Cheap Pizza Hut Delivery Car Insurance in 2025 (10 Affordable Companies)

Our top companies for cheap Pizza Hut delivery car insurance are USAA, Geico, and State Farm. USAA has rates that start at $22 per month, but only military families qualify for coverage. If that doesn’t fit you, Geico and State Farm offer cheap Pizza Hut auto insurance for everyone else.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Joel Ohman

Executive Chairman

Joel Ohman is the CEO of a private equity-backed digital media company. He is a published author, angel investor, and serial entrepreneur who has a passion for creating new things, from books to businesses. He has previously served as the founder and resident CFP® of a national insurance agency, Real Time Health Quotes. He has an MBA from the University of South Florida. Joel has been mentione...

Executive Chairman

UPDATED: Jun 28, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jun 28, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

6,589 reviews

6,589 reviewsCompany Facts

Min. Coverage for Pizza Hut Delivery

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage for Pizza Hut Delivery

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage for Pizza Hut Delivery

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviewsUSAA, Geico, and State Farm take the top spots for cheap Pizza Hut delivery car insurance.

USAA has the cheapest auto insurance for Pizza Hut delivery drivers, but only military members qualify for coverage. If that’s not you, you can find cheap car insurance from Geico and State Farm.

Our Top 10 Company Picks: Cheap Pizza Hut Delivery Car Insurance

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $22 | A++ | Military Benefits | USAA | |

| #2 | $30 | A++ | Competitive Rates | Geico | |

| #3 | $33 | B | Competitive Rates | State Farm | |

| #4 | $37 | A++ | Personalized Service | Travelers | |

| #5 | $39 | A+ | Customizable Coverage | Progressive | |

| #6 | $43 | A+ | Tailored Coverage | The Hartford |

| #7 | $44 | A+ | Widespread Availability | Nationwide |

| #8 | $53 | A | Budget-Friendly Premiums | Farmers | |

| #9 | $61 | A+ | Flexible Coverage | Allstate | |

| #10 | $68 | A | Comprehensive Coverage | Liberty Mutual |

Below, you can find pizza delivery car insurance reviews that can point you in the direction of the best coverage. Then, enter your ZIP code into our free comparison tool above to see the best Pizza delivery insurance costs in your area.

- Pizza Hut does not provide insurance to its drivers

- You’ll need commercial coverage during work hours, or your claims can be denied

- USAA and Geico have the cheapest pizza delivery driver car insurance quotes

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – USAA: Top Pick Overall

Pros

- Military Discounts: USAA offers significant savings for military members and their families. See all of USAA’s discount options in our USAA car insurance review.

- Accident Forgiveness: USAA’s accident forgiveness offers protection from rate increases after one at-fault accident, which can be helpful when you need food delivery driver insurance.

- High Customer Satisfaction: USAA has superb customer service and claims handling, with the vast majority of customers saying they’d recommend the service.

Cons

- Eligibility Restriction: USAA has strict eligibility requirements to buy car insurance. USAA membership is only available to military members, veterans, and their families.

- Specialty Coverage Lacking: USAA has a variety of good options, but it lacks some specific add-ons that other commercial policies offer. One of the most glaring omissions is gap insurance.

#2 – Geico: Best for Affordable Rates

Pros

- Affordable Premiums: Geico has a reputation for cheap pizza delivery insurance by offering low rates and numerous discounts.

- Digital Tools: Geico offers an excellent mobile app and online services for easy policy management. Learn more about Geico’s online tools in our Geico car insurance review.

- Customizable Coverage: Tailor your coverage or the best pizza delivery driver insurance with options like rideshare insurance and roadside assistance.

Cons

- Limited Agent Interaction: Geico does its business predominantly online, which might be a drawback for those preferring personal interaction.

- Commercial Use Restrictions: Geico may have restrictions on delivery driving that need to be clarified before you start working.

#3 – State Farm: Best for Personalized Service

Pros

- Agent Network: State Farm maintains a large network of agents, making it easy to get personalized service.

- Multi-Policy Discounts: State Farm offers more than just car insurance. You can save on your policies when you buy home and auto from State Farm.

- Usage-Based Insurance: State Farm offers the usage-based insurance (UBI) program, Drive Safe & Save, which offers a maximum discount of 30% for good driving.

Cons

- Higher Base Rates: No matter where you live or what car you drive to deliver pizzas, State Farm usually has higher initial premiums without discounts. See how much you might pay in our State Farm auto insurance review.

- Strict Underwriting: State Farm can be hesitant to approve delivery driver coverage due to the increased risk drivers face on the road.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – Travelers: Best for Full Coverage Service

Pros

- Specialized Coverage: Travelers offers specific policies so you can get the perfect pizza delivery car insurance. Popular options include accident forgiveness and roadside assistance.

