Cheapest Georgia Car Insurance Rates in 2025 (Unlock Big Savings From These 10 Companies!)

Explore Geico, State Farm, and Travelers for the cheapest Georgia car insurance rates, starting as low as $24 a month. These providers excel with their competitive pricing and comprehensive coverage options in Georgia, ensuring affordability and quality for drivers seeking optimal insurance solutions.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kalyn Johnson

Insurance Claims Support & Sr. Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she has similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Insurance Claims Support & Sr. Adjuster

UPDATED: Oct 15, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 15, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage for Georgia

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage for Georgia

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 1,733 reviews

1,733 reviewsCompany Facts

Min. Coverage for Georgia

A.M. Best Rating

Complaint Level

1,733 reviews

1,733 reviews

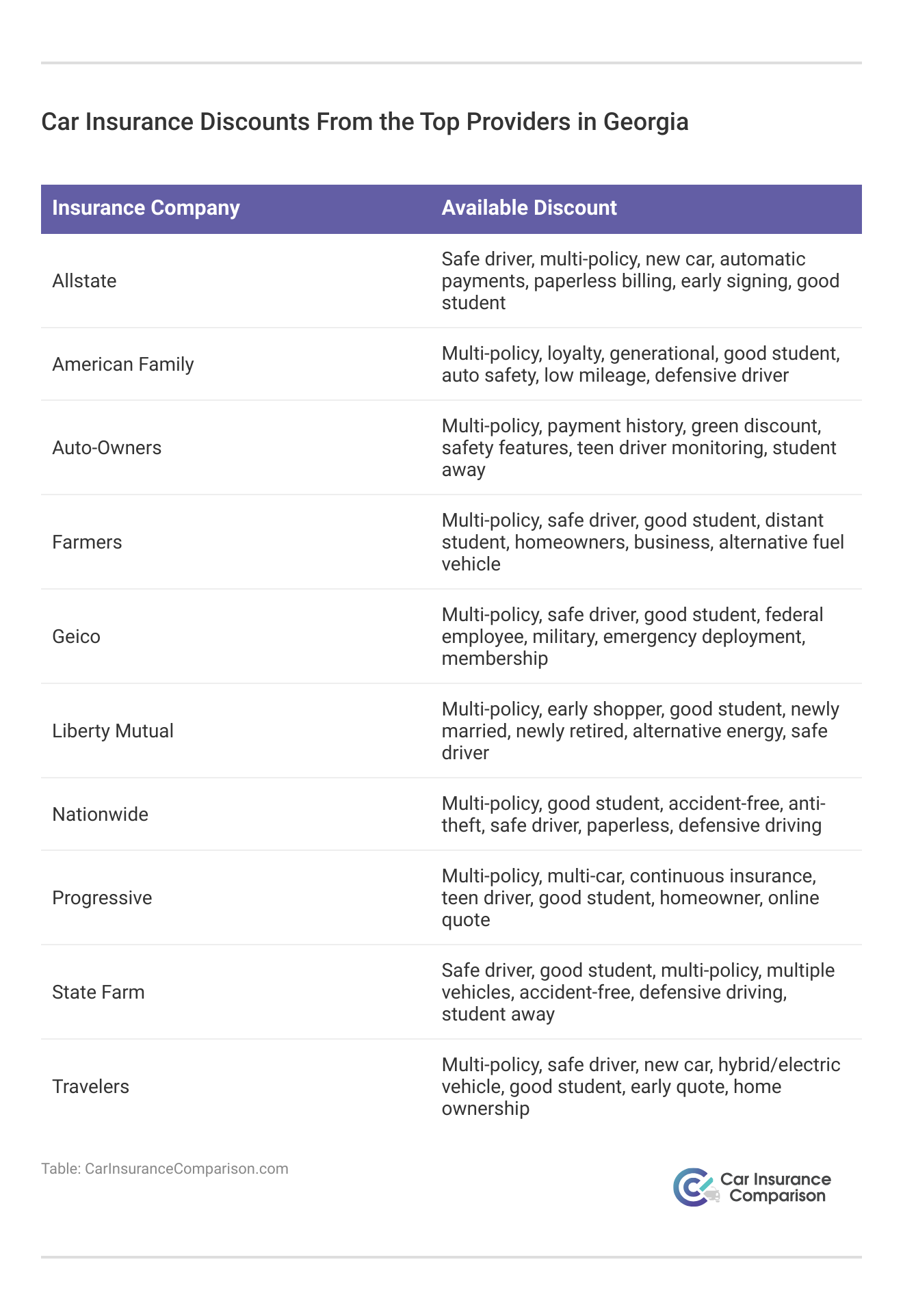

The top picks for the cheapest Georgia car insurance rates are Geico, State Farm, and Travelers, known for their excellent value and coverage.

These companies provide diverse policy options that cater to a wide range of drivers, ensuring that you can find a plan that suits your specific needs. Learn more in our “What is the best car insurance?”

Our Top 10 Company Picks: Cheapest Georgia Car Insurance Rates

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $24 A++ Good Drivers Geico

#2 $43 B Competitive Pricing State Farm

#3 $44 A++ Hybrid Discounts Travelers

#4 $46 A+ Snapshot Program Progressive

#5 $48 A++ Bundle Savings Auto-Owners

#6 $50 A Generous Discounts American Family

#7 $60 A Customizable Plans Farmers

#8 $61 A+ Vanishing Deductible Nationwide

#9 $66 A+ Driver Rewards Allstate

#10 $106 A Flexible Policies Liberty Mutual

Exploring these providers will allow you to benefit from significant savings while securing reliable insurance protection. As you compare what each has to offer, you’ll discover why they are favored by many Georgia drivers looking for quality insurance at an affordable price.

- Compare Georgia Car Insurance Rates

- Best Tallapoosa, GA Car Insurance in 2025

- Best Social Circle, GA Car Insurance in 2025

- Best Senoia, GA Car Insurance in 2025

- Best Rome, GA Car Insurance in 2025

- Best Peachtree City, GA Car Insurance in 2025

- Best Evans, GA Car Insurance in 2025

- Best Donalsonville, GA Car Insurance in 2025

- Best Canton, GA Car Insurance in 2025

- Best Carrollton, GA Car Insurance in 2025

- Best Augusta, GA Car Insurance in 2025

- Best Austell, GA Car Insurance in 2025

- Best Auburn, GA Car Insurance in 2025

- Best Columbus, GA Car Insurance in 2025

If you want to get started on finding Georgia auto insurance right away, check out our free quote comparison tool.

- Geico leads with the most affordable Georgia car insurance rates

- Tailored policies meet diverse driver needs at competitive prices

- Frequent discounts and rewards lower costs for Georgia drivers

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – Geico: Top Overall Pick

Pros

- Competitive Rates: Geico offers some of the lowest monthly rates starting at $24. Discover more about offerings in our Geico car insurance review.

- High Customer Satisfaction: Geico consistently receives high marks for customer service and claims processing.

- Safe Driver Discounts: Substantial savings for drivers with a clean driving record.

Cons

- Coverage Limitations: Some specialty coverages are not as comprehensive as those offered by competitors.

- Policy Customization: Fewer options for tailoring policies compared to other insurers.

#2 – State Farm: Best for Competitive Pricing

Pros

- Bundling Policies: Significant discounts for combining multiple insurance types.

- High Low-Mileage Discount: Major savings for drivers with lower annual mileage.

- Wide Coverage: Extensive options that cater to various needs. Unlock details in our State Farm car insurance review.

Cons

- Limited Multi-Policy Discount: Less competitive compared to others in the industry.

- Premium Costs: Rates can be higher for certain levels of coverage.

#3 – Travelers: Best for Hybrid Discount

Pros

- Hybrid Vehicle Discounts: Offers discounts specifically for hybrid vehicle owners.

- Customizable Coverage: Broad range of coverage options that can be tailored.

- Accident Forgiveness: Policies include accident forgiveness elements. See more details on our Travelers car insurance review.

Cons

- Higher Base Prices: Starts at a higher monthly rate compared to some other competitors.

