Best Audi A4 Car Insurance in 2025 (Your Guide to the Top 10 Companies)

State Farm, Erie, and Farmers offers the best Audi A4 car insurance, with premiums starting at $43/month. These providers stand out for their competitive price, dependable service to customers, and flexible coverage alternatives, making them the top choices for Audi A4 drivers.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Jan 6, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 6, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Audi A4

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 1,883 reviews

1,883 reviewsCompany Facts

Full Coverage for Audi A4

A.M. Best Rating

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviews 3,072 reviews

3,072 reviewsCompany Facts

Full Coverage for Audi A4

A.M. Best Rating

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviews

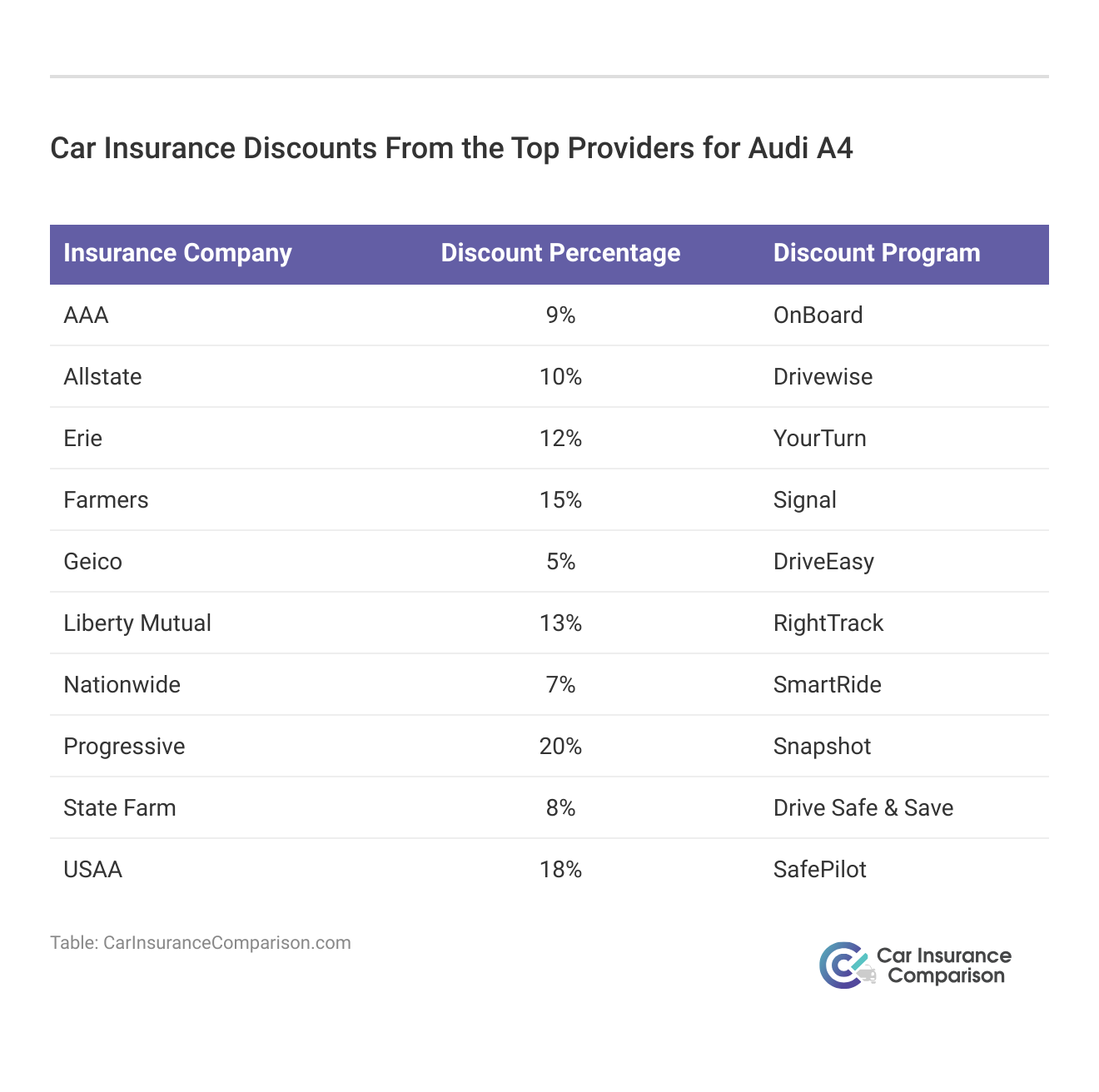

This article explores how these companies compare, taking into account factors like safety ratings, driver demographics, and available car insurance discounts, to help you find the best coverage for your Audi A4.

