Travelers Car Insurance Review [2025]

Travelers car insurance was founded in 1864. They are the ninth-largest car insurance company in the nation. A.M. Best gives them a financial rating of A++, which is an excellent score.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

UPDATED: Feb 24, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

By law, most states require that all registered vehicles be insured. With the time and research involved, buying insurance can seem like a necessary evil.You never know what will happen. The good thing is, insurance protects you and your assets from injuries and damage, and unexpected expenses that can drain your resources.Travelers’ famous red umbrella is ready to protect you on that rainy day. Their long history of robust financial growth and variety of coverage options will prepare you for any storms you face along life’s journey.Join us to explore how Travelers started, how its rates compare to a different auto insurance provider, the factors the company uses to set prices, and everything else you need to know about the company.Compare car insurance quotes to see how much you could save.

Rating Agency

Travelers Insurance Rating Agency

| Agency | Rating |

|---|---|

| AM Best | A++ |

| Better Business Bureau (Hartford, CT - Travelers' largest office) | A+ |

| Moody's | Aa2 |

| S&P | AA |

| NAIC Complaint Index (2017) | 0.09 |

| JD Power | 3 out of 5 stars |

| Consumer Affairs | 1 out of 5 stars |

Ratings by reputable sources can tell you a lot about a company’s financial strength and ability to pay and handle its claim process, the quality of its coverage options, and the level of its customer service. Let’s see how Travelers ranked among some of the top rating agencies.

– AM Best Rating: A++

AM Best ranks companies according to their financial strength and histories. Travelers’ A++ rating shows its superior financial standing, which means they can pay despite handling a high amount of other customers and potentially thousands of other claims.

– Better Business Bureau: A+

The Better Business Bureau (BBB) rates many different local Travelers offices. For this rating, we researched the largest office in Hartford, Connecticut, which received the BBB’s highest rating of A+. The BBB grades companies based on the customer complaints they collect and how companies handle them.

– Moody’s: A2

Similar to A.M. Best, Moody’s assigns scores based on financial stability. Their A2 rating indicates Travelers’ long-term financial strength and that it will likely continue to stay solid in the future.

– S&P: AA

Travelers also makes Standard & Poor’s grade, garnering an “AA” for stability and a positive outlook.

– NAIC Complaint Ratio: 0.09

The National Association of Insurance Commissioners measures company complaint ratios. The average insurer has a complaint ratio of 1.0.At less than 10 percent, Travelers’ ratio indicates they receive fewer complaints than most other companies. Often, people see filing a complaint as a hassle, and they won’t do so unless they feel it’s essential, so this is another indicator of the company’s reliable service.

–Travelers Customer Service: One Out of Five Stars

Consumer Affairs bases their ratings on customer reviews. Travelers has received fewer than 50 complaints so far this year.

– JD Power: Three Out of Five Stars for Claims Satisfaction

JD Power compiles data from customers to measure claims satisfaction. Travelers performed “about average” coming in eighth out of 23 companies in their U.S. Auto Insurance Study. In its home region of New England, Travelers received 810 out of a possible 1000 points, which ranked it ahead of Liberty Mutual and Hanovers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Company History

In 1864, Hartford stonecutter James G. Batterson founded Travelers with several fellow townsmen to sell accident insurance. The company sold its first auto insurance policy in 1897. When Batterson died in 1901, it offered health, liability, and auto insurance at a time when most companies offered only one product line.Since it started, the company has achieved many milestones, including establishing the Office of Consumer Information and becoming the only property-casualty insurance company to make the Dow Jones Industrial Average. It has also bought or merged with other companies several times.Among its notable transactions, in 1997, it bought Salomon Brothers Inc. and merged that investment banking company with its own Shearson-Smith Barney unit to form Salomon Smith Barney Holdings Inc. The next year, it had merged with Citicorp to form Citigroup.In 2004, Travelers Insurance Group and Saint Paul Fire and Marine Insurance Company (founded in 1853), merged to form The St. Paul Travelers Company. Later, in 2007, the company changed its name to The Travelers Companies, Inc. and since then, has continued to grow. Let’s see how it has kept building upon its solid track record.

Travelers maintained steady growth between 2015 and 2018 in its market share despite some stiff competition. This slow, steady increase led it to move in 2017 up from the tenth largest private auto insurance provider to the ninth.

– Travelers Agents

Travelers relies on a network of nearly 14,000 independent insurance agents, yet they also offer service online through their website and MyTravelers® app.Some companies are mostly web or mobile-based. Others, especially those that have existed for a long time, like Travelers, are also flexible enough to answer phone calls and meet customers in person. Keeping up with the latest technology while using traditional methods enhances their ability to serve a broad customer base.

– Travelers Commercials

Travelers first ad featuring its signature umbrella appeared in 1870. It didn’t become the company’s official trademark until 1960, as protection from a “rainy day.” In 2007, the company rebought the rights to the red umbrella.The company’s latest ads take a more low-key approach compared to some of their big-name competitors. Their latest campaign focuses on bringing their “promise to life” while they feature people in everyday situations insurance protects them from.https://youtu.be/dkZqtXxpjmsThe commercials end with their catchphrase: “Travelers: it’s better under the umbrella,” which encourages the purchase of umbrella policies for greater asset protection.

– Community Service

Travelers boasts they have contributed more than $218 million to their employees’ communities in the past ten years. In 2017 and 2018, employees volunteered more than 250,000 hours of their time to give back to their communities.Travelers encourages communities in need to apply for grants and scholarships to create educational and economic opportunities.The company says that “we do what we can to support our employees’ community initiatives. We also gave $2.3 million to match employee donations and provide grants for time donated by employees to nonprofits. In 2018, we gave more than $925,000 in funding to nonprofits in support of team volunteer initiatives across the United States and Canada.”Through their Travelers EDGE education program, for more than ten years, the insurer has helped increase college graduation rates and prepare students for careers in the insurance and financial services industries.https://youtu.be/uc6PJTWGm48

– How Is Travelers Positioned for the Future?

Through building a steady financial base, recent mergers, and steady growth, Travelers will likely continue to earn its place among the leading insurance companies.As the company has outlined in its annual report, the company uses the following strategies for success:

- Deliver superior returns on equity by leveraging our competitive advantages

- Generate earnings and capital substantially in excess of our growth needs

- Thoughtfully rightsize capital and grow book value per share over time

U.S. News and World Report predicts that the company’s stock will continue to rise in the coming years despite claims payouts for major natural disasters.

– Employee Experience

When compared to the average wage for entry-level positions nationwide, Travelers employees tend to start at lower than average to average salaries.For example, based on 182 salaries examined, a Travelers account executive could expect a wage starting at just over $86,000, which is in the middle of the average nationwide range ($55,000-$121,000).An account manager can expect a starting salary of about $53,000 a year, on the lower end of an average $45,000 to $83,000 nationwide.At Glassdoor, more than 2,500 employees have reviewed Travelers, which received an average of four out of five stars; 76 percent would refer the company to a friend.Overall, Travelers is considered a good place to work that offers low to average starting pay depending on the position. Employees rate the company highly for its benefits (401k, health insurance) and culture that fosters caring, diversity, and change.

