Best Chevrolet Trax Car Insurance in 2025 (Find the Top 10 Companies Here)

State Farm, Geico, and USAA are leading providers of best Chevrolet Trax car insurance, with plans starting at $44 per month. These insurers are known for their excellent support in service and affordability, ideal for Chevrolet Trax owners seeking dependable, cost-effective insurance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

UPDATED: Jan 10, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 10, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Chevrolet Trax

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Chevrolet Trax

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for Chevrolet Trax

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews

The best Chevrolet Trax car insurance providers are State Farm, Geico, and USAA, known for their outstanding service and comprehensive coverage options.

These companies lead the market by offering tailored policies that meet the specific needs of Chevrolet Trax owners. With a focus on customer satisfaction and competitive pricing, they ensure that drivers receive the protection they need without breaking the bank.

Our Top 10 Company Picks: Best Chevrolet Trax Car Insurance

Company Rank Multi-Vehicle Discount A.M. Best Best For Jump to Pros/Cons

#1 10% B Many Discounts State Farm

#2 12% A++ Custom Plan Geico

#3 15% A++ Military Savings USAA

#4 18% A+ Add-on Coverages Allstate

#5 13% A+ Innovative Programs Progressive

#6 14% A Customizable Polices Liberty Mutual

#7 16% A++ Accident Forgiveness Travelers

#8 11% A+ Usage Discount Nationwide

#9 17% A Local Agents Farmers

#10 19% A Online App AAA

Exploring these top insurers will give Chevrolet Trax owners peace of mind on the road. Learn more in our article titled “Best Chevrolet Car Insurance Rates.”

Enter your ZIP code above into our free comparison tool to see how much car insurance costs in your area.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Defensive Driving Discounts: Chevrolet Trax drivers can lower their rates by completing approved defensive driving courses.

- Green Vehicle Discount: Reduced rates for Chevrolet Trax models that adhere to specific environmental criteria. Learn more about what we offer in our article titled “State Farm Car Insurance Review.”

- Mobile App: The State Farm mobile app offers convenient on-the-go policy management for Chevrolet Trax insurance.

Cons

- Young Driver Surcharge: Higher rates for young or inexperienced Chevrolet Trax drivers.

- Limited Usage-Based Insurance: Limited or unavailable usage-based insurance options for Chevrolet Trax owners.

#2 – Geico: Best for Custom Plan

Pros

- Higher Multi-Vehicle Discount: Geico offers a 12% discount for Chevrolet Trax owners who insure multiple vehicles, higher than State Farm.

- Superior Financial Rating: With an A++ from A.M. Best, Geico ensures strong financial reliability for Chevrolet Trax insurance claims.

- Customized Coverage Plans: Geico provides highly customizable Chevrolet Trax insurance plans, allowing for personalized coverage. Read up on the “Geico Car Insurance Review” for more information.

Cons

- Pricing Variability: Chevrolet Trax insurance costs can vary significantly with Geico, depending on the customizations and options chosen.

- Customer Service Variance: While Geico generally offers strong customer service, the experience can vary by region for Chevrolet Trax owners.

#3 – USAA: Best for Military Savings

Pros

- Exclusive Military Discounts: USAA offers exclusive Chevrolet Trax insurance discounts for military personnel, which can be substantial.

- Top Financial Rating: With an A++ rating from A.M. Best, USAA is highly reliable for fulfilling Chevrolet Trax insurance claims. More information is available about this provider in our article titled “USAA Car Insurance Review.”

- Largest Multi-Vehicle Discount: Chevrolet Trax owners enjoy a 15% discount for insuring multiple vehicles through USAA, the highest among listed companies.

Cons

- Limited Eligibility: USAA’s Chevrolet Trax insurance is only available to military members, veterans, and their families, limiting its availability.

- Fewer Physical Locations: For Chevrolet Trax owners who prefer in-person service, USAA has fewer offices compared to other major insurers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for Add-on Coverages

Pros

- Comprehensive Add-Ons: Allstate offers extensive add-on coverage options for Chevrolet Trax insurance, enhancing protection. Read more about this provider in our article titled “Allstate Car Insurance Review.”

