Best Car Insurance for New Drivers Over 21 in 2025 (Top 10 Companies)

Discover the best car insurance for new drivers over 21, offering exclusive 15% discounts from Progressive, State Farm, and Allstate. These industry leaders provide tailored coverage and substantial savings, ensuring new drivers receive competitive rates and personalized benefits that they deserve.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

UPDATED: Oct 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for 21-Years-Old New Driver

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for 21-Years-Old New Driver

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for 21-Years-Old New Driver

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviewsProgressive, State Farm, and Allstate emerge as the top contenders for the best car insurance for new drivers over 21, each showcasing tailored coverage options and competitive rates that cater to the unique needs of young drivers stepping into the realm of car ownership.

However, among these reputable providers, Progressive shines as the top pick overall, boasting comprehensive benefits and a standout 15% discount.

Our Top 10 Company Picks: Best Car Insurance for New Drivers Over 21

| Company | Rank | New Driver Discount | Multi-Vehicle Discount | Best for | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 15% | 17% | Bundle Discounts | Progressive | |

| #2 | 12% | 15% | Customizable Policies | State Farm | |

| #3 | 10% | 18% | Big Discounts | Allstate | |

| #4 | 8% | 14% | Policy Options | Liberty Mutual |

| #5 | 9% | 16% | Accident Forgiveness | Farmers | |

| #6 | 10% | 12% | Online Convenience | National General | |

| #7 | 7% | 18% | Add-on Coverages | Safeco | |

| #8 | 6% | 13% | Customizable Coverage | Travelers | |

| #9 | 8% | 14% | Quick Claims | American Family | |

| #10 | 10% | 15% | Personalized Service | Safe Auto |

Tailored specifically for new drivers, thereby offering an attractive combination of affordability and reliability for this demographic.

Finding cheap car insurance quotes is easy. Just enter your ZIP code into our free comparison tool above to instantly compare quotes near you.

- Progressive offers a 15% discount for new drivers over 21

- Tailored coverage meets the unique needs of young drivers

- Competitive rates ensure affordability and reliability

#1 – Progressive: Top Overall Pick

Pros

- Generous Discounts: The Progressive car insurance review demonstrates the company’s tailored coverage options for new drivers, with potential discounts of up to 15%, and for policies covering multiple vehicles, with potential savings of up to 17%.

- Bundle Discount Excellence: Progressive offers tailored coverage options, including insurance for first-time drivers over 21, with discounts of up to 15% for this demographic and up to 17% for multi-vehicle policies.

- Diverse Coverage Options: The company provides a wide range of policies to suit various needs, including car insurance for new drivers over 21.

Cons

- Variable Customer Service: Quality of customer service may vary by region and agent.

- Higher Rates in Some Areas: Rates in certain locations may be higher, impacting affordability for some policyholders, particularly those seeking coverage at or below the average car insurance cost for new driver.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#2 – State Farm: Best for Customizable Policies

Pros

- Customized Coverage Options: State Farm car insurance review showcase tailored coverage options offer discounts of up to 12% for new drivers and up to 15% for policies covering multiple vehicles, ensuring competitive rates for average insurance cost for new drivers.

- Excellent Customer Service: Renowned for exceptional service, State Farm provides personalized assistance, enhancing the experience for car insurance rates for new drivers.

- Wide Range of Policy Features: State Farm’s diverse policy features allow customization to meet specific needs, balancing comprehensive protection and affordability for first time driver insurance cost.

Cons

- Potential for Higher Rates: Rates may be higher in some areas, impacting affordability for insurance price for new drivers.

- Limited Discounts: State Farm’s discount offerings may be less extensive than competitors, potentially reducing opportunities for savings on car insurance rates for new drivers.

#3 – Allstate: Best for Big Discounts

Pros

- Customized Coverage for New Drivers: Allstate offers tailored options, including discounts to reduce new driver car insurance cost, making it an affordable choice for first-time drivers.

- Accessibility: Allstate car insurance review provides affordable auto insurance for new drivers, ensuring accessibility to young drivers seeking coverage.

