Kemper Car Insurance Review for 2025 [Rates, Discounts, & Options]

This Kemper car insurance review covers its competitive rates for high-risk drivers, including those with DUIs or accidents. While Kemper insurance rates are affordable at $44/month, customer complaints about slow claims processing and difficulty reaching representatives may be a concern.

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

UPDATED: Nov 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Kemper

Average Monthly Rate For Good Drivers

$44A.M. Best Rating:

A++Complaint Level:

MedPros

- Offers SR-22 insurance for high-risk drivers

- Add-on auto coverage options

- Student discounts for good grades

Cons

- Higher rates for safe drivers

- Mixed customer satisfaction

This Kemper car insurance review highlights the key benefits of Kemper Auto, such as competitive rates for those with DUIs or accidents on their record and SR-22 insurance filing.

Kemper can be a good fit for young drivers and those with a troubled driving history who need high-risk car insurance.

However, Kemper’s customer service receives mixed reviews, with complaints about slow claims processing.

Kemper Car Insurance Rating

| Rating Criteria | |

|---|---|

| Overall Score | 3.8 |

| Business Reviews | 3.5 |

| Claim Processing | 2.5 |

| Company Reputation | 4.0 |

| Coverage Availability | 5.0 |

| Coverage Value | 3.4 |

| Customer Satisfaction | 2.8 |

| Digital Experience | 4.0 |

| Discounts Available | 4.7 |

| Insurance Cost | 3.8 |

| Plan Personalization | 4.0 |

| Policy Options | 3.8 |

| Savings Potential | 4.1 |

While Kemper can offer lower rates for high-risk drivers, those with clean driving records may find cheaper options elsewhere. Be sure to compare multiple quotes to ensure you’re getting the best deal for your situation.

- Kemper car insurance rates start at $44/mo for drivers

- Kemper Auto offers SR-22 filing for high-risk drivers

- Safe drivers with clean records may score cheaper rates elsewhere

Kemper Car Insurance: Average Monthly Rates

Price is an important factor in choosing a company, especially if the company considers you a high-risk driver. For example, teenagers will pay more than adults, so it’s important to compare teen driver car insurance rates before signing up. See below what Kemper charges for different ages.

Kemper Car Insurance Monthly Rates by Age, Gender & Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $239 | $619 |

