Best Jeep Car Insurance Rates in 2025 (Compare The Top 10 Companies)

The best Jeep car insurance rates come from Geico, State Farm, and Progressive, with rates starting at $70 per month. These companies offer coverage options for Jeep owners, like insurance that covers off-roading. You can get the cheapest Jeep insurance quotes from these companies through generous discounts.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

UPDATED: Jul 19, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jul 19, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Jeep

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Jeep

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Jeep

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsGeico, State Farm, and Progressive offer the best Jeep car insurance rates, especially if you take your Jeep off-road.

Geico is our top pick for Jeep insurance because it offers low rates, solid discounts, and off-road coverage. You can also save on your Jeep auto insurance by taking advantage of Geico’s discounts. Geico is also one of the best usage-based insurance companies with its program DriveEasy.

Our Top 10 Company Picks: Best Jeep Car Insurance Rates

| Company | Rank | Multi-Vehicle Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | A++ | Cheap Rates | Geico | |

| #2 | 15% | B | Many Discounts | State Farm | |

| #3 | 20% | A+ | Online Convenience | Progressive | |

| #4 | 10% | A+ | Add-on Coverages | Allstate | |

| #5 | 30% | A++ | Military Savings | USAA | |

| #6 | 10% | A | Local Agents | Farmers | |

| #7 | 20% | A+ | Usage Discount | Nationwide |

| #8 | 30% | A | Customizable Polices | Liberty Mutual |

| #9 | 15% | A++ | Accident Forgiveness | Travelers | |

| #10 | 25% | A | Student Savings | American Family |

Whether you want to look at Jeep Wrangler insurance costs or quotes for a Patriot, you can explore your options below. Then, enter your ZIP code into our free quote comparison tool to find the best Jeep insurance today.

- Jeep insurance rates can be high because of repair and replacement costs

- Some companies offer special off-road coverage for Jeep owners

- Geico and State Farm have the best rates for Jeep insurance

#1 – Geico: Top Pick Overall

- Compare Jeep Car Insurance Rates

- Best Jeep Wagoneer Car Insurance in 2025 (Your Guide to the Top 10 Companies)

- Best Jeep Patriot Car Insurance in 2025 (See the Top 10 Companies Here!)

- Best Jeep Liberty Car Insurance in 2025 (Check Out the Top 10 Companies)

- Best Jeep Commander Car Insurance in 2025 (Check Out the Top 10 Companies)

- Best Jeep Compass Car Insurance in 2025 (See the Top 10 Companies Here!)

Pros

- Competitive Rates: Geico usually offers lower Jeep insurance prices than its competitors.

- Off-Road Coverage: With options for coverage on off-road use, Jeep owners can get coverage that benefits their lifestyle from Geico. Explore other coverage options in our Geico car insurance review.

- Multiple Discounts: With 16 ways to save, Geico offers almost every driver a way to save on their Jeep insurance quotes.

Cons

- Limited Local Agents: Geico’s network of agents is smaller than that of some other companies. If you’re uncomfortable with online policy management, Geico might not be the right choice for you.

- Higher Rates for High-Risk Drivers: Geico usually has affordable average Jeep insurance costs, but drivers with a DUI should look at coverage somewhere else.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#2 – State Farm: Best for Competitive Prices

Pros

- Customizable Policies: State Farm has a variety of coverage options to meet the needs of Jeep drivers looking for affordable rates.

- Safety Feature Discounts: State Farm has savings for Jeeps equipped with advanced safety features.

- Local Agents: State Farm maintains a wide network of local agents to answer questions about your policy, help you pick new coverage, and start claims.

Cons

- High Rates for Low Credit: State Farm has low rates for most drivers, but people with low credit scores can probably find lower prices at another company. Learn more about State Farm rates in our State Farm car insurance review.

- Limited Digital Options: With its focus on a more personalized insurance experience, State Farm’s digital tools can be lacking.

#3 – Progressive: Best for Robust Digital Tools

Pros

- Snapshot Program: Snapshot is Progressive’s usage-based insurance (UBI) program that tracks your driving behaviors. Safe drivers can save up to 30% by signing up for Snapshot.

