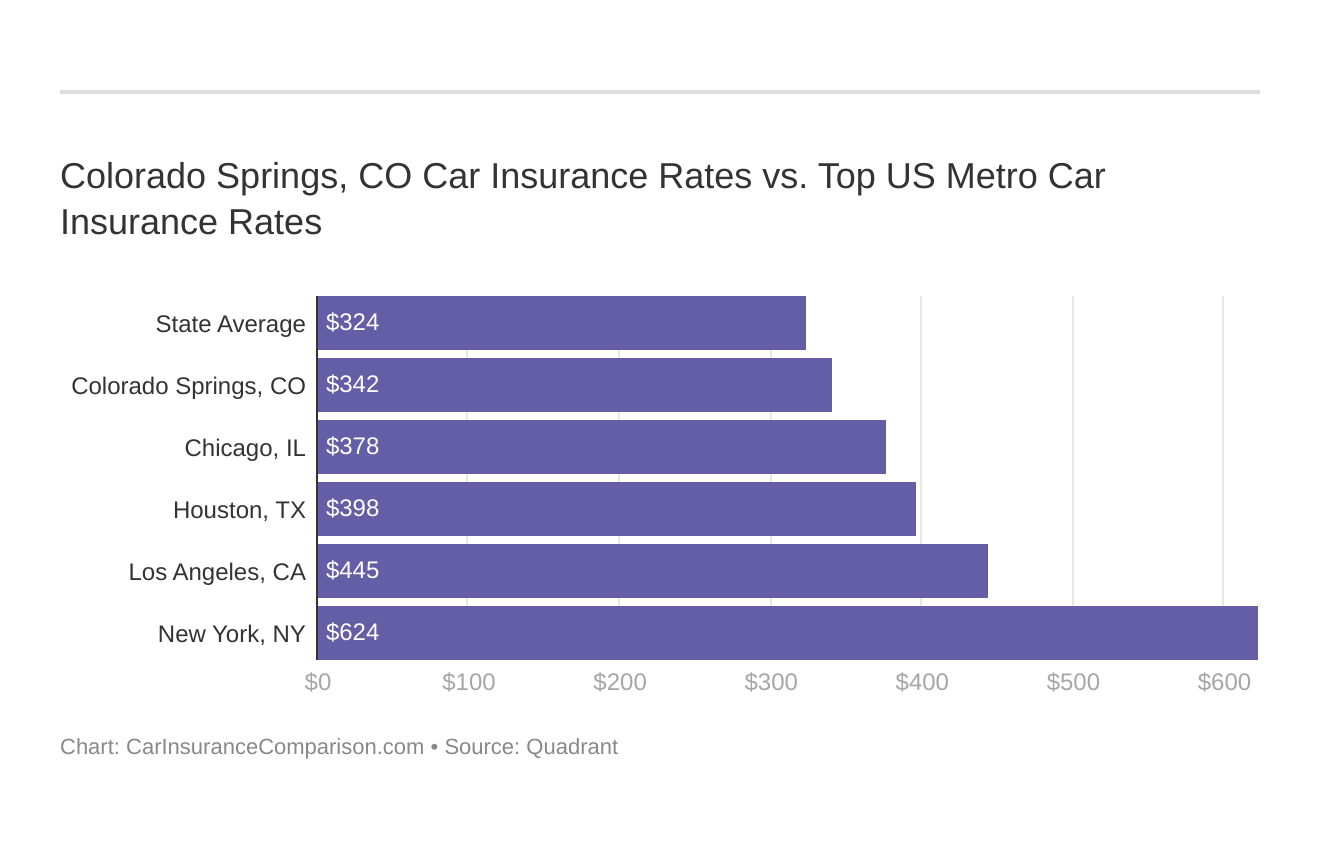

Is car insurance more expensive in Colorado Springs than in other cities?

You might find yourself asking how does my Colorado Springs, Colorado stack up against other top US metro areas’ auto insurance rates? We’ve got your answer below.

