Cheap Car Insurance for Wheelchair-Accessible Vehicles in 2026 (Save Big With These 10 Companies!)

Cheap car insurance for wheelchair-accessible vehicles starts as low as $30/month with top providers Geico, AAA, and State Farm leading the pack. These companies offer the best rates and comprehensive coverage options tailored for wheelchair-accessible vehicles, ensuring affordability and security for drivers.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Feature Writer

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, All...

Rachel Bodine

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated January 2025

19,116 reviews

19,116 reviewsCompany Facts

Min Coverage for Wheelchair-Accessible Vehicles

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 3,027 reviews

3,027 reviewsCompany Facts

Min Coverage for Wheelchair-Accessible Vehicles

A.M. Best Rating

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviews 18,157 reviews

18,157 reviewsCompany Facts

Min Coverage for Wheelchair-Accessible Vehicles

A.M. Best Rating

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviewsThe top picks for cheap car insurance for wheelchair-accessible vehicles are Geico, USAA, and American Family. These providers are distinguished by their affordable pricing and specialized coverage.

If you’re looking for disability car insurance, make sure you have the right policy to cover any vehicle modifications. Geico, USAA, and American Family have the best wheelchair-accessible vehicle insurance rates starting at $180/mo.

Our Top 10 Company Picks: Cheap Car Insurance for Wheelchair-Accessible Vehicles

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $30 | A++ | Senior Discounts | Geico | |

| #2 | $32 | A | Roadside Assistance | AAA |

| #3 | $33 | A++ | High-Risk Drivers | State Farm | |

| #4 | $37 | A++ | Unique Coverage | Travelers | |

| #5 | $38 | A+ | UBI Discount | Progressive | |

| #6 | $43 | A+ | Commercial Insurance | Nationwide |

| #7 | $43 | A | Customer Service | American Family | |

| #8 | $52 | A | Great Add-ons | Farmers | |

| #9 | $60 | A+ | Drivewise Programs | Allstate | |

| #10 | $66 | A | Policy Options | Liberty Mutual |

Fully disclose your disability for accurate insurance rates. While your condition won’t affect premiums, certain vehicle mods can increase costs. Compare online for wheelchair-accessible vehicle insurance, focusing on coverage for modified parts. This guide outlines rates for popular accessible vehicles to help you get accurate quotes.

#1 – Geico: Top Overall Pick

Pros

- Competitive Senior Rates: Geico offers especially low rates for seniors, starting at $30/month.

- Strong Financial Rating: Rated A++ by A.M. Best, indicating excellent financial stability. See more details on our Geico car insurance review.

- Comprehensive Discounts: Offers a variety of discounts including for safe driving and vehicle safety features.

Cons

- Customer Service Variability: Some customers report variability in service quality.

- Policy Customization: Fewer customization options for policies compared to competitors.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – AAA: Best for Roadside Assistance

Pros

- Exceptional Roadside Assistance: AAA is renowned for its comprehensive roadside help.

- Decent Financial Strength: Rated A by A.M. Best. Discover more about offerings in our AAA car insurance review.

- Additional Member Benefits: Access to various discounts and travel services beyond insurance.

Cons

- Higher Rates for Non-members: Non-members may face higher rates.

- Limited Availability: Insurance offerings can vary significantly by region.

#3 – State Farm: Best for High-Risk Drivers

Pros

- Bundling Policies: Significant discounts for bundling multiple insurance policies.

- High Low-Mileage Discount: Substantial savings for drivers with lower annual mileage.

- Wide Coverage: Offers a range of coverage options tailored to different needs. Read up on the State Farm car insurance review for more information.

Cons

- Limited Multi-Policy Discount: Smaller multi-policy discounts compared to some competitors.

- Premium Costs: Despite discounts, premiums can be higher for certain coverage levels.

#4 – Travelers: Best for Unique Coverage

Pros

- Innovative Coverage Options: Travelers offers unique insurance solutions that cater to specific needs.

- High Financial Rating: An A++ rating from A.M. Best assures strong financial health.

- Flexible Policy Options: A wide range of policy adjustments are available. Learn more in our Travelers car insurance review.

Cons

- Pricing: Premiums can be higher, especially for unique coverage options.

- Complex Policies: Some customers find their policy options complex and hard to understand.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Progressive: Best for UBI Discount

Pros

- Strong UBI Discounts: Progressive’s Snapshot program can significantly reduce premiums.