- Customizable Coverage: Progressive’s flexible policies include off-road and adventure coverage, so you can hit the trails without worrying about your Jeep.

- Robust Digital Tools: Progressive offers innovative online tools for your insurance needs. For example, the Name Your Price tool makes matching coverage to your monthly budget simple.

Cons

- Snapshot Increase Rates: Snapshot is one of the few UBI programs that will increase your rates if you don’t drive safely enough. Learn more in our Progressive car insurance review.

- Unexpected Rate Hikes: A common complaint from Progressive customers is that their rates unexpectedly increased when nothing about their policy was different.

#4 – Allstate: Best for Full Coverage Service

Pros

- Full Coverage Options: Allstate offers a variety of coverage options, including off-road coverage.

- Discount Opportunities: While it doesn’t offer as many as some of its competitors, Allstate’s 12 discount options can help you save.

- Local Agent Network: Buy an Allstate policy to gain access to one of the largest networks of agents in the country. Discover what Allstate’s agents can do for your Jeep insurance needs in our Allstate car insurance review.

Cons

- Higher Rates: In general, Allstate has higher Jeep Cherokee insurance rates and quotes for other models than most of its competitors charge.

- Mixed Reviews: Allstate may be one of the biggest companies in the U.S., but not all customers are happy. Many report negative experiences with Allstate’s customer service.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#5 – USAA: Best for Military Families

Pros

- Competitive Prices: Get affordable Jeep Wrangler insurance rates and quotes for other models from USAA. See how USAA keeps rates low in our USAA car insurance review.

- Excellent Customer Service: USAA consistently receives high ratings for its claims handling and customer service.

- Comprehensive Coverage Options: Get the most out of your insurance on Jeeps with USAA’s policy options, including off-road and specialty coverage.

Cons

- Membership Restrictions: You need a USAA membership to buy auto insurance, and only military members and their direct families are eligible for coverage.

- Some Coverage Options Lacking: USAA does not sell gap insurance, so new Jeep owners might want to find a different insurance provider.

#6 – Farmers: Best Selection of Car Insurance Discounts

Pros

- Policy Customization: Get the best Jeep insurance for your needs with Farmers’ flexible policy options.

- Long List of Discounts: Farmers has one of the longest lists of discounts of any company, with an impressive 23 options. See how many you qualify for in our Farmers car insurance review.

- Local Agent Support: Farmers believes in a more traditional insurance experience. The company keeps a large network of agents to ensure its customers get the support they need.

Cons

- Fewer Digital Tools: Farmers is not known for its digital tools, particularly for its less competitive mobile app.

- Claims Handling Problems: Some customers are left feeling unsatisfied with Farmers’ claims processing times.

#7 – Nationwide: Best for Safe Driver Discounts

Pros

- Ample Coverage Options: Add a variety of coverage to your Jeep insurance quotes, including special coverage for off-road adventures.

- SmartRide Program: Nationwide has one of the best UBI savings opportunities, with safe drivers saving up to 40% with SmartRide.

- Opportunities to Save: Take advantage of Nationwide’s respectable 11 discount options, which include savings for multi-policy bundling and safety features. Make sure to explore all of Nationwide’s car insurance discounts to maximize your savings.

Cons

- Premium Increases: Nationwide offers affordable Jeep insurance, but many drivers report that the low prices don’t last.

- Limited Local Agents: Nationwide’s fewer local agents in some areas make it harder to get personalized help.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Best for Diverse Coverage Options

Pros

- Flexible Policies: Customizable coverage options from Liberty Mutual include off-road protection. See all your policy options in our Liberty Mutual car insurance review.

- Savings Opportunities: Find cheap Jeep Patriot insurance costs and low rates for other models with Liberty Mutual’s 17 discount options.

- Accident Forgiveness: One of the best add-ons Liberty Mutual offers is accident forgiveness, which prevents your rates from increasing after your first at-fault accident.

Cons

- Customer Service Problems: Customers leave mixed reviews for the quality of Liberty Mutual’s service and the response speed of its representatives.

- Limited Local Agents: Liberty Mutual doesn’t maintain a huge network of agents, but you can always call the claims hotline if you need help from a person.

