Best Car Insurance for Drivers Under 25 in 2025 (Top 10 Companies)

Find the best car insurance for drivers under 25 with Progressive, USAA, and State Farm offering discounts up to 30%. Assess factors that impact rates to make well-informed decisions regarding efficient vehicle coverage and discover how coverage options and pricing change as drivers approach 25 years of age.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michael Vereecke

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Commercial Lines Coverage Specialist

UPDATED: Feb 17, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 17, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for 25-Year-Olds

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for 25-Year-Olds

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for 25-Year-Olds

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsThe best car insurance for drivers under 25 are Progressive, USAA, and State Farm, by evaluating key factors such as credit score, mileage, coverage, and driving record. Make an informed decision by taking into account diverse elements, including military savings and available discounts.

When needing car insurance for those under 25 years old, it means car insurance shopping is one of the first lessons where being an adult isn’t necessarily easy or cheap.

Our Top 10 Company Picks: Best Car Insurance for Drivers Under 25

| Company | Rank | Multi-Policy Discount | Low-Mileage Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | 30% | Online Convenience | Progressive | |

| #2 | 10% | 20% | Military Savings | USAA | |

| #3 | 17% | 30% | Many Discounts | State Farm | |

| #4 | 25% | 30% | Add-on Coverages | Allstate | |

| #5 | 25% | 25% | Cheap Rates | Geico | |

| #6 | 25% | 15% | Customizable Polices | Liberty Mutual |

| #7 | 20% | 30% | Usage Discount | Nationwide |

| #8 | 8% | 20% | Accident Forgiveness | Travelers | |

| #9 | 25% | 15% | Local Agents | AAA |

| #10 | 29% | 15% | Student Savings | American Family |

Facing the question, “How old do you have to be to own a car?” is a common rite of passage for many young adults. They often find themselves grappling with the financial responsibilities associated with the risks posed by their peer group. Compare car insurance quotes for young drivers by entering a ZIP code now.

- Progressive, USAA, and State Farm are the best companies for 25-year-old drivers

- Evaluating credit score, mileage, coverage, and driving record is crucial

- Providers offer online convenience and family-friendly coverage

#1 – Progressive: Top Overall Pick

Pros

- Competitive Rates: Progressive offers competitive rates, making it a cost-effective option for many drivers.

- Online Convenience: The company stands out for its user-friendly online platform, allowing customers to manage policies conveniently.

- Financial Strength: A.M. Best rating of A reflects Progressive’s strong financial stability. As mentioned in our Progressive car insurance review.

Cons

- Varied Customer Experience: Some customers may have varied experiences with Progressive, as with any large insurer.

- Coverage Limitations: The coverage options may not be as extensive or customizable compared to other providers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Savings

Pros

- Military Savings: USAA is renowned for offering significant discounts to military members and their families.

- High Financial Rating: A+ A.M. Best rating underlines the company’s excellent financial stability.

- Low Complaint Level: USAA maintains a low complaint level, indicative of customer satisfaction. Learn more in our USAA car insurance review.

Cons

- Eligibility Restrictions: Only available to military members, veterans, and their families.

- Limited Branch Locations: USAA primarily operates online and via phone, which may be a drawback for those who prefer in-person interactions.

#3 – State Farm: Best for Many Discounts

Pros

- Many Discounts: As outlined in our State Farm car insurance review, they offer a variety of discounts, providing opportunities for policyholders to save money.

- High Financial Rating: A+ A.M. Best rating signifies the company’s financial strength.

- Low Complaint Level: Demonstrates a low complaint level, indicating customer satisfaction.

Cons

- Potentially Higher Rates: Some customers may find State Farm’s rates to be slightly higher compared to other insurers.

- Coverage Options Complexity: The multitude of discounts and coverage options might be overwhelming for some customers.

#4 – Allstate: Best for Add-on Coverages

Pros

- Add-on Coverages: As outlined in our Allstate car insurance review, they stand out for its extensive range of add-on coverages.

