Best Chevrolet Camaro Car Insurance in 2025 (Compare the Top 10 Companies)

For the best Chevrolet Camaro car insurance, State Farm, Geico, and Progressive stand out as top picks. State Farm offers top-tier coverage at a competitive rate of $65 per month, combining excellent service. Geico and Progressive also provide great options, ensuring reliable protection for Chevrolet Camaro owners.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Oct 21, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 21, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Chevrolet Camaro

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Chevrolet Camaro

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Chevrolet Camaro

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews

State Farm is the top pick for the best Chevrolet Camaro car insurance, offering rates starting at $87 per month. Geico and Progressive also deliver competitive options with impressive coverage.

The average cost for minimum coverage is around $75 monthly, but rates vary based on factors like age, location, and driving record. Gain deeper understanding through our article entitled “Best Chevrolet Spark Car Insurance.”

Our Top 10 Company Picks: Best Chevrolet Camaro Car Insurance

Company Rank Bundling Discount A.M. Best Best For Jump to Pros/Cons

#1 17% B Young Drivers State Farm

#2 15% A++ Low Rates Geico

#3 10% A++ Online Tools Progressive

#4 10% A++ Military Families USAA

#5 10% A+ Accident Forgiveness Allstate

#6 15% A+ Customer Service Amica

#7 15% A++ Customizable Policies Farmers

#8 10% A+ Comprehensive Coverage Nationwide

#9 12% A New-Car Replacement Liberty Mutual

#10 10% A Hybrid Vehicles Travelers

Understanding these elements helps you find the best deal for your Chevrolet Camaro. This guide breaks down the top providers and what they offer, helping you make an informed decision. Find cheap car insurance quotes by entering your ZIP code.

#1 – State Farm: Top Overall Pick

Pros

- Competitive Rates: State Farm offers affordable insurance premiums for Chevrolet Camaro owners. Gain deeper insights by perusing our article named “State Farm Car Insurance Review.”

- Strong Customer Service: State Farm has a reputation for responsive claims service for Chevrolet Camaro drivers.

- Extensive Agent Network: Access to local agents ensures personalized support for Chevrolet Camaro insurance needs.

Cons

- Limited Discounts: Chevrolet Camaro owners may find fewer discount opportunities compared to other providers.

- Average Online Experience: The online tools for managing Chevrolet Camaro insurance are not as advanced as some competitors.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#2 – Geico: Best for Low Rates

Pros

- Low Rates: Geico provides some of the lowest insurance premiums for Chevrolet Camaro owners.

- Wide Range of Discounts: Chevrolet Camaro drivers can benefit from a variety of discounts, including for safe driving.

- User-Friendly Apps: The Geico app makes managing Chevrolet Camaro insurance policies convenient. Dive into the details with our article entitled “Geico Car Insurance Review.”

Cons

- Limited Local Agents: Chevrolet Camaro owners who prefer in-person support may find Geico’s local presence lacking.

- Mixed Customer Service Reviews: Some Chevrolet Camaro drivers report less consistent customer service experiences.

#3 – Progressive: Best for Tech-Savvy Drivers

Pros

- Snapshot Program: Chevrolet Camaro owners can save money by participating in Progressive’s usage-based insurance program.

- Competitive rates: Progressive offers affordable premiums for Chevrolet Camaro insurance. Explore further in our article titled “Progressive Car Insurance Discounts.”

- Strong Online Tools: Chevrolet Camaro drivers benefit from Progressive’s robust digital tools for managing policies.

Cons

- High Rates for High-Risk Drivers: Chevrolet Camaro owners with a less-than-perfect driving record may face higher premiums.

- Average Claims Satisfaction: Some Chevrolet Camaro drivers report less-than-stellar claims processing experiences.

#4 – USAA: Best for Military Families

Pros

- Excellent Customer Service: USAA is known for top-tier service, particularly for Chevrolet Camaro owners in the military.

- Competitive Rates: USAA offers some of the most affordable premiums for Chevrolet Camaro drivers. Delve into the specifics in our article called “USAA Car Insurance Review.”

- Comprehensive Coverage Options: USAA provides a wide range of coverage choices tailored to Chevrolet Camaro owners.

Cons

- Membership Restrictions: Chevrolet Camaro drivers must meet specific military-related eligibility criteria to qualify.