#9 – Travelers: Best Customer Service Ratings

Pros

- Add-On Options: Travelers’ gives you the ability to tailor your policy to include off-road and specialty coverage for Jeeps.

- Discount Opportunities: Get the cheapest car insurance for a Jeep by taking advantage of Travelers’ 15 discount opportunities.

- Superior Customer Service: Not only can you find cheap Jeep insurance at Travelers, but you’ll likely have an excellent customer service experience anytime you need insurance support.

Cons

- Digital Tools Lacking: Travelers’ online and mobile tools are less robust compared to some competitors. See if the digital options meet your expectations in our Travelers car insurance review.

- Limited Local Agents: If agent interaction is important to you, you’ll probably find coverage better suited to you elsewhere.

#10 – American Family: Best for Fast Claims Handling

Pros

- Tailored Coverage Options: American Family insurance representatives will help you get the perfect car insurance for Jeeps with the company’s flexible coverage options.

- Generous Discounts: American Family helps drivers save on their car insurance for Jeeps with 18 discount options.

- Claims Handling: Most customers agree that American Family’s claims handling process is satisfactorily quick.

Cons

- Higher Base Premiums: Initial rates can be high before discounts apply at American Family.

- Limited Availability: American Family sells insurance in a limited number of states. See if you can purchase AmFam coverage in our American Family car insurance review.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Jeep Car Insurance Rates

The average Jeep driver pays about $137 a month for car insurance, but several factors can make your rates higher or lower. Regardless, most Jeep drivers see rates that match the national average.

Adventure’s golden hour. pic.twitter.com/mvJM82Qe9l

— Jeep (@Jeep) May 11, 2024

Because Jeep car insurance matches the national average so closely, you can get an idea of where to start your search for coverage by looking at average prices from the largest companies in the U.S. Check below to see how much you might pay based on the company you choose.

Jeep Car Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $77 | $157 |

| American Family | $91 | $172 |

| Farmers | $80 | $159 |

| Geico | $70 | $174 |

| Liberty Mutual | $76 | $168 |

| Nationwide | $72 | $153 |

| Progressive | $82 | $171 |

| State Farm | $90 | $178 |

| Travelers | $85 | $161 |

| USAA | $87 | $165 |

Companies have unique formulas to craft insurance quotes, so you should always compare your options.

Read our post on how to compare cheap car insurance policies to find out more ways to save. You probably won’t pick the most affordable company for your Jeep insurance on your first try, so looking at multiple quotes is important.

Jeep Car Insurance Rates by Model

Although Jeep car insurance usually matches the national average, some models are more expensive to insure than others. Check below to see how much some of Jeep’s most popular models cost for insurance.

Jeep Car Insurance Monthly Rates by Coverage Type & Model

| Jeep Model | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Jeep Cherokee | $36 | $65 | $48 | $169 |

| Jeep Compass | $29 | $50 | $37 | $132 |

| Jeep Gladiator | $31 | $55 | $46 | $152 |

| Jeep Grand Cherokee | $32 | $56 | $37 | $141 |

| Jeep Patriot | $26 | $45 | $43 | $128 |

| Jeep Wrangler | $30 | $40 | $44 | $135 |

The Jeep Cherokee is currently one of the most expensive models to insure, while car insurance for the Jeep Patriot or Wrangler have the lowest rates.

Keep in mind that the prices listed above are averages — you might see much different prices when you look at personalized quotes.

Jeep Car Insurance Rates by Age

As you’ll see below, your age plays an important role in determining your Jeep insurance costs. Young drivers pay more for car insurance because they file more claims than older adults.

Check out the prices below to see how your age might affect your Jeep insurance rates.

Jeep Car Insurance Monthly Rates by Age & Model

| Jeep Model | 20-Year-Old | 30-Year-Old | 40-Year-Old | 50-Year-Old | 60-Year-Old |

|---|---|---|---|---|---|

| Jeep Cherokee | $372 | $171 | $164 | $149 | $146 |

| Jeep Compass | $300 | $138 | $132 | $121 | $118 |

| Jeep Gladiator | $350 | $160 | $155 | $142 | $138 |

| Jeep Grand Cherokee | $320 | $148 | $141 | $129 | $126 |

| Jeep Patriot | $285 | $131 | $126 | $115 | $112 |

| Jeep Renegade | $310 | $140 | $135 | $123 | $120 |

| Jeep Wrangler | $285 | $131 | $126 | $114 | $112 |

Teens and young adults can pay four times as much for Jeep insurance as older drivers. The good news is that your rates will lower around age 25 if you keep your driving record clean.