- Young Driver Discounts: With the Allstate young driver discount, policyholders can benefit from additional savings on their premiums.

Cons

- Limited Options for Short-Term Coverage: Allstate may not offer 1 day car insurance over 21, limiting options for young drivers seeking temporary coverage.

- Potential Price Variability: While Allstate aims to provide affordable car insurance for first-time drivers, rates may vary, potentially impacting budget-conscious policyholders.

#4 – Liberty Mutual: Best for Policy Options

Pros

- Customized Coverage Options: Liberty Mutual offers tailored insurance solutions, making it the best car insurance for 17-year-olds, best car insurance for 18-year-olds, and best car insurance for first-time drivers.

- Comprehensive Policies: The company provides extensive coverage options to meet the diverse needs of policyholders, including insurance for new drivers over 21.

- Strong Financial Stability: Liberty Mutual car insurance review showcase solid financial stability, providing peace of mind to customers.

Cons

- Limited Discount Opportunities: While Liberty Mutual excels in providing tailored coverage, it may offer fewer discount opportunities compared to other providers.

- Potential for Higher Premiums: Depending on individual circumstances, policyholders may experience higher premiums with Liberty Mutual, particularly for specific demographics such as 17-year-olds and 18-year-olds.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#5 – Farmers: Best for Accident Forgiveness

Pros

- Competitive Rates: Farmers offers competitive rates for various demographics, including how much is car insurance for a 21-year-old monthly.

- Comprehensive Coverage Options: The company provides a wide range of coverage options tailored to different needs, ensuring that customers can find suitable policies, even how much is insurance for new drivers over 25.

- Strong Customer Service: Farmers car insurance review demonstrate responsive and supportive customer service, of the company assisting policyholders throughout their insurance journey.

Cons

- Limited Availability of Discounts: While Farmers provides some discounts, the availability may vary, and policyholders might find the selection limited compared to other insurers.

- Higher Premiums for Riskier Drivers: Drivers with less favorable driving records or higher risk profiles may face relatively higher premiums with Farmers, potentially impacting affordability for certain individuals.

#6 – National General: Best for Online Convenience

Pros

- Customized Coverage Options: National General offers tailored car insurance for 21-year-old new drivers and car insurance for new drivers over 25, ensuring personalized solutions for different age groups.

- Competitive Rates for Experienced Drivers: With policies designed for car insurance for new drivers over 25, National General provides affordable options for those with more driving experience.

- Additional Benefits: The National General car insurance review highlights the company’s tailored coverage options, showcasing a variety of supplementary services aimed at enhancing policyholder protection.

Cons

- Limited Availability: Coverage may not be accessible in all areas.

- Potential for Higher Premiums: Some policyholders may face higher costs compared to other insurers.

#7 – Safeco: Best for Add-on Coverages

Pros

- Add-on Coverages: The Safeco car insurance review highlights Safeco’s array of customizable additional protections, including services like roadside assistance and rental car reimbursement, empowering clients to personalize their policies according to their unique requirements.

- Competitive Rates: Safeco provides competitive rates, ensuring affordability without compromising coverage quality.

- Online Convenience: Safeco offers user-friendly online tools and a mobile app for easy policy management, payments, and claims filing.

Cons

- Limited Availability: Safeco’s coverage may be restricted in certain areas, limiting options for potential customers.

- Customer Service: While generally satisfactory, some customers may experience delays or challenges in reaching support or resolving issues.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#8 – Travelers: Best for Customizable Coverage

Pros

- Customizable Coverage: Travelers offers customizable coverage options, allowing drivers to tailor their policies to their specific needs.

- Strong Financial Stability: Travelers car insurance review underscores the company’s robust financial stability, ensuring prompt and reliable handling of insurance claims.

- Multi-Policy Discounts: Travelers offers discounts for bundling multiple policies, such as home and auto insurance, helping customers save on premiums.

Cons

- Limited Availability: Travelers may not be available in all regions, limiting options for some drivers.

