Best Hampton, VA Car Insurance in 2025

The average cost of Hampton, Virginia car insurance is $206 per month or $2,476 annually. The cheapest Hampton, VA car insurance company is USAA, followed by GEICO. However, your Hampton, VA car insurance quotes depend on your age, driving record, and coverage needs. By law, all Hampton residents must carry at least the Virginia minimum car insurance limits of 25/50/20 in liability coverage or pay an annual Uninsured Motor Vehicle Fee to the DMV to drive on the roads.

Read moreFree Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

UPDATED: Oct 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- The cheapest Hampton, VA car insurance company is USAA, followed by Geico

- Minimal traffic congestion and average vehicle theft rates influence your regional Hampton, VA car insurance quotes

- Hampton car insurance costs are average for the state of Virginia

Hampton, Virginia car insurance costs $206 per month or $2,476 per year on average. However, your Hampton, VA car insurance rates depend on your age, driving record, and coverage needs.

Keep reading to compare the average annual cost for car insurance companies charge Hampton residents and learn how you can find cheap car insurance in your city.

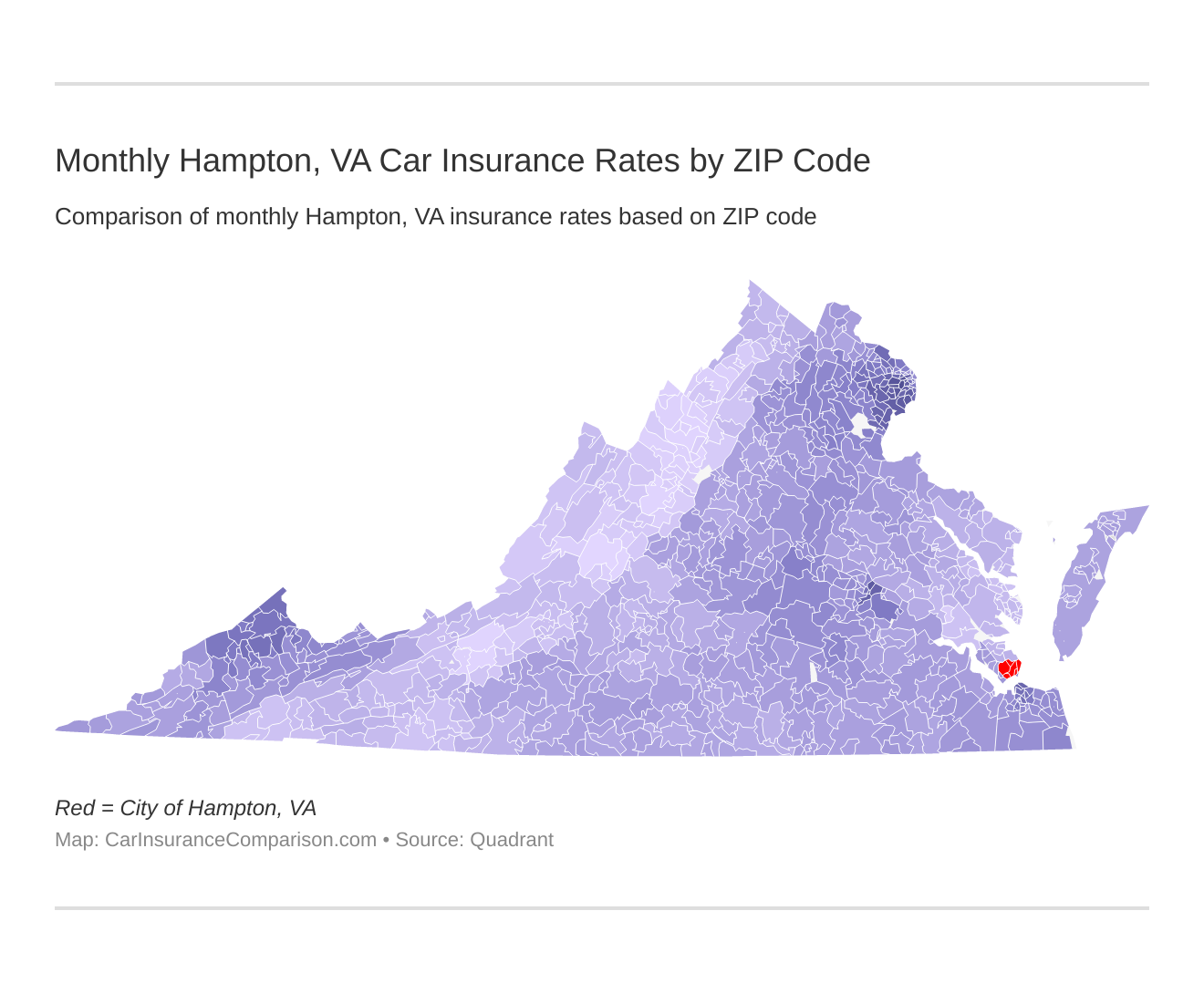

Monthly Hampton, VA Car Insurance Rates by ZIP Code

ZIP codes will play a major role in your auto insurance rates because factors like crime and traffic are calculated by the ZIP code. Find more info about the monthly Hampton, VA auto insurance rates by ZIP Code below:

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

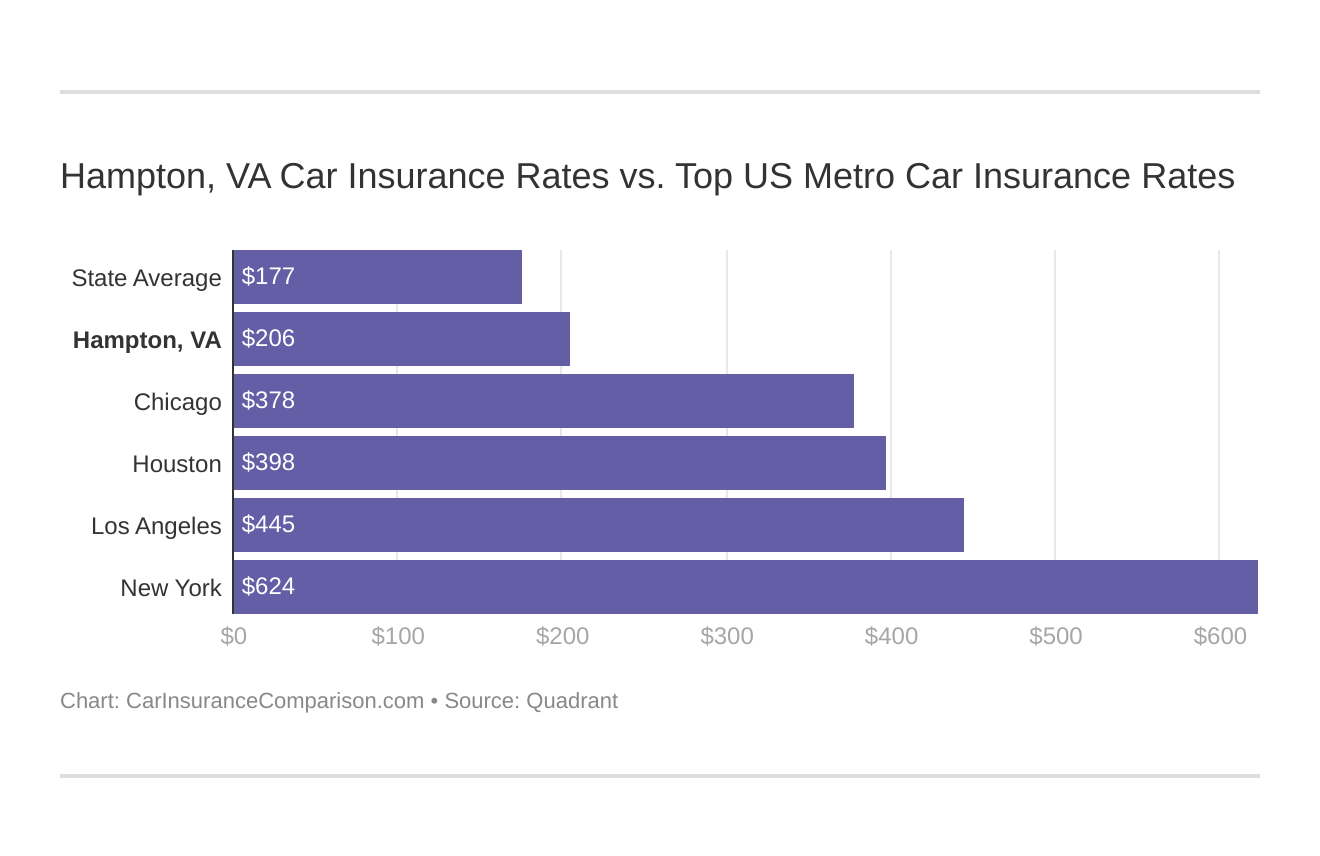

Hampton, VA Car Insurance Rates vs. Top US Metro Car Insurance Rates

What city you reside in will impact your car insurance. That’s why it’s essential to compare Hampton, VA against other top US metro areas’ auto insurance costs.

You can quickly comparison shop and buy Hampton, VA car insurance by entering your ZIP code into our free quote tool above.

What is the cheapest car insurance company in Hampton, VA?