– Awards and Accolades

Travelers has earned several awards and accolades in recent years on the corporate level and for its overall culture. Among them, it has been recognized on lists of the “best places to work for.”Corporate:

- Fortune 500, Fortune, 1995-2018

- FTSE4Good Index Series, 2001-2018

- World’s Most Admired Company, Fortune, 2006-2018

- America’s Most JUST Companies list, JUST Capital and Forbes, 2019

- North America Index Component, Dow Jones Sustainability Index, 2007-2018

- Barron’s 500, Barron’s, 2008-2017

- Largest U.S. Workers Compensation and Commercial Auto Carrier, NAIC, 2014-2017

Culture:

- Military Friendly® Company, VIQTORY, 2018-2019

- Military Friendly® Employer, VIQTORY, 2007-2019

- Military Friendly® Brand, VIQTORY, 2017-2019

- Military Friendly® Supplier Diversity Program, VIQTORY, 2018-2019

- Best for Vets, Military Times, 2010-2011, 2014-2018

- Military Times Best for VETS Index, 2017-2019

- Top Veteran-Friendly Company, U.S. Veterans Magazine, 2014 and 2017

- America’s Best Employers, Forbes, 2015-2018

- America’s Best Employers for Diversity, Forbes, 2019

- America’s Best Employers for Women, Forbes, 2019

- Best Place to Work for LGBTQ Equality, Human Rights Campaign Foundation, 2016-2019

- Best Place to Work for Disability Inclusion, Disability: IN and American Association of People with Disabilities, 2018

- Clear Assured Bronze Standard for Inclusive Best Practices (UK), Clear Company, 2019

- Employer of the Year, Lifeworks, 2019

- Best Place to Work, Glassdoor, 2018-2019

Cheap Car Insurance Rates

Many times, insurance shoppers don’t just want to learn more about a company — they want to find out how much they charge for their coverage.Are Travelers’ rates among the cheapest? How do they compare to other top insurers? It’s not always easy to find answers to those questions.Below, we partnered with Quadrant Data Solutions to show you Travelers’ average rates for their insurance. This information also includes comparisons by company and by state and how credit history, driving record, and other situations affect them.So, get ready to learn more about the different factors that can affect Travelers’ insurance prices.

– Travelers’ Availability and Rates by State

Travelers offers coverage in 44 states. We have data on most of the states they cover below.Travelers' Availability and Rates by State

| State | State Average Annual Premium | Travelers Average Annual Premium | Travelers +/- Average |

|---|---|---|---|

| AL | $3,567 | $3,698 | $131 |

| AR | $4,125 | $5,973 | $1,848 |

| AZ | $3,771 | $3,085 | -$686 |

| CA | $3,689 | $3,350 | -$339 |

| CT | $4,619 | $6,004 | $1,385 |

| DE | $5,986 | $4,182 | -$1,804 |

| IA | $2,981 | $5,429 | $2,448 |

| ID | $2,979 | $3,226 | $247 |

| IL | $3,305 | $2,500 | -$806 |

| IN | $3,415 | $3,394 | -$21 |

| KS | $3,280 | $4,341 | $1,062 |

| KY | $5,195 | $6,552 | $1,356 |

| ME | $2,953 | $2,253 | -$700 |

| MA | $2,679 | $3,538 | $859 |

| MI | $10,499 | $8,774 | -$1,725 |

| MS | $3,665 | $3,729 | $65 |

| NC | $3,393 | $3,133 | -$260 |

| NJ | $5,515 | $4,254 | -$1,261 |

| NV | $4,862 | $5,360 | $499 |

| NY | $4,290 | $4,579 | $289 |

| OH | $2,710 | $3,135 | $425 |

| OR | $3,468 | $2,892 | -$576 |

| PA | $4,035 | $7,842 | $3,808 |

| RI | $5,003 | $6,909 | $1,906 |

| TN | $3,661 | $2,739 | -$922 |

| Median | $3,661 | $3,729 | $68 |

Depending on where you live, your rates may be above or below average.Among the states where Travelers is cheapest, Michigan, Delaware, and New Jersey make up the top three, with higher rates.Annual Travelers premiums in Pennsylvania, Rhode Island, and Kentucky top out at over $6,000 while Idaho and Ohio’s rates come in at less than half of those.

– Comparing the Top Ten Companies by Market Share

Below, we’ve listed the biggest insurers’ average annual premiums compared to state averages.Comparing the Top 10 Companies by Market Share

| State | Average by State |  |  | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Alaska | $3,421.51 | $3,145.31 | $4,153.07 | NA in State | $2,879.96 | $5,295.55 | NA in State | $3,062.85 | $2,228.12 | NA in State | $2,454.21 |

| Alabama | $3,566.96 | $3,311.52 | NA in State | $4,185.80 | $2,866.60 | $4,005.48 | $2,662.66 | $4,450.52 | $4,798.15 | $3,697.80 | $2,124.09 |

| Arkansas | $4,124.98 | $5,150.03 | NA in State | $4,257.87 | $3,484.63 | NA in State | $3,861.79 | $5,312.09 | $2,789.03 | $5,973.33 | $2,171.06 |

| Arizona | $3,770.97 | $4,904.10 | NA in State | $5,000.08 | $2,264.71 | NA in State | $3,496.08 | $3,577.50 | $4,756.25 | $3,084.74 | $3,084.29 |

| California | $3,688.93 | $4,532.96 | NA in State | $4,998.78 | $2,885.65 | $3,034.42 | $4,653.19 | $2,849.67 | $4,202.28 | $3,349.54 | $2,693.87 |

| Colorado | $3,876.39 | $5,537.17 | $3,733.02 | $5,290.24 | $3,091.69 | $2,797.74 | $3,739.47 | $4,231.92 | $3,270.77 | NA in State | $3,338.87 |

| Connecticut | $4,618.92 | $5,831.60 | NA in State | NA in State | $3,073.66 | $7,282.87 | $3,672.34 | $4,920.35 | $2,976.24 | $6,004.29 | $3,190.00 |

| District of Columbia | $4,439.24 | $6,468.92 | NA in State | NA in State | $3,692.81 | NA in State | $4,848.98 | $4,970.26 | $4,074.05 | NA in State | $2,580.44 |

| Delaware | $5,986.32 | $6,316.06 | NA in State | NA in State | $3,727.29 | $18,360.02 | $4,330.21 | $4,181.83 | $4,466.85 | $4,182.36 | $2,325.98 |

| Florida | $4,680.46 | $7,440.46 | NA in State | NA in State | $3,783.63 | $5,368.15 | $4,339.60 | $5,583.30 | $3,397.67 | NA in State | $2,850.41 |

| Georgia | $4,966.83 | $4,210.70 | NA in State | NA in State | $2,977.20 | $10,053.44 | $6,484.90 | $4,499.22 | $3,384.88 | NA in State | $3,157.46 |

| Hawaii | $2,555.64 | $2,173.49 | NA in State | $4,763.82 | $3,358.86 | $3,189.55 | $2,551.83 | $2,177.93 | $1,040.28 | NA in State | $1,189.35 |

| Iowa | $2,981.28 | $2,965.86 | $3,021.81 | $2,435.72 | $2,296.16 | $4,415.28 | $2,735.44 | $2,395.50 | $2,224.51 | $5,429.38 | $1,852.57 |

| Idaho | $2,979.09 | $4,088.76 | $3,728.79 | $3,168.28 | $2,770.68 | $2,301.51 | $3,032.19 | NA in State | $1,867.96 | $3,226.29 | $1,877.61 |

| Illinois | $3,305.48 | $5,204.41 | $3,815.31 | $4,605.20 | $2,779.16 | $2,277.65 | $2,711.81 | $3,536.65 | $2,344.88 | $2,499.76 | $2,770.21 |

| Indiana | $3,414.97 | $3,978.81 | $3,679.68 | $3,437.55 | $2,261.07 | $5,781.35 | NA in State | $3,898.00 | $2,408.94 | $3,393.75 | $1,630.86 |

| Kansas | $3,279.62 | $4,010.23 | $2,146.40 | $3,703.77 | $3,220.65 | $4,784.42 | $2,475.59 | $4,144.38 | $2,720.00 | $4,341.43 | $2,382.61 |

| Kentucky | $5,195.40 | $7,143.92 | NA in State | NA in State | $4,633.59 | $5,930.97 | $5,503.23 | $5,547.63 | $3,354.32 | $6,551.68 | $2,897.89 |

| Louisiana | $5,711.34 | $5,998.79 | NA in State | NA in State | $6,154.60 | NA in State | NA in State | $7,471.10 | $4,579.12 | NA in State | $4,353.12 |

