Best Car Insurance for Unmarried Couples in 2025 (Top 10 Companies)

Discover the best car insurance for unmarried couples, with State Farm, USAA, and Progressive offering a 25% discount. Explore why they stand out, including their competitive rates, designed to meet the needs of unmarried couples. Compare quotes and find the perfect coverage for you and your partner.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

UPDATED: Jan 23, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 23, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Unmarried Couples

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for Unmarried Couples

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Unmarried Couples

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsState Farm, USAA, and Progressive take the top spots as the best car insurance options for unmarried couples, renowned for their competitive rates and comprehensive coverage.

Delve into this comprehensive guide to explore why these companies stand out, offering tailored solutions that perfectly fit the needs and circumstances of unmarried couples.

Our Top 10 Company Picks: Best Car Insurance for Unmarried Couples

| Company | Rank | Multi-Car Discount | Safe-Driver Discount | Best For | Jump Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | 15% | Personalized Service | State Farm | |

| #2 | 15% | 20% | Military Savings | USAA | |

| #3 | 30% | 25% | Advanced Technology | Progressive | |

| #4 | 20% | 20% | Claim Satisfaction | Allstate | |

| #5 | 25% | 20% | Multi-Car Discounts | Liberty Mutual |

| #6 | 25% | 15% | Family Coverage | Nationwide |

| #7 | 15% | 20% | Customized Coverage | Farmers | |

| #8 | 20% | 30% | Driving Innovations | Travelers | |

| #9 | 20% | 15% | Customer Loyalty | American Family | |

| #10 | 10% | 25% | Online Convenience | Esurance |

With a focus on affordability and quality service, you can confidently compare quotes and find the ideal coverage to protect you and your partner on the road.

Finding cheap car insurance quotes is easy. Just enter your ZIP code into our free comparison tool above to instantly compare quotes near you.