- Higher Premiums: While offering comprehensive coverage, Travelers’ premiums may be slightly higher compared to some competitors.

#9 – American Family: Best for Quick Claims

Pros

- Quick Claims: American Family is recognized for its efficient claims processing, ensuring prompt resolution for policyholders.

- Competitive Rates: The company offers competitive rates, making it an attractive option for budget-conscious drivers.

- Personalized Service: In the American Family car insurance review, the company demonstrates its commitment to customized coverage for each customer, ensuring that individual needs are met effectively.

Cons

- Limited Availability: American Family’s coverage may be limited to certain regions, restricting options for potential policyholders.

- Coverage Options: While offering customizable coverage, the range of options may not be as extensive as some competitors.

#10 – Safe Auto: Best for Personalized Service

Pros

- Personalized Service: Safe Auto offers personalized service, catering to the specific needs of each customer.

- Competitive Rates: Safe Auto provides competitive rates, making it an affordable option for many drivers.

- Quick Claims: Safe Auto is known for its efficient claims process, ensuring timely resolution for customers.

Cons

- Limited Coverage Options: Safe Auto may have limited coverage options compared to larger insurance providers.

- Restricted Availability: Safe Auto’s services may not be available in all areas, limiting options for some drivers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

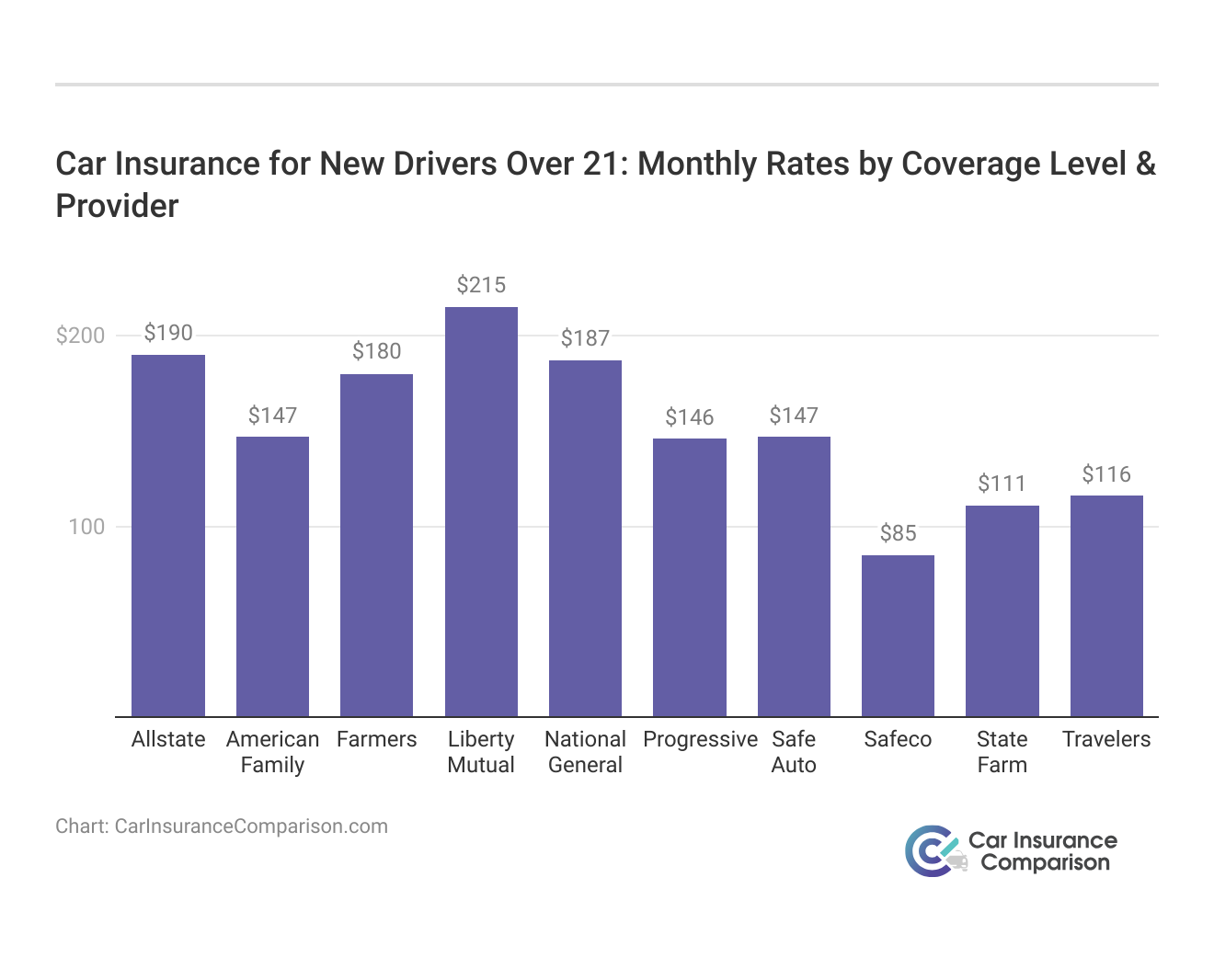

Monthly Insurance Costs for New Drivers Over 21

The table below outlines the average monthly car insurance rates tailored for new drivers over 21 years old, offering insights into both full coverage and minimum coverage options provided by various insurance companies.

Car Insurance for New Drivers Over 21: Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $72 | $190 |

| American Family | $55 | $147 |

| Farmers | $68 | $180 |

| Liberty Mutual | $83 | $215 |

| National General | $70 | $187 |

| Progressive | $54 | $146 |

| Safe Auto | $42 | $147 |

| Safeco | $32 | $85 |

| State Farm | $42 | $111 |

| Travelers | $44 | $116 |

Safeco emerges as the most affordable option for both full and minimum coverage, with rates at $85 and $32, respectively. Conversely, Liberty Mutual presents the highest rates for both coverage types, highlighting the significant disparity among providers.

