Best GMC Yukon Car Insurance in 2025 (Compare the Top 10 Companies)

For the best GMC Yukon car insurance, AAA, Farmers, and Erie are top contenders. AAA leads with comprehensive coverage starting at $33/month. Farmers and Erie follow closely, each offering strong protection at competitive rates. These providers excel in delivering top-notch insurance for GMC Yukon owners.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

UPDATED: Jan 9, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 9, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

3,027 reviews

3,027 reviewsCompany Facts

Full Coverage for GMC Yukon

A.M. Best Rating

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviews 3,072 reviews

3,072 reviewsCompany Facts

Full Coverage for GMC Yukon

A.M. Best Rating

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviews 1,883 reviews

1,883 reviewsCompany Facts

Full Coverage for GMC Yukon

A.M. Best Rating

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviews

The best GMC Yukon car insurance options are AAA, Farmers, and Erie. AAA is the top pick, offering superior coverage and value. Farmers and Erie also provide strong rates and reliable protection, making them excellent choices.

Whether you prioritize cost, coverage, or customer support, these providers deliver the best GMC Yukon car insurance solutions. Compare quotes today to find the best fit for your needs and start saving. Dive deeper into our “Finding Free Car Insurance Quotes Online” for a comprehensive understanding.

Our Top 10 Company Picks: Best GMC Yukon Car Insurance

Company Rank Multi-Vehicle Discount A.M. Best Best For Jump to Pros/Cons

#1 10% A Online App AAA

#2 12% A Local Agents Farmers

#3 8% A+ 24/7 Support Erie

#4 14% A+ Add-on Coverages Allstate

#5 15% B Many Discounts State Farm

#6 18% A++ Custom Plan Geico

#7 20% A++ Military Savings USAA

#8 9% A+ Innovative Programs Progressive

#9 17% A+ Usage Discount Nationwide

#10 16% A Customizable Polices Liberty Mutual

You can start comparing quotes for GMC Yukon car insurance rates from some of the best car insurance companies by using our free online tool now.

- AAA offers the best GMC Yukon car insurance with comprehensive coverage

- Farmers and Erie provide competitive rates and strong protection options

- AAA leads with coverage starting at $47/month for GMC Yukon owners

GMC Yukon Car Insurance Rates: Monthly Costs by Coverage & Provider

When selecting the best insurance for your GMC Yukon, understanding monthly rates for different coverage levels is crucial. Here’s a breakdown of what you can expect to pay for minimum and full coverage from various top providers.

AAA and Nationwide offer competitive rates for both coverage levels, while USAA has the highest full coverage cost. Compare these options to find the best fit for your budget and coverage needs.

GMC Yukon Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $53 $140

Allstate $33 $139

Erie $47 $158

Farmers $68 $142

Geico $47 $154

Liberty Mutual $55 $176

Nationwide $46 $116

Progressive $56 $102

State Farm $45 $176

USAA $42 $189

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Cut Costs on GMC Yukon Insurance

You have more options at your disposal to save money on your GMC Yukon car insurance costs. For example, try these five tips:

Top GMC Yukon Insurance Companies

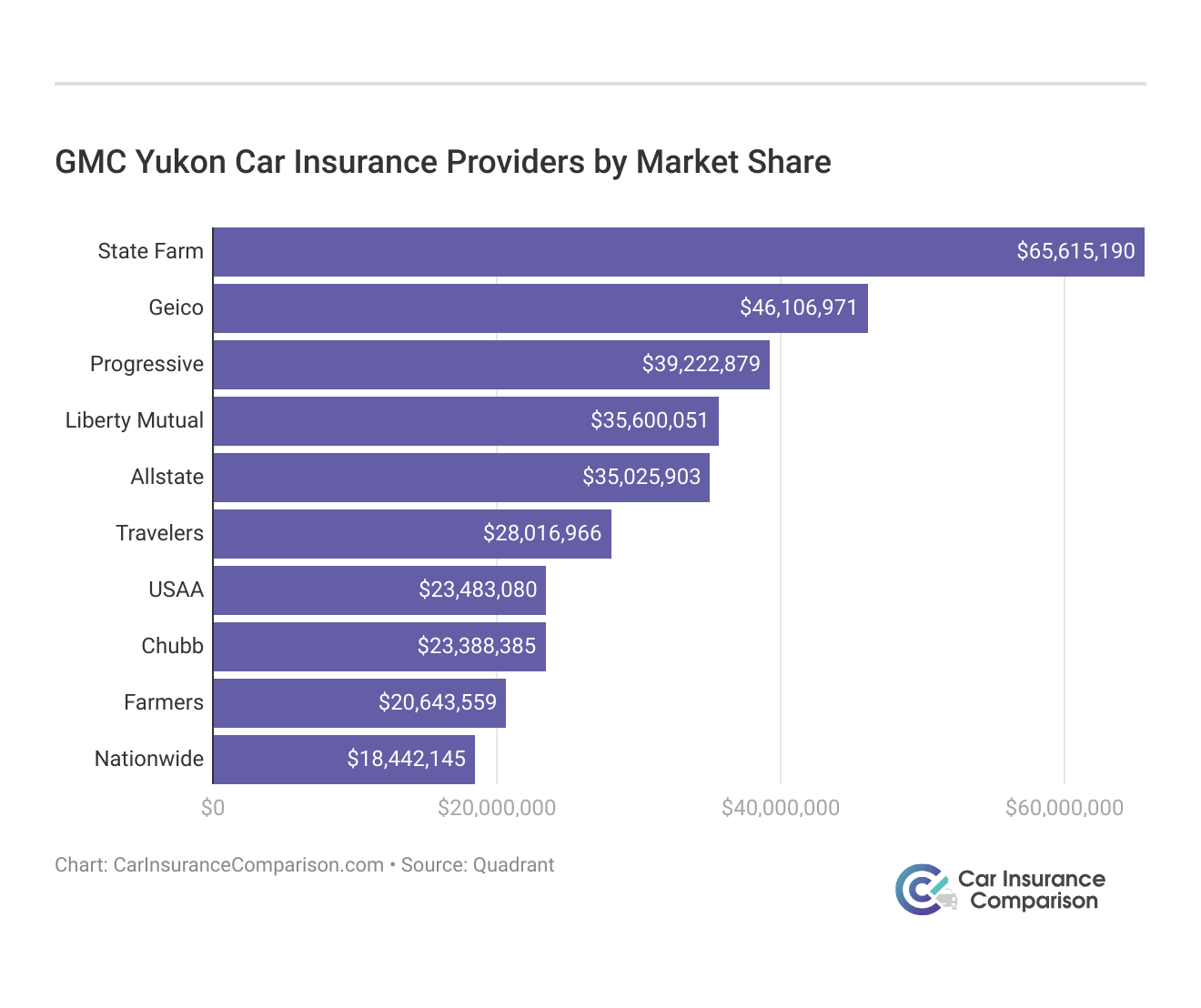

Choosing the right insurance company can significantly impact your GMC Yukon insurance rates. While rates vary based on individual factors, here are the top companies offering GMC Yukon coverage, ranked by market share. Many of these providers offer discounts for the security and safety features of the GMC Yukon.

Compare Free GMC Yukon Insurance Quotes Online

To start comparing GMC Yukon car insurance quotes for free, use our online car insurance comparison tool. On average, a 12-month premium for the GMC Yukon SLE Sport Utility is $108 per month. The cost of insurance is often overlooked, but an extremely important factor to consider before purchasing a vehicle. Enter your ZIP code now for FREE car insurance quotes!

The GMC Yukon is a popular option among large SUVs. It carries an overall four-star safety rating from SaferCar.gov and is widely believed to be a good, affordable option in its class. For further details, consult our article named “Compare Monthly Car Insurance.”

The answer is yes! Insurance rates are a significant cost of ownership and need to be taken into consideration when deciding if the GMC Yukon is the right vehicle for you.

The GMC Yukon ranks well among affordable large sport utility vehicles, but factors such as maintenance, gasoline, and insurance will all impact the amount of money you spend each month on your vehicle.

