Best Nissan Leaf Car Insurance in 2025 (Find the Top 10 Companies Here!)

The best Nissan Leaf car insurance is offered by State Farm, Geico, and USAA, highlighting their low and competitive rates at $62/month. These companies offers exceptional coverage at competitive rates, excel in customer service, safe-driving discounts, and overall value for Nissan Leaf owners.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Jan 10, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 10, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Nissan Leaf

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Nissan Leaf

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for Nissan Leaf

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews

The best Nissan Leaf car insurance is offered by State Farm, Geico, and USAA, offering a low and affordable rate at $62 per month.

State Farm is the top choice for its excellent customer service and generous safe-driving discounts. Geico and USAA offer great value with low premiums and reliable coverage.

Our Top 10 Company Picks: Best Nissan Leaf Car Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 17% B Customer Service State Farm

#2 15% A++ Competitive Rates Geico

#3 10% A++ Safe-Driving Discounts USAA

#4 10% A+ Flexible Coverage Progressive

#5 20% A+ Comprehensive Coverage Nationwide

#6 12% A Accident Forgiveness Liberty Mutual

#7 12% A+ Drivewise Rewards Allstate

#8 10% A+ Tailored Coverage Farmers

#9 15% A+ Dividend Policies Amica

#10 8% A++ IntelliDrive Discounts Travelers

These companies provide top insurance options for Nissan Leaf owners seeking savings and comprehensive coverage. Check out “Collision vs. Comprehensive: What is the difference?” for more on insurance coverage.

Affordable car insurance rates are just a click away. Enter your ZIP code into our free quote tool above to find the best policy for you.

- State Farm offers the best Nissan Leaf car insurance with top rates and discounts

- Companies provide competitive rates starting at $62/month for Nissan Leaf

- Explore top providers for affordable and reliable Nissan Leaf car insurance options

#1 – State Farm: Top Overall Pick

Pros

- Outstanding Customer Assistance: State Farm offers excellent support for Nissan Leaf owners, handling queries and claims efficiently, which you can check out in our State Farm review.

- Generous Safe-Driving Incentives: State Farm offers considerable discounts for safe driving, which can significantly lower costs for Nissan Leaf drivers.

- Broad Range of Policy Customizations: The company’s diverse policy options allow Nissan Leaf owners to tailor their coverage according to personal needs.

Cons

- Less Emphasis on Specialized Electric Vehicle: State Farm’s coverage might not be as specialized for electric vehicles like the Nissan Leaf compared to insurers who focus more on EVs.

- Few Eco-Friendly Perks: State Farm’s offerings might lack specialized eco-friendly benefits specifically designed for electric vehicles like the Nissan Leaf.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#2 – Geico: Best for Competitive Rates

Pros

- Solid Financial Resilience: Geico’s strong financial health ensures that claims for Nissan Leaf damages are reliably covered. Find out more in our Geico review.

- Discounts for Nissan Leaf Owners: Geico provides various discounts specifically for Nissan Leaf owners, including those for eco-friendly vehicles, which can further lower insurance premiums.

- Strong Customer Service: Geico’s customer support is generally well-regarded, providing assistance to Nissan Leaf owners with various insurance-related queries.

Cons

- Limited Customization: While Geico offers competitive rates, their insurance policies for the Nissan Leaf may have limited customization options compared to other providers.

- Inconsistent Support Experience: Some Nissan Leaf drivers might find Geico’s customer service experience less personalized and inconsistent.

#3 – USAA: Best for Safe-Driving Discounts

Pros

- Safe-Driving Discounts: USAA offers significant discounts for safe driving, which can be particularly beneficial for Nissan Leaf owners.

- Affordable Rates: Due to its focus on safe driving, USAA provides competitive insurance rates for Nissan Leaf owners, often lower than many other insurers.

- Highly Rated Service: USAA’s reputation for superior customer service translates to a positive experience for Nissan Leaf owners, which you can read more about in our review of USAA.

Cons

- Fewer Discounts: While USAA excels in safe-driving discounts, it may offer fewer options for other types of discounts that could benefit Nissan Leaf owners.

- Higher Rates for Older Models: Older Nissan Leaf models might not benefit as much from USAA’s discounts, potentially resulting in higher premiums.

#4 – Progressive: Best for Flexible Coverage

Pros

- Flexible Coverage Options: Progressive offers flexible coverage options for Nissan Leaf owners, allowing customization of policies to meet specific needs.

