Best Toyota Tundra Car Insurance in 2025 (Check Out the Top 10 Companies)

State Farm, Allstate, and Farmers provide the best Toyota Tundra car insurance, with rates starting at $110 per month. These providers excel with competitive pricing and strong coverage options, making them the top choices for Toyota Tundra owners seeking reliable and affordable insurance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Aug 30, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Aug 30, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage forToyota Tundra

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for Toyota Tundra

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 3,072 reviews

3,072 reviewsCompany Facts

Full Coverage for Toyota Tundra

A.M. Best Rating

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviews

These companies deliver excellent value, making them the best choices for Toyota Tundra owners seeking reliable and affordable insurance.

Our Top 10 Company Picks: Best Toyota Tundra Car Insurance

| Company | Rank | Multi-Vehicle Discount | A.M Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 30% | B | Customer Service | State Farm | |

| #2 | 20% | A+ | Multi-Policies | Allstate | |

| #3 | 20% | A | Family Plans | Farmers | |

| #4 | 25% | A+ | Qualifying Coverage | Progressive | |

| #5 | 15% | A+ | SmartRide Program | Nationwide |

| #6 | 15% | A | Coverage Options | Liberty Mutuak |

| #7 | 12% | A | Loyalty Rewards | American Family | |

| #8 | 10% | A++ | Bundling Policies | Travelers | |

| #9 | 10% | A+ | Exclusive Benefits | The Hartford |

| #10 | 5% | A++ | Reliability Focused | Auto-Owners |

Evaluate these top providers to secure the best coverage for your needs. For additional insights, refer to our “Best Full Coverage Car Insurance.”

By entering your ZIP code above, you can get instant quotes for the best Toyota Tundra car insurance from top providers.

- Find the best Toyota Tundra car insurance with top providers

- Compare rates and coverage options for Toyota Tundra owners

- State Farm offers the best Toyota Tundra car insurance starting at $110/month

Frequently Asked Questions

What factors affect Toyota Tundra car insurance rates?

Rates depend on factors like your driving history, location, age, coverage levels, and the Tundra’s model and safety features. Discover a wealth of knowledge about the best Toyota Corolla Hybrid car insurance.

How can I lower my Toyota Tundra car insurance premiums?

Increase your deductible, maintain a clean driving record, bundle policies, and take advantage of discounts.

