Compare Vancouver, WA Car Insurance Rates [2024]

Car insurance in Vancouver, WA averages $263 a month. Vancouver, Washington car insurance requirements are 25/50/10, but you might need full coverage insurance if your car is financed. To find cheap Vancouver car insurance rates, compare quotes from the top car insurance companies in Vancouver, WA.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

UPDATED: Nov 27, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 27, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- The cheapest car insurance company in Vancouver is USAA

- Average car insurance rates in Vancouver, WA are $3,161/year

- The cheapest ZIP code in Vancouver is 98662

If you need to buy Vancouver, Washington car insurance, the options can be confusing. Everything you need to know about car insurance in Vancouver, WA is right here.

You’ll find Vancouver car insurance rates, the cheapest Vancouver, WA car insurance companies, and information on Washington car insurance laws. You can also compare Vancouver, Washington car insurance rates to Vancouver car insurance rates, Federal Way car insurance rates, and Bellevue car insurance rates.

Ready to find affordable Vancouver, WA car insurance today? Enter your ZIP code for fast, free Vancouver car insurance quotes.

Cheapest Vancouver, WA Car Insurance Rates By Age, Gender, and Marital Status

How do age, gender, and marital status affect Vancouver, WA car insurance rates? Every Vancouver, Washington car insurance company weighs these factors differently, so check out the comparison rates.

| Insurance Company | Married 35-Year-Old Female | Married 35-Year-Old Male | Married 60-Year-Old Female | Married 60-Year-Old Male | Single 17-Year-Old Female | Single 17-Year-Old Male | Single 25-Year-Old Female | Single 25-Year-Old Male |

|---|---|---|---|---|---|---|---|---|

| Allstate | $2,095 | $2,068 | $1,942 | $2,035 | $7,483 | $8,666 | $2,220 | $2,297 |

| American Family | $2,068 | $2,068 | $1,889 | $1,889 | $7,903 | $10,795 | $2,068 | $2,776 |

| Farmers | $2,249 | $2,311 | $2,057 | $2,350 | $5,221 | $5,624 | $2,838 | $2,914 |

| Geico | $1,923 | $1,956 | $1,800 | $1,800 | $4,246 | $5,536 | $3,286 | $2,367 |

| Liberty Mutual | $1,826 | $1,986 | $1,627 | $1,910 | $10,272 | $11,272 | $1,932 | $2,095 |

| Nationwide | $1,485 | $1,518 | $1,381 | $1,437 | $4,082 | $4,959 | $1,781 | $1,920 |

| Progressive | $1,612 | $1,504 | $1,456 | $1,472 | $8,253 | $9,251 | $1,930 | $1,921 |

| State Farm | $1,679 | $1,679 | $1,514 | $1,514 | $4,942 | $6,253 | $1,915 | $2,202 |

| USAA | $1,135 | $1,118 | $1,099 | $1,097 | $4,974 | $5,860 | $1,433 | $1,566 |

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Minimum Car Insurance in Vancouver, WA

Every driver must carry the minimum car insurance in Vancouver, WA. Take a look at the Washington car insurance requirements.

| Liability Insurance Required | Minimum Coverage Limits Required |

|---|---|

| Bodily Injury Liability Coverage | $25,000 per person $50,000 per accident |

| Property Damage Liability Coverage | $10,000 minimum |

Cheapest Vancouver, WA Car Insurance Rates by Credit Score

Your credit affects car insurance costs in Vancouver, WA. Compare credit history car insurance rates in Vancouver from top companies for good, fair, and poor credit.

| Insurance Company | Poor | Fair | Good |

|---|---|---|---|

| Allstate | $4,462 | $3,414 | $2,926 |

| American Family | $4,642 | $3,790 | $3,365 |

| Farmers | $3,866 | $2,963 | $2,758 |

| Geico | $3,410 | $2,728 | $2,455 |

| Liberty Mutual | $5,871 | $3,628 | $2,846 |

| Nationwide | $2,766 | $2,169 | $2,025 |

| Progressive | $3,767 | $3,368 | $3,140 |

| State Farm | $3,945 | $2,361 | $1,831 |

| USAA | $2,881 | $2,114 | $1,861 |

Cheapest Vancouver, WA Car Insurance Rates by Driving Record

Your driving record is one of the biggest factors affecting car insurance costs. Compare bad driving record car insurance rates in Vancouver, WA to rates for a clean record with top companies.