- Varied Discounts: Offers multiple discounts including multi-car, safe driver, and online quotes.

- Responsive Customer Service: Known for efficient claim handling and customer support. Unlock details in our Progressive car insurance review.

Cons

- Variable Rates Post-Trial: UBI program can result in higher rates for some drivers post-trial.

- Policy Pricing: Generally higher rates before discounts apply.

#6 – Nationwide: Best for Commercial Insurance

Pros

- Tailored Commercial Policies: Specializes in a wide array of commercial insurance options.

- Discounts for Business Bundling: Discounts are available when bundling multiple business policies.

- Strong Agent Network: Robust network of agents specialized in commercial risks. Check out insurance savings in our complete Nationwide car insurance discounts.

Cons

- Higher Premiums: This can be pricey, especially for specialized commercial policies.

- Complex Claims Process: Some business clients find the claims process cumbersome.

#7 – American Family: Best for Customer Service

Pros

- Exceptional Customer Support: American Family is highly rated for its customer service.

- Broad Coverage Options: Offers a comprehensive range of coverage including unique personal property insurance.

- Rewards Program: Benefits for customer loyalty and multiple policy holdings. Delve into our evaluation of the American Family car insurance review.

Cons

- Availability: Not available in all states, limiting potential reach.

- Rate Fluctuations: Some customers report inconsistent rate changes.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Farmers: Best for Policy Add-ons

Pros

- Extensive Add-ons: Farmers offers numerous add-ons for personalized coverage.

- Dedicated Agents: Known for personalized service through a vast agent network.

- Recovery and Assistance Services: Strong support services in case of loss. Delve into our evaluation of Farmers car insurance review.

Cons

- Cost: Generally higher base premiums before add-ons.

- Complexity in Policies: Some customers find their policies to be complex and difficult to manage.

#9 – Allstate: Best for Drivewise Programs

Pros

- Innovative Drivewise Program: Rewards safe driving with potential savings. More information is available about this provider in our Allstate car insurance review.

- Multiple Discount Opportunities: Offers various discounts including new car and anti-theft.

- Strong Online Tools: Provides a robust set of online tools for policy management.

Cons

- Higher Rates: Rates tend to be higher compared to other insurers.

- Customer Feedback: Some dissatisfaction with claim resolution times.

#10 – Liberty Mutual: Best for Policy Options

Pros

- Wide Range of Policy Choices: Offers a broad array of policy options to suit diverse needs.

- Customizable Packages: Allows extensive customization of policies. Discover insights in our Liberty Mutual car insurance review.

- Strong Financial Health: Maintains a solid A rating from A.M. Best.

Cons

- Premium Pricing: Generally higher rates for their extensive coverage options.

- Mixed Customer Service Reviews: Some customers report variability in service quality.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