- Complexity in Policy Options: This can be complex due to the variety of choices.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – Progressive: Best for Snapshot Program

Pros

- Innovative Discounts: The snapshot program rewards safe driving behavior with discounts.

- Wide Acceptance: Accepts drivers with varied driving records. Delve into our evaluation of Progressive car insurance review.

- Flexible Payments: Offers multiple payment plans and methods.

Cons

- Inconsistent Pricing: Rates can vary significantly between customers.

- Customer Service Variability: Some reports of inconsistent customer service experiences.

#5 – Auto-Owners: Best for Bundle Savings

Pros

- Strong Bundle Discounts: Competitive discounts for combining home and auto insurance.

- High Claims Satisfaction: Known for efficient and satisfactory claims processing.

- Agent Network: Strong local agent support for personalized assistance. See more details in our guide titled “Auto-Owners Car Insurance Review.”

Cons

- Availability Limitations: Not available in all states.

- Higher Rates Without Bundling: More expensive if not bundling policies.

#6 – American Family: Best for Generous Discounts

Pros

- Wide Range of Discounts: Offers a variety of discounts for different demographics. See more details on our American Family car insurance review.

- Robust Coverage Options: Extensive coverage options across different insurance products.

- Customer Resources: Provides ample educational resources and tools for policyholders.

Cons

- Higher Rates for Some Demographics: Some groups may find rates higher than average.

- Limited Availability: Not available in all states.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Farmers: Best for Customizable Plan

Pros

- Tailored Options: Allows extensive customization of insurance plans.

- Dedicated Agents: Provides personalized service through a network of local agents.

- Recovery Support: Strong support services for claims and accidents. Learn more in our Farmers car insurance review.

Cons

- Higher Premiums: Generally more expensive monthly rates.

- Complex Policies: These can be overwhelming due to numerous customization options.

#8 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Rewards safe driving by reducing the deductible over time.

- Broad Coverage: Offers a comprehensive range of insurance products. Check out insurance savings in our complete Nationwide car insurance discount.

- SmartRide Program: A discount program that tracks driving habits for potential savings.

Cons

- Higher Initial Deductibles: Starts with higher deductibles before reductions apply.

- Pricing Variability: Premiums can vary widely based on individual profiles.

#9 – Allstate: Best for Driver Rewards

Pros

- Reward Programs: Offers points and rewards for safe driving. Discover more about offerings in our Allstate car insurance review.

- Multiple Policy Discounts: Significant discounts are available for holding multiple policies.

- Innovative Tools: Access to tools and apps that help manage policies and track driving.

Cons

- Higher Premiums: Generally higher starting rates.

- Claims Process Issues: Some users report a less streamlined claims process.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best for Flexible Policy

Pros

- Extensive Customization: Policies can be highly customized to meet individual needs.

- Accident Forgiveness: Includes accident forgiveness in many of its plans. Read up on the Liberty Mutual car insurance review for more information.

- Lifetime Repair Guarantee: Offers a guarantee on all vehicle repairs made through their service.

Cons

- High Premiums: Among the highest rates in the market.

- Varied Customer Satisfaction: Mixed reviews on customer service and claims handling.

Georgia Car Insurance Rates: Coverage Comparison

Navigating car insurance rates in Georgia can be complex, with significant variances between minimum and full coverage options across different providers. Below, we detail the monthly costs for both types of coverage to help you make an informed decision.

Georgia Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $66 $165

American Family $50 $124

Auto-Owners $48 $128

Farmers $60 $149

Geico $24 $61

Liberty Mutual $106 $263

Nationwide $61 $152

Progressive $46 $115

State Farm $43 $107

Travelers $44 $110

The table presents a clear comparison of what drivers might expect to pay for insurance, depending on the extent of coverage chosen. For those looking for the most cost-effective option, Geico offers the lowest monthly rate for minimum coverage at just $24, and a remarkably affordable $61 for full coverage.

On the higher end, Liberty Mutual’s rates start at $106 for minimum and soar to $263 for full coverage, reflecting a premium service. Such disparities highlight the importance of comparing rates to find the best fit for your insurance needs and budget.

Other notable entries include State Farm and Travelers, which provide competitive and moderate pricing tiers for both coverage levels. Learn more in our “Compare Comprehensive Car Insurance: Rates, Discounts, & Requirements.”

Cheap Georgia Car Insurance Coverage and Rates

The “Peach State” is a great place to live if you love Southern charm, friendly people, and beautiful beaches. US News & World Report ranked two Georgia cities in the top 100 places to live in the nation in 2018. But do you know what it costs to own and operate a vehicle in Georgia?

Although it might feel mundane, understanding basic things like car insurance rates and requirements can, and sometimes should impact where you decide to live. Read on to find out what we mean.

Minimum Car Insurance Requirements in Georgia

In Georgia, drivers are required to meet specific minimum car insurance requirements to legally operate a vehicle. These include liability coverages for bodily injury and property damage, as well as uninsured motorist coverage, ensuring protection in various accident scenarios.

Georgia Car Insurance Minimum Coverage Requirements

| Coverage | Limits |

|---|---|

| Bodily Injury Liability | $25,000 per person and $50,000 per accident |

| Property Damage Liability | $25,000 per accident |

| Uninsured Motorist Bodily Injury | $25,000 per person and $50,000 per accident |

| Uninsured Motorist Property Damage | $25,000 with a $250, $500, or $1000 deductible |

Liability auto insurance coverage pays all individuals, drivers, passengers, pedestrians, bicyclists, etc, who are owed compensation for property damage and/or injuries resulting from a car accident that you or anyone under your policy causes.

Georgia is an “at-fault” accident state. This means, if you are the at-fault driver during an accident, you will be held liable for any personal injury or property claims.

In Georgia, drivers must carry liability insurance to legally operate a vehicle, with the state mandating minimum coverage amounts. This insurance is essential to cover costs associated with damages or injuries you may cause to others in an accident. As such, liability insurance is required in the state of Georgia at these minimum coverage amounts:

- $25,000: To cover the Injury or death of one person in an accident you caused

- $50,000: To cover total injuries or death of more than one person in an accident you caused

- $25,000: To cover property damage in an accident you caused

Remember, these amounts are minimum requirements and do not cover injury, death, or damage to yourself or your passengers. That will require additional coverage. These minimum coverage costs also vary from state to state.

Liability coverage provides protection regardless of who is driving your car, ensuring that damages or injuries caused to others are covered. Additionally, this coverage extends to when you are driving a rented vehicle, safeguarding you from financial responsibilities in case of an accident.

Required Forms of Financial Responsibility in Georgia

Georgia law requires every driver and every owner of a vehicle to have proof of financial responsibility (proof of liability coverage) at all times. Here are the six forms of acceptable proof of vehicle liability insurance coverage in Georgia:

- Liability Insurance Policy

- Rental Agreement

- Fleet Insurance Policy Card

- Bill of Sale (Dated within 30 days of the vehicle purchase date, and a valid insurance binder page issued by a Georgia licensed insurer.)

- Valid Self-Insured Insurance Card/Certificate of Self-Insurance

- Valid Georgia International Registration Plan (IRP)

Every time a motorist operates a vehicle, he or she is required to have on hand one of the above six forms proving financial responsibility.

The Georgia Department of Revenue is required, by law, to suspend or revoke vehicle registrations on any vehicles found to be driving without continuous liability coverage.

You will also incur a $25 fine for a lapse in coverage. That fine jumps to an additional $160 if the lapse in coverage is not paid in 30 days.

