Cheap Car Insurance for Pilots and Navigators in 2025 (Top 10 Affordable Companies)

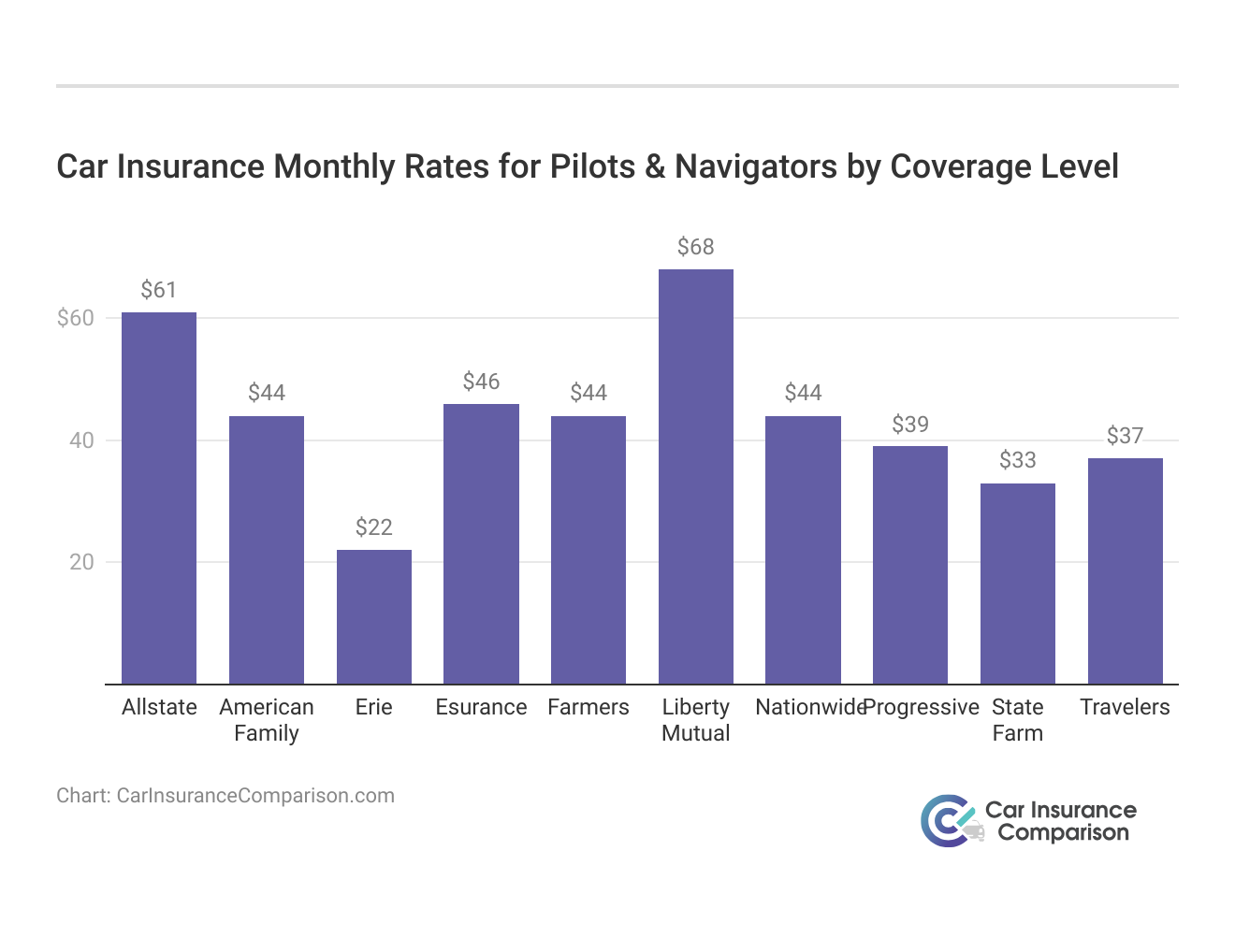

Discover the top picks for cheap car insurance for pilots and navigators, with Progressive, State Farm, and Allstate leading the pack with competitive rates starting from $39 for minimum coverage. Discover why these companies stand out in providing tailored coverage for this unique profession.