State Farm and Travelers offer competitive rates for both full and minimum coverage and insurance rates, providing viable options for new drivers seeking affordable insurance. For additional details, explore our comprehensive resource titled “Average Car Insurance Rates by Age and Gender”

The data underscores the importance of shopping around and comparing quotes to find the most suitable coverage for new drivers, balancing affordability with comprehensive protection on the road.

New Driver Car Insurance Necessity

Car insurance companies consider new drivers, or first-time drivers, a higher risk than others with more driving experience, so insurance rates for anyone under the age of 25 will be much higher than rates for drivers over 25.

Car insurance companies consider the following people new or first-time drivers:

- Teen drivers that just got a driver’s license

- Young adults (under 25) that, for some reason, have yet to get a driver’s license, car, or car insurance

- Drivers of any age with a gap in car insurance coverage

Consequently, insurance rates for this demographic tend to be considerably higher compared to more experienced drivers. Understanding these factors can help individuals navigate the complexities of obtaining insurance as a new driver and make informed decisions about coverage options.

Many other factors go into determining your car insurance rates no matter your age such as where you live, your state’s laws, your driving record, and your credit score.

To gain profound insights, consult our extensive guide titled below:

- Compare 18-Year-Old Driver Car Insurance Rates

- Compare Children of Divorced Parents Car Insurance Rates

Car Insurance Costs for New Drivers Over 21

Car insurance for first-time 21 varies by age. The younger the driver, the higher the average annual rate. Let’s take a look at average car insurance rates by age in a chart.

Car Insurance Monthly Rates by Driver Age

| Age | Rates |

|---|---|

| 17-Year-Old Driver | $691 |

| 21-Year-Old Driver | $373 |

| 25-Year-Old Driver | $267 |

| 35-Year-Old Driver | $204 |

| 60-Year-Old Driver | $190 |

Does car insurance go down at 21? Yes. Based on the average annual rates in the data, car insurance is nearly cut in half for 21-year-old drivers. Car insurance for first-time drivers over 25 is $1,200 less than 21-year-old driver car insurance and nearly $5,000 less than 17-year-old driver car insurance.