| Group | Clean Record | With 1 Accident | With 1 DUI | With 1 Speeding Violation |

|---|---|---|---|---|

| Allstate | $3,024 | $3,787 | $4,205 | $3,387 |

| American Family | $3,152 | $4,038 | $4,675 | $3,864 |

| Farmers | $2,649 | $3,308 | $3,529 | $3,296 |

| Geico | $2,211 | $2,827 | $4,208 | $2,211 |

| Liberty Mutual | $3,509 | $4,425 | $4,507 | $4,019 |

| Nationwide | $1,803 | $2,441 | $3,065 | $1,972 |

| Progressive | $2,772 | $4,351 | $3,232 | $3,345 |

| State Farm | $2,460 | $2,964 | $2,712 | $2,712 |

| USAA | $1,677 | $2,434 | $3,048 | $1,982 |

Cheapest Vancouver, WA Car Insurance for Teen Drivers

Teen car insurance in Vancouver, WA can be expensive. Take a look at rates from the top car insurance companies in Vancouver for teenagers.

| Insurance Company | Single 17-Year-Old Female | Single 17-Year-Old Male |

|---|---|---|

| Allstate | $7,483 | $8,666 |

| American Family | $7,903 | $10,795 |

| Farmers | $5,221 | $5,624 |

| Geico | $4,246 | $5,536 |

| Liberty Mutual | $10,272 | $11,272 |

| Nationwide | $4,082 | $4,959 |

| Progressive | $8,253 | $9,251 |

| State Farm | $4,942 | $6,253 |

| USAA | $4,974 | $5,860 |

Cheapest Vancouver, WA Car Insurance for Seniors

Take a look at Vancouver, WA senior car insurance rates from top companies. Shopping around can make a big difference for senior drivers.

| Insurance Company | Married 60-Year-Old Female | Married 60-Year-Old Male |

|---|---|---|

| Allstate | $1,942 | $2,035 |

| American Family | $1,889 | $1,889 |

| Farmers | $2,057 | $2,350 |

| Geico | $1,800 | $1,800 |

| Liberty Mutual | $1,627 | $1,910 |

| Nationwide | $1,381 | $1,437 |

| Progressive | $1,456 | $1,472 |

| State Farm | $1,514 | $1,514 |

| USAA | $1,099 | $1,097 |

Cheapest Vancouver, WA Car Insurance Rates After a DUI

A DUI in Vancouver, WA increases car insurance rates. Compare Vancouver, Washington DUI car insurance by company to find the cheapest option.

| Insurance Company | Annual Car Insurance Rates With a DUI |

|---|---|

| Allstate | $4,205 |

| American Family | $4,675 |

| Farmers | $3,529 |

| Geico | $4,208 |

| Liberty Mutual | $4,507 |

| Nationwide | $3,065 |

| Progressive | $3,232 |

| State Farm | $2,712 |

| USAA | $3,048 |

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Cheapest Vancouver, WA Car Insurance Rates by Commute Length

How does how far you drive affect car insurance rates in Vancouver, WA by commute? Take a look at a comparison of the top companies by commute length.

| Insurance Company | 10 Mile Commute, 6,000 Annual Mileage | 25 Mile Commute, 12,000 Annual Mileage |

