Best BMW Car Insurance Rates in 2025 (Check Out the Top 10 Providers)

Get the best BMW car insurance rates with State Farm, USAA, and Allstate, which offer competitive rates and discounts up to 31%. They provide excellent customer service and comprehensive coverage options to ensure peace of mind. Compare now to find the lowest premiums and the best coverage tailored to your needs.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

UPDATED: Jul 18, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jul 18, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for BMW

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for BMW

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for BMW

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews

Let’s delve into the best BMW car insurance rates with State Farm, USAA, and Allstate as the top contenders, offering discounts up to 31%. These companies provide exceptional customer service and comprehensive coverage options tailored to BMW owners. Compare now to find the best coverage for your BMW.

BMW, or Bavarian Motor Works, is a German high-end car manufacturer. BMW car insurance rates are higher than other luxury brands due to expensive maintenance costs. Read our guide to find the best BMW SUV and sports car insurance, compare prices, and choose the right coverage (Read More: Safest Cars in America).

Our Top 10 Company Picks: Best BMW Car Insurance Rates

Company Rank Good Driver Discount A.M. Best Best For Jump to Pros/Cons

#1 15% B Comprehensive Coverage State Farm

#2 10% A++ Military Discounts USAA

#3 20% A+ Accident Forgiveness Allstate

#4 22% A++ Affordable Rates Geico

#5 31% A+ Snapshot Program Progressive

#6 15% A+ Customer Satisfaction Amica

#7 15% A Car Replacement Liberty Mutual

#8 10% A Customizable Policies Farmers

#9 10% A+ Vanishing Deductible Nationwide

#10 10% A++ Hybrid Discounts Travelers

By entering your ZIP code above, you can get instant car insurance quotes from top providers.

- Compare BMW Car Insurance Rates

- Best BMW Z3 Car Insurance in 2025 (Find the Top 10 Companies Here)

- Best BMW X2 Car Insurance in 2025 (Your Guide to the Top 10 Companies)

- Best BMW M2 Car Insurance in 2025 (Top 10 Companies Ranked)

- Best BMW 4 Series Gran Coupe Car Insurance in 2025 (Compare the Top 10 Companies)

- Best BMW 2 Series Gran Coupe Car Insurance in 2025 (Top 10 Companies Ranked)

- Best BMW M5 Car Insurance in 2024 (Find the Top 10 Companies Here)

- Best BMW M6 Car Insurance in 2025 (Your Guide to the Top 10 Companies)

- Best BMW M3 Car Insurance in 2025 (Your Guide to the Top 10 Companies)

- Best BMW 5 Series Car Insurance in 2025 (Your Guide to the Top 10 Companies)

- Best BMW 3 Series Car Insurance in 2025 (Find the Top 10 Companies Here)

- Compare State Farm, USAA, and Allstate for the best BMW car insurance rates

- BMW’s higher maintenance costs increase luxury car insurance rates

- State Farm offers top-notch service and comprehensive coverage

#1 – State Farm: Top Overall Pick

Pros

- Top Overall Pick: State Farm is highly recommended for its overall customer satisfaction and service.

- Extensive Coverage Options: Offers a wide range of coverage options to meet various needs. Learn more in our State Farm car insurance review.

- Extensive Agent Network: Provides access to a large network of agents for personalized service.

Cons

- Potentially Higher Rates: Rates may be higher compared to some competitors.

- Lengthy Claims Process: Some customers report longer than average claims processing times.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Discounts

Pros

- Best for Military Discounts: As mentioned in our USAA car insurance review, they offer exclusive discounts and benefits for military members and their families.

- Excellent Customer Service: USAA is well-known for its exceptional customer service and claims handling.

- Strong Financial Ratings: Has top ratings for financial stability and customer satisfaction.

Cons

- Limited Membership: Only available to military members, veterans, and their families.

- Availability of Services: Limited physical locations may not be convenient for all customers.

#3 – Allstate: Best for Accident Forgiveness

Pros

- Best for Accident Forgiveness: Offers accident forgiveness programs that can help keep rates lower after a claim.

- Variety of Discounts: Provides numerous discounts to help lower premiums.

- User-Friendly Technology: Offers innovative tools like the Drivewise program for safe drivers. Learn more in our Allstate car insurance review.

Cons

- Higher Premiums: Allstate tends to be more expensive compared to some competitors.

- Mixed Customer Service Reviews: Some customers report dissatisfaction with claims handling and customer service.

