Best Paterson, NJ Car Insurance in 2025

The cheapest Paterson, NJ car insurance is offered by GEICO, but rates will vary by driver. Auto insurance in Paterson must meet the state minimum requirements of 15/30/5 in liability coverage and $15,000 in personal injury protection. Compare Paterson, NJ auto insurance rates online to find the best deal for you.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michael Leotta

Insurance Operations Specialist

Michael earned a degree in Business Management degree with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Au...

Insurance Operations Specialist

UPDATED: Nov 4, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Nov 4, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Geico offers the cheapest car insurance on average in Paterson, NJ

- Paterson car insurance is more expensive than the national average

- Some Paterson drivers may qualify for the Special Automobile Insurance Policy program if they have Medicaid

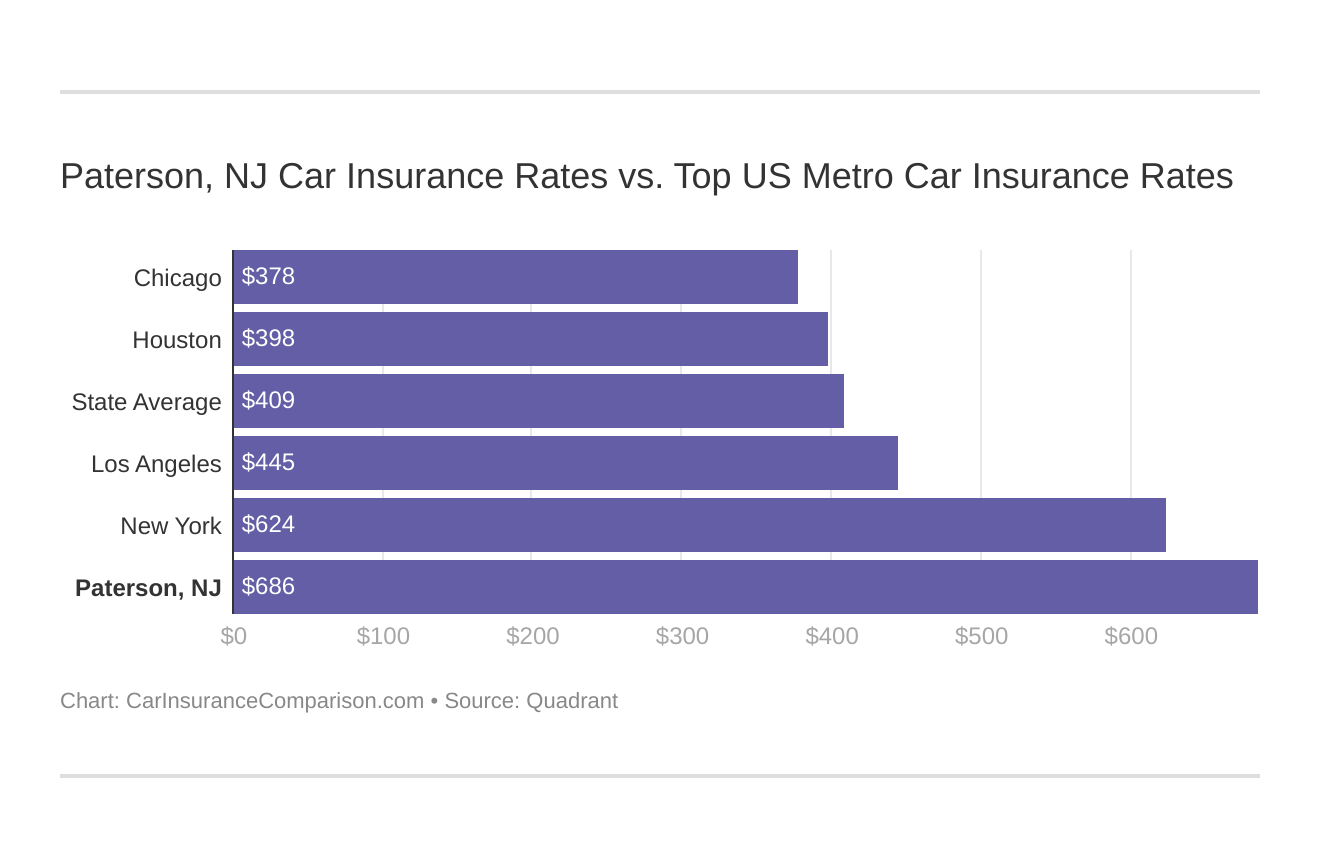

Paterson, NJ car insurance is much higher than the national average. It’s not surprising since New Jersey car insurance on average is also more expensive.

However, you can still find affordable Paterson, NJ car insurance if you shop around. Compare rates from multiple companies to find the cheap car insurance that fits your needs.