Read moreFree Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

UPDATED: Feb 16, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 16, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage for Pilot & Navigator

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Pilot & Navigator

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Pilot & Navigator

A.M. Best Rating

Complaint Level

Pros & Cons

Progressive emerges as the prime option for cheap car insurance for pilots and navigators, with rates starting from $39 for full coverage. Dive into our thorough comparison of leading insurers like State Farm and Allstate, blending personalized service with affordability.

Discover how Progressive stands out among the rest, providing tailored solutions for pilots and navigators to ensure optimal coverage at the best possible rates.

Our Top 10 Company Picks: Cheap Car Insurance for Pilots and Navigators

| Company | Rank | Monthly Rates | Multi-Vehicle Discount | Best for | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $22 | 16% | Customizable Policies | Erie |

| #2 | $33 | 15% | Local Agents | State Farm | |

| #3 | $37 | 12% | Multi-Policy Discounts | Travelers | |

| #4 | $39 | 17% | Comprehensive Coverage | Progressive | |

| #5 | $44 | 15% | Vanishing Deductible | Nationwide |

| #6 | $44 | 14% | Bundle Discounts | American Family | |

| #7 | $44 | 16% | 24/7 Support | Farmers | |

| #8 | $46 | 13% | Safe-Driving Discounts | Esurance | |

| #9 | $61 | 18% | Policy Options | Allstate | |

| #10 | $68 | 14% | Online Convenience | Liberty Mutual |

The cost of allstate car insurance per month for pilots is typically lower compared to other professions, aside from scientists and retirees. It’s crucial to seek out the best insurance rates for pilot navigators, which can be further reduced through research.

Find cheap car insurance quotes by entering your ZIP code above.

#1 – Progressive: Top Overall Pick

Pros

- Comprehensive Coverage: Progressive offers extensive coverage options suitable for the specific needs of pilots and navigators.

- Up to 15% Pilot & Navigator Discount: Progressive provides a significant discount tailored for professionals in this field.

- Up to 17% Multi-Vehicle Discount: Progressive car insurance review uncovers considerable savings for customers with multiple vehicles.

Cons

- Limited Local Agent Presence: Progressive may not be the ideal choice for those who prefer in-person interactions with local agents.

- Varied Customer Service Reviews: Some customers report mixed experiences with Progressive’s customer service.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#2 – State Farm: Best for Personalized Service

Pros

- Local Agents: State Farm excels in personalized service via a vast network of local agents.

- Up to 12% Pilot & Navigator Discount: Offers a substantial discount for pilots and navigators.

- Up to 15% Multi-Vehicle Discount: State Farm’s car insurance review emphasizes the savings generated by multi-vehicle discounts.

Cons

- Policy Options: While State Farm offers diverse policy options, some customers may find other companies more flexible.

- Rates May be Higher for Certain Profiles: In some cases, State Farm’s rates may be higher for specific customer profiles.

#3 – Allstate: Best for Diverse Policy Options

Pros

- Policy Options: In the Allstate car insurance review, the company offers a variety of policy options for customized coverage.

- Up to 10% Pilot & Navigator Discount: Offers a decent discount for professionals in this field.

- Up to 18% Multi-Vehicle Discount: High multi-vehicle discount potential for additional savings.

Cons

- Premiums May be Higher: Allstate’s rates might be relatively higher for some individuals.

- Mixed Reviews on Claims Process: Some customers report varied experiences with the claims process.

#4 – Liberty Mutual: Best for Online Convenience

Pros

- Online Convenience: In the Liberty Mutual car insurance review, a convenient online platform is provided for easy policy management.

- Up to 8% Pilot & Navigator Discount: Provides a reasonable discount for professionals in this field.

- Up to 14% Multi-Vehicle Discount: Significant multi-vehicle discount potential for cost savings.