- Highest Multi-Vehicle Discount: Chevrolet Trax owners receive an 18% discount on multi-vehicle policies, the highest rate among the companies listed.

- Robust Policy Customization: Allows Chevrolet Trax owners to tailor their insurance policies with various endorsements and additional protections.

Cons

- Higher Premiums: Allstate’s premiums for Chevrolet Trax insurance can be higher, especially with added coverages and endorsements.

- Variable Customer Service: Customer service quality can vary widely for Chevrolet Trax owners depending on the region and local agents.

#5 – Progressive: Best for Innovative Programs

Pros

- Usage-Based Savings: Progressive offers Snapshot, a usage-based insurance program that can significantly lower rates for Chevrolet Trax drivers based on driving behavior.

- Continuous Insurance Discount: Chevrolet Trax owners benefit from discounts for continuous coverage, promoting loyalty and long-term policy holding.

- Online Tools and Resources: Progressive provides advanced online tools that help Chevrolet Trax owners manage their policies and claims efficiently. Learn more about coverage options and monthly rates in our guide titled “Progressive Car Insurance Review.”

Cons

- Rate Fluctuations: Progressive’s rates for Chevrolet Trax insurance may increase upon renewal, depending on the usage and driving behavior recorded.

- Claims Satisfaction Variances: Some Chevrolet Trax owners may experience variations in claims satisfaction, influenced by local service levels.

#6 – Liberty Mutual: Best for Customizable Policies

Pros

- Tailored Coverage Options: Liberty Mutual offers a wide range of customizable coverage options specifically for Chevrolet Trax insurance needs.

- Accident Forgiveness: Chevrolet Trax drivers can benefit from Liberty Mutual’s accident forgiveness program, which helps to prevent premium increases after the first accident.

- Diverse Discounts: Offers multiple discounts for Chevrolet Trax insurance, including for safety features and low mileage. You can learn more about Liberty Mutual’s insurance options in our complete guide titled “Liberty Mutual Car Insurance Review.”

Cons

- Higher Cost with Customizations: Customizing Chevrolet Trax insurance policies with multiple add-ons at Liberty Mutual can lead to higher overall costs.

- Inconsistent Agent Experience: The experience with agents can vary, potentially affecting the service quality for Chevrolet Trax insurance holders.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Travelers: Best for Accident Forgiveness

Pros

- Accident Forgiveness Program: Travelers offers an accident forgiveness program for Chevrolet Trax insurance, which prevents rate increases after your first accident.

- High Financial Stability: With an A++ rating from A.M. Best, Travelers ensures reliability in handling Chevrolet Trax insurance claims efficiently. Read more about Travelers’ ratings in our article titled “Travelers Car Insurance Review.”

- Generous Multi-Vehicle Discount: Chevrolet Trax owners benefit from a 16% discount when insuring multiple vehicles, promoting savings on bulk policies.

Cons

- Premium Variability: Premiums for Chevrolet Trax insurance can vary greatly based on individual driving records and geographic locations.

- Policy Customization Costs: While Travelers allows for extensive policy customization, these options can significantly increase the overall cost of Chevrolet Trax insurance.

#8 – Nationwide: Best for Usage Discount

Pros

- SmartRide Discount Program: Nationwide offers the SmartRide program, providing discounts for Chevrolet Trax insurance based on safe driving habits.

- Wide Coverage Options: Provides a broad range of coverage choices, allowing Chevrolet Trax owners to select levels that meet their specific needs. Explore more add-on options in our article titled “Nationwide Car Insurance Discounts.”

- Good Customer Service: Nationwide is known for providing dependable customer service, which can enhance the insurance experience for Chevrolet Trax owners.

Cons

- Discount Eligibility: Discounts on Chevrolet Trax insurance can be conditional, requiring specific qualifications that may not apply to all drivers.

- Rate Adjustments: Nationwide may adjust rates based on regional trends and personal driving data, which could increase premiums for some Chevrolet Trax owners.