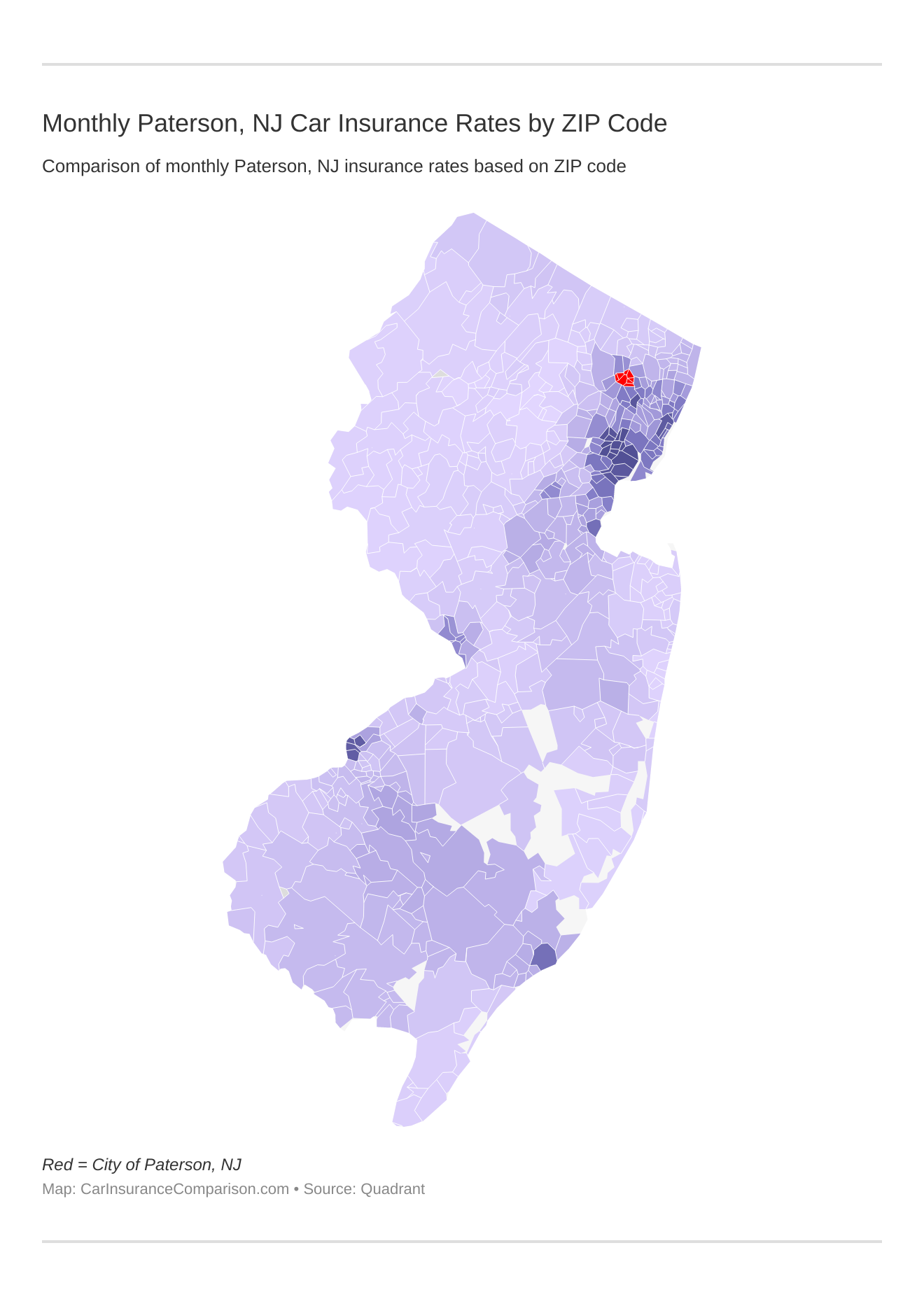

Monthly Paterson, NJ Car Insurance Rates by ZIP Code

ZIP codes will play a major role in your auto insurance rates because factors like crime and traffic are calculated by the ZIP code. Find more info about the monthly Paterson, NJ auto insurance rates by ZIP Code below:

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Paterson, NJ Car Insurance Rates vs. Top US Metro Car Insurance Rates

What city you reside in will impact your car insurance. That’s why it’s essential to compare Paterson, NJ against other top US metro areas’ auto insurance costs.

Enter your ZIP code now to compare Paterson, NJ car insurance quotes for free today.

What is the cheapest car insurance company in Paterson, NJ?