- Access to Online Tools: Progressive’s online tools and mobile app make it easy for Nissan Leaf owners to manage their policies, track claims, and access support.

- Comprehensive Add-Ons: The company provides various add-ons that can enhance coverage for Nissan Leaf owners. Discover our Progressive review for a full list.

Cons

- Inconsistent Pricing: Nissan Leaf insurance rates with Progressive may fluctuate, leading to unpredictable premiums.

- Variable Customer Service Quality: Progressive’s customer service can vary, potentially affecting the support Nissan Leaf owners receive.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Comprehensive Coverage

Pros

- Affordable Premiums: Their comprehensive coverage rates are competitive, helping Nissan Leaf owners find affordable insurance options.

- Strong Network of Repairs: Nationwide has a wide network of repair shops that are familiar with the Nissan Leaf’s unique requirements.

- Broad Range of Discounts: The company offers a variety of discounts that can benefit Nissan Leaf owners, which is covered in our Nationwide review.

Cons

- Availability of Discounts Varies: Discounts for Nissan Leaf owners, such as eco-friendly incentives, may not be available in all areas.

- Claims Process Complexity: The process for filing claims might be more intricate, potentially causing delays for Nissan Leaf drivers.

#6 – Liberty Mutual: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Liberty Mutual’s accident forgiveness program can be beneficial for Nissan Leaf owners, helping to prevent premium increases after an accident.

- Eco-Friendly Vehicle Discounts: Liberty Mutual offers discounts for electric vehicles like the Nissan Leaf, reducing insurance costs for eco-friendly drivers. For a complete list, read our Liberty Mutual review.

- Numerous Discount Options: Liberty Mutual provides various discounts that can help lower insurance costs for Nissan Leaf owners.

Cons

- Complex Policy Options: The wide range of coverage options for the Nissan Leaf can be overwhelming, making it harder to choose the best policy.

- Limited Eco-Friendly Incentives: Liberty Mutual might offer fewer eco-friendly discounts specifically for electric vehicles like the Nissan Leaf.

#7 – Allstate: Best for Drivewise Rewards

Pros

- Nissan Leaf Incentives: Allstate may offer specific incentives for electric vehicle owners like the Nissan Leaf, which can further reduce insurance costs.

- Eco-Friendly Vehicle Coverage: Allstate provides coverage for eco-friendly vehicles like the Nissan Leaf, with potential benefits and discounts, which you can learn about in our Allstate review.

- Strong Customer Support: Allstate is known for good customer support, which can be advantageous for Nissan Leaf owners needing assistance.

Cons

- Regional Availability: The benefits and rewards for Nissan Leaf owners, including Drivewise, may not be available in all regions, potentially limiting coverage options.

- Limited Discounts for Eco-Friendly Vehicles: Allstate might not provide as many specific discounts for electric vehicles like the Nissan Leaf.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#8 – Farmers: Best for Tailored Coverage

Pros

- Tailored Coverage Options: Farmers offers coverage tailored specifically for Nissan Leaf owners, addressing the unique needs of electric vehicle insurance.

- Wide Range of Discounts: Farmers provides a variety of discounts that can benefit Nissan Leaf drivers, including those for safe driving and multiple policies.

- Flexible Policy Adjustments: With Farmers, you can easily adjust your policy to accommodate changes in your Nissan Leaf’s usage or value. Learn more in our Farmers review.

Cons

- Higher Rates for Younger Drivers: Farmers might have higher rates for younger Nissan Leaf drivers compared to other insurers.

- Complex Policy Options: The variety of policy options might be overwhelming for some Nissan Leaf owners, making it harder to choose the right plan.

#9 – Amica: Best for Dividend Policies

Pros

- Dividend Policies: Amica’s dividend policies can offer Nissan Leaf owners potential savings and refunds based on their claims experience.

- Eco-Friendly Vehicle Incentives: Amica may offer incentives or discounts for Nissan Leaf owners due to its eco-friendly nature.

- Cost Savings: The potential for dividend returns can make Amica’s rates more competitive for Nissan Leaf owners over time. Read more in our review of State Farm vs. Progressive.

Cons

- Availability Restrictions: Amica may not be available in all regions, potentially limiting access for Nissan Leaf owners in certain states.

- Increased Costs for Frequent Claims: Frequent claimants might face higher premiums, which can affect Nissan Leaf owners with a history of claims.

