Best Car Insurance for Minors With a DUI in 2026 (Top 10 Companies)

State Farm, USAA, and Progressive lead the pack in offering tailored car insurance rates after a DUI as a minor, with discounts of up to 20% available. Embracing high-risk drivers, they provide customizable coverage options and unbeatable value, ensuring peace of mind on every journey.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Professor & Published Author

D. Gilson is a writer and author of essays, poetry, and scholarship that explore the relationship between popular culture, literature, sexuality, and memoir. His latest book is Jesus Freak, with Will Stockton, part of Bloomsbury’s 33 1/3 Series. His other books include I Will Say This Exactly One Time and Crush. His first chapbook, Catch & Release, won the 2012 Robin Becker Prize from S...

D. Gilson, PhD

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Daniel Walker

Updated February 2025

18,157 reviews

18,157 reviewsCompany Facts

Full Coverage for DUI as a Minor

A.M. Best Rating

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviews 6,590 reviews

6,590 reviewsCompany Facts

Full Coverage for DUI as a Minor

A.M. Best Rating

Complaint Level

Pros & Cons

6,590 reviews

6,590 reviews 13,285 reviews

13,285 reviewsCompany Facts

Full Coverage for DUI as a Minor

A.M. Best Rating

Complaint Level

Pros & Cons

13,285 reviews

13,285 reviewsState Farm leads the pack as the top choice for car insurance rates after a DUI as a minor, closely trailed by USAA and Progressive. These companies prioritize comprehensive coverage and exceptional customer service, catering to high-risk drivers with flexible options.

Young drivers are automatically deemed to be high-risk and thus pay higher than usual premiums. Finding car insurance coverage for a high-risk teenager is certainly possible although not always easy.

Our Top 10 Company Picks: Car Insurance Rates After a DUI as a Minor

| Company | Rank | Multi-Policy Discount | Low-Mileage Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | 15% | Many Discounts | State Farm | |

| #2 | 25% | 20% | Military Savings | USAA | |

| #3 | 10% | 30% | Snapshot Program | Progressive | |

| #4 | 10% | 10% | Add-on Coverages | Allstate | |

| #5 | 20% | 10% | Usage Discount | Nationwide |

| #6 | 5% | 10% | Local Agents | Farmers |

| #7 | 25% | 30% | Customizable Polices | Liberty Mutual |

| #8 | 29% | 10% | Student Savings | American Family | |

| #9 | 13% | 10% | Accident Forgiveness | Travelers | |

| #10 | 5% | 10% | Local Agents | AAA |

Some auto insurance companies will flat-out decline a minor with a DUI while others will accept the minor for coverage but at increased rates.

Despite past incidents, drivers can still find affordable car insurance options tailored to their needs, ensuring comprehensive protection and peace of mind on the road. Not all companies handle DUI and DWI with minors the same so make sure to compare DUI insurance quotes from many different companies.

Enter your ZIP above to start with a FREE car insurance quote comparison today!

The Ramifications of a DUI For a Minor

When a minor is arrested on a charge of DUI, it can change a lot of things in regards to their driving. Even if they do not already have a driver’s license, it will be noted on their driving record. This could delay their eligibility for a driver’s license.

For those with a beginner’s license or a regular license, it usually means revocation of it. When they become eligible for a license again, they will be deemed high risk and will pay heavily for DUI high risk insurance.

Many states require that a DUI convicted motorist have SR-22 liability insurance for a period of time following the incident. This means that the driver must have a certificate proving financial responsibility to the department of motor vehicles in the state in which he or she resides.

If a minor driver with a DUI offense does not own a vehicle, he must still carry a non-owner SR-22 insurance policy.

Check the requirements for your state by contacting the state insurance division or the department of motor vehicles before seeking insurance coverage for a minor with a DUI conviction.

Additionally, most insurance companies will be able to let you know of the SR-22 requirements in your state of residence.

Finding Companies That Offer High-Risk Insurance for Teens

You will be relieved to know that there are indeed Car insurance companies that accept DUI out there which will be willing to insurance the minor with a DUI on his or her record.