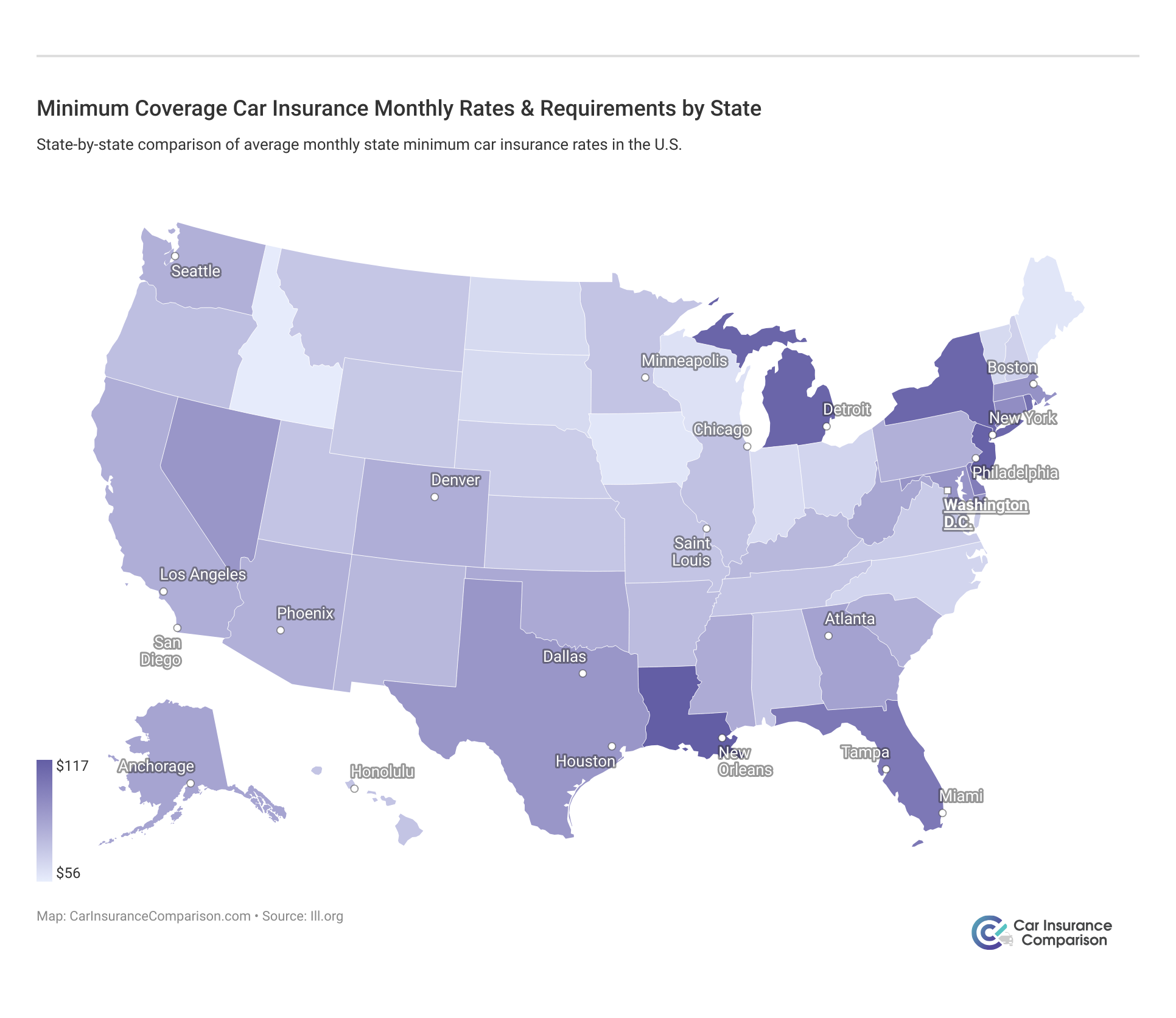

Rates as Percentage of Income in Georgia

In 2017, the annual per capita disposable personal income in Georgia was $38,326. Disposable personal income (DPI) is the total amount of money available for an individual to spend (or save) after their taxes have been paid.

The average monthly cost of car insurance in Georgia is approximately $103, which is just over 3% of the average disposable personal income.

The average Georgian has only $3,194 each month to buy food, pay bills, etc. The car insurance bill alone will deduct about $100 out of that and much more for more than minimum coverage and/or car insurance for a bad driving record. American Consumer Credit Counseling suggests saving 20% of every paycheck. With Georgia’s DPI, that’s a whopping $639 each month.

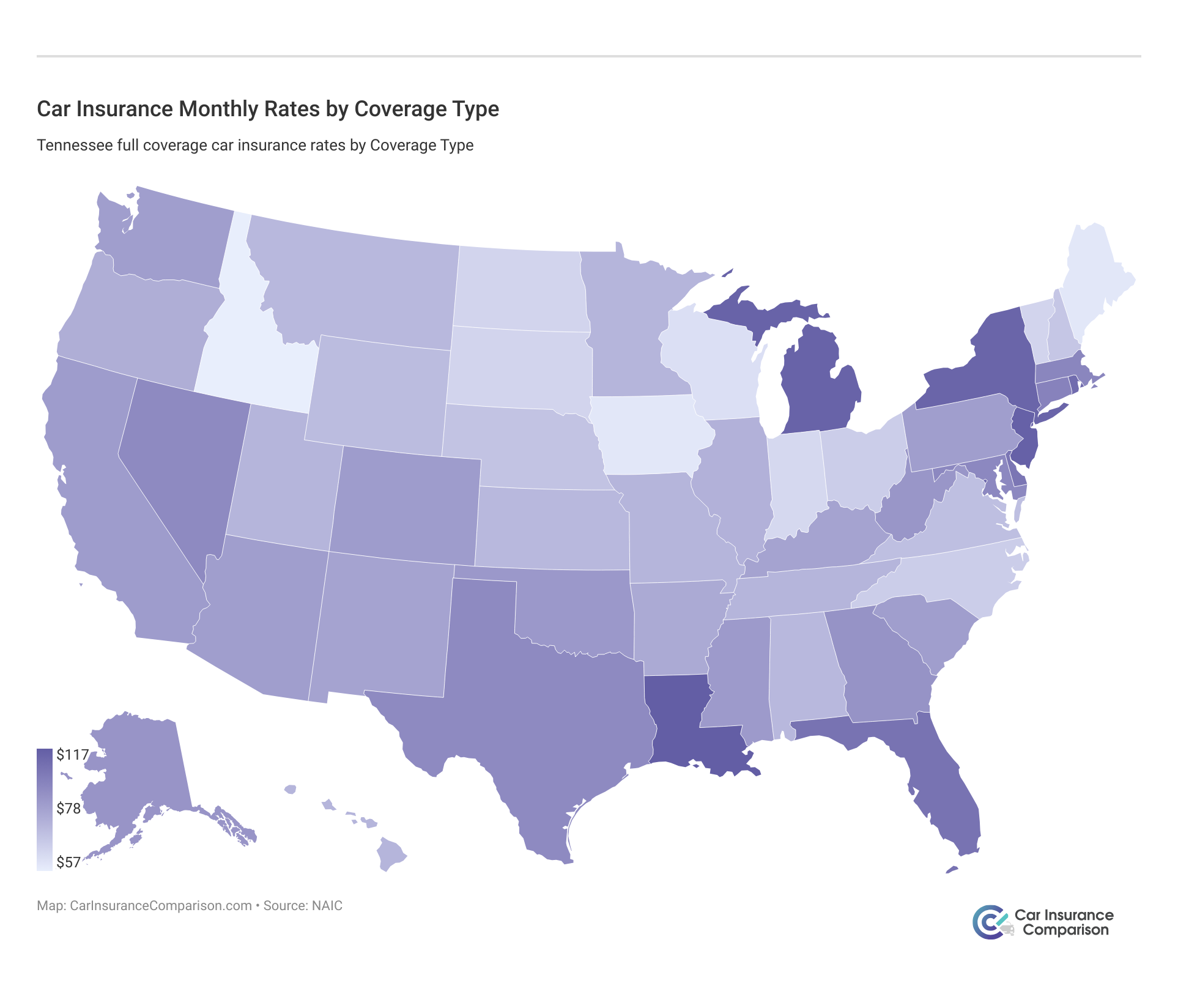

Average Monthly Car Insurance Rates in GA (Liability, Collision, Comprehensive)

Explore the latest trends in car insurance costs in Georgia with our overview of average monthly rates for liability, collision, and comprehensive coverage. This chart, drawing from data from the National Association of Insurance Commissioners, projects a significant increase in rates starting in 2018.

