Cheap Car Insurance for Women in 2025 (Earn Savings With These 10 Companies!)

The top companies for cheap car insurance for women are State Farm, USAA, and Progressive. Our top pick, State Farm, offers affordable options for women with rates starting from $70/mo. Explore the best deals for cheap car insurance for lady drivers and find the coverage that fits your needs and budget.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Zach Fagiano

Insurance & Finance Analyst

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Insurance & Finance Analyst

UPDATED: Jan 6, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 6, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage for Women

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 6,589 reviews

6,589 reviewsCompany Facts

Min. Coverage for Women

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 13,283 reviews

13,283 reviewsCompany Facts

Min. Coverage for Women

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews

State Farm, USAA, and Progressive are the top choices for cheap car insurance for women. State Farm offers is our top pick because of its comprehensive discounts.

These insurers present some of the cheapest car insurance for ladies, making it easier to find budget-friendly options. It’s important to compare quotes from several options before you make your decision.

Our Top 10 Company Picks: Cheap Car Insurance for Women

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $70 | B | Student Savings | State Farm | |

| #2 | $73 | A++ | Military Savings | USAA | |

| #3 | $76 | A+ | Budget Shopping | Progressive | |

| #4 | $80 | A++ | Federal Discounts | Geico | |

| #5 | $83 | A+ | Deductible Options | Nationwide |

| #6 | $85 | A | Safety Discounts | Farmers | |

| #7 | $87 | A+ | UBI Savings | Allstate | |

| #8 | $90 | A | Discount Options | American Family | |

| #9 | $97 | A+ | Youth Discounts | Erie | |

| #10 | $100 | A | Add-on Options | Liberty Mutual |

Comparing quotes will help you take advantage of discounts and save money to get the coverage you need at a price that fits your budget. Find cheap car insurance quotes by entering your ZIP code above.

- State Farm offers the cheapest car insurance for women

- Women pay around 5% less than men on average for auto insurance

- A clean driving record can lead to below-average car insurance rates

#1 – State Farm: Top Pick Overall

Pros

- Generous Travel Coverage: Offers extensive coverage for travel expenses and rental cars.

- Strong Customer Service: Robust customer service survey results indicate high satisfaction. Learn more in our State Farm review.

- High Customer Loyalty: Scored high for customer loyalty, showing trust and satisfaction.

Cons

- Higher Premiums for Adults: Adult drivers’ sample premiums are higher than average.

- Mixed Reviews: Customer reviews of State Farm insurance are varied.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Savings

Pros

- Affordable Rates: USAA offers competitive pricing, often lower than many other insurers.

- Military Savings: USAA offers significant discounts and benefits tailored specifically for military members and their families.

- High Customer Satisfaction: Consistently high performance on J.D. Power customer surveys.

Cons

- Membership Required: Before receiving a quote, you must sign up. Check out our review of USAA for more details.

- Higher Rates After DUI: Not the most affordable option for drivers with a DUI.

#3 – Progressive: Best for Budget Shopping

Pros

- Wide Coverage Options: Progressive offers a variety of coverage types and add-ons.

- Usage-Based Discount: Save money with the Snapshot program that rewards safe driving.

- Budget Shopping: Progressive offers competitive rates and a variety of discount options, Learn more in our Progressive review.

Cons

- Snapshot Program Risks: The Snapshot program can raise rates for some drivers.

- Average Customer Service: Progressive has only average ratings for customer service.

#4 – Geico: Best for Federal Discounts

Pros

- Competitive Rates: Rates below the national average in most categories, including for drivers with a speeding ticket or accident on their record. Learn more about rates in our Geico review.

- Federal Discounts: Geico offers special discounts for federal employees

- Non-Owner Policies: Offers non-owner policies and files SR-22s.

Cons

- No Rideshare Insurance: Geico does not offer insurance coverage for rideshare drivers.

- No Gap Insurance: Geico does not provide gap insurance for new car owners.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Deductible Options

Pros

- Multiple Discounts: See how much you can save on your auto insurance rates with Nationwide car insurance discounts in our guide.

- Competitive Rates: Great rates for drivers with speeding tickets and those with poor credit.

- Deductible Options: Nationwide allows policyholders to choose from various deductible amounts.

Cons

- Higher Costs: Higher average insurance costs compared to some competitors.