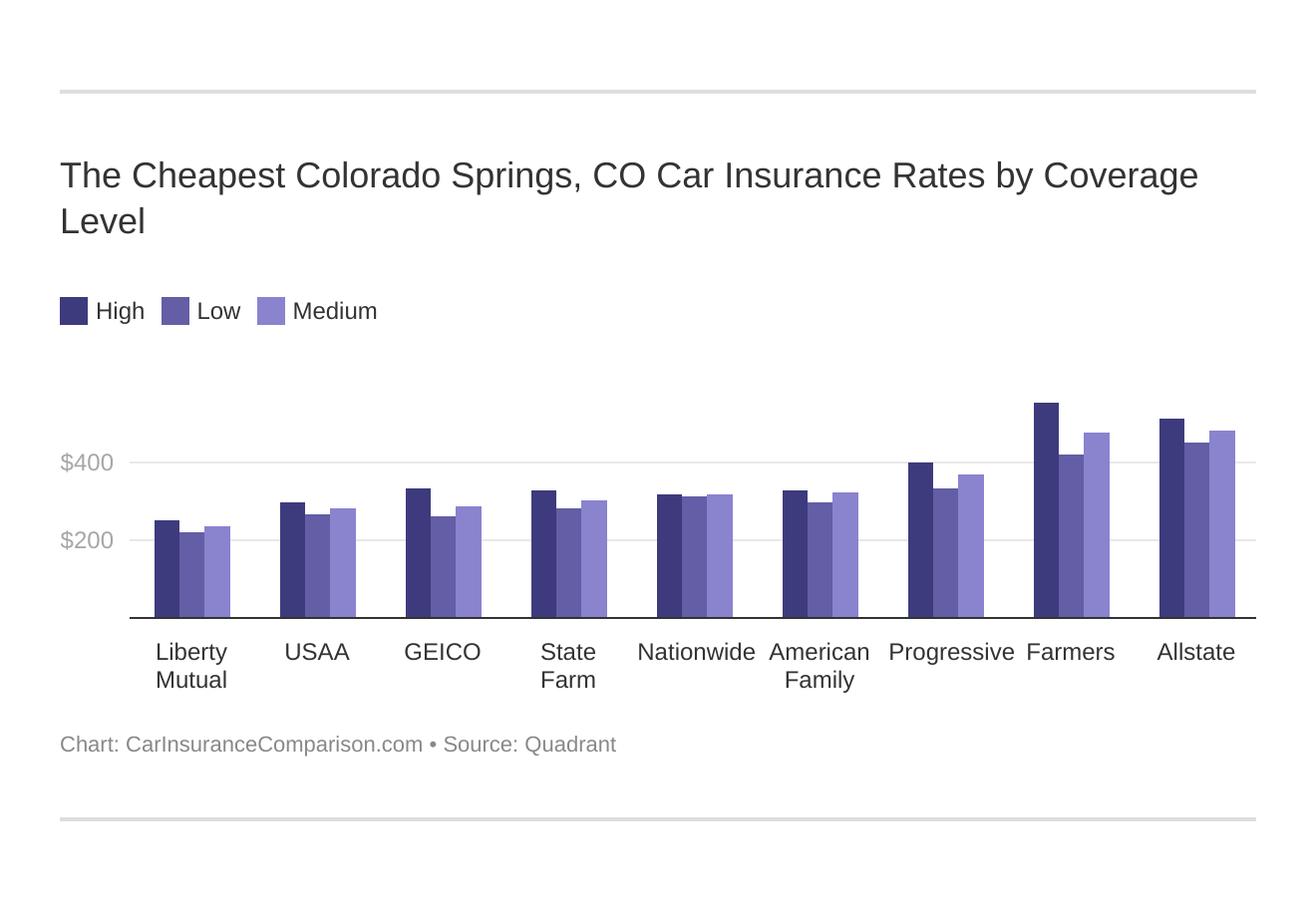

What are the cheapest Colorado Springs rates by coverage level?