Cons

- Mixed Customer Reviews: Some customers express varying opinions about Liberty Mutual’s customer service.

- May not be the Most Affordable: Depending on individual profiles, Liberty Mutual’s rates may not be the most budget-friendly.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#5 – Farmers: Best for 24/7 Support

Pros

- 24/7 Support: Farmers stands out with around-the-clock customer support, providing assistance when needed.

- Up to 9% Pilot & Navigator Discount: Offers a competitive discount for pilots and navigators.

- Up to 16% Multi-Vehicle Discount: Farmers car insurance review reveals significant potential for extra savings through multi-vehicle discounts.

Cons

- Policy Rates Could be Higher: Some customers may find that Farmers’ rates are comparatively higher.

- Mixed Reviews on Claims Process: Like many insurers, Farmers has received mixed reviews regarding the claims process.

#6 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Nationwide introduces an innovative vanishing deductible feature, rewarding safe driving behavior.

- Up to 11% Pilot & Navigator Discount: Provides a substantial discount tailored for professionals in this field.

- Up to 15% Multi-Vehicle Discount: Multi-vehicle discounts contribute to overall cost savings.

Cons

- May Lack Personalized Service: Nationwide’s approach may be perceived as less personalized compared to companies with extensive local agent networks.

- Higher Premiums for Certain Profiles: Certain customer profiles might experience higher rates, even with Nationwide car insurance discounts.

#7 – Esurance: Best for Safe-Driving Discounts

Pros

- Safe-Driving Discounts: Esurance encourages safe driving with discounts, promoting responsible behavior.

- Up To 9% Pilot & Navigator Discount: Esurance car insurance review includes a competitive discount for professionals.

- Up To 13% Multi-Vehicle Discount: Multi-vehicle discounts contribute to overall cost savings.

Cons

- Limited Local Agent Presence: Esurance may not be the best choice for those who prefer in-person interactions with local agents.

- Mixed Reviews on Customer Service: Some customers report mixed experiences with Esurance’s customer service.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#8 – Travelers: Best for Multi-Policy Discounts

Pros

- Multi-Policy Discounts: Travelers incentivizes customers to bundle policies, offering multi-policy discounts.

- Up to 7% Pilot & Navigator Discount: Provides a reasonable discount for professionals in this field.

- Up to 12% Multi-Vehicle Discount: Travelers car insurance review highlights significant multi-vehicle discount potential for savings.

Cons

- May Lack Personalized Service: Travelers may not offer the same level of personalized service as companies with extensive local agent networks.

- Rates May Be Higher For Certain Profiles: In some cases, Travelers’ rates may be higher for specific customer profiles.

#9 – American Family: Best for Bundle Discounts

Pros

- Bundle Discounts: American Family promotes cost savings through bundling, offering discounts for combining multiple policies.

- Up to 8% Pilot & Navigator Discount: Provides a reasonable discount for professionals in this field.

- Up to 14% Multi-Vehicle Discount: American Family car insurance review notes significant multi-vehicle discount potential for added savings

Cons

- Limited Local Agent Presence: American Family may not be the ideal choice for those who prefer in-person interactions with local agents.

- Mixed Customer Reviews: Some customers express varying opinions about American Family’s customer service.

#10 – Erie: Best for Customizable Policies

Pros

- Customizable Policies: Erie allows customers to tailor policies to their specific needs, providing flexibility.

- Up to 10% Pilot & Navigator Discount: Offers a competitive discount for professionals in this field.

- Up to 16% Multi-Vehicle Discount: High multi-vehicle discount potential for cost savings.

Cons

- Regional Availability: Erie’s services may be limited to specific regions, potentially excluding some customers.

- Online Presence: Erie car insurance review reveals that its online platform may not match the sophistication of larger competitors’.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Your Everyday Actions Impact Your Role as a Pilot or Navigator

Navigating the car insurance landscape for pilots and navigators is crucial, and we’ve compiled the specific coverage rates for 2024 from top providers. Progressive leads with rates of $105 for minimum and $39 for full coverage, followed closely by State Farm at $86 and $33.