There are also many companies out there who will flat out refuse to cover such a driver. Therefore, you may have to search a little harder than usual to find one to provide the coverage needed.

The quickest and easiest way to find companies who will indeed provide the insurance that you are seeking is to use an online quote tool.

The tool will get you the quotes you need from companies that know the situation up front and will automatically exclude quotes from those who do not offer such coverage. In the case of being unable to locate an insurer this way, you will need to contact the insurance department in your state, which may have a high-risk group available to help you.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tips to Keep the Cost Down

If you are seeking car insurance for a minor with a record of DUI, expect to pay thousands of dollars for liability insurance alone.

One of the best ways to keep the overall cost of insurance down is to invest in an older car for that driver to use.

Lower valued cars such as these do not need comprehensive and collision insurance coverage which is an added expense.

Other tips to help you save money on car insurance for minors with a DUI are as follows:

- Make sure that he or she takes a driver training course. Often insurers will give a discount on prices based on the completion of such courses.

- Good student discounts are also common with many insurers. Encourage your minor driver to strive for As and Bs in high school or college in order to be eligible.

- When possible, opt to pay for the insurance policy in full up front if it gives you a discount. Many companies will give you a break on your premium for doing so, but be sure to check it out first.

- The top way to make sure that your car insurance cost is as low as possible is by shopping around carefully and extensively to make sure that you have the best price possible.

There are many insurers out there who simply don’t want to insure high-risk drivers. For this reason, you definitely don’t want to accept the first price you receive. Compare as many quotes as possible before making your decision.

When insuring a minor with a DUI record, explore cost-saving measures like investing in an older car and taking advantage of discounts. Comparison shopping is crucial for finding the best rates.

DUI Auto Insurance Quotes for Minors

An easy way to get multiple car insurance quotes is by using our online quote tool. The tool will provide quick and easy access to car insurance quotes from a variety of insurers serving your area.

The results are even provided in an easy to compare format, making the whole process much easier for you.

Use our car insurance comparison quote tool to find affordable car insurance for a minor with a DUI today.

Case Studies: Comparing Car Insurance Rates After a DUI as a Minor

Finding the right coverage is crucial, especially for individuals with unique circumstances like DUI convictions. Here, we delve into three case studies of young drivers seeking insurance after a DUI incident. These case studies shed light on their choices and outcomes with different insurance providers.

