Best Amazon Flex Delivery Car Insurance in 2025 (Your Guide to the Top 10 Companies)

Allstate, Farmers, and Travelers top our list of the best Amazon Flex delivery car insurance, starting at just $70 a month. Discover which provider offers the best coverage and value for your needs, ensuring optimal protection and affordability while delivering with Amazon Flex.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Joel Ohman

Executive Chairman

Joel Ohman is the CEO of a private equity-backed digital media company. He is a published author, angel investor, and serial entrepreneur who has a passion for creating new things, from books to businesses. He has previously served as the founder and resident CFP® of a national insurance agency, Real Time Health Quotes. He has an MBA from the University of South Florida. Joel has been mentione...

Executive Chairman

UPDATED: Jul 3, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jul 3, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for Amazon Flex Delivery

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 3,072 reviews

3,072 reviewsCompany Facts

Full Coverage for Amazon Flex Delivery

A.M. Best Rating

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviews 1,733 reviews

1,733 reviewsCompany Facts

Full Coverage for Amazon Flex Delivery

A.M. Best Rating

Complaint Level

1,733 reviews

1,733 reviewsThe top picks for the best Amazon Flex delivery car insurance are Allstate, Farmers, and Travelers, offering unparalleled protection for delivery drivers.

This comprehensive guide will help you understand the free insurance provided by Amazon Flex and why you might consider additional coverage. See more details on our “Compare Car Insurance by Coverage Type.”

Our Top 10 Company Picks: Best Amazon Flex Delivery Car Insurance

| Company | Rank | Safe Driving Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 21% | A+ | Quick Claims | Allstate | |

| #2 | 19% | A+ | Flexible Coverage | Farmers | |

| #3 | 17% | A++ | Customized Policies | Travelers | |

| #4 | 19% | B | Nationwide Coverage | State Farm | |

| #5 | 22% | A | Affordable Rates | Nationwide |

| #6 | 20% | A | Extensive Coverage | Liberty Mutual |

| #7 | 21% | A+ | Reliable Service | Progressive | |

| #8 | 16% | A+ | Tailored Protection | The Hartford |

| #9 | 15% | A+ | Competitive Rates | Erie | |

| #10 | 14% | A | Trusted Provider | MetLife |

We’ll explore the unique benefits of each insurer and how to qualify for their plans. Whether you’re new to delivery driving or looking to optimize your current coverage, this article ensures you’re well-informed to make the best choice.

Do you want more coverage than the Amazon Flex delivery auto insurance provides? Enter your ZIP code above, and we will help you find affordable rates.

- Allstate leads as the top choice for Amazon Flex Delivery Car Insurance

- Amazon Flex provides essential coverage but additional insurance is advised

- Understand eligibility and benefits for the best insurance experience

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – Allstate: Top Overall Pick

Pros

- Efficient Claims Process: Allstate is known for its fast and efficient claims resolution, helping clients quickly recover from losses. Discover more about offerings in our Allstate car insurance review.

- Safe Driving Discount: Drivers can save up to 21% with Allstate’s safe driving discount.

- High Financial Rating: With an A+ rating from A.M. Best, Allstate stands as a financially secure insurer.

Cons

- Cost Variability: Premiums can vary significantly depending on location and driver history.

- Policy Upselling: Some customers report frequent upselling of additional coverage.

#2 – Farmers: Best for Flexible Coverage

Pros

- Customizable Policies: Farmers offers highly flexible policies that can be tailored to meet specific needs.

- Safe Driving Discount: Offers a 19% discount for safe driving. Learn more in our Farmers car insurance review.

- Strong Financial Stability: Backed by an A+ A.M. Best rating, ensuring reliability.

Cons

- Higher Premiums: Premiums can be higher than average, especially without bundling.

- Complex Claims Process: Some users find the claims process to be more complex and time-consuming.

#3 – Travelers: Best for Customized Policies

Pros

- Policy Customization: Travelers excels in providing customized insurance policies to fit unique needs.

- Safe Driving Discount: Provides a 17% discount for safe driving. See more details on our Travelers car insurance review.

- Superior Financial Rating: An A++ rating from A.M. Best indicates exceptional financial health.