Parents and guardians can also help teens get the best car insurance. You can cut a teen’s rate in half if you add them to a pre-existing family policy.

Types of Jeep Car Insurance

Jeeps hold a special place in their owners’ hearts as one of the best-known adventure brands in America. Buying the right coverage is one of the best ways to protect your Jeep.

Minimum insurance is the least amount of coverage you can buy in your state and still drive. It’s an excellent option for people with low-value, older cars and can help keep your insurance costs down.

Brandon Frady Licensed Insurance Agent

The best full coverage car insurance includes a suite of insurance types and offers much better protection. Many Jeep owners opt for full coverage, even when they own older models. Some Jeep models — especially the Wrangler — have low depreciation rates. That means your Jeep will retain its value for a long time, and full coverage protects your investment.

Consider the following types of car insurance below to understand what full coverage offers your Jeep:

- Liability: If you cause an accident, liability car insurance pays for damages and injuries to other drivers, their passengers, and bystanders. It doesn’t cover your car. Read more: Compare Liability Car Insurance: Rates, Discounts, & Requirements

- Collision: Collision car insurance covers your Jeep after you cause an accident. Collision insurance pays for your repairs if you hit another driver, a parked car, or a stationary object.

- Uninsured/Underinsured Motorist: Most states require insurance, but that doesn’t mean every driver carries enough. Uninsured/underinsured motorist insurance protects you from drivers without enough coverage.

- Comprehensive: For everything that can damage your car outside a collision, there’s comprehensive insurance. It covers damage from fire, floods, vandalism, extreme weather, animals, and theft.

- Personal Injury Protection/Medical Payments: Medical bills are more expensive than ever, but medical payments or personal injury protection insurance helps pay for them after an accident. They also cover your passengers. Learn more: What is personal injury protection (PIP) insurance?

With all the coverage listed above, it’s easy to see why many Jeep owners choose full coverage. Many drivers want to drive their Jeeps for years to come, and full coverage is one of the best ways to accomplish that.

Factors That Affect Jeep Car Insurance Rates

Although Jeeps are usually affordable vehicles to cover, certain factors might make your insurance more expensive. Below are some of the following factors that affect car insurance rates:

- Age and Gender: Men and young drivers pay more for car insurance because they get into more accidents and file more claims. The good news is that the price gap lessens with age when you compare car insurance rates by age and gender.

- Location: Depending on where you live, you might pay more for car insurance. Some states are more expensive than others due to heavy traffic, more accidents, and extreme weather risks.

- Driving History: Car insurance companies check your driving records, so expect to pay less for your insurance if you have a clean driving record. Traffic incidents can significantly increase your rates.

- Credit Score: It surprises many drivers, but insurance companies can use your credit scores to determine your rates in most states. Drivers with higher scores receive better insurance rates.

- Marital Status: Married people file fewer claims than single, divorced, or widowed people, so they usually pay less for insurance. Find out more: Why are car insurance rates higher for singles vs. married couples?

- Your Car: The car you drive is integral to your rates. Insurance companies look at your car’s age, title history, and model to determine how much you should pay for insurance.

You also need to consider how much insurance you need. Minimum insurance is your cheapest option, but it leaves your Jeep unprotected. Full coverage offers better protection but can cost double or even triple what minimum insurance costs.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

How to Save on Jeep Car Insurance

Although Jeep drivers tend to pay rates that match the national average, you don’t have to settle for the first price you see. Try the following tips to find the lowest rates possible:

- Lower Your Coverage: You should consider lowering your coverage if your Jeep is older or worth less than a few thousand dollars. Your Jeep will be less protected, but you’ll save on monthly rates.

- Raise Your Deductible: Your car insurance deductible is the amount you pay when filing a claim. You can lower your car insurance rates by increasing your deductible.