|---|---|---|

| Allstate | $3,601 | $3,601 |

| American Family | $3,852 | $4,012 |

| Farmers | $3,196 | $3,196 |

| Geico | $2,828 | $2,901 |

| Liberty Mutual | $4,115 | $4,115 |

| Nationwide | $2,320 | $2,320 |

| Progressive | $3,425 | $3,425 |

| State Farm | $2,637 | $2,788 |

| USAA | $2,263 | $2,308 |

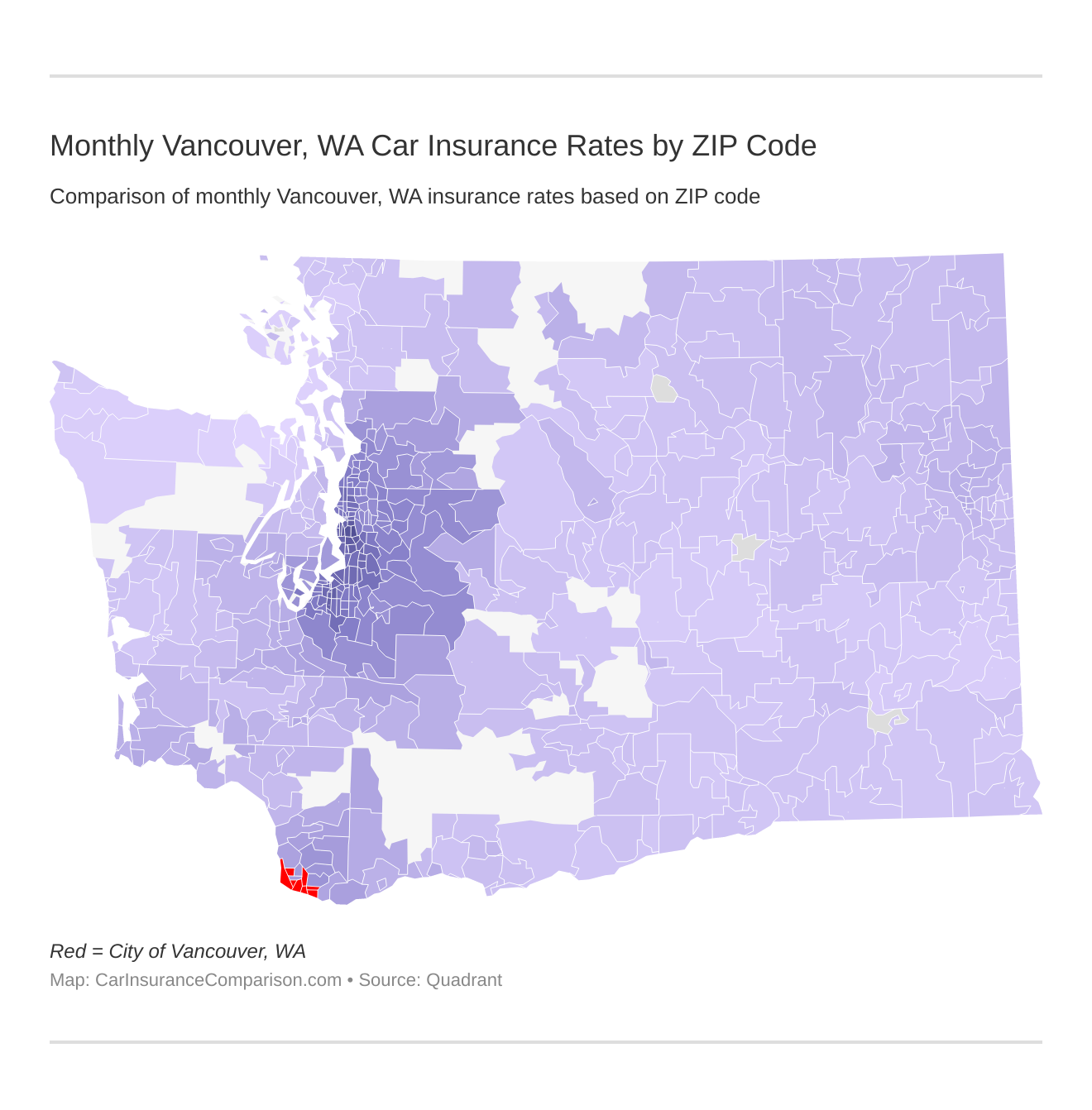

Check out the difference in car insurance rates by ZIP code in Vancouver, WA.

Monthly Vancouver, WA Car Insurance Rates by ZIP Code

Vancouver car insurance rates vary based on where you live. Check out the difference in car insurance rates by ZIP code in Vancouver, WA.