Cons

- Premium Cost: Higher-end policies can be expensive.

- Customer Service: Some reports of inconsistent customer service experiences.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – State Farm: Best for Nationwide Coverage

Pros

- Wide Coverage: State Farm offers a variety of coverage options nationwide.

- Safe Driving Discount: Provides a 19% discount for safe driving. Unlock details in our State Farm car insurance review.

- Bundling Policies: State Farm offers significant discounts for clients who bundle multiple insurance policies.

Cons

- Premium Costs: Despite discounts, premiums may still be higher for certain levels of coverage.

- Limited Multi-Policy Discount: The multi-policy discount is not as competitive as others.

#5 – Nationwide: Best for Affordable Rates

Pros

- Competitive Pricing: Known for offering some of the most affordable rates in the industry.

- Highest Safe Driving Discount: Offers a 22% discount, the highest among the listed companies.

- Solid Financial Stability: Holds a strong A rating from A.M. Best. Check out insurance savings in our complete Nationwide car insurance discount.

Cons

- Coverage Limitations: Some customers report limitations in coverage options.

- Service Variability: Experience can vary significantly depending on the region and agent.

#6 – Liberty Mutual: Best for Extensive Coverage

Pros

- Broad Coverage Options: Offers a wide range of coverage options for various needs.

- Safe Driving Discount: Provides a 20% discount for safe drivers. Read up on the Liberty Mutual car insurance review for more information.

- Comprehensive Support: Known for excellent customer support and resources.

Cons

- Higher Cost: Premiums can be higher, particularly for more extensive coverage.

- Variable Customer Satisfaction: Customer satisfaction can vary widely based on individual experiences and regions.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Progressive: Best for Reliable Service

Pros

- Reliable Customer Service: Progressive is reputed for its reliable and responsive customer service.

- Safe Driving Discount: Offers a 21% discount for safe driving. Delve into our evaluation of Progressive car insurance review.

- Versatile Policy Options: Provides a wide array of policy options and tools for customization.

Cons

- Rate Fluctuations: Rates may increase significantly at renewal.

- Claim Resolution Speed: Some customers report delays in the claim resolution process.

#8 – The Hartford: Best for Tailored Protection

Pros

- Tailored Insurance Solutions: Specializes in providing tailored protection plans for diverse needs.

- Strong Financial Health: Boasts an A+ rating from A.M. Best. Discover insights in our The Hartford car insurance discounts.

- Dedicated Service: Known for excellent customer service tailored to older drivers.

Cons

- Niche Market Focus: Primarily focuses on the senior market, which may limit options for younger drivers.

- Cost Efficiency: This may not be the most cost-effective option for all customers.

#9 – Erie: Best for Competitive Rates

Pros

- Competitive Pricing: Offers some of the most competitive rates in the market.

- Personalized Service: Known for providing highly personalized service through local agents.

- Safe Driving Discount: Offers a 15% safe driving discount. Learn more in our Erie car insurance review.

Cons

- Limited Availability: Services are not available nationwide.

- Policy Flexibility: Less flexibility in policy customization compared to larger insurers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – MetLife: Berst for Trusted Provider

Pros

- Reputation and Reliability: MetLife is a globally trusted provider with a strong track record.

- Comprehensive Offerings: Offers a broad range of insurance products and services.

- Safe Driving Discount: Provides a 14% discount for safe driving. See more details on our MetLife car insurance discounts.

Cons

- Higher Premiums: Generally higher premiums compared to some competitors.

- Transition Phases: Recent changes in business structure may affect service consistency.

Comparative Monthly Rates for Amazon Flex Delivery Insurance

Amazon Flex Delivery Car Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $70 | $150 |

| Erie | $70 | $145 |

| Farmers | $78 | $160 |

| Liberty Mutual | $75 | $155 |

| MetLife | $80 | $155 |

| Nationwide | $75 | $160 |

| Progressive | $80 | $160 |

| State Farm | $72 | $145 |

| The Hartford | $75 | $150 |

| Travelers | $80 | $155 |

Allstate and Erie offer the lowest minimum coverage starting at $70, with Erie offering full coverage for $145 and Allstate for $150. Farmers and Progressive show higher premiums, with minimum coverages at $78 and $80 respectively, and full coverages reaching $160.

