Cheap Car Insurance for High-Performance Vehicles in 2025 (Top 10 Low-Cost Companies)

Erie, USAA, and Geico are the top providers of cheap car insurance for high-performance vehicles. Erie is the cheapest option, with minimum coverage averaging $26/mo. However, high-performance cars can be more expensive to insure because they are considered higher-risk due to their speed and replacement cost.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michael Leotta

Insurance Operations Specialist

Michael earned a degree in Business Management degree with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Au...

Insurance Operations Specialist

UPDATED: Nov 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

1,883 reviews

1,883 reviewsCompany Facts

Min. Coverage for High-Performance Vehicles

A.M. Best Rating

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviews 6,589 reviews

6,589 reviewsCompany Facts

Min. Coverage for High-Performance Vehicles

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage for High-Performance Vehicles

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsErie, USAA, and Geico are the top picks for cheap car insurance for high-performance vehicles.

Most high-performance cars start around $40,000. In most cases, you won’t have to find cheap high-performance car insurance specific to a high-performance car, though some cars — such as cars that exceed $150K in price — require specialty insurance because many regular insurance companies won’t insure them. Most providers can offer cheap performance car insurance.

Our Top 10 Company Picks: Cheap Car Insurance for High-Performance Vehicles

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $26 | A+ | Personalized Policies | Erie | |

| #2 | $27 | A++ | Military Savings | USAA | |

| #3 | $36 | A++ | Coverage Options | Geico | |

| #4 | $40 | B | Customer Service | State Farm | |

| #5 | $47 | A+ | Competitive Rates | Progressive | |

| #6 | $52 | A+ | Vanishing Deductible | Nationwide |

| #7 | $53 | A | Loyalty Rewards | American Family | |

| #8 | $64 | A | Family Plans | Farmers | |

| #9 | $73 | A+ | Safe-Driving Discounts | Allstate | |

| #10 | $81 | A | Accident Forgiveness | Liberty Mutual |

Read on to learn how to find the best cheap performance car insurance. Enter your ZIP code to get affordable auto insurance from multiple providers for your high-performance car.

- Erie has the most affordable car insurance for high-performance vehicles

- Because of your car’s horsepower, you can expect to pay higher premiums

- Unless your car is extremely expensive, you should be able to get coverage

#1 – Erie: Top Pick Overall

Pros

- Personalized Policies: Personalize your performance vehicle insurance by adding specialized coverages and adjusting deductibles.

- Accident Forgiveness: Avoid rate increases after your first at-fault accident if you qualify for this perk.

- Customer Service: Erie has high customer satisfaction and claims handling ratings. Learn more in our Erie review.

Cons

- Availability: Sales are limited to less than 20 states.

- Discount Availability: Fewer discounts are available at some locations.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Savings

Pros

- Military Savings: Military members and veterans will find the best rates and discounts at USAA.

- Exceptional Service: Learn about USAA’s consistently high ratings in our USAA review.

- Multi-Policy Discount: Save even more if you purchase home insurance from USAA and your auto insurance.

Cons

- Eligibility: USAA can only be sold to military members, veterans, and their families.

- Local Agents: There is a limited availability of local USAA agents.

#3 – Geico: Best for Coverage Options

Pros

- Coverage Options: Several specialty coverages can be added to insurance for high-performance cars.

- Wide Availability: Geico is available in all states. Learn more about the company by reading our Geico car insurance review.

- Discounts: Geico has numerous discount opportunities, such as good driver discounts.

Cons

- Claim Handling: Some customers have noted slow claims processing at Geico.

- Personalized Service: Geico has less personalized service due to online processing.

#4 – State Farm: Best for Customer Service

Pros

- Customer Service: State Farm has high ratings due to its local agent network. Read more in our State Farm review.

- Financial Reputation: A.M. Best highly rated State Farm’s financial management.

- Roadside Assistance: Extra insurance for performance car repairs and tows.

Cons

- Credit Score Rates: State Farm uses credit scores in some states to calculate rates.

- Accident Forgiveness: Customers must be with State Farm for almost a decade to qualify.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#5 – Progressive: Best for Competitive Rates

Pros

- Competitive Rates: Progressive has competitive high-performance auto insurance rates.