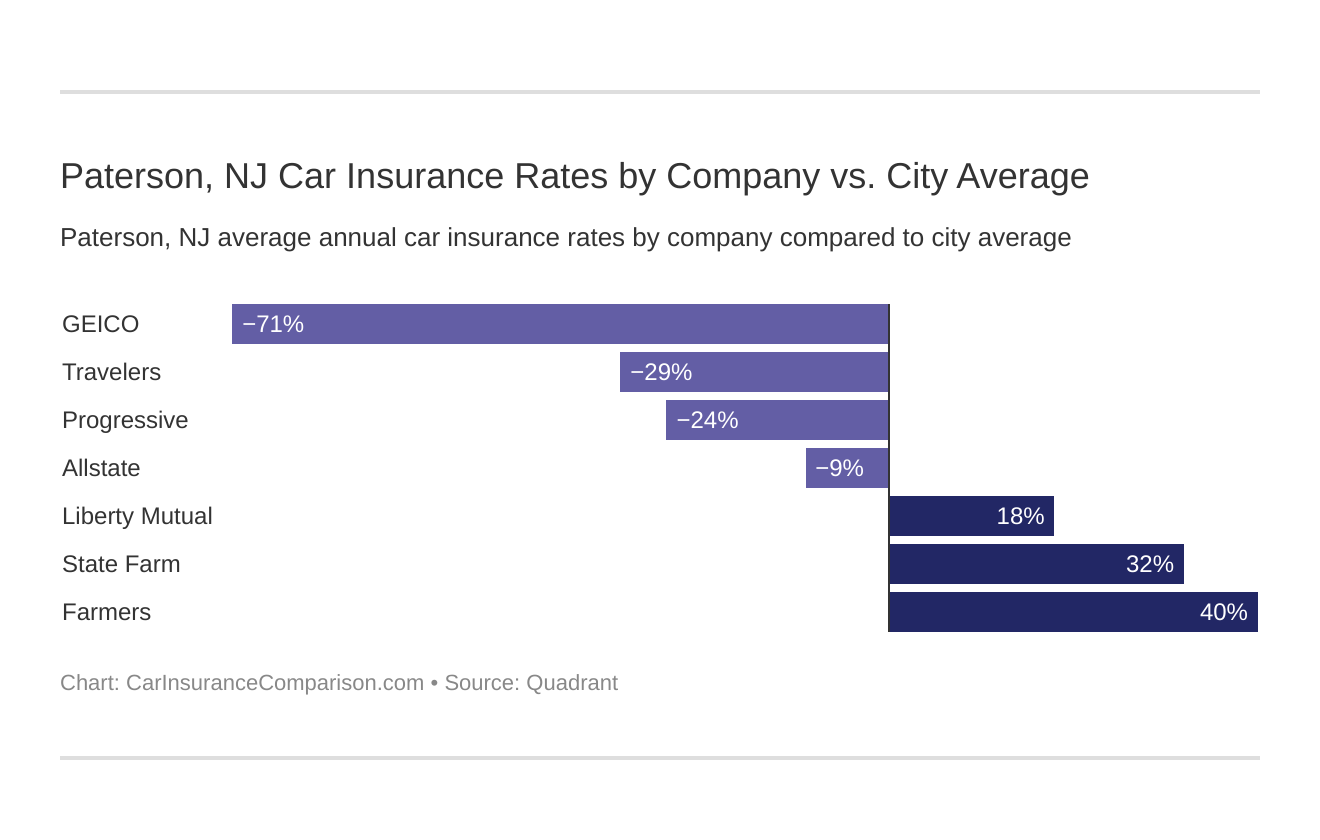

Geico offers the cheapest car insurance in Paterson on average, although rates will vary by driver.

The cheapest Paterson, NJ car insurance providers can be found below. You also might be wondering, “How do those Paterson, NJ rates compare against the average New Jersey car insurance company rates?” We uncover that too.

The top car insurance companies in Paterson, NJ listed from least to most expensive are:

- Geico car insurance – $3,909.34

- Travelers car insurance – $6,129.69

- Progressive car insurance – $6,496.94

- Allstate car insurance – $7,531.75

- Liberty Mutual car insurance – $9,817.84

- State Farm car insurance – $11,318.82

- Farmers car insurance – $12,394.50

Car insurance rates are affected by many different factors such as your age, gender, driving record, and credit history. Even the Paterson, NJ weather can affect your rates since icy roads lead to more accidents.

The size of the city can also influence your rates. Larger cities typically see more traffic and theft, causing auto insurance rates to rise. For example, although the cities are near each other, Newark car insurance is much higher than coverage in Paterson.

New Jersey also offers the Special Automobile Insurance Policy (SAIP), or dollar-a-day car insurance which offers extremely low coverage for about a dollar a day. Drivers must meet certain requirements, such as being enrolled in Medicaid, in order to qualify for the SAIP program.