#9 – Farmers: Best for Local Agents

Pros

- Personalized Service Through Local Agents: Farmers provides personalized service for Chevrolet Trax insurance through a network of local agents, offering tailored advice and support.

- Flexible Coverage Options: Offers flexible coverage options for Chevrolet Trax insurance, allowing owners to customize policies to suit their needs. Find more details in our article titled “Farmers Car Insurance Review.”

- Competitive Multi-Vehicle Discounts: Chevrolet Trax owners can take advantage of competitive discounts when insuring multiple vehicles with Farmers.

Cons

- Variable Pricing Models: Farmers’ pricing for Chevrolet Trax insurance can vary, often dependent on the agent’s discretion and local market conditions.

- Coverage Complexity: The array of available options can be complex, requiring Chevrolet Trax owners to navigate through various choices, which can be challenging without thorough guidance.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – AAA: Best for Online App

Pros

- Advanced Online App: AAA provides an advanced online application for managing Chevrolet Trax insurance policies, making it easy to handle claims and payments.

- Highest Multi-Vehicle Discount: Offers the highest discount rate of 19% for Chevrolet Trax owners who insure multiple vehicles, promoting substantial savings.

- Excellent Roadside Assistance: Includes exceptional roadside assistance with Chevrolet Trax insurance policies, adding value beyond basic coverage. Find out more about AAA in our article titled “AAA Car Insurance Review.”

Cons

- Membership Requirements: AAA requires membership for access to Chevrolet Trax insurance, which might not be desirable for all potential clients.

- Inconsistent Online Services: While the app is generally beneficial, the online service quality can vary, sometimes affecting user experience for Chevrolet Trax insurance policyholders.

Monthly Insurance Rates for Chevrolet Trax: Minimum vs Full Coverage

Understanding the cost of car insurance for your Chevrolet Trax can help you make an informed decision about the coverage level that’s right for you. Below is a detailed breakdown of the monthly rates for both minimum and full coverage by various insurance providers.

Chevrolet Trax Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $63 $184

Allstate $44 $136

Farmers $77 $237

Geico $63 $191

Liberty Mutual $65 $188

Nationwide $95 $283

Progressive $75 $214

State Farm $53 $154

Travelers $69 $209

USAA $77 $234

The table reveals notable differences in monthly Chevrolet Trax insurance rates based on coverage level and provider. For example, Allstate provides the lowest minimum coverage at $44 per month, whereas Nationwide’s rates are the highest, with minimum coverage at $95 and full coverage at $283 per month. Find more information about Allstate’s rates in our article titled “Allstate Car Insurance Discounts.”

State Farm offers a cost-effective option for Chevrolet Trax insurance, with minimum coverage at $53 and full coverage at $154. This pricing variation highlights the importance of comparing rates and coverage to ensure you receive optimal protection for your Trax at a budget-friendly price.

Chevrolet Trax Insurance Cost

The average monthly insurance rate for a Chevrolet Trax is approximately $107. This figure represents the typical cost that owners can expect to pay for insuring this model. This rate may vary based on factors such as location, driver’s age, and driving history.

Chevrolet Trax Car Insurance Monthly Rates by Coverage Type

Type Rate

Discount Rate $63

High Deductibles $92

Average Rate $107

Low Deductibles $134

High Risk Driver $227

Teen Driver $390

To secure the best Chevrolet Trax insurance rates, it’s crucial to compare different policies and consider factors like deductibles and driver profiles. Find more details in our guide titled “Does car insurance cover all other drivers?”

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Are Chevrolet Traxs Expensive to Insure

The chart below details how Chevrolet Trax insurance rates compare to other crossovers like the Ford Escape, Mazda CX-3, and Toyota RAV4.

Chevrolet Trax Car Insurance Monthly Rates vs. Similar Vehicles by Coverage Type

Vehicle Model Comprehensive Collision Minimum Coverage Full Coverage

Chevrolet Trax $23 $39 $31 $107

Ford Escape $23 $37 $26 $98

Mazda CX-3 $26 $42 $31 $112

Toyota RAV4 $23 $40 $33 $109

Ford EcoSport $23 $42 $31 $109

Toyota C-HR $21 $38 $22 $90

Audi SQ5 $33 $65 $22 $129

There are several strategies to secure the lowest insurance rates for a Chevrolet online. By comparing quotes from multiple insurers and leveraging discounts, you can effectively minimize your premiums.