| Maine | $2,953.28 | $3,675.59 | NA in State | $2,770.15 | $2,823.05 | $4,331.39 | NA in State | $3,643.59 | $2,198.68 | $2,252.97 | $1,930.79 |

| Maryland | $4,582.70 | $5,233.17 | NA in State | NA in State | $3,832.63 | $9,297.55 | $2,915.69 | $4,094.86 | $3,960.87 | NA in State | $2,744.14 |

| Massachusetts | $2,678.85 | $2,708.53 | NA in State | NA in State | $1,510.17 | $4,339.35 | NA in State | $3,835.11 | $1,361.86 | $3,537.94 | $1,458.99 |

| Michigan | $10,498.64 | $22,902.59 | NA in State | $8,503.60 | $6,430.11 | $20,000.04 | $6,327.38 | $5,364.55 | $12,565.52 | $8,773.97 | $3,620.00 |

| Minnesota | $4,403.25 | $4,532.01 | $3,521.29 | $3,137.45 | $3,498.54 | $13,563.61 | $2,926.49 | NA in State | $2,066.99 | NA in State | $2,861.60 |

| Missouri | $3,328.93 | $4,096.15 | $3,286.90 | $4,312.19 | $2,885.33 | $4,518.67 | $2,265.35 | $3,419.14 | $2,692.91 | NA in State | $2,525.78 |

| Mississippi | $3,664.57 | $4,942.11 | NA in State | NA in State | $4,087.21 | $4,455.94 | $2,756.53 | $4,308.85 | $2,980.48 | $3,729.32 | $2,056.13 |

| Montana | $3,220.84 | $4,672.10 | NA in State | $3,907.55 | $3,602.35 | $1,326.11 | $3,478.26 | $4,330.76 | $2,417.74 | NA in State | $2,031.89 |

| North Carolina | $3,393.11 | $7,190.43 | NA in State | NA in State | $2,936.69 | $2,182.71 | $2,848.03 | $2,382.61 | $3,078.65 | $3,132.66 | NA in State |

| North Dakota | $4,165.84 | $4,669.31 | $3,812.40 | $3,092.49 | $2,668.24 | $12,852.83 | $2,560.35 | $3,623.06 | $2,560.53 | NA in State | $2,006.80 |

| Nebraska | $3,283.68 | $3,198.83 | $2,215.13 | $3,997.29 | $3,837.49 | $6,241.52 | $2,603.94 | $3,758.01 | $2,438.71 | NA in State | $2,330.78 |

| New Hampshire | $3,151.77 | $2,725.01 | NA in State | NA in State | $1,615.02 | $8,444.41 | $2,491.10 | $2,694.45 | $2,185.46 | NA in State | $1,906.96 |

| New Jersey | $5,515.21 | $5,713.58 | NA in State | $7,617.00 | $2,754.94 | $6,766.62 | NA in State | $3,972.72 | $7,527.16 | $4,254.49 | NA in State |

| New Mexico | $3,463.64 | $4,200.65 | NA in State | $4,315.53 | $4,458.30 | NA in State | $3,514.38 | $3,119.18 | $2,340.66 | NA in State | $2,296.77 |

| Nevada | $4,861.70 | $5,371.62 | $5,441.18 | $5,595.56 | $3,662.09 | $6,201.55 | $3,477.14 | $4,062.57 | $5,796.34 | $5,360.41 | $3,069.07 |

| New York | $4,289.88 | $4,740.97 | NA in State | NA in State | $2,428.24 | $6,540.73 | $4,012.93 | $3,771.15 | $4,484.58 | $4,578.79 | $3,761.69 |

| Ohio | $2,709.71 | $3,197.22 | $1,515.17 | $3,423.01 | $1,867.19 | $4,429.74 | $3,300.89 | $3,436.96 | $2,507.88 | $3,135.16 | $1,478.46 |

| Oklahoma | $4,142.33 | $3,718.62 | NA in State | $4,142.40 | $3,437.34 | $6,874.62 | NA in State | $4,832.35 | $2,816.80 | NA in State | $3,174.15 |

| Oregon | $3,467.77 | $4,765.95 | $3,527.28 | $3,753.52 | $3,220.12 | $4,334.55 | $3,176.83 | $3,629.13 | $2,731.48 | $2,892.19 | $2,587.15 |

| Pennsylvania | $4,034.50 | $3,984.12 | NA in State | NA in State | $2,605.22 | $6,055.20 | $2,800.37 | $4,451.00 | $2,744.23 | $7,842.47 | $1,793.37 |

| Rhode Island | $5,003.36 | $4,959.45 | NA in State | NA in State | $5,602.63 | $6,184.12 | $4,409.63 | $5,231.09 | $2,406.51 | $6,909.45 | $4,323.98 |

| South Carolina | $3,781.14 | $3,903.43 | NA in State | $4,691.85 | $3,178.01 | NA in State | $3,625.49 | $4,573.08 | $3,071.34 | NA in State | $3,424.77 |

| South Dakota | $3,982.27 | $4,723.72 | $4,047.47 | $3,768.80 | $2,940.29 | $7,515.99 | $2,737.66 | $3,752.81 | $2,306.23 | NA in State | NA in State |

| Tennessee | $3,660.89 | $4,828.85 | NA in State | $3,430.07 | $3,283.42 | $6,206.69 | $3,424.96 | $3,656.91 | $2,639.30 | $2,738.52 | $2,739.28 |

| Texas | $4,043.28 | $5,485.44 | $4,848.72 | NA in State | $3,263.28 | NA in State | $3,867.55 | $4,664.69 | $2,879.94 | NA in State | $2,487.89 |

| Utah | $3,611.89 | $3,566.42 | $3,698.77 | $3,907.99 | $2,965.57 | $4,327.76 | $2,986.57 | $3,830.10 | $4,645.83 | NA in State | $2,491.10 |

| Virginia | $2,357.87 | $3,386.80 | NA in State | NA in State | $2,061.53 | NA in State | $2,073.00 | $2,498.58 | $2,268.95 | NA in State | $1,858.38 |

| Vermont | $3,234.13 | $3,190.38 | NA in State | NA in State | $2,195.71 | $3,621.08 | $2,128.21 | $5,217.14 | $4,382.84 | NA in State | $1,903.55 |

| Washington | $3,059.32 | $3,540.52 | $3,713.02 | $2,962.00 | $2,568.65 | $3,994.73 | $2,129.84 | $3,209.52 | $2,499.78 | NA in State | $2,262.16 |

| West Virginia | $2,595.36 | $3,820.68 | NA in State | NA in State | $2,120.80 | $2,924.39 | NA in State | NA in State | $2,126.32 | NA in State | $1,984.62 |

| Wisconsin | $3,606.06 | $4,854.41 | $1,513.27 | $3,777.49 | $3,926.20 | $6,758.85 | $5,224.99 | $3,128.91 | $2,387.53 | NA in State | $2,975.74 |

| Wyoming | $3,200.08 | $4,373.93 | NA in State | $3,069.35 | $3,496.56 | $1,989.36 | $3,187.20 | $4,401.17 | $2,303.55 | NA in State | $2,779.53 |

| Median | $3,660.89 | $4,532.96 | $3,698.77 | $3,907.99 | $3,073.66 | $5,295.55 | $3,187.20 | $3,935.36 | $2,731.48 | $3,729.32 | $2,489.49 |

Overall, Travelers’ rates are sometimes higher than the average premiums in certain states (and those of its competitors), but at other times, they’re lower. Generally, Travelers’ rates are in the middle of the pack.