#10 – Travelers: Best for IntelliDrive Discounts

Pros

- Customer Service: Travelers is known for good customer service, which can be beneficial for Nissan Leaf owners seeking assistance with their policies and claims.

- Usage-Based Insurance: The IntelliDrive program provides Nissan Leaf owners with usage-based insurance, meaning you pay based on your driving behavior, which can lead to savings.

- Advanced Tracking Technology: IntelliDrive tracks driving habits, rewarding Nissan Leaf drivers for safe and eco-friendly driving. Read our Travelers review to learn what else is offered.

Cons

- Inconsistent Discount Levels: The level of discounts with Travelers might fluctuate, resulting in variable savings for Nissan Leaf owners.

- Customer Service Variability: Some Nissan Leaf drivers might experience variability in customer service quality with Travelers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Analyzing Monthly Car Insurance Costs and Savings for Nissan Leaf Owners

Finding the right insurance for your Nissan Leaf means more than just comparing rates. This guide will help you explore monthly insurance rates from various providers and discover discounts tailored for Nissan Leaf owners, including multi-car savings and eco-friendly incentives.

State Farm offers the best overall coverage and customer service for Nissan Leaf owners, making it the top pick for affordable and comprehensive car insurance.

Justin Wright Licensed Insurance Agent

By utilizing these insights, you can make an informed decision that not only provides the coverage you need but also optimizes your insurance costs, ensuring that you get the best value for your money while driving your Nissan Leaf. See our guide “Compare Car Insurance by Coverage Type“, for a thorough analysis.

Nissan Leaf Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $73 $155

Amica $67 $145

Farmers $74 $155

Geico $68 $145

Liberty Mutual $75 $160

Nationwide $70 $150

Progressive $70 $150

State Farm $72 $155

Travelers $71 $148

USAA $62 $140

This table shows monthly insurance rates for a Nissan Leaf, with USAA offering the lowest rates at $62 for minimum and $140 for full coverage. Liberty Mutual is the highest, at $75 and $160. Other providers like Geico and Allstate offer rates in between.