- Discounts: Did not score well for available discounts.

#6 – Farmers: Best for Safety Discounts

Pros

- Many Discount Opportunities: Farmers offers numerous discounts to help lower premium costs.

- Well-Reviewed Mobile App: The Farmers mobile app is highly rated for its user-friendly interface and features.

- Safety Discounts: Farmers offers a variety of discounts for safe driving, including rewards for maintaining a clean driving record, completing driver safety courses, and installing safety features in your vehicle.

Cons

- Premiums Can Be High: Farmers’ premiums are higher than average in some states. Learn more about rates in our Farmers review.

- Mixed Customer Service Reviews: Customer experiences with Farmers’ service are inconsistent.

#7 – Allstate: Best for UBI Savings

Pros

- Higher Driver Tracking Satisfaction: Higher satisfaction ratings for the driver tracking program compared to many insurers.

- Low Premiums for Poor Credit: Affordable premiums for drivers with poor credit.

- Easy Plug-In Device: Simple and user-friendly plug-in device for tracking. Discover more in our Allstate Milewise review.

Cons

- Low Customer Loyalty: Low satisfaction rates for customer loyalty and likelihood to recommend or renew.

- Expensive for High-Mileage Drivers: Higher premiums for drivers who log a lot of miles.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#8 – American Family: Best for Discount Options

Pros

- Several Car Insurance Discounts: Offers numerous discounts to help lower premiums.

- Many Add-On Coverage Options: Provides a wide range of optional coverages to customize your policy.

- Affordable Policy Choices: Competitive rates for various driver profiles. Read our American family car insurance review for more information.

Cons

- Poor Customer Reviews: Receives low ratings from the Better Business Bureau (BBB) and Trustpilot.

- Average Collision Repair Scores: Rated only a C+ by collision repair professionals.

#9 – Erie: Best for Youth Discounts

Pros

- Youth Discounts: Erie offers substantial discounts for young drivers, including good student discounts, driving training discounts, and discounts for young drivers who maintain a clean driving record.

- Offers Gap Insurance: Provides gap insurance to cover the difference between the car’s value and the amount owed on the loan.

- Rate Lock Feature: Erie’s Rate Lock keeps your premium consistent year after year, helping with budgeting. Find out more about Erie’s rating in our Erie car insurance review.

Cons

- High Rates for Bad Credit: Erie tends to have higher premiums for drivers with poor credit.

- No Usage-Based Insurance: Erie does not offer a usage-based insurance option for drivers looking to save based on driving habits.

#10 – Liberty Mutual: Best for Add-on Options

Pros

- Excellent Financial Ratings: Liberty Mutual has strong ratings from AM Best and the BBB.

- Numerous Discounts: Offers a wide range of discounts. See what discounts are offered in our Liberty Mutual review.

- Variety of Coverage Options: Provides a variety of car policies and add-on coverage.

Cons

- Premiums Can Be High: Liberty Mutual’s rates are often higher than average compared to other insurers.

- Middling Claims Ratings: Customer service and claims handling receive mixed reviews.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Where Women Can Find Cheap Car Insurance

You should shop and compare car insurance quotes from several companies to find the cheapest coverage options for women in your area.

Car Insurance for Women: Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $87 | $125 |

| American Family | $90 | $130 |

| Erie | $97 | $135 |

| Farmers | $85 | $120 |

| Geico | $80 | $110 |

| Liberty Mutual | $100 | $140 |

| Nationwide | $83 | $115 |

| Progressive | $76 | $105 |

| State Farm | $70 | $95 |

| USAA | $73 | $100 |

While your gender may have an impact on your insurance rates, other factors, like your age, location, driving history, and credit score may make more of an impact on your monthly or annual insurance payments.

How To Find Affordable Car Insurance as a Woman

To find the most affordable car insurance rates in your area, you should compare car insurance rates for women with multiple insurance companies.

On average, State Farm offers the cheapest car insurance coverage for women. In some cases, State Farm provides rates that are 30% cheaper than rates with other auto insurance companies.

State Farm charges $70 per month for auto insurance for women. USAA is next, charging around $73 each month. Rates are around $76 per month for women with Progressive and $80 monthly with Geico.

Read more: Compare Single-Mother Car Insurance Rates

Cost of Car Insurance for Teen Girl Drivers

Teen drivers pay more for car insurance than any other demographic due to a lack of experience and being more of a risk behind the wheel.