– Average Travelers Male vs. Female Car Insurance Rates

Now, let’s see how much Travelers’ rates vary by age and gender.Travelers Car Insurance Rates for Male vs. Female by Status, Age & Gender

| Company | Single 17-year old male | Single 17-year old female | Single 25-year old male | Single 25-year old female | Married 35-year old male | Married 35-year old female | Married 60-year old male | Married 60-year old female |

|---|---|---|---|---|---|---|---|---|

| $12,851 | $9,307 | $2,491 | $2,325 | $2,200 | $2,179 | $2,074 | $2,052 |

Like other insurers, regardless of gender, the cost of Travelers’ premiums tend to be higher for younger, inexperienced drivers, and level off for older drivers.

– Average Company Rates by Make and Model Last Five-Year Average

Next, let’s explore how Travelers’ vary for their auto insurance premium for recent popular vehicle makes and models.Make and Model Average Travel Rates for the Last 5-year average

| Make and Model | Travelers |

|---|---|

| 2015 Ford F-150 Lariat SuperCab with 2WD 6.5 footbed and 2.7L V6 | $4,023 |

| 2015 Honda Civic Sedan LX with 2.0L 4cyl and CVT | $4,420 |

| 2015 Toyota RAV4 XLE | $4,384 |

| 2018 Ford F-150 Lariat SuperCab with 2WD 6.5 footbed and 2.7L V6 | $4,412 |

| 2018 Honda Civic Sedan LX with 2.0L 4cyl and CVT | $4,661 |

| 2018 Toyota RAV4 XLE | $4,708 |

As shown, Travelers’ rates tend to decrease for older vehicles.

– Average Travelers Commute Rates

Below are average rates by commute distance for every state.Travelers Average Commute Rates

| State | 10 Miles to Commute. 6000 Annual Mileage. | 25 Miles to Commute. 12000 Annual Mileage. |

|---|---|---|

| AL | $3,698 | $3,698 |

| AR | $5,973 | $5,973 |

| AZ | $3,085 | $3,085 |

| CA | $3,013 | $3,686 |

| CT | $6,004 | $6,004 |

| DE | $4,182 | $4,182 |

| IA | $5,429 | $5,429 |

| ID | $3,226 | $3,226 |

| IL | $2,402 | $2,598 |

| IN | $3,394 | $3,394 |

| KS | $4,341 | $4,341 |

| KY | $6,552 | $6,552 |

| MA | $3,370 | $3,706 |

| ME | $2,253 | $2,253 |

| MI | $8,724 | $8,824 |

| MS | $3,729 | $3,729 |

| NC | $3,133 | $3,133 |

| NJ | $4,254 | $4,254 |

| NV | $5,360 | $5,360 |

| NY | $4,579 | $4,579 |

| OH | $3,135 | $3,135 |

| OR | $2,777 | $3,008 |

| PA | $7,842 | $7,842 |

| RI | $6,909 | $6,909 |

| TN | $2,631 | $2,846 |

In most states, your commute distance won’t affect your rates with Travelers.There are exceptions, however. Insurance providers in states such as California, Massachusetts, Tennessee, and Illinois tend to base their rates on annual mileage (among other factors). So, you’ll notice a slight difference in those states in Travelers’ rates for 10-mile versus 25-mile commutes.

– Average Travelers Coverage Level Rates

The more coverage you buy, generally, the more protection you receive for yourself and your loved ones in case of an accident. Let’s see how rates vary for low, medium, and high coverage levels.Travelers Car Insurance Monthly Rates by State & Coverage Level

| State | Minimum Coverage | Full Coverage |

|---|---|---|

| AL | $37 | $104 |

| AR | $53 | $154 |

| AZ | $55 | $145 |

| CA | $63 | $192 |

| CT | $59 | $114 |

| DE | $51 | $96 |

| IA | $27 | $112 |

| ID | $23 | $78 |

| IL | $54 | $141 |

| IN | $37 | $108 |

| KS | $34 | $106 |

| KY | $62 | $169 |

| MA | $49 | $126 |

| ME | $35 | $88 |

| MI | $126 | $262 |

| MS | $45 | $120 |

| NC | $64 | $151 |

| NJ | $124 | $194 |

| NV | $48 | $115 |

| NY | $114 | $220 |

| OH | $34 | $89 |

| OR | $71 | $139 |

| PA | $40 | $121 |

| RI | $44 | $103 |

| TN | $35 | $112 |

In some states, despite the conventional wisdom that low and medium level coverage will cost less, it’s actually higher. For example, in Pennsylvania, high coverage costs less for Travelers customers than the lower-level options.Though higher coverage can cost more, it may be worth buying for greater peace of mind because you never know what will happen.

– Average Company Credit History Rates

Not every state or company bases their insurance rates on credit scores. Below, we’ll examine the differences among Travelers’ rates in different states for poor, fair, and good credit scores.Travelers' Company Credit History Rates

| State | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| AL | $3,564 | $3,497 | $4,032 |

| AR | $5,346 | $5,720 | $6,854 |

| AZ | $2,435 | $3,063 | $3,757 |

| CA | $3,350 | $3,350 | $3,350 |

| CT | $5,517 | $5,680 | $6,815 |

| DE | $4,029 | $3,852 | $4,667 |

| IA | $4,968 | $5,214 | $6,106 |

| ID | $2,877 | $3,108 | $3,694 |

| IL | $1,994 | $2,455 | $3,050 |

| IN | $3,200 | $3,202 | $3,779 |

| KS | $3,921 | $4,083 | $5,021 |

| KY | $6,161 | $6,183 | $7,312 |

| MA | $3,538 | $3,538 | $3,538 |

| ME | $1,935 | $2,172 | $2,652 |

| MI | $8,610 | $8,720 | $8,992 |

| MS | $3,502 | $3,453 | $4,233 |

| NC | $3,001 | $3,044 | $3,353 |

| NJ | $2,856 | $4,186 | $5,721 |

| NV | $4,963 | $5,256 | $5,863 |

| NY | $3,395 | $3,945 | $6,397 |

| OH | $2,850 | $3,051 | $3,505 |

| OR | $2,229 | $2,833 | $3,615 |

| PA | $7,283 | $7,710 | $8,535 |

| RI | $6,726 | $6,753 | $7,249 |

| TN | $1,996 | $2,735 | $3,484 |

California and Massachusetts are among the states where insurance rates stay the same regardless of different credit scores.But, even the rates based on credit score aren’t consistent. As you’ll see, Alabama, Delaware, and Mississippi have lower rates for drivers with “fair” rather than “good” scores.

– Average Travelers Driving Record Rates

Like credit score and other factors, including driving record, insurers consider drivers with poor histories more of a risk. They adjust their rates accordingly. It’s not always fair, but in the case of a driver’s record, it may be justified. Let’s see how Travelers’ rates compare for common driving infractions.Travelers Car Insurance Monthly Rates by State & Driving Record

| State | Clean Record | One Speeding Ticket | One Accident | One DUI |

|---|---|---|---|---|

| AL | $104 | $146 | $117 | $190 |

| AR | $154 | $191 | $163 | $249 |

| AZ | $145 | $188 | $195 | $214 |

| CA | $192 | $260 | $270 | $400 |

| CT | $114 | $161 | $127 | $208 |

| DE | $96 | $101 | $96 | $172 |

| IA | $112 | $200 | $172 | $259 |

| ID | $78 | $119 | $108 | $183 |

| IL | $141 | $182 | $189 | $208 |

| IN | $108 | $122 | $141 | $160 |

| KS | $106 | $165 | $156 | $212 |

| KY | $169 | $203 | $195 | $306 |

| MA | $126 | $171 | $177 | $262 |

| ME | $88 | $120 | $102 | $136 |

| MI | $262 | $478 | $668 | $1,284 |

| MS | $120 | $135 | $130 | $186 |

| NC | $151 | $231 | $243 | $694 |

| NJ | $194 | $263 | $308 | $292 |

| NV | $115 | $139 | $174 | $222 |

| NY | $220 | $253 | $272 | $275 |

| OH | $89 | $110 | $122 | $197 |

| OR | $139 | $180 | $188 | $208 |

| PA | $121 | $193 | $193 | $251 |

| RI | $103 | $127 | $113 | $162 |

| TN | $112 | $145 | $151 | $165 |

Generally speaking, drivers will receive higher rates for one DUI versus a more minor penalty, such as a speeding ticket. So, one of the best ways to keep your rates low is to maintain a clean record.

