Best Loyalty Car Insurance Discounts in 2025 [Save up to 20% With These Companies]

State Farm, Geico, and Allstate have the best loyalty car insurance discounts, with up to 20% savings. To qualify, you must stay with the same provider for a while, keep an active policy, and have a clean driving record. Compare quotes to ensure you're getting the best discounts for customer loyalty.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Licensed Agent & Financial Advisor

UPDATED: Jun 26, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jun 26, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

State Farm, Geico, and Allstate have the best loyalty car insurance discounts with savings of up to 20%.

With prices increasing on virtually everything these days, it is more important than ever to save money on car insurance whenever and wherever possible.

Loyalty discounts are a simple way to reduce your premiums and keep more money in your pocket, especially if you’ve been with your insurer for a few years.

Our Top 10 Company Picks: Best Loyalty Car Insurance Discounts

| Company | Rank | Savings Potential | A.M. Best | Tenure Needed |

|---|---|---|---|---|

| #1 | 20% | B | 5+ Years | |

| #2 | 15% | A++ | 3+ Years | |

| #3 | 10% | A+ | 3 Years | |

| #4 | 10% | A+ | 4 Years | |

| #5 | 10% | A+ | 5 Years |

| #6 | 10% | A | 3 Years | |

| #7 | 7% | A | 3 Years |

| #8 | 5% | A++ | 4 Years | |

| #9 | 5% | A+ | 4 Years |

| #10 | 5% | A | 3 Years |

Want to see how much you could save with a loyalty discount? Enter your ZIP code into our free comparison tool to compare rates from top providers and start saving on your car insurance today.

- Several large insurance companies offer loyalty rewards programs

- Drivers can save with loyalty rewards, safe driving, referrals, and more

- Bundling policies is another way insurers reward loyalty with savings

How to Qualify for Loyalty Car Insurance Discounts

If you’ve been with your car insurance company for a while, you might be missing out on some serious savings. Loyalty discounts are one way to lower the cost of your insurance just by sticking around.

Stay With Your Insurer for a Few Years

Car insurance companies like having long-term customers and are often willing to reward loyal policyholders by offering them discounted rates.

Generally, you’ll need to stay with your insurer for at least 3 to 5 years to qualify. The longer you remain a customer, the more opportunities you may have to access these discounts.

An auto insurance loyalty rewards program may convince customers to stay with their current car insurance company rather than switch to another.

Keep Your Policy Active

Loyalty discounts aren’t just about staying with the same company—they’re also about consistency. If your policy lapses, even temporarily, you may become disqualified from earning those savings.

Insurance companies look for uninterrupted coverage as a sign of reliability, so always renew your policy on time and avoid lapses in coverage for lower rates.

Maintain a Safe Driving Record

Insurance companies appreciate customers who are both loyal and safe drivers. If you’ve been with the same insurer for years and have a clean driving record, you’re more likely to be rewarded with loyalty discounts. Staying accident-free will help you lower your car insurance rates.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Car Insurance Companies Offering the Best Loyalty Car Insurance Discounts

Insurance companies that offer car insurance loyalty rewards programs include State Farm, Geico, Allstate, and Progressive.

For example, when drivers switch to get Progressive loyalty rewards, it will honor the time they spent with a previous insurer with a discount. This amount will vary based on how long you’ve been continuously insured.

You can save when you have two or more State Farm policies, such as auto and home insurance. And you can also qualify for multi-car discounts when you have more than one vehicle on your policy.

So, how much can you expect to pay after applying your loyalty discount? Take a look at the table below for a comparison of the top 10 providers and their rates with a loyalty discount applied:

Top Loyalty Savings: Auto Insurance Monthly Rates With Discount

| Insurance Company | Before Discount | After Discount |

|---|---|---|

| $340 | $313 | |

| $325 | $286 | |

| $330 | $294 | |

| $300 | $255 | |

| $360 | $328 |

| $325 | $280 |

| $310 | $279 | |

| $320 | $282 | |

| $350 | $305 | |

| $340 | $306 |

At Nationwide, drivers may qualify for several discounts, including the Safe Driver program that rewards regular customers with at least five years of safe driving, including no at-fault accidents or major violations.

Nationwide also offers a bundling savings plan that can save people up to $646 for combining home and auto insurance, a usage-based insurance program, and a SmartMiles discount that offers a flexible monthly rate based on how many miles you drive. Check out our guide on Nationwide car insurance discounts for more details.

