Best Ford EcoSport Car Insurance in 2025 (Top 10 Companies Ranked)

The best Ford EcoSport car insurance is provided by State Farm, Geico, and Progressive, with rates starting at $20/month. These companies excel due to their affordable premiums, flexible coverage options, and strong local agent networks, ensuring comprehensive protection for your Ford EcoSport.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

UPDATED: Nov 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 1, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Ford EcoSport

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage for Ford EcoSport

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Ford EcoSport

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews

The best Ford EcoSport car insurance are State Farm, Geico, and Progressive, renowned for their comprehensive car insurance coverage and customer satisfaction.

These companies lead the market with robust policy offerings that cater to the diverse needs of Ford EcoSport owners. By comparing these providers, drivers can benefit from tailored insurance solutions that provide excellent value and security.

Our Top 10 Company Picks: Best Ford EcoSport Car

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | B | Customer Satisfaction | State Farm | |

| #2 | 20% | A++ | Low Rates | Geico | |

| #3 | 15% | A+ | Coverage Options | Progressive | |

| #4 | 10% | A+ | Local Agents | Allstate | |

| #5 | 28% | A++ | Military Families | USAA | |

| #6 | 12% | A | Online Tools | Liberty Mutual |

| #7 | 18% | A | Customizable Policies | Farmers | |

| #8 | 22% | A+ | Affordable Rates | Nationwide |

| #9 | 17% | A++ | Car Replacement | Travelers | |

| #10 | 14% | A | Family Discounts | American Family |

This comparison pinpoints the most affordable rates, starting at $20 for minimum coverage, and explains how safety ratings, driver location, and driving records influence insurance costs.

Get the right car insurance at the best price — enter your ZIP code above to shop for coverage from the top insurers.