- Be a Safe Driver: You’ll pay less for car insurance with a clean driving record. Speeding tickets, reckless driving charges, or DUIs can dramatically impact your rates. Find out how much does a speeding ticket affect car insurance rates.

- Look for Discounts: You should look at how many car insurance discounts a company offers before choosing. Popular discounts include paying your policy in full and bundling policies for auto and home insurance.

- Enroll in a Telematics Program: Insurance companies offer safe drivers an easy way to save on their insurance. You’ll earn a discount if you let your company track your driving habits. Compare usage-based car insurance here.

- Keep Your Car Safe: Keeping your Jeep parked in a secure spot every night will help keep your rates low. You might earn a discount if you have security features like audible alarms or GPS tracking.

Like other types of insurance, the most important way to ensure you get affordable Jeep car insurance is to compare Jeep car insurance quotes. You can do this by requesting individual quotes on the homepage of insurance websites.

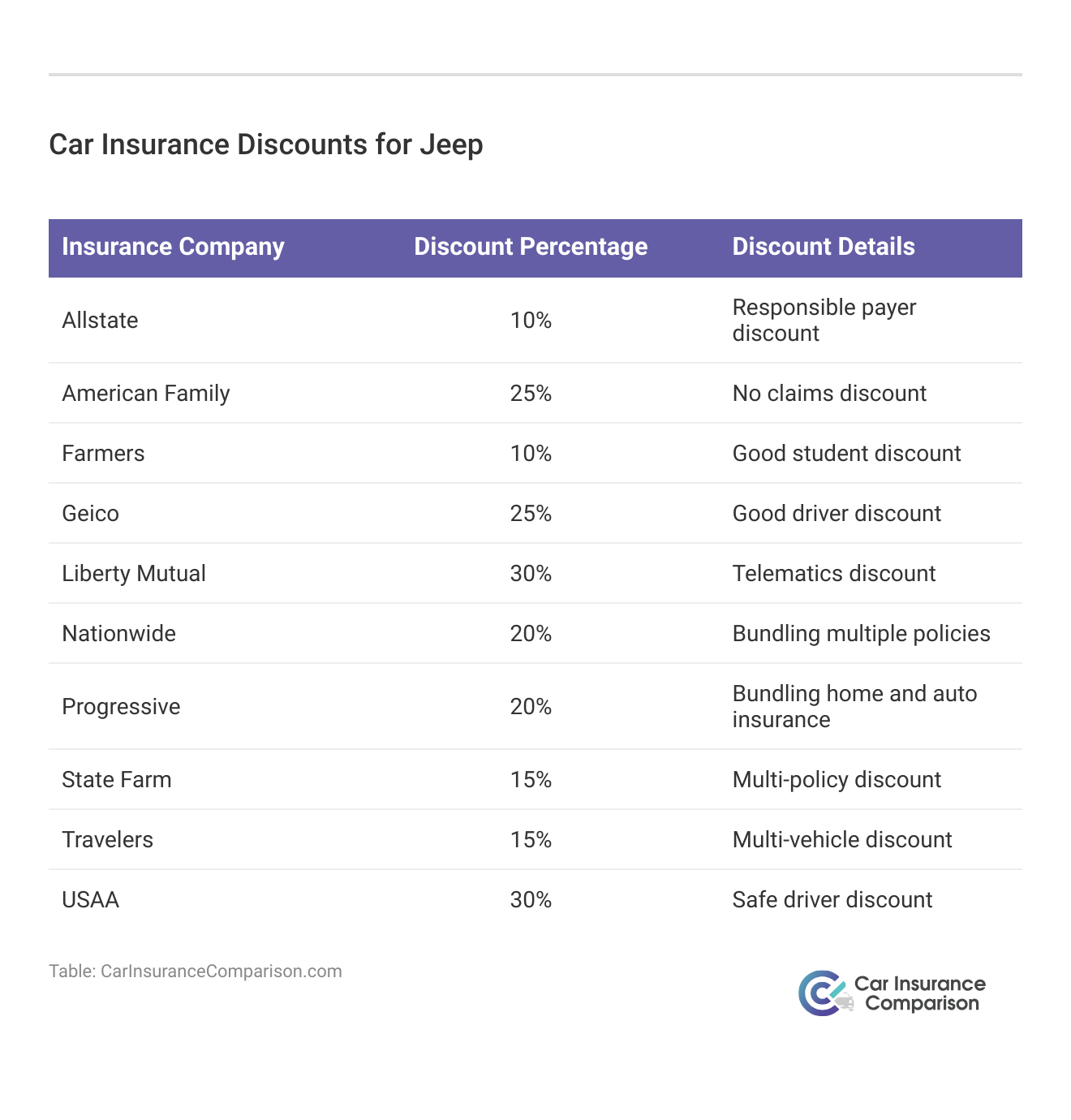

Some companies will have lower prices than others for your unique situation. For example, State Farm is one of the cheapest options for drivers with a DUI. While you compare rates, you can also compare discounts. Check below for a selection of discounts from our top companies.

Although most insurance discounts will apply to your account automatically, some require proof. For example, your insurance company will need to see proof of good grades before you can save with a good student discount.

Find the Best Jeep Car Insurance Rates Today

As one of America’s most easily recognized brands, Jeeps are a popular choice for everyone, from outdoor enthusiasts to high school drivers. Affordable Jeep insurance rates add another reason to consider buying a Jeep.

Whether you want full coverage car insurance or the bare minimum, there are always more ways to save on your Jeep coverage. While finding discounts and being a safe driver is important, it is best to compare Jeep car insurance rates to maximize your savings. Use our free quote comparison tool by entering your ZIP code into our free tool to find cheap Jeep car insurance in your area today.

Frequently Asked Questions

How can I compare Jeep car insurance rates?

Comparing Jeep car insurance rates involves the following steps:

- Gather Information: Collect details about your Jeep, such as its make, model, year of manufacture, trim level, and any additional features or modifications.

- Research Insurance Providers: Look for reputable insurance companies that offer coverage in your area. Consider factors like customer reviews, financial stability, and the range of coverage options they provide.

