Best Mckinney, TX Car Insurance in 2025

Car insurance in Mckinney, TX averages $322 a month. Mckinney, Texas car insurance requirements are 30/60/25, but you might need full coverage insurance if your car is financed. To find cheap Mckinney car insurance rates, compare quotes from the top car insurance companies in Mckinney, TX.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Joel Ohman

Executive Chairman

Joel Ohman is the CEO of a private equity-backed digital media company. He is a published author, angel investor, and serial entrepreneur who has a passion for creating new things, from books to businesses. He has previously served as the founder and resident CFP® of a national insurance agency, Real Time Health Quotes. He has an MBA from the University of South Florida. Joel has been mentione...

Executive Chairman

UPDATED: Oct 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- The cheapest car insurance company in McKinney is USAA

- Average car insurance rates in McKinney, TX are $3,866/year

- The cheapest car insurance company in McKinney for teen drivers is USAA

If you need to buy McKinney, Texas car insurance, the options can be confusing. Everything you need to know about car insurance in McKinney, TX is right here.

You’ll find McKinney car insurance rates, the cheapest McKinney, TX car insurance companies, and information on Texas car insurance laws. You can also compare McKinney, Texas car insurance rates to Laredo car insurance rates, Austin car insurance rates, and El Paso car insurance rates.

Ready to find affordable McKinney, TX car insurance today? Enter your ZIP code for fast, free McKinney car insurance quotes.

Cheapest McKinney, TX Car Insurance Rates By Age, Gender, and Marital Status

How do age, gender, and marital status affect McKinney, TX car insurance rates? Every McKinney, Texas car insurance company weighs these factors differently, so check out the comparison rates.

| Insurance Company | Married 35-Year-Old Female | Married 35-Year-Old Male | Married 60-Year-Old Female | Married 60-Year-Old Male | Single 17-Year-Old Female | Single 17-Year-Old Male | Single 25-Year-Old Female | Single 25-Year-Old Male |

|---|---|---|---|---|---|---|---|---|

| Allstate | $3,328 | $3,348 | $3,284 | $3,284 | $8,926 | $10,742 | $4,108 | $4,263 |

| American Family | $2,638 | $2,956 | $2,528 | $2,912 | $7,432 | $9,696 | $3,871 | $4,418 |

| Geico | $2,617 | $2,841 | $2,532 | $2,902 | $5,934 | $6,131 | $2,847 | $2,833 |

| Nationwide | $2,271 | $2,305 | $2,007 | $2,121 | $6,571 | $8,418 | $2,681 | $2,897 |

| Progressive | $2,292 | $2,190 | $2,051 | $2,083 | $9,833 | $11,005 | $2,738 | $2,800 |

| State Farm | $2,165 | $2,165 | $1,938 | $1,938 | $5,374 | $6,879 | $2,367 | $2,434 |

| USAA | $1,627 | $1,625 | $1,560 | $1,534 | $4,699 | $5,085 | $2,163 | $2,295 |

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Minimum Car Insurance in McKinney, TX

Every driver must carry the minimum car insurance in McKinney, TX. Take a look at the Texas car insurance requirements.

| Liability Insurance Required | Minimum Coverage Limits Required |

|---|---|

| Bodily Injury Liability Coverage | $30,000 per person $60,000 per accident |

| Property Damage Liability Coverage | $25,000 minimum |

Cheapest McKinney, TX Car Insurance Rates by Credit Score

Your credit affects car insurance costs in McKinney, TX. Compare credit history car insurance rates in McKinney from top companies for good, fair, and poor credit.

| Insurance Company | Poor | Fair | Good |

|---|---|---|---|

| Allstate | $6,554 | $4,808 | $4,120 |

| American Family | $6,199 | $3,990 | $3,480 |

| Geico | $5,536 | $3,125 | $2,078 |

| Nationwide | $4,379 | $3,530 | $3,067 |

| Progressive | $4,906 | $4,260 | $3,956 |

| State Farm | $4,470 | $2,784 | $2,219 |

| USAA | $3,767 | $2,189 | $1,764 |

Cheapest McKinney, TX Car Insurance Rates by Driving Record

Your driving record is one of the biggest factors affecting car insurance costs. Compare bad driving record car insurance rates in McKinney, TX to rates for a clean record with top companies.