- State Farm offers top Ford EcoSport insurance at $20/month

- Coverage options cater to Ford EcoSport’s safety features

- Factors like location and driving history affect rates

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

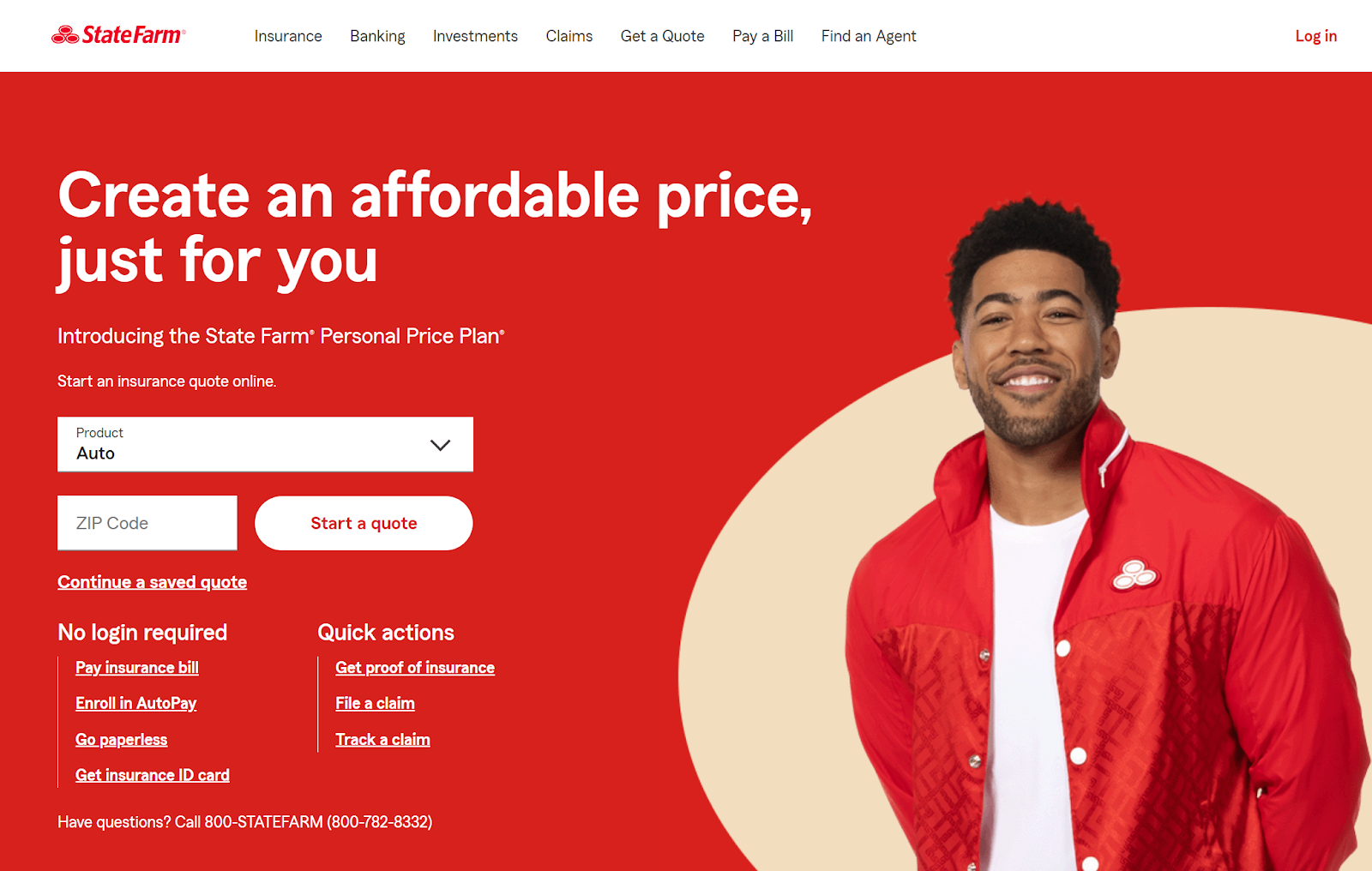

#1 – State Farm: Best for Customer Satisfaction

Pros

- Tailored Support: State Farm agents offer personalized advice and coverage options for your Ford EcoSport.

- Streamlined Claims: State Farm’s efficient claims process simplifies handling your Ford EcoSport insurance needs.

- Strong Local Support: With our State Farm car insurance review, you’ll find that accessibility to local agents enhances customer service for Ford EcoSport insurance.

Cons

- Higher Premiums: State Farm’s comprehensive service may result in higher costs for Ford EcoSport insurance.

- Inconsistent Agent Quality: Experiences with Ford EcoSport insurance can vary depending on the local agent.

#2 – Geico: Best for Low Rates

Pros

- Competitive Pricing: Discover our Geico car insurance review to learn how Geico offers affordable Ford EcoSport car insurance rates.

- Fast Claims Service: Efficient online and app services expedite claims for Ford EcoSport owners.

- Extensive Discounts: Multiple discounts available specifically for Ford EcoSport insurance.

Cons

- Limited Personal Interaction: Less face-to-face engagement may affect personalized service.

- Overwhelmed Call Centers: High volume can lead to longer wait times for Ford EcoSport insurance queries.

#3 – Progressive: Best for Coverage Options

Pros

- Broad Coverage: Explore our Progressive car insurance review to understand how Progressive provides diverse insurance options for Ford EcoSport owners.

- Customization Tools: Online tools help tailor Ford EcoSport insurance to individual needs.

- Loyalty Rewards: Benefits and discounts increase with time for Ford EcoSport policyholders.

Cons

- Variable Rates: Premium costs can vary widely for Ford EcoSport insurance.

- Aggressive Upselling: Customers may experience frequent upselling of additional services.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for Local Agents

Pros

- Localized Service: Allstate’s network of agents provides community-focused support for Ford EcoSport insurance.

- Comprehensive Coverage: Offers detailed coverage options tailored to Ford EcoSport owners’ needs.

- Proactive Communication: In our Allstate car insurance rview, find out how agents frequently update policyholders on new benefits and changes.

Cons

- Premium Costs: Higher service levels from local agents could lead to increased insurance rates for Ford EcoSport.

- Agent Dependence: Quality of service may depend heavily on the individual agent’s expertise and responsiveness.

#5 – USAA: Best for Military Families

Pros

- Specialized Rates: Exclusive, competitively priced Ford EcoSport insurance for military members and their families.

- Exceptional Service: View our USAA car insurance review and see why they have high customer satisfaction ratings due to tailored services for military needs.

- Military Benefits: Additional perks and coverage options that cater specifically to service members.

Cons

- Limited Eligibility: USAA’s Ford EcoSport insurance is only available to military personnel and their families, restricting access for others.

- Fewer Physical Locations: Limited number of offices might affect those preferring in-person service.