Coverages Offered

Travelers is one of the biggest auto insurers, yet car insurance makes up less than 20 percent of their property and casualty options. They offer all the following types of optional coverage and personal insurance:

- Home

- Auto

- Renters

- Condo

- Boat and Yacht

- Landlord

- Umbrella

- Jewelry and Valuable Items

- Wedding and Special Events

They also offer several commercial insurance options.

– Types of Coverages

Travelers provides a variety of coverage options and add-ons for different needs. Like other insurers, they cover many of the most popular types of car insurance.Here are the basic forms of car insurance Travelers sells:

- Liability Coverage

- Comprehensive Coverage

- Collision Coverage

- Personal Injury Protection

- Uninsured/Underinsured Motorist Coverage

- Medical Payments Coverage

And these additional options:

- Loan/Lease GAP Insurance

- Rental Coverage

- Roadside Assistance

- New Car Replacement

- Accident Forgiveness

- Ridesharing

Travelers hasn’t left a big “footprint” in the ridesharing market, with only limited coverage in Colorado and Illinois. Yet, with the increasing popularity of these services, they will likely expand their offerings to compete.

– Discounts Offered

Let’s see how much you can save with the different types of discounts Travelers provides.Travelers Discounts Offered

| Discount Type | Savings Discount |

|---|---|

| Affinity Program | n/a |

| Continuous Coverage Discount | 15% |

| Driver Training Discount | 8% |

| Early Quote Discount | 6% |

| EFT (Electronic Funds Transfer) Discount | 3% |

| Good Payer Discount | 15% |

| Good Student Discount | 8% |

| Home Ownership Discount | 5% |

| Hybrid/Electric Vehicle Discount | n/a |

| IntelliDrive Program | 2% |

| Low Mileage Discount | n/a |

| Multi-Policy Discount | 13% |

| MultiCar Discount | 8% |

| New Car Discount | 10% |

| Paid in Full Discount | 8% |

| Safe Driver Discount | 15% |

| Student Away at School Discount | 7% |

Overall, the ways to save the most with Travelers is through their continuous coverage and Safe Driver Discounts. If you’re a Travelers car insurance customer for several years, you can qualify for a 15 percent discount. On top of that, if you go without an accident claim for five years, you’ll save 23 percent on your annual premiums.Bundling a car and homeowners insurance policy can also lead to higher savings, of up to 13 percent. For instance, if you pay $75 monthly for home insurance and you add car insurance, your car insurance policy could drop by about $10 per month.So, it may be worth considering the discounts Travelers offers and how you can save through them.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Canceling Your Policy

Like other insurers, Travelers lets unsatisfied customers cancel their auto policy. In this section, we’ll go over the process: fees that may be involved, refunds, how to cancel, and the best time to cancel.

– When to Cancel & Cancellation Fees

Unlike other companies, Travelers doesn’t publicly disclose if they charge their customers any cancellation or processing fees. Generally, one of the best ways to avoid potential fees is to not renew your coverage at the end of your policy’s term. However, make sure to notify them or your insurance representative to stop coverage at renewal. Otherwise, Travelers might not stop the policy right away and charge you for the extra month or so of coverage.If you cancel in the middle of your term, or earlier, you may end up paying fees. Ask your agent to tell you if there will be any fees for cancellation or processing before you cancel. Also, don’t forget to find out when your policy will end.

– Is There a Refund?

Travelers doesn’t disclose if they offer any refunds for cancellations. Before you cancel, ask if you’re entitled to a refund.

– How to Cancel

Unlike other insurers, Travelers doesn’t offer any information on its website about how to cancel one of their insurance policies.You can contact the company online, call their Billing & Policy Service Questions line at (800) 842-5075, or reach out to your local office.

How to Make a Claim

Filing a claim when you have a car accident will help you recover from potential financial losses. Let’s explore Travelers’ claims process. For a bigger picture, we’ll also cover what goes into their ability to pay claims, including the average number of claims the company underwrites.

– Ease of Making a Claim

You can file a claim online or call Travelers directly at (800) 238-6225. In some situations, the company recommends that you call them instead of submitting a claim online. You can also check your claim status online and track claims.To make a claim online, you should have the following information ready:

- Your policy number

- Your contact information

- Incident date

- Incident description

The company suggests that claimants call them in the following situations:

- Claims that require immediate assistance, such as significant injuries or fatalities or major automobile damage from fire or theft

- a claim that involves only damage to glass

- When you don’t have the information required to file an online claim

– Premiums Written

As with the Travelers’ steady financial growth, the number of premiums they’ve written have also increased:

- 2015 – $3,377,404

- 2016 – $3,896,786

- 2017 – $4,396,705

- 2018 – $4,697,743

– Loss Ratio

An insurance company’s loss ratio reveals how much it paid on claims compared to how much it earned in premiums.Travelers’ loss ratio for 2018 was 60 percent. In other words, that year, for every $100 it earned in premiums, the company paid $60.00 in claims.Below are the company’s loss ratios from 2015 to 2018:

- 2015 – 56.48 percent

- 2016 – 65.45 percent

- 2017 – 66.60 percent

- 2018 – 60.00 percent

For the most part, these ratios have remained consistent, with slight rises in 2016 and 2017. This means that Travelers is likely to be able to afford to pay claims.

How to Get a Quote Online

Getting a Travelers quote online is a quick and easy process that involves filling in a few blanks along the way.Before you proceed, you should have the following information ready with you:

- the vehicle(s) you want quotes for

- information about other members of your household

- your driving and insurance history

- VIN: in case Travelers’ system can’t get the data based on vehicles registered at your address.

- your current level of insurance coverage

Step #1 — Explore the Travelers Site

Step #2 — Start with Your Location

Travelers currently insures 43 states. You’ll also be asked, after entering your ZIP code, if you already have Travelers insurance. Select yes or no then click “Continue Quote.”

