Best Lotus Car Insurance Rates in 2025 (Check Out the Top 10 Companies)

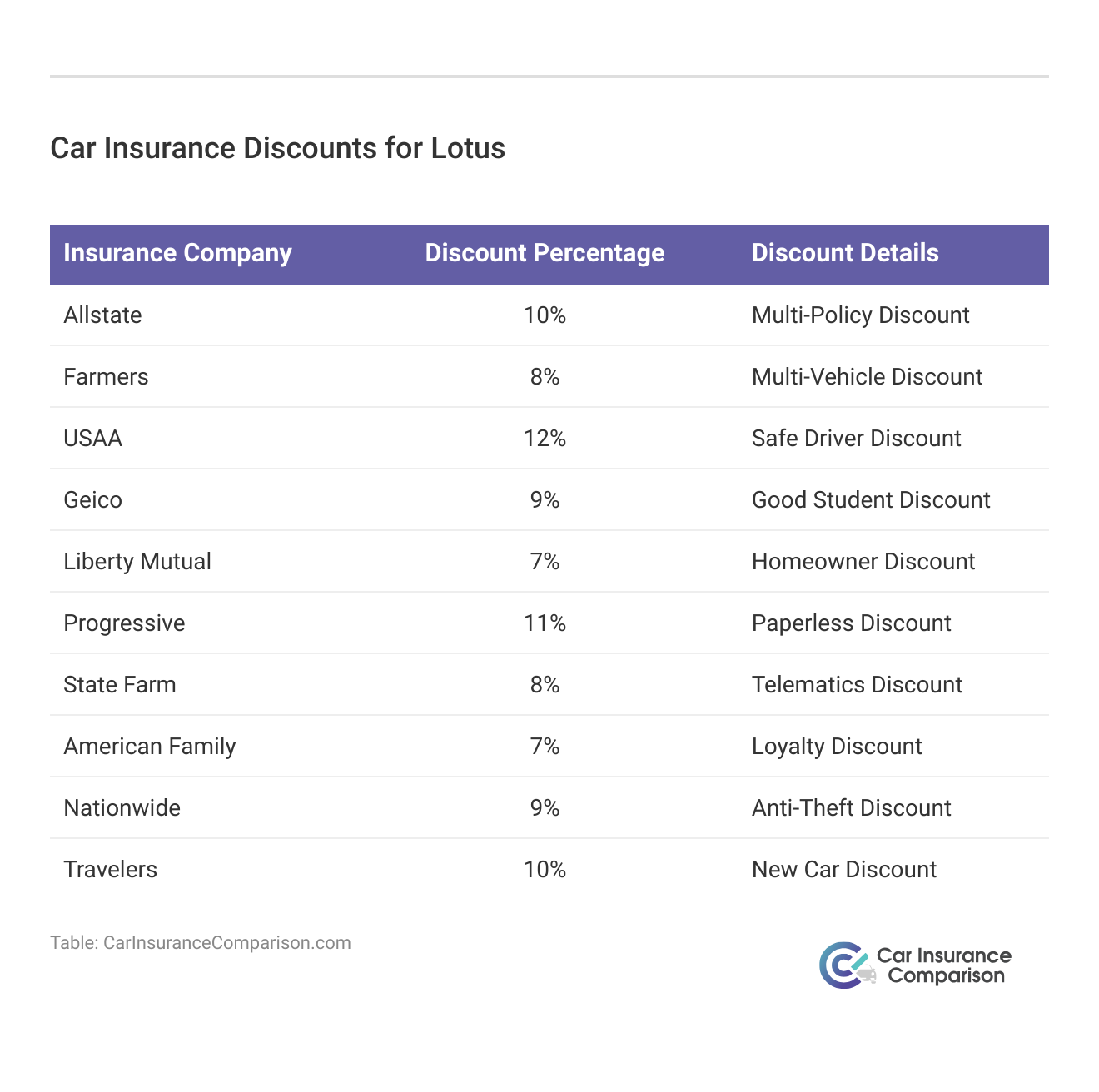

Allstate, Farmers, and USAA have the best Lotus car insurance rates. Allstate's minimum coverage rates for a Lotus average $81/mo, and it offers a 10% discount if drivers insure multiple vehicles. When you compare Lotus car insurance rates to other luxury vehicles, Lotus car insurance is more affordable.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Jul 19, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jul 19, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for Lotus