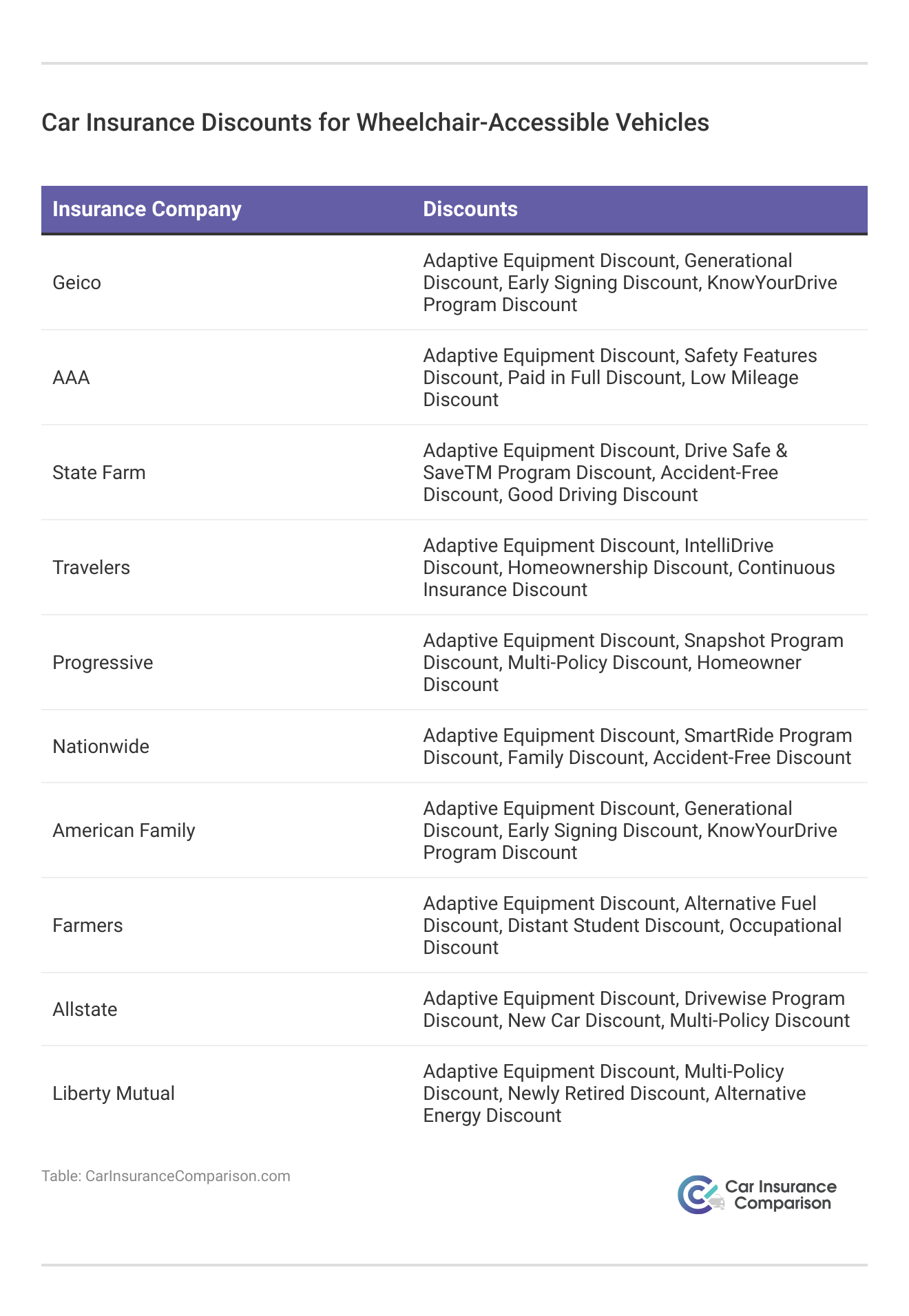

Monthly Premiums for Wheelchair-Accessible Vehicle Insurance

Auto insurance rates for wheelchair-accessible vehicles vary significantly between providers, reflecting differences in the scope and extent of coverage offered. Here’s a breakdown of the monthly costs you might expect:

Car Insurance for Wheelchair-Accessible Vehicles: Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $32 | $84 |

| Allstate | $60 | $157 |

| American Family | $43 | $114 |

| Farmers | $52 | $136 |

| Geico | $30 | $78 |

| Liberty Mutual | $66 | $170 |

| Nationwide | $43 | $112 |

| Progressive | $38 | $103 |

| State Farm | $33 | $84 |

| Travelers | $37 | $97 |

Geico offers the most affordable minimum coverage at $30 and full coverage at $78 per month, making it a budget-friendly option for those seeking comprehensive benefits at a lower cost. Close behind, AAA and State Farm present competitive rates for both minimum and full coverage, costing $32/$84 and $33/$84 respectively.

Travelers and Progressive edge slightly higher, with Travelers charging $37 for minimum and $97 for full coverage, while Progressive’s rates are $38 for minimum and $103 for full. Nationwide and American Family also offer robust packages at moderate price points, with Nationwide at $43/$112 and American Family at $43/$114.

On the higher end of the spectrum, Farmers, Allstate, and Liberty Mutual present higher rates, reflective of their extensive coverage options, charging $52/$136, $60/$157, and $66/$170 respectively for minimum and full coverages. See more details on our “Compare Monthly Car Insurance: Rates, Discounts, & Requirements.”

Compare Wheelchair-Accessible Vehicle Insurance Rates by Driving Record

Look at the table below to see how much one speeding ticket, at-fault accident, or DUI can affect your car insurance rates.