Our Top 10 Company Picks: Best Audi A4 Car Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 8% | B | Many Discounts | State Farm | |

| #2 | 12% | A+ | 24/7 Support | Erie |

| #3 | 15% | A | Local Agents | Farmers | |

| #4 | 10% | A+ | Add-on Coverages | Allstate | |

| #5 | 5% | A++ | Custom Plan | Geico | |

| #6 | 20% | A+ | Innovative Programs | Progressive | |

| #7 | 7% | A+ | Usage Discount | Nationwide |

| #8 | 18% | A++ | Military Savings | USAA | |

| #9 | 13% | A | Customizable Polices | Liberty Mutual |

| #10 | 9% | A | Online App | AAA |

Audi A4 insurance rates are slightly more than the average vehicle with full coverage costing $129 a month. Owners of an older Audi A4 may choose to get liability coverage only which averages $52 a month. Let’s take a closer look at Audi A4 insurance rates, safety ratings, and more.

Explore your car insurance options by entering your ZIP code above and finding which companies have the lowest rates.

- State Farm offers the best Audi A4 car insurance with rates starting at $43/month

- Compare quotes to find the most affordable coverage tailored to your needs

- Top providers offer discounts and safety feature benefits specific to Audi A4 drivers

#1 – State Farm: Top Overall Pick

Pros

- Many Discounts: State Farm car insurance review provides a wide variety of discounts for Audi A4 insurance, making it easier for drivers to save on their premiums.

- Low Monthly Rates: State Farm offers competitive monthly rates at $57 for the Audi A4 with minimum coverage.

- Bundling Policies: State Farm offers significant discounts for bundling multiple insurance policies, which enhances savings for Audi A4 owners.

Cons

- Limited Multi-Policy Discount: The multi-policy discount from State Farm is not as high compared to some competitors for the Audi A4.

- Premium Costs: Despite discounts, State Farm’s premiums might still be relatively higher for certain coverage levels, which could affect Audi A4 owners.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#2 – Erie: Best for 24/7 Support

Pros

- 24/7 Support: Erie offers round-the-clock customer service, which is ideal for Audi A4 drivers who may need assistance at any time.

- Affordable Rates: Erie car insurance review provides minimum coverage for the Audi A4 at $64 per month, which aligns with the industry standard for luxury vehicles.

- High Customer Satisfaction: Erie is known for excellent customer service, which ensures Audi A4 owners receive personalized and attentive support.

Cons

- Limited Availability: Erie’s insurance policies are not available in all states, which might limit access for some Audi A4 owners.

- Fewer Add-Ons: Erie’s add-on coverage options are less extensive compared to other insurers, which might be a drawback for Audi A4 drivers seeking more comprehensive protection.

#3 – Farmers: Best for Local Agents

Pros

- Local Agents: Farmers car insurance review provides access to local agents, offering personalized service for Audi A4 insurance policies.

- Good Multi-Vehicle Discount: Farmers offers a 15% multi-vehicle discount, making it cost-effective for Audi A4 owners with multiple cars.

- Specialized Coverage: Farmers offers specialized coverage options for the Audi A4, catering to the specific needs of luxury car owners.

Cons

- Higher Premiums: Farmers’ insurance rates for the Audi A4 start at $78 per month for minimum coverage, which is higher than some competitors.

- Limited Digital Tools: Farmers’ online tools and mobile app are less robust, which might be inconvenient for tech-savvy Audi A4 owners.

#4 – Allstate: Best for Add-On Coverages

Pros

- Extensive Add-On Options: Allstate offers a wide range of add-on coverages tailored for Audi A4 owners, including accident forgiveness and new car replacement.

- Safe Driver Discounts: Allstate car insurance review provides significant discounts for Audi A4 drivers with a clean driving record, lowering the cost to $43 per month for minimum coverage.

- High Financial Strength: With an A+ A.M. Best rating, Allstate ensures that Audi A4 claims are paid reliably and promptly.

Cons

- Expensive Premiums: Allstate’s premiums can be on the higher side, particularly for younger Audi A4 drivers or those with less driving experience.