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 3,072 reviews

3,072 reviewsCompany Facts

Full Coverage for Lotus

A.M. Best Rating

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage for Lotus

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviewsAllstate, Farmers, and USAA have the best Lotus car insurance rates for most drivers.

How do Lotus car insurance rates compare to other cars? Most luxury cars come with higher insurance rates, but that doesn’t seem to be the case for Lotus cars. Rather than paying luxury car insurance prices, most Lotus owners see rates closer to the national average.

Our Top 10 Company Picks: Best Lotus Car Insurance Rates

Company Rank Multi-Vehicle Discount A.M. Best Best For Jump to Pros/Cons

#1 10% A+ Add-on Coverages Allstate

#2 8% A Local Agents Farmers

#3 12% A++ Military Savings USAA

#4 9% A++ Good Drivers Geico

#5 7% A Customizable Polices Liberty Mutual

#6 11% A+ Online Convenience Progressive

#7 8% B Many Discounts State Farm

#8 7% A Student Savings American Family

#9 9% A+ Usage Discount Nationwide

#10 10% A++ Accident Forgiveness Travelers

The best insurance for luxury cars costs more than regular coverage rates. However, there are several other steps you can take to minimize how much you spend on your coverage.

Read on to compare Lotus car insurance rates and learn more about how to maximize your savings, then compare quotes from as many companies as possible with our free quote tool to find a policy that matches the quality of your Lotus.

- Allstate has the best Lotus car insurance rates

- Despite being a luxury car, Lotus car insurance rates aren’t too expensive

- Most Lotus car insurance buyers choose to buy full coverage policies

- Compare Lotus Car Insurance Rates

#1 – Allstate: Top Pick Overall

Pros

- Add-On Coverages: Extras include roadside assistance, rideshare insurance, and more. Read our Allstate review for a full list of coverages.

- Pay-Per-Mile Insurance: A great way to get cheap Lotus auto insurance if drivers have low mileage.

- Usage-Based Discount: Good drivers will get the best Lotus insurance rates at Allstate if they participate in Allstate’s usage-based discount program.

Cons

- Customer Complaints: Customer service isn’t as highly rated as at other companies.

- DUI Rates: Lotus car insurance rates will be much higher for DUI drivers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#2 – Farmers: Best for Local Agents

Pros

- Local Agents: Farmers provides local support in most areas. Read more about its customer service in our Farmers review.

- Signal Discount: Lotus owners could earn reduced rates with their driving skills in the Signal usage-based program.

- New Car Replacement: A good add-on coverage choice for owners of new Lotus vehicles.

Cons

- Young Driver Rates: Lotus drivers under the age of 25 will find Farmers’ rates to be less economical.

- Telematics Tracking: Signal tracks driving data, so Lotus owners need to be comfortable with this.

#3 – USAA: Best for Military Savings

Pros

- Military Savings: USAA offers affordable Lotus car insurance rates to military service members and veterans.

- Customer Service: USAA’s customer service is highly recommended, which you can learn about in our USAA review.

- Youth Discounts: USAA families can save if teen drivers qualify for a good student discount.

Cons

- Add-On Coverages: USAA doesn’t offer as vast a selection as other companies.

- Eligibility: Lotus drivers who aren’t veterans or military won’t qualify for insurance.

#4 – Geico: Best for Good Drivers

Pros

- Good Drivers: Geico offers some of the cheapest Lotus car insurance to good drivers.