Full Coverage Car Insurance Monthly Rates by Driving Record & Provider

| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Allstate | $318 | $416 | $522 | $374 |

| American Family | $225 | $310 | $361 | $252 |

| Farmers | $288 | $377 | $393 | $340 |

| Geico | $179 | $266 | $406 | $220 |

| Liberty Mutual | $398 | $517 | $634 | $475 |

| Nationwide | $229 | $283 | $379 | $260 |

| Progressive | $283 | $398 | $331 | $334 |

| State Farm | $235 | $283 | $303 | $266 |

| Travelers | $287 | $358 | $478 | $355 |

| USAA | $161 | $210 | $292 | $183 |

Your driving record is the single most influential factor on your premium rates. If you even get one speeding ticket, your rates can go up anywhere from 12 to 24% with these major insurers.

Geico stands out as the premier choice for consumers looking for high-value insurance at lower costs.

Tracey L. Wells Licensed Insurance Agent & Agency Owner

One accident that’s your fault is worse at an increase of 20% to 49%. But a DUI increases rates by 17% to 127%, with Geico charging the highest rates for this offense.

Read More:

- Compare Car Insurance Rates With a Bad Driving Record

- Compare Car Insurance Rates After a DUI

- Compare Best Car Insurance Companies That Accept DUI

- Compare Car Insurance Rates for Disabled Drivers

- Do all car insurance companies check your driving records?

Compare Wheelchair-Accessible Vehicle Insurance Rates by Credit Score

Credit is a pretty big factor, too. Unless you live in a state that has passed legislation that prevents discrimination based on factors like your credit history, you’ll be seeing a difference here.

Full Coverage Car Insurance Monthly Rates by Credit Score & Provider

| Insurance Company | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| $322 | $382 | $541 | |

| $224 | $264 | $372 | |

| $306 | $325 | $405 | |

| $203 | $249 | $355 | |

| $366 | $467 | $734 |

| $244 | $271 | $340 |

| $302 | $330 | $395 | |

| $181 | $238 | $413 | |

| $338 | $362 | $430 | |

| $152 | $185 | $308 |

If you have poor credit, you could be paying 27% more than your counterpart with good credit with Travelers but 128% more with State Farm. In this instance, it pays to shop around and get multiple quotes to see where you can save.

Learn more by reading our guide: What are the benefits of State Farm?

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare Wheelchair-Accessible Vehicle Insurance Rates by Commute

Your commute length also affects your rates. If you’re working from home or close by, you’ll see cheaper rates than if you’re driving half an hour or longer every day.

Full Coverage Car Insurance Monthly Rates by Annual Mileage & Provider

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| Allstate | $404 | $411 |

| American Family | $283 | $290 |

| Farmers | $348 | $351 |

| Geico | $264 | $272 |

| Liberty Mutual | $500 | $513 |

| Nationwide | $286 | $289 |

| Progressive | $336 | $337 |

| State Farm | $265 | $279 |

| Travelers | $367 | $373 |

| USAA | $207 | $216 |

This isn’t nearly as big of a factor as your credit or driving record, but it’s worth noting. Even a 5% increase at State Farm can add up. Delve into our evaluation of “Do all car insurance companies check your driving records?”

What to Consider When Applying for Wheelchair-Accessible Vehicle Insurance

You may want to consider the following concepts before you buy wheelchair-accessible vehicle insurance:

- Full Disclosure: When looking into how to insure a wheelchair-accessible vehicle, be sure to fully disclose all modifications to your vehicle. Different types of changes can have different effects on your rates. It’s really important that these modifications were installed properly by a licensed installer.

- Equipment Coverage: Make sure that any of the handicapped equipment, such as wheelchairs, is covered under your insurance. Wheelchairs that are going to be placed on the outside of your vehicle, as well as any other equipment that you take with you, should be covered.

- Disability Classification: Fully disclose your specific disability to remove doubts about your level of risk while driving. Your rates may be determined based on the likelihood of an accident due to your disability but not because of the disability itself.

Ask questions before signing up when you have a wheelchair-accessible vehicle.

If you ask the right questions when you apply for insurance, you will be able to compare different types of insurance coverage adequately and make a more educated decision on your policy.