#6 – Liberty Mutual: Best for Online Tools

Pros

- Digital Innovation: Advanced online tools for managing Ford EcoSport insurance policies with ease.

- Customizable Policies: Allows for high levels of policy customization to suit individual Ford EcoSport coverage needs.

- Quick Claims Process: Delve into our Liberty Mutual car insurance review to see how their streamlined digital process ensures faster response and resolution of claims.

Cons

- Inconsistent Pricing: Ford EcoSport insurance rates can vary significantly based on online data inputs.

- Customer Service Variability: While online tools are advanced, human customer service can vary in effectiveness.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#7 – Farmers: Best for Customizable Policies

Pros

- Tailor-Made Policies: See our Farmers car insurance review for insights on their extensive customization options for Ford EcoSport insurance policies.

- Educational Resources: Provides valuable insights and information specific to Ford EcoSport owners.

- Dedicated Agents: Personalized service through dedicated agents focusing on client education.

Cons

- Higher Price Tag: Customized options and agent involvement may lead to higher Ford EcoSport insurance rates.

- Complexity: The wide array of options could be overwhelming for some Ford EcoSport insurance buyers.

#8 – Nationwide: Best for Affordable Rates

Pros

- Competitive Pricing: Offers some of the most affordable rates for Ford EcoSport insurance.

- Wide Coverage: Broad coverage options that provide extensive protection for Ford EcoSport owners.

- Discounts and Rewards: According to our review of Nationwide car insurance discounts, various discounts available can substantially lower Ford EcoSport insurance costs.

Cons

- Varied Customer Service: Experience can vary significantly from one customer service rep to another.

- Limited Customization: Less flexibility in policy customization compared to competitors.

#9 – Travelers: Best for Car Replacement

Pros

- Car Replacement Options: Excellent provisions for replacing a Ford EcoSport in case of total loss.

- Reliable Claims Service: Efficient and reliable claims processing for Ford EcoSport insurance.

- Extensive Network: Based on our Travelers car insurance review, there is a wide agent network available for personal consultation.

Cons

- Premium Costs: Higher premiums for comprehensive car replacement benefits.

- Policy Restrictions: Certain restrictions apply on car replacement provisions that might not suit all Ford EcoSport owners.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#10 – American Family: Best for Family Discounts

Pros

- Family-Focused Discounts: Offers significant discounts for families insuring multiple vehicles, including Ford EcoSports.

- Personalized Service: Agents provide tailored service, focusing on family-based insurance needs.

- Comprehensive Coverage: Within our American Family car insurance review, discover how their broad coverage benefits families with multiple drivers.

Cons

- Geographic Limitations: Services are not available nationwide, which could limit options for some Ford EcoSport owners.

- Dependence on Agent Quality: Like others, service quality can heavily depend on the specific agent.

Essential Guide to Ford EcoSport Car Insurance Costs

Understanding the cost of insuring your Ford EcoSport can be straightforward with this detailed comparison of monthly car insurance rates from leading insurance providers. The guide provides a breakdown of the monthly expenses for both minimum and full coverage options across a range of insurance companies, including Allstate, Geico, and others.

Ford EcoSport Car Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $35 | $105 |

| American Family | $29 | $99 |

| Farmers | $38 | $108 |

| Geico | $20 | $85 |

| Liberty Mutual | $40 | $110 |

| Nationwide | $33 | $103 |

| Progressive | $30 | $100 |

| State Farm | $25 | $90 |

| Travelers | $31 | $101 |

| USAA | $28 | $88 |

Discover the most economical or comprehensive insurance solutions to suit your personal or financial preferences. Explore Ford EcoSport insurance price from multiple providers. Minimum coverage prices range from $20 with Geico to $40 with Liberty Mutual. Full coverage rates stretch from $85 with Geico to $110 with Liberty Mutual. Use this guide to navigate your options and secure the best coverage for your vehicle.

Securing affordable insurance for your Ford EcoSport is straightforward. Evaluate the available discounts from prominent providers to tailor coverage that suits your budget and requirements. Benefit from savings through multi-policy, safe driving, and more. Begin your comparison today to lock in the best rate and enjoy peace of mind on the road.

Insurance Rate Benchmarking for the Ford EcoSport

This table offers a detailed look at how the Ford EcoSport’s insurance costs compare to those of other renowned models such as the BMW X6, Infiniti QX30, and Nissan Rogue. By evaluating these insurance rates, you can better understand the relative affordability and value of insuring the EcoSport across different coverage types, from comprehensive to full coverage car insurance.