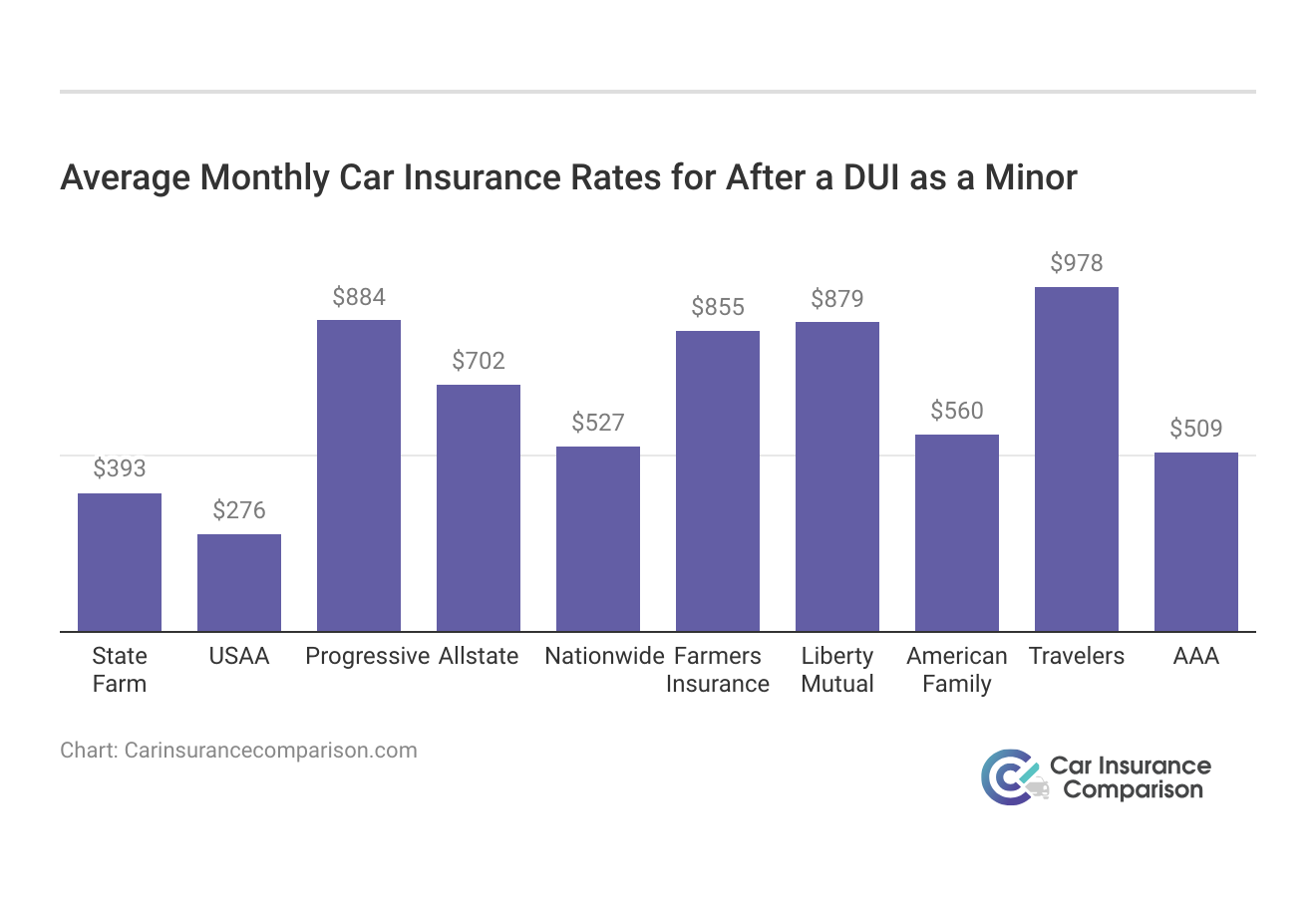

- Case Study #1 – Neighborhood Protection for a First-Time Driver: Alex, an 18-year-old first-time driver with a DUI on their record, sought affordable coverage with State Farm. With a minimum coverage rate of $393, State Farm proved to be a reasonable choice for Alex, who benefited from the trust associated with its nationwide presence.

- Case Study #2 – Serving a Military Family Post-DUI: Emily, a 20-year-old with a DUI, belongs to a military family and explored USAA’s offerings. With a minimum coverage rate of $276 and full coverage at $552, USAA aligned with Emily’s budget while providing specialized support for military-affiliated individuals.

- Case Study #3 – Innovation for a Tech-Savvy Driver: David, a 22-year-old tech enthusiast with a DUI, sought innovation on the road and chose Progressive. Despite higher rates with a minimum coverage cost of $884, Progressive offered David the innovative features he valued, showcasing the importance of tailoring coverage to individual preferences.

The importance of exploring various insurance options tailored to individual needs, particularly for young drivers navigating the aftermath of a DUI, includes understanding DUI auto insurance rates. Whether seeking affordability, specialized support, or innovative features, providers like State Farm, USAA, and Progressive offer solutions for different preferences and circumstances.

State Farm emerges as the premier option for post-DUI car insurance for minors, boasting an impressive 95% customer satisfaction rating.

Tracey L. Wells Licensed Insurance Agent & Agency Owner

The journey to finding suitable car insurance after a DUI can vary depending on factors like age, background, and preferences, including DUI insurance rates. By understanding the experiences of individual young drivers facing similar situations, you can make more informed decisions, ensuring peace of mind on the road.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Navigating Car Insurance After a DUI as a Minor

After a DUI as a minor, navigating the car insurance landscape can be daunting. However, with the right knowledge and approach, it’s possible to find suitable coverage that meets both your needs and budget.