For those looking for a balance between cost and comprehensive coverage, State Farm provides a reasonable minimum rate of $72 and a full coverage option at $145.

Liberty Mutual, MetLife, Nationwide, The Hartford, and Travelers also offer competitive rates, all under $80 for minimum coverage and ranging from $150 to $160 for full coverage, ensuring a variety of choices to fit different budgetary needs.

Read more: Compare Comprehensive Car Insurance: Rates, Discounts, & Requirements

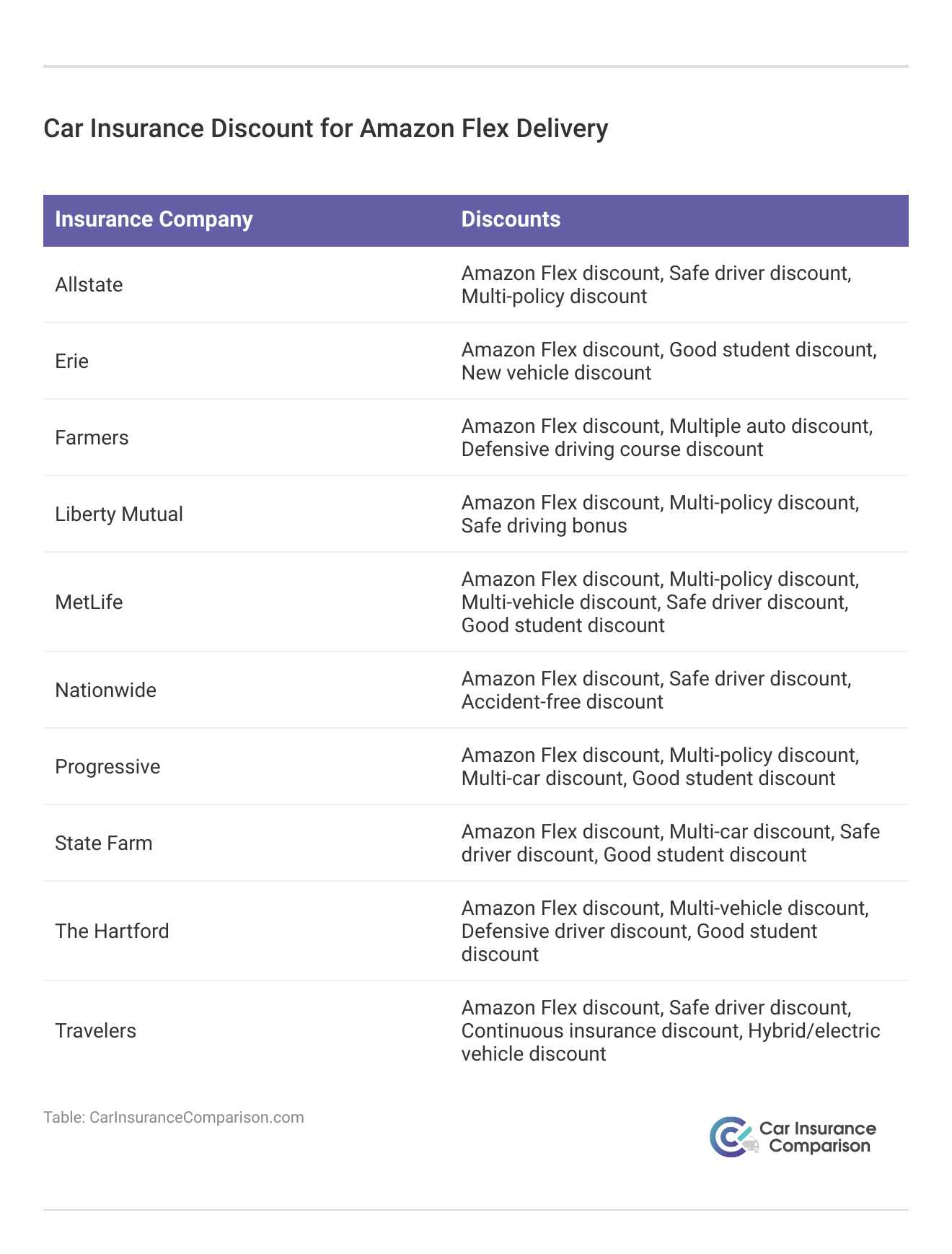

What Insurance Companies Cover Delivery Drivers

According to the Bureau of Labor Statistics, more than one million delivery drivers are currently working in the US. So it’s no surprise that the vast majority of major insurance carriers offer some type of commercial car insurance or endorsement on personal policies for delivery drivers.