The above chart illustrates the most recent data provided by the leading source on the matter, the National Association of Insurance Commissioners expects car insurance rates in Georgia to be significantly higher for 2018 and on.

Don’t forget: Georgia has minimum requirements for liability coverage, but experts suggest drivers purchase more than what state law requires, especially when the state is an “at-fault” state like Georgia is.

Exploring additional coverage options for your auto insurance policy can enhance your protection and provide greater peace of mind on the road. These popular add-ons, ranging from collision and comprehensive to roadside assistance, cater to diverse needs and help mitigate various risks associated with driving.

Additional Liability Coverage in Georgia

As of July 2018, two states required Medical Payments coverage (Maine and Wisconsin), two states (plus D.C.) required Uninsured Motorist coverage (Montana and Wisconsin), and 17 states required both Uninsured & Underinsured Motorist coverage.

Georgia Auto Insurance Loss Ratio Percentages

| Coverage | Percentage |

|---|---|

| Personal Injury Protection (PIP) | 86% |

| Medical Payments Loss Ratio | 80% |

| Uninsured Motorist Loss Ratio | 22% |

| Underinsured Motorist Loss Ratio | 25% |

Medical payments and uninsured/underinsured motorist coverages are all optional in Georgia, but they are still important to have. Why? In 2015 13% of motorists in the U.S. were uninsured, according to the Insurance Information Institute, and 12% of motorists in Georgia. These drivers would likely go bankrupt before they could pay off bills for damage and injuries they caused in a car accident.

Georgia ranked 25th in the nation in 2015 for uninsured or underinsured drivers.

Georgia has remained pretty steady as far as the loss ratio is concerned and on the higher end of how much is covered.

Add-ons, Endorsements, and Riders in Georgia

We know getting the complete coverage you need for an affordable price is your goal. The good news: there are lots of powerful but cheap extras you can add to your policy. Here is a list of useful coverage available to you in Georgia:

- Gap insurance

- Personal umbrella policy (PUP)

- Rental car reimbursement

- Emergency roadside assistance

- Mechanical breakdown insurance

- Non-owner car insurance

- Modified car insurance coverage

- Classic car insurance

- Pay-as-you-go Insurance

By considering the diverse range of add-ons such as gap insurance, personal umbrella Policy, and more, residents of Georgia can customize their auto insurance to meet specific needs. These options ensure that you’re not only protected adequately but also managing your insurance budget effectively.

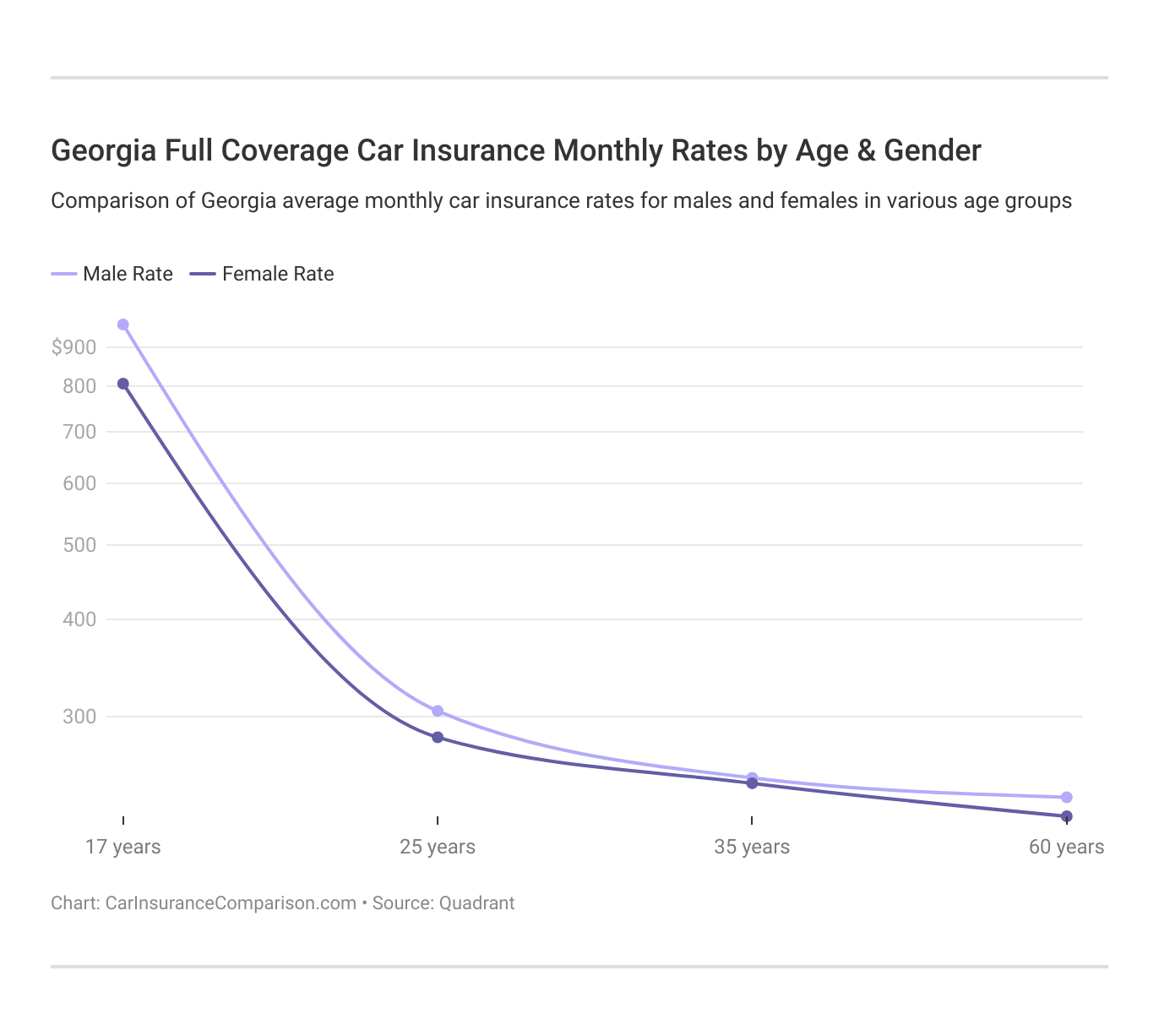

Male vs Female Car Insurance Rates in Georgia

In Georgia, the comparison of car insurance rates between male and female drivers reveals distinct differences across two major providers, Geico and Progressive. This breakdown showcases the costs for both 25-year-old and 55-year-old drivers, highlighting variations by age and gender.

Georgia Full Coverage Car Insurance Monthly Rates by Gender, Age, & Provider

| Insurance Company | Age: 16 Male | Age: 16 Female | Age: 25 Male | Age: 25 Female | Age: 30 Male | Age: 30 Female | Age: 55 Male | Age: 55 Female |

|---|---|---|---|---|---|---|---|---|

| Allstate | $567 | $481 | $208 | $190 | $193 | $177 | $156 | $156 |

| American Family | $541 | $439 | $156 | $132 | $145 | $123 | $117 | $116 |

| Auto-Owners | $414 | $370 | $188 | $172 | $161 | $150 | $135 | $130 |

| Farmers | $834 | $874 | $194 | $186 | $180 | $173 | $142 | $142 |

| Geico | $357 | $315 | $121 | $104 | $112 | $96 | $58 | $59 |

| Liberty Mutual | $1,264 | $1,250 | $289 | $271 | $269 | $252 | $250 | $230 |

| Nationwide | $964 | $807 | $211 | $191 | $196 | $178 | $144 | $138 |

| Progressive | $815 | $803 | $171 | $160 | $159 | $149 | $109 | $120 |

| State Farm | $402 | $338 | $131 | $121 | $122 | $113 | $101 | $101 |

| Travelers | $1,009 | $797 | $128 | $118 | $119 | $110 | $104 | $103 |

Popular myth: Men pay more for car insurance. In most states, that isn’t always true and Georgia is one of them.

In Georgia, both Geico and Progressive charge females more than males who have the exact same profile and driving record.

Our researchers discovered that females in Georgia are charged as much as $50 a year more than males who are the same age and have identical backgrounds and driving records.

