Car Insurance Calculator: Get Free Car Insurance Estimates Online

Use a car insurance calculator to get free car insurance estimates online. Most drivers pay $120 monthly for full coverage, but an auto insurance estimate calculator will use your unique driving profile to get more accurate rates. Start comparing today with the free online car insurance calculator below.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

UPDATED: Jan 8, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 8, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Websites like the one you’re on right now offer car insurance calculators to get free car insurance estimates online. By entering pertinent information, such as your ZIP code and Vehicle Identification Number (VIN), the calculator can scan quotes from the best auto insurance companies in the U.S. and spit out the results for the most affordable coverage.

Car insurance cost calculators are an excellent way to find affordable insurance near you based on your driving profile. Read on to learn how to calculate car insurance quotes online from multiple companies.

- Car insurance calculators are tools websites use to generate quotes for potential auto insurance customers

- The more information you enter, the more accurate your car insurance quotes will be

- Your driving record and where you live will have the biggest impact on your quotes

How to Use a Car Insurance Calculator

Using a car insurance premium calculator is not a complicated process. You will probably be asked a few questions about the following before the insurance calculator can generate a quote for you:

- Your address

- The make and model of your car

- The age and gender of all drivers

- General driving habits

The calculator scans this information and calculates an approximate cost for each different provider. The quote you receive is only an estimate of how much you would be paying if you were approved for coverage.