It would not be a wise decision to purchase a Yukon and not factor in the cost of insurance, as it can be a significant, but necessary, expense. This largely depends upon the type of coverage you choose, however.

Most states require a minimum level of liability coverage, but this will not protect you or your vehicle should it be necessary. You would need to purchase a policy that includes collision and/or comprehensive coverage if you wanted your Yukon insured as well.

Interestingly, the Yukon doesn’t have any extra special safety features considering how much it costs. Here are the standard safety features on the Yukon:

- Airbags: driver, passenger, side-impact first row, head impact first row

- Tire pressure monitoring system

- OnStar

- Side blind zone alert

According to the specs, there are no second or third-row air bags. In addition, they are not available as an extra feature; which can leave your passengers a little exposed.

The OnStar system adds some safety value because if you are in an accident the impact is immediately registered to someone and 911 can be dispatched immediately.

In many cases, this can mean the difference between a few stitches and some blood loss, serious injury or death!

The insurance rates for a sports utility vehicle are not necessarily higher than those of a full-size sedan. A variety of factors is considered by insurance companies when determining rates. They will take into account various vehicle safety features, as well as vehicle repair and replacement costs. The GMC Yukon offers many safety features that will help to reduce the probability that you will be involved in an accident.

AAA offers unmatched comprehensive coverage for GMC Yukon owners, making it the top choice for exceptional value and protection

Chris Abrams Licensed Insurance Agent

These include the StabiliTrak stability control system, traction control, and a side blind zone alert. It also offers dual-stage front air bags with built-in sensors that will respond to the severity of the crash by employing two different levels of inflation.

These amenities that help make the vehicle safer also decrease your likelihood of being involved or injured in an accident. This, in turn, lowers rates because the risk that the insurance company will have to pay out a claim on your policy is smaller.

Vehicle repair costs for the Yukon are similar to other SUVs in its class, which is a benefit if you are shopping for insurance rates.

Repair costs have a noteworthy impact on insurance rates because the insurer will calculate the probable cost of repairs that may be necessary throughout the term of the policy, as well as the cost to replace the vehicle.

It is important to be aware of the coverage your policy offers in terms of replacement costs. A majority of policies will only pay you the cash value of your vehicle should it be declared a total loss. Depending on the age and condition, this amount may or may not replace your vehicle to your satisfaction.

Insurance policies differ dramatically in terms of benefits and coverage that are offered. It is imperative that you thoroughly research the amount and type of coverage provided by the policy you ultimately choose. Some policies may cover things you aren’t even aware of, such as roadside assistance.

Roadside assistance is an invaluable service if the need was ever to arise, and a significant expense if you are not aware that it could have been covered by your insurance. Your rate will also depend on the deductible you choose. It is wise to choose a deductible that you can reasonably afford if you have to file a claim. Keep in mind, however, that the higher the deductible, the lower the premium.