- Flexible Payment Plans: It’s easy to get car insurance for pizza delivery drivers that matches your budget needs with Travelers’ various options for premium payments.

- Discounts for Safe Driving: Among Travelers’ 15 available discounts are savings for maintaining a clean driving record.

Cons

- Customer Service Variability: Travelers’ customer service reviews are mixed. See what customers have to say in our Travelers car insurance review.

- Claim Processing Time: Customers often report that claims processing times can be excessively long.

#5 – Progressive: Best for Robust Digital Tools

Pros

- Snapshot Program: Enroll in Progressive’s UBI program Snapshot to save up to 30% for your safe driving habits. See if Snapshot is right for you in our Progressive car insurance review.

- Commercial Auto Policies: If you want to separate your personal and professional coverage, Progressive offers excellent commercial auto insurance for pizza delivery drivers.

- Generous Discounts: Progressive offers 13 discounts to help you get cheap pizza delivery car insurance, including savings for bundling policies and being a loyal customer.

Cons

- Snapshot Increases Rates: Snapshot is one of the few UBI programs that will increase your rates if you don’t drive well enough.

- Higher Rates Post-Accident: Insurance rates always increase after an at-fault accident, but Progressive premiums see significant jumps.

#6 – The Hartford: Best for Older Delivery Drivers

Pros

- AARP Discounts: The Hartford sells insurance exclusively to AARP members and offers significant savings for members as a benefit.

- Comprehensive Coverage: Get the best pizza delivery auto insurance with The Hartford’s broad range of policy options.

- Good Claims Service: The Hartford gets primarily positive reviews for its efficient claims handling. Learn more about the claims resolution process in our review of The Hartford and AARP’s car insurance.

Cons

- AARP Membership Required: Coverage and discounts are mainly for AARP members, though older drivers can add younger people to their policies.

- Limited Availability: Even though you can add younger drivers to your policy, The Hartford’s rates are usually higher than the national average.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Nationwide: Best for Vanishing Deductible Savings

Pros

- Vanishing Deductible: The Vanishing Deductible reduces your deductible by $100 for every year you spend claims-free, up to $500. Learn more in our Nationwide car insurance review.

- Multi-Policy Discounts: Purchase your home or renters insurance with auto coverage from Nationwide to earn significant savings.

- On Your Side Review: Once a year, a Nationwide agent will review your policy to make sure you’re paying for coverage that still benefits you.

Cons

- Premium Increases: Nationwide customers report that their rates increased more frequently than drivers at other companies.

- Coverage Restrictions: Before you put your Pizza Hut car topper on and hit the road, you may need to verify your business use with Nationwide.

#8 – Farmers: Best List of Auto Insurance Discounts

Pros

- Customizable Policies: Farmers makes it easy to find the best pizza delivery car insurance with its coverage options, like full glass coverage, custom equipment insurance, and roadside assistance.

- Ample Discounts: Farmers has one of the longest lists of insurance discounts on the market. Explore all 23 discounts in our Farmers car insurance review.

- Personalized Service: Farmers maintains a large network of local agents, so you always have access to personalized assistance.

Cons

- Higher Base Premiums: Farmers generally has higher rates before discounts. If you don’t qualify for many discounts, Farmers probably won’t have the best auto insurance for pizza delivery drivers for you.

- Digital Experience: Although it has digital options, Farmers’ online tools and mobile app could be more user-friendly.

#9 – Allstate: Best for UBI Savings

Pros

- Drivewise Program: Allstate has one of the best UBI discounts on the market. Safe drivers can save up to 40% with Drivewise.

- Extensive Network of Local Agents: Allstate maintains an extensive network of agents for personal assistance. Learn more in our Allstate car insurance review.

- Good Hands Coverage: Get yourself into Allstate’s good hands with coverage options like roadside assistance and accident forgiveness.

Cons

- Higher Rates: Allstate is rarely the cheapest car insurance for Pizza Hut delivery drivers, especially compared to some competitors.

- Claim Satisfaction Ratings: Allstate has mixed reviews on claims handling and customer service.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best for Diverse Coverage Options

Pros

- Customizable Coverage: Get the best pizza delivery car insurance with Liberty Mutual’s optional add-ons, like original parts replacement coverage or roadside assistance.

- Solid Discounts: Liberty Mutual offers a respectable 17 discount opportunities to help you find low pizza delivery car insurance rates.

- Accident Forgiveness: Delivery drivers spend a lot of time on the road. Signing up for this program prevents rate increases after the first accident.

Cons

- Premium Variability: Liberty Mutual rates can vary significantly based on individual factors, making it difficult to estimate how much you might pay.

- Customer Service: Liberty Mutual gets mixed reviews on its customer service quality. See why in our Liberty Mutual car insurance review.