Read More:

What Impacts the Cost of Chevrolet Trax Insurance

The cost of insuring a Chevrolet Trax varies based on factors like vehicle age, with newer models attracting higher premiums due to increased value and repair costs. Additionally, younger and less experienced drivers often face higher rates due to a perceived greater risk of accidents. Explore insurance savings in our full article titled “Compare Young Driver Car Insurance Rates.”

Geographic location is another crucial factor, as areas with higher rates of vandalism, theft, and traffic accidents tend to have elevated insurance premiums. Additionally, the choice of deductible amount can alter costs significantly; a higher deductible reduces monthly premiums but increases out-of-pocket expenses in the event of an accident.

A driver’s history is crucial; a clean record can lead to lower premiums, while past incidents or violations may increase them. Lastly, the level of coverage chosen—whether opting for basic liability or full coverage—will directly impact the cost, with more comprehensive options commanding higher premiums. Understanding these factors can help Chevrolet Trax owners effectively manage their insurance costs.

Age of the Vehicle

Older Chevrolet Trax models generally cost less to insure. For example, monthly car insurance for a 2020 Chevrolet Trax costs about $107, while 2015 Chevrolet Trax insurance costs approximately $103 per month, a difference of $5.

Chevrolet Trax Car Insurance Monthly Rates by Model Year

Model Year Comprehensive Collision Minimum Coverage Full Coverage

2024 Chevrolet Trax $25 $42 $29 $112

2023 Chevrolet Trax $24 $41 $30 $110

2022 Chevrolet Trax $24 $40 $30 $109

2021 Chevrolet Trax $23 $40 $30 $108

2020 Chevrolet Trax $23 $39 $31 $107

2019 Chevrolet Trax $22 $38 $33 $106

2018 Chevrolet Trax $21 $37 $33 $105

2017 Chevrolet Trax $21 $36 $35 $105

2016 Chevrolet Trax $20 $35 $36 $104

2015 Chevrolet Trax $19 $34 $37 $103

Choosing older Chevrolet Trax models can lead to modest savings in insurance costs, reflecting slightly lower premiums with each preceding model year.

Driver Age

Driver age can have a significant effect on Chevrolet Trax car insurance rates. For example, 30-year-old drivers pay approximately $5 more per month for Chevrolet Trax car insurance than 40-year-old drivers.

Chevrolet Trax Car Insurance Monthly Rates by Age

Age Rates

Age: 16 $390

Age: 18 $327

Age: 20 $242

Age: 30 $111

Age: 40 $107

Age: 45 $102

Age: 50 $97

Age: 60 $95

The age of a driver significantly influences Chevrolet Trax insurance rates, reflecting the risk assessment insurers apply based on driving experience and maturity.

Driver Location

Where you live can have a large impact on Chevrolet Trax insurance rates. For example, drivers in Phoenix may pay approximately $59 a month less than drivers in Los Angeles.

Chevrolet Trax Car Insurance Monthly Rates by City

State Rates

Los Angeles, CA $182

New York, NY $169

Houston, TX $167

Jacksonville, FL $155

Philadelphia, PA $143

Chicago, IL $141

Phoenix, AZ $124

Seattle, WA $104

Indianapolis, IN $91

Columbus, OH $89

The data indicates that your location has a significant impact on Chevrolet Trax insurance rates, with costs differing greatly among major U.S. cities.

Your Driving Record

Your driving record can have an impact on the cost of Chevrolet Trax auto insurance. Teens and drivers in their 20’s see the highest jump in their Chevrolet Trax auto insurance rates with violations on their driving record. Learn more about what’s available in our article titled “Compare Teen Driver Car Insurance Rates.”