| Age: 16 Male | $258 | $639 |

| Age: 18 Female | $194 | $456 |

| Age: 18 Male | $221 | $520 |

| Age: 25 Female | $57 | $152 |

| Age: 25 Male | $58 | $156 |

| Age: 30 Female | $53 | $141 |

| Age: 30 Male | $54 | $145 |

| Age: 45 Female | $48 | $128 |

| Age: 45 Male | $47 | $125 |

| Age: 60 Female | $44 | $114 |

| Age: 60 Male | $46 | $117 |

| Age: 65 Female | $48 | $125 |

| Age: 65 Male | $46 | $122 |

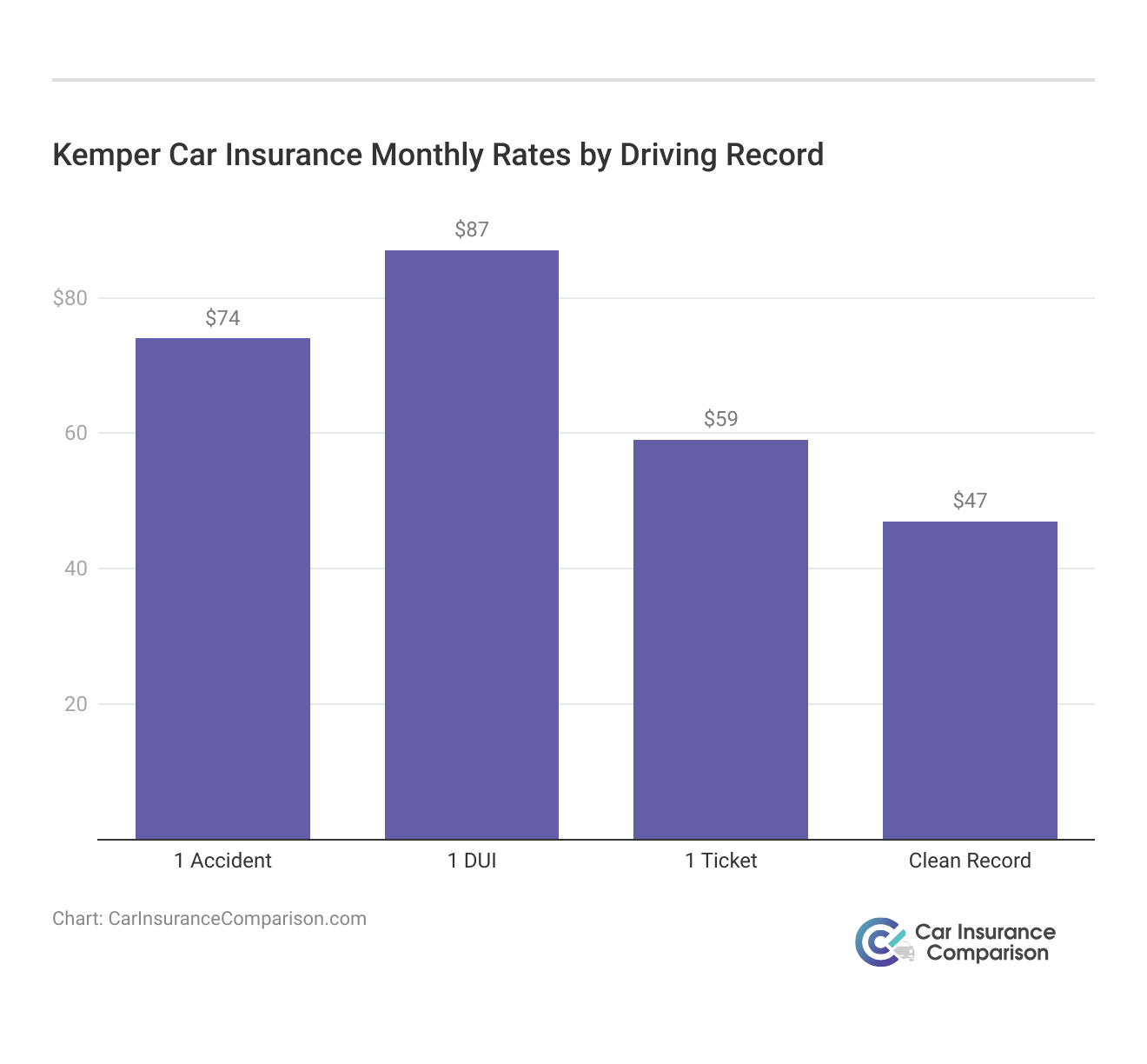

Other factors that will affect your Kemper auto insurance rates are traffic tickets, DUIs, and accidents. See what Kemper charges on average for infractions below.

The rates above are averages, but they will give you a good idea of what you can expect to pay at Kemper. You can also get a quote directly from Kemper Auto or use a quote finder tool to compare multiple companies’ rates.

Continue reading to learn about how Kemper insurance rates compare to other companies and the coverages and discounts you can get as a high-risk driver.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Kemper Corporation vs. the Competition: Car Insurance Rates

Who are Kemper competitors? Take a look below to see several other companies who compete with Kemper and if they offer cheaper rates for different driver ages.

Kemper Monthly Car Insurance Rates by Age, Gender & Provider

| Insurance Company | Age: 18 Female | Age: 18 Male | Age: 30 Female | Age: 30 Male | Age: 45 Female | Age: 45 Male | Age: 65 Female | Age: 65 Male |

|---|---|---|---|---|---|---|---|---|

| $448 | $519 | $168 | $176 | $162 | $160 | $158 | $157 | |

| $452 | $456 | $333 | $371 | $333 | $371 | $333 | $371 | |

| $298 | $312 | $125 | $128 | $114 | $111 | $111 | $109 | |

| $456 | $520 | $141 | $145 | $128 | $125 | $114 | $117 | |

| $778 | $742 | $573 | $603 | $573 | $603 | $573 | $603 |

| $305 | $414 | $116 | $137 | $115 | $117 | $113 | $114 |

| $411 | $476 | $303 | $387 | $303 | $387 | $303 | $387 | |

| $220 | $254 | $90 | $87 | $80 | $80 | $78 | $78 | |

| $298 | $312 | $220 | $254 | $220 | $254 | $220 | $254 | |

| $608 | $638 | $448 | $519 | $448 | $519 | $448 | $519 |

If you have a clean driving record and are looking for the cheapest car insurance on the market, Kemper will not be the best choice.