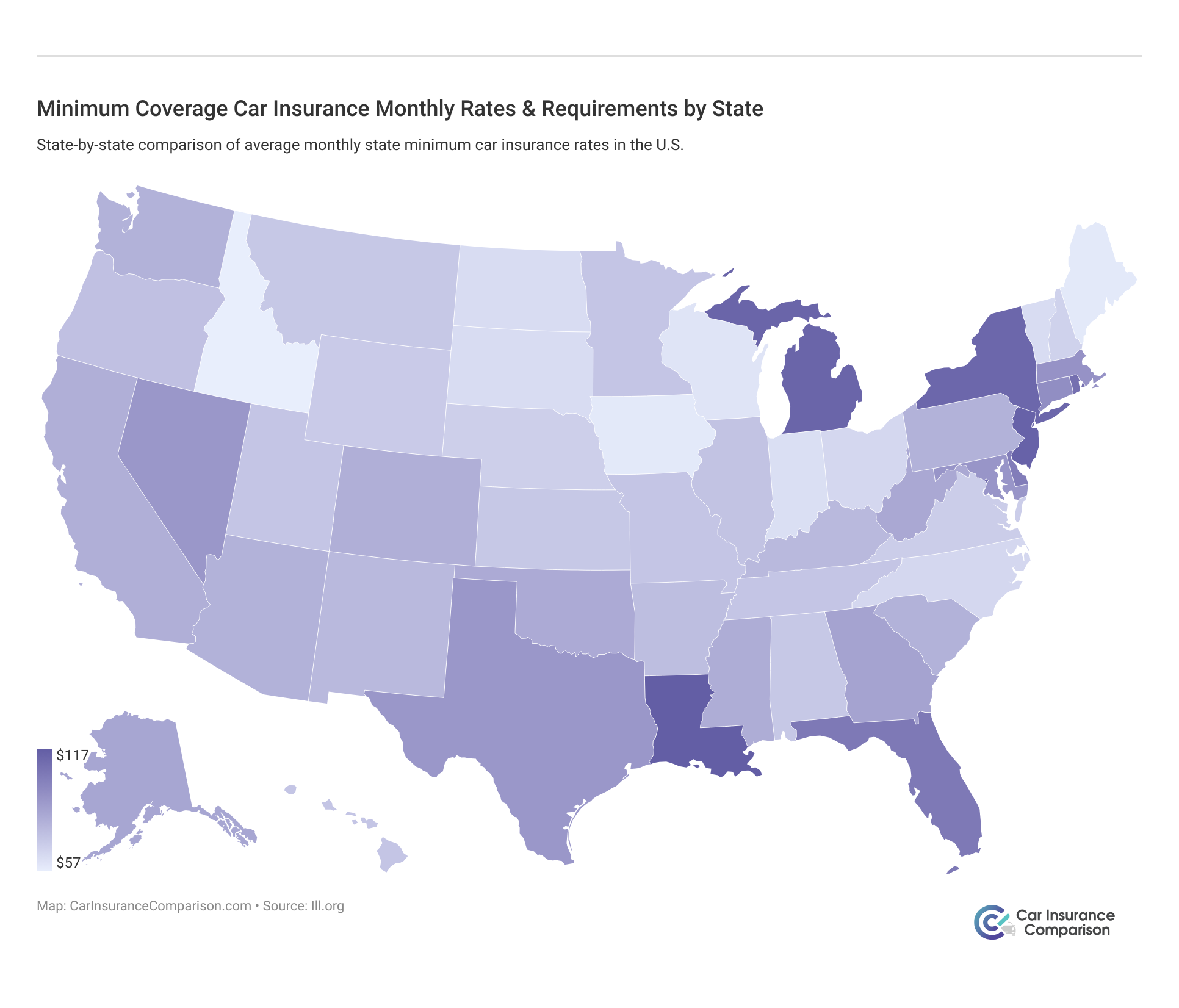

To give you an idea of what you might pay, take a look at this table for average rates by state.

Car Insurance Quotes by State

| States | Term Policy | Whole Policy |

|---|---|---|

| Alabama | $76 | $194 |

| Alaska | $45 | $141 |

| Arizona | $91 | $218 |

| Arkansas | $60 | $193 |

| California | $58 | $168 |

| Colorado | $91 | $233 |

| Connecticut | $60 | $144 |

| Delaware | $88 | $172 |

| District of Columbia | $102 | $180 |

| Florida | $134 | $225 |

| Georgia | $92 | $204 |

| Hawaii | $41 | $113 |

| Idaho | $33 | $112 |

| Illinois | $43 | $133 |

| Indiana | $38 | $120 |

| Iowa | $28 | $111 |

| Kansas | $42 | $135 |

| Kentucky | $70 | $195 |

| Louisiana | $125 | $249 |

| Maine | $29 | $103 |

| Maryland | $67 | $162 |

| Massachusetts | $41 | $145 |

| Michigan | $136 | $211 |

| Minnesota | $60 | $117 |

| Mississippi | $60 | $167 |

| Missouri | $53 | $141 |

| Montana | $42 | $137 |

| Nebraska | $34 | $128 |

| Nevada | $123 | $286 |

| New Hampshire | $30 | $109 |

| New Jersey | $71 | $146 |

| New Mexico | $48 | $147 |

| New York | $185 | $343 |

| North Carolina | $56 | $92 |

| North Dakota | $32 | $114 |

| Ohio | $37 | $120 |

| Oklahoma | $49 | $159 |

| Oregon | $61 | $140 |

| Pennsylvania | $50 | $135 |

| Rhode Island | $87 | $172 |

| South Carolina | $70 | $161 |

| South Dakota | $34 | $127 |

| Tennessee | $42 | $126 |

| Texas | $70 | $183 |

| Utah | $52 | $131 |

| Vermont | $29 | $110 |

| Virginia | $45 | $123 |

| Washington | $50 | $131 |

| West Virginia | $47 | $139 |

| Wisconsin | $32 | $105 |

| Wyoming | $34 | $132 |

Keep in mind that you will still need to go through the underwriting process once you apply for coverage from a particular car insurance company, and if the insurance company discovers something about you or your vehicle that puts you in a higher risk category, it can refuse to cover you or charge a higher rate.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

What You Need to Calculate Car Insurance Quotes

Car insurance premium calculators help you discover what you will most likely pay for auto insurance, but you’ll need to decide on the types and levels of coverage you want before getting quotes:

- Liability car insurance is required by the state and covers bodily injury and property damage that occurs to someone else because of an accident for which you are found at fault.

- Collision car insurance will pay for your car’s damage regardless of who is at fault.

- Comprehensive car insurance covers your car’s damage due to non-collision-related incidents.

- Uninsured/underinsured motorist coverage pays out when the at-fault driver in an accident does not have coverage in place.

- Personal injury protection (PIP) covers medical bills and lost income if you’re injured in a collision.

Depending on where you live, you may be required to have a certain level of car insurance coverage in place. In most parts of the United States, drivers must have third-party liability insurance to drive legally. Take a look at this chart to see the minimum required insurance in each state.

Along with the car insurance required under state law, consumers can choose from different types of optional coverage available on the market.

- Collision coverage protects a driver’s own vehicle from losses resulting from striking another vehicle or object.

- Comprehensive car insurance coverage provides protection from losses other than collisions, such as fire, flooding, and vandalism.

- Gap insurance is required by leases and lessors if you haven’t paid off your vehicle in full.