- Limited Availability: USAA’s services are not accessible to all Chevrolet Camaro owners due to its membership requirements.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#5 – Allstate: Best for Financial Stability

Pros

- Wide Range of Discounts: Chevrolet Camaro drivers can access numerous discounts, including bundling options.

- Strong Financial Stability: Allstate’s solid financial standing ensures reliability for Chevrolet Camaro insurance claims. For a comprehensive understanding, consult our article titled “Allstate Car Insurance Review.”

- Local Agents: Chevrolet Camaro owners have access to a network of local agents for personalized service.

Cons

- Higher Premiums: Allstate’s rates for Chevrolet Camaro insurance can be higher than some competitors.

- Mixed Online Experience: Chevrolet Camaro owners may find Allstate’s digital tools less user-friendly than other providers.

#6 – Amica: Best for Customer Satisfaction

Pros

- High Customer Satisfaction: Amica is consistently rated highly for customer service by Chevrolet Camaro drivers.

- Dividend Policies: Chevrolet Camaro owners may receive a portion of their premium back with Amica’s dividend policies.

- No Deductible on Glass Repair: Chevrolet Camaro drivers benefit from zero-deductible glass repair coverage. Enhance your knowledge by reading our “Amica vs. The Hartford Car Insurance Comparison.”

Cons

- Limited Availability: Amica’s services may not be available to all Chevrolet Camaro owners in certain regions.

- Fewer Discounts: Chevrolet Camaro drivers might find fewer discount opportunities compared to larger insurers.

#7 – Farmers: Best for Customizable Coverage

Pros

- Customizable Coverage: Farmers offers Chevrolet Camaro owners a variety of customizable coverage options.

- Local Agents: Chevrolet Camaro drivers have access to a strong network of local agents for personalized service.

- Good Claims Experience: Farmers is known for a straightforward claims process for Chevrolet Camaro insurance. Uncover more by delving into our article entitled “Farmers Car Insurance Review.”

Cons

- Higher Premiums: Chevrolet Camaro owners may pay more for insurance with Farmers compared to other companies.

- Average Customer Service: Chevrolet Camaro drivers report mixed experiences with Farmers’ customer service.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#8 – Nationwide: Best for Deductible Benefits

Pros

- Vanishing Deductible: Chevrolet Camaro drivers can benefit from Nationwide’s vanishing deductible program.

- Strong Financial Stability: Nationwide’s financial strength ensures reliability for Chevrolet Camaro insurance claims.

- Wide Range of Discounts: Chevrolet Camaro owners can access various discounts, including safe driving incentives. Get a better grasp by checking out our article titled “Nationwide Car Insurance Discounts.”

Cons

- Higher Premiums: Chevrolet Camaro insurance rates with Nationwide can be higher than some competitors.

- Mixed Digital Experience: Chevrolet Camaro drivers may find Nationwide’s online tools less intuitive.

#9 – Liberty Mutual: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage Options: Liberty Mutual offers a wide range of coverage options for Chevrolet Camaro owners. Expand your understanding with our article called “Liberty Mutual Car Insurance Discounts.”

- Better Car Replacement: Chevrolet Camaro drivers can take advantage of Liberty Mutual’s Better Car Replacement program.

- 24/7 Claims Support: Liberty Mutual provides round-the-clock claims assistance for Chevrolet Camaro insurance.

Cons

- Higher Premiums: Chevrolet Camaro owners may find Liberty Mutual’s rates higher than other providers.

- Limited Discount Options: Chevrolet Camaro drivers may find fewer discount opportunities with Liberty Mutual.

#10 – Travelers: Best for Discount Variety

Pros

- Multiple Discounts: Chevrolet Camaro drivers can benefit from a variety of discount opportunities with Travelers.

- Robust Digital Tools: Travelers offers strong online tools for managing Chevrolet Camaro insurance policies. For additional insights, refer to our “Travelers Car Insurance Review.”

- Financial Stability: Travelers’ strong financial standing ensures reliable claims handling for Chevrolet Camaro owners.

Cons

- Average Customer Service: Chevrolet Camaro drivers report varied experiences with Travelers’ customer service.