- High Maximum Discounts: Offers substantial multi-policy and low-mileage discounts, up to 25% and 30% respectively.

- Strong Financial Rating: A+ A.M. Best rating reflects Allstate’s financial stability.

Cons

- Higher Premiums: Some customers may find Allstate’s premiums to be on the higher side.

- Mixed Customer Service Reviews: While many customers are satisfied, some have reported mixed experiences with customer service.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#5 – Geico: Best for Cheap Rates

Pros

- Cheap Rates: Geico is known for providing some of the most affordable rates in the industry.

- Ease of Online Management: The company offers a user-friendly online platform for policy management. Learn more in our Geico car insurance review.

- Financial Strength: Geico maintains a strong financial standing with a high A.M. Best rating.

Cons

- Limited Agent Interaction: Geico’s focus on online services may not be suitable for those who prefer in-person agent interactions.

- Customer Service Perception: While efficient, some customers report experiences where the service could be more personalized.

#6 – Liberty Mutual: Best for Customizable Policies

Pros

- Customizable Policies: Liberty Mutual allows for customizable policies to meet individual needs.

- Financial Stability: The company boasts a strong A.M. Best rating, indicating financial strength.

- Usage Discount: Offers a usage-based discount, providing potential savings for safe drivers.

Cons

- Potentially Higher Premiums: Some customers may find Liberty Mutual’s premiums to be higher compared to other insurers. Learn more about their rates in our Liberty Mutual car insurance review.

- Limited Low-Mileage Discount: The maximum low-mileage discount may be lower than some competitors.

#7 – Nationwide: Best for Usage Discount

Pros

- Usage Discount: Nationwide offers a usage-based discount, encouraging safe driving habits.

- Strong Financial Rating: A+ A.M. Best rating highlights Nationwide’s financial stability.

- Variety of Discounts: Nationwide offers a variety of discounts catering to different customer profiles. (Read more: Nationwide Car Insurance Discounts)

Cons

- Average Customer Service: Some customers report average experiences with Nationwide’s customer service.

- Potentially Higher Rates for Certain Profiles: Rates may be higher for specific demographics or driving histories.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#8 – Travelers: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Travelers provides accident forgiveness options for qualifying policyholders.

- Financial Strength: The company holds a strong A.M. Best rating, indicating financial stability.

- Ease of Online Management: Travelers offers user-friendly online tools for policy management.

Cons

- Limited Low-Mileage Discount: The maximum low-mileage discount may be lower compared to some competitors.

- Mixed Customer Service Reviews: Some customers report varying experiences with Travelers’ customer service. Learn more about their reviews in our Travelers car insurance review.

#9 – AAA: Best for Local Agents

Pros

- Local Agents: AAA’s focus on local agents allows for personalized and in-person service.

- Membership Benefits: AAA members can enjoy additional benefits beyond car insurance.

- High Maximum Discounts: Provides substantial multi-policy and low-mileage discounts, up to 25% and 15% respectively.

Cons

- Membership Requirement: Access to AAA’s insurance requires membership, which comes with additional costs. Find out their membership fees in our AAA car insurance review.

- Potentially Higher Premiums: Some customers may find AAA’s premiums to be on the higher side.

#10 – American Family: Best for Student Savings

Pros

- Student Savings: American Family offers student savings, making it appealing for young drivers.

- High Maximum Discounts: Provides significant multi-policy and low-mileage discounts, up to 29% and 15% respectively.

- Wide Range of Coverage Options: American Family car insurance offers a variety of coverage options to meet individual needs.

Cons

- Potentially Higher Premiums: Some customers may find American Family’s premiums to be higher compared to other insurers.