- Discount Restrictions: Some discounts, such as the multi-policy discount, might not be as generous compared to other insurers for the Audi A4.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#5 – Geico: Best for Custom Plan

Pros

- Custom Plan Options: Geico car insurance review highlights the Audi A4 owners to tailor their insurance plans according to their specific needs, offering flexibility in coverage.

- Competitive Rates: Geico offers minimum coverage rates at $77 per month for the Audi A4, making it a cost-effective choice for many drivers.

- Strong Digital Presence: Geico’s robust online tools and mobile app make managing Audi A4 insurance easy and convenient.

Cons

- Lower Multi-Vehicle Discount: Geico’s multi-vehicle discount is only 5%, which is lower compared to other insurers for the Audi A4.

- Limited Local Agents: Geico primarily operates online, which might be a downside for Audi A4 owners who prefer face-to-face interactions.

#6 – Progressive: Best for Innovative Programs

Pros

- Innovative Programs: Progressive’s Snapshot program rewards Audi A4 drivers with safe driving habits, potentially lowering rates to $66 per month for minimum coverage.

- Extensive Discounts: Progressive offers a wide variety of discounts, making it easier for Audi A4 owners to save on their premiums.

- Flexible Payment Plans: Progressive car insurance review provides Audi A4 owners with flexible payment options, making it easier to manage insurance costs.

Cons

- Higher Rates for High-Risk Drivers: Audi A4 owners with a history of accidents or violations might find Progressive’s rates higher than average.

- Customer Service Variability: Progressive’s customer service experience can vary, which may be a concern for Audi A4 owners needing consistent support.

#7 – Nationwide: Best for Usage-Based Discount

Pros

- Usage-Based Discounts: Nationwide’s SmartRide program offers discounts for Audi A4 drivers based on their driving habits, potentially reducing costs to $72 per month for minimum coverage.

- Accident Forgiveness: Nationwide offers accident forgiveness car insurance options, protecting Audi A4 owners from premium increases after their first at-fault accident.

- Strong Financial Stability: Nationwide’s A+ A.M. Best rating ensures reliability in handling Audi A4 insurance claims.

Cons

- Limited Online Tools: Nationwide’s digital tools are not as advanced as some competitors, which could be a drawback for tech-savvy Audi A4 owners.

- Higher Baseline Rates: Nationwide’s initial rates for Audi A4 insurance tend to be higher, making it less competitive for budget-conscious drivers.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

#8 – USAA: Best for Military Savings

Pros

- Military Savings: USAA car insurance review includes particular benefits to members of the military, making it a good choice to Audi A4 customers with military links.

- High Customer Satisfaction: USAA has a reputation to deliver exceptional service to clients, ensuring that Audi A4 owners receive the best possible assistance.

- Competitive Rates: USAA offers minimum coverage rates for Audi A4 insurance starting at $95 per month, which is higher than some competitors but comes with excellent service.

Cons

- Eligibility Restrictions: The general population of Audi A4 drivers is not eligible for USAA because it is exclusively available to military personnel and their families.

- Fewer Local Offices: USAA has fewer physical locations, which might be a downside for Audi A4 owners who prefer in-person service.

#9 – Liberty Mutual: Best for Customizable Policies

Pros

- Customizable Coverage: Liberty Mutual offers highly customizable policies for Audi A4 owners, allowing them to select coverage that suits their needs.

- New Car Replacement: Liberty Mutual car insurance review provides new car replacement coverage for Audi A4 owners, ensuring the value of the car is protected.

- Multi-Policy Discount: Liberty Mutual offers a 13% discount for Audi A4 owners who bundle their auto insurance with other policies.

Cons

- Higher Premiums: Liberty Mutual’s minimum coverage rates for the Audi A4 start at $78 per month, which is higher than many competitors.

- Limited Discount Availability: Some discounts may not be available in all states, potentially reducing savings for Audi A4 owners.

#10 – AAA: Best for Online App

Pros

- Strong Online Tools: AAA car insurance review has a robust online app that allows Audi A4 owners to easily manage their insurance policies.

- Roadside Assistance: AAA’s membership provides comprehensive roadside assistance, which is a valuable benefit for Audi A4 owners.

- Competitive Multi-Vehicle Discount: AAA offers a 9% multi-vehicle discount, which can help Audi A4 owners save when insuring multiple cars.

