Best Car Insurance for Retirees in 2025 (Top 10 Companies)

State Farm, Allstate, and Progressive emerge as top picks for the best car insurance for retirees, offering competitive rates with a start rates of $31 per month. These companies offer exceptional coverage options, ensuring retirees get comprehensive protection they need at a budget-friendly price.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Oct 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Retirees

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for Retirees

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Retirees

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews

The best car insurance for retirees are State Farm, Allstate, and Progressive emerging as top contenders, offering competitive rates and comprehensive protection.

These insurers offer a winning approach for securing financial stability during retirement, presenting comprehensive bundle discounts and cost-effective choices.

Our Top 10 Company Picks: Best Car Insurance for Retirees

Company Rank Retiree Discount Multi-Policy Discount Best For Jump to Pros/Cons

#1 12% 20% Bundle Discounts State Farm

#2 15% 18% Comprehensive Coverage Allstate

#3 10% 12% Safe-Driving Discounts Progressive

#4 12% 15% Policy Options Farmers

#5 10% 15% Vanishing Deductible Nationwide

#6 8% 14% Multi-Policy Discounts Liberty Mutual

#7 10% 16% 24/7 Support Travelers

#8 7% 13% Accident Forgiveness American Family

#9 9% 14% Online Convenience Esurance

#10 12% 15% Roadside Assistance AAA

As retirees navigate their golden years, understanding factors such as driving record, vehicle type, and age becomes crucial in selecting the optimal insurance provider. Affordable car insurance rates are just a click away. Enter your ZIP code into our free quote tool above to find the best policy for you.

#1 – State Farm: Top Overall Pick

Pros

- Bundle Discounts: State Farm car insurance review reveals significant savings, with discounts of up to 20% for combining various policies, offering a comprehensive and affordable option.

- Flexible Discounts: With discounts of up to 12%, State Farm caters to a variety of needs, allowing retirees to personalize their coverage based on individual circumstances.

- Reputation: State Farm’s longstanding reputation for reliability and customer service adds a layer of trust for retirees seeking stable insurance options.

Cons

- Potentially Higher Rates: While competitive, State Farm may not always offer the absolute lowest rates, and retirees should compare quotes to ensure optimal savings.

- Varied Customer Experience: Customer experiences may vary based on the locality and specific agents, potentially leading to inconsistent service quality.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#2 – Allstate: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage: Allstate is praised for its comprehensive coverage options, offering retirees a wide range of protection against various risks.

- Generous Discounts: Allstate provides up to 18% discounts, ensuring retirees can enjoy substantial savings without compromising on coverage.

- Tech-Savvy Solutions: Retirees seeking convenient and efficient service are drawn to Allstate’s user-friendly interface and advanced online tools in their search for Allstate car insurance review.

Cons

- Higher Premiums: Allstate’s premiums, especially for full coverage, may be higher compared to some competitors, impacting retirees on a tight budget.

- Claim Satisfaction: Customer reviews indicate varying levels of satisfaction with Allstate’s claims process, suggesting potential room for improvement.

#3 – Progressive: Best for Prioritizing Safety

Pros

- Safe-Driving Discounts: Progressive’s emphasis on safe-driving discounts rewards retirees with clean records, potentially resulting in significant savings.

- Competitive Rates: Progressive car insurance review highlights its appeal to retirees looking for cost-effective coverage without sacrificing quality, thanks to its consistently competitive rates.

- Online Convenience: Progressive’s user-friendly online platform offers retirees the convenience of managing policies and obtaining quotes from the comfort of home.

Cons

- Limited Local Agents: Some retirees may prefer face-to-face interactions, but Progressive’s focus on online services means there are fewer local agents available.

- Discount Variability: Progressive’s discounts may vary depending on factors such as location and driving history, leading to differing rates for retirees.

#4 – Farmers: Best for Tailored Coverage

Pros

- Flexible Discounts: Farmers provides a range of discounts, up to 15%, offering retirees the opportunity to maximize savings based on their specific circumstances.

- Policy Options: Farmers stands out with diverse policy options, allowing retirees to tailor coverage to their unique needs and preferences.