The interactive chart presented below illustrates a clear trend: as individuals age, the influence of age on certain variables diminishes significantly. This means that while age might be a critical factor in the early stages, its impact lessens, indicating a leveling off or stabilization as people grow older.

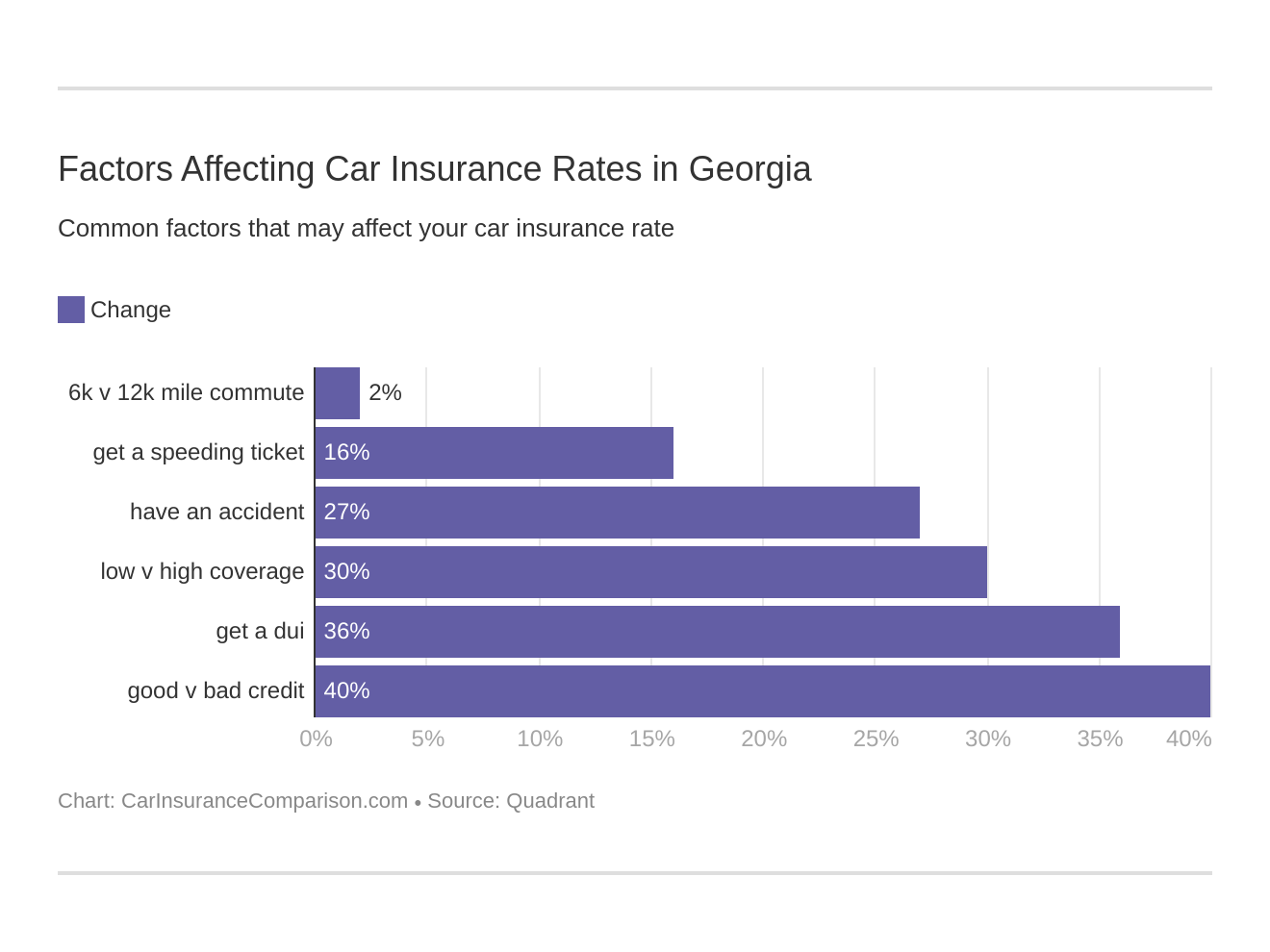

One important aspect to keep in mind when selecting your insurance coverage is the impact of your coverage limits and driving history on your overall costs. Higher coverage limits generally mean higher premiums, but they can provide more financial protection in the event of an accident, while a clean driving record can help reduce your insurance expenses significantly.

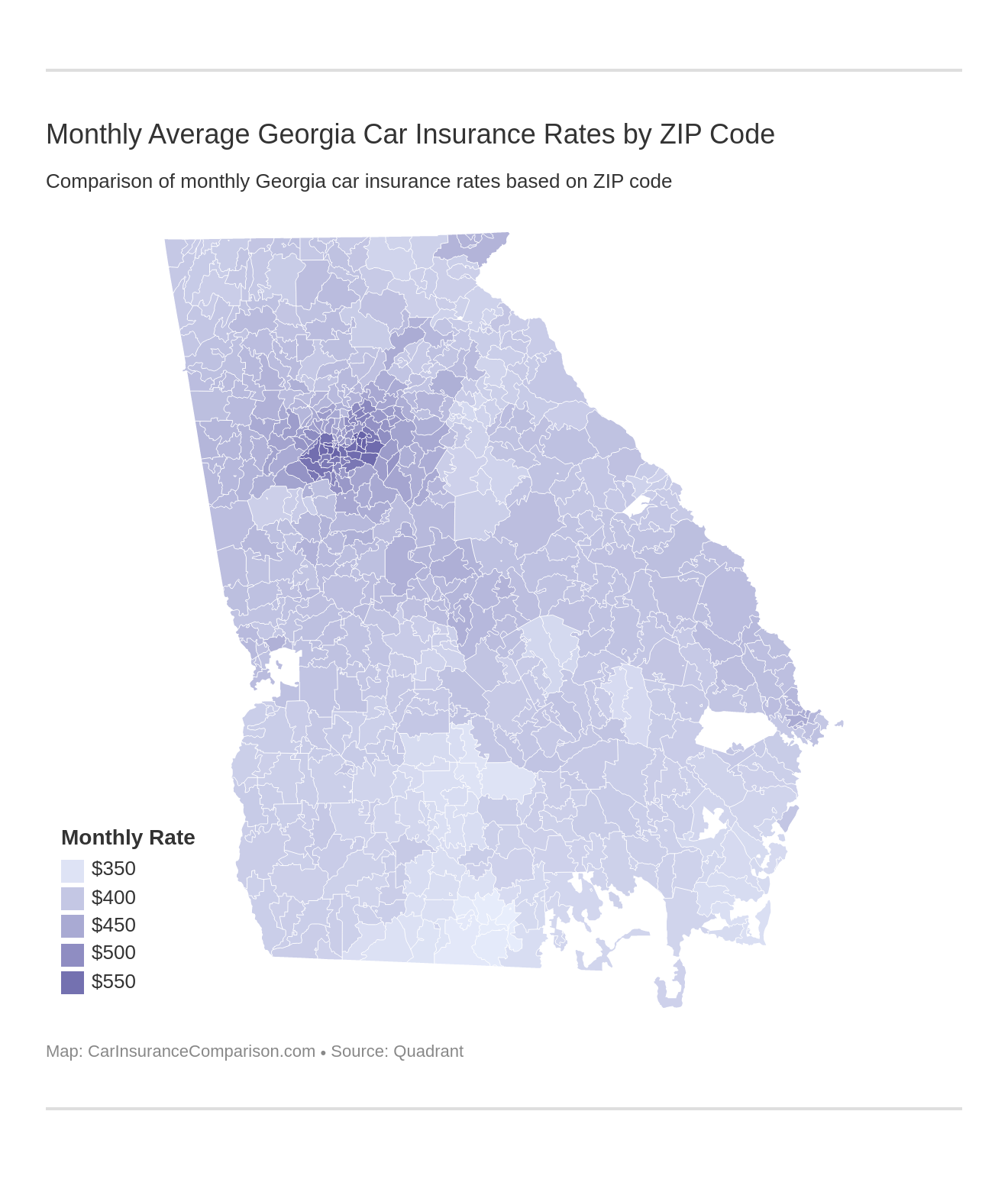

Cheapest Georgia Car Insurance Rates by ZIP Code

Exploring car insurance rates in Georgia reveals significant variability based on ZIP codes. This detailed overview highlights the most and least expensive areas across the state, providing a clear comparison of rates by ZIP code and insurance company.

