Best Car Insurance Companies for Financed Cars in 2025

Progressive, State Farm, and Allstate are the top providers for the best car insurance companies for financed cars, stand out with rates as low as $27 per month. These companies offer tailored coverage specifically designed to protect your financed vehicle against a range of risks and uncertainties.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

UPDATED: Jan 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Financed Cars

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Financed Cars

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for Financed Cars

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviewsProgressive, State Farm, and Allstate are the leading providers for the best car insurance companies for financed cars, offering low rates and wide range of tailored coverage options.

From comprehensive protection against accidents and theft to customizable policy features that meet your specific needs, these companies ensures that your financed vehicle is well-protected at an affordable price.

Our Top 10 Company Picks: Best Car Insurance Companies for Financed Cars

| Company | Rank | New Car Discount | Gap Coverage Discounts | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 12% | 18% | Multi-Policy Discount | Progressive | |

| #2 | 15% | 20% | Gap Coverage | State Farm | |

| #3 | 18% | 22% | Car Replacement | Allstate | |

| #4 | 12% | 18% | Gap Insurance | Nationwide |

| #5 | 10% | 15% | Mechanical Breakdown | Geico | |

| #6 | 12% | 18% | Replacement Coverage | Liberty Mutual |

| #7 | 18% | 22% | RecoverCare Assistance | The Hartford |

| #8 | 15% | 20% | Additional Discounts | Travelers | |

| #9 | 12% | 18% | Financing Coverage | Safeco | |

| #10 | 10% | 15% | Local Agents | Farmers |

This article dives into choosing the perfect insurance provider, covering both affordability and comprehensive coverage to match your needs. Stop overpaying for car insurance. Our free quote comparison tool allows you to shop for quotes from the top providers near you by entering your ZIP code above.

- Progressive, top for financed cars, starting rate at $27 per month

- Understanding the necessity of full coverage for financed cars is crucial

- Online quote tools help individuals compare rates for their financed vehicles

#1 – Progressive: Top Overall Pick

Pros

- Lease Payoff Coverage: By offering coverage of up to 18% for lease payoff, we ensure financial security by safeguarding against unforeseen circumstances.

- Competitive Rates: Discounts are offered to guarantee competitive rates across various demographics of policyholders, ensuring affordability and value for a wide spectrum of individuals seeking insurance coverage.

- Wide Range of Coverage: Offers diverse coverage choices to suit varying requirements, as outlined in a Progressive car insurance review.

Cons

- Varied Rates: Fluctuations in rates stem from diverse individual factors, thereby influencing the stability of consistency.

- Limited Coverage Options: Some competitors may provide a wider range of coverage options, encompassing a diverse selection tailored to various needs and preferences.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#2 – State Farm: Best for Coverage Mastery

Pros

- Gap Coverage: State Farm car insurance review highlights a significant advantage: offering up to a 20% coverage for gap insurance, particularly advantageous for those with financed vehicles.

- A+ A.M. Best Rating: This feature serves as a testament to State Farm’s robust financial stability and unwavering reliability, reassuring customers of its ability to provide dependable coverage and support in times of need.

- Low Complaint Level: A scarcity of complaints typically signifies high levels of customer satisfaction. When customers have few grievances, it suggests that they are content with the product or service they received.

Cons

- Higher Average Monthly Rates: State Farm’s rates could potentially be somewhat elevated in comparison to those of certain competitors.

- Limited Online Management: Accessing and managing policies online might have restricted options available.

#3 – Allstate: Best for Total Protection

Pros

- Car Replacement Coverage: Ensure thorough protection with Allstate car insurance review, offering up to a 22% coverage for car replacement.

- A+ A.M. Best Rating: This phrase conveys a robust financial standing and unwavering stability, indicative of a solid foundation built on fiscal prowess and resilience.

- Diverse Discounts: This service extends an array of enticing discount opportunities, rendering it exceptionally budget-friendly.

Cons

- Higher Average Monthly Rates: This could be due to various factors such as the level of service provided, the quality of products or services offered, or the specific needs and requirements of those customers.

- Complex Coverage Options: Coverage options may present a vast array of choices, encompassing a wide range of possibilities, yet they might appear intricate or convoluted upon initial examination.

#4 – Nationwide: Best for Comprehensive Assurance

Pros

- Gap Insurance Coverage: Nationwide car insurance discounts reveals they offer up to an 18% coverage for gap insurance, addressing the requirements of financed vehicles.