- State Farm offers a 25% discount, ideal for unmarried couples

- Tailored coverage options and competitive rates benefit unmarried couples

- Explore why companies excel in providing car insurance for unmarried couples

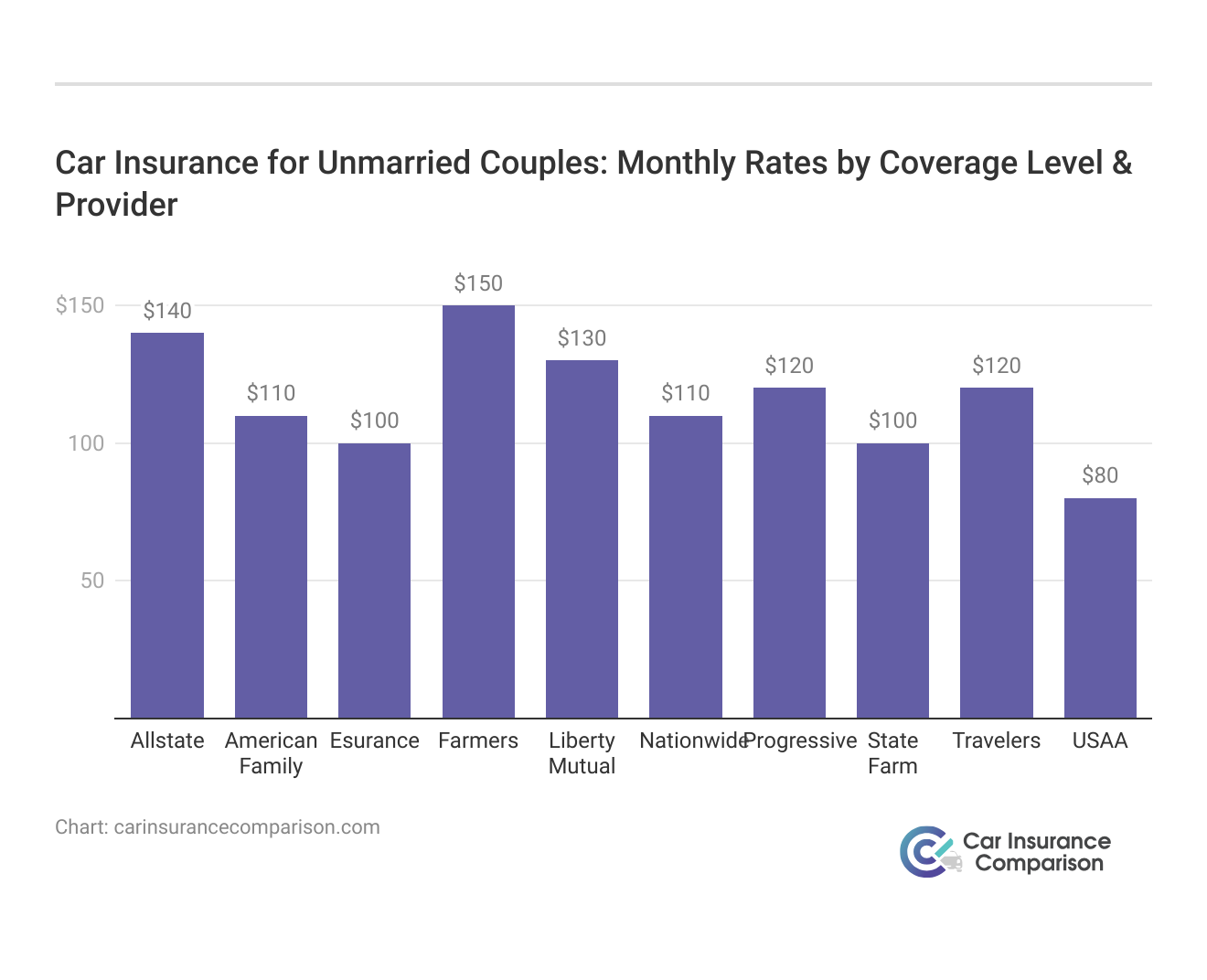

Car Insurance for Unmarried Couples: Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $140 | $400 |

| American Family | $110 | $330 |

| Esurance | $100 | $300 |

| Farmers | $150 | $450 |

| Liberty Mutual | $130 | $380 |

| Nationwide | $110 | $320 |

| Progressive | $120 | $350 |

| State Farm | $100 | $300 |

| Travelers | $120 | $350 |

| USAA | $80 | $250 |

Adding Your Fiancé to Your Auto Insurance

The sharing of a household by an unmarried couple is referred to as cohabitation. In a cohabitation situation, can you share insurance? The short answer is yes but with some caveats, which we’ll discuss in this and the following sections.

What is unmarried couple car insurance? Can I add my boyfriend to my car insurance? What about my girlfriend? My domestic partner? Should I add my significant other to my car insurance? Unmarried couples can share car insurance coverage when they’re living in the same household or driving the same vehicle. (For more information, read our “Can I add my girlfriend to my car insurance policy?“).

There are stipulations your insurance provider may place on the policy, though these vary based on the number of cars being insured and the living situation.

Insurance providers often require that you list individuals living in your household on your insurance policy as a driver, regardless of marital status, because your provider assumes someone living in your home may operate your vehicle.

If you don’t want to list an individual on your policy and your provider discovers this omission, this could be a red flag they use to consider raising your rates or even not renewing your policy.

State Farm stands out as the top choice for unmarried couples, offering a 25% discount and tailored coverage to protect their journey together.

Brad Larson Licensed Insurance Agent

Your other option is to specify that the other person in your home is an excluded driver, which means they cannot operate your vehicle.

This label means they are not figured into your insurance coverage premiums, and your policy will not cover the loss if they do drive your vehicle.

Read More: Does car insurance cover excluded drivers?

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Insurance Policy With Your Domestic Partner

If your partner lives with you, you share a vehicle, or they frequently drive your vehicle, it’s a good idea to consider sharing an insurance policy. Also, having multiple drivers (and often multiple vehicles) can mean policy discounts that reduce your rates.

The first step to joint car insurance for unmarried couples is understanding your car insurance policy. When considering the options, make sure to figure in any potential discounts for switching coverage or adding policies with your provider. Read this guide for steps you can take to get the right insurance for your needs.

When is a good idea to maintain separate car insurance policies? If you don’t live together or don’t regularly use each other’s vehicles, it may not make sense to share a policy.