Car insurance for new drivers over 21 has an average rate of $371 or less per month. Perhaps you have just left your parents’ home and have just purchased your first car. If so, you will need to get an auto insurance policy.

When you start to shop for an auto insurance policy, there are some important things you need to consider. First, let’s examine the required auto insurance coverage for your state.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Affordable New Driver Insurance Providers

Driving experience, driving record, and credit score aren’t the only factors that affect your rates. The company you choose at any given point in your life can offer the best rate depending on your characteristics at that time in your life.

Popular Car Insurance Discounts From the Top Providers

| Discounts | Allstate | Liberty Mutual | Nationwide | Progressive | State Farm | Travelers | USAA |

|---|---|---|---|---|---|---|---|

| Defensive Driver | 10% | 10% | 5% | 10% | 5% | 10% | 3% |

| Driver's Ed | 10% | 10% | 8% | 10% | 15% | 8% | 3% |

| Driving Device/App | 20% | 30% | 40% | 20% | 50% | 30% | 5% |

| Early Signing | 10% | 8% | 8% | 10% | 10% | 10% | 12% |

| Full Payment | 10% | 5% | 10% | 12% | 15% | 7.5% | 10% |

| Newer Vehicle | 30% | 10% | 8% | 15% | 40% | 10% | 12% |

| Paperless Documents | 10% | 7% | 5% | 50% | 25% | 15% | 5% |

| Paperless/Auto Billing | 5% | 5% | 30% | 15% | 2% | 3% | 3% |

| Safe Driver | 45% | 9% | 35% | 31% | 15% | 23% | 12% |

| Vehicle Recovery | 10% | 35% | 25% | 5% | 5% | 10% | 8% |

Right now, we will focus on age, as it will definitely affect your rates. You are consider a young driver if you are under the age of 25. However, you may be able to get a lower rate with a different company, so it pays to shop around.

- USAA, Geico, Nationwide, and State Farm offer the cheapest car insurance rates for drivers aged 21 to 25.

- Note: USAA is exclusively available to military members, active and inactive, retirees, and their immediate family members.

Also, you can change companies any time you like, even mid-policy, just make sure you don’t have a coverage gap. (For more information. read our “Can I change my car insurance company mid-policy?“).

Top Discounts for New Driver Car Insurance

Some of the more popular auto insurance discounts for drivers between 21 and 25 are offered based on completion of defensive driving or other driver training courses, having had no tickets or accidents, or participating in a company’s usage-based car insurance program.

- Usage-based insurance programs track driving habits via mobile apps or plug-in devices, rewarding safe driving with discounts.

- Auto insurance companies offer various discounts applicable to new drivers, such as good student discounts for college students.

- Safe driver discounts are common but typically require maintaining a clean driving record for eligibility. For a comprehensive overview, explore our detailed resource titled “Safe Driver Car Insurance Discounts.”

If you choose to bundle your auto insurance policy with homeowners/renters insurance, you might be entitled to a multi-policy discount.

Discounts for New Drivers

| New Driver Discount | Qualifications |

|---|---|

| Good Student Discount | Maintain a B average or better. |

| Part-Time Driver Discount | Go to college without a vehicle and only drive when home during school breaks. |

| Safe Driving Discount | Complete a driver's education course |

Participating in a company’s usage-based car insurance program is one of the best discounts to ask about.

Make sure you’re getting all of the discounts you’re entitled to, and keep potential discounts in mind when you’re shopping around for the lowest rate.

Rate Drop Timing: Car Insurance

Your car insurance rates will drop when you turn 25 because statistically, the chances of your death in a vehicle lower considerably. Actuaries determine these statistics.

Insurance companies use actuaries and statistics to estimate the chances of a severe accident. For detailed information, refer to our comprehensive report titled “Understanding car accidents.”

Then they take these figures and make estimates on the likelihood of having to pay out claims on you.

- Insurers use actuaries and stats to predict accident likelihoods.

- Your premium decreases post-25 if you maintain a clean driving record.

- Car insurance rates notably drop at age 25.