Your coverage level will play a major role in your Colorado Springs car insurance rates. Find the cheapest Colorado Springs, CO car insurance rates by coverage level below:

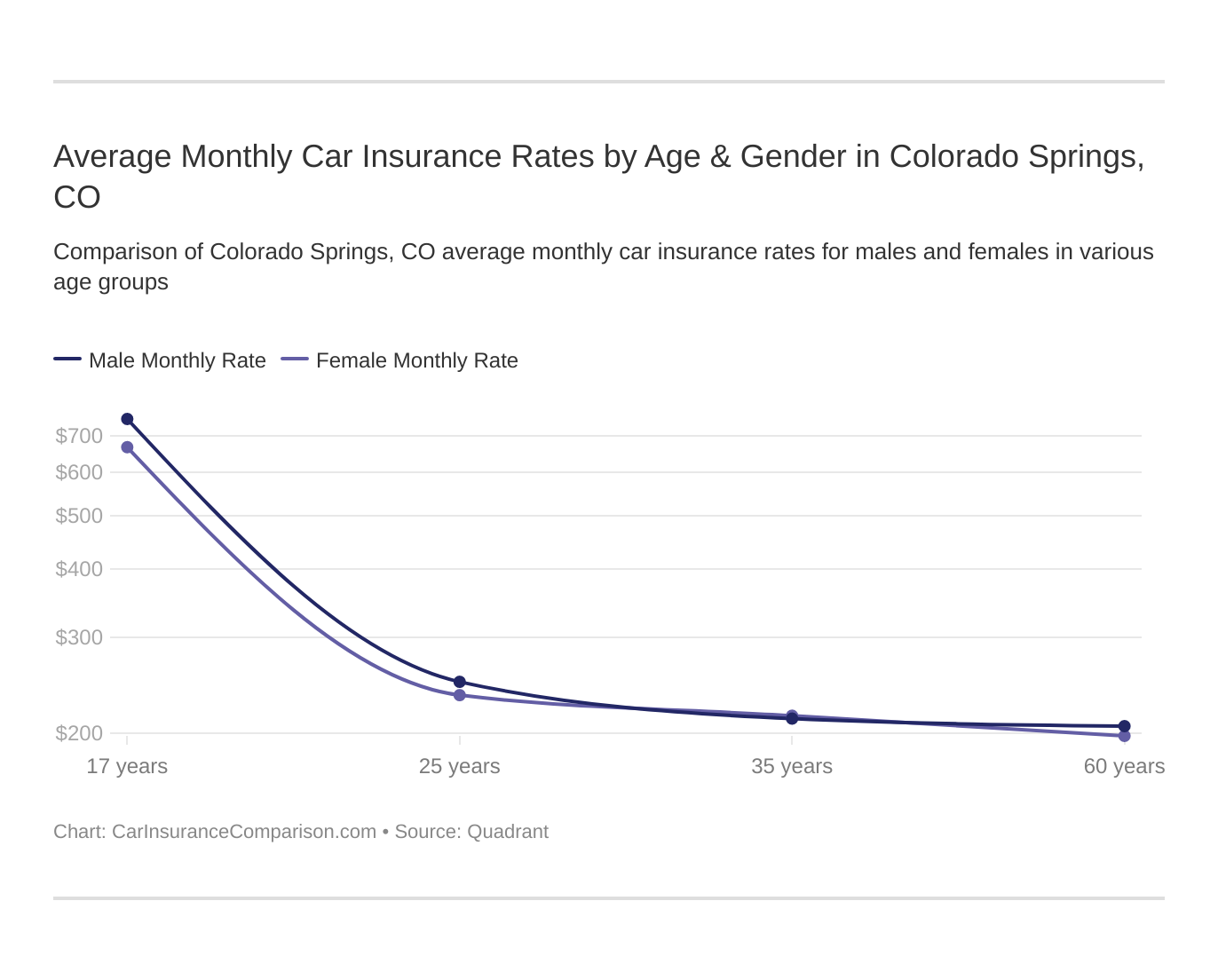

What are the average rates by age and gender in Colorado Springs?

These states are no longer using gender to calculate your car insurance rates — Hawaii, Massachusetts, Michigan, Montana, North Carolina, and Pennsylvania. But age is still a major factor because teenage drivers are often considered high-risk. High-risk usually means higher insurance rates, but you can find more affordable rights with these tips for finding car insurance for young drivers.