| Group | Clean Record | With 1 Accident | With 1 DUI | With 1 Speeding Violation |

|---|---|---|---|---|

| Allstate | $3,971 | $6,211 | $6,488 | $3,971 |

| American Family | $4,131 | $5,319 | $4,645 | $4,131 |

| Geico | $3,034 | $4,050 | $3,334 | $3,902 |

| Nationwide | $3,175 | $3,175 | $4,701 | $3,585 |

| Progressive | $3,814 | $4,942 | $4,448 | $4,292 |

| State Farm | $2,786 | $3,221 | $3,838 | $2,786 |

| USAA | $1,909 | $2,836 | $3,358 | $2,191 |

Cheapest McKinney, TX Car Insurance for Teen Drivers

Teen car insurance in McKinney, TX can be expensive. Take a look at rates from the top car insurance companies in McKinney for teenagers.

| Insurance Company | Single 17-Year-Old Female | Single 17-Year-Old Male |

|---|---|---|

| Allstate | $8,926 | $10,742 |

| American Family | $7,432 | $9,696 |

| Geico | $5,934 | $6,131 |

| Nationwide | $6,571 | $8,418 |

| Progressive | $9,833 | $11,005 |

| State Farm | $5,374 | $6,879 |

| USAA | $4,699 | $5,085 |

Cheapest McKinney, TX Car Insurance for Seniors

Take a look at McKinney, TX senior car insurance rates from top companies. Shopping around can make a big difference for senior drivers.

| Insurance Company | Married 60-Year-Old Female | Married 60-Year-Old Male |

|---|---|---|

| Allstate | $3,284 | $3,284 |

| American Family | $2,528 | $2,912 |

| Geico | $2,532 | $2,902 |

| Nationwide | $2,007 | $2,121 |

| Progressive | $2,051 | $2,083 |

| State Farm | $1,938 | $1,938 |

| USAA | $1,560 | $1,534 |

Cheapest McKinney, TX Car Insurance Rates After a DUI

A DUI in McKinney, TX increases car insurance rates. Compare McKinney, Texas DUI car insurance by company to find the cheapest option.

| Insurance Company | Annual Car Insurance Rates With a DUI |

|---|---|

| Allstate | $6,488 |

| American Family | $4,645 |

| Geico | $3,334 |

| Nationwide | $4,701 |

| Progressive | $4,448 |

| State Farm | $3,838 |

| USAA | $3,358 |

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Cheapest McKinney, TX Car Insurance Rates by Commute Length

How does how far you drive affect car insurance rates in McKinney, TX by commute? Take a look at a comparison of the top companies by commute length.

| Insurance Company | 10 Mile Commute, 6,000 Annual Mileage | 25 Mile Commute, 12,000 Annual Mileage |