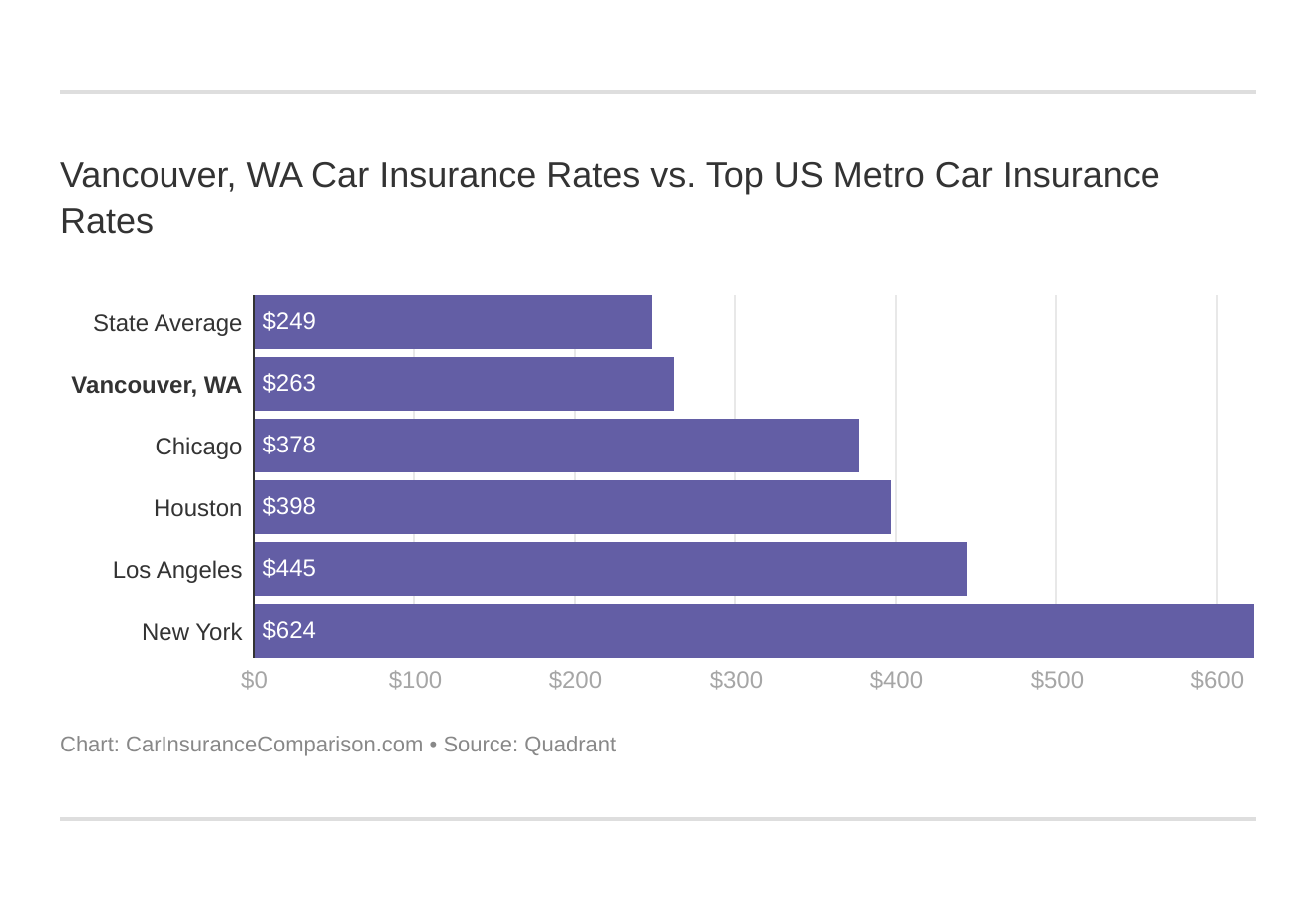

Vancouver, WA Car Insurance Rates vs. Top US Metro Car Insurance Rates

You might find yourself asking how does my Vancouver, WA stack up against other top metro auto insurance rates? We’ve got your answer below.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