Cons

- Membership Requirement: AAA requires a membership, which adds an additional cost for Audi A4 owners who might not need the other benefits.

- Higher Rates for Younger Drivers: AAA’s rates for younger Audi A4 drivers tend to be higher, which might not be ideal for that demographic.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Insurance Pricing for the Audi A4

When considering car insurance for an Audi A4, monthly premiums can vary significantly based on both the level of coverage and the insurance provider. For minimum coverage, rates from major insurers range from $43 with Allstate to $95 with USAA.

Audi A4 Car Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $64 | $189 |

| Allstate | $43 | $140 |

| Erie | $64 | $198 |

| Farmers | $78 | $240 |

| Geico | $77 | $221 |

| Liberty Mutual | $78 | $243 |

| Nationwide | $72 | $215 |

| Progressive | $66 | $193 |

| State Farm | $57 | $155 |

| USAA | $95 | $266 |

For full coverage car insurance, these rates are notably higher, with Allstate offering one of the more affordable options at $140 per month, while USAA charges up to $266. On average, Audi A4 insurance costs around $129 per month, but this can fluctuate based on specific factors such as deductible choices or driver profiles.

Audi A4 Car Insurance Monthly Rates by Coverage Type

| Category | Rates |

|---|---|

| Average Rate | $129 |

| Discount Rate | $76 |

| High Deductibles | $111 |

| High Risk Driver | $274 |

| Low Deductibles | $162 |

| Teen Driver | $470 |

For example, those opting for high deductibles might see lower premiums at $111, whereas high-risk drivers could pay as much as $274 monthly. Teen drivers face the steepest rates, averaging $470 per month. These variations highlight the importance of comparing insurance options to find the best rate for your coverage needs.

Reasons Behind High Insurance Costs for Audi A4

When comparing the monthly insurance rates of the Audi A4 with similar vehicles across different types of coverage, it becomes clear that the Audi A4 offers relatively competitive rates. For comprehensive coverage, the Audi A4 is priced at $28, which is lower than most of the other vehicles except the Lexus ES 350 (Read more: Compare Porsche Car Insurance Rates).

Audi A4 Car Insurance Monthly Rates vs. Similar Vehicles by Coverage Type

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Audi A4 | $28 | $55 | $33 | $129 |

| Infiniti Q70 | $31 | $65 | $28 | $135 |

| Mercedes-Benz S450 | $41 | $82 | $33 | $169 |

| Porsche Panamera | $43 | $87 | $33 | $177 |

| Lexus ES 350 | $30 | $55 | $26 | $123 |

| Audi A8 | $39 | $75 | $33 | $159 |

| Mercedes-Benz E300 | $33 | $62 | $28 | $134 |

Collision coverage for the Audi A4 stands at $55, aligning closely with the Lexus ES 350 and significantly lower than the Porsche Panamera and Mercedes-Benz S450, which are the most expensive in this category. For minimum coverage, the Audi A4’s rate of $33 is comparable to those of higher-end models like the Mercedes-Benz S450 and the Porsche Panamera, both of which share the same cost for this coverage type.

Full coverage for the Audi A4 is set at $129 per month, making it more affordable than luxury models like the Porsche Panamera and the Mercedes-Benz S450, yet slightly more expensive than the Lexus ES 350. Overall, the Audi A4 strikes a balance between cost-effectiveness and coverage compared to its luxury counterparts.

Elements Affecting Audi A4 Insurance Rates

When determining the cost of insurance for an Audi A4, the specific trim and model you select play a significant role. Different trims and models can come with varying features, performance capabilities, and values, all of which insurers consider when calculating premiums. Uncover our guide “Factors That Affect Car Insurance Rates.”

High-performance models or those with advanced technology may lead to higher insurance costs due to the increased risk associated with repairs and replacements. Consequently, choosing a particular Audi A4 model can directly influence the overall price of your auto insurance coverage.

Age of the Vehicle

The monthly insurance rates for an Audi A4 vary depending on the age of the vehicle, with both comprehensive and collision coverage generally decreasing as the car gets older. For a brand new 2024 Audi A4, comprehensive insurance costs $29 per month, while collision coverage is $57, and full coverage totals $132. As the vehicle ages, these costs gradually decline.