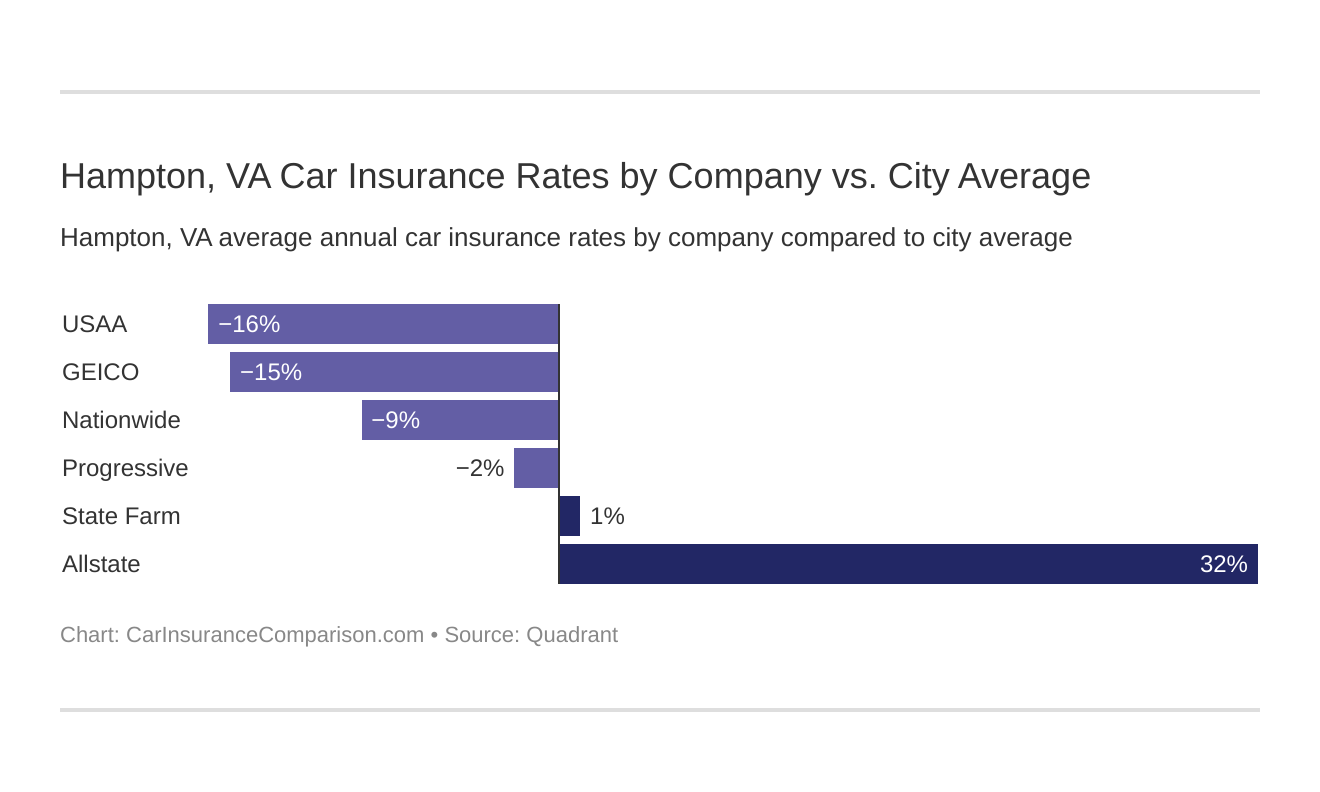

Who are the best Virginia car insurance companies? The cheapest Hampton, VA car insurance company is USAA; however, only military personnel can use this company’s services. For more on USAA, see USAA car insurance review.

The cheapest Hampton, VA car insurance providers can be found below. You also might be wondering, “How do those Hampton, VA rates compare against the average Virginia car insurance company rates?” We uncover that too.

Geico provides the next most affordable Hampton, VA car insurance quotes and is available to everyone.

Check out the list below to compare the average annual rates the top car insurance providers charge Hampton residents for coverage:

- USAA – $2,107.54

- Geico – $2,124.72

- Nationwide – $2,269.66

- Progressive – $2,436.33

- State Farm – $2,491.94

- Allstate – $3,427.75

It’s important to understand that each insurance company uses a unique formula to calculate car insurance costs.

Your age, driving record, and coverage needs all influence your overall premiums.

To quickly secure your lowest prices, compare quotes from more than one of the providers listed above. For a few quick tips, see how to compare multiple car insurance quotes online.