Ford EcoSport Car Insurance Monthly Rates vs. Other Cars by Coverage Type

| Vehicle | Comprehensive | Collision | Liability | Full Coverage |

|---|---|---|---|---|

| Ford EcoSport | $23 | $42 | $31 | $109 |

| BMW X6 | $36 | $70 | $33 | $152 |

| Infiniti QX30 | $29 | $57 | $33 | $132 |

| Nissan Rogue | $22 | $43 | $37 | $117 |

| Lincoln MKX | $25 | $50 | $33 | $121 |

| Chevrolet Equinox | $26 | $44 | $31 | $114 |

| Mazda CX-5 | $27 | $44 | $31 | $115 |

To secure cost-effective insurance for your Ford EcoSport, compare these rates with those of similar vehicles. This breakdown identifies which models are more economical to insure, helping you make an informed decision based on coverage needs and financial considerations. Start comparing now to find the best insurance option for your budget and requirements.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Key Factors Influencing Ford EcoSport Insurance Costs

When considering insurance for the Ford EcoSport, several factors play pivotal roles in determining the premium rates. The vehicle’s safety features, such as airbags and stability controls, directly impact rates by potentially lowering the risk of costly claims. The driver’s age and driving history influence premiums, with younger drivers generally facing higher costs due to perceived inexperience.

State Farm sets the standard for Ford EcoSport car insurance, offering unrivaled customer service and robust policy choices.

Dani Best Licensed Insurance Producer

The location where the vehicle is primarily driven also affects insurance costs, as areas with higher traffic or theft rates might lead to increased premiums. Understanding these factors, along with safety features car insurance discounts, can help EcoSport owners navigate insurance options more effectively, ensuring they choose a policy that best fits their needs and budget.

Age of the Vehicle

When insuring your Ford EcoSport, it’s crucial to recognize how the vehicle’s age influences insurance premiums. This overview provides a detailed comparison of monthly insurance costs across different model years, covering all major types of coverage:

Ford EcoSport Car Insurance Monthly Rates by Model Year and Coverage Type

| Vehicle | Comprehensive | Collision | Liability | Full Coverage |

|---|---|---|---|---|

| 2024 Ford EcoSport | $25 | $43 | $32 | $112 |

| 2023 Ford EcoSport | $25 | $43 | $32 | $111 |

| 2022 Ford EcoSport | $24 | $43 | $32 | $111 |

| 2021 Ford EcoSport | $24 | $42 | $31 | $110 |

| 2020 Ford EcoSport | $23 | $42 | $31 | $109 |

| 2019 Ford EcoSport | $22 | $40 | $33 | $108 |

| 2018 Ford EcoSport | $21 | $40 | $33 | $108 |

This comparison illuminates how insurance rates for the Ford EcoSport tend to decrease as the vehicle ages. This guide is invaluable for owners seeking the most cost-effective coverage, be it comprehensive, collision, minimum, or full coverage. Understanding these trends, along with the average car insurance rates by age and gender, helps you choose the most appropriate and economical insurance plan for your Ford EcoSport.

Driver Age

The correlation between driver age and car insurance rates is a crucial aspect to consider when managing your auto insurance expenses. This guide provides a detailed breakdown of the monthly insurance rates for a Ford EcoSport across various age groups. It illustrates the financial impact of age on insurance costs, from young, new drivers to more mature, experienced ones.

Ford EcoSport Car Insurance Monthly Rates by Age

| Age | Rates |

|---|---|

| Age: 16 | $590 |

| Age: 18 | $399 |

| Age: 20 | $248 |

| Age: 30 | $114 |

| Age: 40 | $109 |

| Age: 45 | $105 |

| Age: 50 | $100 |

| Age: 60 | $98 |

Insurance rates for the Ford EcoSport show younger drivers typically face higher costs, decreasing as they age and gain experience. Recognizing this trend helps drivers plan and budget more effectively. For tailored advice and optimal coverage, consult an insurance advisor. If you’re wondering how to get car insurance fast, an advisor can provide immediate solutions.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Driver Location

Geographic location plays a significant role in determining car insurance rates due to varying risks and costs associated with different areas. For Ford EcoSport owners, where you park your car at night can lead to substantial differences in annual premiums. This guide highlights how insurance rates fluctuate across major U.S. cities, from Los Angeles to Columbus, demonstrating the impact of location on what drivers pay.