- Local Agents: Farmers car insurance review highlights commitment to tailored assistance through a vast network of local agents, catering especially to retirees who value in-person support.

Cons

- Potentially Higher Rates: While offering various discounts, Farmers’ rates may not always be the most competitive, prompting retirees to compare quotes thoroughly.

- Discount Availability: Some discounts may have eligibility criteria that not all retirees meet, limiting access to potential savings.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Nationwide’s Vanishing Deductible feature is an attractive option, rewarding retirees with safe driving habits by reducing deductibles over time.

- Diverse Discounts: Nationwide car insurance discounts enable retirees to select the ones that best suit their situation and maximize their savings.

- User-friendly Online Tools: Nationwide’s online platform is user-friendly, providing retirees with convenient options for managing policies, obtaining quotes, and accessing resources.

Cons

- Potentially Higher Premiums: Nationwide’s premiums, especially for full coverage, may be higher compared to some competitors, impacting retirees on a budget.

- Claim Satisfaction: Customer reviews indicate varying levels of satisfaction with Nationwide’s claims process, suggesting potential room for improvement.

#6 – Liberty Mutual: Best for Maximizing Discounts

Pros

- Multi-Policy Discounts: Liberty Mutual offers multi-policy discounts, up to 14%, making it an appealing option for retirees seeking savings through bundling.

- Coverage Options: Liberty Mutual car insurance review reveals a range of coverage choices that cater to retirees, enabling them to customize policies according to their individual requirements and desires.

- User-Friendly Online Experience: With a focus on online services, Liberty Mutual offers retirees convenience and efficiency in managing policies and obtaining quotes.

Cons

- Higher Premiums: Liberty Mutual’s premiums, especially for full coverage, may be higher compared to some competitors, impacting retirees on a budget.

- Limited Discounts: While offering multi-policy discounts, Liberty Mutual may not have as many diverse discount options as some competitors.

#7 – Travelers: Best for 24/7 Support

Pros

- 24/7 Support: Travelers car insurance review stands out due to its round-the-clock support, ensuring retirees receive continuous assistance and tranquility.

- Discounts for Safe Driving: With up to 16% discounts for safe driving, Travelers rewards retirees with clean records, promoting cost-effectiveness.

- Wide Range of Policy Options: Travelers offers a comprehensive selection of policy options, allowing retirees to tailor coverage based on individual needs.

Cons

- Potentially Higher Rates: While competitive, Travelers’ rates may not always be the most affordable, prompting retirees to compare quotes thoroughly.

- Discount Availability: Some discounts may have eligibility criteria that not all retirees meet, limiting access to potential savings.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#8 – American Family: Best for Accident Forgiveness

Pros

- Accident Forgiveness: American Family offers Accident Forgiveness, preventing rate increases after certain incidents and adding a layer of security for retirees.

- Diverse Discounts: With discounts up to 13%, American Family provides retirees with various options to maximize savings based on their circumstances.

- Coverage Options: American Family car insurance review reveals a range of coverage options that cater to retirees’ individual requirements and preferences.

Cons

- Potentially Higher Premiums: American Family’s premiums, especially for full coverage, may be higher compared to some competitors, impacting retirees on a budget.

- Discount Availability: Some discounts may have eligibility criteria that not all retirees meet, limiting access to potential savings.

#9 – Esurance: Best for Streamlined Convenience

Pros

- Online Convenience: How do you get an Esurance car insurance quote? Esurance’s emphasis on online convenience provides tech-savvy retirees with an efficient platform for managing policies and obtaining quotes.

- Diverse Discounts: With discounts up to 14%, Esurance caters to a variety of needs, allowing retirees to personalize their coverage based on individual circumstances.

- Coverage Options: Esurance offers diverse coverage options, allowing retirees to tailor policies to their specific needs and preferences.

Cons

- Limited Local Agents: Esurance’s focus on online services means fewer local agents are available for retirees seeking face-to-face interactions.

- Varied Customer Experience: Customer experiences may vary based on the locality and specific agents, potentially leading to inconsistent service quality.