The Best Cheap Car Insurance Companies in Vancouver, WA

Take a look at a side-by-side comparison of the top car insurance companies in Vancouver, WA to find the best option for your needs.

| Insurance Company | Average Annual Rates |

|---|---|

| Allstate | $3,601 |

| American Family | $3,932 |

| Farmers | $3,196 |

| Geico | $2,864 |

| Liberty Mutual | $4,115 |

| Nationwide | $2,320 |

| Progressive | $3,425 |

| State Farm | $2,712 |

| USAA | $2,285 |

Category Winners: Cheapest Car Insurance in Vancouver, Washington

Find the cheapest car insurance companies in Vancouver, WA for each category right here.

| Category | Insurance Company |

|---|---|

| Teenagers | Nationwide |

| Seniors | USAA |

| Clean Record | USAA |

| With 1 Accident | USAA |

| With 1 DUI | State Farm |

| With 1 Speeding Violation | Nationwide |

Cheapest Vancouver, WA Car Insurance Rates by Coverage Level

How much coverage you choose will have an impact on your Vancouver car insurance rates. Find the cheapest Vancouver, WA car insurance rates by coverage level.

| Insurance Company | Low | Medium | High |

|---|---|---|---|

| Allstate | $3,388 | $3,589 | $3,826 |

| American Family | $3,720 | $3,927 | $4,149 |

| Farmers | $2,950 | $3,196 | $3,441 |

| Geico | $2,681 | $2,867 | $3,045 |

| Liberty Mutual | $3,870 | $4,125 | $4,351 |

| Nationwide | $2,196 | $2,321 | $2,444 |

| Progressive | $3,096 | $3,334 | $3,845 |

| State Farm | $2,522 | $2,726 | $2,889 |

| USAA | $2,129 | $2,284 | $2,442 |

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

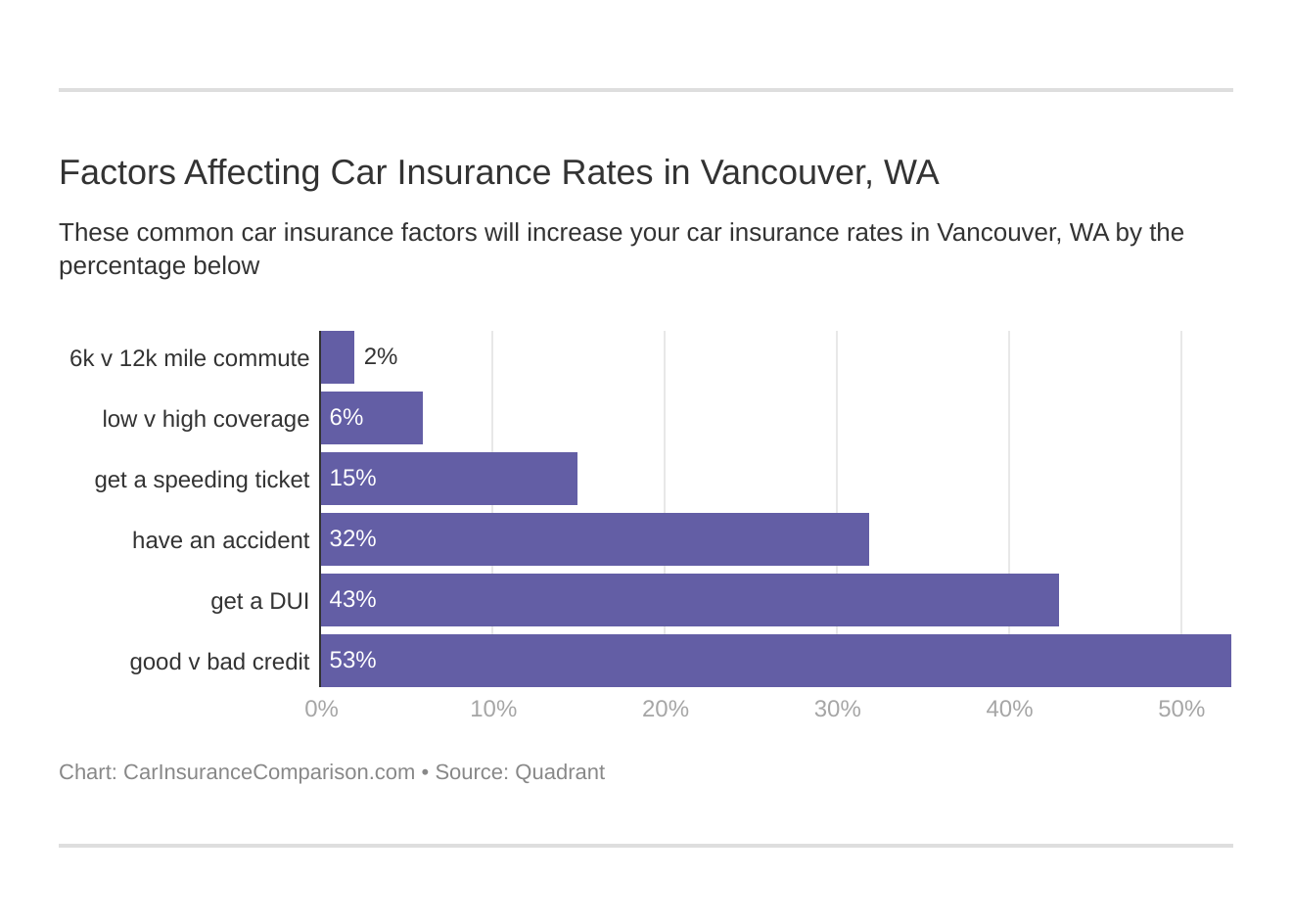

What affects car insurance rates in Vancouver, Washington?

Factors affecting auto insurance rates in Vancouver, WA may include your commute, coverage level, tickets, DUIs, and credit. Controlling these factors will help you maintain cheap Vancouver, Washington auto insurance.