You will need to decide if you want liability only, or a policy with collision, comprehensive, uninsured motorist, and personal injury protection. You will also need to decide if you are getting only state-mandated coverage or higher limits.

Once you know what the main type of car insurance and the level of coverage you need, you can use this knowledge to evaluate online car insurance quotes properly and make the right buying decision for you.

Read more: Is it cheaper to purchase car insurance online?

Factors That Determine Car Insurance Quotes

There are several factors the insurance company will consider when working up a quote for insurance and a final price for your policy. These include:

- Driving history: If your driving record includes an accident or two and moving violations, you will be considered a higher risk than someone with a clean record. High-risk drivers always pay higher rates.

- Location: Customers who live in urban areas with a lot of cars on the road and a higher likelihood of being involved in a car accident will be paying more for their coverage than people who live in rural areas.

- Gender: Most men pay higher premiums than women do.

- Age: Young drivers pay more than middle-aged drivers, and teen male drivers have some of the highest rates. Compare car insurance rates by age and gender.

- Claims history: The number of claims you’ve made over the past few years could raise your insurance rates, especially if you were at fault for an accident.

- Credit score: Those with bad credit will pay more for car insurance.

- Annual mileage: The more time you spend behind the wheel and the more miles you put on your car, the greater the risk of loss.

- VIN: The year, make, and model of your car will impact how you pay for car insurance. Compare car insurance rates by vehicle make and model.

This is not an exhaustive list of factors car insurance companies consider when adjusting your rates, but these are some of the main ones to keep in mind. Read our guide on the factors that affect car insurance rates to learn more.

Read More: How do you get car insurance fast?

Exploring Free Car Insurance Calculators

When it comes to estimating car insurance costs, various tools are available to provide quick and accurate quotes. Getting a car insurance quote estimate with a car insurance rate calculator, car insurance estimator tool, or car insurance online calculator can give you a detailed breakdown of potential expenses. If you have your vehicle’s number plate, you can check the insurance price by the plate number to get a more specific estimate.

For commercial vehicles, tools like the commercial vehicle insurance premium calculator offer tailored solutions, allowing for detailed and precise cost calculations. By leveraging these resources, you can effectively estimate car insurance and even estimate my car insurance for a personalized quote.

Comprehensive and Free Insurance Tools

Free auto insurance calculators or free car insurance estimators are invaluable for those looking to get an initial quote without any cost. A free insurance calculator can provide insights into various insurance types, including comprehensive coverage. Using a comprehensive calculator ensures you understand the full scope of your insurance needs. For those considering new vehicles, a new car insurance calculator can help predict the insurance costs associated with a fresh purchase. Companies like Geico offer specific tools such as the Geico estimate, which can be used to get a tailored quote. Overall, an insurance car calculator or an insurance cost estimator makes it easy to navigate the often complex world of car insurance by providing clear and concise estimates.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Getting Cheaper Car Insurance Quotes

Price is not the only important consideration when looking for car insurance. If you choose a provider only because of its cheaper premiums, you may find that you do not have enough coverage when you need it.

Always look at the coverage details as well as the price when comparing quotes to get the best price on the car insurance you need.

Dani Best Licensed Insurance Producer

As you increase the limits of your car insurance and add more coverage options, your rates will increase. However, there are ways you can reduce your overall car insurance costs:

- Modify your deductible.

- Add safety and security features.

- Have multiple cars or policies with the same insurance company.

- Take a defensive driving course.

- Maintain a good driving record.

- Keep good grades if you are a student.

- Park your car in a locked garage.

Read more: Where To Get Multiple Car Insurance Quotes

One of the best ways to save money on your car insurance is simply by comparing rates from different car insurance companies. During the comparison process, you’ll see not only the overall cost of the policy but how that money is being applied in the following areas:

- Deductible amounts

- Types of coverage

- Extra features a policy offers

You can modify these coverage amounts to see how your car insurance quotes change. It is also imperative to include any qualifying condition that may make you eligible for auto insurance discounts in order to bring down your premiums.

For example, multi-policy car insurance discounts are available to drivers who bundle two or more types of insurance with the same company, such as car insurance and homeowners/renters insurance. Take a look at this table for a list of major car insurance carriers that offer a variety of discount types.