As you approach 25, your car insurance rates are likely to decrease significantly due to decreased statistical risk. Actuaries play a crucial role in determining these probabilities. By maintaining a clean driving record, you can further lower your premiums. Keep in mind that different insurers offer varying rates, but generally, expect a notable drop in rates once you reach 25.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Required Car Insurance Coverage for New Drivers

First, there are some required auto insurance coverages that you will need to make sure you have. The level of coverage and amounts are up to the states so you should first get familiar with what your state requires. The National Association of Insurance Commissioners (NAIC) provides a map where you can find the insurance law of your state.

Some of the most common types of insurance that are required are listed below.

- Bodily Injury Liability: This type of coverage covers injury that you are legally responsible for in the case of negligence or at-fault situations in an accident. Even in no-fault states, it is possible that the person you hit could sue you.

Property damage liability just like bodily injury liability insurance, property damage liability covers the damages that you caused another driver’s vehicle in an accident. Liability always implies that you were at fault and that your negligence caused the problem or loss.

While uninsured/underinsured (in some states) this type of coverage is sometimes required, but usually, it’s optional coverage. It covers damages and injury that you receive when the other driver is either uninsured or underinsured.

- Personal Injury Protection: Personal injury protection (PIP) is usually an optional coverage, but it is one you may want to consider when you are shopping for coverage. PIP coverage will often cover your medical expenses. For a comprehensive overview, explore our detailed resource titled “Best Personal Injury Protection (PIP) Insurance.”

Keep in mind that the minimum coverage required by law does not afford you very much protection. It’s recommended that you increase your liability limits and consider adding collision coverage and comprehensive coverage to your policy.

There are a lot of coverage options available from most companies, so talk to an insurance agent if you’re not sure exactly what you need.

Progressive's 15% discount for new drivers over 21 reflects their commitment to offering competitive rates and tailored coverage.

Melanie Musson Published Insurance Expert

Start comparing car insurance for new drivers over 21 with our free comparison tool. Enter your ZIP code to get started.

Transitioning From Parents Car Insurance

If you are leaving your parents’ insurance and getting your coverage, you will want to talk to your parents about it so that they will be able to help you make the transition.

They will have to call their insurance company and have them take you off their plan so that you can get your coverage but do not do so until you locate a new policy.

Insurance agents and others involved in the insurance industry are required to remind you that you should wait to cancel any previous coverages until you have the new one in your possession.

If you don’t, you may not be covered for a short period in between as you are changing your insurance plan. It is important to note that you should not have your parents cancel the insurance policy you have under their policy until you have the new policy in hand.

To gain in-depth knowledge, consult our comprehensive resource titled “How long can you stay on your parents’ car insurance?.”

Steering Clear: Tips for New Drivers to Avoid Insurance Lapses

One thing you need to avoid at all costs is driving without insurance. When you let your car insurance lapse, you put yourself at risk for legal and financial loss.

- Be cautious when switching plans to avoid any periods of being uninsured.

- Even a single day without coverage can leave you financially responsible for accidents, including injuries and damages to yourself or others.

It also puts you at a high legal risk as you are required to carry insurance in every state except for two (New Hampshire and Virginia).

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Exploring Real-World Insurance Success: Case Studies of New Drivers

In the following case studies, we explore how young adults navigate the complexities of car insurance as they embark on new journeys in their lives.

- Case Study #1 –Transitioning to Independence: Emily, a 22-year-old recent college graduate, decided to move out of her parents’ house and get her own car insurance policy. She researched different insurance providers and opted for a policy with Progressive due to their competitive rates for young drivers.

- Case Study #2 – Flexible Coverage for Freelancers: David, a 24-year-old freelance photographer, needed car insurance that could accommodate his irregular driving patterns. He often traveled for photoshoots and needed coverage that could adapt to his changing needs.

- Case Study #3 – Safe Driving Rewards: Sarah, a 23-year-old nurse, was determined to maintain safe driving habits to lower her insurance premiums. She enrolled in Allstate’s DriveWise program, which tracked her driving behavior using a mobile app.