- DriveEasy Discount: Earn a discount by joining the DriveEasy program. Learn more in our Geico DriveEasy review.

- Coverage Options: Lotus drivers can choose from several different add-on coverages.

Cons

- Local Agent Availability: Most Lotus owners won’t have access to a local agent.

- Telematics Tracking: Geico’s good driver discount requires data tracking.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for Customizable Policies

Pros

- Customizable Policies: Liberty Mutual has customizable policy options for Lotus owners. Learn more in our Liberty Mutual review.

- Accident Forgiveness: Claim-free Lotus owners may be able to avoid increased rates.

- Discount Options: Lotus owners can get lower rates by applying for discounts.

Cons

- Claims Satisfaction: Liberty Mutual has negative feedback from some customers.

- High-Risk Rates: Lotus auto insurance rates are less competitive at Liberty Mutual if drivers are high-risk.

#6 – Progressive: Best for Online Convenience

Pros

- Online Convenience: Lotus owners will have access to several useful online tools at Progressive, such as a budgeting tool.

- Snapshot Program: A free usage-based discount program for Progressive policyholders.

- Bundling Discount: Lotus owners can also buy home or renters insurance for a discounted rate.

Cons

- Snapshot Rate Increases: Lotus drivers who have poor driving skills may have their rates increased.

- Customer Claim Reviews: Negative reviews have been left after customers filed claims. Learn more in our Progressive review.

#7 – State Farm: Best for Many Discounts

Pros

- Many Discounts: Lotus policyholders can reduce rates with State Farm discounts.

- Local Support: State Farm has a vast network of agents who can assist Lotus policyholders. Learn more in our State Farm insurance review.

- Coverage Options: Choose coverages like roadside assistance for Lotus breakdown assistance.

Cons

- Online Tools: Online functions may be limited due to local agent services.

- Credit Score Rates: Poor credit scores will increase Lotus rates in some states.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#8 – American Family: Best for Student Savings

Pros

- Student Savings: American Family has a few discounts specifically for student drivers.

- Coverage Options: Lotus policies can be tailored according to customers’ needs. Read more in our American Family review.

- Accident Forgiveness: A great saving opportunity for claim-free Lotus drivers.

Cons

- Availability: Coverage is not yet sold everywhere across the U.S.

- DUI Rates: Lotus drivers with a DUI will find rates less cheap.

#9 – Nationwide: Best for Usage Discount

Pros

- Usage Discount: A great way for Lotus drivers to save based on their driving skills.

- Accident Forgiveness: Claims-free drivers may be forgiven accidents and earn additional Nationwide car insurance discounts.

- Pay-Per-Mile Insurance: Great for Lotus owners who travel fewer than 10,000 miles annually.

Cons

- Telematics Tracking: Lotus drivers will have to let their data be tracked to get the usage discount.

- Availability: Lotus drivers may not have coverage in their state.

#10 – Travelers: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Lotus drivers who qualify will avoid rate increases.

- Usage Discount: Drivers could possibly save up to 30% on their Lotus auto insurance.

- Coverage Options: Lotus owners can get extras for their policy or carry the bare minimum.

Cons

- IntelliDrive Rate Increases: The IntelliDrive program will increase rates in some states for bad drivers.

- Customer Satisfaction: Not always highly rated in reviews. Learn more in our Travelers review.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Compare Lotus Car Insurance Rates

Typically speaking, luxury cars have higher insurance rates because they cost more to repair and replace. However, the average Lotus car insurance rates are slightly lower — instead, Lotus drivers pay rates only a little higher than the national average. Take a look at the average rates at the best companies for Lotus auto insurance below.

Lotus Car Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $81 | $202 |

| American Family | $88 | $194 |

| Farmers | $101 | $205 |

| Geico | $94 | $198 |

| Liberty Mutual | $99 | $190 |

| Nationwide | $97 | $186 |

| Progressive | $92 | $185 |

| State Farm | $84 | $178 |

| Travelers | $102 | $199 |

| USAA | $89 | $181 |

The average car insurance for a Lotus costs about $144 a month for car insurance, but several factors affect that price. For example, drivers with low credit scores or traffic violations on their driving records will pay much higher rates for their insurance.

