Best Car Insurance for Seniors Over 60 in 2025 (Top 10 Companies)

Get the best car insurance for seniors over 60 from Farmers, Travelers, and National General. Farmers excels with unbeatable rates. Get multi-policy discounts of up to 25%, Discover why these companies are the best choices for senior drivers as they offer competitive rates and tailored coverage options.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

UPDATED: Nov 3, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 3, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

3,072 reviews

3,072 reviewsCompany Facts

Full Coverage for Seniors Over 60

A.M. Best Rating

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviews 1,733 reviews

1,733 reviewsCompany Facts

Full Coverage for Seniors Over 60

A.M. Best Rating

Complaint Level

1,733 reviews

1,733 reviews 437 reviews

437 reviewsCompany Facts

Full Coverage for Seniors Over 60

A.M. Best Rating

Complaint Level

Pros & Cons

437 reviews

437 reviewsExplore the best car insurance for seniors over 60, delving into top companies like Farmers, Travelers, and National General. Consider essential factors influencing rates, including driving record, vehicle type, and online options.

So you got a job, paid your way, and lived happily ever after, after hitting the age of 25 (which gave you a big drop in your insurance rates). Fast forward to the present day: you hit 65 years of age and are now seeing a big increase in your rates once again.

Our Top 10 Picks: Best Car Insurance Companies for for Seniors Over 60

| Company | Rank | Safe Driver Discount | Multi-Policy Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 15% | 20% | Military Affiliation | Farmers | |

| #2 | 18% | 15% | Personalized Service | Travelers | |

| #3 | 17% | 22% | Snapshot Program | National General | |

| #4 | 16% | 19% | Vanishing Deductible | Nationwide |

| #5 | 24% | 16% | Drivewise Program | Allstate | |

| #6 | 20% | 15% | Signal App | USAA | |

| #7 | 16% | 20% | RightTrack Program | Liberty Mutual |

| #8 | 15% | 25% | Online Convenience | Geico | |

| #9 | 18% | 20% | IntelliDrive Program | State Farm | |

| #10 | 32% | 14% | AARP Partnership | Progressive |

Indeed, individuals over the age of 60 are considered seniors by the insurance industry. (For more information, read our “Compare Best Car Insurance Companies for Seniors“).

Find affordable car insurance quotes by entering your ZIP code above now.

- Farmers, Travelers, and National General are top providers

- Changes in reflexes and eyesight impact insurance rates

- Vehicle choice affects premiums; shopping around and using online tools are crucial

#1 – Farmers: Top Overall Pick

Pros

- Military Affiliation: Offers specialized benefits and discounts for military personnel.

- Diverse Coverage Options: Provides a range of coverage options to meet individual needs.

- Strong Customer Support: Known for responsive and helpful customer service. Learn more about their ratings in our Farmers car insurance review.

Cons

- Potentially Higher Rates: Some customers may find rates slightly higher than competitors.

- Limited Online Presence: Online tools and features may not be as advanced as some other providers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#2 – Travelers: Best for Tailored Protection

Pros

- Personalized Service: Emphasizes personalized service and tailored insurance solutions.

- Claim Satisfaction: Receives positive reviews for customer satisfaction with the claims process.

- Extensive Coverage: As outlined in our Travelers car insurance review, they offer a wide range of coverage options.

Cons

- Potentially Higher Premiums: Premiums may be higher compared to some budget-focused insurers.

- Limited Discounts: Some customers might find fewer discount opportunities.

#3 – National General: Best for Snapshot Program

Pros

- Snapshot Program: Utilizes a telematics program (Snapshot) to reward safe driving habits. Learn more about this program in our National General car insurance review.

- Discount Opportunities: Offers various discounts, including those for safe driving.

- User-Friendly Mobile App: Positive feedback on the user-friendly mobile app.

Cons

- Telematics Privacy Concerns: Some users may have privacy concerns with telematics tracking.