Customer loyalty discounts at Geico can be earned by insuring more than one car with the company — this can save you up to 25% on most car insurance coverage. There is also a multi-policy car insurance discount when you insure your car along with a homeowners, renters, condo, or mobile home policy.

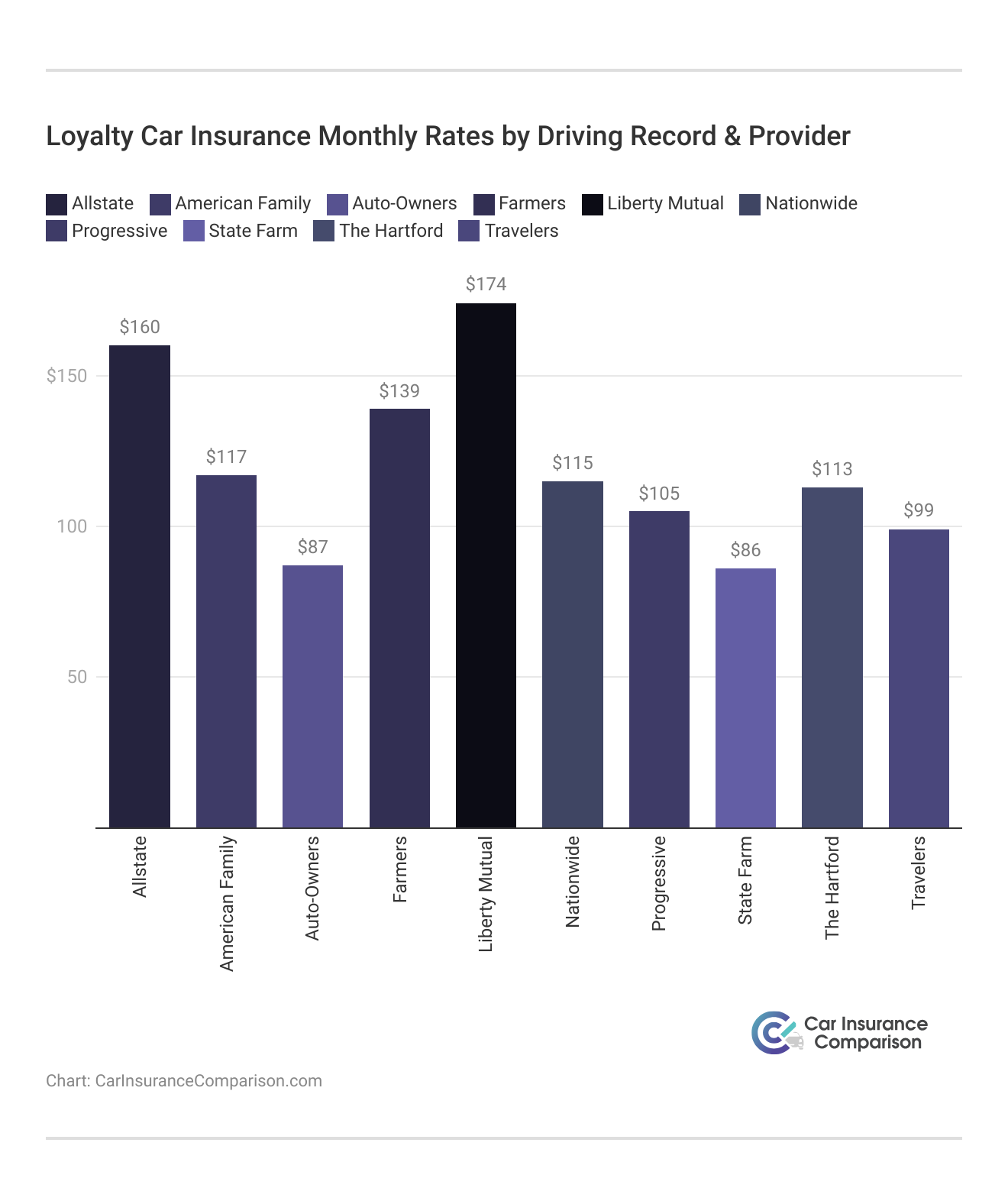

Average Cost of Auto Insurance

The cost of car insurance can vary significantly based on your driving record, the type of coverage you need, and other factors like your location and the insurer you choose. Loyalty discounts can lower your rates, but it’s essential to understand how different driving behaviors affect premiums.