In some cases, it may cost you more to share a policy than to maintain separate coverage. For example, if your partner has a poor driving record or some other factor that designates them as high-risk (like poor credit), keeping your policies separate will probably save you money.

Options for Unmarried Couples for Having Car Insurance

There are two primary choices for shared insurance households as an unmarried couple; each of these options requires both individuals to be a named insured on the policy.

While your insurance policy may cover individuals that are not listed, a named insured is someone the insurance provider is aware of and can provide additional assistance or information to when a loss occurs.

- One option is to list each other on your respective policies if you own more than one car

- The other option is to have the owner of the shared car list the additional person as a driver

Each option will affect your coverage in different ways, meaning you may qualify for additional discounts or end up paying higher rates depending on how your policy changes.

When two households become one, at least from an insurance provider’s perspective, your policies are linked into one joint policy within a single. To gain profound insights, consult our extensive guide titled “Compare Joint Ownership Car Insurance.”

Assumption of Vehicle Usage: Shared Responsibility Within the Household

Joining two households into one single household on a single policy works well when there’s at least one car per person; you are the primary driver of one, and your partner is the primary driver of the other. However, your insurance provider will consider you both additional drivers on the other vehicles.

There are other benefits to a single household policy, including:

- Easier claim resolution if you are driving another car from the household

- Earning additional discounts for purchasing other product lines

- Multi-car insurance discounts for insuring multiple cars with the same provider

Take a look at this table for specifics on how much you can save with multi-car discounts.

Multi-Car Insurance Discount Amount by Company

| Insurance Company | Discount Percentage |

|---|---|

| American Family | 20% |

| Geico | 25% |

| Esurance | 10% |

| Farmers | 15% |

| Liberty Mutual | 10% |

| Nationwide | 20% |

| Progressive | 10% |

| State Farm | 20% |

| Travelers | 8% |

| USAA | 15% |

Your other option applies to instances where you only have one vehicle or where you and your partner have different insurance providers. For coverage to apply, you can list the other person on your policy as an additional driver, even if they are not in your household.

This provision is allowed since you are not insuring their vehicle; you are merely stating they may drive your car. If you want to purchase joint coverage, this is not the correct option.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Removing Individuals or Vehicles From Car Insurance

When it comes to changing your policy, removing an individual or a vehicle is fairly straightforward. This change can occur when you move out of the house or decide you are no longer a couple.

Removing a driver follows the same process as adding a driver. Contact your insurance provider to remove the individual from your policy. You can choose to remove a vehicle in the same way.

If you are currently sharing joint policies with another person, it’s important to make sure the other party has insurance before you cancel their coverage.

Even when two people decide to part ways, it’s important to end the agreement amicably.

Remember that your insurance provider may be providing you a discount if you have multiple policies, so be prepared for a possible increase if you remove a vehicle (or driver) from your insurance policy. For a comprehensive overview, explore our detailed resource titled “Multiple Policy Car Insurance Discounts.”

Exploring Real-World Insurance Solutions: Case Studies

In the dynamic landscape of car insurance, individual needs and preferences play a crucial role in determining the best coverage options. These case studies provide a glimpse into how different individuals and families navigate their unique insurance requirements.

From families adjusting to new drivers to professionals seeking tailored coverage and tech enthusiasts embracing digital solutions, each scenario sheds light on the practical application of insurance policies in everyday life. Let’s delve into these real-life examples to understand how various insurance companies meet distinct client needs.

- Case Study #1 – Home Safety Upgrade: An unmarried couple decides to renovate their home for added security. With their homeowners insurance policy, they receive coverage for the installation of advanced security systems, ensuring enhanced protection for their shared residence and peace of mind for their future together.

- Case Study #2 – Road Trip Mishap: While embarking on a cross-country road trip, an unmarried couple’s vehicle breaks down in a remote area. Utilizing their roadside assistance coverage, they swiftly receive towing services and repairs, allowing them to resume their journey and continue making unforgettable memories together.