- Competitive Rates: We provide highly competitive rates, particularly tailored to reward responsible drivers with substantial discounts.

- Nationwide Network: A vast and extensive network of agents strategically positioned for effortless accessibility, ensuring seamless connection and convenience.

Cons

- Limited Customer Reviews: Without a robust collection of feedback from consumers, valuable insights into product performance, user satisfaction, and potential areas for improvement may remain elusive.

- Communication Challenges: These challenges may arise from various factors, such as unclear channels of communication, prolonged response times, or insufficient avenues for addressing concerns.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#5 – Geico: Best for Protection Plus

Pros

- Mechanical Breakdown Coverage: By offering up to 15% coverage for mechanical breakdown, we significantly enhance the comprehensiveness of our protection plans.

- Competitive Rates: Our company prides itself on providing not only competitive rates but also a wide array of discounts to ensure our clients receive the most cost-effective coverage possible.

- Online Policy Management: Geico car insurance review highlights its robust digital platform, enabling convenient policy handling and effortless access for users.

Cons

- Limited Coverage Options: When it comes to coverage options for financed cars, you might find that the choices available are somewhat more restricted than those offered by certain competitors.

- Specific Eligibility Criteria: These criteria often vary depending on the nature of the discount and the policies set forth by the provider.

#6 – Liberty Mutual: Best for Replacement Assurance

Pros

- Replacement Coverage: Enjoy up to an impressive 18% coverage for replacements, offering you the peace of mind of comprehensive protection.

- Competitive Rates: By extending discounts of up to 12%, this service becomes a remarkably cost-effective option for a diverse range of policyholders.

- Variety of Coverage: Offers various coverage choices to accommodate diverse requirements, as seen in Liberty Mutual car insurance review.

Cons

- Varied Rates: Rates may vary based on individual factors, affecting consistency, such as personal preferences, geographical location, market demand, and economic conditions.

- Discount Limitations: While some discounts may be available, it’s important to note that their extent might not always measure up to what competitors offer.

#7 – The Hartford: Best for Assistance Excellence

Pros

- Recover Care Assistance: Beneficiaries can now enjoy an increased coverage of up to 22% for recover care assistance, providing them with invaluable additional support during times of need. To gain further insights, consult our comprehensive guide titled “Vehicle Recovery Car Insurance Discounts.”

- Competitive Rates: Our extensive range of discounts, offering up to 18% off, ensures that our rates remain highly competitive for a diverse array of policyholders.

- Additional Benefits: By incorporating exclusive assistance coverage, our policy goes beyond traditional offerings, providing invaluable support in times of need.

Cons

- Higher Average Monthly Rates: While our rates may appear relatively higher in comparison to certain competitors, it’s important to recognize the value proposition they represent.

- Limited Coverage Options: While our offerings are comprehensive, it’s worth noting that some competitors may present a wider range of coverage options to cater to varying needs and preferences.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#8 – Travelers: Best for Savings Spectrum

Pros

- Additional Discounts: Unlock up to 20% in extra discounts, presenting even more chances to save big and maximize your savings potential.

- Competitive Rates: Travelers car insurance review reveals that it emerges as a highly affordable choice, offering discounts of up to 15% for certain customer profiles.

- Variety of Discounts: Our platform extends an array of discounts that go beyond the conventional, tailoring savings to your individual preferences and needs.

Cons

- Varied Rates: The variability in rates is subject to individual factors, thereby exerting an influence on the level of consistency.

- Limited Coverage Options: While our company provides comprehensive coverage options tailored to your needs, it’s important to acknowledge that some competitors may present a wider range of coverage choices.

#9 – Safeco: Best for Financing Security

Pros

- Financing Coverage: Safeco car insurance review highlights a significant 18% coverage option tailored specifically for financed vehicles, addressing their unique insurance requirements.

- Competitive Rates: By extending discounts of up to 12%, our policy offerings are tailored to be highly cost-effective, catering to the diverse needs of policyholders across the board.

- Positive Customer Reviews: Positive feedback serves as a glowing testament to the satisfaction of customers, embodying their contentment and delight with a product, service, or experience.

Cons

- Varied Rates: Rates may fluctuate based on individual factors, thereby impacting the consistency of the financial landscape.