CO does use gender, so check out the average monthly car insurance rates by age and gender in Colorado Springs, CO.

Read more: Compare Male vs. Female Car Insurance Rates in Colorado

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

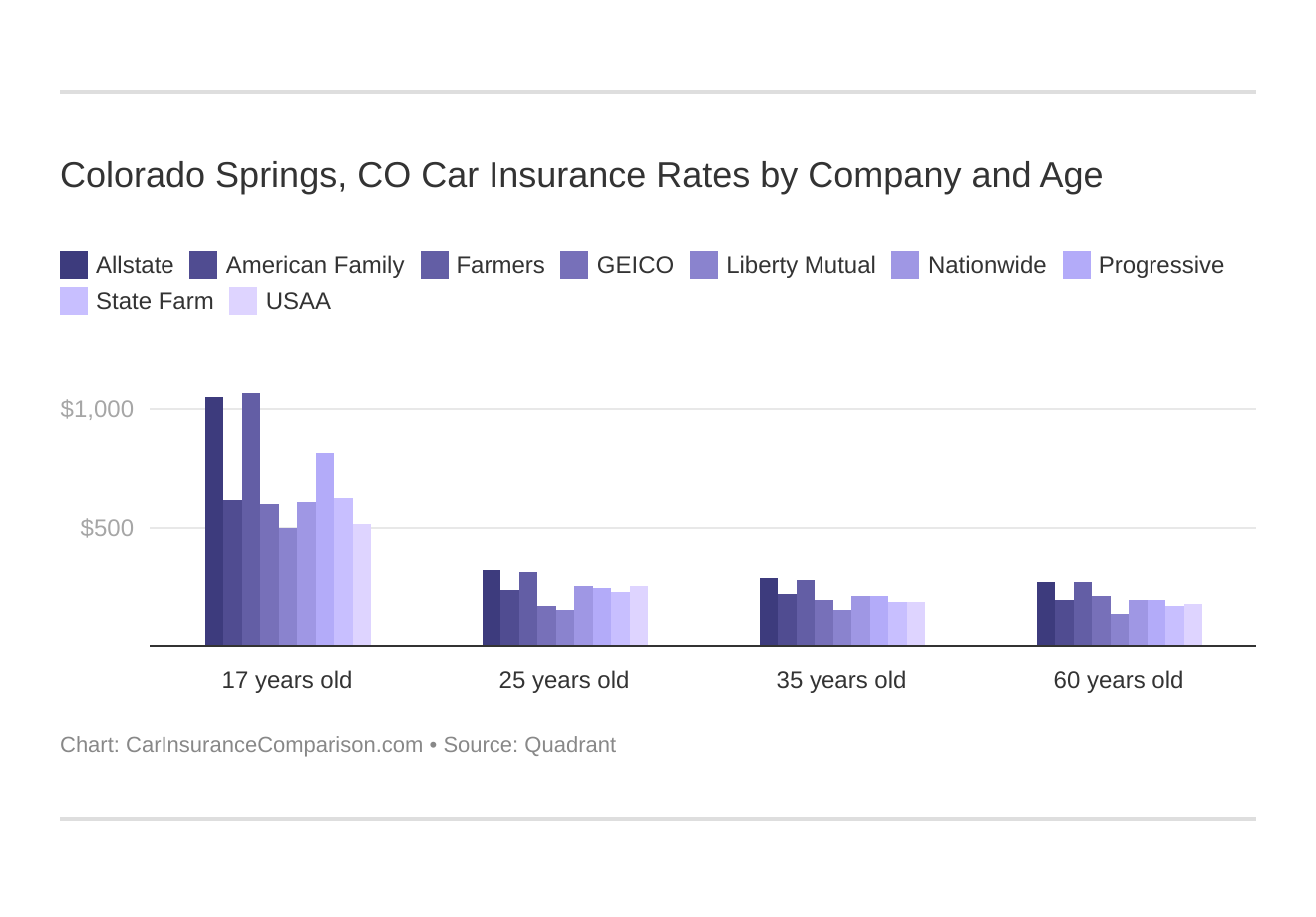

What companies have the cheapest car insurance for your age group?