#4 – Geico: Best for Affordable Rates

Pros

- Best for Affordable Rates: Geico is well-known for its competitive pricing and discounts.

- User-Friendly Online Platform: Offers a convenient and easy-to-use website and mobile app.

- High Customer Satisfaction: Generally receives positive feedback for customer service. Learn more in our Geico car insurance review.

Cons

- Limited Personalized Service: Geico is primarily online, which may not appeal to customers who prefer in-person interactions.

- Claims Satisfaction: Some customers report issues with the claims process and settlement amounts.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#5 – Progressive: Best for Snapshot Program

Pros

- Best for Snapshot Program: Offers a usage-based insurance program (Snapshot) that can help lower premiums.

- Innovative Tools: Provides tools like Name Your Price® and online quote comparison.

- Wide Range of Coverages: Offers a variety of insurance products beyond just auto insurance. Read more about their discounts in our Progressive car insurance review.

Cons

- Rate Increases: Some customers experience rate increases over time.

- Complex Claims Process: Claims processing can be more complicated compared to other insurers.

#6 – Amica: Best for Customer Satisfaction

Pros

- Best for Customer Satisfaction: Amica consistently receives high ratings for customer service and claims satisfaction.

- Financial Stability: Strong financial stability and reliability in the insurance industry.

- Personalized Service: Known for its personalized customer service and individual attention. (Read More: How do you get an amica mutual car insurance quote online?)

Cons

- Potentially Higher Rates: Premiums may be higher compared to some competitors.

- Limited Availability: Amica may not be available in all states, limiting accessibility.

#7 – Liberty Mutual: Best for Car Replacement

Pros

- Best for Car Replacement: Offers unique benefits like New Car Replacement Coverage.

- Customizable Policies: Provides options for tailoring policies to individual needs.

- Financial Strength: Liberty Mutual has strong financial ratings and stability.

Cons

- Higher Premiums: Liberty Mutual can be more expensive compared to other insurers. For more information, read our Liberty Mutual car insurance review.

- Mixed Customer Reviews: Some customers report dissatisfaction with claims handling and customer service.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#8 – Farmers: Best for Customizable Policies

Pros

- Best for Customizable Policies: Farmers offers a wide range of coverage options and customization.

- Local Agents: Provides access to local agents for personalized service and support.

- Discount Opportunities: As mentioned in our Farmers car insurance review, they offer various discounts to help lower premiums.

Cons

- Potentially Higher Rates: Premiums may be higher compared to some competitors.

- Claims Processing: Some customers report issues with claims processing and settlement.

#9 – Nationwide: Best for Vanishing Deductible

Pros

- Best for Vanishing Deductible: Offers the Vanishing Deductible program for safe drivers.

- Personalized Service: Provides local agents for personalized service and support.

- Wide Range of Products: Offers various insurance products beyond auto insurance (Read More: Nationwide Car Insurance Discounts).

Cons

- Higher Premiums: Nationwide can be more expensive compared to other insurers.

- Claims Handling: Some customers report delays and issues with claims processing

#10 – Travelers: Best for Hybrid Discounts

Pros

- Best for Hybrid Discounts: Offers discounts for hybrid and electric vehicle owners.

- Strong Financial Stability: Travelers has strong financial ratings and stability.

- Innovative Products: Provides innovative insurance products and coverage options.

Cons

- Higher Premiums: Travelers tends to be more expensive compared to some competitors. Learn more about their rates in our Travelers car insurance review.

- Customer Service: Mixed customer reviews regarding claims handling and customer service.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

BMW Car Insurance Costs

BMW is one of the world’s most respected automakers and has been in business since 1916. Originally aircraft builders, the company began producing cars in the early 1920s. Now BMW is known for its luxury cars and SUVs.

The average car insurance cost for a BMW is going to be higher than economy car brands. However, you can still receive affordable BMW auto insurance rates by understanding how car insurance companies calculate your premiums.

Let’s say our hypothetical driver is looking for car insurance costs for a 2009 BMW M3. Using our car insurance cost estimator for the BMW, his car insurance on a BMW will look as follows:

BMW Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $160 $320

Amica $155 $310

Farmers $165 $330

Geico $130 $260

Liberty Mutual $170 $340

Nationwide $150 $305

Progressive $145 $290

State Farm $150 $300

Travelers $155 $315

USAA $140 $280

So, how much does car insurance cost for a BMW? As you can see, the lowest rates will be around $104.34 per month. But remember, these estimates are for the BMW 3 series and our hypothetical driver is very low-risk.