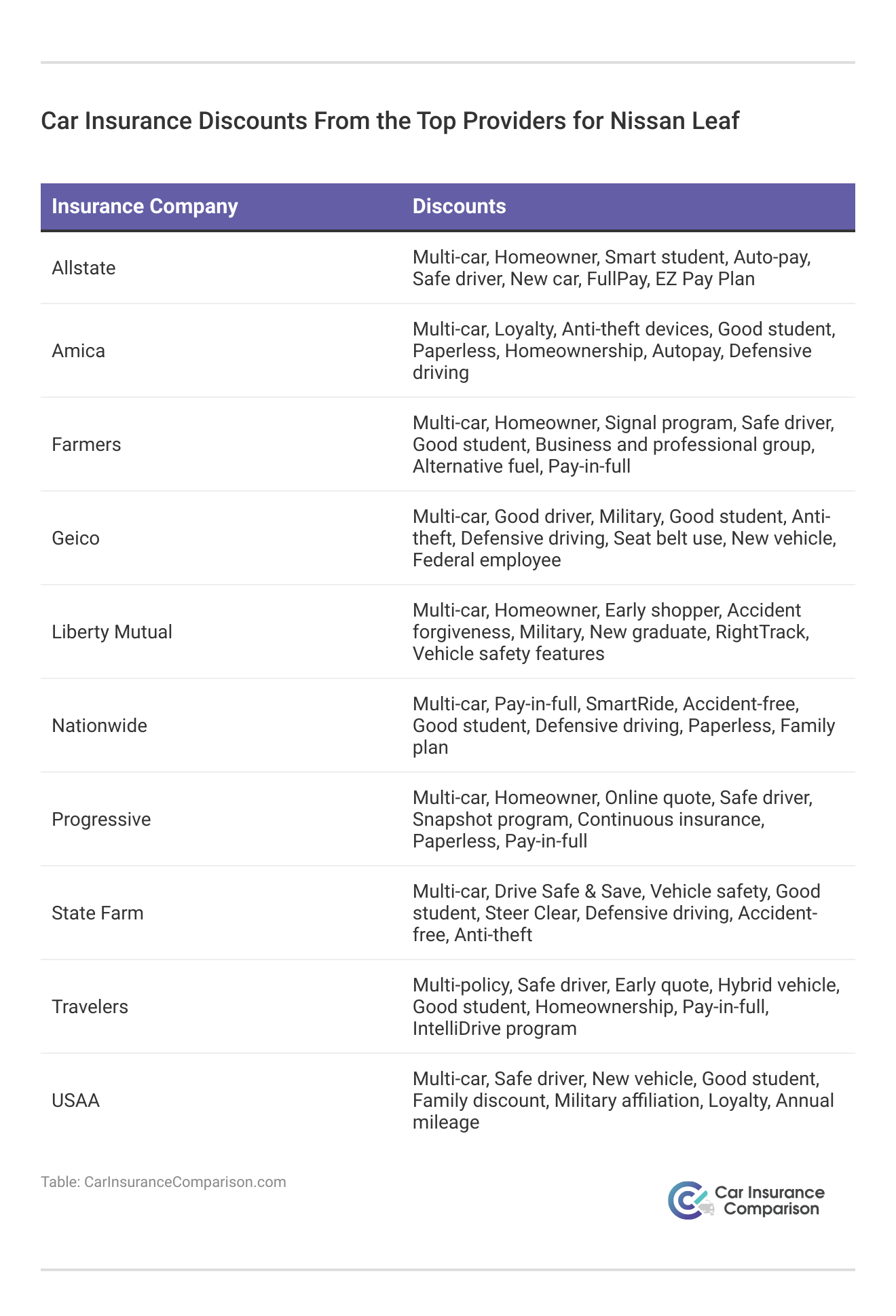

This guide lists car insurance discounts for Nissan Leaf owners from top providers like Allstate, Geico, and State Farm. Discounts include multi-car, safe driver, good student, and eco-friendly vehicle incentives, helping drivers find the best savings.

Understanding Insurance Costs for Nissan Leafs

The chart below details how Nissan Leaf insurance rates compare to other hybrid/electrics like the Ford Fusion Energi, Honda Accord Hybrid, and Chrysler Pacifica Hybrid.

Nissan Leaf Car Insurance Monthly Rates vs. Other Cars by Coverage Type

| Vehicle | Comprehensive | Collision | Liability | Full Coverage |

|---|---|---|---|---|

| Ford Fusion Energi | $28 | $52 | $31 | $124 |

| Honda Accord Hybrid | $30 | $60 | $26 | $128 |

| Chrysler Pacifica Hybrid | $31 | $55 | $28 | $125 |

| Buick LaCrosse | $27 | $47 | $28 | $113 |

| Hyundai Sonata Hybrid | $27 | $52 | $35 | $129 |

| Toyota Prius | $26 | $43 | $28 | $107 |

| Nissan Leaf | $29 | $53 | $30 | $122 |

The Nissan Leaf’s monthly insurance rates are $29 for comprehensive, $53 for collision, $30 for minimum coverage, and $122 for full coverage. These rates are generally mid-range compared to other vehicles. For a comprehensive analysis, refer to our detailed guide titled “Compare Collision Car Insurance: Rates, Discounts, & Requirements.”

Key Elements Affecting Nissan Leaf Insurance Rates

While the average cost of insuring a Nissan Leaf varies, your premium may differ based on factors such as your age, marital status, location, driving history, and the model year of your Leaf. Refer to “Factors That Affect Car Insurance Rates” for details.

Additionally, your credit score may influence your insurance rates, depending on your location.

Assessing Vehicle Age

Older Nissan Leaf models generally cost less to insure. The costs for comprehensive, collision, minimum, and full coverage change depending on the vehicle’s age and the type of protection selected. For a comprehensive overview, explore our detailed resource titled “Compare Car Insurance Rates by Vehicle Make and Model.”