Chevrolet Trax Car Insurance Monthly Rates by Age & Driving Record

Age Clean Record One Ticket One Accident One DUI

Age: 16 $390 $430 $475 $555

Age: 18 $327 $360 $400 $470

Age: 20 $242 $263 $310 $364

Age: 30 $111 $121 $148 $189

Age: 40 $107 $116 $143 $182

Age: 45 $102 $111 $137 $174

Age: 50 $97 $106 $131 $166

Age: 60 $95 $104 $128 $162

Maintaining a clean driving record is crucial as it directly influences Chevrolet Trax insurance costs, with premiums significantly increasing with any violations or accidents, especially for younger drivers.

Chevrolet Trax Safety Ratings

The auto insurance rates for your Chevrolet Trax are significantly impacted by the vehicle’s safety ratings. These ratings help insurers assess the risk associated with insuring the vehicle, influencing the cost of your policy. See the breakdown below:

Chevrolet Trax Safety Ratings

Test Rating

Small overlap front: driver-side Good

Small overlap front: passenger-side Acceptable

Moderate overlap front Good

Side Good

Roof strength Good

Head restraints and seats Good

The safety ratings of the Chevrolet Trax, which demonstrate strong performance in several critical areas, play a vital role in influencing your auto insurance rates.

Chevrolet Trax Crash Test Ratings

The crash test ratings of the Chevrolet Trax directly influence the insurance rates for this vehicle. Higher safety ratings typically lead to lower insurance premiums, reflecting the reduced risk of costly claims.

Chevrolet Trax Crash Test Ratings

Vehicle Tested Overall Frontal Side Rollover

2024 Chevrolet Trax SUV FWD 5 stars 5 stars 5 stars 4 stars

2024 Chevrolet Trax SUV AWD 5 stars 5 stars 5 stars 4 stars

2023 Chevrolet Trax SUV FWD 5 stars 5 stars 5 stars 4 stars

2023 Chevrolet Trax SUV AWD 5 stars 5 stars 5 stars 4 stars

2022 Chevrolet Trax SUV FWD 5 stars 5 stars 5 stars 4 stars

2022 Chevrolet Trax SUV AWD 5 stars 5 stars 5 stars 4 stars

2021 Chevrolet Trax SUV FWD 5 stars 5 stars 5 stars 4 stars

2021 Chevrolet Trax SUV AWD 5 stars 5 stars 5 stars 4 stars

2020 Chevrolet Trax SUV FWD 5 stars 5 stars 5 stars 4 stars

2020 Chevrolet Trax SUV AWD 5 stars 5 stars 5 stars 4 stars

2019 Chevrolet Trax SUV FWD 5 stars 5 stars 5 stars 4 stars

2019 Chevrolet Trax SUV AWD 5 stars 5 stars 5 stars 4 stars

2018 Chevrolet Trax SUV FWD 5 stars 5 stars 5 stars 4 stars

2018 Chevrolet Trax SUV AWD 5 stars 5 stars 5 stars 4 stars

2017 Chevrolet Trax SUV FWD 5 stars 5 stars 5 stars 4 stars

2017 Chevrolet Trax SUV AWD 5 stars 5 stars 5 stars 4 stars

2016 Chevrolet Trax SUV FWD 5 stars 5 stars 5 stars 4 stars

2016 Chevrolet Trax SUV AWD 5 stars 5 stars 5 stars 4 stars

The consistently high crash test ratings across various models of the Chevrolet Trax underline its reliability and can lead to more favorable insurance rates due to enhanced safety.

Chevrolet Trax Safety Features

Most drivers don’t realize that not only do Chevrolet Trax safety features play a vital role in keeping passengers safe in crashes, but they can also help lower Chevrolet Trax auto insurance rates. The Chevrolet Trax’s safety features include:

- Air Bag System: Includes driver, passenger, front head, rear head, and front side air bags.

- Braking Features: Equipped with 4-wheel ABS and front disc/rear drum brakes.

- Stability and Control: Features electronic stability control and traction control.

- Safety Enhancements: Fitted with daytime running lights for increased visibility.

- Child Safety: Integrated with child safety locks for added protection.

The comprehensive safety features of the Chevrolet Trax not only provide substantial protection in the event of an accident but also contribute to lower auto insurance rates due to reduced risk. Access comprehensive insights into our article titled “How much does a minor accident affect car insurance rates?”