For example, if you have a clean driving record, you’ll likely pay less for insurance than someone with an accident or DUI on their record.

Below is a comparison of average auto insurance rates from our top ten car insurance providers, showing how different driving histories can impact your rates. The table illustrates typical rates for drivers with a clean record, one accident, one DUI, and one ticket.

As you can see, a clean driving record typically results in the lowest rates across most providers. However, a single accident, DUI, or ticket can significantly increase your premiums. The impact on your rates depends on the severity of the violation and your insurer’s policies.

Read More: Factors That Affect Car Insurance Rates

For instance, if you’re a safe driver with no accidents or violations, you’re in a good position to take advantage of loyalty discounts and other cost-saving options, such as bundling or multi-car discounts. However, even with a clean record, rates can vary depending on your insurance provider’s discounts.

If you’ve had an accident, ticket, or DUI, your rates will likely be higher. The good news is that many insurers, such as Progressive, Nationwide, and Geico, may still offer loyalty discounts to help mitigate the cost.

Over time, your premiums may decrease as you maintain a clean driving record and continue your relationship with the insurer.

Kristen Gryglik Licensed Insurance Agent

It’s also important to shop around regularly to get the best deal. While a loyalty discount can help lower your premiums, comparing quotes across different providers can help you find even more savings—especially if you’re working to rebuild your driving record.

The Drawbacks of Auto Insurance Loyalty Rewards Programs

While qualifying for a discount on car insurance due to loyalty auto insurance programs is a positive thing, you might be able to find another car insurance provider that offers the same coverage you have now, only at a lower rate.

In other words, just because you have been with the same car insurance company for years and you are pleased with your savings, it does not mean that your insurance company is the best one for your needs or budget.

Several life changes may make a different insurer a better choice for you. Some of these include:

- Moving to a new state

- Adding another person to your insurance policy

- Getting a new car

- Adding a vehicle to your policy

You should evaluate your insurance needs every year to make sure that your current insurer is still the best choice for you.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

How to Join Car Insurance Loyalty Rewards Programs

Since the rules regarding eligibility for auto insurance loyalty rewards discounts differ for each insurance company, it is best to start by contacting your agent, if you have one, or looking at the company’s website for information.

Even if your car insurance company does not offer savings to customers who have been with it for years, you might still qualify for other car insurance discounts.

For example, good driver discounts, good student discounts, referral rewards, and more. Some car insurance companies may also give you a discount for good credit. According to the Federal Trade Commission, car insurance companies will issue lower rates to consumers with good credit, as there’s a correlation between having good credit and being a responsible driver.

Maximizing Your Savings with the Best Loyalty Car Insurance Discounts

Several major companies offer car insurance loyalty rewards programs, and they are an easy way to get savings on your rates. It is worth the time to research which rewards you may qualify for. Even if you have not been with a company for that long, you might still get other savings on your car insurance.

Read More: Compare Ways to Save Money on Car Insurance

Curious how these discounts can work for you? Enter your ZIP code to compare car insurance rates and loyalty programs from the best providers near you.

Frequently Asked Questions

Which companies offer the best loyalty car insurance discounts?

Many people ask, “Which car insurance companies offer loyalty rewards?” Some car insurance companies with loyalty programs include Progressive, Allstate, and Geico. For instance, the Progressive loyalty rewards program allows drivers to save when piggybacking insurance policies or insuring multiple vehicles.

Companies like State Farm also provide loyalty discounts when you meet certain criteria, such as maintaining continuous coverage.

How do auto insurance loyalty rewards programs work?

Car insurance loyalty programs reward long-term policyholders with discounts to encourage them to stay with the same company. These insurance rewards programs might offer reduced premiums, bonus perks, or other incentives based on how long you’ve been a customer.

How can I join car insurance loyalty rewards programs?

Joining an insurance loyalty program depends on your provider’s rules. In most cases, you must maintain an active policy for several years. Want to know if you qualify? Reach out to your insurance agent or check your company’s website for details. If your current insurer doesn’t offer car insurance loyalty discounts, it’s still worth asking about other savings opportunities.