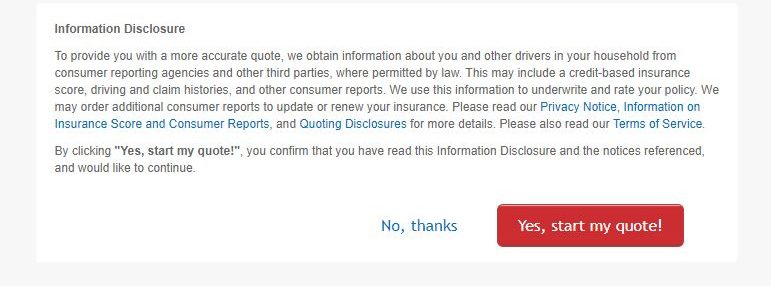

Step #3 — Agree to the Information Disclosure

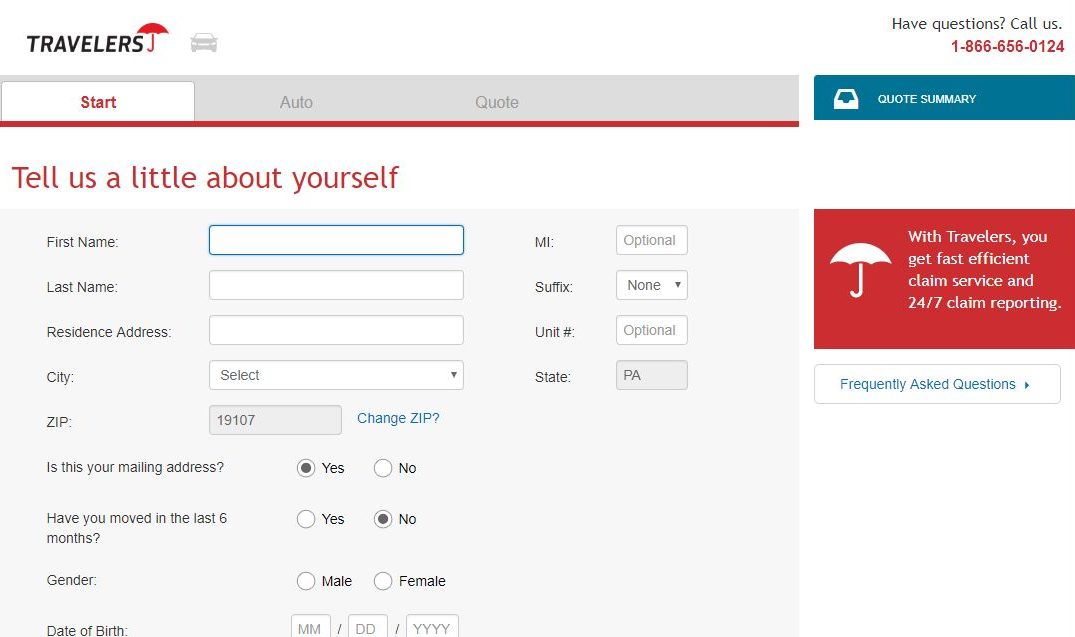

Step #4 — Enter Your Personal Information

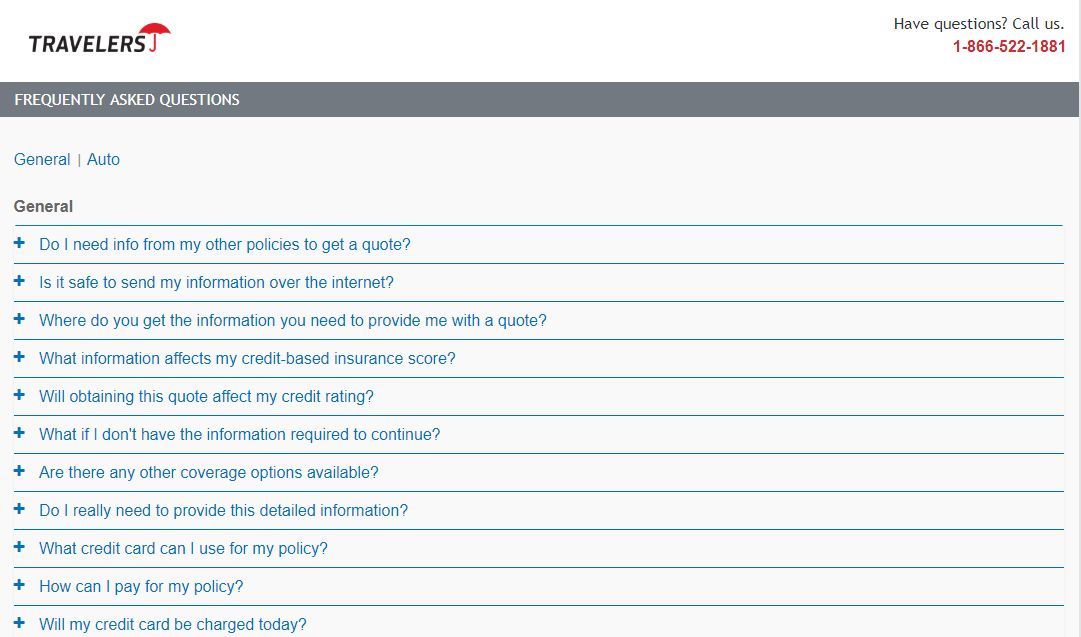

Step #5 — Get Answers to Frequently Asked Questions

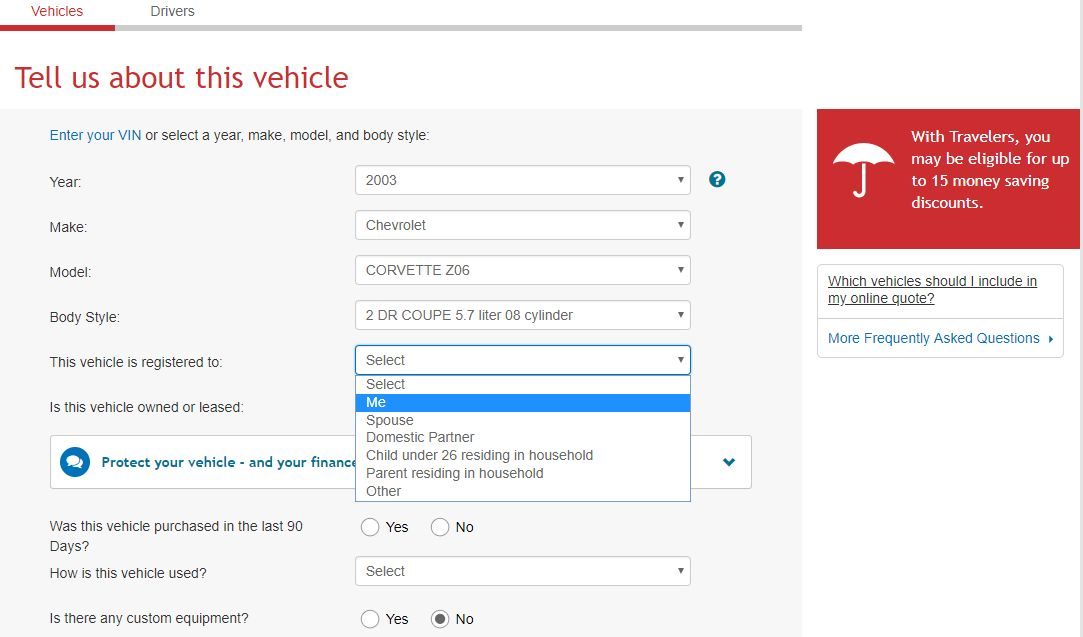

Step #6 — Describe Your Car

After you’ve entered your information, it’s time to talk about your vehicle.You can enter your vehicle’s year, make, model, and other details by hand, or simply enter your VIN and have the information automatically inputted.Your VIN can be found on the inside of your driver’s side door frame or on your vehicle title or registration. You can also check your current car insurance agreement or call up your provider (if you have one) and ask them for this information.

Who’s the owner?

You can choose yourself, of course, but you’ll also have the ability to choose a spouse, domestic partner, parent, or parent or child under 26 who lives in the same house.

You can repeat this process for multiple vehicles.

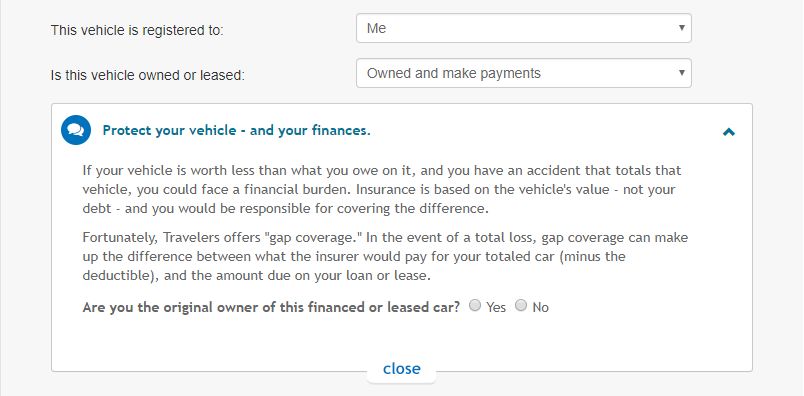

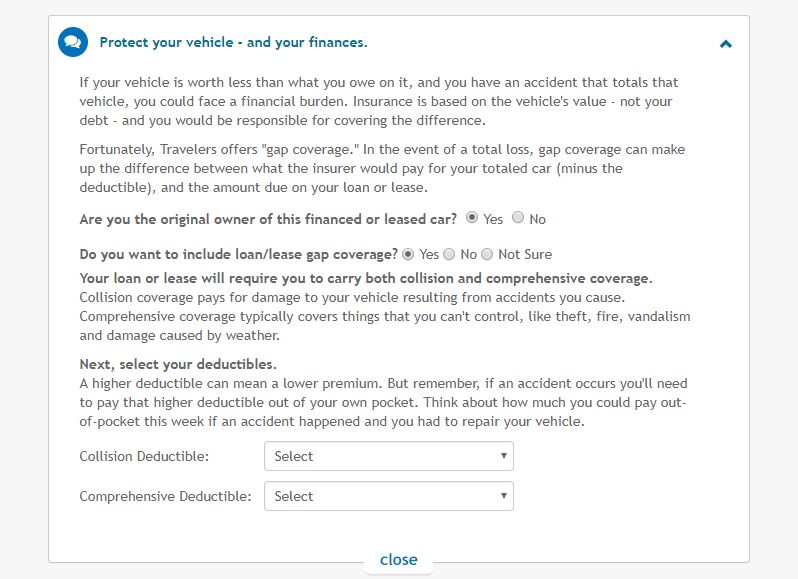

Do you need gap coverage?