Audi A4 Car Insurance Monthly Rates by Age of the Vehicle

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| 2024 Audi A4 | $29 | $57 | $34 | $132 |

| 2023 Audi A4 | $29 | $56 | $34 | $131 |

| 2022 Audi A4 | $28 | $55 | $34 | $130 |

| 2021 Audi A4 | $28 | $55 | $34 | $129 |

| 2020 Audi A4 | $28 | $55 | $33 | $129 |

| 2019 Audi A4 | $27 | $54 | $33 | $128 |

| 2018 Audi A4 | $27 | $53 | $35 | $128 |

| 2017 Audi A4 | $26 | $51 | $36 | $126 |

| 2016 Audi A4 | $26 | $51 | $36 | $126 |

| 2015 Audi A4 | $24 | $49 | $37 | $124 |

| 2014 Audi A4 | $24 | $46 | $38 | $120 |

| 2013 Audi A4 | $23 | $43 | $38 | $117 |

| 2012 Audi A4 | $22 | $39 | $38 | $112 |

| 2011 Audi A4 | $20 | $36 | $38 | $107 |

| 2010 Audi A4 | $20 | $33 | $39 | $105 |

For example, a 2020 Audi A4 has comprehensive coverage priced at $28, collision at $55, and full coverage at $129 per month. Older models, such as the 2010 Audi A4, see further reductions, with comprehensive coverage at $20 and full coverage costing $105 per month.

Interestingly, while comprehensive and collision rates decrease consistently with the car’s age, the minimum coverage cost shows a slight increase for older models, particularly in vehicles from 2017 and earlier. This trend reflects how insurance premiums adjust over time, taking into account factors like depreciation and the availability of replacement parts.

Driver Age

Audi A4 Car Insurance Monthly Rates by Age

| Age | Rates |

|---|---|

| Age: 16 | $720 |

| Age: 18 | $470 |

| Age: 20 | $292 |

| Age: 30 | $134 |

| Age: 40 | $129 |

| Age: 45 | $125 |

| Age: 50 | $117 |

| Age: 60 | $115 |

For example, by the age of 18, the monthly premium drops to approximately $470, and by age 20, it further decreases to $292. Once drivers reach their 30s, insurance costs stabilize at more affordable rates, with individuals in their 30s, 40s, and 50s paying between $117 and $134 per month.

The lowest rates are typically seen among drivers aged 60, who can expect to pay around $115 monthly. This trend illustrates how insurers adjust premiums based on the perceived risk associated with different age groups.

Driver Location

The monthly insurance rates for an Audi A4 vary significantly depending on the city. In Los Angeles, CA, the rate is notably higher at $220 per month, making it the most expensive among the listed cities. Following closely is New York, NY, where the monthly cost is $203. Houston, TX, and Jacksonville, FL, have rates of $177 and $187, respectively, placing them in the mid-range.

Audi A4 Car Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Los Angeles, CA | $220 |

| New York, NY | $203 |

| Houston, TX | $177 |

| Jacksonville, FL | $187 |

| Philadelphia, PA | $172 |

| Chicago, IL | $170 |

| Phoenix, AZ | $149 |

| Seattle, WA | $125 |

| Indianapolis, IN | $109 |

| Columbus, OH | $107 |

Philadelphia, PA, and Chicago, IL, offer slightly more affordable rates at $172 and $170 per month. Phoenix, AZ, stands out with a rate of $149, while Seattle, WA, provides a more economical option at $125. The lowest rates can be found in Indianapolis, IN, and Columbus, OH, with rates of $109 and $107, respectively. These variations reflect the influence of location-specific factors on car insurance premiums.

Your Driving Record

Audi A4 Car Insurance Monthly Rates by Age & Driving Record

| Age | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Age: 16 | $720 | $1,000 | $1,450 | $950 |

| Age: 18 | $470 | $690 | $920 | $600 |

| Age: 20 | $292 | $470 | $670 | $450 |

| Age: 30 | $134 | $280 | $450 | $250 |

| Age: 40 | $129 | $270 | $440 | $240 |

| Age: 45 | $125 | $265 | $430 | $235 |

| Age: 50 | $117 | $260 | $420 | $230 |

| Age: 60 | $115 | $255 | $415 | $225 |

For example, an 18-year-old with a clean record might pay around $470 monthly, while a 20-year-old would pay approximately $292. By the time drivers reach their 30s, the rates drop further, with a 30-year-old paying about $134 per month with a clean record. The trend of decreasing premiums continues into middle age, with those in their 40s and 50s enjoying lower rates.