Car Insurance Discount Availability by Provider

| Discount Name |  |  | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Adaptive Cruise Control | NA | NA | 10% | 10% | 5% | 3% | NA | 7% | 10% | NA |

| Adaptive Headlights | 15% | 15% | 10% | 5% | 5% | 10% | 15% | 5% | 5% | 15% |

| Anti-lock Brakes | 10% | 10% | 10% | 5% | 5% | 5% | 10% | 5% | NA | NA |

| Anti-Theft | 10% | NA | NA | 23% | 20% | 25% | 20% | 15% | NA | NA |

| Claim Free | 35% | 10% | 15% | 26% | 15% | 10% | 15% | 15% | 23% | 12% |

| Continuous Coverage | NA | 10% | 10% | NA | 15% | 15% | 10% | 10% | 15% | 5% |

| Daytime Running Lights | 2% | NA | 2% | 3% | 5% | 5% | 7% | 3% | NA | NA |

| Defensive Driver | 10% | 10% | NA | 10% | 10% | 5% | 10% | 5% | 10% | 3% |

| Distant Student | 35% | 15% | 30% | 30% | 20% | 10% | 20% | 20% | 7% | NA |

| Driver's Ed | 10% | 10% | 8% | NA | 10% | 8% | 10% | 15% | 8% | 3% |

| Driving Device/App | 20% | 40% | 20% | NA | 30% | 40% | 20% | 50% | 30% | 5% |

| Early Signing | 10% | 12% | 15% | 15% | 8% | 8% | 8% | 15% | 10% | 12% |

| Electronic Stability... | 2% | 3% | 3% | 2% | 5% | NA | 5% | NA | 3% | 2% |

| Emergency Deployment | 5% | NA | 20% | 25% | NA | NA | NA | NA | 20% | 25% |

| Engaged Couple | 10% | 10% | 5% | NA | 5% | 10% | 5% | NA | NA | 10% |

| Family Legacy | NA | 10% | NA | 5% | 10% | 5% | 5% | NA | 5% | 10% |

| Family Plan | 20% | NA | 15% | NA | 10% | 25% | NA | 15% | 15% | NA |

| Farm Vehicle | 10% | NA | 10% | NA | 10% | 5% | NA | 5% | 10% | NA |

| Fast 5 | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| Federal Employee | 13% | 15% | NA | 12% | 10% | 16% | NA | 15% | NA | NA |

| Forward Collision Warning | 5% | 10% | 5% | 10% | 5% | NA | 5% | 5% | 5% | 10% |

| Full Payment | 10% | 10% | 8% | NA | $50 | 8% | 10% | NA | 8% | NA |

| Further Education | NA | NA | NA | NA | 10% | 15% | NA | NA | NA | NA |

| Garaging/Storing | NA | NA | NA | NA | NA | NA | NA | NA | NA | 90% |

| Good Credit | 10% | NA | 5% | 10% | 5% | NA | 10% | NA | 10% | NA |

| Good Student | 20% | 23% | NA | 15% | 23% | 10% | 8% | 25% | 8% | 3% |

| Green Vehicle | 10% | NA | 5% | NA | 10% | NA | NA | 10% | 10% | NA |

| Homeowner | 3% | 3% | 5% | NA | 5% | 5% | NA | 3% | 5% | NA |

| Lane Departure Warning | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| Low Mileage | 30% | 30% | 25% | 25% | 30% | 25% | NA | 25% | 30% | 25% |

| Loyalty | 5% | 15% | 5% | NA | 15% | 5% | 15% | 15% | 5% | NA |

| Married | 5% | NA | 5% | NA | NA | NA | 5% | NA | NA | NA |

| Membership/Group | NA | 7% | NA | NA | 10% | 7% | NA | NA | NA | 7% |

| Military | NA | NA | 15% | 15% | 4% | 10% | NA | NA | NA | 30% |

| Military Garaging | NA | NA | NA | NA | NA | NA | NA | NA | NA | 15% |

| Multiple Drivers | 25% | 20% | 20% | NA | NA | 25% | NA | NA | 25% | NA |

| Multiple Policies | 10% | 29% | 20% | 10% | 20% | 10% | 12% | 17% | 13% | NA |

| Multiple Vehicles | NA | 10% | 8% | 25% | 10% | 20% | 10% | 20% | 8% | NA |

| New Address | NA | 5% | NA | NA | 5% | 5% | NA | 5% | NA | NA |

| New Customer/New Plan | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| New Graduate | 5% | 15% | 10% | NA | 5% | 15% | 10% | 5% | 15% | 10% |