- Limited Local Presence: Chevrolet Camaro owners who prefer in-person support may find fewer local agents.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Chevrolet Camaro Car Insurance Monthly Rates by Coverage Level & Provider

Chevrolet Camaro Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $95 $195

Amica $85 $180

Farmers $93 $198

Geico $75 $170

Liberty Mutual $90 $185

Nationwide $88 $190

Progressive $78 $175

State Farm $87 $195

Travelers $98 $198

USAA $65 $160

Explore the differences in rates and coverage levels to choose the plan that offers the best value. Whether you’re seeking basic protection or comprehensive coverage, this guide ensures you make an informed decision. Find out more by reading our “Best Chevrolet Aveo Car Insurance.“

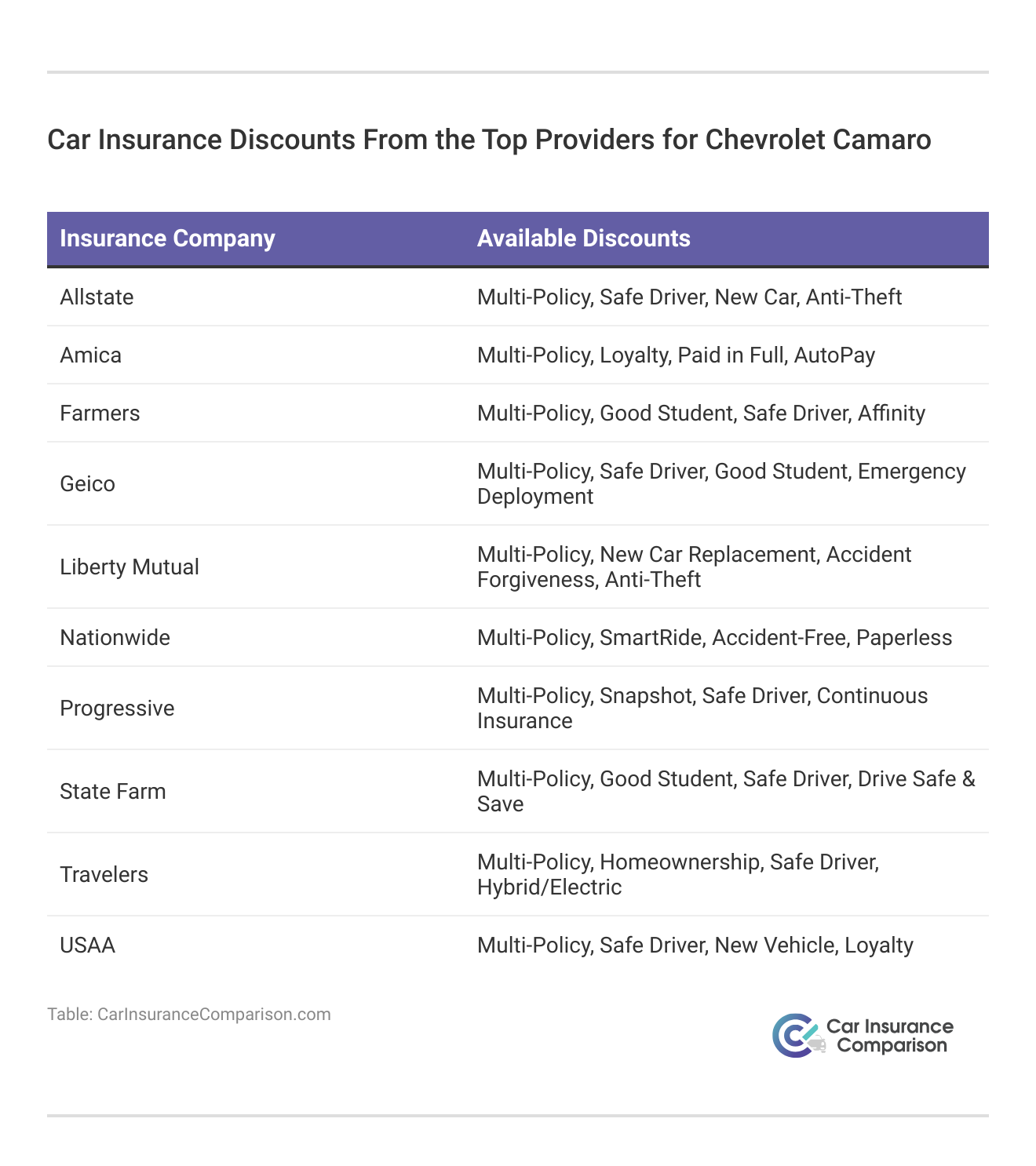

Car Insurance Discounts From the Top Providers for Chevrolet Camaro

Discover how you can lower your premium while securing reliable protection for your Camaro. Explore the top discounts and maximize your savings today. Broaden your knowledge with our article named “Best Chevrolet Impala Car Insurance.”