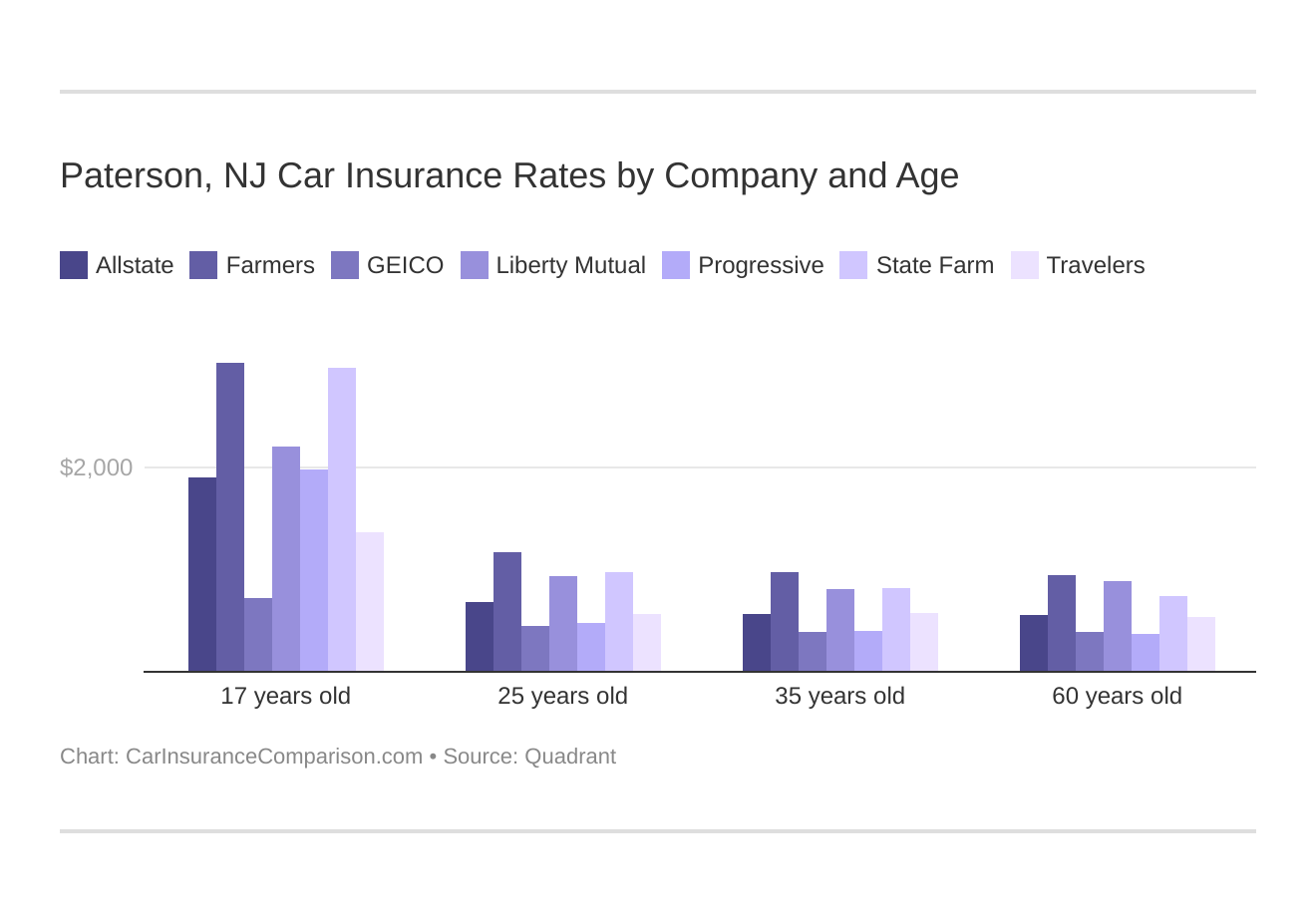

Comparing Paterson, New Jersey car insurance rates by age is an essential comparison because the top car insurance company for one age group may not be the best provider for another age group.

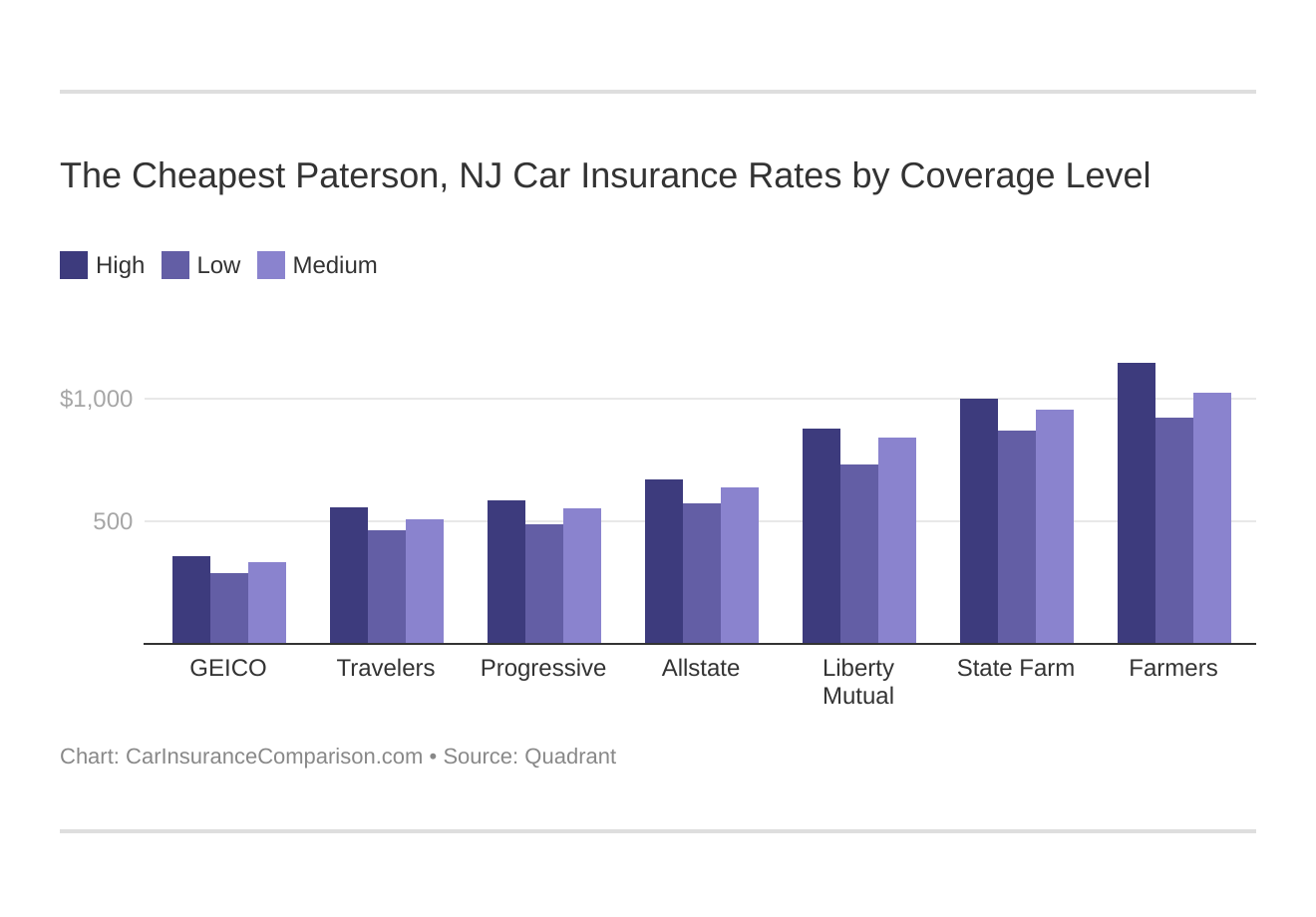

Your coverage level will play a major role in your Paterson, NJ car insurance costs. Find the cheapest Paterson, New Jersey car insurance costs by coverage level below:

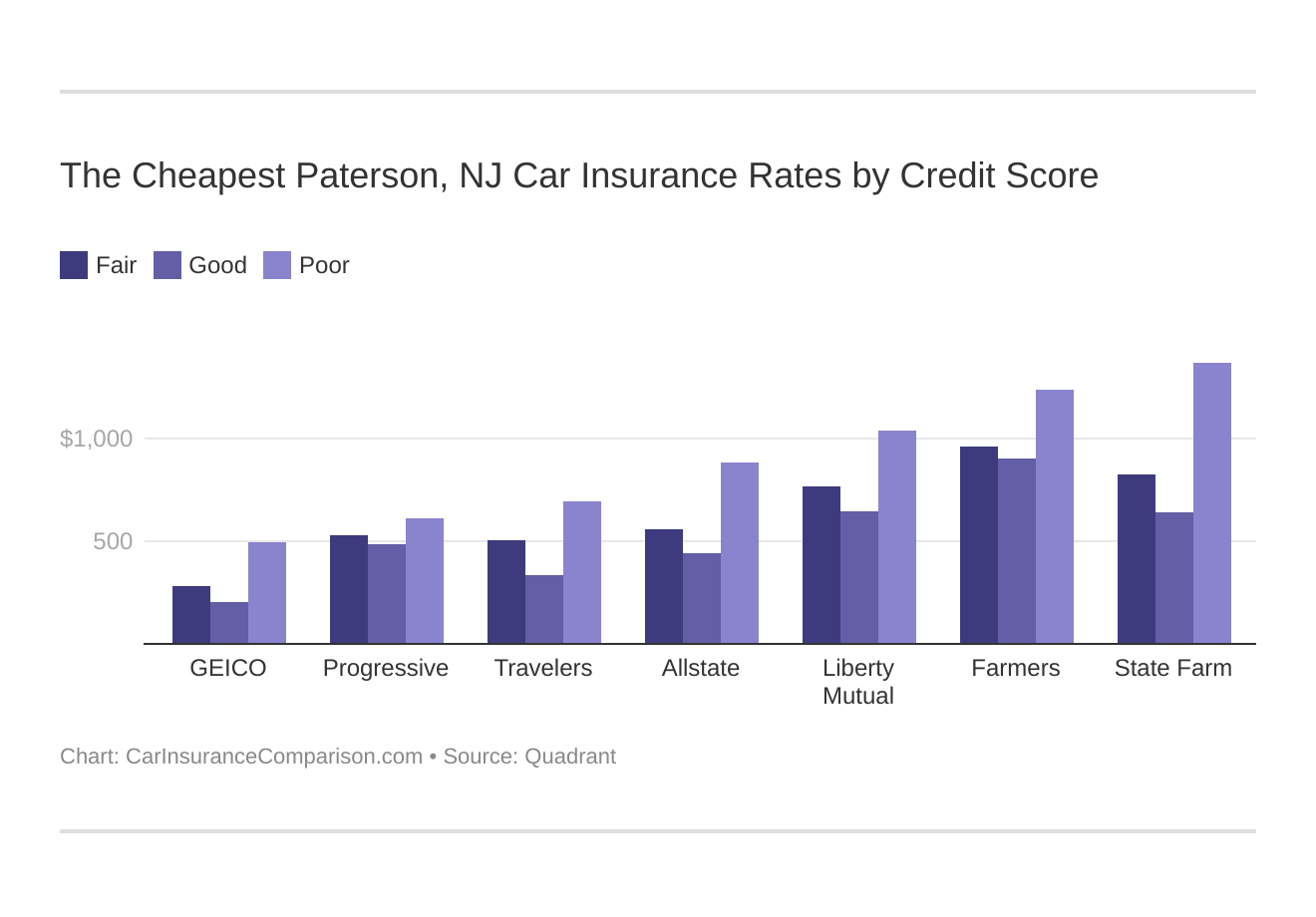

Your credit score will play a major role in your Paterson, NJ car insurance costs unless you live in these states where discrimination based on credit is not allowed: California, Hawaii, and Massachusetts. You may be able to get a good credit discount. Find the cheapest Paterson, New Jersey car insurance costs by credit score below.