- Mixed Customer Reviews: While many customers are satisfied, there are mixed reviews regarding customer service experiences.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

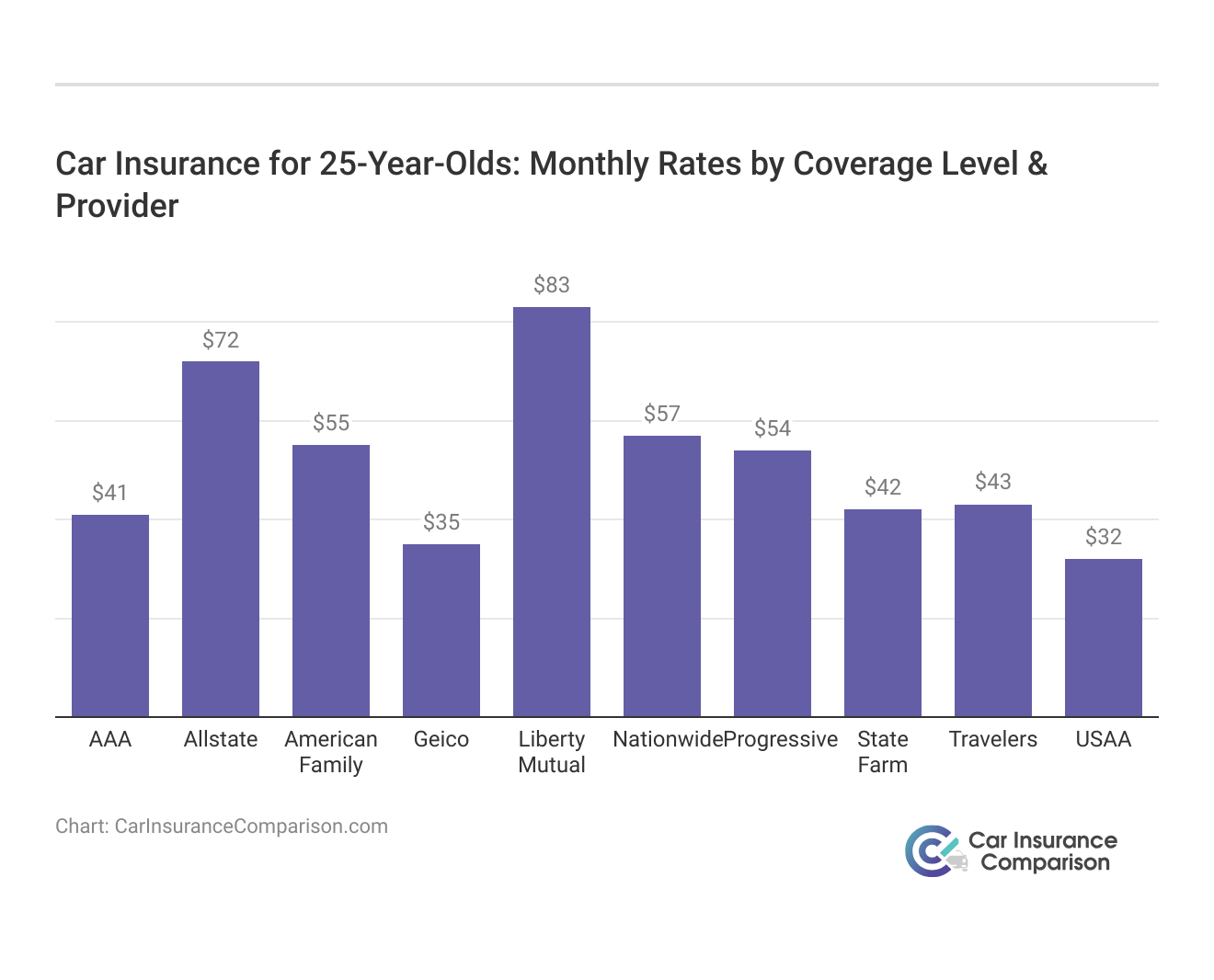

Comparing Car Insurance Rates for 25-Year-Old Drivers With the Top 10 Companies

When it comes to car insurance for 25-year-old drivers, making an informed decision is crucial. Below is a detailed comparison of the best insurance companies, examining both minimum and full coverage rates. Aiming for Full Coverage? Get more insights in our “Best Full Coverage Car Insurance“.