Chevrolet Camaro Car Insurance Costs

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Chevrolet Camaros Expensive to Insure

Are Chevrolet Camaros more expensive to insure than other similar vehicles on the market today? The Camaro is considered to be a muscle car. Muscle cars and sports cars tend to receive higher car insurance prices than economy sedans or family vehicles.

One reason for car insurance rate increases is that providers worry these types of vehicles tempt drivers to make reckless choices on the road, such as speeding.

How does the Camaro compare to other classic muscle cars like the Cadillac ATS-V, Ford Mustang, or Audi R8? Take a look at the table below to find out. Gain insights by reading our article titled “Best Chevrolet Trax Car Insurance.”

The Cost of Chevrolet Camaro Car Insurance is Impacted by Several Factors

The Age and Trim of Your Chevrolet Camaro and Your Car Insurance Rates

How Your Driver Age Impacts Your Chevrolet Camaro Car Insurance Rates

Driver age can have a significant effect on Chevrolet Camaro car insurance rates. Insurance providers equate age to driving experience. Younger drivers are more likely to get into accidents and file claims. As a result, they receive higher rates.

Teenagers driving sports cars will always appear high-risk to car insurance companies. However, once you turn 25, your car insurance costs decrease dramatically. Discover more by delving into our article entitled “Best Chevrolet Cobalt Car Insurance.”

Ready to find cheaper car insurance coverage? Enter your ZIP code to begin.

How Your Driver Location Impacts Your Chevrolet Camaro Car Insurance Rates

Where you live can have a large impact on Chevrolet Camaro insurance rates. Bigger cities with higher vehicle theft rates and denser populations make you more prone to filing claims.

That can lead to more expensive car insurance rates. Another reason why your location matters is because car insurance laws vary by state. The legal car insurance limits in California are different than in Texas. Get a better grasp by reading our article titled “Best Chevrolet Blazer Car Insurance.”

How Your Driving Record Impacts Your Chevrolet Camaro Car Insurance Rates

Your driving record can have an impact on the cost of your Chevrolet Camaro car insurance. Safe drivers qualify for more discounts and receive some of the lowest average rates. Teens and drivers in their 20s see the highest jump in their Chevrolet Camaro car insurance rates with violations on their driving records.

Ultimately, bad driver car insurance rates will be much higher than average. If you commit too many traffic violations, some major companies might refuse to insure you altogether. However, if you only have one or two minor violations on your record, ask about accident forgiveness programs.

Uncover additional insights in our article called “Compare Chevrolet Express Car Insurance Rates.”

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Chevrolet Camaro Safety Ratings and the Impact on Your Car Insurance Rates

Your Chevrolet Camaro car insurance rates are influenced by the Chevrolet Camaro’s safety ratings. The Insurance Institute for Highway Safety (IIHS) tests different vehicles and publishes the results for the public. A rating of ‘Good’ is the highest possible score given by the IIHS. Overall the Chevrolet Camaro did okay during the crash tests.

However, the roof did receive an ‘Acceptable’ rating. See a video of the 2016 Chevy Camaro moderate overlap crash test performed by the IIHS below.

These safety results are decent for a sports car, which means your premiums should not increase too dramatically. If you currently own a Camaro, your insurance rates likely already reflect your vehicle’s safety ratings. Explore further details in our “Best Chevrolet Bolt EV Car Insurance.”

How the Chevrolet Camaro Safety Features Affect Your Car Insurance Rates

How the Chevrolet Camaro Insurance Loss Probability Affects Your Car Insurance Rates

Understanding the Chevrolet Camaro’s insurance loss probability will help you predict your car insurance costs. Lower insurance loss probabilities mean lower insurance rates. However, higher percentages mean higher Chevrolet Camaro car insurance costs.

Take a look at the Chevrolet Camaro insurance loss probability details in the table below.

Chevrolet Camaro Insurance Loss Probability Details

| Insurance Coverage Category | Loss Rate |

|---|---|

| Collision | 64% |

| Property Damage | 12% |

| Comprehensive | 34% |

| Personal Injury | 19% |

| Medical Payment | 27% |

| Bodily Injury | 28% |

The Chevrolet Camaro’s insurance loss probability varies between different coverage types. Unfortunately, the collision and comprehensive loss ratios for the Camaro are substantially worse than average. Expect your rates for collision coverage and comprehensive coverage on the Chevrolet Camaro to be higher than average.