Ford EcoSport Car Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Los Angeles, CA | $187 |

| New York, NY | $173 |

| Houston, TX | $171 |

| Jacksonville, FL | $158 |

| Philadelphia, PA | $146 |

| Chicago, IL | $144 |

| Phoenix, AZ | $127 |

| Seattle, WA | $106 |

| Indianapolis, IN | $93 |

| Columbus, OH | $91 |

Drivers in larger cities like Los Angeles and New York face higher insurance rates due to greater risks of accidents, theft, and vandalism, while those in cities like Indianapolis and Columbus enjoy lower premiums. Understanding location-based differences aids Ford EcoSport drivers in budgeting for comprehensive car insurance. For detailed guidance on location-specific pricing, consult an insurance expert.

Your Driving Record

The impact of your driving record on car insurance rates is significant, particularly for Ford EcoSport owners. Traffic violations, accidents, and DUIs can substantially raise premiums, with younger drivers often experiencing the most pronounced increases. This breakdown illustrates how rates vary based on driving history across different age groups, providing a clear picture of the financial consequences of driving infractions.

Ford EcoSport Car Insurance Monthly Rates by Age & Driving Record

| Age | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Age: 16 | $590 | $770 | $1,050 | $720 |

| Age: 18 | $399 | $610 | $830 | $530 |

| Age: 20 | $248 | $410 | $620 | $350 |

| Age: 30 | $114 | $180 | $290 | $160 |

| Age: 40 | $109 | $170 | $280 | $150 |

| Age: 45 | $105 | $165 | $275 | $145 |

| Age: 50 | $100 | $160 | $270 | $140 |

| Age: 60 | $98 | $155 | $260 | $135 |

The data highlights the need for a clean driving record to reduce insurance costs. For Ford EcoSport drivers, a single ticket can significantly increase rates, while accidents and DUIs can drastically raise premiums, particularly for younger drivers. Understanding how your driving affects insurance rates can lead to better decisions and savings. For customized advice to lower your rates, consult an insurance professional.

Ford EcoSport Safety Ratings

Safety ratings are a crucial factor in determining car insurance rates, as they reflect the potential risk and cost of injuries in accidents. The Ford EcoSport has been evaluated across several safety tests, and understanding these ratings can help you grasp how they influence Ford car insurance rates. Here’s a detailed look at the safety performance of the Ford EcoSport, which boasts impressive scores in various categories.

Ford EcoSport Safety Ratings

| Type | Rating |

|---|---|

| Small overlap front: driver-side | Good |

| Small overlap front: passenger-side | Good |

| Moderate overlap front | Good |

| Side | Good |

| Roof strength | Good |

| Head restraints and seats | Good |

The “Good” ratings in all safety categories for the Ford EcoSport enhance its insurance affordability. Strong safety performance protects passengers and lowers insurance costs by reducing severe injuries and claims.

Knowing the EcoSport’s safety ratings helps owners make informed decisions about insurance and vehicle choice. Consulting an insurance agent can provide more insights on how these ratings impact your Ford car insurance quote.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Ford EcoSport Crash Test Ratings

Crash test ratings are pivotal in assessing vehicle safety and subsequently impact car insurance premiums. For Ford EcoSport owners, understanding how these ratings correlate with insurance costs can be crucial. The following details the crash test results for various model years of the Ford EcoSport, showcasing their overall, frontal, side, and rollover ratings.

Ford EcoSport Crash Test Ratings by Model Year

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Ford EcoSport SUV FWD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2024 Ford EcoSport SUV AWD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2023 Ford EcoSport SUV FWD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2023 Ford EcoSport SUV AWD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2022 Ford EcoSport SUV FWD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2022 Ford EcoSport SUV AWD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2021 Ford EcoSport SUV FWD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2021 Ford EcoSport SUV AWD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2020 Ford EcoSport SUV FWD | 4 stars | 4 stars | 5 stars | 3 stars |

| 2020 Ford EcoSport SUV AWD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2019 Ford EcoSport 4 DR FWD | 4 stars | 4 stars | 5 stars | 3 stars |

| 2019 Ford EcoSport 4 DR AWD | 4 stars | 4 stars | 5 stars | 4 stars |

| 2018 Ford EcoSport 4 DR FWD | 4 stars | 4 stars | 5 stars | 3 stars |

| 2018 Ford EcoSport 4 DR AWD | 4 stars | 4 stars | 5 stars | 4 stars |

The Ford EcoSport consistently earns high crash test ratings, especially in side impacts, reflecting its strong safety features that protect occupants and can lower insurance premiums. Understanding car accidents and these ratings validate the EcoSport’s safety and can influence insurance decisions, encouraging owners to discuss with insurers how to use these results for better rates.