Nissan Leaf Car Insurance Monthly Rates by Model Year and Coverage Type

| Model Year | Comprehensive | Collision | Liability | Full Coverage |

|---|---|---|---|---|

| 2024 Nissan Leaf | $30 | $55 | $33 | $131 |

| 2023 Nissan Leaf | $29 | $54 | $32 | $130 |

| 2022 Nissan Leaf | $29 | $53 | $32 | $128 |

| 2021 Nissan Leaf | $28 | $52 | $33 | $127 |

| 2020 Nissan Leaf | $27 | $51 | $34 | $125 |

| 2019 Nissan Leaf | $27 | $50 | $34 | $124 |

| 2018 Nissan Leaf | $26 | $49 | $35 | $122 |

| 2017 Nissan Leaf | $27 | $53 | $35 | $128 |

| 2016 Nissan Leaf | $26 | $51 | $36 | $126 |

| 2015 Nissan Leaf | $24 | $49 | $37 | $124 |

| 2014 Nissan Leaf | $24 | $46 | $38 | $120 |

| 2013 Nissan Leaf | $23 | $43 | $38 | $117 |

| 2012 Nissan Leaf | $22 | $39 | $38 | $112 |

| 2011 Nissan Leaf | $20 | $36 | $38 | $107 |

Nissan Leaf insurance rates vary by model year and coverage type. Comprehensive coverage ranges from $20/month to $30/month. Collision coverage costs between $36 and $55 monthly. Minimum coverage starts at $33, while full coverage ranges from $107 to $131 monthly.

Driving Through the Ages: How Age Affects Driving Skills

Car insurance rates for a Nissan Leaf vary by age, with younger drivers facing higher premiums. Rates start at $467 for a 16-year-old and decrease to $114 for a 60-year-old. For a thorough understanding, refer to our detailed analysis titled “Average Car Insurance Rates by Age and Gender.”

Nissan Leaf Car Insurance Monthly Rates by Age

| Age | Rates |

|---|---|

| Age: 16 | $467 |

| Age: 18 | $375 |

| Age: 20 | $290 |

| Age: 30 | $133 |

| Age: 40 | $128 |

| Age: 45 | $122 |

| Age: 50 | $117 |

| Age: 60 | $114 |

The monthly car insurance rates for a Nissan Leaf vary by age. For a 16-year-old, the rate is $467, while an 18-year-old pays $375. Rates decrease as drivers get older, with a 20-year-old paying $290. At age 30, the rate drops to $133, and further decreases to $128 at age 40, $122 at age 45, $117 at age 50, and $114 at age 60.

State Farm offers the best overall car insurance for Nissan Leaf owners, combining competitive rates with exceptional customer service.

Brandon Frady Licensed Insurance Agent

Age plays a significant role in Nissan Leaf insurance rates, with younger drivers paying more and rates dropping as drivers get older. Compare quotes now to find the best deal for your age group.

Driver Positioning

Insurance rates for a Nissan Leaf vary by city. Here’s a quick look at monthly premiums across different locations to see how costs stack up. For detailed information, refer to our comprehensive report titled “Compare Car Insurance Rates by City.”

Nissan Leaf Car Insurance Monthly Rates by City

| State | Rate |

|---|---|

| Los Angeles, CA | $219 |

| New York, NY | $202 |

| Houston, TX | $200 |

| Jacksonville, FL | $185 |

| Philadelphia, PA | $171 |

| Chicago, IL | $169 |

| Phoenix, AZ | $148 |

| Seattle, WA | $124 |

| Indianapolis, IN | $109 |

| Columbus, OH | $106 |

Monthly insurance rates for a Nissan Leaf vary significantly by city. For instance, Los Angeles, CA, has the highest rate at $219, while Columbus, OH, offers the most affordable rate at $106. Other cities fall in between, with New York at $202, Houston at $200, and Seattle at $124.

Your Driving History Overview

Your driving record can have an impact on the cost of Nissan Leaf auto insurance. Teens and drivers in their 20’s see the highest jump in their Nissan Leaf auto insurance rates with violations on their driving record. Adults 25 years old and older with a clean driving record typically will have lower insurance rates. Check out our ranking of the top providers: Best Car Insurance for a Bad Driving Record

Nissan Leaf Car Insurance Monthly Rates by Age & Driving Record

| Age | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| Age: 16 | $467 | $512 | $544 | $629 |

| Age: 18 | $375 | $410 | $437 | $518 |

| Age: 20 | $290 | $315 | $348 | $416 |

| Age: 30 | $133 | $145 | $168 | $215 |

| Age: 40 | $128 | $139 | $162 | $206 |

| Age: 45 | $122 | $132 | $156 | $198 |

| Age: 50 | $117 | $127 | $150 | $191 |

| Age: 60 | $114 | $124 | $146 | $186 |

The monthly car insurance rates for a Nissan Leaf vary by age and driving record. For drivers with a clean record, rates range from $114 for those aged 60 to $467 for those aged 16. With a single ticket, rates increase slightly, while one accident further raises the cost. Drivers with one DUI face the highest premiums, with costs ranging from $186 at age 60 to $629 at age 16.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Nissan Leaf Safety Ratings: Crash Test Results

The Nissan Leaf boasts strong crash test ratings, consistently achieving high marks for safety across various categories, providing reliable protection for drivers and passengers. To gain profound insights, consult our extensive guide titled “Which state has the best drivers?”