- Case Study #3 – Joint Vehicle Purchase: Opting to purchase a new car together, an unmarried couple secures a joint auto insurance policy. With customized coverage tailored to their unique needs, they enjoy comprehensive protection for their shared vehicle, fostering trust and security in their partnership. To gain in-depth knowledge, consult our comprehensive resource titled “Understanding Your Car Insurance Policy.”

Mike enjoyed a seamless digital experience with Progressive, from easy policy management through their app to discounts aligned with his safe driving habits.

State Farm offers unparalleled affordability with minimum coverage starting at $100, coupled with exceptional service and tailored solutions for unmarried couples.

Justin Wright Licensed Insurance Agent

The tech-forward approach of Progressive resonated well with his lifestyle, offering both convenience and cost savings.

Joint Car Insurance for Unmarried Couples: The Bottom Line

Unmarried couples can purchase insurance coverage together (a joint policy), or they can alter their current policies to meet their needs. For detailed information, refer to our comprehensive report titled “Compare Joint Ownership Car Insurance: Rates, Discounts, & Requirements.”

With joint coverage, all your vehicles and both you and your partner are covered under a single policy, enabling you to have a single insurance bill. This may be difficult, however, if the primary policyholder doesn’t own all the vehicles.

This allows you to have a policy for each vehicle while ensuring you may drive any vehicle on the policies.

If you have only the one vehicle or are not living together, then listing the other person as an added driver may be your only choice.

Car insurance providers can list someone as an additional driver on your policy if you believe they will regularly operate your car.

Make sure to shop around for coverage before making your choice, regardless of which path you pursue. Some insurance providers offer better discounts for multiple lines of insurance or safe driving records, so compare three or four quotes beforehand.

Ready to buy joint car insurance for unmarried couples? Enter your ZIP code in our free tool to begin comparing rates for joint car insurance for unmarried couples today and save on your rates.

Frequently Asked Questions

Can unmarried couples be on the same car insurance policy?

Yes, unmarried couples can often share the same car insurance policy if they reside in the same household and jointly own or operate vehicles.

Is it possible for unmarried couples to get car insurance together?

Absolutely, insurance companies typically allow unmarried couples to obtain joint car insurance policies, provided they meet the insurer’s criteria for coverage.

Get the right car insurance at the best price — enter your ZIP code below to shop for coverage from the top insurers.

Can you add a girlfriend to your car insurance policy?

Yes, many insurance providers allow individuals to add and combine their girlfriends to their car insurance policies, especially if they reside in the same household and share a vehicle.

For a comprehensive analysis, refer to our detailed guide titled “How To Combine Car Insurance Coverage With the Right Deductible.”

Can you add a boyfriend to your car insurance policy?

Certainly, insurance companies often permit policyholders to add their boyfriends to their car insurance policies, assuming they meet the necessary requirements.

Can you add a fiancé to your car insurance policy?

Yes, insurance providers generally allow individuals to add their fiancés to their car insurance policies, provided they meet the insurer’s eligibility criteria.

Can unmarried couples share the same health insurance policy?

While car insurance policies can typically be shared by unmarried couples, health insurance policies often have specific regulations regarding eligibility for coverage together.

To delve deeper, refer to our in-depth report titled “How do you get car insurance fast?.”

Can you add someone to your insurance if you’re not married?

Yes, individuals can often add someone to their insurance policies even if they are not married, as long as they meet the insurer’s requirements for eligibility.

Can unmarried couples share car insurance coverage?

Absolutely, unmarried couples can share car insurance coverage on a joint policy, allowing them to enjoy the benefits of combined coverage and potentially save on premiums.

Can you add your girlfriend to your car insurance policy if she doesn’t live with you?

Insurance companies typically require individuals listed on a car insurance policy to reside in the same household, so adding a girlfriend who doesn’t live with you might not be feasible.

For a thorough understanding, refer to our detailed analysis titled “Minimum Car Insurance Requirements by State.”

Can you add your boyfriend to your car insurance if he has a poor driving record?

Adding someone with a poor driving record to your car insurance policy may affect your premiums, as insurance companies often consider the driving history of all listed drivers when determining rates.

Stop overpaying for car insurance. Our free quote comparison tool allows you to shop for quotes from the top providers near you by entering your ZIP code below.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.