Ford EcoSport Safety Features

The Ford EcoSport boasts an impressive range of safety features, which can lead to car insurance discounts. These include driver and passenger airbags, front and rear head airbags, and front and rear side airbags.

The vehicle is also equipped with 4-wheel ABS, 4-wheel disc brakes, brake assist, electronic stability control, daytime running lights, child safety locks, and traction control. Such comprehensive safety equipment enhances the vehicle’s overall safety profile and can potentially lower insurance premiums for owners.

Impact of Safety Features on Insurance Costs for Compact SUVs

Safety features and crash safety ratings significantly affect car insurance costs, with agencies like the National Highway Traffic Safety Administration being key evaluators. While the Ford EcoSport lacks U.S. crash safety ratings due to its market absence, the similar Ford Escape shows strong performance, earning five stars for side impacts and improved front impact ratings over time.

data-media-max-width=”560″>

👀Looking for exceptional car insurance? Look no further than Ben Carr State Farm agency! State Farm is amazing and provides reliable coverage you can trust. Call (415)-569-2277 to speak with a State Farm agent today and experience the difference for yourself.#StateFarm pic.twitter.com/pLxb4wOQO3

— Ben Carr (@MyAgentBenCarr) August 9, 2024

The insurance implications for the EcoSport and Escape are also influenced by their classification as compact SUVs, which are perceived as slightly riskier than standard station wagons but not significantly more expensive in urban settings. Car insurance companies generally view compact SUVs like the EcoSport as less likely to engage in extensive off-road activities, which moderately affects their insurance premiums.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Exploring Ford EcoSport Insurance: Rates and Coverage Differences

Insuring a Ford EcoSport can vary in cost depending on several factors including coverage types and driver profiles. On average, owners might expect to pay about $1,310 annually or $109 monthly for standard coverage.

Ford EcoSport Car Insurance Monthly Rates by Coverage Type

| Category | Rates |

|---|---|

| Average Rate | $109 |

| Discount Rate | $64 |

| High Deductibles | $94 |

| High Risk Driver | $233 |

| Low Deductibles | $137 |

| Teen Driver | $399 |

However, this cost can fluctuate significantly based on your chosen deductible level, risk profile, and eligibility for discounts. Understanding how to combine car insurance coverage with the right deductible can further optimize these costs. Understanding the breakdown of Ford EcoSport insurance rates is crucial for budgeting and choosing the right insurance plan.

Whether you qualify for a discount rate of $64 or face higher premiums as a high-risk driver or teen driver, being aware of these variations helps you navigate the complexities of auto insurance and ensures that you find coverage that best suits your needs and budget.

5 Smart Ways to Lower Your Ford EcoSport Insurance Costs

Reducing your insurance expenses for the Ford EcoSport doesn’t have to be complicated. By taking advantage of specific discounts and adjusting your insurance approach, you can secure significant savings. Consider the total cost of ownership, invest in safety features like dashcams, and explore educational and usage-based discounts.

- Evaluate Insurance Costs Before Purchase: Understand the long-term insurance expenses before buying your EcoSport.

- Install a Dashcam: A dashcam can provide proof in the event of an incident, potentially lowering your insurance rates.

- Educational Achievement Discounts: If you have a college degree, you might qualify for reduced rates.

- Good Student Discount for Young Drivers: Young drivers can often get discounts for maintaining good grades.

- Opt for Usage-Based Insurance: Tailor your insurance costs to your driving habits to potentially save money.

Implementing these strategies can help you manage and reduce the cost of insuring your Ford EcoSport. From pre-purchase cost considerations to technological enhancements and personalized insurance plans, each tactic offers a way to make your insurance more affordable. Exploring ways to lower the cost of your insurance can further enhance these benefits.