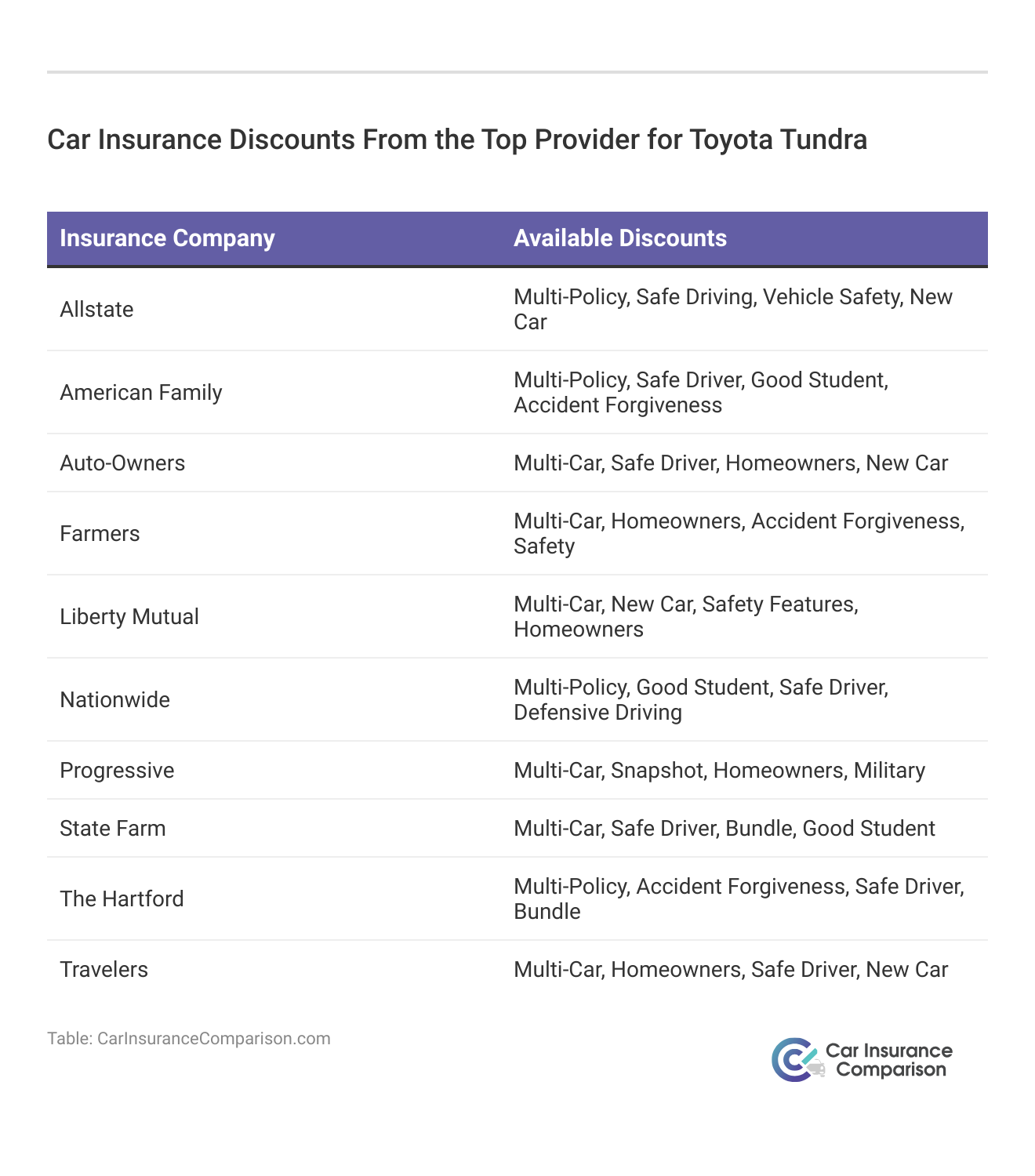

Are there any discounts available for Toyota Tundra car insurance?

Yes, you may qualify for discounts like safe driver, multi-policy, anti-theft, and good student discounts. Shop for the best Toyota Tundra car insurance, specifically liability-only coverage, with our free quote comparison tool. Enter your ZIP code below to begin.

Is Toyota Tundra car insurance more expensive than other truck models?

It can be, depending on factors like the Tundra’s size, power, and repair costs compared to other trucks.

What coverage options should I consider for Toyota Tundra car insurance?

Consider liability, collision, comprehensive, uninsured motorist, and medical payments coverage. Expand your understanding with the best Toyota RAV4 Hybrid car insurance.

How do I compare Toyota Tundra car insurance rates?

Use online comparison tools, get quotes from multiple insurers, and review coverage options side by side.

What is the best way to find affordable Toyota Tundra car insurance?

Shop around, compare quotes, and take advantage of discounts and bundling options.

Do safety features on my Toyota Tundra reduce car insurance rates?

Yes, features like airbags, anti-lock brakes, and anti-theft systems can lower your premiums.

Is full coverage necessary for Toyota Tundra car insurance?

Full coverage is recommended if your Tundra is new or valuable, otherwise, liability may suffice. Gain deeper insights by exploring the best Toyota RAV4 car insurance.

How does my driving record impact Toyota Tundra car insurance rates?

A clean driving record can lower rates, while accidents and violations increase premiums.

Can I bundle my Toyota Tundra car insurance with other policies for discounts?

Yes, bundling with home or other vehicle insurance often results in a discount.

What is the average cost of Toyota Tundra car insurance?

The average cost varies, but it typically ranges from $1,200 to $1,800 annually, depending on coverage and location.

Does the model year of my Toyota Tundra affect car insurance rates?

Yes, newer models may have higher premiums due to increased value, repair costs, and technology. Learn more about the best Toyota Camry car insurance for a broader perspective.

How do I file a claim with my Toyota Tundra car insurance provider?

Contact your insurer, provide details of the incident, submit necessary documents, and follow up on the claim’s status.

What are the top companies for Toyota Tundra car insurance?

Top insurers include State Farm, Geico, Progressive, and Allstate, known for competitive rates and good customer service.

Can I get Toyota Tundra car insurance quotes online?

Yes, most insurers offer online quotes through their websites or comparison platforms.

What should I do if I can’t afford Toyota Tundra car insurance?

Consider adjusting your coverage, increasing deductibles, or exploring state-sponsored insurance programs. Elevate your knowledge with the best Toyota Highlander car insurance.

Does Toyota Tundra car insurance cover aftermarket modifications?

Standard policies may not, but you can add coverage for custom parts and equipment.

How can I switch my Toyota Tundra car insurance to a new provider?

Get quotes, choose a new policy, and ensure continuous coverage before canceling the old policy.

What are the benefits of using a comparison tool for Toyota Tundra car insurance?

Comparison tools help you find the best rates, coverage options, and discounts quickly.

Are there specific Toyota Tundra car insurance policies for high-risk drivers?

Yes, some insurers offer specialized policies for high-risk drivers, but they may come with higher premiums. Discover what lies beyond the best Toyota Avalon Hybrid car insurance.”

How does my location affect Toyota Tundra car insurance rates?

Rates vary by location due to factors like crime rates, traffic density, and accident frequency in your area. Get the best Toyota Tundra car insurance at the best price — enter your ZIP code below to shop for coverage from the top insurers.

Can I get Toyota Tundra car insurance if I use my truck for business purposes?

Yes, but you may need a commercial auto policy if your Tundra is used primarily for business.

What happens if I let my Toyota Tundra car insurance lapse?

A lapse can result in higher premiums, fines, license suspension, or being uninsured in an accident. Access the complete picture of the best Toyota Sienna car insurance.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.