If you end up at one of the following ZIP codes in Georgia, you will have one of the highest rates in the state.

Most Expensive Georgia Car Insurance Monthly Rates by ZIP Code & Provider

| ZIP Code | City | Average Rate | Most Expensive Company | Most Expensive Rate | Cheapest Company | Cheapest Rate |

|---|---|---|---|---|---|---|

| 30314 | Atlanta | $583 | Liberty Mutual | $1,150 | USAA | $324 |

| 30021 | Clarkston | $579 | Liberty Mutual | $1,125 | USAA | $288 |

| 30088 | Stone Mountain | $576 | Liberty Mutual | $1,083 | USAA | $298 |

| 30083 | Stone Mountain | $575 | Liberty Mutual | $1,125 | USAA | $290 |

| 30035 | Decatur | $574 | Liberty Mutual | $1,083 | USAA | $311 |

| 30334 | Atlanta | $574 | Liberty Mutual | $1,191 | USAA | $299 |

| 30315 | Atlanta | $574 | Liberty Mutual | $1,150 | USAA | $322 |

| 30310 | Atlanta | $573 | Liberty Mutual | $1,072 | USAA | $314 |

| 30304 | Atlanta | $570 | Liberty Mutual | $1,191 | USAA | $295 |

| 30303 | Atlanta | $566 | Liberty Mutual | $1,191 | Geico | $283 |

| 30311 | Atlanta | $563 | Liberty Mutual | $1,072 | USAA | $294 |

| 30058 | Lithonia | $561 | Liberty Mutual | $1,083 | USAA | $285 |

| 30038 | Lithonia | $561 | Liberty Mutual | $1,083 | USAA | $308 |

| 30032 | Decatur | $558 | Liberty Mutual | $1,083 | USAA | $284 |

| 30034 | Decatur | $558 | Liberty Mutual | $1,083 | USAA | $297 |

| 30079 | Scottdale | $557 | Liberty Mutual | $1,125 | USAA | $261 |

| 30331 | Atlanta | $555 | Liberty Mutual | $1,072 | USAA | $296 |

| 30316 | Atlanta | $554 | Liberty Mutual | $1,094 | USAA | $314 |

| 30318 | Atlanta | $552 | Liberty Mutual | $1,094 | USAA | $324 |

| 30312 | Atlanta | $552 | Liberty Mutual | $1,094 | USAA | $295 |

| 30313 | Atlanta | $549 | Liberty Mutual | $1,191 | Geico | $283 |

| 30072 | Pine Lake | $548 | Liberty Mutual | $1,033 | USAA | $295 |

| 30349 | Atlanta | $546 | Liberty Mutual | $1,054 | USAA | $304 |

| 30291 | Union City | $541 | Liberty Mutual | $1,054 | USAA | $320 |

| 30087 | Stone Mountain | $539 | Liberty Mutual | $1,125 | USAA | $293 |

On the other hand, moving to one of the ZIP codes below will result in a cheaper rate.

Least Expensive Georgia Car Insurance Monthly Rates by ZIP Code & Provider

| ZIP Code | City | Average Rate | Most Expensive Company | Most Expensive Rate | Cheapest Company | Cheapest Rate |

|---|---|---|---|---|---|---|

| 31699 | Moody A F B | $331 | Liberty Mutual | $768 | Geico | $175 |

| 31605 | Valdosta | $331 | Liberty Mutual | $768 | Geico | $175 |

| 31606 | Valdosta | $335 | Liberty Mutual | $768 | Geico | $193 |

| 31632 | Hahira | $335 | Liberty Mutual | $768 | Geico | $187 |

| 31698 | Valdosta | $336 | Liberty Mutual | $768 | Geico | $177 |

| 31602 | Valdosta | $337 | Liberty Mutual | $768 | Geico | $177 |

| 31601 | Valdosta | $338 | Liberty Mutual | $768 | Geico | $192 |

| 31625 | Barney | $340 | Liberty Mutual | $768 | Geico | $195 |

| 31638 | Morven | $341 | Liberty Mutual | $768 | Geico | $195 |

| 31643 | Quitman | $341 | Liberty Mutual | $768 | Geico | $195 |

| 31750 | Fitzgerald | $350 | Liberty Mutual | $768 | Geico | $215 |

| 31783 | Rebecca | $350 | Liberty Mutual | $768 | State Farm | $229 |

| 31079 | Rochelle | $350 | Liberty Mutual | $768 | State Farm | $239 |

| 31629 | Dixie | $351 | Liberty Mutual | $768 | Geico | $227 |

| 31626 | Boston | $351 | Liberty Mutual | $768 | Geico | $205 |

| 31792 | Thomasville | $353 | Liberty Mutual | $768 | Geico | $205 |

| 31757 | Thomasville | $353 | Liberty Mutual | $768 | Geico | $205 |

| 31627 | Cecil | $354 | Liberty Mutual | $768 | Geico | $218 |

| 31620 | Adel | $354 | Liberty Mutual | $771 | Geico | $218 |

| 31778 | Pavo | $357 | Liberty Mutual | $768 | Geico | $218 |

| 31738 | Coolidge | $357 | Liberty Mutual | $768 | Geico | $218 |

| 31558 | Saint Marys | $358 | Liberty Mutual | $752 | Geico | $203 |

| 31714 | Ashburn | $358 | Liberty Mutual | $768 | Geico | $223 |

| 31569 | Woodbine | $358 | Liberty Mutual | $752 | Geico | $203 |

| 31793 | Tifton | $358 | Liberty Mutual | $768 | State Farm | $230 |

Find Your Perfect Coverage: Compare Car Insurance Rates in Your City

Easily compare car insurance rates across various cities in Georgia, including Auburn, Columbus, Senoia, Augusta, Donalsonville, Social Circle, and more. Start now to find the best rates for your needs.

Georgia Auto Insurance Cost by City

Finding the right car insurance doesn’t have to be complicated. With our comprehensive comparison tool, you can quickly and easily explore options in cities like Donalsonville, Social Circle, Tallapoosa, and more, ensuring you get the protection you need at a price that fits your budget.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Best Georgia Car Insurance Companies

With the hundreds of car insurance providers out there, it is nearly impossible to know who you can trust or when is the right time to switch (if ever). Let us help you figure that out. Keep reading to get the inside scoop on who the best car insurance companies are (and why) across the Peach State.

How Georgia Car Insurance Companies Compare

Let’s dive right in with financial ratings and a look at the top ten Insurance providers in Georgia…

The 10 Largest Georgia Car Insurance Companies’ Financial Ratings

Exploring the financial stability of car insurance providers in Georgia is crucial for making informed decisions. This guide ranks the ten largest car insurance companies by their A.M. Best ratings, offering a clear snapshot of their fiscal health.

Top 10 Largest Georgia Car Insurance Companies by Market Share

| Rank | Insurance Company | Market Share | A.M. Best | J.D. Power |

|---|---|---|---|---|

| #1 | State Farm | 18% | B | 835 |

| #2 | Geico | 13.30% | A++ | 862 |

| #3 | Progressive | 13.30% | A+ | 862 |

| #4 | Allstate | 9.10% | A+ | 870 |

| #5 | USAA | 6.30% | A++ | 909 |

| #6 | Liberty Mutual | 4.70% | A | 876 |

| #7 | American Family | 2.10% | A | 889 |

| #8 | Nationwide | 2.10% | A+ | 809 |

| #9 | Travelers | 2.08% | A++ | 810 |

| #10 | Auto-Owners | 1.34% | A++ | 826 |

Sometimes it’s more important to know what people are saying about these companies than it is to know the financial data. You’re the customer, after all, and you need to be treated well. Read on to find out what other customer experiences have been like…

Georgia’s Car Insurance Companies With the BEST Customer Ratings

J.D. Powers and Associates in 2018 ranked Farm Bureau Insurance Tennessee the highest for customer satisfaction in the southeast. That’s a rather surprising result, seeing as how it beat out the big-name companies.