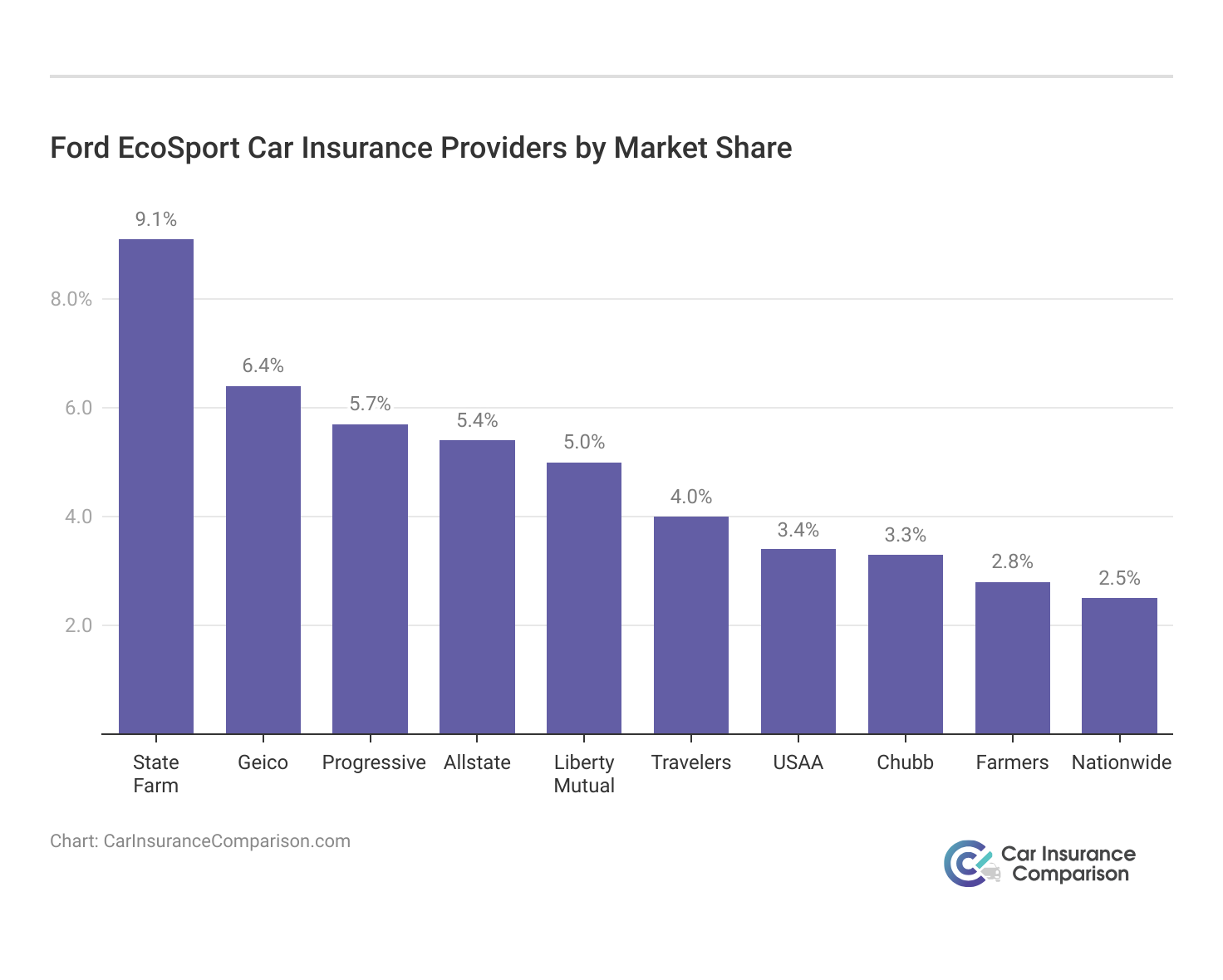

Top Ford EcoSport Insurance Companies

Selecting the right insurer for your Ford EcoSport involves more than just finding the lowest rate; it’s about understanding which companies lead the market and why. This list details the best car insurance providers by market share, shedding light on their dominance and the breadth of their customer base.