|---|---|---|

| Allstate | $5,033 | $5,288 |

| American Family | $4,556 | $4,556 |

| Geico | $3,516 | $3,643 |

| Nationwide | $3,659 | $3,659 |

| Progressive | $4,374 | $4,374 |

| State Farm | $3,158 | $3,158 |

| USAA | $2,541 | $2,606 |

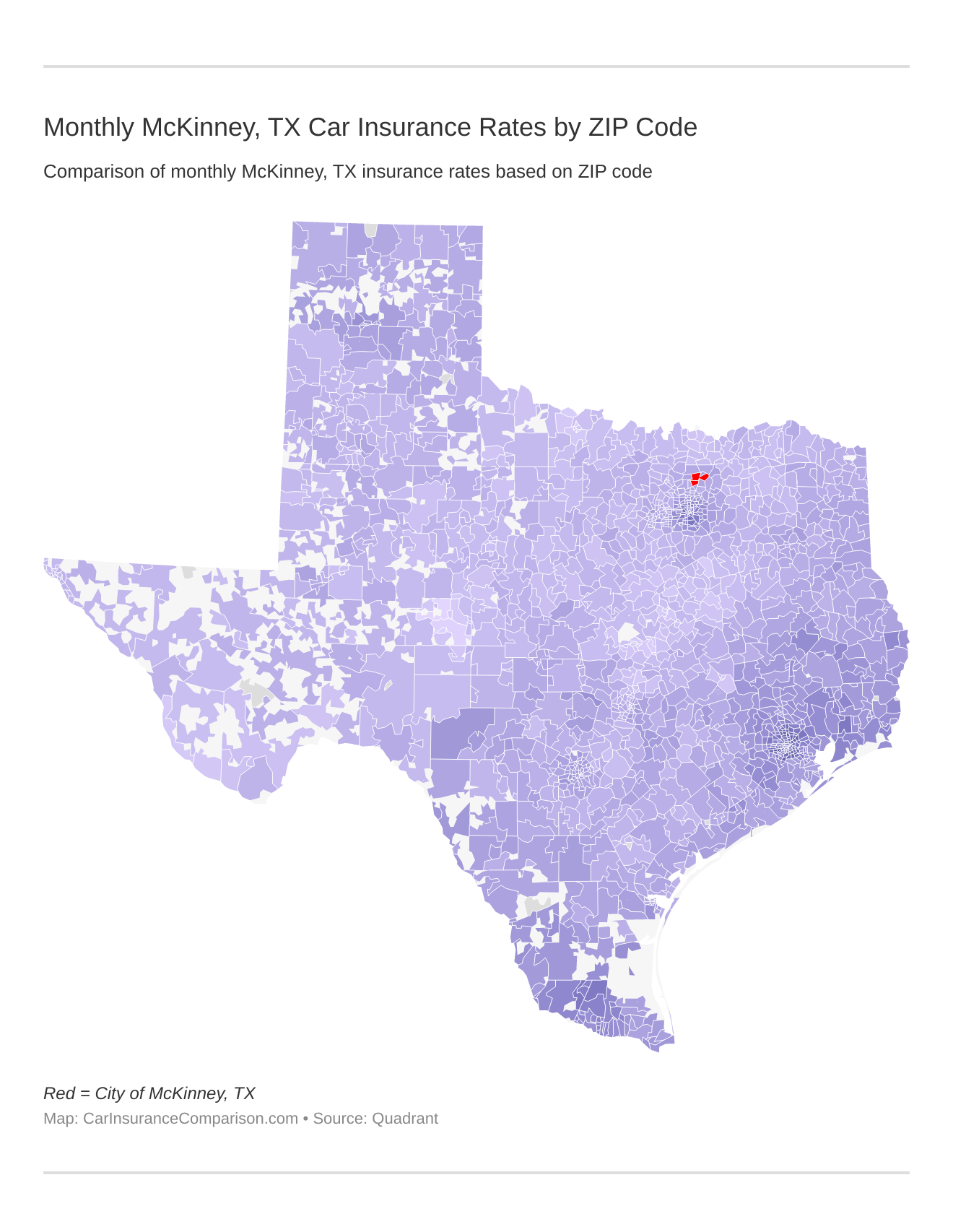

Monthly McKinney, TX Car Insurance Rates by ZIP Code

ZIP codes will play a major role in your car insurance rates because factors like crime and traffic are calculated by ZIP code. Check out the monthly McKinney, Texas auto insurance rates by ZIP Code below:

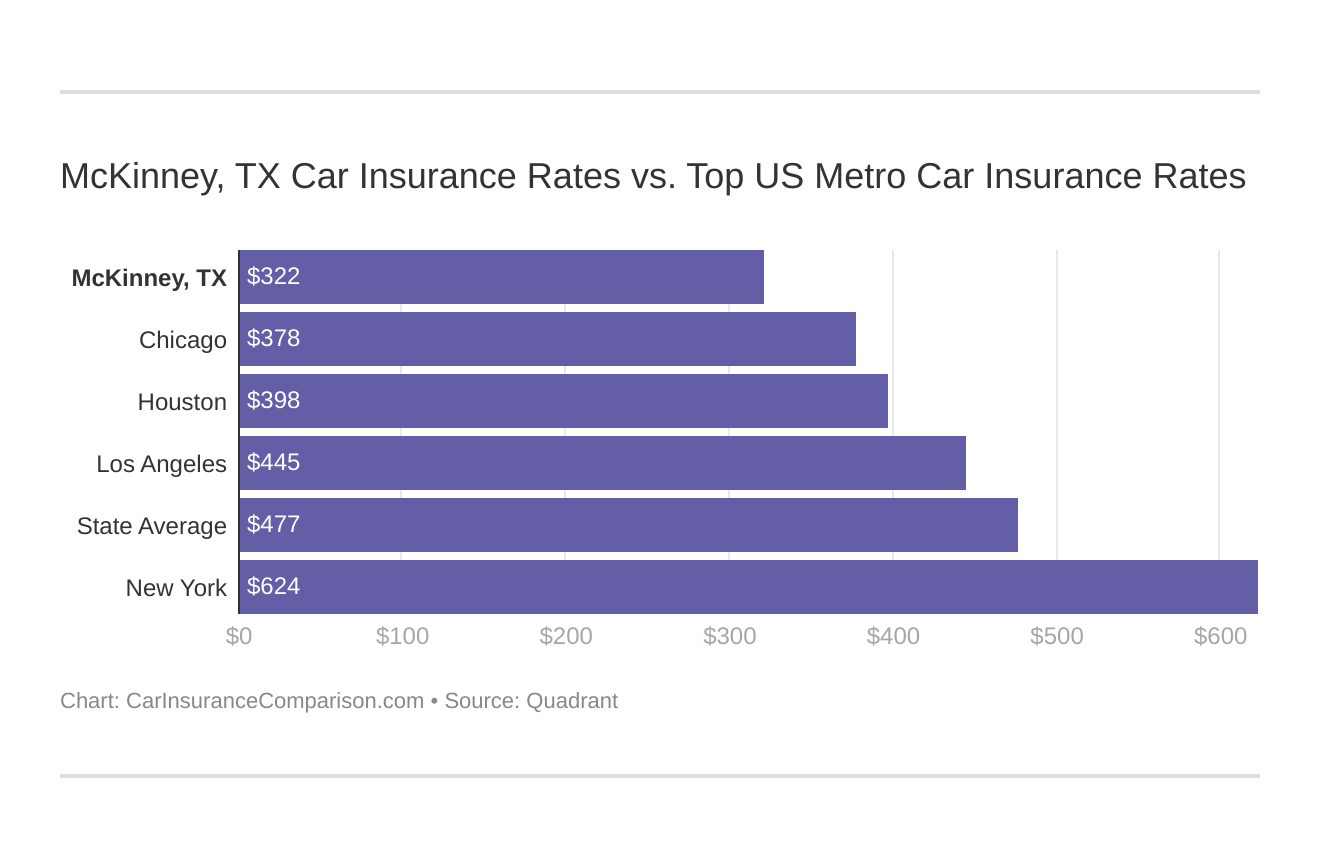

McKinney, TX Car Insurance Rates vs. Top US Metro Car Insurance Rates

You might find yourself asking how does my McKinney, Texas stack up against other top US metro areas’ auto insurance rates? We’ve got your answer below.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

The Best Cheap Car Insurance Companies in McKinney, TX

Take a look at a side-by-side comparison of the top car insurance companies in McKinney, TX to find the best option for your needs.

| Insurance Company | Average Annual Rates |

|---|---|

| Allstate | $5,160 |

| American Family | $4,556 |

| Geico | $3,580 |

| Nationwide | $3,659 |

| Progressive | $4,374 |

| State Farm | $3,158 |

| USAA | $2,573 |

Category Winners: Cheapest Car Insurance in McKinney, Texas

Find the cheapest car insurance companies in McKinney, TX for each category right here.