Teen Full Coverage Car Insurance Monthly Rates by Provider & Gender

| Insurance Company | Female Teen | Male Teen |

|---|---|---|

| Allstate | $608 | $638 |

| American Family | $414 | $509 |

| Farmers | $810 | $773 |

| Geico | $297 | $312 |

| Liberty Mutual | $722 | $785 |

| Nationwide | $411 | $476 |

| Progressive | $801 | $814 |

| State Farm | $310 | $349 |

| Travelers | $719 | $910 |

| USAA | $245 | $249 |

| U.S. Average | $566 | $618 |

With State Farm, teen boy drivers pay $4,205 annually or $350 each month for auto insurance, while teen girls pay $3,347 annually or $279 monthly. The cost of car insurance is higher for teenage boys than teenage girls, but some companies charge higher rates for women.

For example, in the teen driver category, Geico charges slightly more for women than men. Teen girls pay $4,794 annually or $400 per month, while teen boys pay $4,718 annually or $393 each month. With Progressive, teen male drivers pay $5,316 annually or $443 monthly, while females pay $4,786 annually or $399 per month.

Teen girls and boys pay the same rates for coverage with Allstate. Teen drivers pay $5,543 annually or $462 monthly with the company. Learn how to compare car insurance rates for teen drivers.

Best Cheap Car Insurance Company for New or Young Women Drivers

The average car insurance for a 17-year-old female is $4,618 annually or $385 per month. Still, some companies offer cheaper rates for this demographic.

State Farm offers the cheapest rates for new women drivers, charging $70per month.

However, rates for teen and young adult drivers can be expensive, so it’s important to shop online and compare quotes from multiple insurance companies before committing to a policy.

If you are a teen or young adult driver, you may save money by joining your parent or guardian’s policy. In addition, most companies charge less for auto insurance coverage if you join another adult’s policy rather than purchasing your own. Compare joint ownership car insurance to find the best rates.

You may be eligible for a good student discount or discounts based on memberships and affiliations that could help you save more on your coverage.

Kristen Gryglik Licensed Insurance Agent

Additionally, some insurance companies offer discounts to people who take a defensive driving course.

As stated earlier, State Farm offers the cheapest car insurance for young female drivers under 25. The average cost for a 24-year-old female driver is $2,159 annually or $180 each month. State Farm charges $1,457 annually or $121 per month for the same age group.

If you’re under 25, you’re well aware that your car 🚘insurance premiums are ridiculously expensive💵. You have options, though. https://t.co/27f1xf1ARb has a list of the best providers for you, and you can find it here👉: https://t.co/F7B9diMpnj pic.twitter.com/Jmdzov0wIr

— AutoInsurance.org (@AutoInsurance) April 30, 2024

Read more: State Farm Car Insurance Discounts

Young adult female drivers typically pay less for car insurance than young adult male drivers, though it varies from one insurance company to the next.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Cost of Car Insurance for Women Over 50

Women over 50 may pay less for coverage than men of the same age group, though it’s not nearly as noticeable as male and female teen rates.

Full Coverage Car Insurance Monthly Rates for 55-Year-Olds by Provider & Gender

| Age and Gender | Female (Age 55) | Male (Age 55) |

|---|---|---|

| Allstate | $153 | $152 |

| American Family | $109 | $111 |

| Farmers | $132 | $131 |

| Geico | $76 | $76 |

| Liberty Mutual | $162 | $165 |

| Nationwide | $107 | $109 |

| Progressive | $106 | $100 |

| State Farm | $82 | $82 |

| Travelers | $93 | $94 |

| USAA | $56 | $56 |

| U.S. Average | $113 | $113 |

If you’re a female over 50, you may want to get quotes from State Farm first. The company offers cheaper rates to women than many other well-known insurance companies on average. Monthly rates for minimum coverage with State Farm cost $70 per month. Read our best car insurance for 50-year-olds guide to learn more.

Best Car Insurance Company for Single Women

Your marital status and your age can significantly impact your car insurance rates. In fact, car insurance rates may be higher for singles versus married couples.

State Farm rates do not vary based on your marital status, while rates with Geico vary up to 4%, and Allstate’s rates vary around 2%.

Therefore, State Farm might be a good option for single women who do not want their marital status negatively impacting their auto insurance rates.