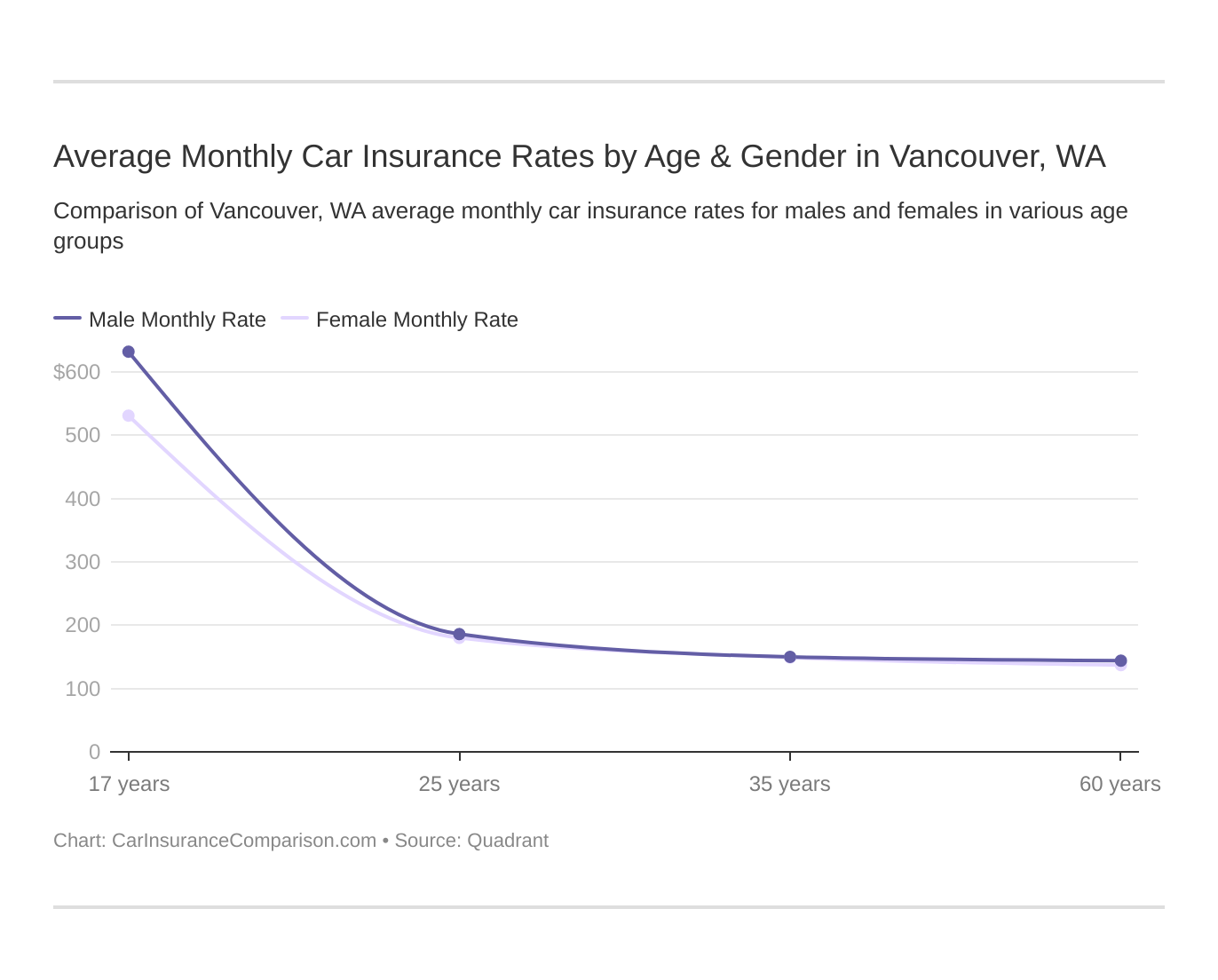

These states no longer using gender to calculate your auto insurance rates — Hawaii, Massachusetts, Michigan, Montana, North Carolina, and Pennsylvania. But age is still a significant factor because young drivers are often considered high-risk. Therefore, teen car insurance is more expensive. Washington does use gender, so check out the average monthly auto insurance rates by age and gender in Vancouver, WA.

Car Theft in Vancouver

High levels of vehicle theft can make car insurance more expensive. Vancouver, WA car theft statistics from the FBI indicate 1,076 vehicle thefts a year.

Commute Time in Vancouver

The more time you spend in your car the higher the risk of an accident. The average commute length in Vancouver, WA is 25.4 minutes according to City-Data.

Traffic in Vancouver

Traffic and commute times go hand in hand, with more traffic meaning more time on the road. Vancouver, WA traffic data from INRIX ranks Vancouver as the 93rd-most congested in the world.

Compare Car Insurance Quotes in Vancouver, WA

Ready to find affordable Vancouver, Washington car insurance today? Enter your ZIP code for fast, free Vancouver, WA car insurance quotes.

Frequently Asked Questions

What are the car insurance requirements in Vancouver, WA?

Vancouver, Washington car insurance requirements are 25/50/10. This means you need to have at least $25,000 in bodily injury liability coverage per person, $50,000 in bodily injury liability coverage per accident, and $10,000 in property damage liability coverage.

Do I need full coverage insurance if my car is financed?

If your car is financed, it’s likely that you will be required to have full coverage insurance. Full coverage insurance typically includes comprehensive and collision coverage in addition to the state-required liability coverage. It’s important to check with your lender to determine the specific insurance requirements for your financed vehicle.

How can I find cheap car insurance rates in Vancouver, WA?

To find cheap car insurance rates in Vancouver, WA, you can compare quotes from the top car insurance companies in the area. By comparing multiple quotes, you can find the best rate that suits your needs and budget. Use the free quote tool by entering your ZIP code to start comparing quotes.

How do age, gender, and marital status affect car insurance rates in Vancouver, WA?

Every car insurance company weighs age, gender, and marital status differently when determining rates. Generally, younger drivers, male drivers, and unmarried drivers may have higher insurance rates. However, the impact of these factors can vary among insurance companies. It’s recommended to compare rates from different insurers to find the best option for your specific situation.

What is the cheapest car insurance company in Vancouver, WA?

Nationwide is the cheapest car insurance company in Vancouver, WA that offers coverage to all drivers. However, USAA is actually cheaper, but it only offers auto insurance to the military, veterans, and their families.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.