Wheelchair-Accessible Vehicle Insurance Coverage Explained

Before you ever set out on the road, make sure you have your car covered. At the very least, that means:

- Liability Insurance: Covers property damage and injuries you cause in a collision

- Personal Injury Protection (PIP): Pays for medical bills, living expenses, and lost wages after an accident

- Medical Payments Coverage (MedPay): Covers medical bills and rehabilitation costs after an accident

- Uninsured and Underinsured Driver Insurance (UM/UIM): Covers damages caused by a hit-and-run or uninsured driver

But that’s just the bare minimum. The chances are good that your car was pretty expensive, so you’ll want to get something that will cover your damages if you get into an accident.

Geico leads with the most cost-effective rates for both minimum and full coverage on wheelchair-accessible vehicles.

Brad Larson Licensed Insurance Agent

Consider these other types of wheelchair-accessible vehicle insurance policies, otherwise, you might have to pay out of pocket for repairs.

- Collision Insurance: Covers your vehicle damage in the event of a wreck.

- Comprehensive Insurance: Covers other types of events, like hail damage, hitting an animal, theft, or fire damage.

- Gap Insurance: Covers payments left on an auto lease or loan after a vehicle is totaled in an accident (For more information, read our “How do I find out if GAP insurance is included in my car lease?“).

- Modified Parts Coverage: This covers the cost of customized auto parts damaged in a covered event.

With the average cost of a brand new wheelchair-accessible vehicle at $80,000, that’s something you’ll want to protect. Even an older vehicle has specialized equipment that you’ll want to keep covered.

What should I know about wheelchair-adapted car insurance? Wheelchair-adapted car insurance typically covers all the standard elements of auto insurance along with additional coverage for modifications such as wheelchair ramps, lifts, and customized driving controls.

Learn More: Compare Car Insurance Companies That Allow Modifications

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Safety Ratings Impact Wheelchair-Accessible Vehicle Insurance Rates

Safety is a big deal for everybody. Most wheelchair-accessible vehicles are either vans or SUVs. Larger wheelchair-adapted vehicles have more space between you and the collision. A large van or SUV has a lot of metal between you and the force of the impact, especially in a frontal collision, which accounts for more than half of fatalities from car crashes.

Let’s look at that data for very large cars — a category here that includes the sort of large minivan that compiles a large portion of wheelchair-accessible vehicles.

The fatality rate of 26 per million registered vehicles isn’t bad. If you compare it to the rate for all cars — which is 48 per million — you can see that it is far lower. A lot of that comes down to the fact that they’re such large vehicles.

However, that’s not the only thing that goes into how safe a vehicle is. There’s a lot of variety within a vehicle type, so it’s important to check safety ratings before choosing your vehicle. This will affect your car insurance rates, also. Insurers want to know they’ll have a lower risk by insuring the vehicle. Learn more in our “Safety Features Car Insurance Discounts.”

Most Commonly Insured Wheelchair-Accessible Vehicles

A wheelchair-accessible vehicle is usually just adapted from a popular large vehicle. Many are minivans, but there are more and more options out there, like SUVs and pickups.

Share of Wheelchair Vans Sold in the U.S.

| Van Make | Percentage Sold |

|---|---|

| Chevrolet | 2% |

| Chrysler | 13% |

| Dodge | 35% |

| Ford | 23% |

| Honda | 4% |

| Other | 9% |

| Toyota | 14% |

Dodges and Fords make up the largest portion, by far. One out of every three wheelchair or handicapped-accessible vehicles sold in the U.S. was a Dodge vehicle. One out of every four was a Ford, and one out of every seven was a Toyota.

- 60.4% of people with disabilities drive vehicles

- 91.7% of people without disabilities drive vehicles

More than twice as many non-workers with a disability live in a household without a vehicle than those without a disability. Not only that, but they’re also less likely to drive vehicles even if there is one in their household.

How should you go about getting van insurance for a converted vehicle? When seeking van insurance for a converted vehicle, it’s important to provide detailed information about all modifications to ensure full coverage. Compare insurers that offer specialized mobility vehicle insurance to find the best rates and coverage options.

Read More:

- Compare Ford Car Insurance Rates

- Compare Dodge Car Insurance Rates

- Compare Toyota Car Insurance Rates

Top Questions to Ask Before Buying Wheelchair-Accessible Vehicle Insurance

By asking these questions upfront, you will have less trouble finding the right coverage as you compare wheelchair-accessible vehicle insurance rates and companies.

- What do you consider a modification on a vehicle?