State Farm offers top-notch service and comprehensive coverage tailored for your BMW

Brad Larson LICENSED INSURANCE AGENT

If you have tickets for speeding violations, at-fault accidents, or are considerably older or younger than our hypothetical individual, your BMW 7 insurance or 2006 BMW 325i car insurance costs will be much higher.

The cheapest BMW to insure might be the BMW x1, while the most expensive might be the BMW i8. If you’re still contemplating which BMW model to buy, look for sample quotes for different models and see if the insurance cost can sway you in one direction or another.

Having a less desirable credit rating may also cause you to have higher than average BMW insurance costs.

The BMW 7 series insurance costs, for example, will look quite different.

States and cities with higher population density or higher crime rates usually have pricier average car insurance rates because you’re more at risk of getting into an accident or having your vehicle stolen.

Don’t skimp on your coverage. BMWs are common targets for thieves, so you definitely want to invest in comprehensive car insurance coverage, and if you don’t have collision coverage, your insurer won’t pay to repair your car if you’re in an at-fault accident.

Fortunately, there are still ways to save on car insurance, no matter where you live. Keep reading to learn more about low-cost BMW insurance.

Lowering Your BMW Auto Insurance Premiums

As you’ve learned from the information above, a question like, “How much does car insurance cost per much for a 2015 BMW 320i” does not have an easy answer, as so many variables impact your individual rates.

No matter your circumstances, checking with different insurance companies for advantageous rates is a good idea. Because our hypothetical individual has no tickets or accidents in their recent past and a relatively clear history, his insurance costs are lower.

Go online to get insurance quotes to compare prices or check with your local insurance agent. Most insurance agencies can provide you with quotes from several different companies.

Before asking for quotes, have the following information available:

- Complete names, dates of birth, driver’s license numbers, and driving records for all drivers of your cars

- The limits of liability that you want

- Deductibles you can accept for damage to your own car

- If you want uninsured motorist coverage

- Year, description, model, and VIN if available for all cars

- How the car will be used

This information will allow the insurance company to give you a reasonable quote for the cost of insurance. They’ll probably ask other questions in the event that you choose to go forward with purchasing a policy.

Comparison shopping for insurance can make a difference in the cost of ownership for the vehicle you’ve chosen.