Learn more about the cost of married car insurance versus single car insurance.

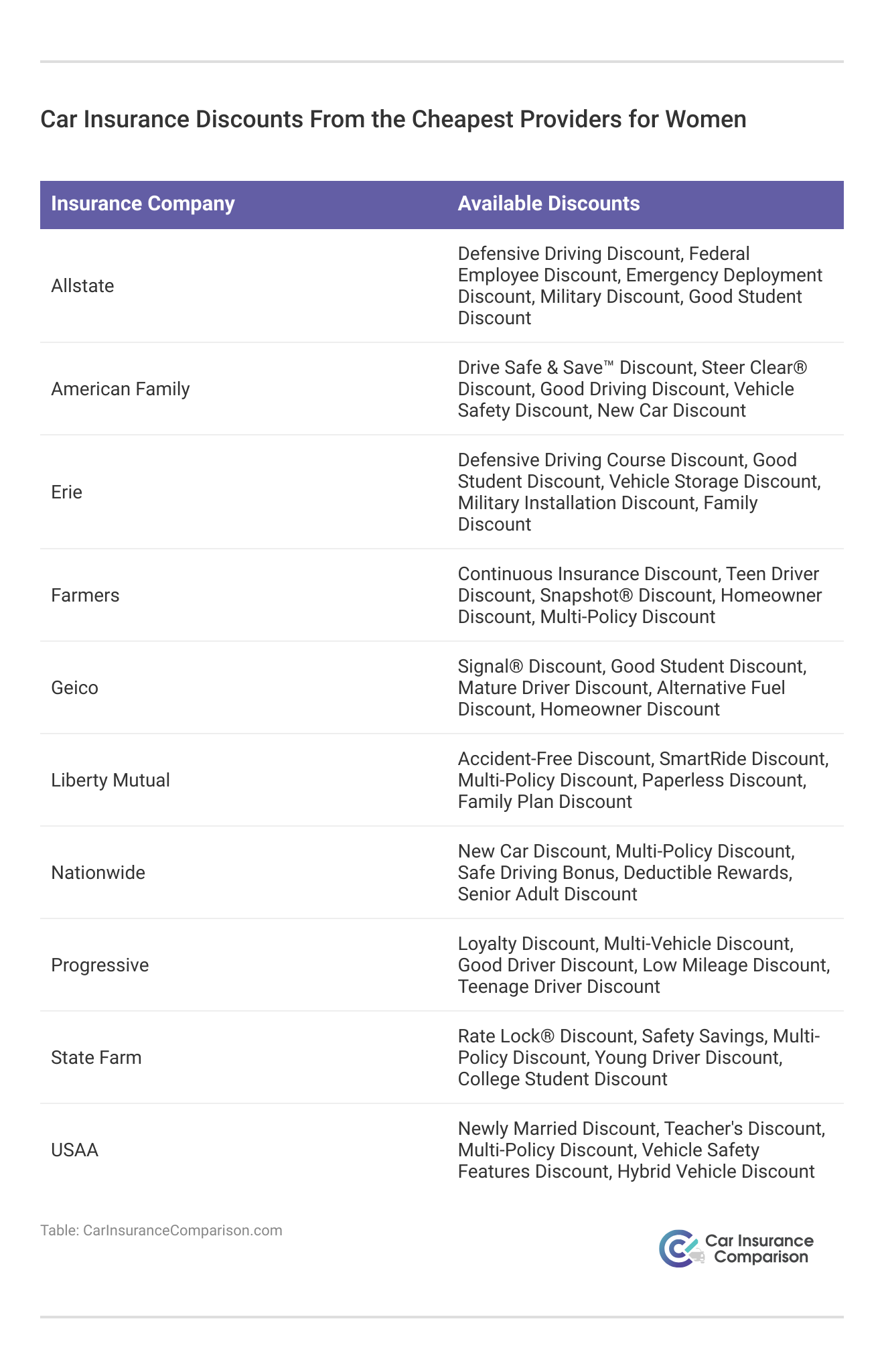

Specific Car Insurance Discounts for Women

Women may be eligible for certain car insurance discounts that could help decrease their overall coverage rates. Some of the most common discounts include:

- Group affiliation

- Multi-policy

- Defensive driving

- Equipment

- Safety devices

- Good driver

- Military

- Multi-car

- Preferred payment

- Good student

If any discount opportunities might work for you, speak with your insurance company to learn how much you could save on coverage.