- Online Tools: There is a great mobile app and other tools for managing Progressive policies

- Coverage Variety: Add specialty coverages for your high-performance vehicle. Learn more in our Progressive review.

Cons

- Snapshot Rate Increases: Bad drivers may have rates increased in the Snapshot discount program.

- Customer Claims: Ratings for claim satisfaction are just average from most customers.

#6 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Nationwide offers deductible deductions to safe drivers.

- Discount Variety: Check out our article on Nationwide discounts to see what opportunities Nationwide has for customers.

- Customer Service: Generally favorably rated by customers.

Cons

- Availability: Not available for purchase in some locations.

- High-Risk Rates: Rates aren’t ideal for DUI drivers.

#7 – American Family: Best for Loyalty Rewards

Pros

- Loyalty Rewards: American Family rewards customers who maintain an auto insurance policy at the company.

- Roadside Assistance: For quick repairs or tows if your high-performance car breaks down. Read more in our American Family review.

- Customer Satisfaction: American Family has been rated favorably by most customers.

Cons

- Availability: You can’t purchase coverage in every state.

- High-Risk Rates: Rates may be less competitive in some states for high-risk drivers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#8 – Farmers: Best for Family Plans

Pros

- Family Plans: Families can save with multi-car discounts or multi-policy discounts.

- On Your Side Review: Every year you can get personalized support with your policy.

- Coverage Variety: Get specialized coverage for your high-performing car. See what is offered in our Farmers review.

Cons

- Claim Reviews: Claims satisfaction isn’t always favorably reviewed at Farmers.

- High-Risk Rates: Rates can be pricier than the average for high-risk customers.

#9 – Allstate: Best for Safe-Driving Discounts

Pros

- Safe-Driving Discounts: Drivers of high-performance vehicles can save with Allstate’s good driver discounts.

- Digital Tools: Allstate offers great mobile app tools for managing policies.

- Pay-Per-Mile Insurance: Great for rarely-driven high-performance cars.

Cons

- Customer Complaints: There are customer complaints about claims handling and filing at Allstate.

- High-Risk Rates: Allstate is pricier for teen drivers, DUI drivers, and multiple accident drivers. Learn more in our Allstate review.

#10 – Liberty Mutual: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Liberty Mutual offers accident forgiveness to some drivers.

- 24/7 Support: Liberty Mutual has representatives available 24/7. Read more in our Liberty Mutual review.

- Military Discount: Save if you are a service member.

Cons

- High-Risk Rates: Liberty Mutual is expensive if customers have multiple driving record violations.

- Claim Reviews: Not all customers favorably rate claim reviews.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

