Best Geico Car Insurance Discounts in 2025 (Save 25% With These Deals!)

The best Geico car insurance discounts can save you 25% on premiums with top options like emergency deployment, good driver discounts, DriveEasy program and the military discount. These discounts make Geico one of the best choices for affordable coverage compared to other top insurers.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Oct 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

You can save 25% with the best Geico car insurance discounts, including emergency deployment, good driver, and the DriveEasy program.

Geico stands out as a top choice for affordable car insurance by offering a wide range of discounts tailored to different drivers’ needs. Find out more in our Geico car insurance review.

Our Top 10 Picks: Best Geico Car Insurance Discounts

Discount Rank Savings Potential Description

Emergency Deployment #1 25% Service members on deployment may qualify for a special rate.

Good Driver #2 22% Consistently safe drivers can qualify for substantial savings.

DriveEasy Program #3 20% Enroll in this usage-based program for personalized savings.

Military Discount #4 15% Active or retired military members can save on their premium.

Vehicle Safety Features #5 15% Cars with safety features can lower premiums.

Federal Employee #6 12% Federal employees receive a discounted rate on car insurance.

Low Mileage #7 12% Driving fewer miles can help you qualify for a lower premium.

New Customer #8 10% New policyholders may receive a welcome discount.

Affinity Groups #9 8% Members of certain organizations may receive a discount.

Seat Belt Use #10 5% Regular seat belt use could lower your insurance costs.

Whether you’re a military member, safe driver, or use tech-based tracking, Geico offers competitive rates that maximize savings, making it a top choice for coverage and value.

Stop overpaying for car insurance. Our free quote comparison tool allows you to shop for quotes from the top providers near you by entering your ZIP code above.

- Geico offers 25% savings with emergency deployment and DriveEasy discounts

- The best Geico discounts cater to military members, safe drivers, and tech users

- Geico’s discounts make it one of the top choices for affordable and flexible coverage

How to Get The Best Car Insurance Discounts Offered at Geico

Finding the best car insurance discounts can lower your monthly premiums. Geico offers various discounts for different drivers and situations. Here’s a look at top Geico discounts and tips to maximize savings. For more details, check out our guide titled “Car Insurance Premium: What is it and how does it work?”

Geico Safe Driver Discount

Geico rewards drivers with clean driving records. If you’ve gone five years or more without an accident, you could save 25% on your premium. The DriveEasy program, Geico’s app that tracks your driving habits, can also help you secure additional savings by demonstrating safe driving. For additional details, explore our comprehensive resource titled “Safe Driver Car Insurance Discounts.”

This table highlights the monthly savings on Geico’s minimum coverage auto insurance rates after applying various discounts. It compares rates before and after discounts, including options like emergency deployment, good driver, military, low mileage, and more. Each discount results in lower monthly payments, with savings ranging from $11 to $16 per discount applied.

Top Geico Savings: Min. Coverage Auto Insurance Monthly Rates With Discount

| Discounts | |

|---|---|

| Emergency Deployment | $58 |

| Good Driver | $60 |

| DriveEasy Program | $62 |

| Military Discount | $59 |

| Vehicle Safety Features | $63 |

| Federal Employee | $61 |

| Low Mileage | $60 |

| New Customer | $64 |

| Affinity Groups | $62 |

| Seat Belt Use | $61 |

Each discount results in lower monthly payments, with savings ranging from $11 to $16 per discount applied. The table also illustrates how Geico’s range of discounts can significantly reduce monthly auto insurance premiums. By taking advantage of these savings opportunities, policyholders can lower their costs and enjoy more affordable coverage tailored to their individual circumstances.

To qualify for Geico’s safe driver discount, you must maintain a clean driving record for at least five years, avoiding accidents and traffic violations during this period. Additionally, enrolling in Geico’s DriveEasy app, which monitors your driving habits, can further enhance your chances of securing additional savings by demonstrating consistent, safe driving behavior.

Geico Vehicle Safety Discounts

If your vehicle is equipped with advanced safety features like anti-lock brakes, airbags, or daytime running lights, you can save up to 25%. These discounts reward drivers for investing in safer cars that reduce the likelihood of accidents. Learn more in our guide, “Safety Features Car Insurance Discounts.”

To qualify for vehicle safety discounts, ensure your vehicle has modern safety features like anti-lock brakes or airbags. When getting a quote from Geico, inform them about these features to secure your discount.

Geico Multi-Vehicle and Bundling Discounts

If you insure more than one car with Geico or bundle your car insurance with homeowners or renters insurance, you can save up to 25% on your premiums. This discount is particularly beneficial for families or households with multiple vehicles, as it allows them to combine policies for greater savings. To delve deeper, refer to our in-depth report titled “Compare Car Insurance Rates by Vehicle Make and Model.”

To be eligible for this discount, you just need to cover multiple vehicles under the same Geico policy or combine your car insurance with other Geico offerings, like homeowners or renters insurance.