Choosing State Farm for your Chevrolet Trax means opting for the market leader in auto insurance, with proven reliability and customer satisfaction.

Daniel Walker Licensed Insurance Agent

Enhanced safety and affordability features make the Chevrolet Trax an attractive option for conscientious drivers. These attributes contribute to its overall appeal.

Chevrolet Trax Insurance Loss Probability

The lower percentage means lower Chevrolet Trax auto insurance rates; higher percentages mean higher Chevrolet Trax car insurance rates. The Chevrolet Trax’s insurance loss probability varies for each form of coverage.

Chevrolet Trax Insurance Loss Probability

Category Probability

Collision -21%

Property Damage no data

Comprehensive no data

Personal Injury no data

Medical Payment no data

Bodily Injury no data

The Chevrolet Trax’s favorable collision loss rate suggests potential for lower auto insurance premiums, highlighting its cost-effectiveness in terms of insurance expenses. Take a look at our guide titled “When should I drop collision coverage?“ to learn more.

Chevrolet Trax Finance and Insurance Cost

When purchasing a Chevrolet Trax, understanding the combined costs of financing and insuring the vehicle is crucial. Financing rates can vary based on down payment, interest rate, and loan term, with options available from dealers and local financial institutions. Read our article titled “How much car insurance am I required to have if I still have a car loan?” to find out.

Insurance premiums for the Trax are influenced by factors like the driver’s history, location, and chosen coverage level, but generally remain moderate due to the vehicle’s good safety features and reasonable repair costs.

Prospective buyers should utilize finance calculators and obtain insurance quotes to accurately estimate the monthly expenses for owning and protecting the Trax, ensuring they can budget effectively for both costs combined.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Ways to Save on Chevrolet Trax Insurance

There are several strategies to reduce the cost of insurance for a Chevrolet Trax. Below, you will find five practical steps to secure more affordable rates on your Chevrolet Trax car insurance. Implementing these actions can lead to significant savings on your insurance premiums.

- If you’re a young driver living at home, add yourself to your parents’ plan.

- Ask about loyalty discounts.

- Apply for your full, unrestricted license as soon as you’re eligible.

- Park your Chevrolet Trax somewhere safe – like a garage or private driveway.

- Choose automatic payments or EFT for your Chevrolet Trax insurance policy.

To secure affordable Chevrolet Trax insurance, combine family policies, use loyalty discounts, upgrade your license timely, park securely, and opt for automatic payments for lower costs and comprehensive protection. Discover insights in our guide titled “How do I find out when my car insurance payment is due?”

Top Chevrolet Trax Insurance Companies

The best car insurance companies for Chevrolet Trax car insurance rates will offer competitive rates, discounts, and account for the Chevrolet Trax’s safety features. The following list of car insurance companies outlines which companies hold the highest market share.

Top Chevrolet Trax Insurance Companies

Rank Insurance Company Premiums Written Market Share

#1 State Farm $65.6 million 9.3%

#2 Geico $46.1 million 6.6%

#3 Progressive $39.2 million 5.6%

#4 Liberty Mutual $35.6 million 5.1%

#5 Allstate $35 million 5%

#6 Travelers $28 million 4%

#7 USAA $23.4 million 3.3%

#8 Chubb $23.3 million 3.3%

#9 Farmers $20.6 million 2.9%

#10 Nationwide $18.4 million 2.6%

State Farm leads the market in providing competitive Chevrolet Trax insurance, closely followed by Geico and Progressive, reflecting their high market shares. These companies are preferred for their ability to combine favorable rates with discounts and appropriate coverage for the Trax’s safety features.

Compare Free Chevrolet Trax Insurance Quotes Online

Finding the right insurance for your Chevrolet Trax is straightforward when you compare free quotes online. This method allows you to quickly assess various insurers, helping you identify the best rates and coverage options tailored to the Trax. When comparing, evaluate coverage details, financial stability, customer service ratings, and discounts for safety features and clean driving records.