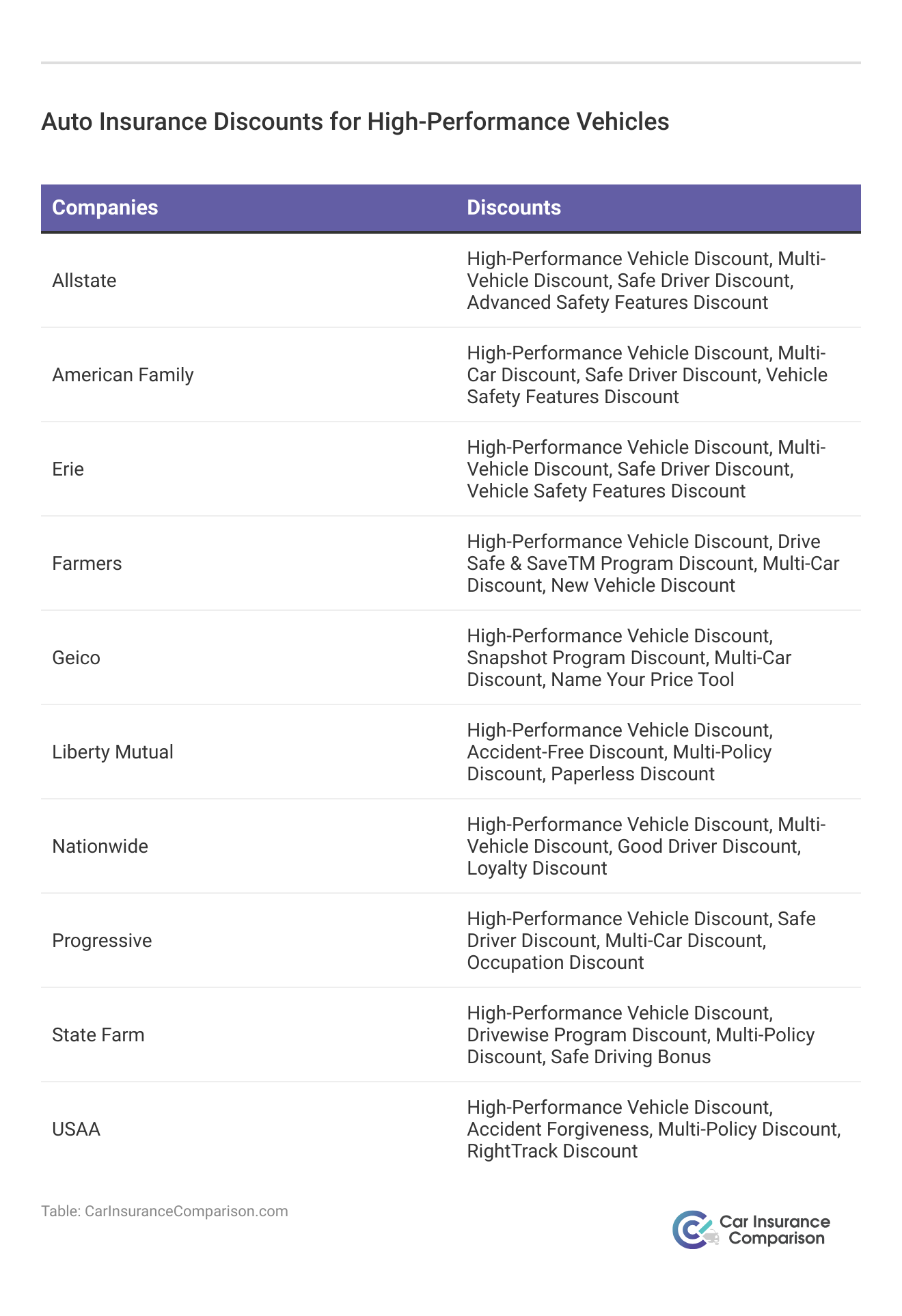

High-Performance Vehicle Safety Features & Discounts

Going beyond the speed limit while driving a high-performance car can often be a huge temptation for many drivers. Because powerful cars can run fast, most insurance companies will assume that you intend to drive fast, leading to a higher price tag for your car insurance.

However, when consumers are committed to driving safely and staying within the bounds of standard-speed limitations, it can often mean significant savings on performance car insurance with safe driver car insurance discounts and other rewards. For example, you’ll find the following discounts at the top companies.

Consumers also have the advantage of researching and saving money on performance car insurance by using an online quote tool:

- Consumers can enter their local zip codes to search for savings, rates, and immediate discounts on performance car insurance.

- Customers have the ability to receive hundreds of quotes from the top national car insurance carriers for the aspect of insurance that is most important for them to receive.

- Customers obtain the ability to understand important policy aspects from the performance car insurance carrier of their choice.

- Vital coverage levels can be revealed in detail upon narrowing down top choices.

The advantage of researching online comparisons for performance car insurance is the perfect choice for consumers because it is 100% free of charge.

View this post on Instagram

In general, consumers should expect standard policy aspects from all performance car insurance carriers. Look for the following features from all companies you considering when doing online-comparison research:

- All policyholders should receive genuine replacement parts in the event of necessary repair.

- Consumers should receive suitable claim services during any 24/7 period.

- Loyal consumers should be able to obtain exclusive relationships with car insurance providers for repair or replacement.

- Consumers should also receive guarantees of workmanship for repairs for the lifetime of the vehicle at authorized facilities.

Compare several companies before you commit to one. Enter your ZIP to high-performance vehicle insurance rates and save.

How to Find Cheap High-Performance Car Insurance Rates

Average high-performance sports car insurance rates are $309 per month. Because of your car’s horsepower, you can expect to pay higher premiums than others, as cars that can travel faster present a higher risk to car insurance companies. If you are searching for cheap insurance for your high-performance sports car, compare quotes from several cheap companies on our list before making a decision (learn more: How do you get competitive quotes for car insurance?).