Pilots & Navigators Car Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $61 | $160 | |

| $44 | $117 | |

| $22 | $58 |

| $46 | $114 | |

| $44 | $139 | |

| $68 | $174 |

| $44 | $115 |

| $39 | $105 | |

| $33 | $86 | |

| $37 | $99 |

Pilot Navigators Car Insurance Rates

As for cheap car insurance policies, pilot car insurance is middle-of-the-pack. These Geico pilot car insurance quotes show that, as a pilot or navigator, your car insurance rates would average around $152 per month.

Keep in mind that it’s important to shop around, as you will find different rates with Progressive pilot car insurance quotes, State Farm, or any other insurer.

How Car Insurance Companies Determine Your Pilot Navigators Car Insurance Rates

When determining your rates, insurance companies will use more than your occupation to determine how much you should pay.

This table using data from the Bureau of Labor Statistics shows the median wage of an airline pilot navigator.

Pilot/ Navigator Bureau of Labor Statistics

| Pilot/ Navigator Statistics | Details |

|---|---|

| Median Pay | $174,870 per year |

| Number of Jobs | 84,520 |

| State with Highest Employment Level | California |

| Top Paying State | Michigan |

Just because you are a pilot doesn’t automatically mean you are going to get the lowest rates, especially if you have any points on your license or have numerous car insurance claims with the insurance company.

In fact, there are some insurance companies that won’t consider your occupation as a marker at all.

Getting a quote from multiple companies is the only way to ensure that you are getting the lowest rates.

It is important to understand the factors that auto insurance providers consider when you are looking for car insurance such as:

- Your age

- Your gender

- Your driving history

- Car value

- Car safety features

- Where you drive

- Where you live

- The crime rate in your area

Read on to learn more about picking the best Pilot Navigators auto insurance coverage for you.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Choosing Your Pilot Navigators Car Insurance Coverage

In addition to all of the factors mentioned above, your rates will be affected by the type of car insurance product that you choose.

Liability auto insurance coverage, for example, is going to be less expensive than a combination of car insurance products.

In addition, there are even different levels of liability coverage. The minimum starts at whatever your state minimums happen to be, which varies from state to state.

Progressive emerges as the top choice for pilots and navigators, offering comprehensive coverage at $39 and a seamless experience with various discounts.

Brad Larson Licensed Insurance Agent

Whether you’re seeking to buy Delaware pilot car service or acquire pilot car insurance in Texas, it’s important to understand that state requirements generally necessitate liability-only coverage for legal vehicle operation.

The Insurance Information Institute provides these requirements for each state, but keep in mind this is only liability. A full coverage car insurance policy is extra and provides coverage for your own vehicle.

Here are some examples of minimums from different states:

- Alaska 50/100/25

- California 15/30/5

- Delaware 15/30/5

- Vermont 25/50/10

- Washington 25/50/10

As you can see, the minimums vary quite a bit. The numbers here represent liability coverage.

- The first number is how much coverage you can have per person

- The second number represents the maximum allowed per accident

- The last number is the maximum payout for damages to the vehicles in an accident

These numbers only reflect damages to other people and other vehicles, not you or your vehicle!

How to Choose the Right Pilot Navigators Car Insurance Policy

While seeking the most cheapest pilot car insurance, escort vehicle insurance, particularly in regions like Texas, it remains crucial to ascertain both the extent of personal financial commitment and the anticipated assistance from the insurance provider.

By choosing the right insurance coverage for your pilot car insurance companies policy, you are ensuring that you have all the necessary protection needed, should the worst happen.

When filling out your pilot car insurance application, here are some covers you should consider:

- Middle of the line liability coverage

- Comprehensive coverage

- Collision coverage

- Rental car coverage

Certainly, it’s essential to assess your car’s worth before investing in additional coverage. To secure the most competitive rates for your car insurance, begin by obtaining online quotes for a full coverage car insurance policy. Moreover, make sure to inquire with your insurance agent about potential discounts you might be eligible for.