25-Year-Olds Car Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $41 | $110 |

| $72 | $190 | |

| $55 | $147 | |

| $35 | $93 | |

| $83 | $215 |

| $57 | $150 |

| $54 | $146 | |

| $42 | $111 | |

| $43 | $116 | |

| $32 | $85 |

Among the all the companies, Progressive stands out as it offers competitive rates, with minimum coverage at $54 and full coverage at $146. USAA follows closely, providing affordability with minimum coverage at $32 and full coverage at $85. State Farm, with minimum coverage at $42 and full coverage at $111, combines competitive pricing with a solid reputation.

Progressive stands out as the top choice for 25-year-old drivers, offering competitive rates, online convenience, and a multi-policy discount for maximum savings.

Brad Larson Licensed Insurance Agent

Balancing cost-effectiveness and coverage, these three companies are noteworthy choices for 25-year-olds seeking reliable and reasonably priced insurance.

Car Insurance Rates for Drivers Under 25 can be Lowered

While insurance requirements can be a rude awakening, there are ways to minimize the pain. Some areas to consider are:

- Driver Training: Car insurance costs less if you attend a certified driver training courses.

- Driving Record: A clean driving record without tickets will have a positive effect on insurance rates. (For more information, read our “Do all car insurance companies check your driving records?“)

- Location: Insurance rates are higher in large metropolitans than they are in rural, unpopulated areas.

Read more: Compare Car Insurance Rates for College Students

Where, When, and Why You Drive

Another factor that can have an impact on cost is the type of driving to be done. Occasional driving for pleasure is going to be less expensive than using the car to commute back and forth to work or school.

Should there be a serious accident, insurance companies will investigate an insured’s driving habits to see if what they claimed coincides with the facts.

In addition to the type of driving, the amount of driving will influence insurance rates. The fewer miles driven, the lower your rates will be. Probability shows that the more miles. Probability shows that the more miles driven, the greater the likelihood of an accident.

Read more: Cheap Car Insurance for Occasional Drivers

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Who You are Impacts Car Insurance Rates

Married couples generally pay less for insurance than their single counterparts. Additionally, having a child can positively impact car insurance rates. Even more than getting married, having children drives home the idea that this young adult is not living just for themselves.

Car insurance companies know the sobering impact that taking responsibility for another human life has on most new parents. They anticipate a more cautious approach to driving, and risk aversion is worth money.

Read more: Can married couples have separate car insurance policies?

What You Drive: Car Type and Insurance Rate

Simply put the type of car you drive impacts car insurance rates, as it provides the insurance company with a strong indicator of the way that person plans to drive. In addition, insurance companies will look at:

- Horsepower

- Vehicle weight

- Crash history

- Theft history

- Historical repair costs

Making a wise choice in the vehicle to be insured can seriously impact the cost of insurance. As we can see, it is not all bad news for drivers needing car insurance under 25 years old.

By carefully considering the type of car you drive and other relevant factors, you can take proactive steps to mitigate insurance costs. Whether you’re seeking coverage for a sleek sports car or a reliable sedan, understanding how your vehicle choice influences insurance rates empowers you to make informed decisions.

What is the best car insurance for under 25 year olds? Enter your ZIP code into the free rates tool and compare car insurance quotes now.

Case Studies: Navigating Car Insurance for 25-Year-Olds

The following case studies offer insights into the experiences of three different individuals in this age group, each choosing a different insurance provider. By examining their stories, we can understand how Progressive, USAA, and State Farm cater to the specific requirements and preferences of young adults.

- Case Study 1 – Progressive’s Online Ease in Action: Meet Alex, a 25-year-old professional with a hectic schedule. Alex values online convenience and competitive rates. Facing a coverage decision, Alex explores Progressive’s user-friendly platform, seamlessly managing policies at any time. The multi-policy discount offered by Progressive adds an extra layer of savings, making it an ideal choice for Alex’s dynamic lifestyle.