- What are the rates for a handicapped driver with my specific disability?

- How can I decrease my insurance rates?

- Do you offer any disability discounts?

- Do you offer comprehensive coverage for handicapped equipment that rides outside my vehicle?

All of these questions will shed some light on your particular options with different companies. If the quote you receive is too high, you may want to consider another company. Unlock details in our “What affects a car insurance quote?”

How to Get The Best Wheelchair-Accessible Vehicle Insurance Rates

If you are disabled and your auto insurance will be affected by your disability or your use of a wheelchair or other mobility products, you can be charged a higher rate, but you do have rights. You are entitled to coverage as long as your disability does not interfere greatly with your ability to drive safely.

Choosing Geico ensures affordability without compromising the quality of coverage for your specialized vehicle needs.

Scott W. Johnson Licensed Insurance Agent

Remember that auto insurance rates are based on a variety of factors, including your age, gender, location, marital status, credit score, and driving record. If your rates are too high, make sure to ask your insurance provider about any discounts that you are eligible for. Most insurance providers offer several discounts, and they can significantly lower the cost of your auto insurance.

If you present the proper information regarding your disability, ask questions, and compare wheelchair-accessible vehicle insurance rates online, there is no reason why you can’t get affordable insurance for a wheelchair-accessible vehicle. Discover insights in our “Finding Free Car Insurance Quotes Online.”

You can start right now. Just enter your ZIP code and get online car insurance quotes for your next international trip today.

Frequently Asked Questions

What should you look for to get handicapped vehicle car insurance coverage?

Shop and compare insurance plans from different providers. Be aware of any state laws that protect physically challenged individuals from discrimination in insurance coverage. By asking questions and comparing policies, you can find suitable insurance for your wheelchair-accessible vehicle.

To find out more, explore our guide titled “The Top 5 Car Insurance Companies.”

What should you consider when applying for car insurance for your wheelchair-accessible vehicle?

It’s important to fully disclose all modifications made to the vehicle, including hand controls and other equipment. Ensure that the modifications were installed properly by a licensed installer. Additionally, make sure that any handicapped equipment, such as wheelchairs, is covered under your insurance policy.

Will Medicaid pay for a wheelchair van?

Unfortunately, Medicaid also doesn’t generally cover insurance for a wheelchair-accessible van.

Does Medicare pay for a wheelchair-accessible van?

Medicare generally does not cover handicap vans or handicap modifications to vehicles, but it might help cover your wheelchair or scooter costs. You may also qualify for a state grant to purchase a wheelchair-accessible vehicle.

Why are wheelchair-accessible vehicles so expensive?

Wheelchair-accessible vehicles have expensive parts and modifications that make them more valuable when damaged in a car accident.

What are the basics of accessible van insurance?

Accessible van insurance covers modifications and special equipment not typically included in standard policies, ensuring that all adaptations are protected against damage or loss.

How is car insurance for wheelchair-adapted vehicles different from standard policies?

Car insurance for wheelchair-adapted vehicles specifically covers the cost of repairs or replacements for modifications such as ramps, lifts, and customized driving controls that standard policies might not cover.

What should I look for in car insurance for wheelchair vans?

Look for policies that include coverage for the full replacement value of the van’s modifications and offer roadside assistance that accommodates the specific needs of wheelchair vans.

How does insurance for a Dodge wheelchair-accessible van work?

Insurance for a Dodge wheelchair-accessible van typically includes coverage for the vehicle itself along with the specialized modifications and equipment needed for wheelchair accessibility.

More information is available about this provider in our “Compare Dodge Grand Caravan Car Insurance Rates.”

Does insurance cover handicapped vans entirely?

Yes, insurance can cover handicap vans, but it’s crucial to ensure that your policy includes coverage for any special equipment and modifications beyond the standard vehicle insurance.

How can I find a full-sized mobility van for sale near me?

Where can I find a handicap van used by the owner near me?

How do I search for handicapped vans used by owner near me?

What does mobility vehicle insurance cover?

How can I find a used handicap van for sale by the owner near me?

Where can I find a wheelchair-accessible van for sale by the owner?

What should I know about wheelchair-adapted car insurance?

What is handicap accessibility called?

What’s the difference between handicap-accessible and wheelchair accessible?

What type of car insurance is the cheapest?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.