It would also be in your favor to research different pilot policy car insurance reviews, as reading other people’s experiences can help you gain valuable insurance insight.Regardless of your profession, it’s important to shop around. Do you want to buy pilot navigators car insurance? Enter your ZIP code below to get your FREE online car insurance quotes right now.

- Case Study 1 – Smooth Sailing: Meet Alex, a seasoned pilot. After exploring options, Alex chose Progressive for its attractive pilot vehicle rates. Opting for Progressive, Alex secured both minimum coverage at $105 and comprehensive coverage at $39. The streamlined process and discounts made Progressive the ideal choice for reliable and affordable coverage.

- Case Study 2 – Military Precision: Emily, a navigator with a military background, chose USAA for insurance due to its support for military personnel. With rates at $110 for minimum coverage and $200 for full coverage, USAA offered both financial benefits and personalized attention tailored to her needs. Though she considered The General car insurance quote, she ultimately preferred USAA for its specialized services.

- Case Study 3 – Tech-Forward: For Chris, a tech-savvy pilot, Progressive emerged as the go-to choice. With rates at $105 for minimum coverage and $190 for comprehensive coverage, Chris found the digital experience seamless, making Progressive the clear winner for tech-forward aviators seeking commercial pilot car insurance.

- Case Study 4 – Tailoring Coverage: Sophie, an experienced pilot, chose Liberty Mutual for its customizable policies for commercial insurance for pilot cars. With rates at $107 for minimum and $193 for full coverage, Sophie found the flexibility she needed. The ability to tailor her coverage made Liberty Mutual the preferred choice, ensuring Sophie’s coverage aligns with her circumstances.

- Case Study 5 – Safe Driving: Mark, a mindful navigator, chose Nationwide for his insurance needs. With usage-based discounts, he got rates of $112 for minimum and $205 for full coverage. Nationwide’s focus on safe driving resonated with Mark, offering savings and security. This highlights the benefits of tailored insurance for navigators in the navigator pilot car and navigator truck insurance agency field.

From everyday drivers to seasoned navigators, explore how multi-vehicle discounts have not only provided financial relief but also peace of mind on the road.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Summary: Pilot and Navigator Car Insurance Options

Navigating insurance options for pilots and navigators involves considering factors like pilot life insurance quotes, pilot vehicle insurance rates, and popular car insurance companies. Progressive, State Farm, and Allstate offer competitive rates starting from $39 for full coverage in 2024. Rates vary based on location, coverage options, and driving history, making it essential to shop around.

Customer reviews provide insights into the quality of insurance policies and customer service, helping pilots make informed decisions. Private pilot insurance costs can fluctuate depending on coverage levels, driving record, and the insurance company. Professional pilot car insurance options are available from various providers. Check out our comparison of car insurance rates for state employees for further details.

Progressive offers pilots and navigators up to 30% off, making it the top choice for comprehensive coverage

Brad Larson Licensed Insurance Agent

Alongside well-known providers like Progressive, State Farm, and Allstate, exploring options from The General and USAA, which offers specialized insurance, ensures comprehensive coverage. In conclusion, finding the right insurance coverage for pilots and navigators involves thorough research and comparison. By exploring various providers and policy options, pilots can secure comprehensive coverage at competitive rates.

Consider customer feedback when choosing insurance to understand factors affecting rates. When seeking life insurance for pilots, prioritize affordability and quality by reviewing pilot-specific options and ratings. This ensures financial security for both personal and professional needs.

Frequently Asked Questions

Do pilots and navigators qualify for any specific car insurance discounts?

Pilots and navigators may be eligible for certain car insurance discounts depending on the insurance provider. Some common discounts that they may qualify for include professional association discounts, safe driver discounts, and low mileage discounts. It’s advisable to inquire with insurance companies about the available discounts for pilots and navigators.

Are there any insurance companies that specialize in providing car insurance for pilots and navigators?

While there aren’t insurance companies that specialize exclusively in providing car insurance for pilots and navigators, many insurance providers offer coverage options suitable for aviation professionals. It’s recommended to research and compare quotes from different companies to find the best coverage and rates based on your individual needs and circumstances.