These case studies illustrate how tailored insurance solutions can meet the diverse needs of individuals like Emily, David, and Sarah, empowering them to navigate the road ahead with confidence and financial security.

Progressive stands out as the top choice for new drivers over 21, offering competitive rates starting from just $54 for minimum coverage.

Brandon Frady Licensed Insurance Agent

By tailoring coverage to their specific circumstances, these insurance solutions enable them to approach their future journeys with a sense of assurance and stability.

The Bottom Line: Best Car Insurance for New Drivers Over 21

When you are shopping online for the best insurance deals, you should always keep in mind what your personal needs are. Do you drive a long distance every day to work? Do you take others in the car with you regularly to and from work or other locations?

If you answered “yes” to any of these questions, then you may want to increase your amount of liability coverage for the carpooling situation and increase your overall coverage for longer distances. (For more information, read our “Does car insurance cover carpooling?“).

Remember that the longer distance you drive, the higher your risk level.

Comparing and shopping around for your insurance plan is the best thing you can do to find the best policy and company to have as your insurance company.

For example, compare State Farm Car Insurance and Geico car insurance to see which has better car insurance rates. If you are in the military, or a veteran, you may want to check out USAA car insurance. When you have the right coverage, you can drive freely knowing that you are covered if something happens and you’ll have peace of mind knowing that your insurance company will back you up when you need it most.

See how much you could save as a young adult driver. Enter your ZIP code in the free comparison tool to start.

Frequently Asked Questions

What factors affect my car insurance rates as a new driver?

Factors like age, driving history, vehicle type, and location influence your insurance rates. New drivers typically face higher premiums due to their lack of driving experience.

How can I lower my car insurance premiums as a young driver?

You can lower your premiums by maintaining a clean driving record, opting for a higher deductible, qualifying for discounts (such as good student or defensive driving discounts), and comparing quotes from multiple insurers.

Stop overpaying for car insurance. Our free quote comparison tool allows you to shop for quotes from the top providers near you by entering your ZIP code below.

Do I need car insurance if I don’t own a car?

Even if you don’t own a car, you may still need non-owner car insurance if you frequently drive someone else’s vehicle or rent cars. This coverage provides liability protection when you’re behind the wheel.

To delve deeper, refer to our in-depth report titled “Compare Liability Car Insurance: Rates, Discounts, & Requirements.”

Can I stay on my parents’ car insurance policy as a young adult?

Yes, in many cases, you can remain on your parents’ policy as a named driver. However, it’s essential to check with your insurer to ensure you’re adequately covered.

What is the minimum car insurance coverage required by law?

Minimum coverage requirements vary by state but typically include liability insurance, which covers injuries and property damage you cause to others in an accident.

What does full coverage car insurance include?

Full coverage typically includes liability, collision, and comprehensive coverage. Collision covers damage to your vehicle in accidents, while comprehensive covers non-collision incidents like theft and vandalism.

For a thorough understanding, refer to our detailed analysis titled “Compare Collision Car Insurance: Rates, Discounts, & Requirements.”

Can I get car insurance with a learner’s permit?

Yes, you can typically get insurance with a learner’s permit, often by adding yourself as a driver to a family member’s policy. However, coverage requirements vary by insurer and state.

How do speeding tickets and accidents affect my car insurance rates?

Speeding tickets and accidents generally lead to higher insurance premiums due to the increased risk you pose as a driver. Your rates may increase significantly, depending on the severity and frequency of violations.

Get the right car insurance at the best price — enter your ZIP code below to shop for coverage from the top insurers.

Does my credit score impact my car insurance rates?

Yes, many insurers use credit scores as a factor in determining insurance rates. A higher credit score may result in lower premiums, as it suggests responsible financial behavior.

To expand your knowledge, refer to our comprehensive handbook titled “What is a Car Insurance Premium?.”

Can I cancel my car insurance policy at any time?

In most cases, you can cancel your car insurance policy at any time. However, you may face cancellation fees or penalties, and it’s crucial to have new coverage in place to avoid a lapse in coverage.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.