- Request Quotes: Contact insurance providers and request quotes for insuring your Jeep. Provide accurate information to get the most accurate quotes.

- Compare Coverage Options: Review the coverage options offered by each insurance company. Look for factors like liability coverage, collision and comprehensive coverage, personal injury protection, and any additional add-ons or discounts available.

- Consider Deductibles and Limits: Compare the deductibles and coverage limits associated with the quotes you receive. Higher deductibles typically lead to lower premiums but require you to pay more out-of-pocket in the event of a claim.

- Evaluate the Reputation and Customer Service: Consider the reputation and customer service of each insurance company. Look for feedback from current or past customers to assess their satisfaction with the company’s claims process and overall experience.

- Finalize Your Decision: After comparing rates, coverage options, deductibles, limits, and customer service, choose the insurance company that best suits your needs and budget.

So, how much is insurance on a Jeep? Rates vary, but keeping the tips above in mind can help you figure out the perfect plan for you.

What factors affect Jeep car insurance rates?

Several factors can influence the cost of Jeep car insurance rates. These may include:

- Jeep Model: The specific model of your Jeep can impact insurance rates. More expensive or high-performance models may have higher premiums.

- Age and Condition: The age and overall condition of your Jeep can affect insurance rates. Older or poorly maintained Jeeps may have higher rates due to potential reliability or safety concerns. As for you, finding cheap car insurance for new drivers is much more difficult than it is for older adults.

- Personal Driving Record: Your individual driving history, including any accidents, traffic violations, or claims, can affect your insurance rates. A clean driving record generally leads to lower premiums.

- Location: The area where you live can impact insurance rates. Locations with higher rates of theft, vandalism, or accidents may have higher premiums.

- Usage: How you use your Jeep can also influence insurance rates. If you use your Jeep for commercial purposes or extensive mileage, it may lead to higher premiums.

- Credit History: In some jurisdictions, insurance companies may consider your credit history when determining rates. A good credit score can lead to lower premiums.

- Coverage and Deductibles: The coverage options and deductibles you choose can affect your insurance rates. Higher coverage limits or lower deductibles may result in higher premiums.