| New Vehicle | 30% | NA | 30% | 15% | 40% | NA | 40% | 10% | 12% | NA |

| Newly Licensed | NA | NA | NA | NA | 5% | NA | NA | NA | NA | NA |

| Newlyweds | 10% | NA | 5% | 5% | 5% | NA | 10% | NA | 10% | NA |

| Non-Smoker/Non-Drinker | NA | NA | 10% | NA | 10% | 10% | NA | NA | NA | 10% |

| Occasional Operator | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| Occupation | NA | NA | NA | NA | 10% | 15% | NA | NA | NA | NA |

| On-Time Payments | 5% | 10% | NA | 10% | 10% | 15% | 15% | NA | 15% | NA |

| Online Shopper | 10% | NA | NA | NA | 10% | NA | 7% | NA | 10% | NA |

| Paperless Documents | 10% | 5% | NA | 5% | 5% | 5% | $50 | 10% | 5% | 10% |

| Paperless/Auto Billing | 5% | 5% | NA | NA | 3% | $30 | NA | $20 | 3% | 3% |

| Passive Restraint | 30% | 30% | NA | 40% | NA | 20% | NA | 40% | NA | NA |

| Recent Retirees | NA | NA | NA | NA | 4% | NA | NA | NA | NA | NA |

| Renter | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| Roadside Assistance | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| Safe Driver | 45% | NA | NA | 15% | NA | 35% | 31% | 15% | 23% | 12% |

| Seat Belt Use | NA | NA | NA | 15% | NA | NA | NA | NA | NA | NA |

| Senior Driver | 10% | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| Stable Residence | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| Students & Alumni | NA | NA | NA | NA | 10% | 7% | NA | NA | NA | NA |

| Switching Provider | NA | NA | NA | NA | 10% | NA | NA | NA | NA | NA |

| Utility Vehicle | 15% | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| Vehicle Recovery | 10% | NA | NA | 15% | 35% | 25% | NA | 5% | NA | NA |

| VIN Etching | NA | NA | NA | NA | 5% | NA | NA | NA | NA | NA |

| Volunteer | NA | NA | NA | NA | NA | NA | NA | NA | NA | NA |

| Young Driver | NA | NA | NA | NA | NA | NA | NA | NA | NA | $75 |

As you can see, different discounts are available from different companies. This can also be a factor in deciding which company is right for you.

Learn More:

- Allstate Car Insurance Discounts

- USAA Car Insurance Discounts

- Safe Driver Car Insurance Discounts

- Anti-Theft Car Insurance Discounts

Top Tips For Getting The Best Car Insurance Estimates Online

Each driver has their own objectives they want to achieve when shopping for rates. If you want to use a car insurance calculator to get the best car insurance estimates online, take the following steps:

- Identify the coverage requirements you want

- Identify the highest deductible you can afford

- Read consumer reviews

Then, compare only the same insurance products with each other, and choose a mix of familiar companies and those you may not know much about. A lesser-known company may be able to offer you coverage at a better price.

Read more: Is it possible to get instant online car insurance?

Many car insurance companies offer free car insurance quotes calculators directly from their websites, which makes getting this valuable information a quick and easy process. But to make sure you're not paying too much for coverage, use a third-party car insurance calculator to get free car insurance estimates online.

Kalyn Johnson Insurance Claims Support & Sr. Adjuster

To find the lowest insurance rate and the best company to work with, you certainly want to get as many quotes as possible. Using an insurance rate comparison site like this one will get you the auto insurance estimates you need to make the right decision. Get started with our free car insurance price calculator above.

Frequently Asked Questions

What is a car insurance calculator?

A car insurance calculator is an online tool that helps individuals estimate the cost of car insurance premiums based on various factors such as the type of car, driver’s age, location, driving history, and coverage options. It provides an approximate quote to give users an idea of how much they might expect to pay for car insurance.

How does a car insurance calculator work?

Car insurance calculators typically require users to input specific information about their vehicle and driving profile. This information is used to determine the level of risk associated with insuring the individual and their car. The calculator uses complex algorithms and data from insurance providers to generate an estimated premium based on the provided details.

How are car insurance amounts calculated?

Car insurance calculators use your driving profile (age, gender, location, and driving record) as well as your vehicle type to calculate a car insurance rate estimate.

How many car insurance quotes are enough to make a good comparison?

Most insurance experts recommend a minimum of three quotations to make a sound financial decision. You should have enough information with three quotes to make a reasonably good decision.

Are the estimates provided by a car insurance calculator accurate?