- Discount Limitations: While certain discounts may be available, it’s essential to note that their scope might not always match up to what competitors offer.

#10 – Farmers: Best for Localized Assurance

Pros

- Local Agents: Offers the convenience of personalized service through local agents for Farmers car insurance reviews.

- Competitive Rates: With discounts of up to 15% available, our product becomes not just a purchase, but a smart investment, especially for certain customer profiles.

- Variety of Coverage: Our service extends a comprehensive array of coverage options meticulously designed to accommodate a diverse spectrum of needs.

Cons

- Higher Average Monthly Rates: While our rates might appear relatively higher compared to some of our competitors, it’s important to consider the comprehensive value proposition we offer.

- Limited Online Management: When it comes to managing policies online, users may find that their options are somewhat restricted.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Top Car Insurance Companies for Financed Cars

If you’re not sure where to shop for car insurance, you should start with the best insurance companies in the United States. Here’s a list of the top car insurance companies in the nation and their average monthly rates. USAA is the cheapest car insurance company, but it is only available to military veterans and their immediate families.

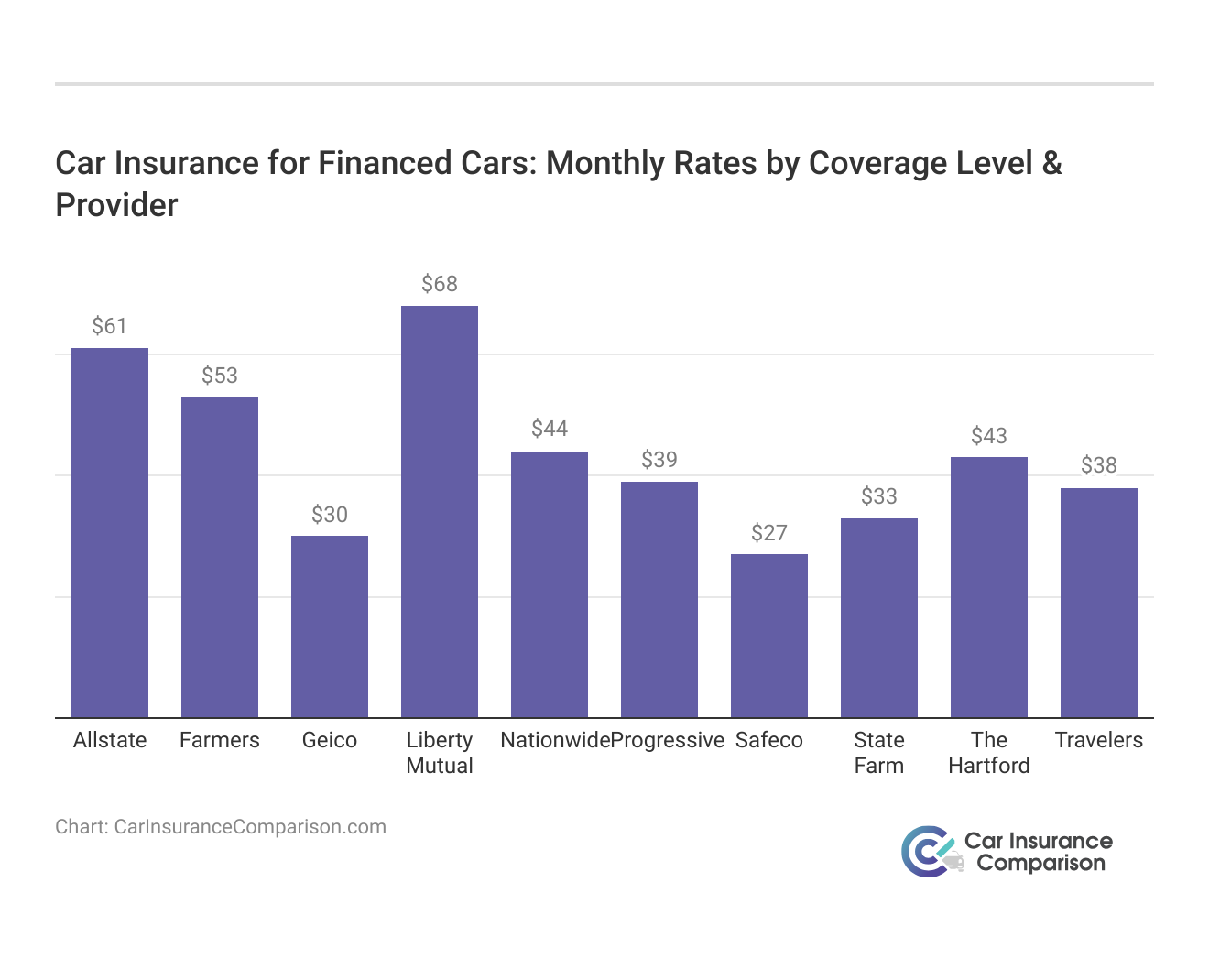

Understanding the nuances of car insurance rates for financed vehicles is pivotal when making informed choices. Examining the average monthly rates reveals distinctive patterns among leading providers. Progressive presents a minimum coverage rate of $39 and a full coverage rate of $105, while State Farm offers competitive rates at $33 for minimum coverage and $86 for full coverage.

Allstate, with a minimum coverage cost of $61 and a full coverage rate of $160, showcases a different pricing structure. Nationwide, Geico, Liberty Mutual, Hartford, Travelers, Safeco, and Farmers similarly exhibit varying rates for both minimum and full coverage. Notably, Safeco stands out with the lowest rates, providing minimum coverage at $27 and full coverage at $71.

Car Insurance for Financed Cars: Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $61 | $160 |

| Farmers | $53 | $139 |

| Geico | $30 | $80 |

| Liberty Mutual | $68 | $174 |

| Nationwide | $44 | $115 |

| Progressive | $39 | $105 |

| Safeco | $27 | $71 |

| State Farm | $33 | $86 |

| The Hartford | $43 | $113 |

| Travelers | $38 | $99 |

Conversely, Liberty Mutual offers more comprehensive coverage at a higher cost, with a minimum coverage rate of $68 and a full coverage rate of $174. This diversity underscores the significance of meticulous rate comparison, enabling individuals to secure optimal coverage aligned with their budget and protection requirements.