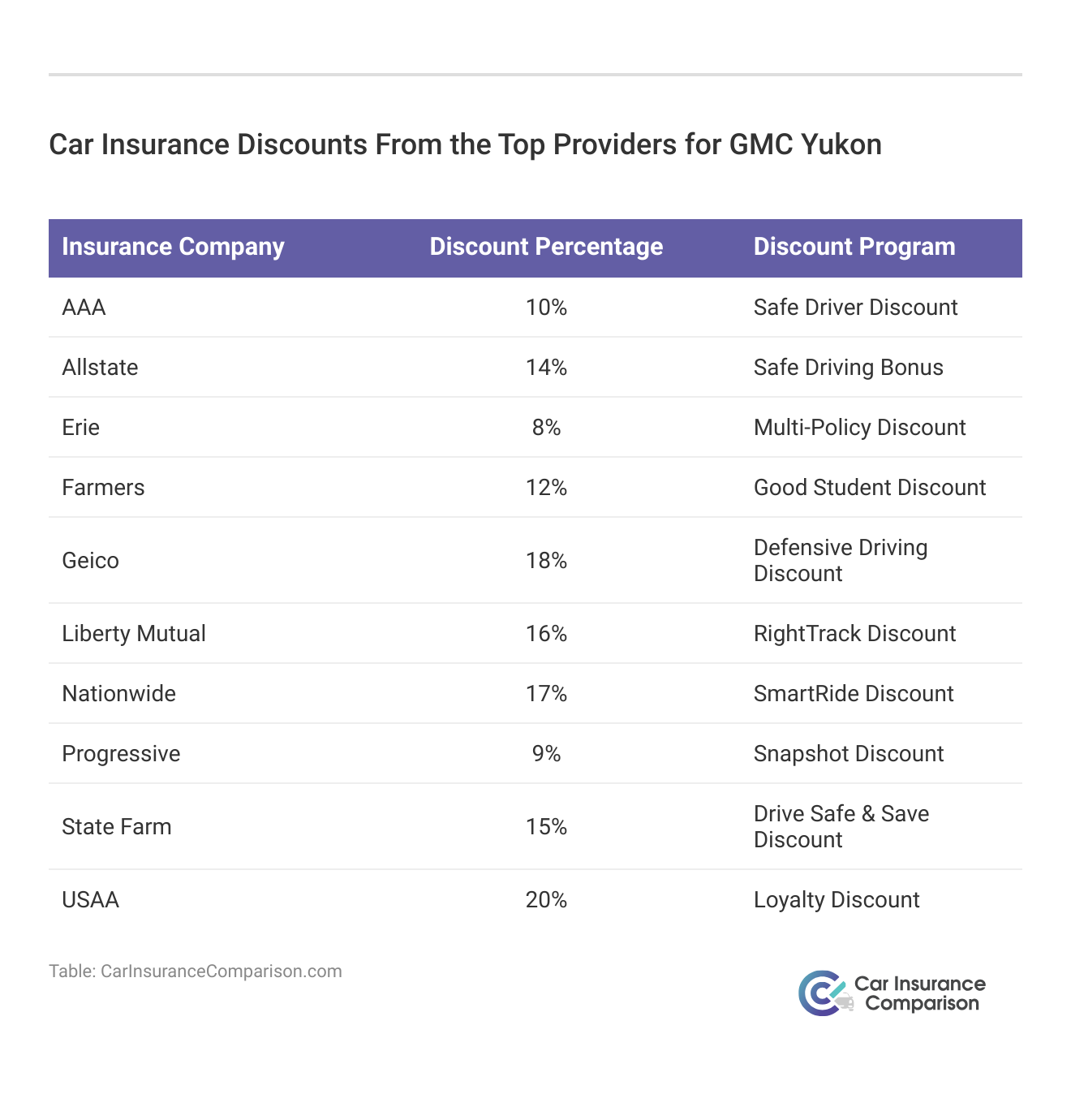

It is also a good idea to ask what discounts each insurance carrier provides. Beyond a discount for a clean driving record, you might be eligible for low mileage discounts or multiple-policy discounts if you bundle your auto and home insurance with one company. To begin researching now, enter your ZIP code into the FREE online car insurance tool.

Frequently Asked Questions

How much does GMC Yukon car insurance cost?

On average, GMC Yukon insurance rates are around $125 per month.

Dive deeper into our “Best GMC Sierra Car Insurance” for a comprehensive understanding.

Are GMC Yukons expensive to insure?

GMC Yukon insurance rates are slightly lower than the average vehicle. Factors such as your age, location, and driving record will affect the cost.

What factors impact the cost of GMC Yukon insurance?

The GMC Yukon trim, age of the vehicle, driver’s age, location, and driving record all influence the cost of insurance.

Affordable car insurance rates are just a click away. Enter your ZIP code into our free quote tool to find the best policy for you.

Do good GMC Yukon crash test ratings affect insurance rates?

Yes, vehicles with good crash test ratings, like the GMC Yukon, tend to have lower insurance rates.

What are some safety features on the GMC Yukon that impact insurance cost?

The GMC Yukon offers safety features such as stability control, traction control, airbags, and the OnStar system, which may help lower insurance rates.

Delve into the depths of our “Best GMC Acadia Car Insurance” for additional insights.

What is the best GMC Yukon car insurance provider?

The best GMC Yukon car insurance provider depends on your needs and preferences, but AAA, Farmers, and Erie are often highlighted for their comprehensive coverage options, competitive rates, and strong customer service.