Pizza Delivery Car Insurance Costs

Finding cheap Pizza Hut auto insurance is usually easy, so long as you don’t have multiple speeding tickets or at-fault accidents. Check below to see how much the top Pizza Hut delivery insurance companies charge for coverage.

Pizza Hut Delivery Car Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $61 | $160 |

| Farmers | $53 | $139 |

| Geico | $30 | $80 |

| Liberty Mutual | $68 | $174 |

| Nationwide | $44 | $115 |

| Progressive | $39 | $105 |

| State Farm | $33 | $86 |

| The Hartford | $43 | $113 |

| Travelers | $37 | $99 |

| USAA | $22 | $59 |

Keep in mind that these are just rates, and you’ll need to evaluate multiple car insurance quotes before you settle on a policy.

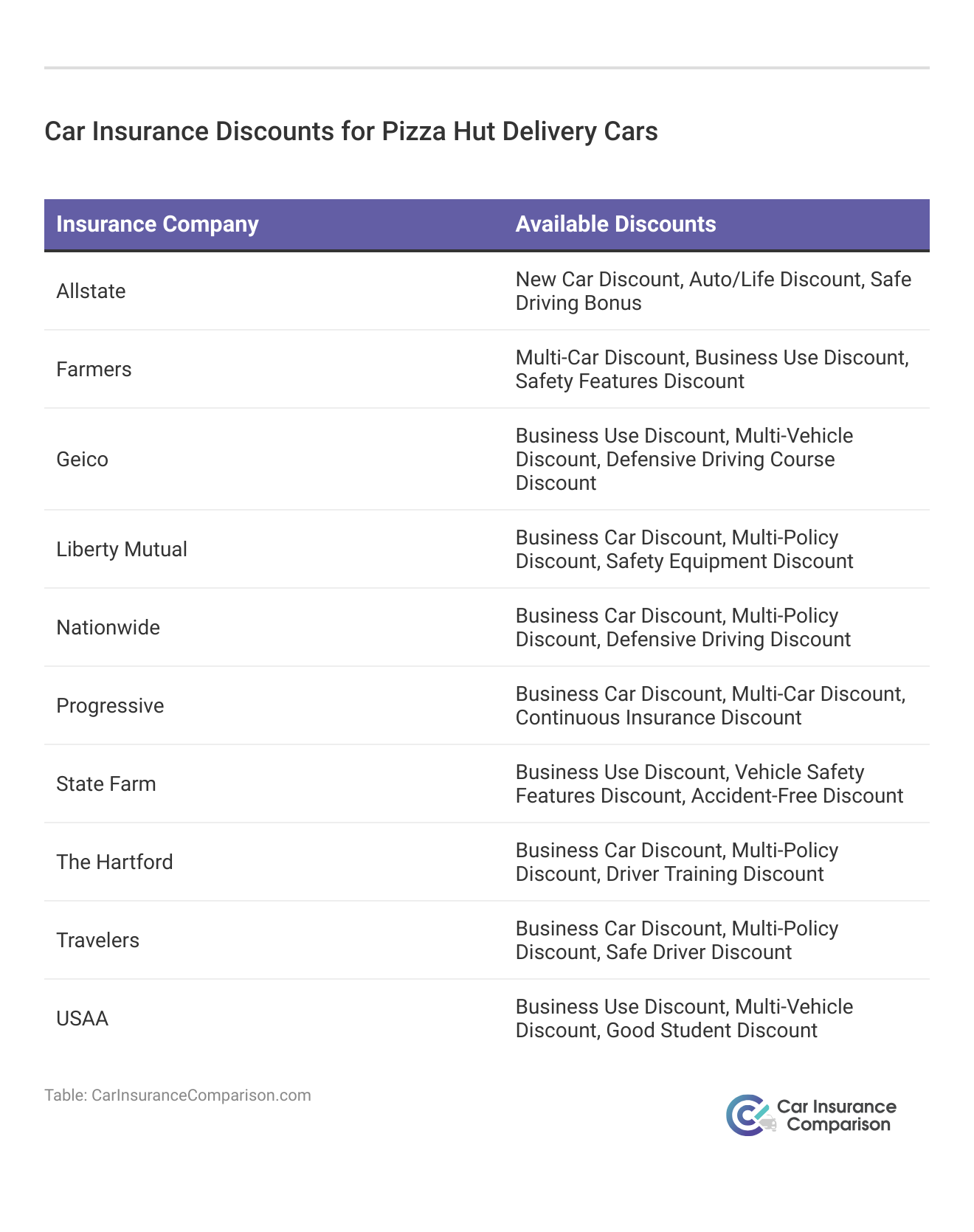

However, you don’t need to jump on the first low quote you find – most companies offer car insurance discounts to show their appreciation for delivery drivers.