While car insurance calculators strive to provide accurate estimates, they are based on general assumptions and average rates. The final premium may vary depending on additional factors considered by insurance companies during the underwriting process. It’s always recommended to obtain quotes directly from insurance providers for precise figures.

Why is it important to learn how insurance companies calculate premiums?

During your research for car insurance, it’s important to know the science behind how car insurance companies calculate their premiums. Understanding the specific factors, like age and written premiums, will help you make a better call on the company you want to buy insurance coverage from.

Can I purchase car insurance directly through a car insurance calculator?

No, car insurance calculators provide estimates and quotes but do not facilitate the purchase of insurance policies. Once you have obtained an estimate, you will need to contact the insurance company directly or use their online platform to complete the purchase process.

Is using a car insurance calculator mandatory?

No, using a car insurance calculator is not mandatory, but it can be a helpful tool when researching and comparing car insurance rates. It allows you to quickly estimate car insurance premiums and compare different coverage options and providers before making a decision.

Are car insurance calculators free to use?

Yes, most car insurance calculators are available for free on insurance company websites or third-party insurance comparison platforms. You can use them as many times as you need to compare quotes and explore different coverage scenarios.

What information do I need to use a car insurance calculator?

The information required may vary slightly between calculators, but common details include your vehicle’s make, model, year of manufacture, estimated annual mileage, your age, driving history, location, and the desired coverage levels. Providing accurate information will result in more precise estimates.

How much car insurance do I need?

You need enough car insurance to meet the requirements of the state and any auto loans or leases you have.

Is $100 a month too much for car insurance?

Paying $100 monthly for car insurance is less than than the national average, which is closer to $200/mo.

Does credit score affect car insurance?

Yes, bad credit can raise your car insurance rates with some companies. Fortunately, some states made it illegal for companies to use credit score to determine rates.

How do state regulatory agencies affect insurance rates?

State insurance regulation departments clarify which type of coverage is needed for each type of driver, whether it’s a younger driver, one who is financing or leasing a vehicle, or someone who is looking to purchase state minimum coverage limits.

Why do insurance companies use third-party car insurance calculators?

By simply making information available to the central clearinghouse, car insurance companies have access to millions of potential customers without ever doing their own marketing campaign. It’s a quick and efficient way to connect insurance providers with potential customers at a pretty low cost.

Can a calculator help me estimate how much car insurance do I need?

A car insurance calculator helps determine the amount of coverage you need based on factors like your vehicle’s value, driving habits, and financial situation. It typically considers liability, collision, and comprehensive coverage needs.

Can I estimate how much homeowners insurance do I need with a calculator?

A homeowners insurance calculator estimates the coverage required to rebuild your home in case of damage or destruction. It factors in your home’s value, local construction costs, and personal property value to suggest appropriate dwelling, liability, and personal property coverage.

How much insurance do I need according to car insurance calculators?

This general insurance calculator assists in determining the appropriate amount of various types of insurance, including life, health, auto, and home insurance. It evaluates your financial situation, dependents, and assets to recommend suitable coverage levels.

how much is a car insurance calculator?

A car insurance cost calculator estimates your premium based on factors like your age, driving record, location, type of vehicle, and chosen coverage levels. It helps you get an idea of your expected monthly or annual insurance costs.

How much is insurance calculator?

A general insurance cost calculator provides estimates for various types of insurance, including auto, home, health, and life insurance. It takes into account personal factors and coverage preferences to offer an approximate premium.

How much is my car insurance going to be?

Use a car insurance calculator to get an estimate of your future car insurance costs and determine how much your car insurance will be. Provide details about your driving record, vehicle, and desired coverage to see how these factors influence your premium.

How much should i be paying for coverage according to car insurance calculators?

A car insurance rate calculator helps you understand if you’re paying a fair price for your coverage. Enter your personal details, vehicle information, and current coverage to compare against average rates in your area.

How much will car insurance cost me?

Use a car insurance calculator to estimate your costs. Input factors such as age, driving record, vehicle type, and coverage preferences to get a personalized premium estimate.

How much will my insurance be when I pass my test?

New drivers can use a car insurance calculator to estimate premiums after passing their driving test. Input factors like age, location, and vehicle type to see how these influence your insurance cost.

How much will my insurance go up with a new car?

A car insurance rate increase calculator estimates how much your premium will increase when you get a new car. Input details about your current and new vehicles, and driving history to see the difference in cost.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.