Geico Student and Driver Education Discounts

Geico offers discounts for young drivers who complete driver’s education courses. Students with good academic records may also qualify for additional discounts, making it easier for parents to insure teenage drivers. Check out our ranking of the top providers: Cheap Car Insurance for Young Drivers

For the student and driver education discounts, you must complete a driver’s education course that is recognized by the state. Additionally, if you’re a student, keeping a strong academic record is crucial. By meeting these requirements, you can unlock considerable savings on your Geico car insurance rates.

Geico Defensive Driving Discount

By completing a defensive driving course, you can earn up to 10% off your insurance premiums. This discount is available in most states and is a great way for drivers of any age to save.

Geico offers a variety of discounts, including up to 25% for safe drivers and bundling policies, making it a top choice for affordable coverage.

Brad Larson Licensed Insurance Agent

You need to successfully complete a defensive driving course that has been approved by Geico. Once you’ve finished the course, you must submit proof of completion during the application process to ensure the discount is applied to your policy. For a thorough understanding, refer to our detailed analysis titled “Understanding Your Car Insurance Policy.”

Geico Affiliate and Loyalty Discounts

Geico partners with various organizations, including professional groups, universities, and employers, to offer affiliate discounts. Additionally, long-term customers can receive loyalty discounts, though the exact savings may vary. To expand your knowledge, refer to our comprehensive handbook titled “Best Car Insurance Discounts.”

data-media-max-width=”560″>

We’re excited to announce that Integrity is now offering GEICO personal auto insurance! Enjoy competitive rates and personalized coverage options from one of the most trusted names in the industry. Call us or visit our website to learn more: (972) 930-7086 pic.twitter.com/e35vl1EqbE

— IntegrityPersonalIns (@InsureIntegrity) September 20, 2024

Explore whether your employer or the university you graduated from has a special partnership with Geico, as this could unlock additional savings on your insurance. If you’ve been with Geico for several years, don’t forget to inquire about potential loyalty discounts, which could further reduce your premiums as a long-term customer.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Maximizing Your Savings With Geico’s Top Discount Opportunities

Geico offers over 30 different car insurance discounts you may qualify for, including the Geico mobile app DriveEasy and defensive driver discounts, which can save you as much as 26% for a single discount (depending on the discount, where you live, what you drive, etc.).

While we won’t cover all 30+ discounts in this guide, we will highlight some of the major savers. Keep reading for more on discounts for Geico car insurance rates. To gain profound insights, consult our extensive guide titled “Factors That Affect Car Insurance Rates.”

Your Path to Big Savings: How to Qualify for Geico’s Top Car Insurance Discounts

Geico provides a variety of car insurance discounts that can help you save up to 25% on your premiums. These discounts include options for safe drivers, vehicles equipped with advanced safety features, and customers insuring multiple vehicles or bundling policies like homeowners or renters insurance. Explore our full guide titled “Multiple Policy Car Insurance Discounts” for more details.

Geico provides discounts for safe drivers, vehicle safety features, multi-policy bundles, students, and DriveEasy app users to help lower premiums.

Additionally, students and young drivers can benefit from completing driver’s education courses, while those who finish a defensive driving course can also earn a discount. Geico’s DriveEasy app offers even more savings by rewarding drivers who demonstrate safe driving habits. By taking advantage of these discounts, you can significantly reduce your car insurance costs.