Understanding the implications of a DUI conviction, such as increased premiums and potential license restrictions, is crucial in making informed decisions about insurance.

Providers offer competitive rates and tailored solutions for young drivers with DUIs. By exploring options, comparing quotes, and leveraging available car insurance discounts, minors can find affordable coverage that provides comprehensive protection on the road.

Affordable car insurance rates are just a click away. Enter your ZIP code into our free quote tool below to find the best policy for you.

Frequently Asked Questions

How much does affordable car insurance dui cost for a minor with a DUI?

Affordable car insurance rates for minors with a DUI can vary depending on factors like location, driving history, and the insurance provider. Generally, expect higher premiums compared to drivers without DUIs.

To expand your knowledge, delve into our extensive guide on insurance coverage titled “Average Car Insurance Rates by Age and Gender,” and gain deeper insights

Where can I find affordable car insurance with DUI for minors?

You can find affordable car insurance for minors with DUIs by comparing quotes from multiple insurance providers. Look for companies that specialize in high-risk drivers or offer discounts for completing driver education courses.

Finding cheap car insurance quotes is easy. Just enter your ZIP code into our free comparison tool below to instantly compare quotes near you.

What are the best auto insurance for DUI companies for DUI for minors?

Some of the best auto insurance companies for minors with DUIs include State Farm, USAA, Progressive, and Allstate. These companies may offer competitive rates and special programs for high-risk drivers.

To enhance your knowledge, delve into our extensive guide on insurance policies titled “Learning About High-Risk Car Insurance,” ensuring you’re well-equipped to make informed decisions.

Can I find car insurance DUI-friendly insurance for minors?

Yes, there are insurance companies that specialize in providing coverage to high-risk drivers, including minors with DUIs. These companies may offer tailored policies and discounts to mitigate the impact of a DUI on insurance rates.

How can I get cheap car insurance for DUI drivers?

Getting cheap car insurance for DUI drivers may require shopping around and comparing quotes from different insurance companies. Additionally, you can explore discounts and programs offered by insurers to mitigate the impact of a DUI on insurance rates.

What are the best car insurance for DUI options for minors with a DUI?

The best car insurance options for minors with a DUI are those that provide comprehensive coverage at affordable rates. Companies like State Farm and USAA may offer tailored policies for high-risk drivers.

For a thorough examination, consult our comprehensive guide entitled “Compare Comprehensive Car Insurance: Rates, Discounts, & Requirements” to delve into all aspects of car insurance coverage.

How can I get cheap auto insurance DUI for minors?

To get cheap auto insurance with a DUI for a minor, compare quotes from multiple insurers, maintain a clean driving record, and explore discounts offered by insurance companies for completing driver improvement courses.

Refer to our thorough report titled “Do all car insurance companies check your driving records?” for detailed insights, ensuring informed decisions.

Where can I get cheap auto insurance with a DUI for minors?

You can get cheap auto insurance with a DUI for minors by comparing quotes from multiple insurance providers. Look for companies that specialize in providing coverage to high-risk drivers or offer discounts for completing driver education courses.

Take the first step toward cheaper car insurance rates. Enter your ZIP code below to see how much you could save.

How can I get DUI car insurance quotes for minors?

You can get DUI car insurance quotes for minors by contacting insurance companies directly or using online comparison tools. Provide accurate information about the minor’s driving history and DUI offense to receive accurate quotes.

To deepen your comprehension, delve into our extensive guide on business insurance entitled “Cheap Car Insurance Companies That Beat Quotes,” ensuring you’re well-informed before making any decisions.

Can I find DUI friendly auto insurance for minors?

Yes, there are insurance companies that specialize in providing coverage to high-risk drivers, including minors with DUIs. These companies may offer tailored policies and discounts to mitigate the impact of a DUI on insurance rates.

Where can I find cheap auto insurance with a DUI for minors?

What are the best car insurance rates for dui companies for minors with a DUI?

What are the cheapest car insurance with DUI options available?

Where can I get the cheapest insurance with DUI for minors?

How can I find the cheapest insurance after DUI for minors?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.