| Category | Insurance Company |

|---|---|

| Teenagers | USAA |

| Seniors | USAA |

| Clean Record | USAA |

| With 1 Accident | USAA |

| With 1 DUI | Geico |

| With 1 Speeding Violation | USAA |

Cheapest McKinney, TX Car Insurance Rates by Coverage Level

How much coverage you choose will have an impact on your McKinney car insurance rates. Find the cheapest McKinney, TX car insurance rates by coverage level.

| Insurance Company | Low | Medium | High |

|---|---|---|---|

| Allstate | $5,032 | $5,112 | $5,337 |

| American Family | $4,246 | $4,393 | $5,029 |

| Geico | $3,389 | $3,542 | $3,809 |

| Nationwide | $3,949 | $3,505 | $3,524 |

| Progressive | $4,201 | $4,360 | $4,560 |

| State Farm | $2,983 | $3,152 | $3,338 |

| USAA | $2,482 | $2,563 | $2,675 |

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

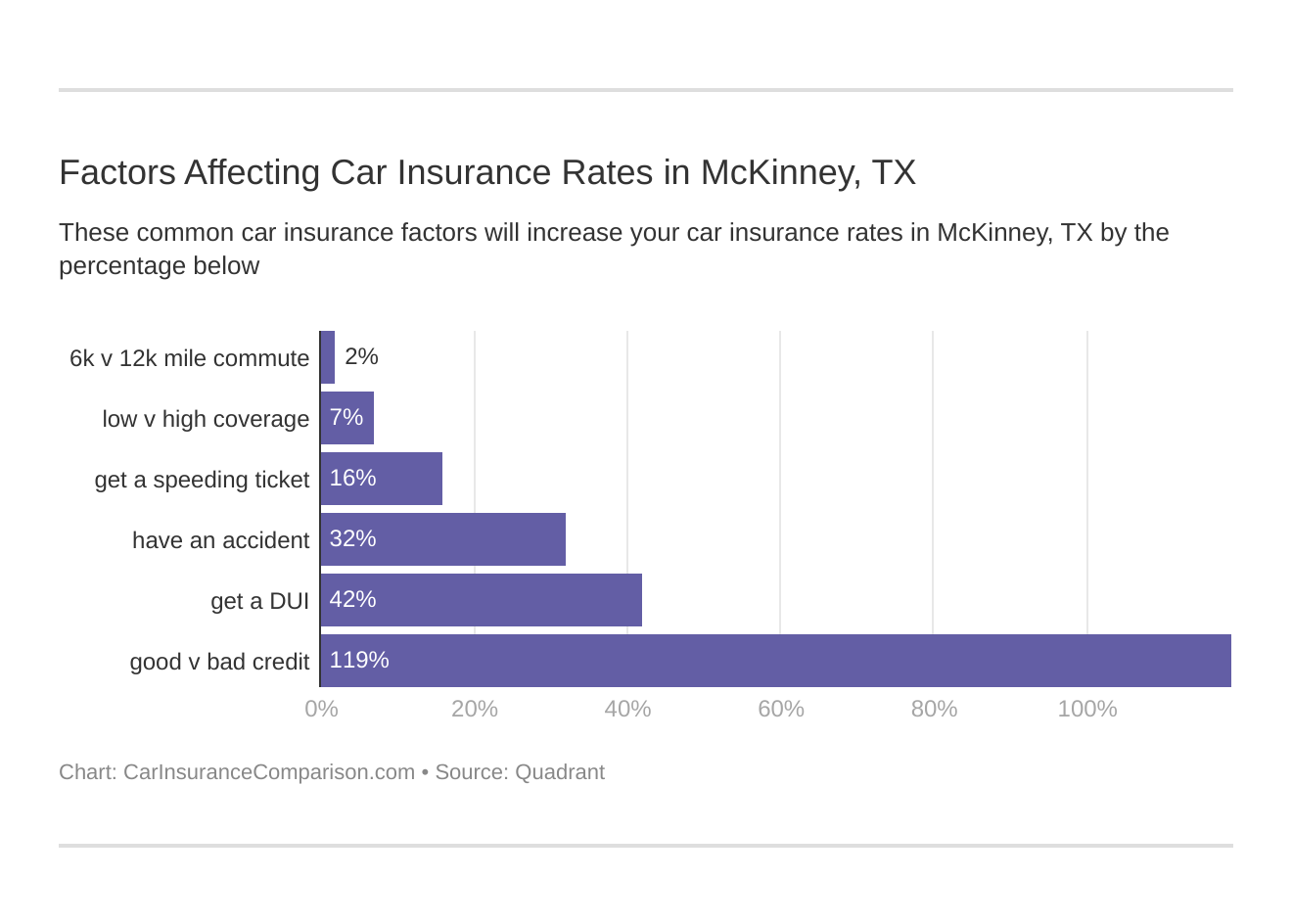

What affects car insurance rates in McKinney, Texas?

Factors affecting car insurance rates in McKinney, TX may include your commute, coverage level, tickets, DUIs, and credit. Controlling these factors will help you maintain cheap McKinney, Texas car insurance.