So how does Lotus have such low average car insurance rates? Compared to other luxury brands, Lotus insurance rates are incredibly low. For example, comparing Lincoln car insurance against Lotus, coverage for a Lincoln is more expensive, even though Lincolns usually have small price tags.

Read more: Best Lincoln Car Insurance Rates

While there are several reasons why Lotus has low car insurance rates, one of the primary reasons is that they aren’t often the target of car thieves.

View this post on Instagram

However, you’ll still pay a little more than the national average for your Lotus car insurance. Although it’s cheaper than many other luxury brands, Lotus cars still cost more to repair or replace. Your insurance company has to absorb these costs, which is why you’ll pay more for coverage.

Types of Car Insurance for a Lotus

Most drivers look for one of two types of policies: minimum insurance or full coverage car insurance for a Lotus.

Minimum insurance is the least amount of coverage you can buy in your state and still legally drive. It’s your cheapest option for insurance, but it provides no protection for your own Lotus if you cause an accident.

Brandon Frady Licensed Insurance Agent

A full coverage policy offers your Lotus much better protection. When you buy full coverage, you get the following types of insurance:

- Liability: Liability insurance pays for damage and injuries you cause in an at-fault accident. It doesn’t protect your Lotus, but it does save you from expensive bills. You can compare liability car insurance rates and requirements here.

- Collision: When you have collision car insurance coverage on a vehicle, it pays for any repairs your Lotus needs after an accident, whether you hit another driver or a stationary object.

- Comprehensive: You can’t protect your Lotus from everything, no matter how hard you try. Comprehensive insurance pays for damage caused by unexpected events, like fires, extreme weather, vandalism, theft, and animals. Comparing comprehensive car insurance rates against a policy without this coverage can show you if it’s worth having.

- Uninsured/Underinsured Motorist: While most states require drivers to carry a minimum amount of insurance, not everyone does. If a driver without enough coverage hits you, uninsured/underinsured motorist coverage will pay for your car repairs and medical bills.

- Personal Injury Protection/Medical Payments: Medical expenses can get pricy quickly after an accident. Medical payments and personal injury protection insurance covers health care expenses for you and your passengers.

While a full coverage policy offers relatively complete protection, it doesn’t cover everything. Many Lotus drivers choose to add extra insurance like Lotus gap insurance, new car replacement coverage, and Lotus car rental insurance to their policies.

How to Save on Lotus Car Insurance Rates

Although Lotus is an exotic luxury car brand, Lotus car insurance rates tend to be relatively low. While there are several reasons for this, one of the biggest is that Lotus cars aren’t often the target of thieves. Just because Lotus rates tend to be low, that doesn’t mean there’s nothing left to save. The first thing to do is find car insurance discounts for a Lotus.

Finding a company that offers as many discounts for you as possible is essential in searching for car insurance. Popular discounts include bundling policies, being a safe driver, and paying for your policy in full.

If you’re trying to find lower Lotus car insurance rates, also consider the following techniques:

- Raise Your Deductible: Your car insurance deductible is the portion of your insurance you must pay before your insurance pays your claim. If you choose a higher deductible, your monthly rates will be less.

- Try Telematics: Most companies offer usage-based car insurance to help safe, low-mileage drivers save on their insurance. You can see significant savings if you regularly practice safe habits.

- Pick the Right Coverage: Many Lotus drivers are tempted to sign up for as much coverage as possible, but add-ons increase rates. You should only sign up for the coverage you need.

- Keep Your Car Safe: New Lotus cars have plenty of safety features, which help keep insurance costs down. You can save a little more by keeping your Lotus in a safe spot every night.