How can I find the most affordable GMC Yukon insurance?

To find the most affordable GMC Yukon insurance, compare quotes from multiple providers using online comparison tools, check for available discounts, and consider your coverage needs and driving history.

Ready to find cheaper car insurance coverage? Enter your ZIP code to begin.

What factors affect GMC Yukon insurance rates?

GMC Yukon insurance rates are influenced by factors such as your driving record, location, age, vehicle trim and model, coverage level, and credit score.

Are there discounts available for GMC Yukon insurance?

Yes, discounts for GMC Yukon insurance may include safe driver discounts, multi-policy discounts, good student discounts, and discounts for advanced safety features like anti-theft systems.

Uncover more about our “Best GMC Terrain Car Insurance” by reading further.

What is the average cost of GMC Yukon insurance?

The average cost of GMC Yukon insurance typically ranges around $125 per month, though this can vary based on factors such as coverage level and personal details.

Which insurance company offers the best coverage for GMC Yukon?

AAA is often recognized for offering some of the best coverage options for GMC Yukon owners, providing comprehensive plans and strong customer service.

How does my driving record impact my GMC Yukon insurance rate?

A clean driving record generally results in lower insurance rates, while a history of traffic violations or accidents can lead to higher premiums.

Does the GMC Yukon’s safety rating affect insurance costs?

Yes, the GMC Yukon’s safety rating can affect insurance costs; higher safety ratings often lead to lower premiums due to reduced risk of accidents and injuries.

Expand your understanding with our “Best GMC Denali Car Insurance.”

What type of coverage is best for a GMC Yukon?

Full coverage is typically best for a GMC Yukon, including liability, collision, and comprehensive coverage to protect against a range of potential risks.

How can I lower my GMC Yukon insurance premiums?

You can lower your GMC Yukon insurance premiums by comparing quotes, bundling policies, maintaining a clean driving record, and taking advantage of available discounts.

Is full coverage necessary for a GMC Yukon?

While full coverage is not legally required, it is recommended for a GMC Yukon to ensure comprehensive protection against various types of damage and loss.

What discounts can I get for a GMC Yukon with advanced safety features?

Discounts for advanced safety features may include lower rates for having systems like anti-theft alarms, lane departure warnings, and adaptive cruise control.

Gain deeper insights by exploring our “Best GMC Suburban Car Insurance.”

How does my location influence GMC Yukon insurance rates?

Your location impacts GMC Yukon insurance rates based on local traffic conditions, crime rates, and regional insurance regulations, with urban areas often having higher premiums.

What is the difference between minimum and full coverage for a GMC Yukon?

Minimum coverage typically includes only the legally required liability insurance, while full coverage encompasses liability, collision, and comprehensive insurance for broader protection.

Are there special insurance programs for GMC Yukon owners?

Some insurers offer specialized programs or discounts for GMC Yukon owners, such as loyalty programs or multi-vehicle discounts, tailored to specific vehicle types.

How does the age of my GMC Yukon affect insurance costs?

Older GMC Yukon models generally cost less to insure due to lower replacement values and potentially fewer high-cost repairs, compared to newer models.

Learn more about our “Best GMC Sierra 2500HD Car Insurance” for a broader perspective.

What is the impact of my credit score on GMC Yukon insurance rates?

A higher credit score can lead to lower GMC Yukon insurance rates, as insurers often view good credit as an indicator of lower risk.

Does the trim level of my GMC Yukon affect my insurance rates?

Yes, the trim level of your GMC Yukon can affect insurance rates, with higher trims often leading to higher premiums due to increased repair and replacement costs.

How can I find the best GMC Yukon insurance rates online?

Use online comparison tools to get multiple quotes, review customer ratings, and compare coverage options to find the best GMC Yukon insurance rates for your needs.

Are there any specific insurance requirements for GMC Yukons?

Insurance requirements for GMC Yukons include meeting state minimum liability coverage, but you may also choose additional coverage types based on your vehicle’s value and personal needs.

Find out more by reading our “Best GMC Savana Car Insurance.”

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.