Nissan Leaf Crash Test Ratings by Model Year

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Nissan Leaf BEV 5 HB FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2023 Nissan Leaf BEV 5 HB FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2022 Nissan Leaf BEV 5 HB FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2021 Nissan Leaf BEV 5 HB FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2020 Nissan Leaf BEV 5 HB FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2019 Nissan Leaf BEV 5 HB FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2018 Nissan Leaf BEV 5 HB FWD | 4 stars | 4 stars | 4 stars | 4 stars |

| 2017 Nissan Leaf BEV 5 HB FWD | 4 stars | 4 stars | 4 stars | 4 stars |

| 2016 Nissan Leaf 5 HB FWD | 4 stars | 4 stars | 4 stars | 4 stars |

The Nissan Leaf has consistently demonstrated strong safety performance in crash tests. The vehicle generally received high ratings, with 4 or 5 stars in overall safety. It earned 4 stars for frontal and rollover protection and 5 stars for side impact tests, reflecting a solid track record of safety across its models.

Exploring the Safety Features of the Nissan Leaf

The Nissan Leaf is equipped with a comprehensive set of safety features designed to enhance driver and passenger protection. To gain further insights, consult our comprehensive guide titled “Safety Features Car Insurance Discounts.”

- Driver and Passenger Air Bags

- 4-Wheel ABS and Disc Brakes

- Electronic Stability Control

- Brake Assist

- Traction Control

These safety innovations not only enhance protection by reducing the risk of accidents and minimizing potential injuries, but they may also make you eligible for lower auto insurance rates.

By investing in a vehicle that actively works to keep you safe on the road, you’re also making a decision that could lead to long-term savings, further highlighting the Leaf’s value in today’s market.

Understanding Insurance Loss Probability for the Nissan Leaf

This overview presents the loss probability percentages for different types of insurance coverage on the Nissan Leaf. These figures illustrate the relative risk reduction for each coverage type, providing insights into how various policies may impact overall insurance losses.

Nissan Leaf Auto Insurance Loss Probability by Coverage Type

| Coverage | Loss |

|---|---|

| Collision | -11% |

| Property Damage | -16% |

| Comprehensive | -55% |

| Personal Injury | -17% |

| Medical Payment | -36% |

| Bodily Injury | -24% |

The Nissan Leaf’s insurance loss probabilities by coverage type are as follows: Collision -11%, Property Damage -16%, Comprehensive -55%, Personal Injury -17%, Medical Payment -36%, and Bodily Injury -24%. See our list of the top providers: Best Full Coverage Car Insurance

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Financial and Insurance Expenses of Owning a Nissan Leaf

After selecting the Nissan Leaf model you wish to buy and finalizing the purchase price, if you’re not paying the full amount upfront, you’ll likely need to finance the remaining balance.

Most lenders will require you to have more extensive coverage, including comprehensive and liability coverage, so it’s essential to compare car insurance rates from top companies using our free tool below. To delve deeper, refer to our in-depth report titled “Compare Liability Car Insurance: Rates, Discounts, & Requirements.”

Cost-Cutting Strategies: Lowering Insurance Rates for Your Nissan Leaf

Cutting insurance costs for your Nissan Leaf is easy with the right strategies. This guide offers five practical tips to help you lower your premiums and boost savings, including defensive driving courses, safety discounts, and smart financial habits.

- Take a defensive Driving Course: Enroll in and complete a driving course to improve your driving skills and knowledge.

- Pay Your Bills On Time: Ensure that you make payments for your Nissan Leaf and insurance promptly to avoid late fees and maintain good financial standing.

- Safety Discounts: Inquire if there are any discounts available for having a Nissan Leaf based on its safety features.

- Apply for Your Full License: Once you meet the requirements, apply for a full driving license without restrictions.

- Student Away From Home Discount: Check if there are discounts available for students who are studying away from their home address.

By applying these strategies, you can significantly reduce your Nissan Leaf insurance costs and ensure you’re getting the best value for your coverage. To learn more, explore our comprehensive resource on insurance titled “16 Ways to Lower the Cost of Your Insurance.”