- Limited Availability: This may not be available in all states or regions.

#4 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Provides a feature where deductibles decrease for safe driving.

- Multi-Policy Discounts: Offers discounts for bundling multiple insurance policies. (Read more: Nationwide Car Insurance Discounts)

- Strong Financial Standing: Nationwide is a financially stable and reputable insurer.

Cons

- Potentially Higher Rates: Some customers may find rates on the higher side.

- Limited Local Agents: Availability of local agents may vary.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#5 – Allstate: Best for Drivewise Program

Pros

- Drivewise Program: Rewards safe driving behavior through the Drivewise program.

- User-Friendly App: Positive reviews for the user-friendly mobile app.

- Numerous Coverage Options: Offers a variety of coverage options and add-ons.

Cons

- Potentially Higher Premiums: Premiums may be higher compared to budget-focused insurers. Learn more about their premiums in our Allstate car insurance review.

- Mixed Customer Service Reviews: Some customers report varied experiences with customer service.

#6 – USAA: Best for Signal App

Pros

- Signal App: Utilizes the Signal app for safe driving insights.

- Exceptional Customer Service: Known for outstanding customer service.

- Military Affiliation: Provides specialized coverage for military members and their families.

Cons

- Limited Membership: As stated in our USAA car insurance review, they are only available to military personnel and their eligible family members.

- Potentially Limited Coverage: Some non-military individuals may not qualify for coverage.

#7 – Liberty Mutual: Best for RightTrack Program

Pros

- Right Track Program: Utilizes the RightTrack program for safe driving discounts.

- Customizable Policies: Offers customizable policies to suit individual needs.

- Variety of Discounts: Provides various discount options. For more information, read our Liberty Mutual car insurance review.

Cons

- Mixed Customer Reviews: Some customers report mixed experiences with customer service.

- Policy Price: Premiums may be relatively higher compared to budget insurers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#8 – Geico: Best for Online Convenience

Pros

- Online Convenience: As mentioned in our Geico car insurance review, they stands out for user-friendly online tools and convenient processes.

- Wide Range of Discounts: Offers a variety of discounts for policyholders.

- Financial Strength: Geico is a financially stable and well-established insurer.

Cons

- Potentially Higher Rates: Some drivers may find rates higher compared to competitors.

- Limited Local Agents: Personalized in-person assistance may be limited.

#9 – State Farm: Best for Intellidrive Program

Pros

- Intellidrive Program: Offers the IntelliDrive program for safe driving discounts.

- Extensive Local Agents: Features a vast network of local agents for personalized assistance.

- Diverse Coverage Options: Provides a comprehensive range of coverage options.

Cons

- Premiums may Vary: Rates can vary, and some customers may find them higher. Get insights in our State Farm car insurance review.

- Mixed Reviews for Claims: Some customers report mixed experiences with the claims process.

#10 – Progressive: Best for AARP Partnership

Pros

- AARP Partnership: Partners with AARP to offer exclusive benefits and discounts. Learn more in our Progressive car Insurance Review.

- Snapshot Program: Utilizes the Snapshot program for personalized rates.

- User-Friendly App: Positive feedback on the user-friendly mobile app.

Cons

- Potentially Higher Premiums: Rates may be on the higher side for certain individuals.

- Mixed Customer Reviews: Some customers report mixed experiences with customer service.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