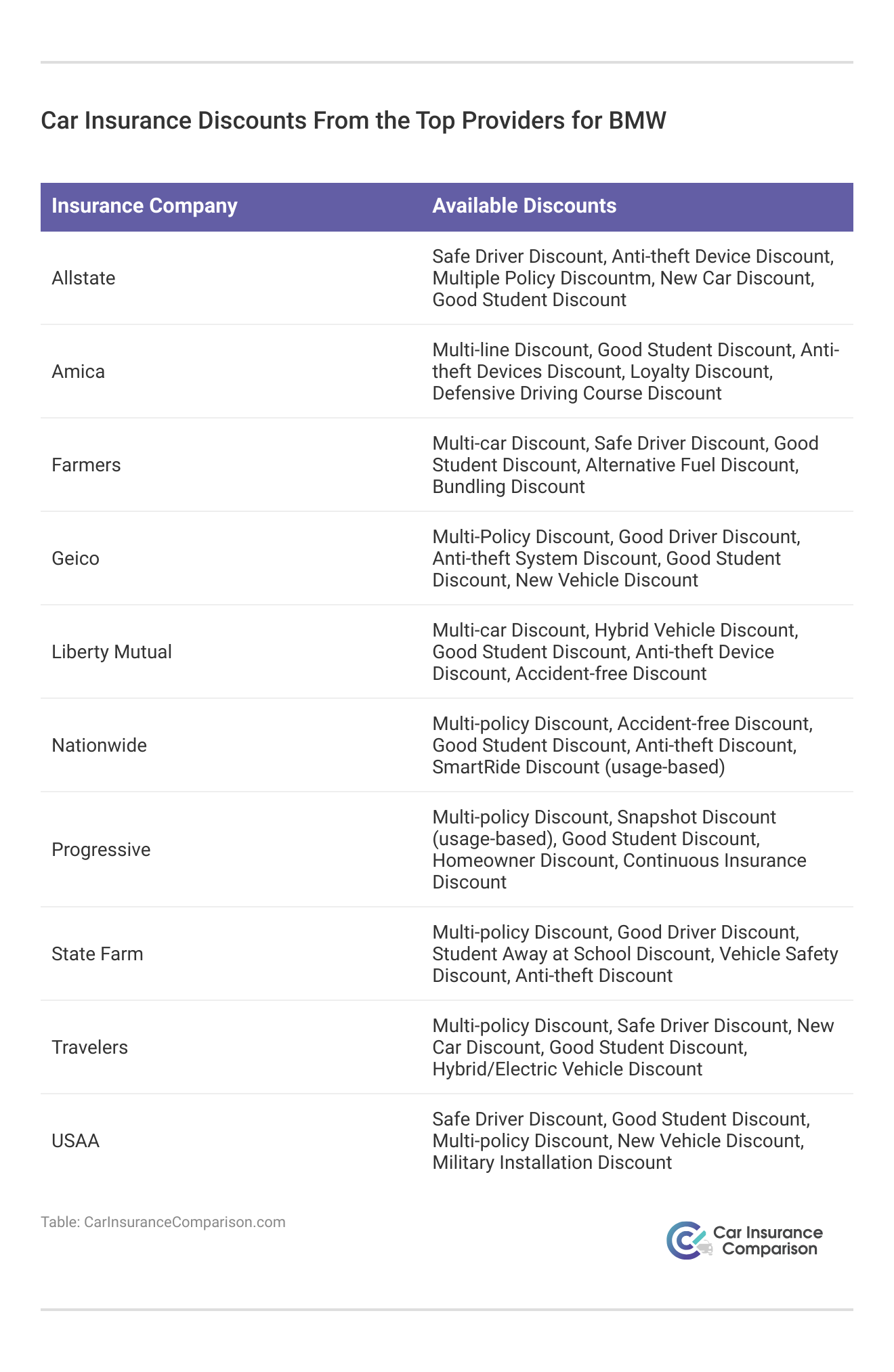

For cheap BMW car insurance rates, we recommend looking at available discounts from insurance providers that you might be eligible for.

What are some unusual car insurance discounts that your BMW might qualify for? Check out our list below.

- Multi-Car Discounts: insuring more than one car with the company

- Package Discounts: insuring both your home and car with the same company

- Good Driver Discounts: no tickets, no accidents

- Good Student Discounts: especially valuable if you have a teen driver

All of this comparison is quite time-consuming but can be beneficial to your bottom line when you purchase a car.

BMW Saftey Ratings

Insurance companies will take safety ratings for your vehicle into consideration when determining your car insurance rates. Fortunately, many BMW models receive great scores across the board.

Take a look at how the Insurance Institute for Highway Saftey rated the 2020 BMW 3 Series below.

- Small Overlap Front (Driver-Side): Good

- Small Overlap Front (Passenger-Side): Good

- Moderate Overlap Front: Good

If you invest in the 2020 BMW 3 sedan, expect your insurance rates to be lower thanks to these stellar safety scores.

The age of your vehicle also matters. Sometimes, newer models of a certain car have better safety ratings than older versions.

For example, the 2018 BMW 3 Series received a five-star overall safety rating from the National Highway Traffic and Saftey Administration. However, the driver’s side crash test only received four stars.

While the BMW safety ratings are not the only factor that will impact your insurance rates, they do make a difference. Putting the time in to research the safest vehicle can help save you money in the long run.

Read More: Safety Features Car Insurance Discounts

Compare BMW Auto Insurance Rates by Model

Explore BMW car insurance rates for distinct models like the 2 Series Gran Coupe, 3 Series, 4 Series Gran Coupe, 5 Series, M2, M3, M5, M6, X2, and Z3.

Compare BMW Car Insurance Rates by Model

This detailed analysis offers insights into the diverse insurance costs associated with each BMW model, empowering you to make well-informed decisions about coverage based on your specific vehicle choice.

BMW Costs & Options

We’ve answered your questions about whether insurance is expensive for a BMW, but there are other costs associated with owning this luxury vehicle. For example, sports cars are notoriously more expensive to insure than other types of cars.

Read More: Best Insurance for Luxury Cars

BMW has divided its vehicle offerings into separate series. Check out the table below for more details about costs. All the costs quoted are the manufacturer’s suggested retail price, or MSRP.