Colorado Springs, CO car insurance rates by company and age is an essential comparison because the top car insurance company for one age group may not be the best company for another age group.

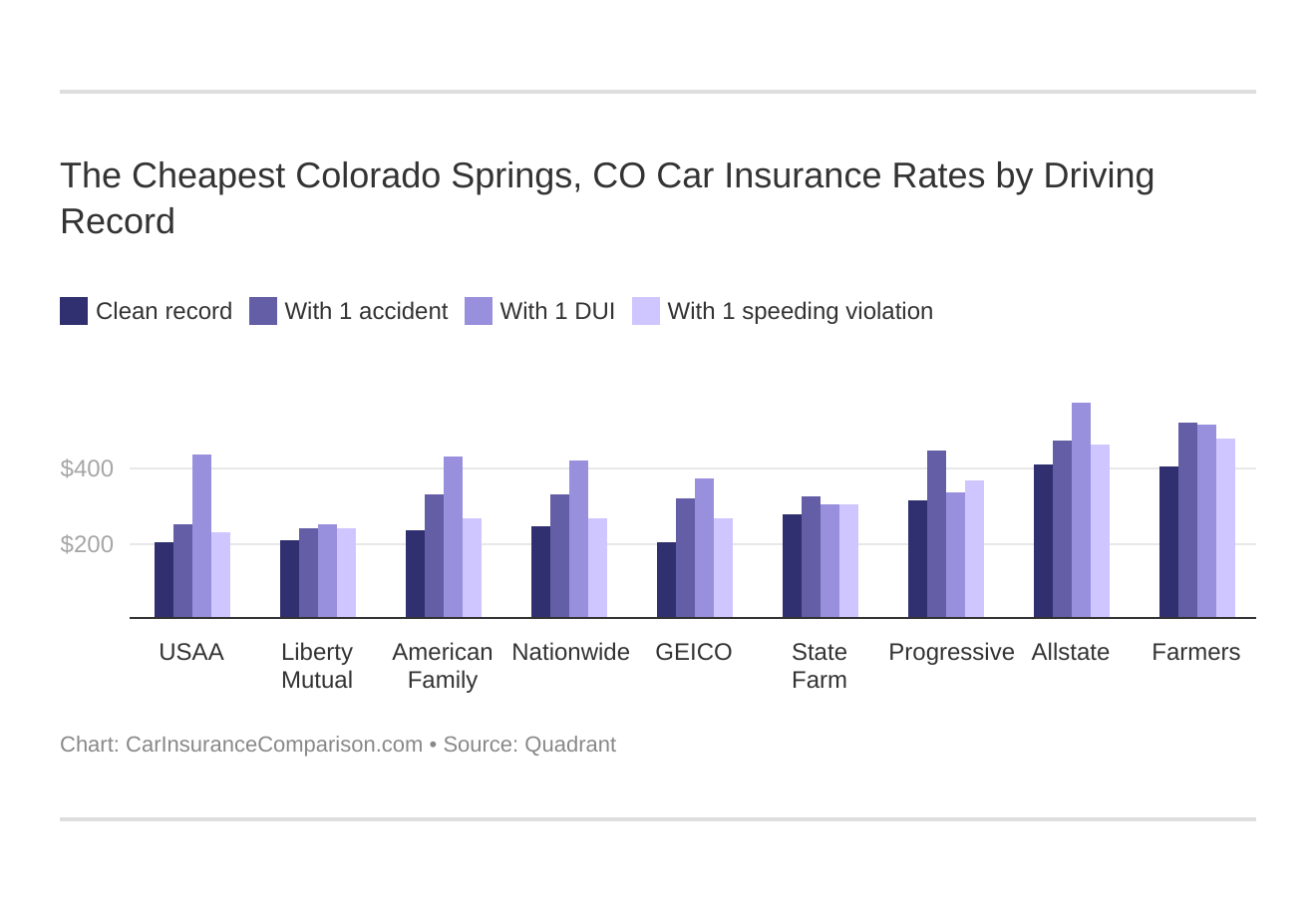

What are the cheapest rates in Colorado Springs by driving record?