Simply enter your ZIP code and basic vehicle details into an online quote tool to receive multiple offers within minutes, streamlining your decision-making process and ensuring you get comprehensive coverage at a competitive price. Our complete article titled “Compare Comprehensive Car Insurance: Rates, Discounts, & Requirements” goes over this in more detail.

Frequently Asked Questions

How much does car insurance for a Chevrolet Trax cost?

Chevrolet Trax insurance costs vary by location, driving history, age, coverage, and provider, along with the model year, safety features, and repair costs. For accurate rates, request quotes from multiple insurers.

Discover more into our guide titled “Do I have to repair my car with the insurance money?”

What are the typical coverage options for Chevrolet Trax car insurance?

Typical coverage options for Chevrolet Trax car insurance include liability coverage, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, and personal injury protection. The coverage options you select will depend on your specific needs and budget.

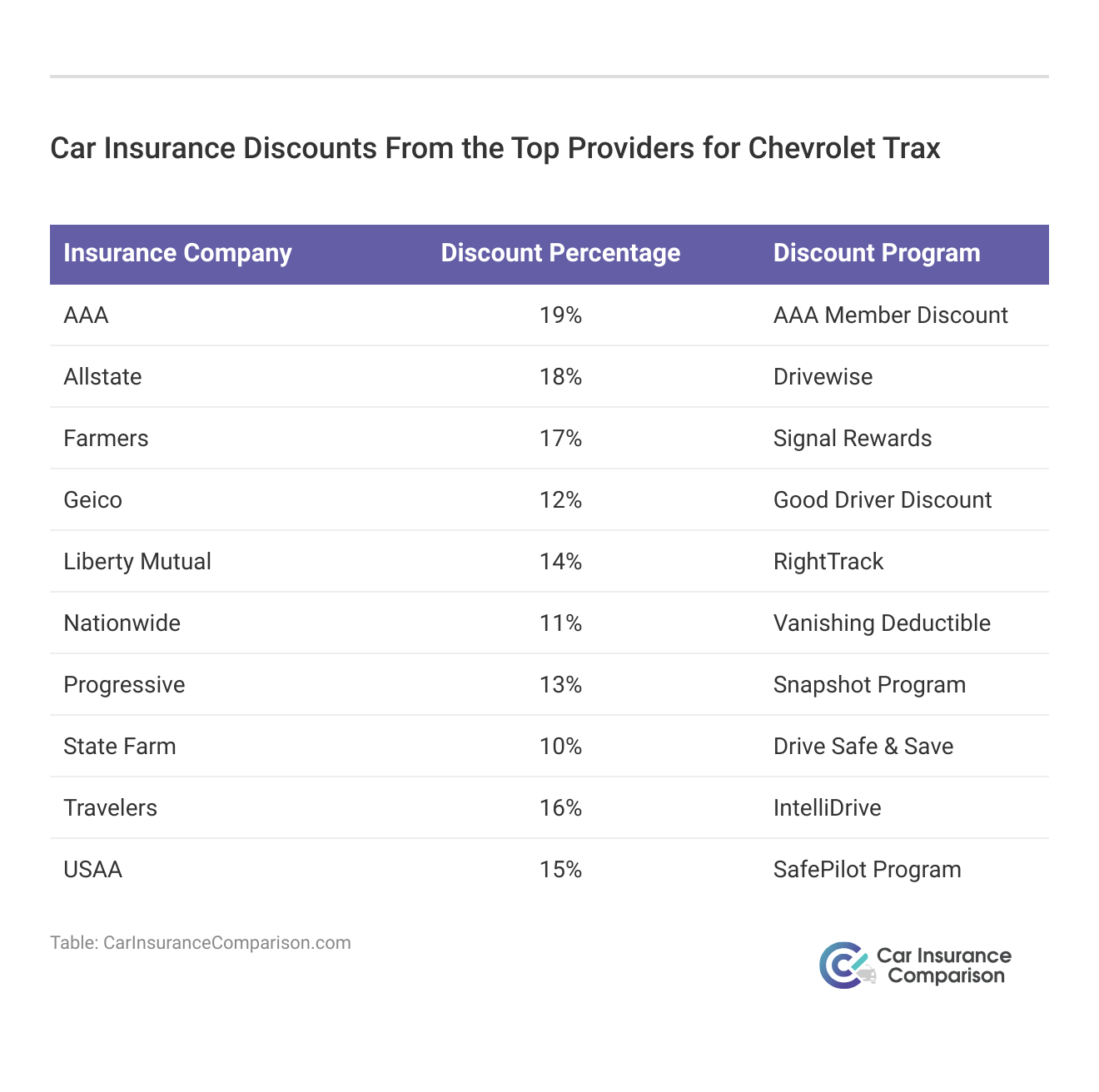

Are there any discounts available for insuring a Chevrolet Trax?

Insurance providers offer various discounts to lower Chevrolet Trax insurance costs, including multi-policy, good driver, and safety feature discounts. Inquire with insurers about specific discounts available.

What factors can affect the cost of Chevrolet Trax car insurance?

Several factors affect Chevrolet Trax insurance costs, such as driving record, age, location, credit history, mileage, and chosen coverage. Crime rates, local accident statistics, repair costs, and theft risk also impact rates. Always provide accurate information for precise quotes.

Discover more by reviewing our guide titled “Will a criminal record affect car insurance rates?”

Are there any specialized insurance considerations for insuring a Chevrolet Trax?

Insuring a Chevrolet Trax typically does not have any specific specialized insurance considerations. However, it’s important to check with insurance providers for any vehicle-specific requirements or recommendations. If you’ve modified your Chevrolet Trax, inform your insurer to ensure proper coverage.

What is the 2024 Chevy Trax insurance cost?

The insurance cost for a 2024 Chevy Trax can vary widely based on factors like location, driver history, and chosen coverage levels. For accurate pricing, it’s best to obtain a personalized quote from insurance providers.

How does the Chevy Trax insurance cost compare to other similar vehicles?