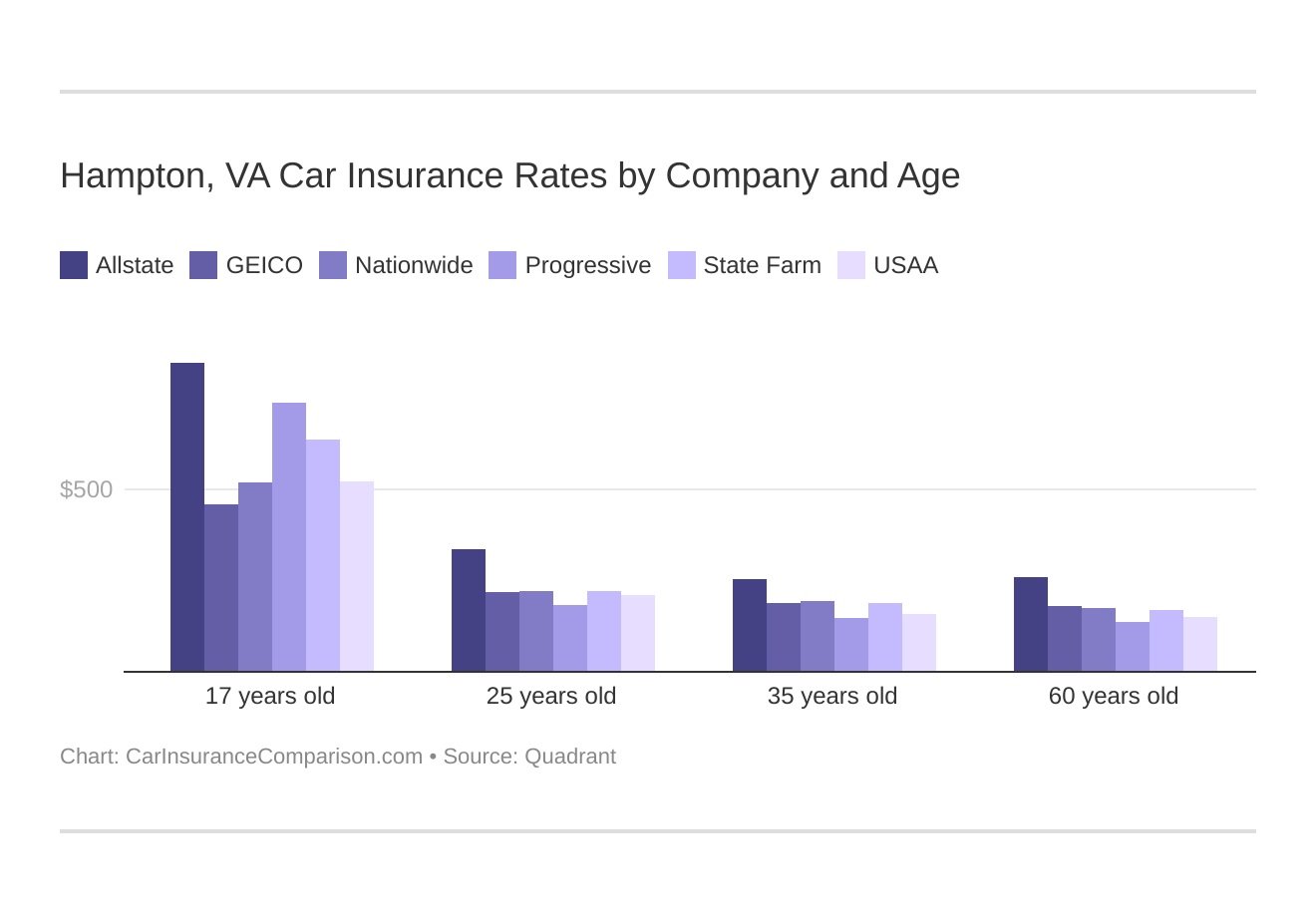

Hampton, Virginia car insurance costs by company and age is an essential comparison because the top car insurance company for one age group may not be the best provider for another age group.