- Case Study 2 – USAA’s Honoring Service and Affordability: Sarah, a 25-year-old military member, seeks car insurance that reflects her commitment to service. USAA becomes the natural choice, offering significant military savings and affordable rates for good drivers. Sarah appreciates the personalized approach, aligning with her values and providing comprehensive coverage.

- Case Study 3 – State Farm’s Comprehensive Savings for Young Families: Chris, a 25-year-old parent, prioritizes family-friendly coverage and discounts. State Farm’s extensive agent network becomes a valuable resource for Chris. The multi-policy discount and array of coverage options cater to Chris’s diverse needs. Despite potentially higher rates, the peace of mind and personalized service make State Farm the top choice for this young family.

Whether it’s the convenience and savings offered by Progressive, the service and affordability provided by USAA, or the comprehensive coverage and family-friendly options from State Farm, each company excels in its respective strengths. By considering the experiences of Alex, Sarah, and Chris, other 25-year-old drivers can make informed decisions when choosing the right car insurance provider for their own lifestyles and needs.

Frequently Asked Questions

What factors should 25-year-old drivers consider when navigating car insurance choices?

25-year-olds should assess crucial factors like credit score, mileage, coverage level, and driving record. Progressive, USAA, and State Farm excel by offering advantageous rates for varied customer profiles.

Why are Progressive, USAA, and State Farm recommended as the top choices for 25-year-old drivers?

These companies stand out for providing competitive rates, diverse coverage options, military savings (USAA), and various discounts. Their strengths cater to the specific needs and preferences of 25-year-old drivers.

Are there specific advantages for military members among the top recommended companies?

Yes, as mentioned in our USAA car insurance review, they offer significant military savings and affordable rates for good drivers. This personalized approach aligns with the values of military members, providing comprehensive coverage and affordability.

How does Progressive’s online convenience benefit a 25-year-old professional with a busy schedule?

Progressive’s user-friendly online platform allows seamless policy management at any time. The additional multi-policy discount enhances savings, making it an ideal choice for those with dynamic lifestyles.

What strategies can 25-year-olds use to lower their car insurance premiums?

25-year-old drivers can consider increasing their deductibles, bundling policies, maintaining a clean driving record, and taking advantage of discounts such as multi-vehicle policies and good student discounts.

Get the right car insurance at the best price — enter your ZIP code below to shop for coverage from the top insurers.

What makes State Farm a preferred choice for 25-year-old parents seeking family-friendly coverage?

State Farm’s extensive agent network becomes a valuable resource for parents. With a multi-policy discount and a range of coverage options, State Farm caters to diverse family needs, prioritizing peace of mind and personalized service. (For more information, read our “State Farm Car Insurance Review“)

How do 25-year-old drivers benefit from usage-based insurance options?

Usage-based insurance can benefit 25-year-old drivers by tracking their driving habits and offering personalized rates based on safe driving behaviors, leading to potential savings.

What are the common coverage options for 25-year-old drivers?

Common coverage options include liability coverage, collision coverage, comprehensive coverage, and uninsured/underinsured motorist coverage. Drivers should assess their needs to choose the most appropriate options.

Read more: Compare Liability Car Insurance: Rates, Discounts, & Requirements

How do local laws and regulations impact insurance rates for 25-year-olds?

Local laws and regulations can influence the required minimum coverage levels and potential penalties for lack of insurance. These factors can affect rates and choices for 25-year-old drivers.

Why should 25-year-old drivers compare quotes from multiple insurance providers?

Comparing quotes from multiple providers allows 25-year-old drivers to find the best combination of coverage and cost, ensuring they receive the most value for their insurance premium.

Ready to find cheaper car insurance coverage? Enter your ZIP code below to begin.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Michael Vereecke

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Commercial Lines Coverage Specialist

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.