#10 – AAA: Best for Comprehensive Coverage

Pros

- Roadside Assistance: AAA’s inclusion of roadside assistance as a benefit adds value for retirees, ensuring support in case of unexpected vehicle issues.

- Diverse Discounts: Retirees can explore a range of savings opportunities tailored to their needs with AAA car insurance review, offering discounts of up to 15%.

- Coverage Options: AAA offers diverse coverage options, allowing retirees to tailor policies to their specific needs and preferences.

Cons

- Membership Cost: While offering additional benefits, AAA’s membership costs may add an extra expense for retirees on a tight budget.

- Potentially Higher Premiums: AAA’s premiums, especially for full coverage, may be higher compared to some competitors, impacting retirees on a budget.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Retiree Car Insurance Costs

In order to understand how your rates may or may not change once you retire, it’s important to look into how insurance companies decide what rates to charge clients. In a nutshell, your rates will rise or fall depending on how large of a risk your insurance company determines you to be.

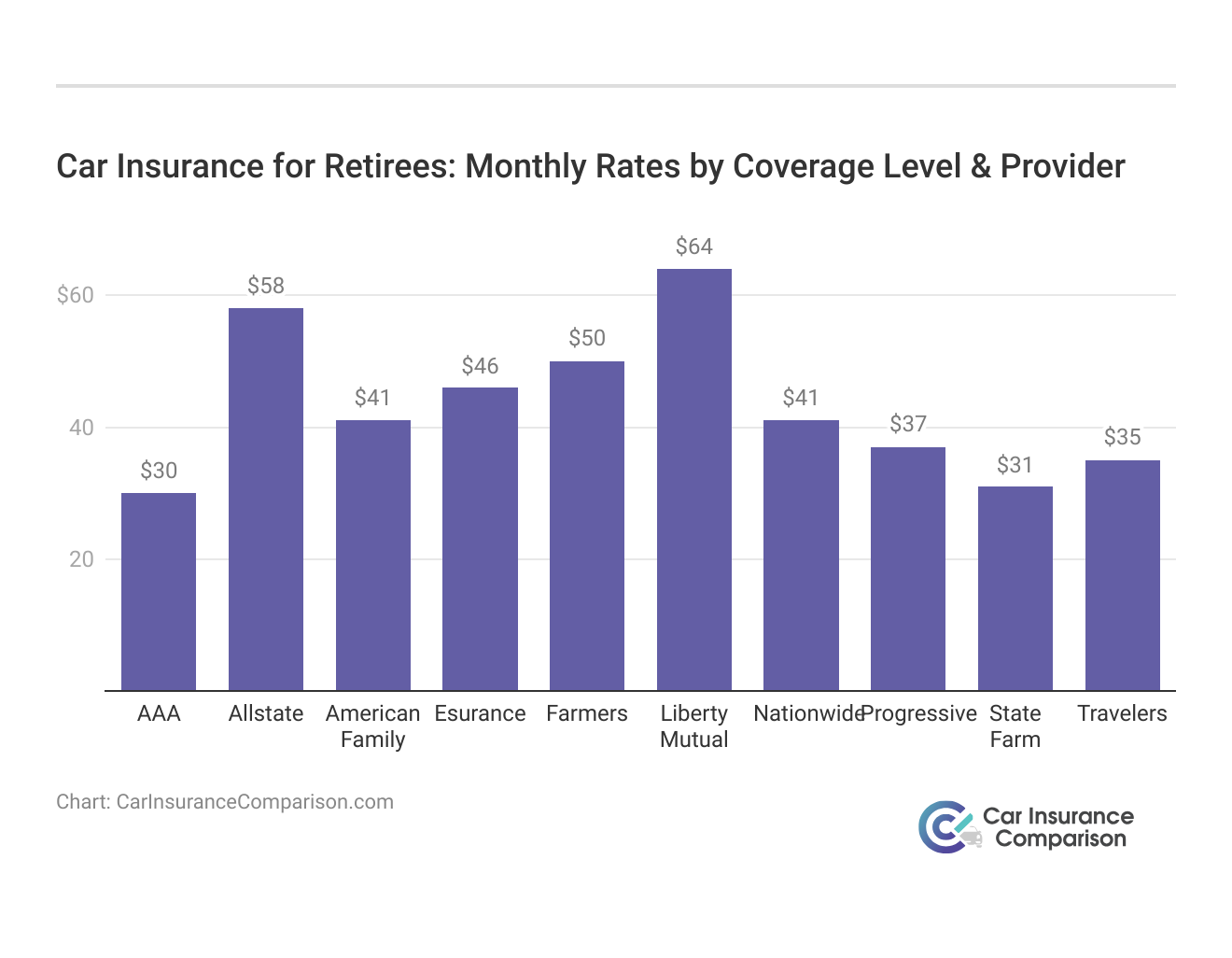

Car Insurance for Retirees: Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $30 $81

Allstate $58 $152

American Family $41 $111

Esurance $46 $114

Farmers $50 $131

Liberty Mutual $64 $165

Nationwide $41 $109

Progressive $37 $100

State Farm $31 $82

Travelers $35 $94

When it comes to the specific coverage rates for retiree car insurance, the numbers tell a crucial tale. Among the leading companies, State Farm stands out with an enticing offer of $82 for full coverage and an economical $31 for minimum coverage. This presents retirees with a budget-friendly option that doesn’t compromise on comprehensive protection.

Conversely, Liberty Mutual, while reputable, comes in at $165 for full coverage and $64 for minimum coverage, making it a higher-cost choice for retirees seeking insurance solutions. Evaluating these figures empowers retirees to make informed decisions, aligning coverage needs with their financial preferences.

If your insurance company feels you are more likely to file a claim, it may consider you to be a higher risk, and thus someone who needs to pay more. The following are some factors your insurance company will use to determine how much to charge for your car insurance rates:

- How old you are at the start of your policy period

- Your gender

- Your driving record

- Average miles you drive each year

- The type of car you drive

- Your age and how long you have driven