Read further about our “Best Chevrolet Traverse Car Insurance“.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Financing a Chevrolet Camaro and Your Car Insurance Costs

Maximizing Savings: Top Strategies to Lower Your Chevrolet Camaro Car Insurance Costs

You have more options at your disposal to save money on your Chevrolet Camaro car insurance costs. For example, try taking advantage of the following five strategies to reduce your Chevrolet Camaro car insurance rates:

- Remove unnecessary insurance once your Chevrolet Camaro is paid off.

- Compare quotes from multiple companies when buying your Chevrolet Camaro car insurance policy.

- Move to an area with a lower cost of living.

- Check your Chevrolet Camaro policy carefully to ensure all information is correct.

- Ask about additional policy discounts. Not every discount is publicly advertised by the insurance provider.

Frequently Asked Questions

What factors make Chevrolet Camaro insurance more expensive than other vehicles?

High performance and repair costs, plus a higher risk of accidents. Gain deeper insights by exploring our “Best Chevrolet Corvette Z06 Car Insurance.”

How does the trim level of a Chevrolet Camaro impact insurance premiums?

Higher trims generally cost more to insure due to increased performance and repair costs.

Are Chevrolet Camaros more expensive to insure than other sports cars like the Ford Mustang or Dodge Challenger?

Insurance costs are similar to other sports cars but can vary based on specific models and driver profiles. Our free online comparison tool allows you to compare cheap car insurance quotes instantly — just enter your ZIP code to get started.

What is the average monthly cost of full coverage insurance for a Chevrolet Camaro?

Around $123 per month or $1,472 per year. Learn more about our “Compare Chevrolet Silverado 1500 Car Insurance Rates” for a broader perspective.

Does the color of my Chevrolet Camaro affect my insurance rates?

No, the color does not impact insurance rates.

What types of insurance coverage are recommended for a Chevrolet Camaro?

Full coverage including liability, collision, and comprehensive. See if you’re getting the best deal on car insurance by entering your ZIP code.

Is comprehensive coverage necessary for a Chevrolet Camaro, or is liability coverage enough?

Comprehensive coverage is recommended for complete protection. Elevate your knowledge with our “Best Chevrolet Equinox Car Insurance.”

How does the inclusion of GAP insurance impact the cost of insuring a Chevrolet Camaro?

GAP insurance increases premiums slightly but covers the loan difference if the car is totaled.

Can I get specialized coverage for aftermarket modifications on my Chevrolet Camaro?

Yes, you can get coverage for aftermarket modifications. Get the right car insurance at the best price — enter your ZIP code to shop for coverage from the top insurers.

What are the benefits of adding uninsured/underinsured motorist coverage to my Camaro insurance policy?

It covers costs if you’re hit by a driver with insufficient insurance. Get the full story by checking out our “Compare Ford vs. Chevrolet Car Insurance Rates.”

What discounts are available for Chevrolet Camaro owners to lower insurance costs?

Safe driver, multi-policy, anti-theft, and good student discounts.

How can installing anti-theft devices on my Chevrolet Camaro reduce my insurance premiums?

It lowers premiums by reducing theft risk.

Do Chevrolet Camaro owners qualify for safe driver discounts more easily compared to other vehicle types?

Safe driver discounts apply to all vehicles but may be more impactful for high-performance cars.Find out more by reading our “The 80 Fastest Cars Ranked by 0-60 Times.”

How can bundling my Camaro insurance with other policies help me save money?

Bundling policies often result in multi-policy discounts.

Are there specific insurance discounts available for military personnel who own a Chevrolet Camaro?

Yes, many insurers offer military discounts. Stop overpaying for car insurance. Our free quote comparison tool allows you to shop for quotes from the top providers near you by entering your ZIP code.

How does my age affect the cost of insuring a Chevrolet Camaro?

Younger drivers typically face higher rates due to higher risk.

Do young drivers face higher insurance rates for Chevrolet Camaros compared to older, more experienced drivers?

Yes, younger drivers usually pay more.

Will my driving record have a significant impact on my Chevrolet Camaro insurance rates?

Yes, a clean record leads to lower rates, while violations increase them. Unlock additional information in our “Top 10 Deadliest Vehicles in History.”

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.