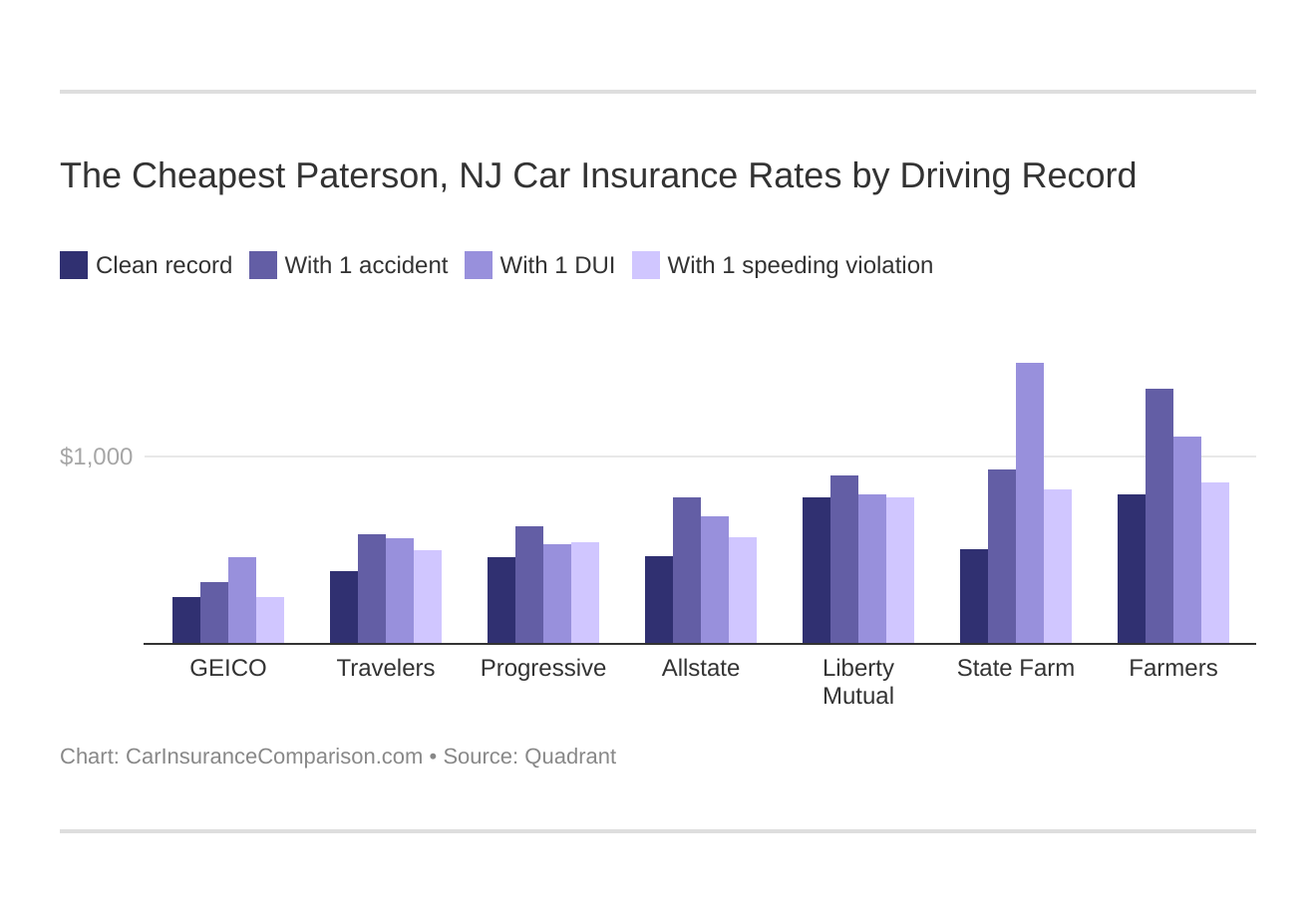

Your driving record will affect your Paterson, NJ car insurance costs. For example, a Paterson, New Jersey DUI may increase your car insurance costs 40 to 50 percent. Find the cheapest Paterson, New Jersey car insurance with a bad driving record.