All other companies are available to all qualified drivers. Therefore, Geico, State Farm, Nationwide, and American Family are the cheapest companies for drivers. You can drive car insurance rates even lower if you qualify for discounts. According to the National Association of Insurance Commissioners (NAIC), the average full coverage rate is $90 a month.

Top Small Car Insurance Companies for Financed Cars

From time to time, smaller car insurance companies stand out by offering rates that are more competitive than those of larger insurers. Our complimentary online quote tool serves as a valuable resource, connecting you with these smaller, local insurers.

Progressive stands out as the top choice for financed car insurance, offering tailored coverage and competitive rates, ensuring both affordability and protection.

Brad Larson Licensed Insurance Agent

By leveraging this tool, you not only gain access to quotes from well-known industry giants but also have the chance to explore offerings from smaller companies that may better cater to your specific needs and budget.

Erie Insurance, North Carolina Farm Bureau, Direct Car, The General, Auto-Owners Insurance, and Esurance are among the smaller insurers recognized for competitive rates and specialized coverage. While not as large as industry giants, they offer tailored services and innovative solutions, making them valuable options for car insurance.

This personalized approach ensures that you have a comprehensive view of the insurance landscape, allowing you to make a well-informed decision when selecting your car insurance provider. Direct Auto and The General are known for non-standard car insurance, which is defined as non-owner car insurance or SR-22/FR-44 insurance.

Full Coverage Car Insurance Requirement for Financed Cars

Whenever you’re making payments on a vehicle, you’ll need full coverage. But what is full coverage car insurance? The full coverage definition means you have liability insurance with several other coverage options, such as collision, comprehensive, rental car reimbursement, and emergency roadside assistance.

Car insurance for financed cars requires full coverage because it protects the asset of the lender. Although you’re the driver, the finance company still owns the vehicle while you make payments.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Liability-Only Car Insurance for Financed Vehicles

While liability insurance is necessary, full coverage, which includes liability, is required for financed vehicles. On average, liability-only insurance is 51% cheaper, but it’s advisable to maintain full coverage, particularly for older vehicles. For additional details, explore our comprehensive resource titled “Compare Liability Car Insurance: Rates, Discounts, & Requirements.”

Our free quote tool outperforms full coverage insurance calculators. It tailors car insurance quotes for financed vehicles based on your personal details, ensuring accuracy. Your unique characteristics influence the availability of affordable coverage.