- Discounts: Insurance companies often offer various discounts that can lower your rates. These may include safe driver discounts, multi-policy discounts, or discounts for safety features on your Jeep.

Insurance companies look at the same factors but use different formulas, which is why it’s important to compare quotes. Buying from the first company you look at means you’ll probably overpay for your insurance.

Are Jeep Wranglers more expensive to insure?

Jeep Wranglers can have varying insurance rates depending on several factors. While insurance rates can be influenced by the model, age, and condition of the Jeep, Wranglers are generally not considered significantly more expensive to insure compared to other SUVs or similar vehicles. However, it’s important to consider that factors such as personal driving history, location, and coverage options will also impact the insurance rates for a Jeep Wrangler.

Can I get discounts on Jeep car insurance?

Yes, you can often obtain discounts on Jeep car insurance. Insurance companies commonly offer discounts based on factors such as:

- Safe Driving: Maintaining a clean driving record and having no accidents or traffic violations can make you eligible for a safe driver discount.

- Multiple Policies: If you have multiple insurance policies with the same provider, such as home and auto insurance, you may qualify for a multi-policy discount.

- Safety Features: Equipping your Jeep with safety features such as anti-lock brakes, airbags, and anti-theft devices can lead to discounts on your insurance premiums.

- Good Student: If you or a member of your household is a student with good grades, you may be eligible for a discount.

- Affiliations: Some insurance companies offer discounts for being a member of certain organizations or professional groups.

Most car insurance discounts apply to your account automatically, but you can always ask a representative to double-check your policy.

Are there any specific insurance companies that specialize in Jeep car insurance?

While there may not be insurance companies that specialize exclusively in Jeep car insurance, many insurance providers offer coverage specifically tailored for Jeeps. It’s recommended to research reputable insurance companies and compare their coverage options, rates, and customer reviews to find the best fit for your Jeep.

Are Jeeps more expensive to insure?

The insurance rates for Jeeps can vary depending on several factors. While rates for certain Jeep models may be higher due to factors such as repair costs or safety ratings, it’s important to note that insurance rates are determined by various factors, including the driver’s history, location, coverage options, and the specific insurance provider. Comparing car insurance costs by vehicle from different insurance companies will help you determine how Jeep car insurance rates compare to other vehicles in your situation.

Why is my Jeep car insurance so expensive?

It could be due to your driving record, age, location, and other factors. Comparing Jeep car insurance rates from different companies is the best way to find savings.

Are Jeep Grand Cherokees the most expensive models to insure?

Jeep Grand Cherokees have more expensive rates on average for Jeep car insurance, but it is not the most expensive Jeep to insure. The Jeep Cherokee actually has the most expensive rates on average.

What is the cheapest car insurance company for a Jeep Wrangler?

It depends on your driving record, area, and more, but some companies that are cheaper in general are USAA, Geico, and State Farm. These companies may be able to help you save on your Jeep Wrangler insurance costs. If you’re buying car insurance for a new vehicle, you’ll need more coverage, which drives up average quotes.

How can I lower my Jeep car insurance rates?

To potentially lower your Jeep car insurance rates, you can consider the following:

- Increase Deductibles: Opting for a higher deductible can lower your premiums. However, ensure you choose a deductible amount you can comfortably afford to pay if you need to make a claim.

- Maintain a Clean Driving Record: Avoid traffic violations and accidents to maintain a good driving record. Safe driving habits can result in lower insurance rates over time.

- Install Safety Features: Adding safety features to your Jeep, such as anti-theft devices, airbags, or lane departure warning systems, can potentially qualify you for discounts on your insurance premiums.

- Seek Discounts: Inquire with your insurance provider about available discounts and ensure you’re taking advantage of all the ones you qualify for.

- Consider Usage-Based Insurance: Some insurance companies offer usage-based insurance programs where your premiums are based on your actual driving habits. If you’re a safe driver, this could lead to potential savings.

- Compare Quotes: Periodically compare quotes from different insurance providers to ensure you’re getting the best possible rate for your Jeep. Insurance rates can vary between companies, so shopping around can be beneficial.

Of course, the most important step is to compare quotes. Enter your ZIP code into our free comparison tool to see the lowest rates in your area.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.