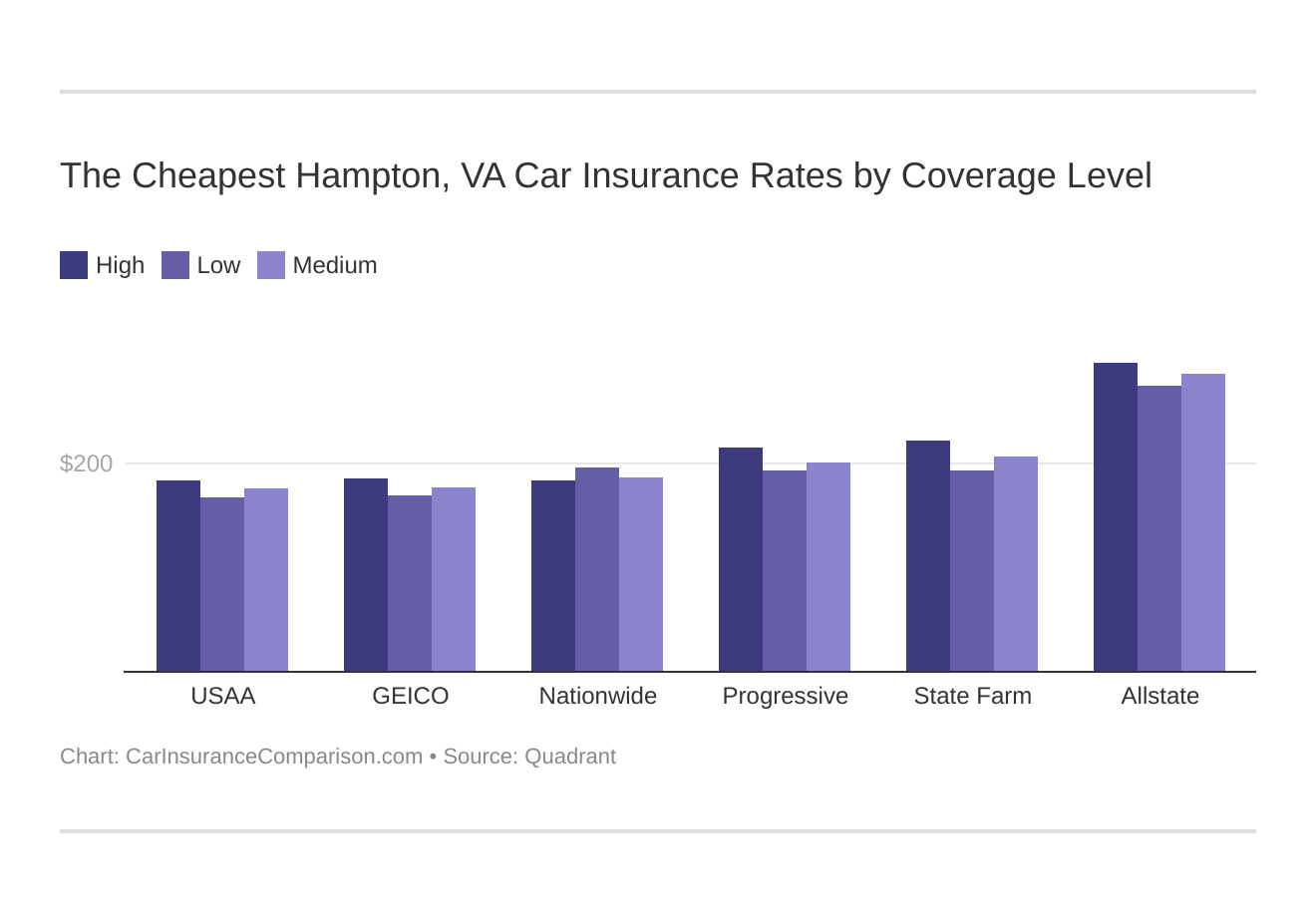

Your coverage level will play a major role in your Hampton, VA car insurance costs. Remember, you must carry the minimum car insurance required by the state. See what is the minimum car insurance required by each state for more information.

Find the cheapest Hampton, Virginia car insurance costs by coverage level below:

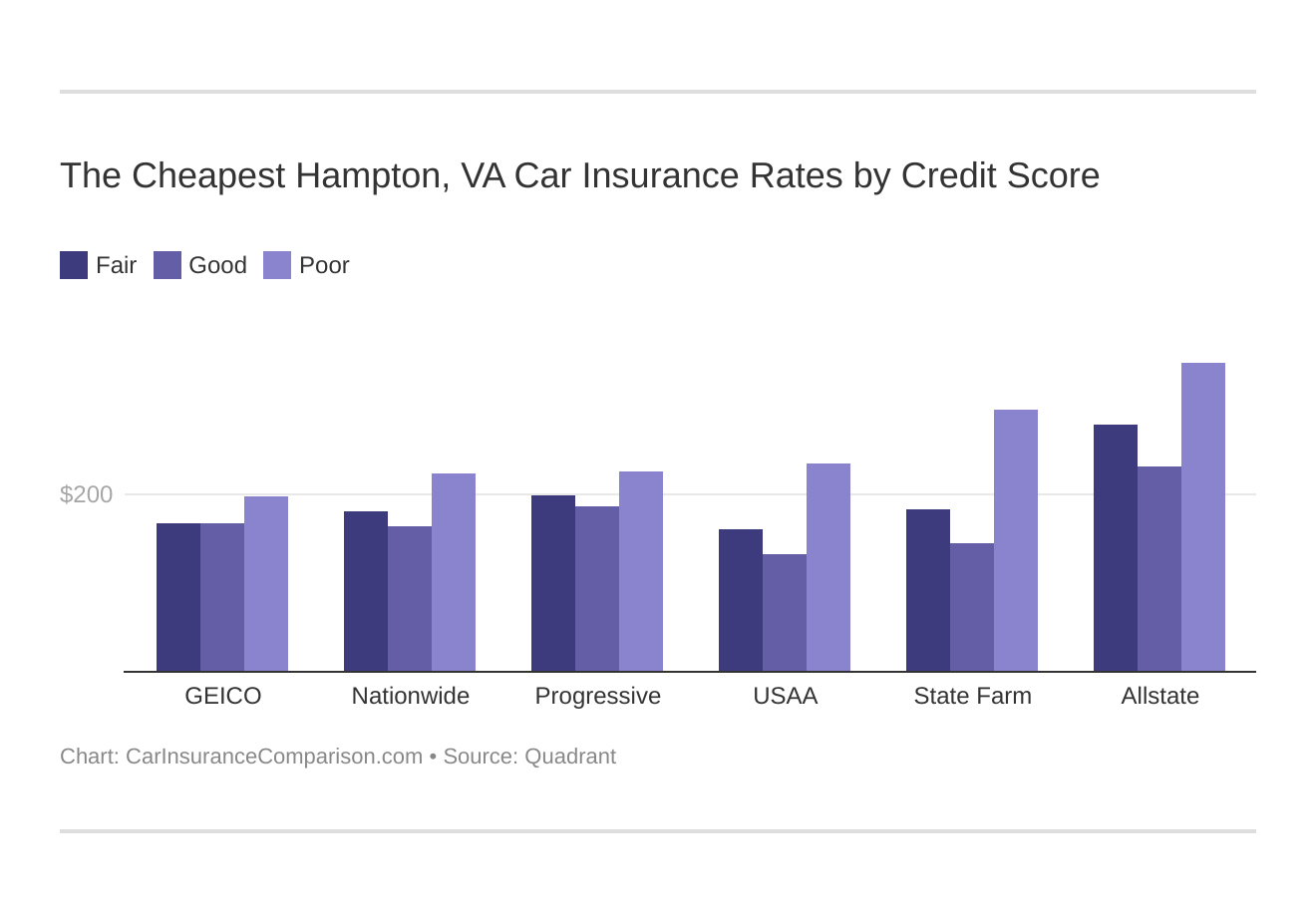

Your credit score will play a major role in your Hampton, VA car insurance costs unless you live in these states where discrimination based on credit is not allowed: California, Hawaii, and Massachusetts. if you find your premiums are high, it might be because of your credit score or history. Check out why is my car insurance score so low for more information.