The most significant factors are age, location, driving record, and credit history. Each factor impacts car insurance rates for financed cars. For example, Nationwide car insurance in Florida may be cheaper in Iowa and more expensive in Michigan.

Car Insurance Monthly Rates for Financed Cars by Age & Gender

| Insurance Company | Age: 20 Female | Age: 20 Male | Age: 30 Female | Age: 30 Male | Age: 45 Female | Age: 45 Male |

|---|---|---|---|---|---|---|

| $190 | $210 | $160 | $180 | $130 | $150 | |

| $190 | $210 | $160 | $180 | $130 | $150 | |

| $150 | $170 | $120 | $140 | $90 | $110 | |

| $200 | $220 | $170 | $190 | $140 | $160 |

| $160 | $180 | $130 | $150 | $100 | $120 |

| $180 | $200 | $150 | $170 | $120 | $140 | |

| $160 | $180 | $130 | $150 | $100 | $120 | |

| $170 | $190 | $140 | $160 | $110 | $130 | |

| $180 | $200 | $150 | $170 | $120 | $140 |

| $170 | $190 | $140 | $160 | $110 | $130 |

This chart summarizes monthly premiums for financed vehicles, by age and gender, from major insurers like Allstate, Farmers, Geico, and more. It helps drivers gauge potential insurance costs based on age and gender, aiding in smart coverage choices.

Discounts for Lowering Car Insurance Rates on Financed Vehicles

Don’t let the average rates discourage you. Your factors could get you car insurance deals. Check out this list of discounts that can help you get affordable car insurance rates for financed vehicles.

- Good Credit Discount: Lower insurance premiums provided to policyholders with a favorable credit score, reflecting responsible financial behavior and reduced risk for the insurer.

- Multi-Vehicle Discount: Discount applied when insuring multiple vehicles under the same policy, acknowledging the reduced administrative costs and overall risk for the insurer.

- Multi-Policy Discount: Reduced rates offered to customers who bundle different insurance policies (such as auto and home insurance) with the same provider, promoting customer loyalty and simplifying insurance management.

- Safe Driver Discount: Discount awarded to policyholders with a clean driving record, demonstrating safe driving habits and a lower likelihood of filing claims, thereby reducing risk for the insurer.

- Usage-Based Insurance Discount: Discount provided based on driving behavior monitored through telematics devices or mobile apps, encouraging safer driving practices and offering personalized pricing based on individual driving habits.

When you maintain a clean driving history, you can secure cheap car insurance rates for financed cars. Stack your discounts, and you can save hundreds of dollars per year.

Filing a Car Insurance Claim for a Financed Vehicle

To file a car insurance claim, notify your provider and fulfill prerequisites: provide name, address, policy number, obtain a police report, take photos of damage, submit medical bills, pay deductibles, and get repair estimates. After contacting emergency services, notify your car insurance provider of the accident and capture photos.

After obtaining a police report, arrange towing and submit estimates or medical bills for claims. If liable, pay the collision deductible; if not, expect the at-fault driver’s insurance to cover costs. To learn more, explore our comprehensive resource titled “Cheap Car Insurance After an At-Fault Accident.”

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Case Studies: Navigating the Best Car Insurance Companies for Your Vehicle’s Security

When it comes to protecting your financed vehicle, finding the right car insurance is essential. With so many options available, it can be overwhelming to navigate through the choices.

- Case Study #1 – Cost-Effective Assurance: John, a conscientious driver, chose Progressive for affordable coverage with lease payoff protection, benefiting from up to 18% coverage and a $105 monthly rate, ensuring both financial security and savings.

- Case Study #2 – Personalized Gap Coverage: Emily opted for State Farm for tailored service and robust gap coverage, securing peace of mind with local agents’ guidance at $86/month. State Farm’s blend of personalized assistance and comprehensive coverage met her needs efficiently.

- Case Study #3 – Allstate’s Comprehensive Car Replacement: Mike chose Allstate for its comprehensive coverage, with up to 22% car replacement benefits, despite a $160 monthly rate. He valued the added protection and benefits like Accident Forgiveness, aligning with his cautious driving approach, proving advantageous for peace of mind and swift recovery from accidents.

Securing your financed vehicle is a priority, and choosing the right car insurance is crucial. By exploring the options provided by top car insurance companies, you can find the coverage that suits your needs best.