Most delivery companies often do not provide commercial car insurance for their drivers. Delivery drivers often have to work with their own insurance companies to purchase a whole commercial car insurance policy or endorse their existing personal car insurance.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

What Does Amazon Flex Delivery Car Insurance Cover

Amazon Flex delivery car insurance company provides three types of coverage:

- Commercial Liability

- Underinsured Motorist Coverage/Uninsured Motorist Protection

- Collision and Comprehensive Insurance

The commercial liability provides up to $1 million in coverage per accident. The under/uninsured motorist protection also covers up to $1 million and protects your vehicle and your person. The comprehensive and collision coverage covers up to $50,000. The comprehensive and collision coverage also has a $1,000 deductible.

How much is Amazon Flex insurance for my Amazon Flex delivery truck? Although Amazon generally covers the cost, the annual expense for Amazon auto insurance can range from $0 to $2,500, varying with the distance you travel each year. Your specific driving record can provide a clearer estimate of these costs.

Is there anything I’m missing when comparing prices? Yes, other factors besides price affect which plan is best for you. Unlock details in our “Compare Collision Car Insurance: Rates, Discounts, & Requirements.”

How Do I Qualify for Amazon Flex Delivery Auto Insurance

There are three main criteria to be able to make use of Amazon delivery car insurance:

- Be at least 21 years old.

- Be located anywhere except New York state.

- Have the minimum car insurance required by your state.

Amazon Flex does not currently provide car insurance for delivery drivers in New York. Instead, you would need to purchase a commercial policy or get an endorsement for your personal car insurance policy to be covered.

In addition, if you are not maintaining the minimum personal auto insurance policy required by your state, Amazon Flex delivery car insurance will not cover you in the event of an accident.

Learn more by reading our guide: Compare Commercial vs. Personal Car Insurance: Rates, Discounts, & Requirements

Allstate consistently leads with the most competitive rates and robust coverage for Amazon Flex drivers.

Brad Larson Licensed Insurance Agent

That means you don’t have to go to any third-party sites and shop around for Amazon Flex delivery insurance quotes to be covered.

Now that you understand more about Amazon Flex delivery auto insurance, enter your ZIP code below to find additional commercial coverage from local companies in minutes.

Frequently Asked Questions

What insurance coverage does Amazon Flex provide for delivery drivers?

Amazon Flex provides commercial liability coverage, under/uninsured motorist protection, and comprehensive and collision coverage.

To learn more, explore our comprehensive resource on “What is the minimum amount of liability car insurance coverage required?“

How much does it cost to insure an Amazon Flex delivery truck?

Do I need additional coverage besides Amazon Flex’s insurance?

If you want more coverage for your vehicle, you may consider purchasing additional insurance on your own.

Finding cheap car insurance quotes is easy. Just enter your ZIP code into our free comparison tool below to instantly compare quotes near you.

How can I qualify for Amazon Flex delivery auto insurance?

To qualify for Amazon Flex delivery auto insurance, you need to maintain the minimum insurance required by your state and meet the eligibility criteria set by Amazon Flex.

Do insurance companies cover delivery drivers?

Most major insurance carriers offer commercial car insurance or endorsements on personal policies for delivery drivers, but delivery drivers often have to work with their own insurance companies to obtain coverage.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Joel Ohman

Executive Chairman

Joel Ohman is the CEO of a private equity-backed digital media company. He is a published author, angel investor, and serial entrepreneur who has a passion for creating new things, from books to businesses. He has previously served as the founder and resident CFP® of a national insurance agency, Real Time Health Quotes. He has an MBA from the University of South Florida. Joel has been mentione...

Executive Chairman

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.