Before committing to a car insurance company, consider multiple facets of the company, from customer service to rates.

Kristen Gryglik Licensed Insurance Agent

Drivers with a poor driving record, however, will find Kemper’s rates more competitive. See how Kemper compares to competitors below.

Kemper Monthly Car Insurance Rates by Driving Record & Provider

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $170 | $195 | $210 | $240 | |

| $160 | $185 | $200 | $230 | |

| $140 | $165 | $180 | $210 | |

| $150 | $175 | $190 | $220 | |

| $180 | $205 | $220 | $250 |

| $155 | $180 | $195 | $225 |

| $165 | $190 | $205 | $235 | |

| $130 | $155 | $170 | $200 | |

| $145 | $170 | $185 | $215 | |

| $120 | $145 | $160 | $190 |

Kemper is one of the more affordable companies for drivers with a DUI or at-fault accident on their record. Compare cheap car insurance after a DUI to see if Kemper Auto is the best high-risk insurance company near you.

Kemper Car Insurance Coverage Options

Kemper offers drivers several coverage choices. You can opt to carry the bare minimum car insurance requirements by state on your vehicle or pay extra for a full coverage package and extras.

Kemper Car Insurance Coverage Options

| Coverage Option | Description |

|---|---|

| Accident Forgiveness | Prevents rate increases after your first at-fault accident |

| Collision Coverage | Pays for damage to your own vehicle in a collision |

| Comprehensive Coverage | Covers non-collision damages to your vehicle (e.g., theft) |

| Custom Parts & Equipment Coverage | Protects aftermarket parts and custom equipment |

| Gap Insurance | Covers gap between car's value and the loan amount |

| Liability Coverage | Covers bodily injury and property damage costs to others |

| Medical Payments (MedPay) | Helps pay medical expenses for you and your passengers |

| New Car Replacement | Replaces your new car with a new one if it’s totaled |

| Personal Injury Protection (PIP) | Covers medical expenses and lost wages |

| Rental Reimbursement | Covers the cost of a rental car during repairs |

| Roadside Assistance | Provides emergency services like towing or fuel delivery |

| Uninsured/Underinsured Motorist | Helps if you're hit by an uninsured/ underinsured driver |

Extras like roadside assistance can be added to personalize a Kemper policy, but they will increase your monthly auto insurance rate.

Kemper Car Insurance Discounts

If you are looking to lower your Kemper auto insurance rates, the best way is to apply for auto insurance discounts.

Kemper Car Insurance Discounts and Potential Savings Percentages

| Discount Name | Savings Potential | Who Qualifies? |

|---|---|---|

| Bundling | 15% | Auto and home/renters policyholders |

| Good Student | 20% | Students with a B average or higher |

| Safe Driver | 10% | Clean driving record holders |

| Low Mileage | 12% | Drivers with minimal car usage |

| Defensive Driving | 10% | Those completing approved safety courses |

| Anti-Theft Device | 5% | Owners of cars with anti-theft technology |

| Homeowner | 5% | Policyholders who own their homes |

| Paid-in-Full | 7% | Upfront premium payers |

| Electronic Payment | 5% | Automatic or electronic payment users |

| Accident-Free | 15% | Drivers with no recent accidents |

Kemper’s largest discount is its good student discount, which can save young drivers 20% on a policy if they have good grades.

Other high discounts that Kemper Insurance Company offers include its accident-free and multiple-line car insurance discounts, which can save customers 15% on Kemper Auto policies.

If you are thinking of combining home or life insurance for a discount, check out Kemper home insurance reviews or Kemper life insurance reviews to make sure these policies are also the right fit for you.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Kemper Customer Reviews

Kemper Corporation receives mixed customer reviews. While some reviewers on places like Reddit have positive things to say about the claim amount they received, other customers express frustration with the company’s customer service, citing slow claims processing and trouble contacting Kemper representatives.

As with any company, the experiences posted by customers on places like Reddit can vary widely depending on individual circumstances and location.

Customer service is essential to any successful auto insurance company. It's not just about offering competitive car insurance rates but about building trust through efficient claims handling and clear communication.

Brandon Frady Licensed Insurance Producer

Reading reviews can grant insight into a company’s customer service and claims processing and make it easier to avoid car insurance companies with the worst customer satisfaction.

Kemper Insurance Business Reviews

Customer reviews provide insight into customer service but don’t give a full picture of a company’s finances, complaint levels, and more. That’s why it’s vital to see how reputable businesses rate Kemper.