- Drive Safe: Having traffic violations on your record can significantly increase your rates. Keep your coverage affordable by avoiding things like speeding tickets and DUIs.

As you can see, there are plenty of ways to keep your insurance rates low. It’s always important to compare rates when shopping for coverage, but that’s particularly true for luxury cars. You can easily get quotes directly from the best Lotus car insurance companies like Allstate.

Many insurance companies consider luxury cars riskier to insure, so you’ll likely overpay if you don’t compare your options.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Find the Best Lotus Car Insurance Quotes Today

As an exotic luxury brand, your Lotus deserves the best protection you can give it. Full coverage costs more than minimum insurance, but it’s usually worth it to buy extra car insurance coverage for your Lotus. Although Lotus drivers pay lower rates than many other luxury brands, there are still plenty of ways to save on your coverage, such as with safety feature car insurance discounts for a Lotus.

Before you sign up for a policy, compare rates with as many companies as possible. This is the best way to find the right coverage for your Lotus. Compare rates now with our free tool to get the best luxury auto insurance quotes.

Frequently Asked Questions

Are Lotus cars expensive to insure?

Lotus car insurance is typically more affordable than other brands despite being a luxury brand. At $144 a month, the average Lotus driver sees low car insurance rates. However, rates will vary by model, as Lotus Emira insurance costs will be different than Lotus Elise insurance costs.

Which auto insurance company has the cheapest Lotus car insurance?

The company with the lowest rates for your Lotus depends on a variety of factors, including your credit score, driving history, age, and location. However, State Farm, Geico, and Progressive often have the cheapest car insurance rates.

Are there any discounts available for Lotus Car Insurance?

Yes, there are various car insurance discounts that may be available for Lotus car insurance. Common discounts include:

- Multi-Policy Discount: Bundling your Lotus car insurance with other policies, such as home or renters insurance, can lead to discounted rates.

- Safe Driver Discount: Maintaining a clean driving record with no accidents or traffic violations may qualify you for lower premiums.

- Anti-Theft Device Discount: Installing anti-theft devices in your Lotus can help lower insurance rates.

- Good Student Discount: If you have a student driver with good grades on your policy, you may qualify for a discount.

- Mature Driver Discount: Older drivers who have completed a defensive driving course may be eligible for discounted rates.

Lotus car discounts will help most drivers reduce their rates.

How much will car insurance cost for a Lotus MKZ?

The Lotus MKZ has higher insurance rates than average, with drivers typically paying about $157 a month. Even though it costs more to insure an MKZ, it’s still more affordable than other luxury brands.

How can I find the best insurance rates for my Lotus car?

To find the best insurance rates for your Lotus car, consider the following steps:

- Compare Quotes: Obtain quotes from multiple insurance companies specializing in sports or luxury cars.

- Research Insurance Providers: Look for insurers with experience in providing coverage for Lotus cars and check their reputation, customer reviews, and financial stability.

- Assess Coverage Options: Evaluate the coverage options offered by different insurers and choose the ones that provide adequate protection for your Lotus.

- Consider Deductibles: Decide on a car insurance deductible that suits your budget and risk tolerance.

- Review Policy Limits: Ensure that the policy limits are sufficient to cover potential damages or liabilities.

- Inquire About Discounts: Ask insurers about available discounts specific to Lotus cars and see if you qualify for any.

Use our free tool to find affordable Lotus car insurance today.

Who makes a Lotus car?

Lotus cars are British cars that are owned by Geely and Etika Automotive.

Is Lotus a good car?

Yes, Lotus cars are considered reliable and are relatively inexpensive to maintain for luxury cars.

Is Lotus owned by Toyota?

No, Toyota does not own Lotus, nor is it a Lotus dealership.

What is the best Lotus car insurance?

Full coverage is the best possible coverage for a Lotus car, even though it costs more (learn more: Best Full Coverage Car Insurance).

Who has the best Lotus car reviews for insurance?

USAA has some of the best customer reviews.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.