Find the cheapest Hampton, Virginia car insurance costs by credit score below.

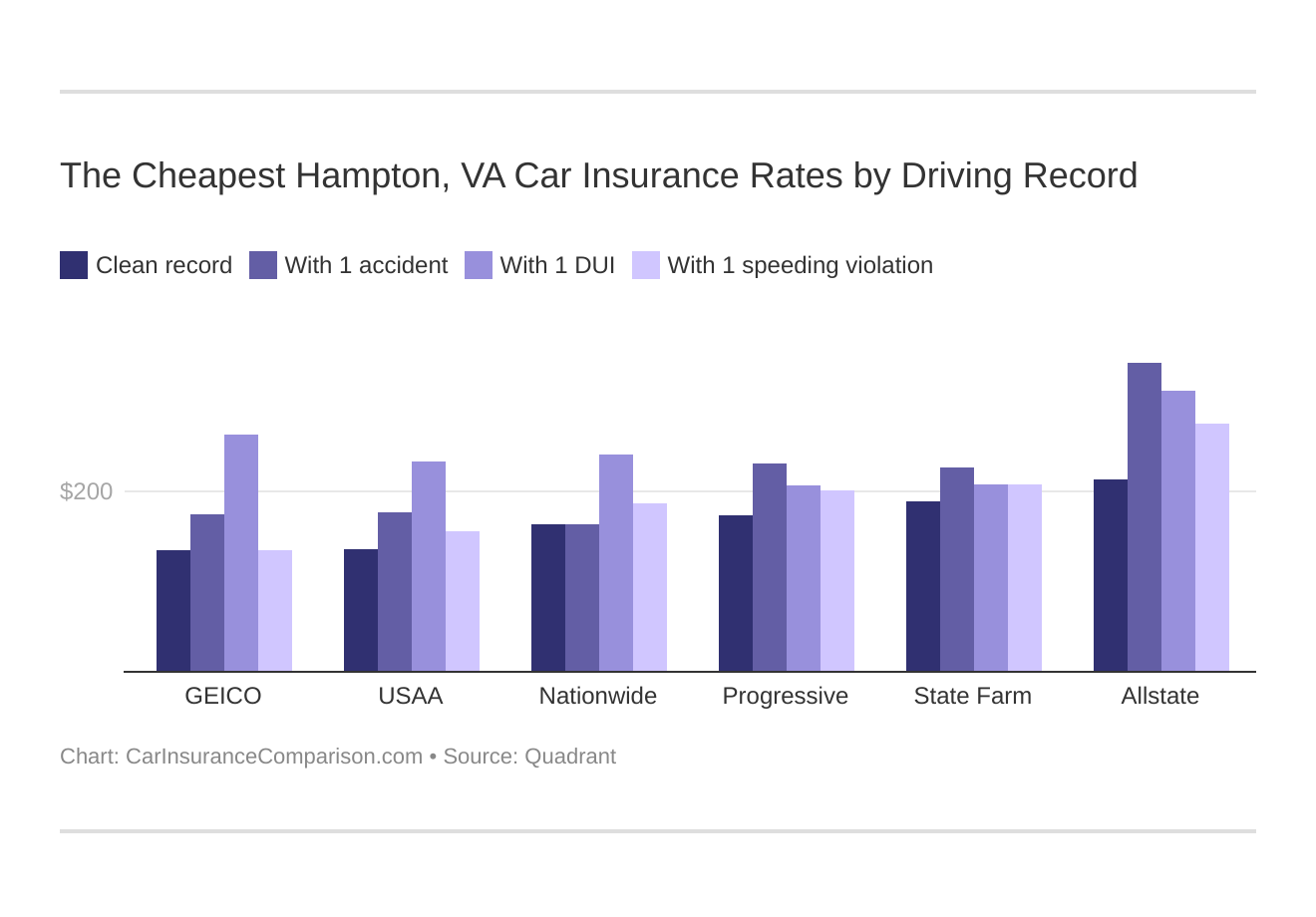

Your driving record will affect your Hampton, VA car insurance costs. For example, a Hampton, Virginia DUI may increase your car insurance costs 40 to 50 percent. Find the cheapest Hampton, Virginia car insurance costs by driving record. See DUI laws in Virginia for specifics.