J.D. Power Business Consultant says that cost is not the sole indicator of customer satisfaction in the auto insurance industry. Low prices may attract new customers, but it is the service that keeps them.

As important as knowing which companies are satisfying to customers, though, is knowing which have disappointed. Customer complaints are telling, and you may want to avoid car insurance companies that have a record of accruing a lot of them. Here’s a break-out of customer complaints against the major insurance providers in Georgia:

Number of Auto Insurance Complaints by Top Georgia Provider

| Insurance Company | Complaints 2023 | Complaints 2022 | Complaints 2021 | Complaints 2020 |

|---|---|---|---|---|

| Allstate | 145 | 158 | 132 | 110 |

| Auto-Owners | 42 | 38 | 36 | 33 |

| Geico | 190 | 210 | 180 | 175 |

| Georgia Farm Bureau | 52 | 49 | 47 | 45 |

| Liberty Mutual | 180 | 200 | 165 | 150 |

| Nationwide | 160 | 155 | 140 | 130 |

| Progressive | 210 | 220 | 205 | 190 |

| State Farm | 165 | 170 | 160 | 150 |

| Travelers | 55 | 60 | 58 | 55 |

| USAA | 50 | 52 | 50 | 45 |

Sometimes complaints are balanced by overall customer satisfaction, too. Be sure to account for all factors as you’re shopping around.

Commute Rates by Company in GA

In Georgia, commute rates vary significantly across different insurance companies, influencing both cost and coverage options for drivers. This analysis explores how these rates are structured and which companies offer the most competitive prices.

Understanding the commute rates by companies in Georgia allows drivers to make informed decisions about their car insurance. By comparing these rates, motorists can choose the insurance provider that best meets their needs and budget.

Laws in Georgia

To keep your car insurance rates low, you have to know the laws in your state so you’re not blindsided by a fine. Don’t worry. We’re here to help. Keep reading to learn about the laws specific to the state of Georgia.

Georgia’s Car Insurance Laws

Georgia has several specific laws unique to their state, so be aware (especially if you’re a new resident or just passing through). One such law is a ban on all hand-held devices for all drivers and a no cell phone policy for drivers under the age of 18. Georgia also enforces red-light stopping in some cities through the use of traffic cameras.

High-Risk Insurance in Georgia

Sometimes, bad things happen to you on the road and your record ends up being less-than-stellar. In Georgia, those in need of high-risk auto insurance must get an SR-22A form as SR-22 car insurance.

Here are some reasons Georgia drivers need an SR-22A once they’re driving privileges are reinstated:

- License suspension or revocation due to a DUI

- Being involved in an accident without insurance

- Getting labeled a negligent operator

- Having too many points on your driving record

If you’re a high-risk driver and unable to find coverage through the free market, Georgia has a provision for you (dating back to 1949). It’s called Georgia Automobile Insurance Plan.

Georgia’s Windshield and Glass Repair Laws

It’s almost a given that at some point you will end up with a cracked windshield. So does Georgia offer any legal provisions for whether or not insurers have to cover your repairs with broken windshield car insurance? The answer is not exactly.

Geico leads the way in Georgia with the most competitive rates for both minimum and full coverage, making it the top choice for budget-conscious drivers.

Brad Larson Licensed Insurance Agent

In Georgia, insurance companies have the option of offering to repair your windshield with aftermarket and used parts as long as you agree. If you decline, you then agree to pay the difference in the cost of repairs to your windshield. This option usually falls under comprehensive car insurance plans.

Read More: Compare SR-22 Car Insurance: Rates, Discounts, & Requirements

The Statute of Limitations in Georgia

If you get into an accident and your claim to what happened is disputed, you must be informed as to what the statute of limitations laws are in your state.

Georgia Statute of Limitations for Civil Lawsuits

| Lawsuit Type | Time Length |

|---|---|

| Personal Injury | 2 Years |

| Property Damage | 4 Years |

The statute of limitations in Georgia provides specific time limits for legal actions: two years for personal injury claims and four years for property damage claims. Knowing these deadlines is essential for protecting your rights and ensuring that your legal actions are timely.

Georgia’s Vehicle Licensing Laws

Navigating the roadways legally in Georgia requires a valid driver’s license, along with adherence to the state’s vehicle licensing laws. This guide will provide you with essential information on what is required to ensure your vehicle registration remains in good standing. Keep reading to find out what Georgia’s mandatory licensing laws are:

- Suspended registration with a $25 lapse fee and a $60 reinstatement fee. Pay any other registration fees and vehicle ad valorem taxes due

- Within Five Years: Suspended registration with a $25 lapse fee and $60 reinstatement fee. Pay any other registration fees and vehicle ad valorem taxes due

Georgia is also one of a growing number of states that allow electronic proof of insurance. Vehicle owners or leasees are required by state law to:

- Maintain continuous Georgia liability insurance coverage on vehicles with active registrations

- Immediately cancel the vehicle registration for any vehicle no longer in service

- Not drive or let anyone else drive a vehicle that does not have a valid vehicle registration and Georgia liability insurance coverage

Georgia’s progressive insurance regulations emphasize the importance of continuous liability coverage and valid vehicle registration to ensure all vehicles on the road are legally protected and registered.

Teen Driver Laws in Georgia

In Georgia, teen driving laws exhibit distinct differences compared to other states, encompassing various stages from learner’s permits to full licensure. Understanding these regulations is crucial for young drivers and their guardians as they navigate the path to safe and legal driving. Here’s what you need to know in Georgia:

Teen Driver Laws in Georgia

| Licensing System | First Requirement | Second Requirement | Third Requirement |

|---|---|---|---|

| To get a learners license you must: | Have a minimum age of 15 | NA | NA |

| Before getting a license or restricted license you must: | Have a mandatory holding period of 12 months | Have a minimum supervised driving time of 40 hours, six of which must be at night | Have a minimum age of 16 |

| Restrictions during intermediate or restricted license stage: | Nighttime restrictions – midnight to 5 a.m. secondary enforcement | Passenger restrictions (family members excepted unless otherwise noted) – first six months — no passengers; second six months — no more than one passenger younger than 21; thereafter, no more than three passengers secondary enforcement | NA |

| Minimum age at which restrictions may be lifted: | Nighttime restrictions – until age 18 (min. age: 18) | Passenger restrictions – until age 18 (min. age: 18) | NA |

Navigating teen driver laws in Georgia involves adhering to specific age and experience requirements across multiple licensing stages. Once these prerequisites are met, the subsequent focus shifts to securing appropriate car insurance for teenagers, marking their transition into responsible driving.

License Renewal Procedures and Older Drivers in Georgia

Georgia’s license renewal procedures for the general population and older drivers are pretty straightforward.

The license renewal process in Georgia ensures that all drivers, regardless of age, adhere to the same eight-year renewal cycle. This consistency helps maintain both convenience and safety on the road for everyone.

New Residents or People Visiting Georgia

As a new resident or visitor, it’s important to familiarize yourself with some unique aspects of the state’s regulations, especially when it comes to navigating the roads and understanding local laws. Here are a few of the things unique to the Peach State:

- Georgia doesn’t have a traditional DMV, but rather two agencies that handle motor vehicles: the Department of Driver Services (DDS) and the Department of Revenue (DOR). DDS handles things like licensing, permits, and ID cards, and DOR handles registration, taxes, and plates.

- Georgia has a move-over law that requires you to move over to emergency vehicles on the side of the road. Violation of this law is the same as a moving violation and can incur a ticket of up to $500.

- Unless you want a $150 fine, texting while driving is prohibited. In cases of emergency it can be allowed, but keep those phones away and on silent when passing through Georgia.

Georgia’s unique vehicle management laws and strict road safety regulations emphasize the importance of adhering to local requirements and leveraging conveniences like electronic proof of insurance for both residents and visitors.