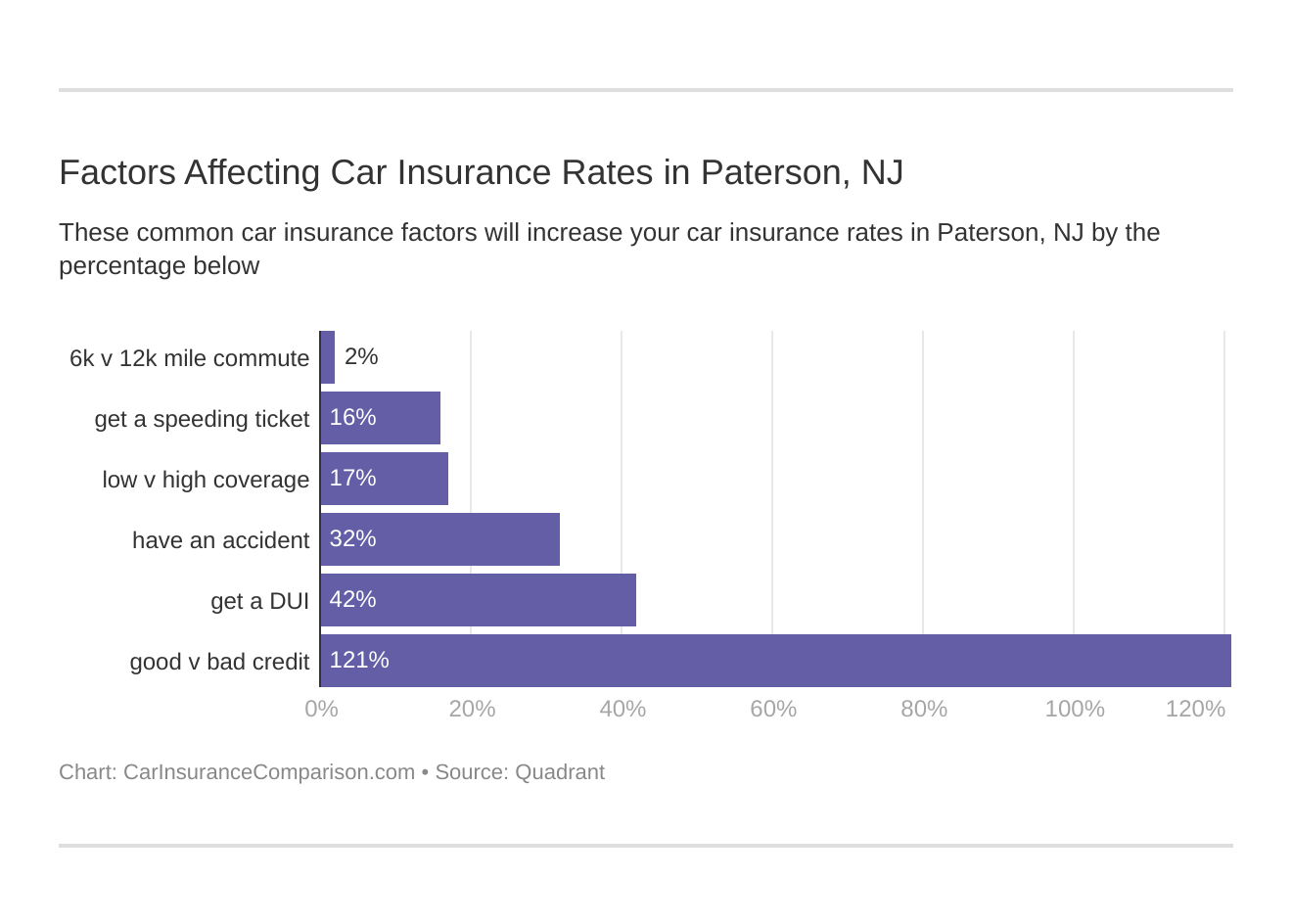

Controlling these risk factors will ensure you have the cheapest Paterson, New Jersey car insurance. Factors affecting car insurance rates in Paterson, NJ may include your commute, coverage level, tickets, DUIs, and credit.