However, any record of accidents, DUIs, or traffic tickets can still significantly raise premiums, even for older, more experienced drivers. For instance, a 50-year-old with one DUI may face a monthly premium of $420. The lowest rates are typically seen by drivers in their 60s, with a clean record rate of $115 per month, although any driving infractions can still lead to increased costs.

Audi A4 Safety Ratings

The safety features of the Audi A4 can significantly impact your car insurance rates. The Audi A4 is equipped with an extensive array of safety features, including driver and passenger airbags, front and rear head airbags, front and rear side airbags, 4-wheel ABS, 4-wheel disc brakes, brake assist, electronic stability control, daytime running lights, child safety locks.

Integrated turn signal mirrors, traction control, a blind spot monitor, auto-leveling headlights, cross-traffic alert, tire pressure monitors, electronic stability control, four-wheel anti-lock brakes, traction control, child seat lowering anchors, airbags (front, side, head, side head curtain), daytime running lights, and adjustable seat belt heights with tensioners.

Audi A4 Safety Ratings

| Type | Rating |

|---|---|

| Small overlap front: driver-side | Good |

| Small overlap front: passenger-side | Good |

| Moderate overlap front | Good |

| Side | Good |

| Roof strength | Good |

| Head restraints and seats | Good |

The Audi A4 insurance costs should be relatively fair considering that these vehicles come with a plethora of safety features car insurance discounts. Depending on the individual insurance company, the actual influence these features will have on your rate will vary.

Some providers give up front discounts that lower your policy rate right from the start, while others may not offer any discount at all for certain features. Comparing multiple quotes will be the only way to ensure you get the best deal on your A4 auto insurance.

Audi A4 Crash Test Ratings

Good Audi A4 crash test ratings mean the VW is safer, which could mean cheaper Audi A4 car insurance rates. The general safety a vehicle is able to afford its passenger is of the utmost importance when insurance companies are trying to determine the risk involved to insure a particular driver and vehicle.

Audi A4 Crash Test Ratings

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Audi A4 4 DR AWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2024 Audi A4 4 DR FWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2023 Audi A4 4 DR AWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2023 Audi A4 4 DR FWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2022 Audi A4 4 DR AWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2022 Audi A4 4 DR FWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2021 Audi A4 4 DR AWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2021 Audi A4 4 DR FWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2020 Audi A4 allroad SW AWD | 5 stars | 4 stars | 5 stars | 5 stars |

| 2020 Audi A4 4 DR AWD | 5 stars | 4 stars | 5 stars | 5 stars |

| 2020 Audi A4 4 DR FWD | 5 stars | 4 stars | 5 stars | 5 stars |

| 2019 Audi A4 4 DR AWD | 5 stars | 4 stars | 5 stars | 5 stars |

| 2019 Audi A4 4 DR FWD | 5 stars | 4 stars | 5 stars | 5 stars |

| 2018 Audi A4 4 DR AWD | 5 stars | 4 stars | 5 stars | 5 stars |

| 2018 Audi A4 4 DR FWD | 5 stars | 4 stars | 5 stars | 5 stars |

| 2017 Audi A4 4 DR AWD | 5 stars | 4 stars | 5 stars | 5 stars |

| 2017 Audi A4 4 DR FWD | 5 stars | 4 stars | 5 stars | 5 stars |

| 2016 Audi A4 4 DR AWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2016 Audi A4 4 DR FWD | 5 stars | 5 stars | 5 stars | 5 stars |

Side impact tests also received a perfect five-star rating. Since the vehicle has been proven to fair very well in crash tests, it is reasonable to assume that rates should remain in the fair range for Audi A4 insurance costs.

Audi A4 Insurance Loss Probability

Audi A4 Car Insurance Loss Probability by Coverage Type

| Coverage | Loss Rate |

|---|---|

| Collision | 79% |

| Property Damage | 7% |

| Comprehensive | 3% |

| Personal Injury | -20% |

| Medical Payment | 12% |

| Bodily Injury | 0% |

Interestingly, personal injury coverage has a negative loss rate of -20%, implying that this type of coverage may result in fewer claims than expected, or perhaps even refunds or credits in certain situations. Medical payment coverage sees a 12% loss rate, reflecting the frequency of claims related to medical expenses after an accident.