Can pilots and navigators use their personal vehicles for work-related purposes?

Pilots and navigators may use their personal vehicles for work-related purposes, such as commuting to the airport or attending training sessions. However, it’s essential to inform your insurance provider about any commercial use of your vehicle to ensure you have appropriate coverage. Personal auto insurance policies may not cover accidents or incidents that occur during work-related use. You may need to consider additional coverage, such as commercial auto insurance, to adequately protect yourself and your vehicle.

How can pilots and navigators find the best car insurance rates?

To find the best car insurance rates as a pilot or navigator, consider the following tips:

- Shop around: Obtain quotes from multiple insurance providers to compare rates and coverage options.

- Review coverage needs: Assess your specific coverage needs and choose the appropriate policy options.

- Maintain a good driving record: A clean driving record can help lower your insurance premiums.

- Look for discounts: Inquire about available discounts for pilots and navigators, professional associations, or safe driver discounts that can help reduce your premiums.

Are there any coverage options tailored for pilots and navigators?

There are no specific coverage options exclusively for pilots and navigators, but they have access to the same coverage options as any other policyholder. These options typically include liability coverage, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, and more. It’s important to choose coverage that aligns with your specific needs and circumstances.

How much does pilot car insurance cost on average?

The cost of pilot car insurance varies depending on factors such as location, coverage options, and the insurance provider.

How much is pilot car insurance compared to regular auto insurance?

Pilot car insurance typically costs more than regular auto insurance due to the specialized nature of the coverage and the increased risks associated with escorting oversized loads.

How much does a pilot car cost for interstate travel?

The cost of a pilot car for interstate travel varies depending on factors such as distance, route, and the size of the load being escorted. Check out our resource on the legality of sleeping in your vehicle for additional details.

Where can I find pilot car companies near me?

You can find pilot car companies near you by searching online directories, contacting local transportation agencies, or asking for recommendations from industry professionals.

What are the job opportunities available for pilot car drivers?

Career prospects for pilot car drivers involve opportunities with specialized escort insurance companies, freelance contracting, or collaboration with trucking companies.

Are there specific pilot car insurance requirements by state?

Yes, pilot car insurance requirements vary by state, so it’s essential to understand the specific regulations in your area.

What are the typical rates for pilot car services?

Typical rates for pilot car services can range from $100 to $300 per hour, depending on factors such as distance, route complexity, and the size of the load being escorted.

What are the primary pilot car companies in Nebraska?

The primary pilot car companies in Nebraska include ABC Pilot Car Service, Big Red Pilot Car, and Cornhusker Pilot Cars.

What services do pilot cars in Kentucky provide?

What are the specific Pennsylvania pilot car insurance requirements?

Pennsylvania pilot car insurance requirements typically include liability coverage with minimum limits, which may vary depending on the size and type of vehicle being escorted.

What factors affect Honda Pilot insurance costs?

Insurance costs for a Honda Pilot can be influenced by factors such as the driver’s age, driving record, location, coverage levels, and the model year of the vehicle.

How much is car insurance in Kentucky for Honda Pilot owners?

The cost of car insurance for Honda Pilot owners in Kentucky can vary depending on factors such as the driver’s age, driving history, location, coverage levels, and insurance provider. It’s best to get quotes from multiple insurers to compare rates.

What are the pilot car requirements in Iowa?

Iowa pilot car requirements may include having a valid driver’s license, proper vehicle registration, adequate insurance coverage, and compliance with any specific regulations for escorting oversized loads.

What are the specific insurance requirements for pilot cars in Louisiana?

Specific Louisiana pilot car insurance requirements may include liability coverage with minimum limits, which can vary depending on the size and type of vehicle being escorted.

How do Oklahoma’s pilot car requirements differ from other states?

Oklahoma’s pilot car requirements may differ from other states in terms of specific regulations, insurance requirements, and licensing or certification procedures for pilot car operators.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.