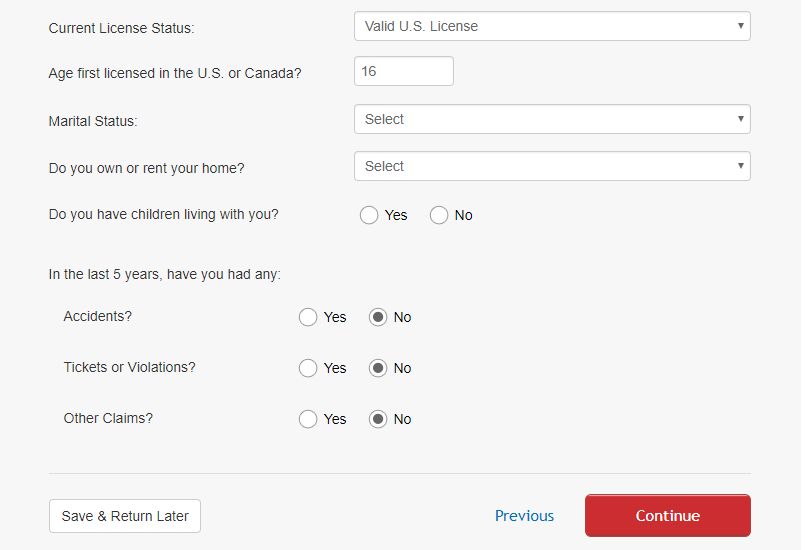

Step #7 — Add Driver Details

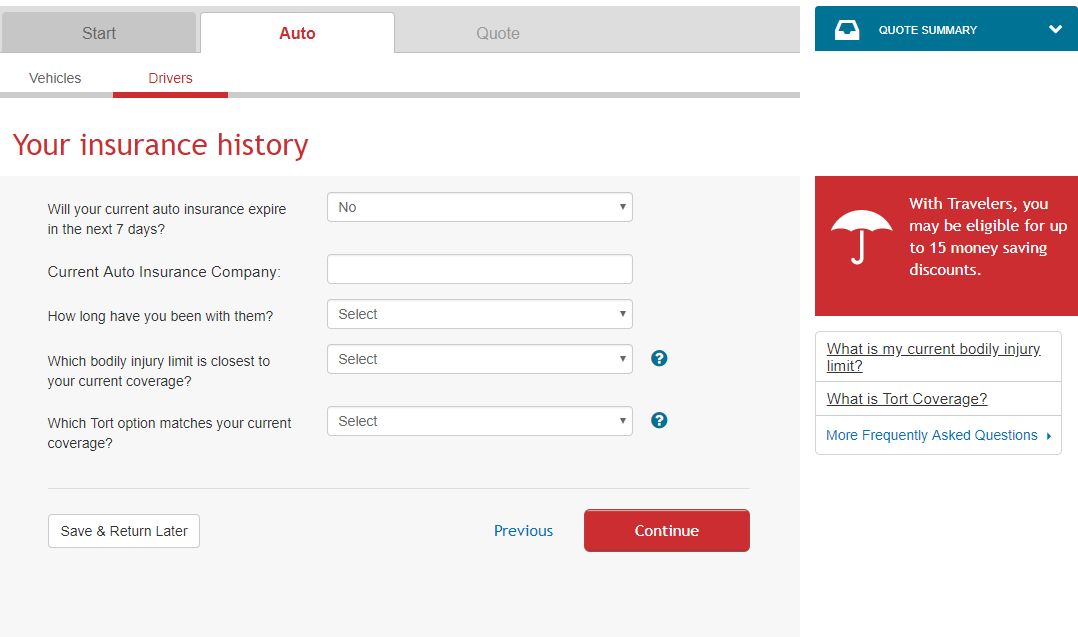

Step #8 — Talk About Your Coverage History

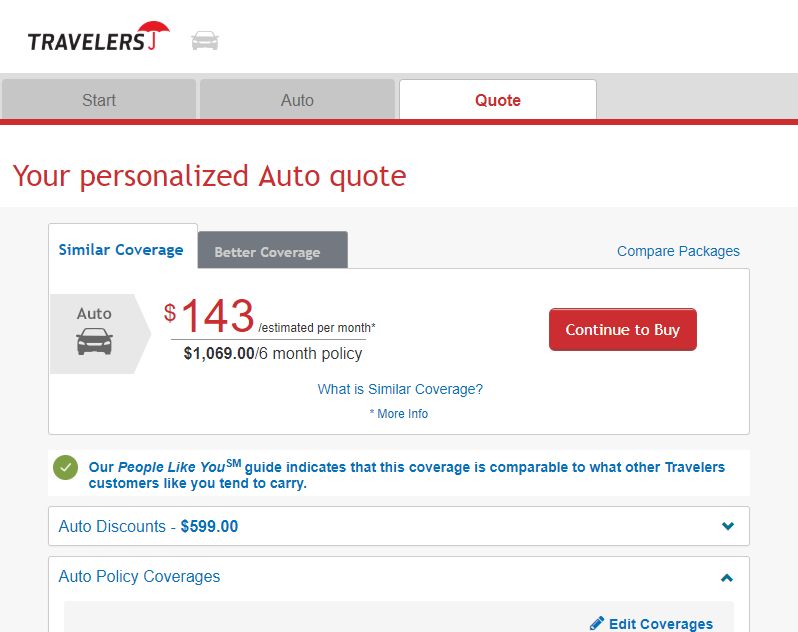

Step #9 — Get Your Quote & Break It Down

Step #10 — Compare Your Estimate with Other Insurance Providers

One of the best ways to save money on car insurance is to comparison shop. Every car insurance provider has their own process of calculating rates, and different factors may cost you more at certain companies.