Your driving record will play a major role in your Colorado Springs car insurance rates. For example, other factors aside, a Colorado Springs, CO DUI may increase your car insurance rates 40 to 50 percent, but you can get car insurance when you’ve had a DUI.

Find the cheapest Colorado Springs, CO car insurance rates by driving record.

Read more: What are the DUI insurance laws in Colorado?

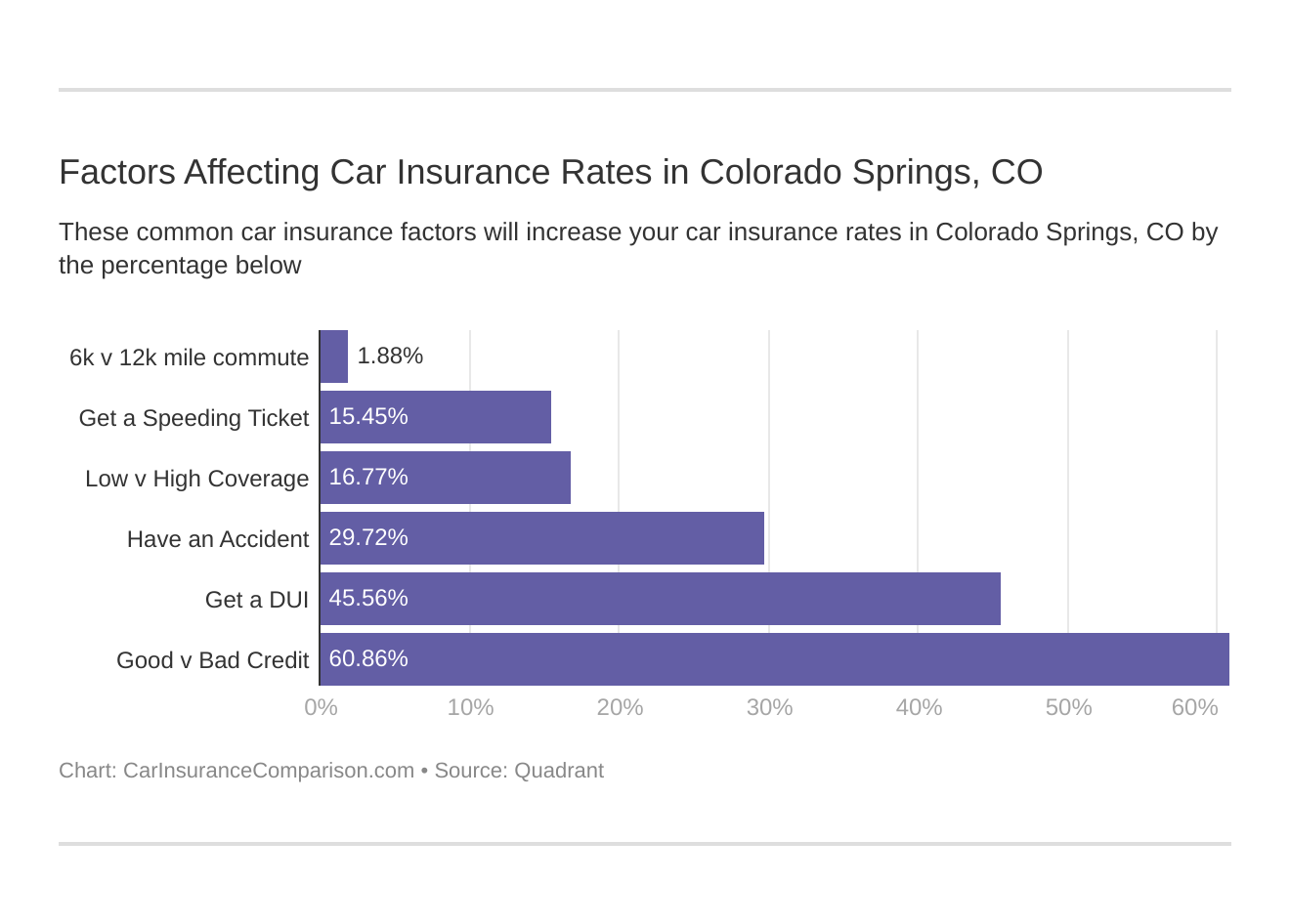

What factors affect car insurance costs in Colorado Springs?