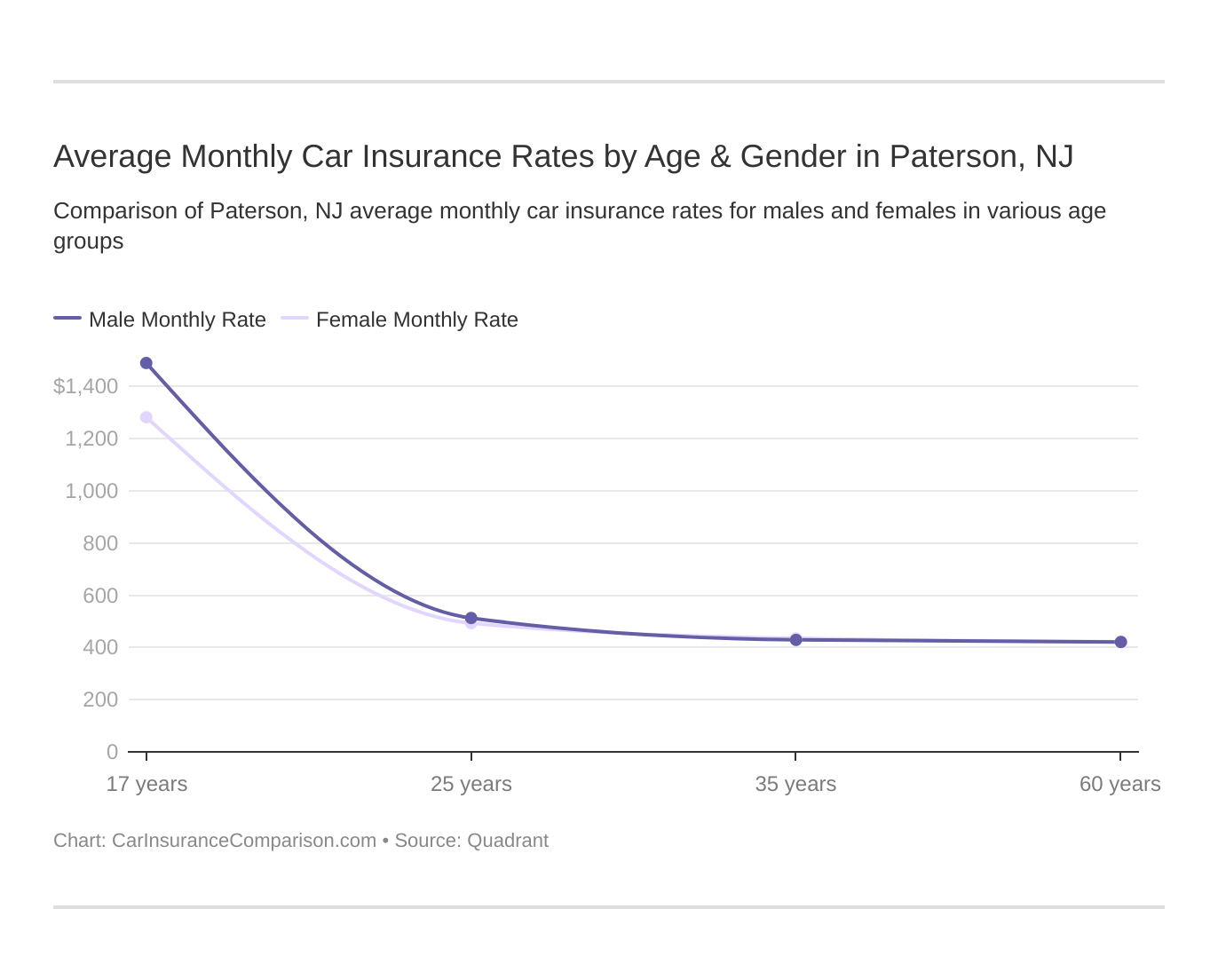

Age is a significant factor for Paterson, NJ car insurance rates. Young drivers are often considered high-risk. Therefore, teen car insurance is more expensive. This Paterson, New Jersey does use gender as a car insurance factor, so check out the average monthly auto insurance rates by age and gender in Paterson, NJ.

What car insurance coverage is required in Paterson, NJ?

New Jersey requires that drivers carry at least a minimum amount of liability car insurance to drive legally. Paterson drivers must carry at least:

- $15,000 per person and $30,000 per incident for bodily injury liability

- $5,000 per incident for property damage

- $15,000 in personal injury protection (PIP) coverage

New Jersey is a no-fault state. This means that your car insurance pays for any damages and injuries from an accident no matter who is at fault.

However, you can see that these limits are very low and would easily be exhausted in a serious accident. Drivers should consider increasing these limits and additional coverages.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

What affects car insurance rates in Paterson, NJ?

Traffic can increase your car insurance rates as well since more cars on the road can equal a greater chance of being in an accident.

INRIX doesn’t have data for Paterson, NJ, but ranks nearby New York City, NY as the most congested city in the U.S. and the third most congested city in the world.

City-Data reports that most drivers in Paterson commute about 15 minutes, although a number of drivers commute an hour or more.

Auto theft can also impact your rates. According to the FBI, there were 631 motor vehicle thefts in one year in Peterson.

Paterson, NJ Car Insurance: The Bottom Line

Paterson auto insurance is much more expensive than the state and national averages. However, you can find great rates if you shop around before you buy Paterson, NJ car insurance. Each company will offer a different rate so compare several to find the best deal.

Enter your ZIP code to compare Paterson, NJ car insurance rates from multiple companies near you.

Frequently Asked Questions

How can I compare car insurance rates in Paterson, NJ?

To compare car insurance rates in Paterson, NJ, you have a few options. You can reach out to individual insurance companies and request quotes directly, or you can use online comparison tools that provide multiple quotes from different insurers. These tools typically require you to provide some personal information and details about your vehicle and driving history to generate accurate quotes.

What factors affect car insurance rates in Paterson, NJ?

Car insurance rates in Paterson, NJ, can be influenced by several factors. The most common factors include your driving record, age, gender, marital status, type of vehicle you drive, your credit history, and the coverage options you choose. Additionally, factors like the frequency of car thefts and accidents in Paterson, NJ, can impact insurance rates in the area.

Are car insurance rates higher in Paterson, NJ, compared to other areas?

Car insurance rates can vary depending on the location, and Paterson, NJ, may have different rates compared to other areas. Insurance companies consider factors like population density, crime rates, and accident statistics when determining rates for a specific area. It’s recommended to compare rates from multiple insurers to get a better understanding of how Paterson, NJ, compares to other areas.

Are there any discounts available for car insurance in Paterson, NJ?

Yes, many insurance companies offer various discounts that can help you save on car insurance in Paterson, NJ. Common discounts include safe driver discounts, multi-policy discounts (if you have multiple policies with the same insurer), good student discounts, low-mileage discounts, and discounts for having safety features installed in your vehicle. It’s worth checking with insurance providers to see which discounts you may qualify for.

How can I lower my car insurance rates in Paterson, NJ?

There are several strategies you can consider to lower your car insurance rates in Paterson, NJ. Maintaining a clean driving record, bundling multiple policies with the same insurer, opting for higher deductibles, and taking advantage of available discounts are some effective methods. You may also want to compare quotes from different insurance companies periodically to ensure you’re getting the best rate.

Is it necessary to have full coverage car insurance in Paterson, NJ?

Full coverage car insurance is not legally required in Paterson, NJ. However, if you have a loan or lease on your vehicle, your lender or leasing company may require you to have comprehensive and collision coverage. Even if it’s not mandatory, having full coverage can provide added protection for your vehicle in case of accidents, theft, or other covered events. It’s essential to evaluate your personal circumstances and financial situation when deciding on the level of coverage you need.

What should I do if I can’t afford car insurance in Paterson, NJ?

If you’re struggling to afford car insurance in Paterson, NJ, there are a few options you can explore. First, consider adjusting your coverage limits or deductibles to lower your premium. You can also shop around and compare quotes from multiple insurers to find more affordable options. Additionally, some states offer low-cost or subsidized insurance programs for individuals with limited incomes. Contact your state’s insurance department or a local insurance agent to inquire about such programs.

Free Car Insurance Comparison

Enter your ZIP code below to view companies that have cheap car insurance rates.

Secured with SHA-256 Encryption

Michael Leotta

Insurance Operations Specialist

Michael earned a degree in Business Management degree with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Au...

Insurance Operations Specialist

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.