Progressive leads the pack in financed car insurance, providing customized coverage and unbeatable rates, starting as low as $27 monthly for minimum coverage.

Dani Best Licensed Insurance Producer

Whether you prioritize comprehensive coverage, competitive rates, or exceptional customer service, this guide equips you with the knowledge to choose the insurance policy that provides peace of mind and security for your financed vehicle.

Bottom Line: Best Car Insurance Companies for Financed Cars

Top insurers provide comprehensive coverage for financed cars with superior performance over smaller competitors, offering reliability and service quality that smaller firms may lack. To delve deeper, refer to our in-depth report titled “Compare Comprehensive Car Insurance: Rates, Discounts, & Requirements.”

Choosing a well-known insurer guarantees peace of mind, leveraging their vast resources and expertise tailored to address diverse needs. Their extensive experience ensures unparalleled support during challenging times, offering reassurance and assistance whenever required.

Get the right car insurance at the best price — enter your ZIP code below to shop for coverage from the top insurers.

Frequently Asked Questions

How can I get cheap car insurance for financed cars?

To get cheap car insurance for financed cars, consider bundling your insurance policies, maintaining a clean driving record, and taking advantage of available discounts. Companies like Geico and Progressive offer discounts for safe driving habits, multiple policies, and vehicle safety features, helping you secure affordable rates for your financed vehicle.

Where can I find cheap auto insurance for financed cars?

You can find cheap auto insurance for financed cars by comparing quotes from multiple insurance providers. Companies like Geico, Nationwide, and American Family often offer competitive rates for full coverage on financed vehicles. Utilizing online comparison tools can help you find the most affordable option that meets your coverage needs.

Ready to shop around for the best car insurance company? Enter your ZIP code below and see which one offers the coverage you need.

What is the best insurance for financed cars?

The best insurance for financed cars typically includes comprehensive coverage options such as collision, comprehensive, rental car reimbursement, and emergency roadside assistance. Companies like Progressive, State Farm, and Allstate are renowned for offering tailored coverage specifically designed to protect financed vehicles against various risks and uncertainties.

To delve deeper, refer to our in-depth report titled “Compare Collision Car Insurance: Rates, Discounts, & Requirements.”

What is the cheapest car insurance for a financed car?

The cheapest car insurance for a financed car varies depending on factors such as location, driving history, and coverage needs. However, companies like Safeco and Farmers are known for offering competitive rates, with minimum coverage starting as low as $27 per month and full coverage at $71 per month, making them ideal options for budget-conscious drivers.

Where can I find the cheapest insurance for a financed car?

You can find the cheapest insurance for a financed car by comparing quotes from multiple insurance providers. Companies like Geico, Nationwide, and State Farm often offer affordable rates for full coverage on financed vehicles. Utilizing online comparison tools allows you to find the cheapest option that meets your coverage requirements.

Which insurance cover is best for car?

Comprehensive insurance cover provides the widest cover and covers for theft and hijacking, damages due to an accident, fire or explosion and natural disasters like hail and floods.

To expand your knowledge, refer to our comprehensive handbook titled “Understanding Car Accidents.”

Does Geico have an in-network collision center for Tesla vehicles?

Yes, Geico does have an in-network collision center for Tesla vehicles. Geico’s Auto Repair Xpress program includes a network of certified repair shops, some of which are equipped to handle repairs for Tesla vehicles. By utilizing Geico’s in-network collision centers, Tesla owners can benefit from streamlined repair processes and high-quality service.

Who is known for cheapest car insurance?

State Farm, American Family, Geico and Progressive are the cheapest car insurance companies for most drivers. USAA has even cheaper rates, but only military members, veterans or their families can qualify. USAA is only available to military members, veterans and some of their family members.

Which car has most expensive insurance?

Dodge, Tesla and BMW models are among the most expensive cars to insure while drivers often find cheap coverage on Mazda, Volkswagen and Subaru vehicles. Discover if you are overpaying for car insurance below.

For a thorough understanding, refer to our detailed analysis titled “Compare Car Insurance Rates by Vehicle Make and Model.”

What type of insurance is most important for cars?

Auto liability coverage is mandatory in most states. Drivers are legally required to purchase at least the minimum amount of liability coverage set by state law. Liability coverage has two components which is bodily injury liability may help pay for costs related to another person’s injuries if you cause an accident.

By entering your ZIP code below, you can get instant car insurance quotes from top providers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.