Are there other ways to save on car insurance besides loyalty rewards?

Yes. Insurance rewards programs are just one option. You can also lower your rates by:

- Bundling auto insurance with other policies.

- Maintaining a clean driving record to qualify for safe driver car insurance discounts.

- Opting for usage-based insurance programs.

Exploring these options alongside car insurance loyalty programs can help you maximize your savings.

Which insurance company offers the most discounts?

State Farm, Geico, and Allstate are top insurance companies offering loyalty discounts. State Farm provides discounts for safe driving and bundling policies, while Geico offers savings for insuring multiple cars or bundling policies. Allstate features a Loyalty Rewards Program with perks like accident forgiveness and discounts for long-term customers. To find the best deal, compare the discounts and rates each company offers.

Do insurance companies give loyalty discounts?

Yes, many companies reward long-term customers with car insurance loyalty discounts as a thank-you for sticking around. Companies like Nationwide and Progressive make saving easier with programs tailored to reward consistency. Even if you’re not eligible for a full loyalty discount yet, you might qualify for other perks.

Does Geico give a loyalty discount?

While Geico doesn’t advertise a specific loyalty discount, it does offer other savings that work similarly to car insurance rewards programs. For example, you can save by bundling multiple policies, like combining car and renters insurance. You can also lower your rates by insuring more than one vehicle under the same policy. Read our review of Geico car insurance for more information.

What is the average loyalty discount?

The typical car insurance loyalty discount ranges between 5% and 15%. However, the exact amount depends on factors like how long you’ve been with your insurer and whether you’ve kept your coverage active. Some companies might even offer higher discounts for excellent driving records.

What is a good loyalty rate?

A good loyalty rate is at least 10% off your car insurance premium. Discounts over 15% are considered excellent. To determine whether your insurance loyalty program offers good value, compare your discounted rate to quotes from other companies.

What is the loyalty discount?

A car insurance loyalty discount allows insurers to reward long-term policyholders. It’s often applied as a percentage off your premium and may be combined with other perks, like bundling discounts or safe driver programs, to boost your overall savings.

Why do people leave loyalty programs?

People might leave loyalty programs if they feel the rewards aren’t worth the commitment or if they find better deals elsewhere. Sometimes, they just forget about the benefits or realize that switching to a new provider could save them more money.

Read More: Can I change my car insurance company mid-policy?

Why choose a loyalty program?

Loyalty programs can be a great way to save money over time. You can unlock discounts and other perks by sticking with the same insurance company. These programs often reward long-term customers with lower rates, so if you plan to stay with one insurer, it’s definitely worth considering.

Who qualifies for USAA insurance loyalty discounts?

USAA offers loyalty discounts for long-term customers, as well as for those who bundle policies. If you combine auto insurance with homeowners or renters coverage, you could save up to 10%. Drivers under 25 with a clean record who have stayed on their parents’ policy for at least three years might also qualify for a family discount of up to 10%. You can also save by insuring multiple vehicles under one policy (Read More: Best USAA Car Insurance Discounts).

How do you calculate loyalty discounts in car insurance?

Insurers typically calculate a loyalty discount in car insurance based on how long you’ve been a customer and whether you bundle policies. For example, State Farm’s loyalty discount can be earned by bundling auto and home insurance, offering savings of up to 20%. Loyalty discounts typically range between 5% and 25%, depending on the insurer.

What are the cons of a loyalty program?

While loyalty programs offer savings, they may not always provide the cheapest rates. Sticking with one company for years could mean missing out on lower prices elsewhere, especially if competitors are offering better promotions. Additionally, some loyalty discounts may not offset rate increases over time, so shopping around periodically is important.

Does Allstate have a loyalty discount?

Allstate ended its loyalty rewards program on October 31, 2023. Previously, customers could earn rewards points through the Drivewise program. If you have accumulated points, contact Allstate at 1-800-255-7828 or their rewards vendor to check if you can redeem them or claim any sweepstakes prizes. Check out our guide on the best Allstate car insurance discounts to learn more.

How much can you save with a car insurance loyalty discount?

With a car insurance loyalty discount, you can typically save between 4% and 20%, depending on the insurer and how long you’ve been with them. Don’t miss out on potential savings. Enter your ZIP code into our free comparison tool and compare discounts across leading insurers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Licensed Agent & Financial Advisor

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.