Some companies allow people to save up to 25% with auto insurance discounts, which could significantly impact your overall auto insurance rates.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Other Ways for Women To Save Money on Coverage

Here are some ways to save money on car insurance as a woman.

Lower Your Coverage Amount

If you have a full coverage policy, you could change to a liability-only policy to save money on your rates. However, keep in mind that minimum coverage does not protect you or your vehicle if you’re at fault in an accident.

Avoid Filing Claims

With a clean driving record, you should pay less for your car insurance. If you have a minor accident or your vehicle is slightly damaged, consider paying for repairs out of pocket instead of filing a claim. Doing so could help you save money on your rates in the future.

Compare Rates

Find and compare rates with other companies to ensure you are not overpaying for your coverage. If you have auto insurance, compare rates with other companies at least once a year to find the cheapest car insurance in your area.

How Much Gender Matters for Car Insurance Rates

In the grand scheme, your gender is not the most important factor insurance companies consider when developing auto insurance rates. The factors that affect car insurance rates may include:

- Age

- Driving record

- Car make and model

- Credit score

- Marital status

Your driving history typically has the biggest impact on your car insurance rates. If you have a clean driving record, you can expect cheaper rates. Similarly, you will pay more for your coverage if you have an at-fault accident or multiple infractions on your driving record.

Full Coverage Car Insurance Monthly Rates by Driving Record & Provider

| Insurance Company | Clean Record | One Ticket | One DUI | One Accident |

|---|---|---|---|---|

| Allstate | $166 | $195 | $303 | $237 |

| American Family | $116 | $131 | $177 | $167 |

| Farmers | $140 | $176 | $191 | $199 |

| Liberty Mutual | $177 | $217 | $325 | $237 |

| Nationwide | $120 | $145 | $252 | $165 |

| Progressive | $109 | $143 | $147 | $190 |

| State Farm | $91 | $102 | $124 | $107 |

| Travelers | $107 | $148 | $230 | $157 |

| U.S. Average | $123 | $152 | $218 | $177 |

Rates could increase as much as 48% for young adult drivers, regardless of gender, if they have an at-fault accident on their record.

Why Car Insurance Is Cheaper for Women

Most companies charge higher rates for men because of the statistical correlation between male drivers and an increase in car insurance claims.

Men drive more miles on average than women, making them more likely to get into an accident. Additionally, young men are more likely to be involved in an accident and make a car insurance claim.

Discover cheap car insurance for young male drivers in our detailed guide.

Statistics prove that men are more likely to engage in risky driving behaviors, like speeding and driving under the influence. Because of this, auto insurance companies offset some of the risks of payouts by charging men more for auto insurance coverage.

Why Companies Use Gender To Determine Rates

As stated previously, men are more likely to be in a car accident and file a claim. Insurance companies increase men’s rates slightly to offset the increase in claims and payouts. Not all insurance companies charge rates based on gender, and the difference decreases substantially for individuals over 25.

Certain states — Hawaii, Pennsylvania, North Carolina, California, and Montana — do not allow insurance companies to change rates based on a person’s gender. Read more: Compare California Car Insurance Rates

States That Charge the Same Amount for Car Insurance for Men and Women

The following states do not increase rates for men:

- Michigan

- California

- Hawaii

- Massachusetts

- Montana

- North Carolina

- Pennsylvania

If you live in a state that is not included in the list, speak with your insurance provider to learn whether your gender impacts your rates.

Read more: Compare Male vs. Female Car Insurance Rates in Florida

Comparison of Insurance Costs Between Men and Women

Men pay more for auto insurance on average, though it depends on the company as to the difference a person’s gender makes.

As you age, your gender is less likely to impact your car insurance rates. For example, a 17-year-old male driver pays $328 more annually for car insurance, while a 65-year-old male pays just $37 more on average. Find the best car insurance for 17-year-olds in our guide.

Car Insurance Rates for Women: The Bottom Line

Women tend to pay less than men for car insurance, but rates are still impacted by location, driving history, credit score, and more.