What is Kemper’s insurance rating? Kemper has an excellent financial rating and an average complaint ratio. Take a look below to see various insurance ratings from businesses.

Kemper Car Insurance Business Ratings & Consumer Reviews

| Agency | |

|---|---|

| Score: 795 / 1,000 Avg. Satisfaction |

|

| Score: A Good Business Practices |

|

| Score: 68/100 Mixed Customer Feedback |

|

| Score: 1.10 Avg. Complaints |

|

| Score: A++ Superior Financial Strength |

Kemper insurance reviews on BBB also resulted in an A rating for business practices. However, Kemper didn’t score above average in customer satisfaction with J.D. Power. Kemper insurance reviews on Consumer Reports were also mixed.

Read More: Consumer Reports Car Insurance Recommendations

Kemper Car Insurance Pros and Cons

When considering Kemper auto insurance, weigh the pros and cons to make an informed decision. Some positives that draw customers to Kemper include:

- SR-22 Insurance: Kemper insures higher-risk drivers and will file SR-22 insurance forms if needed. Compare SR-22 car insurance to learn more.

- Coverage Options: Kemper offers full coverage or bare minimum coverage to its customers.

- Discount Opportunities: kemper has a few large discounts that can significantly reduce rates, such as its good student savings.

However, Kemper has some issues that may make it a less attractive option for some drivers who are shopping for coverage.

- Customer Complaints: Customer satisfaction is inconsistent, with some customers remarking on the difficulty of reaching representatives during claims processing.

- Good Driver Rates: Kemper is less affordable than other companies for drivers with clean driving records.

Comparing pros and cons of Kemper Insurance will help you assess whether the benefits outweigh potential frustrations, particularly if timely customer support is a priority for you.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Deciding if Kemper is the Best Car Insurance Company for You

Our Kemper car insurance review found that Kemper’s competitive rates for high-risk drivers, like those with DUIs or accidents, make it one of the best car insurance companies for those needing to file an SR-22. However, customer complaints about slow claims processing and trouble getting ahold of Kemper representatives can be a significant downside.

Kemper’s average starting rate of $44/month is particularly affordable for high-risk drivers, setting it apart from many competitors. However, we recommend comparing quotes from multiple car insurance providers to ensure you find a policy that meets your needs for the best coverage at the best price. Enter your ZIP code below to get started.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

Is Kemper Insurance going out of business?

No, Kemper is not going out of business but has moved its focus to specialty auto insurance.

What is the Kemper car insurance phone number?

The Kemper auto customer service line is 800-782-1020.

Is Kemper Insurance a reputable company?

Yes, Kemper Auto is a reputable auto insurance company, so you can feel safe purchasing Kemper coverage online (Read More: Is it safe to buy car insurance online?).

Where is the Kemper insurance login?

You will see the Kemper insurance login button on the upper right side of its website.

What is the lawsuit against Kemper Insurance?

The most recent lawsuit that was resolved was about a data breach that risked customer’s personal data.

What type of insurance is Kemper?

Kemper sells auto, life, property, and casualty insurance. You can bundle some of these coverages for a discount (Learn More: Multiple Policy Car Insurance Discounts).

Who owns Kemper Insurance Companies?

Kemper auto insurance is owned by Kemper Corporation.

Is Infinity owned by Kemper?

Yes, Kemper owns Infinity car insurance.

How do I cancel my Kemper car insurance?

You can cancel your Kemper auto insurance policy by calling customer service or visiting an agent (Read More: How to Cancel Car Insurance).

What did Kemper insurance used to be called?

Kemper Insurance used to be called Unitrin.

Is Kemper leaving California?

Yes, Kemper is no longer selling home and auto policies in California. If you need to find affordable coverage in California, use our free quote finder to find insurance companies in your area.

Is Kemper a big company?

Kemper is a large company, but it is not as big as companies like State Farm (Learn More: State Farm Car Insurance Review).

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

lisal

Stay far away

deniser89

Negligent Company

Moni_R

Horrible insurance

Josh_P

Kemper auto insurance is a scam

Josh Pico

Kemper Corporation review

Karla_

Too expensive!

Moquendo_

This company is not trustworthy! Look for another insurance

sergeche

the worst insurance ever

Garrett_W

THE WORST INSURANCE COMPANY EVER - THEY WILL NOT HELP YOU

MsKendall

Worst Customer Service