You also have to understand the types of car insurance available and read the fine print — there typically aren’t “all-in-one deals” that have everything you need, and in some cases, a low rate might mean inadequate coverage.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Design of Website/App

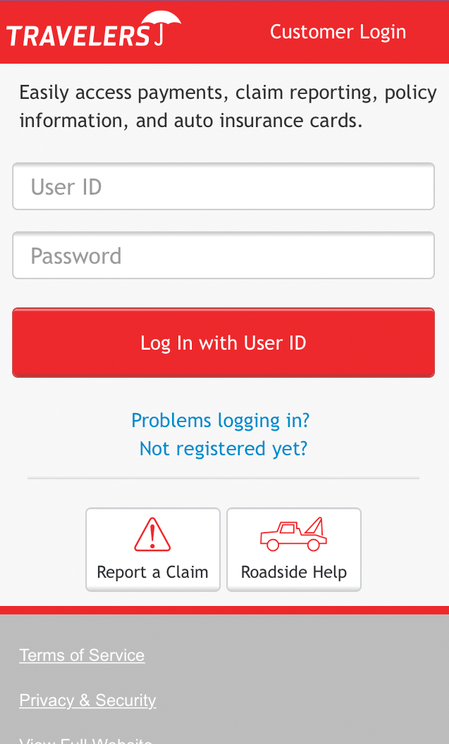

Whether you need to file or check on the status of a claim, get a quote, or contact an agent, you’ll find what you need quickly at Travelers’ website. The basic navigation, which includes the ability to search, will take you where you need to go on any computer or mobile device.The company’s mobile app, known as MyTravelers®, also offers options at the touch of a few buttons. From the login screen, users can report a claim, request roadside help, or jump to the full website.https://youtu.be/YOw6Gd6NmpkThe app also lets users pay their premiums, view, and download their insurance cards.When it comes to filing claims, it boasts an “enhanced glass claim experience.” It conveniently gives step-by-step guidance while filing claims, which is crucial if you’re at the scene of an accident. You can take damage photos, get the other party’s contact information, and record notes or statements.

– App Reviews & Ratings

MyTravelers® receives an average of three out of five stars in user reviews. Travelers was an early adopter of app technology, publishing its first app about ten years ago.Those who like the app praise it for its ease of use. In recent years, the company has worked to fix issues with its Face and Touch ID features — which don’t require a password for login — to make them more reliable. Apple device users have complained about the inability to pay their premiums with Apple Wallet. Android users have reported having problems loading the app.In iTunes’ App Store, the company responds to all reviews, whether positive or negative, but isn’t so responsive in Google Play.Users have noted that the app should be programmed to load well on all devices. It should also offer users a more reliable experience, from log-in to site access, and allow for more flexible payment options.As we mentioned, Travelers doesn’t have a section at their website or in their app to help users cancel their policies. They don’t even address cancellation.Obviously, they don’t want to lose business, some openness about how to sign up and how to cancel policies can ease customers complaints about their service and help increase customer satisfaction, too.

Pros and Cons of Travelers Insurance

Like other companies, Travelers’ products and service have their share of the good and the bad. We explore their key strengths and weaknesses below.Travelers Pros and Cons

| Pros | Cons |

|---|---|

| Growing market share | Not available in every state |

| Strong financial rating | Mediocre customer satisfaction ratings |

| Good discounts and programs | No information about canceling policies |

| Multiple lines of insurance available | Limited availability of rideshare coverage |

All in all, Travelers builds on its strong financial base and variety of discounts in its offerings; however, limited market saturation and rideshare insurance coverage, combined with the need for a better customer experience may keep the company from reaching the top.

The Bottom Line

More than 160 years after its founding, Travelers shows no signs of stopping. With its steady financial foundation and growth, and continued positive outlook, the company’s customers can trust that it has the means to pay claims.As expected with a leading insurance company, Travelers offers a strong variety of basic coverage for many situations and many different types of damage. Depending on the local market, Travelers’ rates tend to rank in the middle range of average premium rates compared to competitors, and its online offerings are standard among insurers.Travelers balances its strengths and weaknesses with a solid track record of success that lets it continue to provide coverage to consumers in need of insurance to protect their assets. If you’re looking for an insurer who can cover your claims in times of need, Travelers is worth considering to see, like its slogan, if its truly “the right insurer for you.”

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

Does Travelers insurance offer travel insurance?

Though the company made its name on providing travel insurance, it no longer offers those types of policies.

Will my car insurance policy automatically renew, or do I have to reapply for coverage?

It depends. According to Travelers, If you qualify, most car policies renew automatically. The company will notify you about any policy or premium changes beforehand. Travelers suggests that it’s important to review your coverage needs with your insurance representative yearly.

How and when can I change car insurance coverage and/or limits on my current policy?

Travelers lets you update your coverage options and policy limits anytime online at MyTravelers.com or by calling your insurance representative. Making changes to your policy can affect your rates. Travelers will notify you and adjust your premium to reflect the changes once they have updated your policy.

What is umbrella insurance and how does it apply to my car policy?

Umbrella insurance is a separate personal liability policy that offers more coverage than your car insurance policy and extends to your home and other policies. The cost of damages you may be responsible to pay after a serious accident can end up exceeding your policy limits. Umbrella insurance can give you extra coverage, especially if you have several assets to protect. Travelers states that underlying auto and home limits may be required. Talk to your insurance representative to see if an umbrella policy is right for you.

How do I get discounts on my Travelers policy?

Travelers applies many of their discounts automatically. You can view your policy online or via the app to see if the company has applied any discounts. If you think you qualify for more discounts, call your local agent to see if they can add anything else.Beyond the discounts we described above, you may also be eligible for discounts if you pay in full, pay on time, by electronic funds transfer (EFT) or by payroll deduction.

How do I get a quote for another line of Travelers insurance?

If you’re getting a car insurance quote, in the process, you’ll be able to add quotes for other insurance lines. Otherwise, you can find more quotes in the dropdown menu in the online quote section to choose the insurance you’re interested in buying.

What is a deductible, and how does it affect my car insurance premium?

A deductible is the amount of money you must pay before your car insurance will provide coverage. Deductibles apply only to certain coverages, such as comprehensive and collision; Travelers’ rates usually range from $100 to $1,000. Typically, the higher your deductible, the lower your premium. But, not all of us can afford high deductibles, so it’s wise to choose coverage that will meet your budget. Contact your insurance representative for more information about the deductible options available to you.

What is a policy limit liability, and how does it affect my car insurance premium?

A policy limit (or “limit of liability”) is the maximum amount of money your insurance company will pay for any claim under your policy. As part of policy limits, there are three set maximum dollar amounts, such as $50,000/$100,000/$50,000.The first figure is the “per person” bodily injury limit ($50,000), the second one ($100,000) is the total bodily injury amount the accident coverage will pay, and the third is the total property damage limit ($50,000) that the policy will pay per accident. To pay less for their premiums, drivers can decrease their policy limits. But they shouldn’t do so if they won’t end up with enough coverage; they could end up being stuck with bills they need to pay out of pocket. That’s where your Travelers insurance agent can help.

What is IntelliDrive®?

IntelliDrive® is a 90-day program that uses a smartphone app to record and score the driving behavior of drivers covered under your policy. If you enroll, you may be eligible for discounts on your policy’s first term. When you renew, Travelers states that safe driving habits can lead to savings of up to 20 percent in the states where IntelliDrive® is available (up to 15 percent in Florida). Risky driving habits can lead to higher premiums in most of the covered areas except for Washington, D.C., Maryland, Montana, Pennsylvania, and Virginia. The program is available in: AZ, AL, CO, CT, DC, FL, GA, IA, ID, IL, IN, KS, KY, MD, ME, MN, MO, MS, MT, NE, NH, NJ, NM, NV, OH, OK, OR, PA, SC, TN, TX, UT, VA, VT, WA, WI. Discounts, program rates, and savings may vary by state.

How does IntelliDrive® work?

An app monitors your driving habits such as speed, acceleration, and braking. You can access a map of your route and your star rating. Travelers says that it gathers location data only for research and development and it won’t affect your car insurance premium.

What kind of phone does the IntelliDrive® app work on?

The app supports Apple iPhones 4S and later running on iOS 9.0 or newer, and all Android phones with cellular, Wi-Fi, and GPS chips. OS Lollipop 5.1 or newer is required.What do you think? Did you learn everything you wanted to know about Travelers?If you’re ready to get some quotes, see how much you could save on car insurance with our free comparison tool — just enter your ZIP code today.

Joe Schmoo

Travelers Companies, Inc. review

Leopard

Fast reply

franbrown11

HORRIBLE

biskutt

Increasing price for no obvious reason

CarterKing2020

Bill

BW2345

Affordable, easy to manage, and great customer service

Rustysgirl

Fast service

Christinewashere

Best option

SPR5036

Good Car Claim

GQ

Great Value