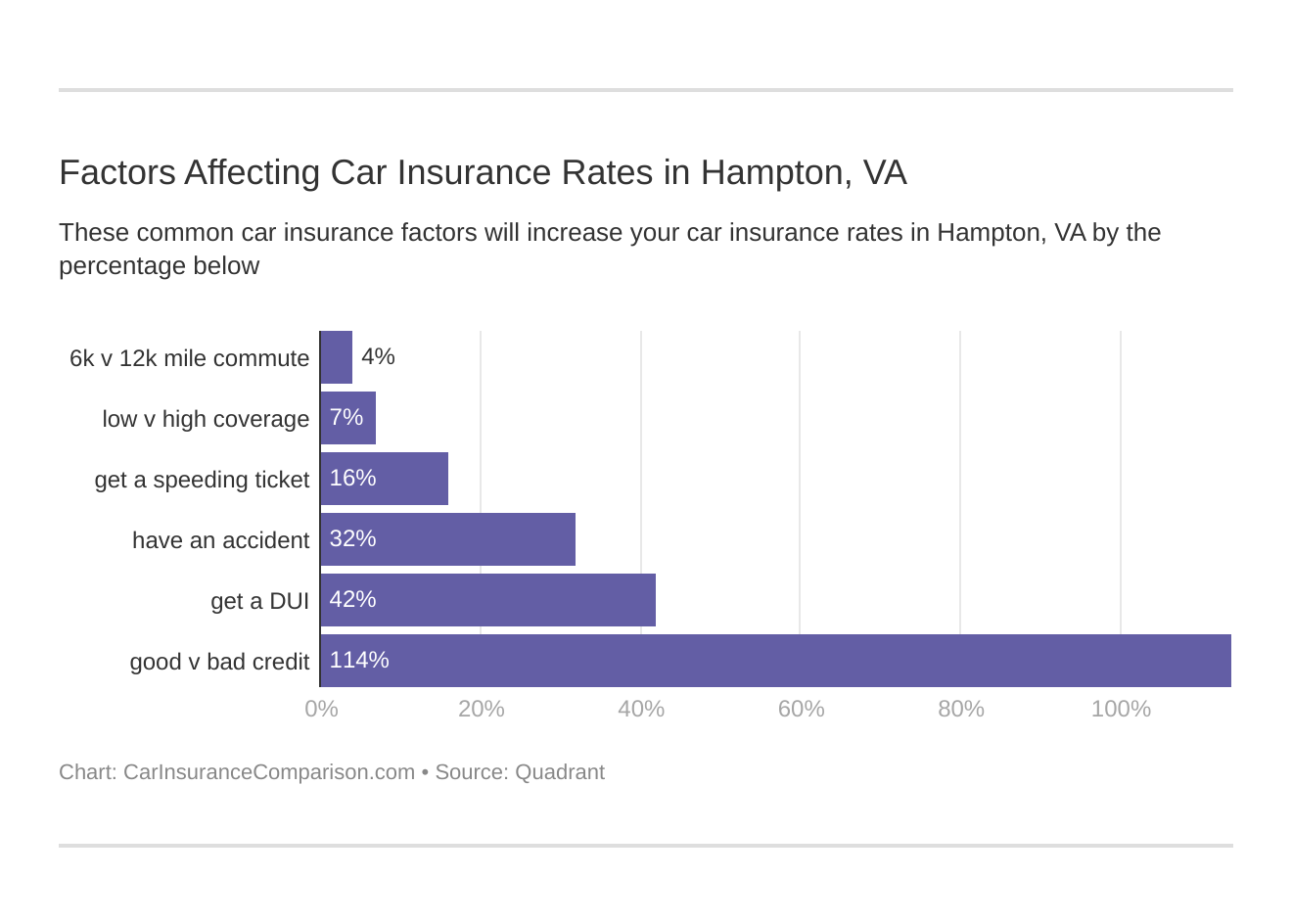

Controlling these risk factors will ensure you have the cheapest Hampton, Virginia car insurance. Factors affecting car insurance rates in Hampton, VA may include your commute, coverage level, tickets, DUIs, and credit.