The Chevy Trax insurance cost is generally competitive with other vehicles in its class, often influenced by its safety features and repair costs. To see how it stacks up against other cars, consider comparing multiple insurance quotes.

Protect your vehicle from whatever the road throws at it by entering your ZIP code into our free comparison tool below to see affordable car insurance quotes.

Is Chevrolet Trax expensive to insure?

Chevrolet Trax insurance costs are generally moderate, falling in line with or slightly below average for its vehicle class.

Do newer Chevrolet Trax cars cost less to insure?

Newer Chevrolet Trax models typically cost more to insure due to their higher value and repair costs.

What color of Chevrolet Trax car is the most expensive to insure?

The color of a Chevrolet Trax does not typically impact insurance costs; rates are more influenced by factors like model year and driver history.

For more information, delve into our detailed guide titled “What is the difference between car make vs. model?”

Are older Chevrolet Trax cars cheaper to insure?

Yes, older Chevrolet Trax models are usually cheaper to insure due to their lower value compared to newer models.

Who typically has the cheapest Chevrolet Trax insurance?

Companies like State Farm, Geico, and USAA often offer the cheapest Chevrolet Trax insurance, depending on your location and eligibility.

What is the lowest Chevrolet Trax car insurance group?

Chevrolet Trax models can fall into lower insurance groups, particularly base models without extensive modifications or high-end features.

To learn more, check out our guide titled “Best Car Insurance for Modified Cars.”

What type of insurance has the lowest premium for Chevrolet Trax?

Liability-only insurance typically has the lowest premium for Chevrolet Trax, but it offers less coverage than full comprehensive policies.

At what age is Chevrolet Trax car insurance cheapest?

Chevrolet Trax insurance is usually cheapest for drivers in their mid-50s to mid-60s, as they are considered lower risk due to more driving experience and typically safer driving behaviors.

How can I save money on Chevrolet Trax insurance?

Save money on Chevrolet Trax insurance by qualifying for discounts such as multi-car, good driver, and safety features, and by comparing rates from several insurers.

Comparing quotes is the easiest way to find affordable car insurance. Simply enter your ZIP code below into our free comparison tool to see rates in your area.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.