BMW Vehicle Costs by Series

| Series | MSRP Range |

|---|---|

| 3 Series | $41,450 - $56,700 |

| 5 Series | $56,000 - $79,900 |

| 7 Series | $93,600 - $157,800 |

| M Series | $73,795 - $150,895 |

You can add features to the base for any of these vehicles to customize them for your particular needs and desires.

Customization can add a great deal to the base price, but the base auto is very plain.

Stuck trying to choose the right coverage? Call State Farm. pic.twitter.com/rwojdNXjFa

— State Farm (@StateFarm) May 7, 2024

A more expensive model might have a complicated transmission or drive packages that allow you to adjust the drive, ride, and responsiveness of the vehicle, which are elements that require hands-on driving to experience.

Adding all the bells and whistles to your BMW may also increase your insurance rates because those parts will be more expensive to replace or repair in the event of an accident.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

The Cost of Ownership for A BMW

Depending upon use and care, the BMW usually doesn’t need a great deal of repair. But that doesn’t mean owning one is inexpensive.

There are a number of sites on the internet that will give you estimates for the cost of ownership of various brands of vehicles. The following table estimates the cost of owning a 2013 BMW 3 series sedan for five years.

BMW Cost of Ownership Over Five Years

| Owner Expenses | Five-Year Cost |

|---|---|

| Depreciation | $20,000 |

| Insurance | $8,500 |

| Fuel | $7,000 |

| Financing | $3,500 |

| Maintenance | $4,000 |

| Repair | $2,000 |

| State Fees | $1,500 |

| Total | $46,500 |

Looking at the data, the total cost of ownership for this particular BMW sedan for five years is $44,764. Because of the high maintenance costs, BMW insurance costs are also higher than average.

Obviously, these are estimates — insurance costs will depend on your area and your insurability, fuel varies from year to year, financing is based on your credit at the time, and the state fees vary depending on how the state outlines road taxes and costs.

Read More: Minimum Car Insurance Requirements by State

The Bottom Line

Before purchasing a BMW, it’s a good idea to check around your neighborhood and find someone who can reliably perform maintenance and repairs on your new car.

You don’t necessarily save money when choosing a less expensive brand name. In fact, many people pay more for their insurance premiums simply because they choose a cheaper brand name.

It pays off to shop around for better deals on insurance policies. Be sure to compare prices between different companies so you know you’re getting the best deal possible.

Stop overpaying for car insurance. Our free quote comparison tool allows you to shop for quotes from the top providers near you by entering your ZIP code below.

Frequently Asked Questions

How much does car insurance cost for a BMW 228 vs a BMW 235?

The BMW 228 will most likely cost less to insure than the BMW 235.

What costs more for car insurance, a BMW 325i or a Corolla?

Usually, a Toyota Corolla will cost less to insure than a BMW 325i. See if you’re getting the best deal on car insurance by entering your ZIP code below.

What coverage options should I consider for my BMW?

Collision and comprehensive coverages are recommended for BMWs due to their high value and potential for expensive repairs. Additionally, consider adding uninsured/underinsured motorist coverage and gap insurance.

Is BMW or Mercedes cheaper to insure?

Often, a Mercedes Benz is more expensive to insure. However, insurance rates depend on more than just vehicle brands. Your individual demographics will also have an impact.

What is the price of BMW car insurance?

Car insurance rates are calculated differently. Some rates for basic sedans are around $612 monthly. Being a luxury brand, BMWs will cost more.

How can I lower my BMW car insurance rates?

You can lower your BMW insurance premiums by comparing quotes from different insurers, maintaining a clean driving record, and taking advantage of available discounts such as multi-policy discounts, or safe driving programs.

What are the car insurance quotes for a BMW?

Car insurance starts at around $177 monthly, but luxury BMWs usually cost more. When it comes to car insurance, compare rates to get the best deal.

Get the lowest BMW car insurance rates by entering your ZIP code into our free quote comparison tool right now.

What factors contribute to higher BMW car insurance rates?

BMWs typically have higher insurance rates due to their expensive maintenance costs, which can drive up repair and replacement expenses for insurers.

How does the type of BMW affect insurance rates?

The type and model of your BMW can significantly impact insurance rates. Sports cars and high-performance models typically have higher insurance premiums due to their increased risk of accidents and theft, compared to SUVs or sedans.

Which insurance company offers the best rates for BMWs?

State Farm, USAA, and Allstate are known for offering competitive rates for BMW car insurance, with discounts of up to 31% available.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.