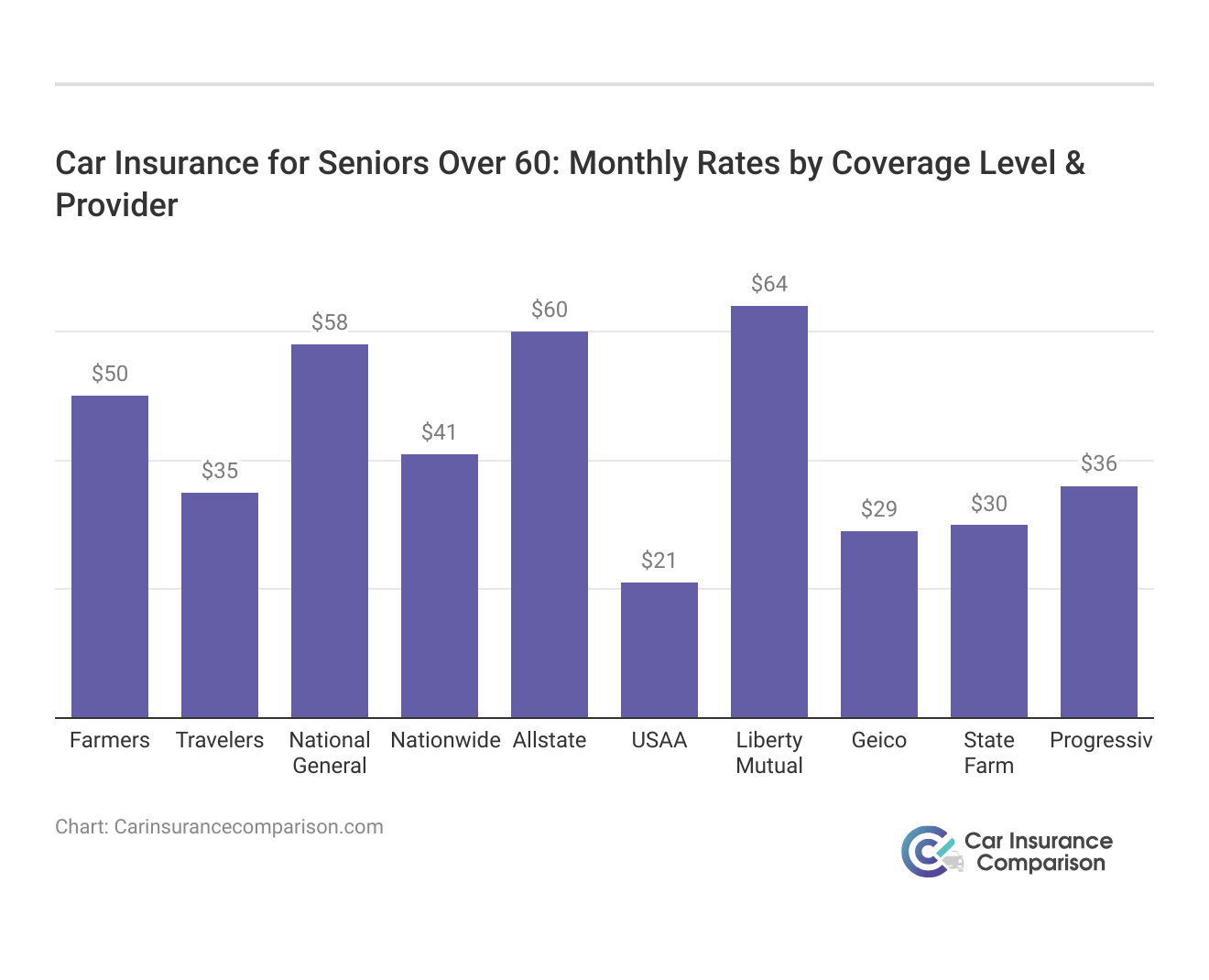

Car Insurance Rates for 60-Year-Old Driver: Unveiling Coverage Insights

Car insurance rates for a 60-year-old driver vary across different insurance companies, providing insight into the cost of both minimum and full coverage.

Car Insurance for Seniors Over 60: Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $60 | $154 |

| Farmers | $50 | $128 |

| Geico | $29 | $74 |

| Liberty Mutual | $64 | $159 |

| National General | $58 | $149 |

| Nationwide | $41 | $104 |

| Progressive | $36 | $95 |

| State Farm | $30 | $76 |

| Travelers | $35 | $90 |

| USAA | $21 | $53 |

Among the surveyed companies, USAA emerges as the most affordable option, with rates as low as $21 for minimum coverage and $53 for full coverage. This suggests that USAA is a cost-effective choice for older drivers seeking comprehensive protection. On the other end of the spectrum, Liberty Mutual exhibits the highest rates, charging $64 for minimum coverage and $159 for full coverage.