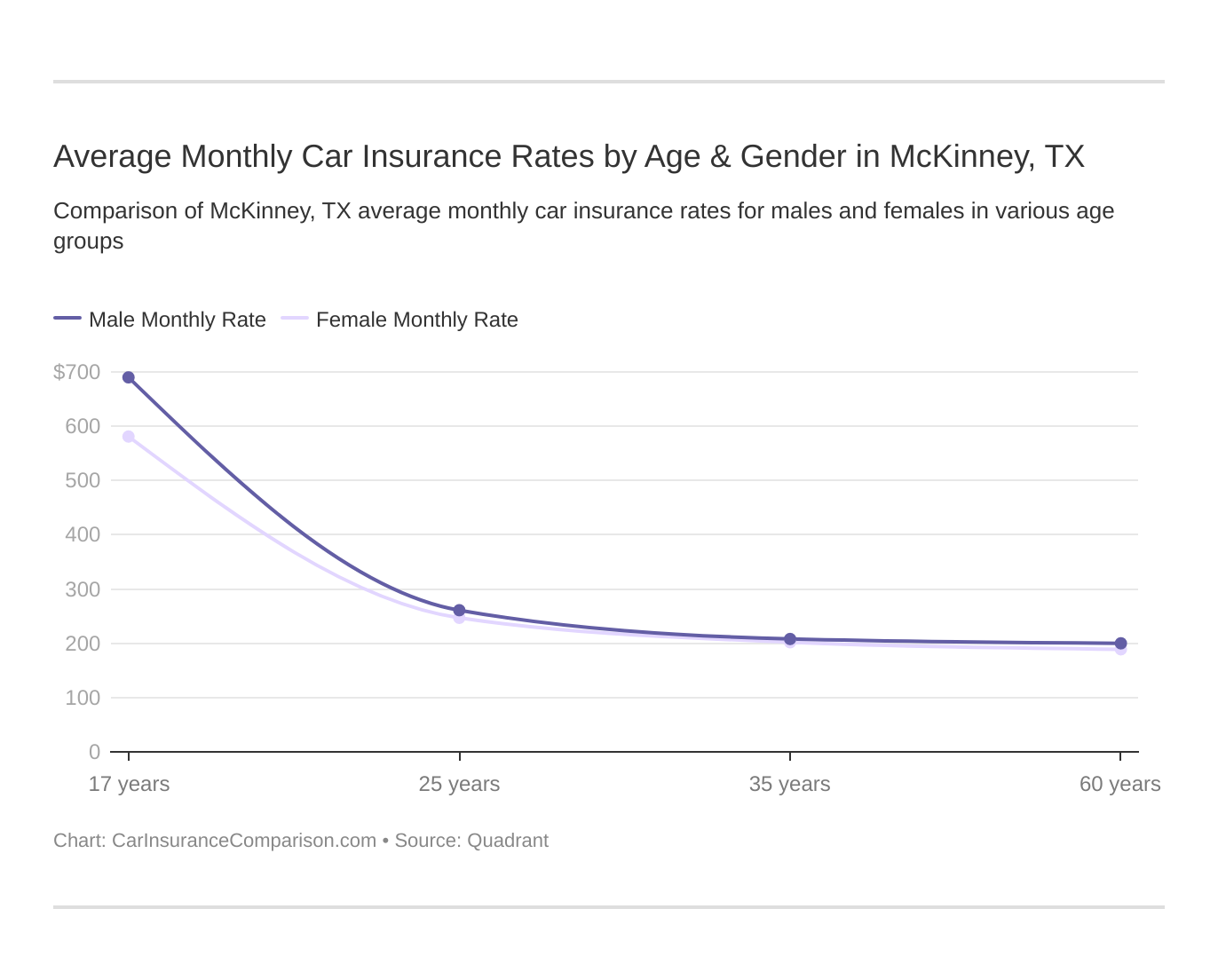

These states are no longer using gender to calculate your car insurance rates — Hawaii, Massachusetts, Michigan, Montana, North Carolina, and Pennsylvania. But age is still a major factor because young drivers are often considered high-risk. Therefore, teen car insurance is more expensive. TX does use gender, so check out the average monthly car insurance rates by age and gender in McKinney, TX.

Car Theft in McKinney

High levels of vehicle theft can make car insurance more expensive. McKinney, TX car theft statistics from the FBI indicate 156 vehicle thefts a year.

Commute Time in McKinney

The more time you spend in your car the higher the risk of an accident. The average commute length in McKinney, TX is 29.3 minutes according to City-Data.

Compare Car Insurance Quotes in McKinney, TX

Ready to find affordable McKinney, Texas car insurance today? Enter your ZIP code for fast, free McKinney, TX car insurance quotes.

Frequently Asked Questions

How does car insurance in McKinney, TX compare to other cities in Texas?

Car insurance rates in McKinney, TX can vary compared to other cities in Texas. Factors such as population density, local traffic patterns, crime rates, and the number of insurance claims in the area can influence insurance premiums. It’s recommended to compare quotes from multiple insurance providers to get an accurate understanding of the cost of car insurance in McKinney.

Are there any specific factors that affect car insurance rates in McKinney, TX?

Several factors can impact car insurance rates in McKinney, TX, including:

- Age and driving experience

- Vehicle make, model, and year

- Personal driving record and claims history

- Annual mileage and usage of the vehicle

- Credit history

- Coverage options and deductibles chosen

- Local crime rates and accident statistics

Which insurance companies provide car insurance coverage in McKinney, TX?