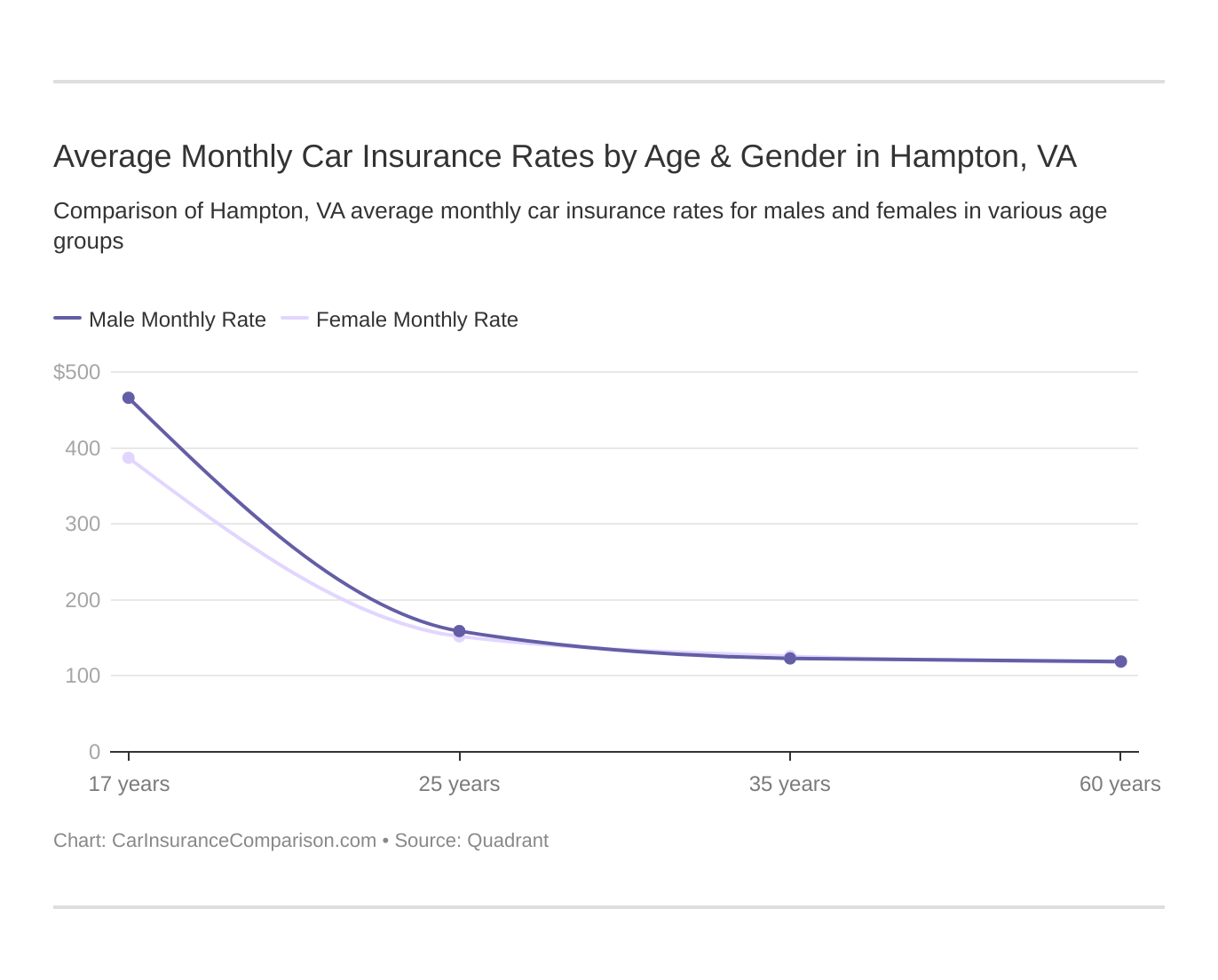

Age is a significant factor for Hampton, VA car insurance rates. Young drivers are often considered high-risk. If you find yourself insuring a young driver, see how can I find cheap car insurance for young drivers?

Hampton, Virginia does use gender as a car insurance factor, so check out the average monthly auto insurance rates by age and gender in Hampton, VA.

What car insurance coverage is required in Hampton, VA?

By law, Hampton residents must carry at least the Virginia minimum car insurance limits to drive on the roads.

However, in Virginia, you also have the option to prove financial responsibility by paying a $500 Department of Motor Vehicle fee, allowing you to drive uninsured at your own financial risk.

Currently, Virginia requires the following coverage levels:

- $25,000 per person and $50,000 per person in bodily injury liability coverage

- $20,000 in property damage liability coverage

Virginia is an at-fault or tort state. If you cause an accident, your liability car insurance coverage pays for the other driver’s damages.

If you decide to forego insurance, you’re responsible for paying entirely out of pocket.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

What affects car insurance rates in Hampton, VA?

Hampton car insurance costs are low thanks to minor traffic congestion and auto theft statistics that match the state average.

Driving often in heavy traffic increases your car insurance rates because you’re at more risk of getting into a car accident.

Fortunately, INRIX ranks Hampton as the 196th most congested city in America. According to City-Data, the average commute time for Hampton residents is only 21 minutes.

Your city’s vehicle theft statistics match the state average, which also helps your car insurance prices.

The Federal Bureau of Investigation (FBI) recorded 332 car thefts in 2017, a rate of 246.1 stolen cars per 100,000 people.

Finally, the Hampton, VA weather patterns also impact your regional car insurance costs.

Despite experiencing mild, temperate weather for most of the year, hurricanes and flooding also occur annually.

Hampton, VA Car Insurance: The Bottom Line

Compared to the rest of Virginia, Hampton auto insurance rates are average. Compare the price of Hampton insurance to the following Virginia cities:

- Alexandria, VA car insurance

- Norfolk, VA car insurance

By taking the time to seek out multiple quotes and ask about car insurance discounts, you’ll quickly secure cheap Hampton car insurance.

Find the best Hampton, VA car insurance company for you right now by entering your ZIP code into our free quote tool below.

Frequently Asked Questions

How much does car insurance cost in Hampton, VA?

The average cost of car insurance in Hampton, VA is $206 per month or $2,476 annually.

Which companies offer the cheapest car insurance in Hampton, VA?

The cheapest car insurance options in Hampton, VA are USAA and GEICO.

What factors affect car insurance rates in Hampton, VA?

Car insurance rates in Hampton, VA are influenced by factors such as age, driving record, and coverage needs.

What is the minimum car insurance required in Hampton, VA?

Residents of Hampton, VA must carry at least the Virginia minimum car insurance limits of 25/50/20 in liability coverage or pay an annual Uninsured Motor Vehicle Fee to the DMV to drive on the roads.

How can I find cheap car insurance in Hampton, VA?

To find cheap car insurance in Hampton, VA, you can compare quotes from different insurance providers and consider available discounts.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.