Finally, bodily injury coverage stands at 0%, indicating that there is no expected loss in this category, which could suggest either very few claims or that the costs are fully covered by premiums.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Methods to Cut Down Audi A4 Insurance Costs

There are several strategies you can employ to reduce the cost of insurance for your Audi A4 and secure the best possible rates. Here are five approaches to consider:

Firstly, if your credit score has improved, it might be worthwhile to request a new insurance quote for your Audi A4, as a better credit rating can often lead to lower premiums. Additionally, if you’re considering adding a second vehicle to your household, it may be more cost-effective to rent a car occasionally instead of purchasing another Audi A4, which can help you avoid the added insurance costs.

It’s also important to be aware that your insurance provider has the right to adjust your rates during the policy term for various reasons, so staying informed about the factors that might trigger these changes can help you anticipate and manage costs. If you have a teenage driver in the family, monitoring their driving habits closely can prevent potential rate hikes due to risky behavior.

Four rings to move them all. There is something new and electrifying waiting on the horizon. Stay tuned.#Audi #FutureIsAnAttitude #news #LookForCirclesDay pic.twitter.com/f359LXzzMM

— Audi (@AudiOfficial) November 2, 2022

Finally, inquire about discounts for students who live away from home, as many insurers offer reduced rates when the primary driver of the vehicle is not regularly using it. By exploring these options, you can make informed decisions to keep your Audi A4 insurance rates manageable. Explore more insight in our guide “Best Car Insurance Companies That Don’t Use Credit Scores.”

Best Insurance Providers for Audi A4

When considering car insurance companies for the Audi A4, it’s essential to look at the top providers by market share to ensure comprehensive coverage and competitive premiums. State Farm leads the market with a significant 9% share, reflecting $66 million in premiums written.

Top Audi A4 Car Insurance Providers by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $66,153,063 | 9% |

| #2 | Geico | $46,358,896 | 6% |

| #3 | Progressive | $41,737,283 | 6% |

| #4 | Allstate | $39,210,020 | 5% |

| #5 | Liberty Mutual | $36,172,570 | 5% |

| #6 | Travelers | $28,786,741 | 4% |

| #7 | USAA | $24,621,246 | 3% |

| #8 | Chubb | $24,199,582 | 3% |

| #9 | Farmers | $20,083,339 | 3% |

| #10 | Nationwide | $18,499,967 | 3% |

Geico and Progressive follow, each holding a 6% market share, with premiums totaling approximately $46 million and $42 million, respectively. Allstate and Liberty Mutual also make a strong showing, each capturing 5% of the market, with premiums hovering around $39 million and $36 million.

Travelers, USAA, Chubb, Farmers, and Nationwide round out the list, each maintaining a 3-4% share, with premiums ranging from $28 million to $18 million. These companies collectively represent the most popular choices for Audi A4 insurance, offering a variety of options to meet different needs and preferences.

Online Comparison of Audi A4 Insurance Quotes

You can easily start comparing insurance quotes for your Audi A4 from top car insurance providers by using our complimentary online tool. This service allows you to quickly assess various rates from leading insurers, helping you find the most competitive and suitable coverage for your needs.

Audi A4 car insurance rates vary greatly between different individuals, and the rate you are offered by different companies can vary greatly as well. Read up on our guide “How long does a car insurance quote last?”

The Audi A4 is part of a lineup of cars that is known for their performance capabilities, luxury, and all around quality of engineering.

To ensure that you get the lowest rate possible when insuring an Audi A4, you will have to shop around getting quotes from as many providers as you can.

Each company has a different method of calculating the risk of insuring someone and weigh different aspects of a person’s driving habits and history accordingly.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Suggestions for Achieving the Lowest Insurance Premiums

When aiming to secure the lowest possible insurance rate for a vehicle like the Audi A4, it’s important to recognize that the average monthly premium for auto insurance in the U.S. The actual amount will depend on various factors, including how insurance companies assess your risk profile. To keep your insurance rate as low as possible, consider a few key strategies.

First, maintaining a good credit score is crucial, as insurance providers often factor in your credit history when determining premiums. A strong credit score can lead to significant savings on your insurance costs. Additionally, having a clean claims history is beneficial since a history of multiple claims can signal a higher risk to insurers, leading to higher premiums.