Whether it’s through driver education or leveraging discounts, these steps can help you keep your premiums manageable and your savings intact. Start implementing these tips today to make the most of your insurance plan.

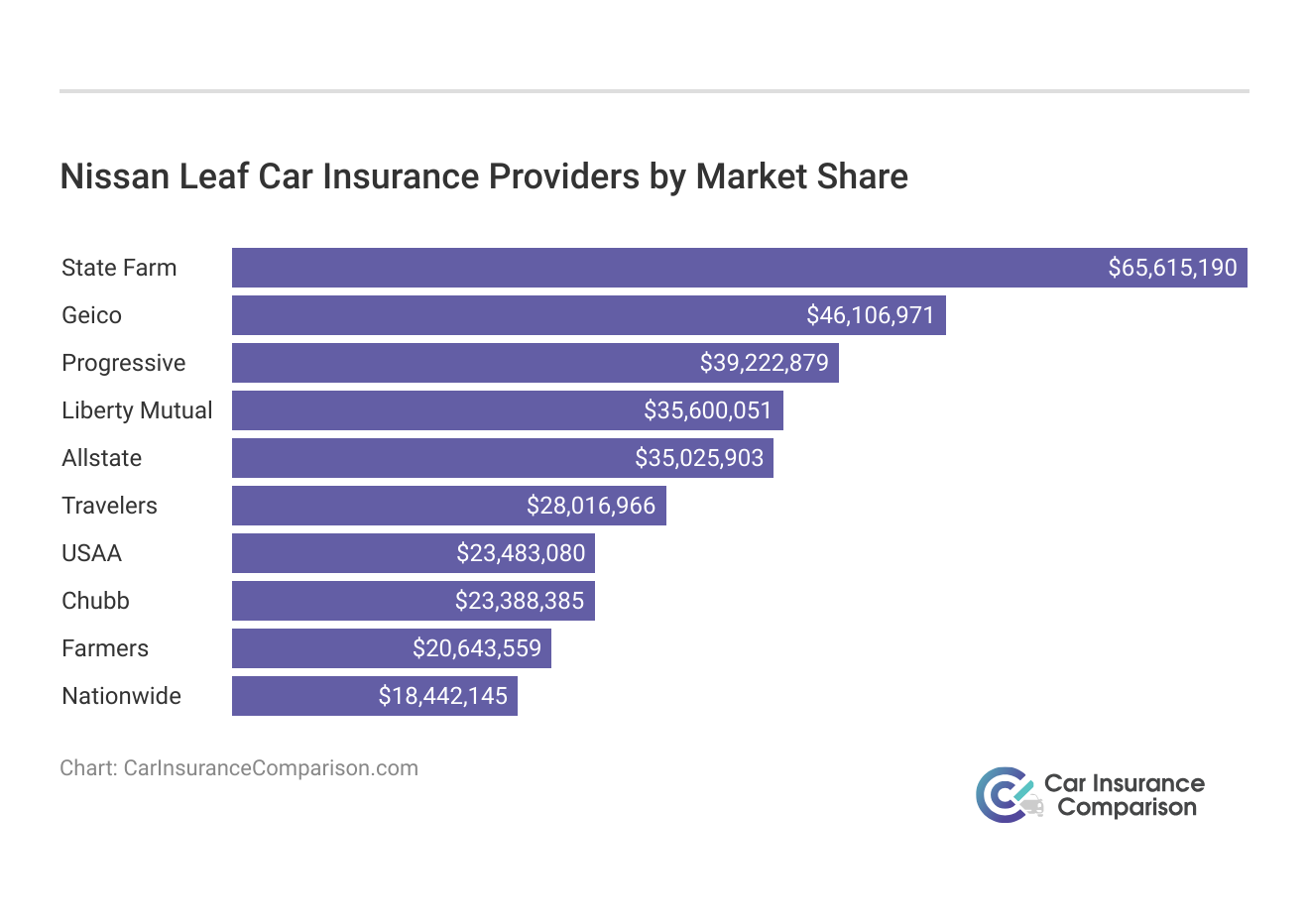

Elite Insurance Choices for Nissan Leaf

Several insurance companies offer competitive rates for the Nissan Leaf based on factors like discounts for safety features. Take a look at these top car insurance companies that are popular with Leaf drivers organized by market share.