Car Insurance Monthly Rates for High-Performance Vehicles by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $73 | $193 |

| American Family | $53 | $141 |

| Erie | $26 | $71 |

| Farmers | $64 | $167 |

| Geico | $36 | $97 |

| Liberty Mutual | $81 | $210 |

| Nationwide | $52 | $138 |

| Progressive | $47 | $127 |

| State Farm | $40 | $104 |

| USAA | $27 | $74 |

Unless your car is a classic or is extremely expensive, you should be able to find coverage from almost any car insurance company. You can get high-performance car insurance quotes fairly quickly from cheap companies like Erie.

A high-performance car is a vehicle that has a lot of power compared to how heavy it is. Many people think that a high-performance car has to be a sports car, but that isn’t the case.

In most cases, you won’t have to find insurance specific to a high-performance car, though some cars — such as cars that exceed $150K in price — require specialty insurance because many regular insurance companies won’t insure them.

Brandon Frady Licensed Insurance Agent

Most high-performance cars start at around $40,000. While this isn’t by any means a cheap vehicle, you won’t have any problem finding regular insurance companies to provide you with coverage. Because of this, you will also have a much wider selection for your car insurance than if you were trying to insure a high-priced vehicle.

This wider selection means that there is more competition, which will equal bigger savings for you.

High-performance car insurance has average rates of $309.08/month in the US. Because powerful cars can run fast, most insurance companies will assume that you intend to drive fast, leading to a higher price tag for your car insurance.

How Car Insurance Performance Rates are Calculated

You can purchase cheap high-performance car insurance from just about any insurer. You do, however, have the option of seeking out specialty companies. Specialty companies often offer more options than a regular car insurance company will for a high-performance car.

You will usually find that specialty companies charge more for these services, so this is something to keep in mind if you are looking for ways to save money.

Insurance companies use the same criteria for determining what your costs will be as they would for a car with less horsepower.

You already know that the higher horsepower is going to affect your rates. Some of the other things that you can expect to affect your rates are:

- Age

- Gender

- Credit score

- Marital status

- Driving history

- Education

- Car safety features

Because every insurance company is unique, it is impossible to list everything that will affect your price, but this is a general list of what they will consider.

The Final Word on Cheap Car Insurance for Performance Cars

A high-performance car is a vehicle that has a lot of power compared to how heavy it is. Many people think that a high-performance car means a sports car that needs the best sports car insurance, but that isn’t the case. While a $40,000 high-performance car isn’t by any means a cheap vehicle, you won’t have any problem finding regular insurance companies to provide you with coverage.

Because of this, you will have a much wider selection for your car insurance than if you were trying to insure a high-priced vehicle. This wider selection means that there is more competition, which will equal bigger savings for you.

No matter where you are looking for cheap, high-performance car insurance, you can find your cheapest options by using a free quote tool. Quote tools are the easiest way to find low prices on any car insurance. With our quote tool, you can find auto insurance quotes from some of the best providers in your area. Enter your ZIP code below to compare auto insurance rates today.

Frequently Asked Questions

What is high-performance vehicle insurance?

High-performance vehicle insurance is a specialized type of auto insurance designed to provide coverage for vehicles that have powerful engines or higher-than-average performance capabilities. Car insurance for high-performance vehicles typically includes coverage for potential risks associated with owning and driving these types of vehicles.

Why is high-performance vehicle insurance important?

High-performance vehicles often come with higher risks and higher costs of repairs in case of an accident or damage. High-performance vehicle insurance provides the necessary coverage to protect your investment and cover potential liabilities in case of an incident.

What factors affect high-performance vehicle insurance rates?

Several factors can impact high-performance vehicle insurance rates, including the make and model of the vehicle, its horsepower, the age and driving history of the owner, the geographical location, the intended use of the vehicle, and the coverage options selected (learn more: Factors That Affect Car Insurance Rates).

Are high-performance vehicle insurance rates higher than regular car insurance rates?

Yes, high-performance vehicle insurance rates are typically higher than regular car insurance rates. High-performance car insurance can average monthly rates of $309.08. This is because high-performance vehicles are often more expensive to repair or replace, and they may be at a higher risk of being involved in accidents or theft due to their performance capabilities.