- The amount of coverage you have on your policy

The best car for retirees hoping to save on car insurance might be a Subaru Outback or Honda CR-V, as these vehicles rank as some of the cheapest to insure. To gain further insights, consult our comprehensive guide titled “Compare Honda Car Insurance Rates.”

As you can see, some of these determining factors are controllable, like which car you drive, if you maintain a safe driving record, and what your policy includes. But others, like your age, are really not changeable.

How Your Age Impacts Your Car Insurance Rates

If you know any teenagers, you may have heard them or their parents complain about how much it costs to insure them. While it is correct that young teen drivers have the highest car insurance rates, the average rate for 16-year-old boys is around $240 a month. Unfortunately, older adults come in second place.

Car Insurance for Retirees: Monthly Rates by Age, Gender, & Coverage Level

Age & Gender Minimum Coverage Full Coverage

60-Year-Old Female $41 $106

60-Year-Old Male $43 $110

65-Year Old Female $45 $117

65-Year-Old Male $45 $117

70-Year-Old Female $49 $129

70-Year-Old Male $47 $124

By the time senior citizens reach age 69 or so, their retiree car insurance rates tend to increase. This is because, according to car insurance companies, older drivers tend to be riskier and are more likely to file a claim.

Anticipating Rate Increases Upon Retirement

The answer to this question depends on several factors. For instance, if you retire early because you are in a profession that allows retirement in your 40s, you will not have reached the age where insurance companies feel you are automatically a riskier client. Check out our ranking of the top providers: Best Car Insurance for Seniors

State Farm stands out as the top choice for retirees, offering comprehensive bundle discounts, budget-friendly options, and a winning strategy for financial stability in retirement.

Brad Larson Licensed Insurance Agent

However, if you are waiting to retire to take full advantage of your Social Security and other benefits, which the Social Security Administration starts at age 62, then yes, your age may mean you will pay more for your car insurance in your golden years.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Strategies for Retirees to Reduce Their Expenses

Drivers in their mid-to-late 60s and beyond can lower their insurance rates and find the best coverage for retirees. Start by checking with your insurer for discounts on driver safety classes. To gain in-depth knowledge, consult our comprehensive resource titled “Recent Retirees Car Insurance Discounts.”