When it’s trick-or-treaters and not the delivery driver. pic.twitter.com/a9Ymq2pl48

— Pizza Hut (@pizzahut) October 31, 2019

Check below to see a selection of car insurance discounts offered by our top companies that might appeal to delivery drivers.

Another easy way to find affordable pizza delivery auto insurance is to compare quotes, as said above. Getting quotes is simple, especially because most companies offer a quote request form on their sites.

However, filling out multiple online quote forms can be time-consuming and monotonous. Using a free quote comparison tool is the quickest and easiest way to check multiple companies at the same time.

Car Insurance Requirements for Pizza Hut Delivery Drivers

While Pizza Hut will require their delivery drivers to maintain personal car insurance, this coverage will not protect you if you get into an accident while on the clock.

Instead, delivery drivers will need to purchase commercial car insurance to act as their pizza delivery insurance.

There are three main types of commercial coverage available:

- Commercial endorsement

- Hybrid policy

- Separate commercial car insurance policy

As long as you have these requirements met, you can add as little or as much insurance as you want. For example, choosing the right car insurance coverage for a new car usually means purchasing additional coverage.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

How to Handle Getting Into an Accident While Delivering for Pizza Hut

Not purchasing commercial coverage when you work as a delivery driver is tantamount to driving uninsured. If you are found at fault for an accident while on the clock, you will be liable for the cost. You can compare car accident statistics to understand why you should never drive without insurance.

According to the CDC, the average cost of injuries alone in an accident is over $3,000. However, keep in mind that you will also be liable to pay for your car repairs. If your vehicle is totaled, this can result in lost wages, and if you suffer from severe injuries, medical bills can quickly exceed the $3,000 average.

Scott W. Johnson Licensed Insurance Agent

All in all, it is not feasible to drive your car uninsured. Instead, take the time to look at your options. While hybrid policies and rideshare endorsements are not available everywhere, they can be a great and affordable option.

Find Cheap Pizza Hut Delivery Car Insurance Today

If you need to purchase a separate commercial auto insurance policy, make sure you shop around and compare multiple free online car insurance quotes before making your final decision.

Are you ready to start comparing Pizza Hut car insurance rates today? Enter your ZIP code below to compare commercial car insurance policies from local companies for free.

Frequently Asked Questions

Which companies have the cheapest auto insurance for Pizza Hut delivery drivers?

Many factors affect car insurance rates, but our research shows that USAA, Geico, and State Farm have the cheapest Pizza Hut delivery driver insurance.

What kind of Pizza Hut delivery insurance do I need?

Pizza Hut requires their delivery drivers to maintain personal car insurance, but this coverage does not protect you while on the job. You will need to purchase commercial car insurance specifically for pizza delivery.

What is the most affordable Pizza Hut car insurance option for delivery drivers?

The most affordable option is to get an endorsement for your existing personal policy. This adds commercial coverage for damages to your car while working. If endorsements are not available, you can consider hybrid car insurance policies that offer both personal and commercial coverage.

Do you need rideshare insurance to deliver pizzas?

While rideshare insurance is similar to commercial auto, it’s meant for a specific type of professional driver. Rideshare car insurance was specifically designed for the needs of people who drive for companies like Lyft or Uber.

What happens if I get into an accident while delivering for Pizza Hut?

If you don’t have commercial coverage, you will be liable for the costs of the accident. This includes injuries, car repairs, lost wages, and medical bills. It is important to have adequate insurance coverage to avoid these financial burdens.

How can I compare Pizza Hut car insurance rates?

To compare commercial car insurance policies, enter your ZIP code to get free quotes from local companies. It is recommended to shop around and compare different insurance providers before making a final decision.

Enter your ZIP code in our free quote comparison tool to see how much you might pay for insurance in your area.

How do you file a pizza delivery driver car insurance claim?

Filing a car insurance claim when you’re working works similarly to personal claims. Most providers make it simple on their website, but you can also call a representative for help.

Does Pizza Hut provide insurance for its drivers?

Although Pizza Hut demands that its drivers carry a certain amount of insurance to deliver pizzas, it does not provide its drivers coverage.

How can you save on your Pizza Hut delivery driver insurance?

Saving on commercial car insurance is was easy as if you were buying a personal policy. Take steps like finding discounts, comparing quotes, lowering your coverage, and raising your deductible to find affordable rates.

Is there car insurance specifically for pizza delivery drivers?

No, there is no car insurance designed specifically for pizza delivery drivers. Instead, you’ll need a generic commercial auto insurance policy.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Joel Ohman

Executive Chairman

Joel Ohman is the CEO of a private equity-backed digital media company. He is a published author, angel investor, and serial entrepreneur who has a passion for creating new things, from books to businesses. He has previously served as the founder and resident CFP® of a national insurance agency, Real Time Health Quotes. He has an MBA from the University of South Florida. Joel has been mentione...

Executive Chairman

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.