Numerous insurance companies provide car insurance coverage in McKinney, TX. Some popular options include well-known national providers such as State Farm, GEICO, Allstate, Progressive, and Farmers Insurance. Additionally, there may be local or regional insurance companies that offer coverage in the area.

How can I find the best car insurance rates in McKinney, TX?

To find the best car insurance rates in McKinney, TX, consider the following tips:

- Shop around and compare quotes from multiple insurance providers.

- Maintain a clean driving record and consider taking defensive driving courses to potentially qualify for discounts.

- Bundle your car insurance with other policies, such as home or renters insurance, to potentially receive a multi-policy discount.

- Increase your deductibles, but make sure you can afford the out-of-pocket costs in the event of a claim.

- Ask about available discounts, such as good student discounts or discounts for safety features installed in your vehicle.

Are there any local factors unique to McKinney, TX that affect car insurance rates?

Some local factors in McKinney, TX that may impact car insurance rates include the traffic patterns, road conditions, and weather patterns specific to the area. Insurance companies consider these factors when determining premiums. Additionally, local crime rates and the prevalence of auto theft in the area can also influence insurance rates.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Joel Ohman

Executive Chairman

Joel Ohman is the CEO of a private equity-backed digital media company. He is a published author, angel investor, and serial entrepreneur who has a passion for creating new things, from books to businesses. He has previously served as the founder and resident CFP® of a national insurance agency, Real Time Health Quotes. He has an MBA from the University of South Florida. Joel has been mentione...

Executive Chairman

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.