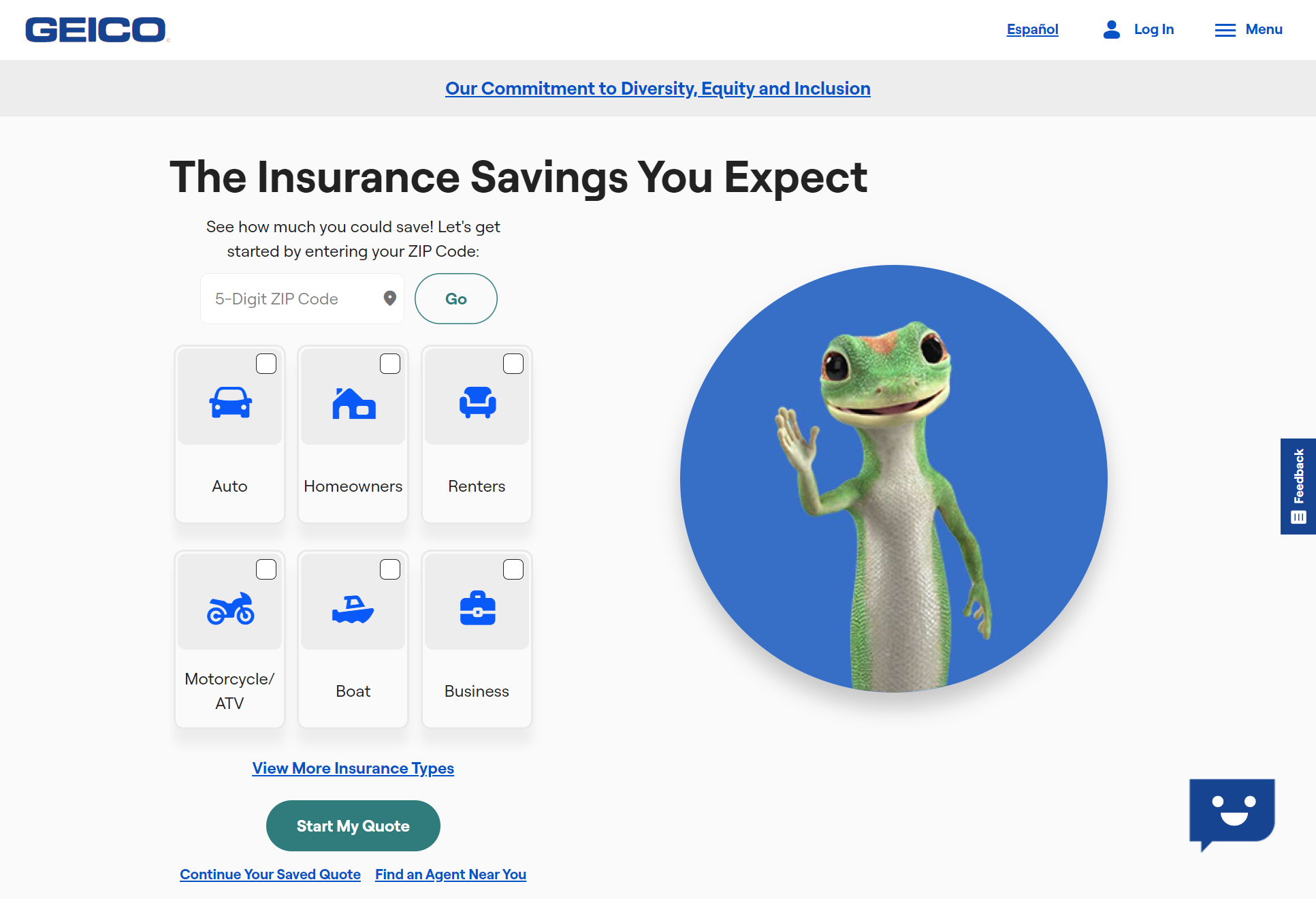

Finding cheap car insurance quotes is easy. Just enter your ZIP code into our free comparison tool below to instantly compare quotes near you.

Frequently Asked Questions

What is the maximum discount I can get with Geico car insurance?

You can save up to 25% with Geico’s top discounts, including safe driver, military, and bundling policies. Some individual discounts, like the DriveEasy program, can help you save even more based on your driving habits.

How does Geico’s DriveEasy program work?

DriveEasy is a mobile app that tracks your driving habits, such as speed, braking, and phone use. By demonstrating safe driving, you may qualify for additional discounts on your car insurance premiums.

Finding cheaper insurance rates is as easy as entering your ZIP code into our free quote comparison tool below.

Does Geico offer discounts for military personnel?

Yes, Geico offers military discounts for both active-duty personnel and veterans. The military discount can save you up to 15% on your premium, and there’s also an emergency deployment discount for those deployed in a designated zone.

To enhance your understanding, explore our comprehensive resource on insurance titled “Best Car Insurance for Veterans.”

Can I combine multiple Geico discounts?

Yes, Geico allows you to stack discounts for maximum savings. For example, you can combine the multi-vehicle discount, good driver discount, and DriveEasy program for greater savings on your premiums.

What is the Geico good driver discount?

The good driver discount rewards drivers who maintain a clean driving record for five years or more. This can reduce your premium by up to 26%.

Does Geico offer student discounts?

Geico provides discounts for students who maintain a good academic record or complete a state-recognized driver’s education course. These discounts help parents save on insurance for their teenage drivers.

For detailed information, refer to our comprehensive report titled “Compare Teen Driver Car Insurance Rates.”

How do I qualify for Geico’s multi-policy discount?

To qualify for the multi-policy discount, you can bundle your car insurance with other Geico policies, such as homeowners or renters insurance. This can save you up to 25% on your combined premiums.

Are there discounts for vehicles with safety features?

Yes, Geico offers discounts for vehicles equipped with advanced safety features, such as anti-lock brakes, airbags, and daytime running lights. These features can save you up to 25% on your premium.

Does Geico offer a discount for completing a defensive driving course?

Yes, completing a defensive driving course can earn you up to a 10% discount on your premium. The course must be approved by Geico and available in most states.

For a comprehensive analysis, refer to our detailed guide titled “Defensive Driver Car Insurance Discounts.”

How can I find out what Geico discounts I qualify for?

You can find out what discounts you qualify for by getting a quote from Geico. During the process, provide details about your driving history, vehicle safety features, and any potential affiliations like military service or professional groups.

Searching for more affordable premiums? Insert your ZIP code below to get started on finding the right provider for you and your budget.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.