So, what are the factors that affect car insurance rates? Factors affecting car insurance rates in Colorado Springs, CO may include your commute, coverage level, tickets, DUIs, and credit. Controlling these factors will help you maintain cheap Colorado Springs, Colorado car insurance.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

What do you need to know about the car insurance laws in Colorado Springs?

In Colorado Springs, both policyholders and car insurance companies must follow certain laws to form and maintain a binding contract. Some examples of area laws in the Springs are detailed below.

Uninsured/Underinsured Motorist Protection

What is uninsured or underinsured motorist coverage? Drivers have a right to purchase uninsured or underinsured motorist protection at the same level as their bodily injury liability limits.

This coverage can only be waived with a written rejection.

Medical Payments Coverage

Colorado insurers must offer at least $5,000 in medical payments coverage, which is automatically applied to the policy unless the policy owner opts out in writing.

Collision Coverage

Collision coverage pays to repair or replace vehicles that are hit by other vehicles or objects. In Colorado Springs, collision coverage must be offered to prospective policy owners, but it is not a state car insurance requirement and can be waived.

For more information, see collision vs. comprehensive: what’s the difference?

Rental Car and Towing Coverage

Insurance companies are not required to offer rental car reimbursement or towing/labor coverage. And some only offer coverages like rental car reimbursement. If these options are offered, buyers are not required to accept them.

Use of Gender in the Application Process

Colorado Springs and the State of Colorado permit gender to be used as a basis for determining auto insurance rates. Since males statistically have more accidents in females, male drivers typically pay higher premiums than female drivers.

Discounts for Seniors in Colorado Springs

Colorado Springs drivers aged 55 and over are eligible for a three-year rate reduction under state law. See senior citizen car insurance discounts.

The drivers must pass a driving course approved by the Department of Motor Vehicles and Public Safety. The discount stays in effect as long as the insured individual maintains a clean driving record.

Cancellation

Insurance companies can cancel policies under one of the following conditions only:

- The required premiums have not been paid by the due date (Colorado law does not offer any grace period)

- One or more drivers listed on the policy have had their licenses suspended or revoked

- The insured knowingly falsifies a claim

- The insured knowingly falsifies information presented on the application for insurance

Car Insurance Companies Serving Colorado Springs

Colorado Springs and the surrounding suburbs are home to a number of options. Major carriers include Allstate car insurance, State Farm car insurance, American Family car insurance, Safeco, Travelers, Northwestern Mutual, Geico car insurance, and Farmers Union Insurance.

Due to the wide range of insurance offerings, many shoppers choose to narrow the competition to a manageable level. The most popular option for distinguishing one insurance company from another is to obtain comparison car insurance quotes for a number of companies.

Even consumers who buy their car insurance policies online can ask for the advice of a local agent.

The city of Colorado Springs hosts a number of regional and national insurance agencies. Some agencies exclusively sell the products of a particular insurance company, while others act as brokers for multiple insurers.

The agent may choose to focus on car insurance only or integrate auto, home, farm, ranch, commercial, life, and health insurance into one protection package.

Popular Colorado Springs car insurance agencies include the Insurance Centers of America, Lohman Insurance Agency, GD Mitchell Insurance, and George Insurance Agency. If they have elected to participate in the program, these agencies may provide free car insurance quotes to interested customers.

What is the average cost of car insurance in Colorado Springs?

The Colorado Springs and El Paso County car insurance rates are only slightly higher than national averages.

Drivers in Colorado Springs typically pay $1,438 per year versus the $1,080 annual rate for average Colorado rates for car insurance.

According to the Rocky Mountain Insurance Information Association, the cost to insure a vehicle in Colorado Springs had dropped approximately 30 percent between 2003 and 2007.

Drivers in Colorado Springs typically pay less than their counterparts in Denver or Pueblo but more than people living in Fort Collins or Grand Junction.