How can I find and compare high-performance vehicle insurance rates?

To compare high-performance vehicle insurance rates, you can follow these steps:

- Gather Necessary Information: Make sure you have the details about your vehicle, your driving history, and your desired coverage options.

- Research Insurance Providers: Look for insurance companies that specialize in high-performance vehicle coverage or offer competitive rates for such vehicles.

- Obtain Quotes: Contact multiple insurance providers and request quotes based on your specific requirements.

- Compare Coverage and Rates: Review the quotes you receive, considering the coverage limits, deductibles, additional features, and the overall cost of the insurance policies.

- Make an Informed Decision: Select the insurance policy that offers the best coverage and value for your high-performance vehicle.

These steps will help you save on any type of vehicle, whether you are shopping for affordable sports car insurance or affordable minivan car insurance.

Are there specialized insurance providers for high-performance vehicles?

Yes, there are insurance providers that specialize in high-performance vehicle insurance. These companies understand the unique needs of high-performance vehicle owners and offer tailored coverage options. It’s advisable to explore these specialized providers as they may offer competitive rates and specialized coverage for high-performance vehicles.

What type of coverage options should I consider for my high-performance vehicle?

When insuring a high-performance vehicle, it’s important to consider comprehensive car insurance, collision car insurance, and liability car insurance. Comprehensive coverage protects against non-collision damages (e.g., theft, vandalism), collision coverage covers damage resulting from accidents, and liability coverage protects you if you cause damage to others.

Additional coverage options like uninsured/underinsured motorist coverage and roadside assistance may also be worth considering.

What are the most important aspects of the best performance car insurance?

The most important aspects of high-performance car insurance are vehicle specifications, mileage of performance vehicles, vehicle security, and driving habits.

How does mileage save money?

Many consumers purchase their high-performance vehicles to drive them on special occasions. If this is the case, the mileage on their vehicles may remain low, which can often mean significant savings on car insurance for the driver.

In most cases, when individuals drive their car less during a policy term, it makes them less of a risk for accidents, repair, and, ultimately, insurance claims. Therefore, insurance companies may give out discounts when customers drive their vehicle less often during the terms of a policy.

Is cheap high-performance car insurance available in every country?

If you are planning on traveling overseas to a country like the UK to stay for an extended period, you need to understand that their car insurance companies work a little differently than they do in the U.S.

Many insurance companies in the UK don’t cover high-performance cars. In this case, you will find that a company that provides insurance for high-performance cars will also provide insurance for sports cars. Unfortunately, this means that you will pay a little more for your insurance because everyone in the risk pool is considered a high-risk driver because of the type of car that they drive (learn more: Best Car Insurance for High-Risk Drivers).

Why do insurance companies take the amount of acceleration that a vehicle can obtain so seriously?

One aspect that insurance carriers look at when giving consumers a quote for performance car insurance is the speed of the vehicle. Without a doubt, the most important reason that insurance carriers take speed so seriously is that statistics have shown that high-accelerating vehicles usually resu lt in higher claim amounts for insurance companies over time.

Consumers must know that the higher the speed their vehicle can obtain, the higher car insurance costs will be compared to standard vehicle models.

How do repair costs impact high-performance car insurance?

Another aspect of performance car insurance costs takes into consideration the costs of repair. Consumers must obtain repair cost information before they purchase any vehicle with high-speed ability.

They must ask themselves if they are prepared to take on any cost associated with a collision that is not covered by their performance car insurance.

Consumers must also understand which parts are covered by their performance car insurance carrier in the event of unexpected repair. When consumers purchase a car with hard-to-find parts this may mean more expenses.

How does security impact performance car insurance?

Although high-performance vehicles are hot items for consumer collectors and connoisseurs, they can also be hot items on the lists of thieves. Therefore, when consumers make the security of their vehicle a high priority, most insurance carriers will reward that with anti-theft car insurance discounts.

Consumers must research approved security measures for the high-performance car insurance carriers they are considering. Tracking devices can often offer consumers the best chance of insurance discounts.

Devices such as immobilizers may also offer consumers a great opportunity to improve the security of their high-performance vehicles and receive discounts from their carriers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Michael Leotta

Insurance Operations Specialist

Michael earned a degree in Business Management degree with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Au...

Insurance Operations Specialist

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.