Opting for a higher car insurance deductible is another way to reduce your insurance costs, although it means you would pay more out-of-pocket in the event of a claim. Some states also offer special low-cost insurance programs for drivers who qualify, which can be a good option to explore. Lastly, the amount you drive is also a factor; reducing unnecessary driving can help lower your rate.

Case Studies: How to Obtain the Best Insurance for an Audi A4

When it comes to securing the best Audi A4 car insurance, individual needs and circumstances can significantly impact the coverage and rates. Below are three real-life case studies that illustrate how different drivers found the ideal insurance plan to match their unique situations.

- Case Study #1 – Young Driver in a High-Risk Area: A 25-year-old Audi A4 owner living in an urban area faced higher insurance premiums due to his age and location. By comparing quotes from multiple providers, he discovered that State Farm offered the most affordable rate at $43/month, thanks to their young driver discounts and comprehensive coverage options.

- Case Study #2 – Experienced Driver With a Clean Record: An experienced driver with a spotless driving history sought the best Audi A4 car insurance that provided maximum coverage without breaking the bank. After evaluating several providers, she chose Erie, which not only offered low rates but also included additional benefits like accident forgiveness and roadside assistance.

- Case Study #3 – Audi A4 Owner Seeking Custom Coverage: A middle-aged Audi A4 owner required customizable coverage due to a mix of city and highway driving. Farmers emerged as the best option, providing tailored policies that matched his specific needs, including coverage for safety features and a usage-based discount that adjusted rates based on his driving habits.

These case studies demonstrate that finding the best Audi A4 car insurance requires understanding your unique circumstances and exploring options from top providers like State Farm, Erie, and Farmers. Browse for more information in our guide “Can you tow a car that doesn’t have insurance?”

State Farm offers unbeatable rates and comprehensive coverage, making it the top choice for Audi A4 insurance.

Tracey L. Wells Licensed Insurance Agent & Agency Owner

Whether you’re a young driver, have a clean record, or need custom coverage, there’s a solution tailored just for you. So how much is insurance for an Audi? Enter your ZIP code below to start comparing Free car insurance quotes online now.

Frequently Asked Questions

What aspects affect the price of insurance for an Audi A4?

The price of Audi A4 auto insurance may vary depending on the specification and approach, age of the car, driving history, driver location, and age of the driver. See our guide, “Do all auto insurance companies check your driving record?” for more information. Learn more in our guide “Do all car insurance companies check your driving records?”

Are the Audi A4s costly to maintain?

Audi A4 insurance rates are slightly higher than the average vehicle. However, there are ways to find the cheapest Audi insurance rates online. Finding affordable car insurance doesn’t have to be a challenge. Enter your ZIP code below into our free comparison tool to find the lowest prices in your area.

How do age, gender, and marital status affect car insurance rates for PKW Audi A4?

Different car insurance companies weigh age, gender, and marital status factors differently, so their impact on rates can vary. Generally, younger drivers, male drivers, and unmarried drivers may have higher insurance rates for their PKW Audi A4 compared to older, female, and married drivers.

Do I need full coverage insurance if my PKW Audi A4 is financed?

If your PKW Audi A4 is financed, the lender may require you to have full coverage insurance. Full coverage insurance typically includes comprehensive and collision coverage in addition to the minimum liability coverage required by the state. Check out our guide “Collision vs. Comprehensive: What is the difference?”

How can I find cheap car insurance rates?

To find cheap car insurance rates, you can compare quotes from the top car insurance companies in the area. By comparing quotes, you can find the best rates for your specific needs.

What are the best companies for Audi A4 car insurance?

State Farm, Erie, and Farmers are among the best companies for Audi A4 car insurance, offering competitive rates and comprehensive coverage.

Can safety features on the Audi A4 reduce insurance costs?

Yes, safety features car insurance on the Audi A4 can lead to lower insurance premiums, as they reduce the risk of accidents and claims.

How does my driving record influence Audi A4 insurance costs?

A clean driving record can significantly reduce your Audi A4 insurance costs, while violations or accidents can increase your premiums.

Are there discounts available for Audi A4 car insurance?

Yes, many insurance companies offer discounts for Audi A4 drivers, including safe driver discounts, multi-policy discounts, and discounts for vehicles with advanced safety features.

Does the age of my Audi A4 affect my insurance rates?

Yes, older Audi A4 models generally have lower insurance rates compared to newer models, as they typically have a lower replacement value. See how much you’ll pay for car insurance by entering your ZIP code below into our free comparison tool.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.