Farmers emerges as the champion, offering unbeatable rates and tailored coverage for 60-year-old drivers.

Dani Best Licensed Insurance Producer

The data underscores the importance of comparing insurance options, as there is a significant disparity in rates. In conclusion, understanding the specific coverage rates for a 60-year-old driver is crucial for making informed decisions and securing an insurance plan that aligns with both financial considerations and comprehensive protection needs. For 80-year-olds, read our article titled “Best Car Insurance for Seniors over 80“.

How to Get a Discount on Over 60 Car Insurance Policies

If you have years of experience behind the wheel, you may feel outraged that your premium rate is increasing. It’s nothing personal, and this hike usually has nothing to do with your driving ability. Insurance companies use statistics and averages to help ensure a yearly profit business.

As we get older, things start to change. Our reflexes may not be as fast as they once were and our eyesight may gradually become worse. These factors make seniors have higher rates due to statistics suggesting that seniors are a higher risk on the road.

If the statistics aren’t in your favor, the rates go up to compensate that extra risk.

However, if you are a good driver, sharp as a tack, and with a clean driving record then you can expect to be rewarded with a discount.

If you are looking to lower your rates, and you do have a blemish or two on your record, you can attend driving safety courses. These can sometimes help remove past errors from the record, which may lower your premiums.

The next step is to find an insurance company that recognizes your good driving history and perceives your lower-than-average risk. Use your age to your advantage by getting senior discounts through companies like the AARP.

You can also ask about senior discounts through your insurance agency. It never hurts to ask about discounts you may qualify for because if you don’t ask, you never know!

Over 60, Car Insurance, and the Make of the Vehicle

Another major factor that will decide the price of your premiums is the type of car you drive and how often you drive it. If you have a super sporty little number, you can’t avoid high premiums.

If you really want to lower your rates, you may consider trading that new car in for something less costly to insure.

If you aren’t sure which cars cost less to insure, you can call an agent and discuss your options. The amount of time you drive your car is also a major factor. If you are retired now or working less than full time, you may save money with low mileage discounts.

If you are driving a paid off car that you’ve had for many years, you may be able to lower your premiums by removing unnecessary coverage. The comprehensive coverage policy may not be needed.

If you are driving the newest of the new, be sure to report all the safety features you have, such as:

- Alarm systems

- Side air bags

- Automatic seat belts

- Anti-theft devices

Keeping your car in a garage instead of parking it on the street can also bring down premium rates.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Unveiling Real Insights: Case Studies Analysis for 60-Year-Old Drivers

This section delves into detailed case studies of three top car insurance companies—Farmers, Travelers, and National General—highlighting their unique approaches to serving 60-year-old drivers. Each company’s strategy is examined to understand how they provide competitive rates, tailored protection, and innovative solutions.

- Case Study #1 – Championing Affordable Coverage: Farmers Insurance has built a strong reputation over the years, focusing on reliability and customer-centric services. With an influx of 60-year-old drivers seeking insurance, Farmers aimed to distinguish itself by offering unbeatable rates and tailored coverage.

- Case Study #2 – Tailoring Protection: Travelers Insurance, known for its tailored protection, has a track record of addressing diverse customer needs. In a competitive market, Travelers aimed to position itself as the preferred choice for 60-year-old drivers seeking customized coverage.

- Case Study #3 – Innovating With the Snapshot Program: National General, with a significant presence in the insurance industry, sought to differentiate itself through innovation. National General aimed to stand out by unveiling the Snapshot Program, providing cutting-edge solutions for 60-year-old drivers. Learn more about National General’s snapshot program in our National General car insurance review.