Learn more: Best Car Insurance Companies That Don’t Use Credit Scores

If you want cheaper car insurance as a female, you can shop online and compare rates with multiple companies. Doing so should help you find the coverage you are looking for at a price that fits your budget. Take the first step toward cheaper car insurance rates. Enter your ZIP code below to see how much you could save.

Frequently Asked Questions

Where can women find cheap car insurance?

Women should shop and compare car insurance quotes from several companies to find cheap car insurance companies in their area.

How can I find affordable car insurance as a woman?

To find affordable car insurance rates, women should compare quotes from multiple insurance companies.

How much is car insurance for teen girl drivers?

Teen girl drivers generally pay more for car insurance than any other demographic due to a lack of experience and higher risk.

What car insurance covers do women need?

Women need the same types of car insurance coverage as men, including liability car insurance, collision, comprehensive, and uninsured/underinsured motorist coverage. However, some insurers offer car insurance for women with specific discounts or benefits tailored to female drivers. Women’s car insurance may include perks like lower rates for safe driving, accident forgiveness, and roadside assistance. Additionally, some policies offer coverage for personal items or customized insurance packages.

How much is car insurance for women over 50?

Car insurance rates for women over 50 may be lower than men of the same age group, but it varies depending on the insurance company.

Are there benefits to taking out a car insurance policy for women?

Yes, there are benefits to taking out a car insurance policy for women. Women’s car insurance often comes with discounts for safe driving and lower rates due to statistically fewer accidents. Some insurers offer specialized benefits in car insurance for women, such as accident forgiveness and enhanced roadside assistance.

How much is the cheapest car insurance in the USA?

State Farm offers the cheapest car insurance for women in the USA, costing $70 per month. This low-cost car insurance provides affordable coverage options. Women seeking cheap car insurance for women can benefit from State Farm’s competitive rates. Compare U.S. car insurance rates here.

Which is the best car insurance for women?

State Farm offers the best car insurance for women. It offers comprehensive coverage options and competitive rates, making it an ideal choice for ladies’ car insurance. State Farm’s strong customer service and extensive network ensure reliable support. For those seeking car insurance for ladies, State Farm is a top recommendation.

Which is the most affordable car insurance for women?

The most affordable car insurance for women is typically offered by State Farm. It provides competitive rates and comprehensive coverage, making it a popular choice for cheap car insurance for women. For budget-conscious women seeking reliable coverage, State Farm is a top option.

How can I save on car insurance?

Consider looking for women’s discount car insurance programs to save on car insurance. Many insurers offer specific discounts for car insurance for women, such as safe driver discounts or lower rates for low-mileage drivers.

Additionally, bundling your car insurance with other policies like home or renters insurance can provide further savings. Maintaining a good credit score and shopping around for the best rates are also effective ways to reduce costs. Check out our ranking of the best companies for bundling home and car insurance for more information.

At what age does a female driver’s car insurance go down?

A woman’s car insurance typically starts to decrease between the ages of 21 to 25. This reduction is due to increased driving experience and a lower risk of accidents. By maintaining a clean driving record, women can see further reductions in their car insurance premiums as they age.

Which company offers the best cheap car insurance for new or young women drivers?

State Farm offers competitive rates for new and young women drivers, but it’s important to compare quotes from multiple insurance companies.

What is the cheapest car insurance for women under 25?

The cheapest car insurance for women under 25 typically comes from State Farm, USAA, and Progressive. These companies are known for offering competitive rates for young female drivers. State Farm provides affordable options with various discounts.

USAA offers low rates for military members and their families. Progressive is known for its competitive pricing and discount opportunities. Read more: Best Car Insurance for Drivers Under 25

What is the best car insurance for single females?

The best car insurance for single females includes State Farm, Geico, and Travelers. These providers offer competitive rates and reliable coverage options, making them popular choices for cheap car insurance for girls. They also provide good customer service and various discounts.

Which age group pays most for car insurance?

The age group that pays the most for car insurance is 16-24. Young drivers in this age range are considered high-risk due to their lack of driving experience and higher likelihood of accidents.

As a result, insurers charge higher premiums to offset the increased risk. This trend usually starts to decrease as drivers gain more experience and reach their mid-20s. Learn more about high-risk car insurance in our article.

Our free online comparison tool below allows you to compare cheap car insurance quotes instantly — just enter your ZIP code to get started.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Zach Fagiano

Insurance & Finance Analyst

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Insurance & Finance Analyst

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.