During the phone call with your agent, mention your upcoming retirement and the fact that you will no longer be working outside of the home, so your annual mileage will decrease. You will probably be asked to give an estimate of how many miles you anticipate driving each week, month, or year. Depending on your reply, you may qualify for a low-mileage discount.

Case Studies: Retiree Insurance Success Stories & Navigating Comprehensive Solutions

Join us as we explore the journeys of these individuals and the strategies they employ to achieve comprehensive coverage tailored to their unique lifestyles and circumstances.

- Case Study #1 – Bundled Protection for Retirees: John and Susan, State Farm retirees, secured savings by bundling auto and home insurance, enjoying 20% off home and 12% off car coverage, freeing up more for retirement fun, simplifying their insurance, and ensuring peace of mind.

- Case Study #2 – Tailored Coverage With Comprehensive Benefits: Emma, a retiree seeking extensive insurance, chose Allstate for its 18% discounts and comprehensive coverage. Her customized policy, featuring roadside assistance and rental car reimbursement, paid off during a roadside emergency, affirming Allstate’s commitment to retirees’ peace of mind.

- Case Study #3 – Safe Driving Rewards for Lasting Savings: David, a safety-conscious retiree, chose Progressive for its safe-driving discounts, earning him a 12% discount and more with Snapshot. His commitment not only saved him money but also promoted safer roads in the community.

Final Thoughts About Car Insurance for Retirees

After working for so many years, retirement is a big deal and an occasion that is worthy of celebration. In order to make your nest egg stretch as far as you can, it is worth the time and effort to look for ways you can lower your bills, including what you pay for retiree auto insurance.

While your age might make your car insurance rates rise, other factors like taking certain classes for seniors and driving less may cause the rates to fall, which would be great news as you enter into your retirement. For a thorough understanding, refer to our detailed analysis titled “Compare Monthly Car Insurance: Rates, Discounts, & Requirements.”

Ready to shop around for the best car insurance company? Enter your ZIP code below and see which one offers the coverage you need.

Frequently Asked Questions

Is car insurance cheaper for retirees?

Generally, car insurance can be cheaper for retirees due to reduced mileage and potential eligibility for senior discounts, but it varies based on individual circumstances.

Does auto insurance go down when you retire?

Yes, auto insurance premiums may decrease when you retire since insurers often view retirees as lower-risk drivers who drive less frequently.

Get the right car insurance at the best price — enter your ZIP code below to shop for coverage from the top insurers.

Do seniors pay more for car insurance?

Seniors may pay more for car insurance due to factors like age-related risk perceptions and potential health considerations, though discounts are often available.

To expand your knowledge, refer to our comprehensive handbook titled “Average Car Insurance Rates by Age and Gender.”

Is car insurance cheaper when you retire?

Yes, car insurance can become cheaper when you retire as you may qualify for retiree discounts and drive less frequently.

Does being retired affect car insurance?

Being retired can affect car insurance rates, usually resulting in potential discounts and lower premiums due to decreased driving.

Does car insurance go up when you retire?

Generally, car insurance rates do not go up when you retire; in fact, they often decrease due to reduced driving.

To gain profound insights, consult our extensive guide titled “How do you lower your car insurance deductible?“

Is car insurance more expensive if retired?

Car insurance is typically not more expensive if you are retired; in many cases, it becomes cheaper due to reduced mileage.

What factors should I take into account when considering auto insurance as a retiree?

When considering auto insurance as a retiree, factors such as reduced mileage, potential discounts for retirees, and coverage needs should be taken into account.

Is Liberty’s comprehensive insurance for Tesla vehicles a recommended option?

Liberty’s comprehensive insurance for Tesla vehicles offers comprehensive coverage options, but it’s recommended to compare quotes to find the best fit.

To delve deeper, refer to our in-depth report titled “Compare Comprehensive Car Insurance: Rates, Discounts, & Requirements.”

What benefits does State Farm offer retirees?

State Farm offers retiree benefits, including various insurance options and potential discounts tailored to retirees, providing comprehensive coverage and potential savings.

Finding cheap car insurance quotes is easy. Just enter your ZIP code into our free comparison tool below to instantly compare quotes near you.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.