The Colorado Department of Regulatory Agencies reports the following statistics to educate consumers about car insurance rates:

- Drivers under age 25 pay more for auto insurance than older drivers.

- Men typically pay higher premiums than women.

- Married couples tend to have fewer claims, and therefore lower premiums, than single drivers.

- Drivers who have long commutes and use their vehicles frequently pay higher rates than low-mileage drivers.

- Auto policy pricing increases for drivers who have had traffic violations and at-fault accidents within the previous five years.

- People who drive an automobile with frequent claims statistics or expensive claim repairs are charged higher rates. The claims numbers can relate to the individual driver or to the vehicle make and model as a whole.

If you have a poor credit score or you don’t have a clean record, make sure to ask about insurance discounts when you’re shopping around for quotes. Auto insurance companies offer savings opportunities like the safe driving discount, good student discount, and defensive driving discount, as well as a lot more.

Many insurance providers also offer a multi-policy discount if you bundle your auto insurance policy with homeowners insurance or renters insurance.

What do you need to know about driving in Colorado Springs?

Colorado Springs is home to some of the busiest roadways in the state, including Interstate 25, which is used for local residential and commercial traffic, north-south travel within Colorado, and interstate travel from Wyoming to New Mexico.

The Colorado Department of Transportation reports that congested roadways cost Colorado Springs travelers $460 per year in wasted time and fuel.

One reason for higher car insurance rates in Colorado Springs may be the increase in auto thefts.

In 2010, the city had nearly 244 vehicle thefts per 100,000 people, up from 214 in 2009. This number rests between the Pueblo’s 319 crimes per 100,000 people and Boulder’s 100 crimes per 100,000.

These statistics had been collected by the National Insurance Crime Bureau, a non-profit agency that partners with insurance companies and police departments to identify, detect, and prosecute insurance-related criminals.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

How do you find the best auto insurance quotes in Colorado Springs?

Overall, getting affordable car insurance in Colorado Springs is quick and hassle-free. It is also the law.

After learning about the different auto insurance options, the next step is to start a free car insurance quote and compare companies.

By completing a simple online form, you avoid the frustration and wasted time of calling five, 10, or 15 insurance companies one by one. Instead, you enter the data once and then each carrier has the opportunity to quote a price and earn your business.

Get started on your FREE car insurance comparison now, and you could have the auto protection you need by the end of the day.

Frequently Asked Questions

What factors affect car insurance rates in Colorado Springs, CO?

Several factors can affect car insurance rates in Colorado Springs, CO. These factors include your age, driving record, the make and model of your car, your credit history, the coverage options you choose, and the deductible amount. Additionally, factors such as the local crime rate, population density, and traffic conditions in Colorado Springs may also influence insurance rates.

What are the minimum car insurance requirements in Colorado Springs, CO?

In Colorado Springs, CO, the minimum car insurance requirements are the same as the state minimums. The state law mandates a minimum coverage of $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $15,000 for property damage per accident. It’s important to note that these are the minimum requirements, and it’s often recommended to consider higher coverage limits for better protection.

Are there any specific insurance considerations for Colorado Springs, CO?

Colorado Springs, CO experiences various weather conditions, including occasional severe weather events such as hailstorms. It may be beneficial for drivers in the area to consider comprehensive coverage, which can help protect against damage caused by hail or other weather-related incidents. Additionally, the proximity to the mountains and potential for driving in winter conditions may warrant considering collision coverage as well.

How can I find affordable car insurance in Colorado Springs, CO?

To find affordable car insurance in Colorado Springs, CO, it’s important to shop around and compare quotes from different insurance providers. Consider factors such as coverage options, deductibles, and discounts offered. Maintaining a good driving record, bundling your car insurance with other policies, and taking advantage of available discounts, such as safe driver or multi-vehicle discounts, can also help lower your insurance premiums.

Are there any specific discounts available for car insurance in Colorado Springs, CO?

Insurance providers in Colorado Springs, CO may offer various discounts for car insurance. Common discounts include safe driver discounts, multi-policy discounts, good student discounts, and discounts for vehicles equipped with safety features such as anti-lock brakes or airbags. It’s advisable to check with insurance providers to see which discounts may apply to you.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.