By offering affordable coverage, customized protection, and innovative programs, these companies demonstrate their commitment to serving this demographic effectively.

Over 60 Car Insurance and the Online Option

The best thing you can do to find discounts for people over 60 for car insurance is to shop around. Don’t go with the very first quote you get.

You can still call the top car insurance agencies in your area and speak to a representative if you like speaking to a live person. You can also try going online and comparing the prices of different companies all at once. (Read more: Over Age 55 Car Insurance Discounts)

See what the best rates are, but be sure to read exactly what is and isn’t covered before you sign on the dotted line. You can find affordable rates if you search for discounts and comparison shop.

Just enter your ZIP code into our comparison tool to get started looking for car insurance quotes today.

Frequently Asked Questions

Why do car insurance rates increase for drivers over 60?

Car insurance rates increase for drivers over 60 because insurance companies consider them higher-risk individuals due to factors like changes in reflexes and eyesight. As individuals age, certain physical changes may impact their driving abilities, leading insurers to adjust rates to account for potential increased risk.

How can I get a discount on car insurance if I’m over 60?

You can get a discount on car insurance if you’re over 60 by maintaining a clean driving record, attending driving safety courses, and seeking out insurance companies that offer discounts for seniors. Good driving habits and a commitment to safety can contribute to lower premiums, and some insurers specifically offer discounts for older drivers.

Read more: Best Car Insurance for Seniors

Does the type of vehicle I drive affect my car insurance rates if I’m over 60?

Yes, the type of vehicle you drive can affect your car insurance rates if you’re over 60. Trading in a high-performance car for a less costly-to-insure vehicle and reporting safety features can help lower your premiums. The make and model of your car, as well as its safety features, play a role in determining insurance rates for drivers in this age group.

See if you’re getting the best deal on car insurance by entering your ZIP code below.

Should I compare quotes from different insurance companies?

Yes, it’s recommended to compare quotes from different insurance companies to find the best rates. Shopping around and comparing prices can help you find affordable car insurance options tailored to your specific needs. Different insurers may offer varying discounts and coverage options, so comparing quotes ensures you make an informed decision.

How can I compare car insurance quotes?

You can compare car insurance quotes by contacting insurance agencies directly or by using online comparison tools. Many insurers provide online tools that allow you to enter your information and receive quotes from multiple companies. Additionally, speaking to insurance agents directly can help you understand the specifics of each policy and make an informed comparison.

What factors influence car insurance rates for seniors over 60?

Several factors influence car insurance rates for seniors over 60, including driving history, vehicle type, annual mileage, and coverage options. Insurers may also consider age-related changes such as vision and reaction time, which can affect driving abilities and risk assessments.

Read more: Factors That Affect Car Insurance Rates

Can seniors over 60 get multi-policy discounts on car insurance?

Yes, many insurance companies offer multi-policy discounts for seniors over 60. By bundling car insurance with other types of insurance, such as home or renters insurance, seniors can often save up to 25% on their premiums.

Are there specific car insurance programs designed for seniors?

Yes, some insurance companies offer specific programs designed for seniors. For example, the AARP partners with The Hartford to provide special rates and benefits for older drivers. Additionally, many insurers have programs that offer discounts for completing defensive driving courses.

How can seniors improve their car insurance rates?

Seniors can improve their car insurance rates by maintaining a clean driving record, taking defensive driving courses, and choosing a car with advanced safety features. Additionally, comparing quotes from multiple insurers and taking advantage of available discounts can help reduce premiums.

Read more: What makes car insurance more expensive?

Is it beneficial for seniors to use telematics devices to monitor driving?

Using telematics devices can be beneficial for seniors as it can lead to lower insurance premiums based on safe driving habits. Programs like National General’s Snapshot Program monitor driving behavior and reward safe drivers with discounts, making it an attractive option for seniors looking to save on car insurance.

Find cheap car insurance quotes by entering your ZIP code below.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.