Top Nissan Leaf Insurance Providers by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $65.6 million | 9.3% |

| #2 | Geico | $46.1 million | 6.6% |

| #3 | Progressive | $39.2 million | 5.6% |

| #4 | Liberty Mutual | $35.6 million | 5.1% |

| #5 | Allstate | $35 million | 5% |

| #6 | Travelers | $28 million | 4% |

| #7 | USAA | $23.4 million | 3.3% |

| #8 | Chubb | $23.3 million | 3.3% |

| #9 | Farmers | $20.6 million | 2.9% |

| #10 | Nationwide | $18.4 million | 2.6% |

Here are the top insurance providers for Nissan Leaf owners by market share. State Farm leads with $65.6 million in premiums and a 9.3% market share, followed by Geico and Progressive. Liberty Mutual, Allstate, and Travelers round out the top five. These rankings highlight the leading companies in the market and their respective share of Nissan Leaf insurance premiums.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Get the Best Nissan Leaf Insurance: Compare Free Quotes Online

Top providers for Nissan Leaf insurance include State Farm, Geico, and USAA, with rates starting around $62 per month. These companies are noted for their competitive premiums, excellent customer service, and valuable discounts. For additional details, explore our comprehensive resource titled “Different Ways to Lower Car Insurance Rates.”

Insurance rates for the Leaf vary based on factors such as age, location, driving record, and the vehicle’s model year. Discounts for eco-friendly vehicles and safe driving can further reduce costs. To find the best rates, compare quotes from different insurers using online tools.

Finding cheap car insurance quotes is easy. Just enter your ZIP code into our free comparison tool below to instantly compare quotes near you.

Frequently Asked Questions

What are the best car insurance companies for Nissan Leaf owners?

The top car insurance companies for Nissan Leaf owners include State Farm, Geico, and USAA. These companies offer competitive rates, excellent customer service, and valuable discounts for electric vehicle owners.

How much can I expect to pay for car insurance on a Nissan Leaf?

Insurance rates for a Nissan Leaf start around $62 per month for minimum coverage. Full coverage can range from $122 to $160 monthly, depending on the provider and your specific circumstances.

Get the minimum car insurance coverage you need to drive legally by entering your ZIP code into our free quote comparison tool below.

Are there any discounts available for insuring a Nissan Leaf?

Yes, many insurance companies offer discounts for Nissan Leaf owners, including safe-driving discounts, multi-car discounts, and eco-friendly vehicle incentives. These can help reduce your overall insurance costs.

To gain further insights, consult our comprehensive guide titled “Multiple Policy Car Insurance Discounts.”

Does the year of my Nissan Leaf affect my insurance rates?

Yes, the model year of your Nissan Leaf can influence your insurance rates. Generally, older models cost less to insure than newer ones due to lower market values and repair costs.

How does my driving record impact my Nissan Leaf insurance premiums?

A clean driving record typically results in lower insurance premiums. Conversely, accidents, traffic violations, or a DUI can significantly increase your insurance costs, especially for younger drivers.

Can I get cheaper insurance for my Nissan Leaf if I live in a specific location?

Yes, your location plays a significant role in determining your insurance rates. Urban areas with higher traffic and crime rates generally have higher premiums, while rural or less congested areas may offer lower rates.

For a thorough understanding, refer to our detailed analysis titled “What Is a Car Insurance Premium?”

What safety features of the Nissan Leaf can help lower my insurance rates?

The Nissan Leaf comes equipped with various safety features, such as automatic emergency braking and lane departure warnings, which can qualify you for safety-related discounts on your insurance policy.

Is insurance more expensive for new Nissan Leaf models compared to used ones?

Yes, new Nissan Leaf models generally have higher insurance rates compared to used ones. This is due to the higher replacement costs and repair expenses associated with newer vehicles.

Are there any special insurance considerations for electric vehicles like the Nissan Leaf?

Yes, insuring an electric vehicle like the Nissan Leaf may come with different considerations, such as higher repair costs for specialized parts. However, many insurers offer discounts and incentives specifically for electric vehicles.

To gain profound insights, consult our extensive guide titled “How can I add a car to my insurance policy?”

How can I compare Nissan Leaf insurance quotes effectively?

To compare Nissan Leaf insurance quotes effectively, use an online comparison tool that allows you to input your ZIP code and other relevant details. This will provide you with quotes from multiple insurers, helping you find the best rate and coverage for your needs.

Comparing quotes is the easiest way to find affordable car insurance. Simply enter your ZIP code below into our free comparison tool to see rates in your area.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.