Georgia Rules of the Road

Whether you’re a resident or just passing through, it’s important to know the rules of the road. Take a peek at this basic rundown to make sure you are following the law:

Fault vs. No-Fault

Georgia is an at-fault state. This means you’ll be held liable for damages in an accident where you are the at-fault driver. Make sure you have a good liability policy in place to protect yourself against risks.

Keep-Right Laws in Georgia

Georgia does have keep-right laws. If you are impeding faster traffic in the left lane, you are to yield to the faster traffic and move to the right.

Speed Limits in Georgia

The maximum speed limit on interstates, both rural and urban, across the state of Georgia is 70 mph. On other roads, it is 65 mph.

Child Safety Laws in Georgia

All children aged 7 and under 57 inches tall or less must be in a child restraint in the state of Georgia while riding in a moving vehicle. Over 57 inches tall, they may wear an adult safety belt. Children aged 7 and under must sit in the rear of the vehicle if a rear seat is available.

Be sure to restrain your children properly — their safety should be your first priority, but you should also be aware that Georgia imposes fines up to $50 for a first offense (increasing on repeat offenses).

Georgia also has restrictions on young people riding in cargo areas. Another thing to consider regarding children in Georgia: The Peach State tragically sees more child fatalities from heatstrokes in cars than almost any other state in the nation.

Ridesharing in Georgia

In 2017, ridesharing services like Lyft and Uber won a victory in the state of Georgia when a court upheld a law allowing them to exist and denying exclusive rights to taxi services.

But what about rideshare car insurance? What happens if your ridesharing driver gets into an accident while you’re in the vehicle?

A 2015 law passed in Georgia requires all ridesharing companies to carry a minimum of $1 million in coverage for “personal injury accident claims, property damage, and death.” So don’t worry, should the worst happen while taking an Uber or a Lyft, you’re covered.

Automation on the Roads in Georgia

What is automation on the roads? Automation is the use of a machine or technology to perform a task or function that was previously carried out by a human. In other words, self-driving or autonomous vehicles (or autonomous functions in vehicles).

This sort of technology requires careful testing and regulation, but laws will vary from state to state. Georgia does allow for the deployment of autonomous vehicles on their roadways. Here’s what else you need to know about what is currently allowed on the roads in Georgia:

- Georgia does not require a licensed operator for a ‘fully autonomous vehicle’ when the ‘automated driving system’ is engaged

- Georgia does not require the operator to be in a ‘fully autonomous vehicle’ when the ‘automated driving system’ is engaged

- Autonomous vehicles in Georgia do require liability insurance

In Georgia, the integration of technology in driving, from accepting electronic proof of insurance to permitting autonomous vehicles on roads without a licensed operator present, illustrates the state’s progressive approach to automotive regulations and safety.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

These Facts Might Raise Your Eyebrow

Have you wondered why how safe is Georgia? Listen we all know there are crazy drivers on the road, but we want to keep you informed so you can avoid the crazies and protect what’s most important.

Vehicle Theft in Georgia

Vehicle theft remains a significant issue in Georgia, where certain car models are more likely to be targeted by thieves. This list highlights the top ten stolen cars in the state, shedding light on trends that can inform owners and prospective buyers. Here are the top ten stolen cars in the state of Georgia:

Top 10 Stolen Cars in Georgia by Model

| Make/Model | Year | # of Thefts |

|---|---|---|

| Ford Pickup (Full Size) | 2006 | 1,152 |

| Chevrolet Pickup (Full Size) | 2020 | 703 |

| Nissan Altima | 2017 | 621 |

| Toyota Camry | 2019 | 581 |

| Honda Accord | 1997 | 1,052 |

| Chevrolet Pickup (Full Size) | 1999 | 948 |

| Honda Civic | 2000 | 653 |

| Toyota Corolla | 2018 | 550 |

| Jeep Cherokee/Grand Cherokee | 2001 | 449 |

| Dodge Charger | 2018 | 440 |

Understanding which vehicles are most at risk of theft in Georgia can help car owners take preventative measures to protect their property. Awareness and proactive security measures are key to combating this persistent issue.

Transportation

If you live in Georgia, chances are you live in a 2-car (or more) household, drive alone to work, and spend a hefty amount of your day commuting.

Choosing Geico means accessing the lowest car insurance rates in Georgia, coupled with the assurance of excellent customer service.

Tracey L. Wells Licensed Insurance Agent & Agency Owner

With an average commute time of 26.9 minutes, Georgia ranks above the national average, and with over 70% (79.3, to be exact) of the population driving alone, that commute doesn’t exactly rank Georgia as the greenest option when it comes to carbon emissions. Discover insights in our guide titled “Traffic Tickets that Raise Car Insurance Rates.”

Finding cheap car insurance quotes is easy. Just enter your ZIP code into our free comparison tool below to instantly compare quotes near you.

Frequently Asked Questions

What are the minimum car insurance requirements in Georgia?

Georgia requires liability car insurance with minimum coverage amounts of 25/50/25. This covers property damage and injuries caused by you or anyone under your policy.

To find out more, explore our guide titled “Finding Free Car Insurance Quotes Online.”

What forms of financial responsibility are accepted in Georgia?

Georgia accepts six forms of proof of liability coverage, including insurance cards, policy declarations, and electronic proof of insurance.

How much does car insurance cost in Georgia?

On average, car insurance rates in Georgia are around $87.37 per month. However, rates vary based on factors such as location, coverage options, and driving record.

Need the cheapest car insurance possible? Enter your ZIP code below into our free comparison tool to find the most affordable rates for your vehicle.

Should I consider additional coverage options?

While not required, it’s recommended to consider additional coverage options such as uninsured/underinsured motorist coverage and medical payments coverage to protect against unforeseen accidents.

To learn more, explore our comprehensive resource on “What is the minimum amount of liability car insurance coverage required?“

How do Georgia car insurance rates vary by city and ZIP code?

Car insurance rates can vary depending on the city and ZIP code in Georgia. Some areas may have higher rates due to factors like population density and accident frequency.

Which car insurance is the least expensive in Georgia?

Geico, State Farm, Progressive, Allstate, and USAA are the cheapest big car insurance companies in Georgia.

How much do people pay for car insurance in Georgia each month?

On average, the monthly cost for minimum coverage is $50, and full coverage is about $103.

Which company usually offers the lowest car insurance rates?

State Farm typically offers the lowest rates at $50 per month for liability-only insurance. American Family and Geico also have low rates, averaging $61 per month. USAA generally has the lowest rates at $34 per month.

Learn more in our “Is it cheaper to purchase car insurance online?”

Why is car insurance expensive in Georgia?

A recent study showed that car insurance rates in Georgia increased by 22% due to more accidents, higher costs for damages and medical claims, and more car thefts and break-ins.

At what age does car insurance become cheaper in Georgia?

There isn’t a specific age when rates drop, but insurers usually charge more for drivers under 25.

Explore your car insurance options by entering your ZIP code below and finding which companies have the lowest rates.

What does full coverage car insurance include in Georgia?

Full coverage includes liability, collision, and comprehensive insurance, and often extras like roadside help and uninsured motorist protection.

What’s the cheapest type of car insurance?

Fully comprehensive insurance is usually the cheapest, though individual circumstances can affect prices.

For additional details, explore our comprehensive resource titled “Best Car Insurance for Modified Cars.”

How much does full coverage car insurance cost per month in Georgia for drivers who’ve had an accident?

Farm Bureau offers the lowest average at about $137 per month, Central Insurance at about $140 per month, and Auto-Owners at about $186 per month.

How long can you go without car insurance in Georgia?

You have 30 days to show proof of new insurance if your previous insurance has expired, as the state keeps track electronically.

Is Georgia a no-fault state for car insurance?

No, Georgia is not a no-fault state; you must prove who was at fault in an accident before insurance pays for damages or injuries.

Access comprehensive insights into our guide titled “Compare No-Fault Car Insurance: Rates, Discounts, & Requirements.”

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Kalyn Johnson

Insurance Claims Support & Sr. Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she has similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Insurance Claims Support & Sr. Adjuster

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.