Ford EcoSport Car Insurance Providers by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $66,153,063 | 9% |

| #2 | Geico | $46,358,896 | 6% |

| #3 | Progressive | $41,737,283 | 6% |

| #4 | Allstate | $39,210,020 | 5% |

| #5 | Liberty Mutual | $36,172,570 | 5% |

| #6 | Travelers | $28,786,741 | 4% |

| #7 | USAA | $24,621,246 | 3% |

| #8 | Chubb | $24,199,582 | 3% |

| #9 | Farmers | $20,083,339 | 3% |

| #10 | Nationwide | $18,499,967 | 3% |

Such insights can guide you in choosing a provider that not only offers competitive rates but also values reliability and comprehensive coverage. By considering the market leaders in auto insurance, such as State Farm, Geico, and Progressive, you position yourself to benefit from not only competitive rates but also robust service and coverage options tailored to your EcoSport.

Assessing these top providers allows you to compare what they offer in terms of discounts, customer service, and claim handling.

Choose a company that aligns well with your needs and preferences to ensure your EcoSport is protected optimally, balancing cost and coverage effectively.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Compare Free Ford EcoSport Insurance Quotes Online

For comparative purposes, the closest U.S. equivalent to the EcoSport would be the Ford Escape. Both the EcoSport and Escape are mid-size SUVs designed for front-wheel and four-wheel drive, targeting middle-class families seeking an SUV’s durability and versatility without the larger size and higher costs. Other vehicles similar in size and weight include the Mazda 2, Ford Fiesta, and Ford Fusion.

Explore your Ford car insurance online options by entering your ZIP code below and finding which companies have the lowest rates.

Frequently Asked Questions

Is insurance high on a Ford EcoSport?

Insurance rates for a Ford EcoSport are relatively moderate, depending on factors like location, driver’s age, and specific model year.

For additional details, explore our comprehensive resource titled “Compare Car Insurance Rates by Vehicle Make and Model,” and find the perfect match for your needs.

Is the EcoBoost version of the Ford EcoSport more expensive to insure?

Yes, the EcoBoost versions of the Ford EcoSport may be more expensive to insure. This is typically because these models feature higher performance capabilities compared to standard versions, which can increase the risk profile and, subsequently, the insurance costs.

See how much you’ll pay for car insurance by entering your ZIP code below into our free comparison tool.

What is the cheapest Ford model to insure, compared to the EcoSport?

The cheapest Ford model to insure typically includes smaller, less expensive models such as the Ford Fiesta. These models tend to have lower insurance costs compared to larger or more performance-oriented models like the Ford EcoSport, due to their less powerful engines and lower repair costs.

To learn more, explore our comprehensive resource on insurance titled “Best Ford Car Insurance Rates,” and discover your optimal coverage options.

What is the recall on the Ford EcoSport engine?

Any recalls, such as those for the engine, can potentially affect insurance rates if they relate to safety issues that could increase the likelihood of accidents or failures.

Are sportier vehicles, including the EcoSport, more expensive to insure?

Yes, sportier models like the Ford EcoSport can be more expensive to insure. This is often due to the increased risk associated with higher speeds and the potential for accidents. Specifically for the EcoSport, insurance costs may be elevated if the vehicle is equipped with performance-oriented features such as the EcoBoost engine, which enhances the vehicle’s speed and power.

Is a Ford EcoSport a high risk vehicle?

The Ford EcoSport is not typically classified as a high-risk vehicle, which helps keep insurance premiums reasonable.

To delve deeper, refer to our in-depth report titled “What is high-risk car insurance?” for further insights.

What factors affect the insurance cost for a Ford EcoSport?

Factors include the driver’s age, driving history, the vehicle’s safety features, and where the vehicle is primarily driven.

Is the Ford EcoSport a safe vehicle?

Yes, the Ford EcoSport is considered safe, featuring various active and passive safety features that contribute to its overall safety ratings.

Enter your ZIP code below into our free comparison tool to see how much car insurance costs in your area.

How safe is the Ford EcoSport car?

The Ford EcoSport is known for its good safety ratings, which can positively impact insurance premiums. These ratings indicate a lower risk of severe damage and injuries in the event of an accident, making it a more favorable option for insurers. This safety profile helps to moderate the cost of insurance for EcoSport owners.

For a thorough understanding, refer to our detailed analysis titled “What is a car insurance premium?” for more information.

How long does a Ford EcoSport last?

The longevity of a Ford EcoSport can influence insurance costs over time, with well-maintained models potentially commanding lower premiums as they prove less risky in terms of unexpected breakdowns and failures.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.